The Industry Outlook

We have already discussed SLB’s (SLB) Q1 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. The company’s management identified the key industry trends like project life-cycle reduction, capital efficiency, step change in production and recovery, and adoption of Digital & Al capabilities. The energy market, particularly in Asia, is in the middle of an upcycle as the countries in the Middle East will continue to invest through the end of the decade. The investments are typically long-term. On top of that, many offshore FIDs came up over the past few years, leading to higher activity in Asia, Africa, Latin America, and Europe.

Offshore, through the OneSubsea joint venture, SLB has sufficient revenue visibility through a substantial backlog. It increased its exposure to the Production and Recovery market. The company’s recent acquisition of ChampionX has strengthened its opportunity by adding a production chemicals business and supplementing its artificial lift portfolio. Offshore, ChampionX’s contributions will be critical in increasing the intensity of production chemicals for flow assurance. The acquisition should reinforce the long-cycle value of its offshore strategy.

CCS opportunities

For the past few years, industry dynamics have changed, and operators focus on emissions reduction and are increasingly adopting low-carbon energy. So, SLB’s strategy combines core transition and building a new energy portfolio, primarily including carbon capture and sequestration (or CCS). CCS is one of the fastest-growing techniques used in carbon emission reductions. Here, SLB will leverage its position to meet the increased demand for storage solutions. Recently, SLB agreed to combine its carbon capture business with Aker Carbon Capture. The acquisition will complement its technology portfolio and process design expertise and enhance its project delivery platform.

Q2 Outlook

Based on increasing global demand and the focus on energy security, SLB expects the momentum to continue in its international business. Energy operators will continue to invest in capacity expansion in the Middle East and in long-cycle global offshore markets. It sees robust growth opportunities in the production and recovery market because these activities maximize the efficiency and longevity of operators’ producing assets. So, it will keep its topline steady in 2024 and beyond.

In Q2, the company expects revenue growth by “mid-single digits” in the international market and “low-single digits” in North America after the slow start in Q1 due to the winter slack. It is also expected to expand adjusted EBITDA margins by “75 bps to 100 bps” in Q2 compared to Q1. Its Digital & Integration division will lead the growth, followed by Reservoir Performance, Production Systems, and Well Construction.

SLB’s Q1 Performance

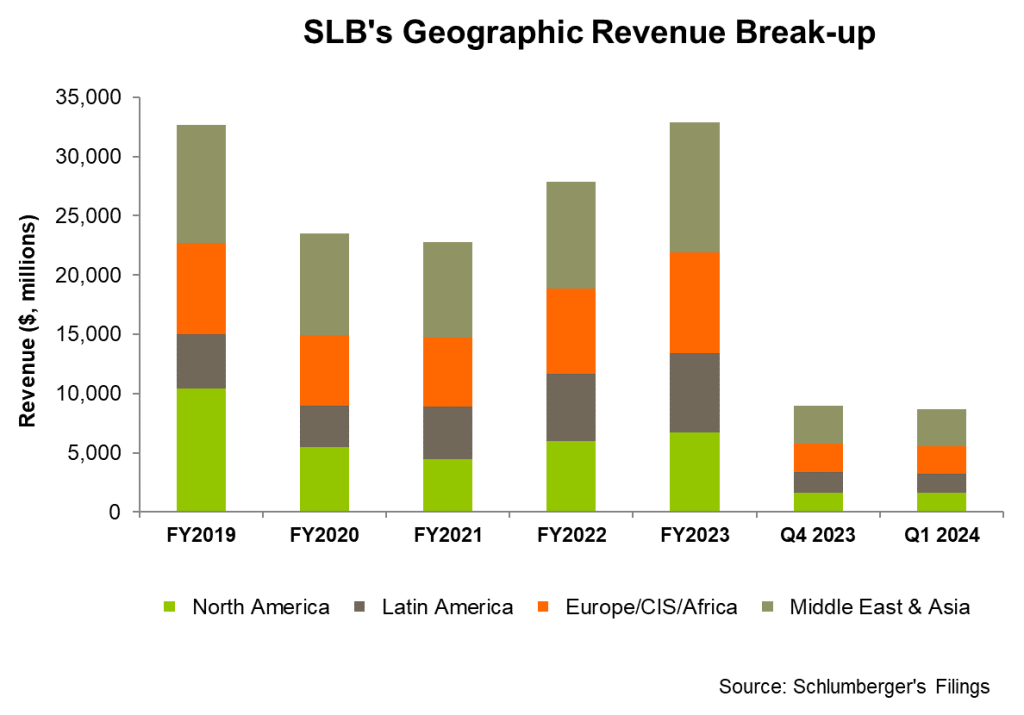

Our short article discussed SLB’s revenue drivers for the operating divisions and key geographic regions. All four operating segments witnessed a quarter-over-quarter revenue decline in Q1. In North America, lower sales of production systems in the US GoM due to softer drilling activity caused this fall.

Looking closely at the figures, we see operating margins in the Digital & Integration division declined 300 basis points year-on-year in Q2 due to the effects of higher APS amortization expense and lower commodity prices in Canada. On the other hand, margins are expected to improve in Q2 and in FY2024 as sales increase, which is in line with the seasonal trend.

Cash Flow & Balance Sheet

We discussed SLB’s cash flow from operations remaining steady in Q1 2024 compared to a year ago. The cash flow reflects the seasonal effects of the payout of employee incentives and lower cash collections. Free cash flow, however, was negative in Q1. In Q2, SLB’s free cash flow is expected to be higher, and it may continue to strengthen in Q3 and Q4. In FY2024, it expects capital investments to be approximately $2.6 billion, which would be 6% higher than in FY2023.

SLB’s leverage is higher than its peers’ (HAL, BKR, and FTI) average. Recently, it raised its 2024 target for total shareholder returns from $2.5 billion to $3 billion (through dividends and share repurchases). However, generating and improving free cash flow will be critical to increasing shareholder returns.

Relative Valuation

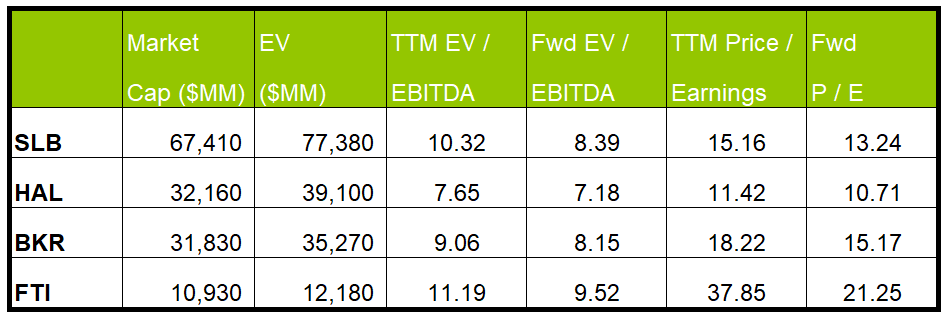

SLB is currently trading at an EV/EBITDA multiple of 10.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 8.4x. The current multiple exceeds its five-year average EV/EBITDA multiple of 11.8x.

SLB’s forward EV/EBITDA multiple contraction versus the adjusted current EV/EBITDA is steeper than its peers because the company’s EBITDA is expected to increase more steeply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than its peers’ (HAL, BKR, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

SLB reckons that the energy markets in Asia are in the middle of an upcycle. Countries in the Middle East will continue to invest through the end of the decade, and the returns from these investments will generate long-term returns. It has increased its exposure to the Production and Recovery market. In this context, the recent acquisition of ChampionX will add to its production chemicals business and supplement its artificial lift portfolio. SLB has a fast-growing carbon capture and sequestration market, especially given the increased demand for storage solutions.

However, SLB’s growth in Q1 was muted due to softer drilling activity in the US GoM. Also, the operating margin in the Digital & Integration division declined. Free cash flows remained negative in Q1 2024, although the company expects it to improve in the coming quarters. The stock is reasonably valued compared to its peers.