Industry Outlook and HAL’s Strategies

We have already discussed Halliburton’s (HAL) Q1 2024 financial performance in our recent article. Despite the current economic uncertainty, HAL’s management projects a strong demand for natural gas in the coming decade, emanating from electricity demand. Electricity demand is estimated to grow by more than 15% by 2030. Energy operators’ multiyear activity plans across multiple markets should support the management’s views.

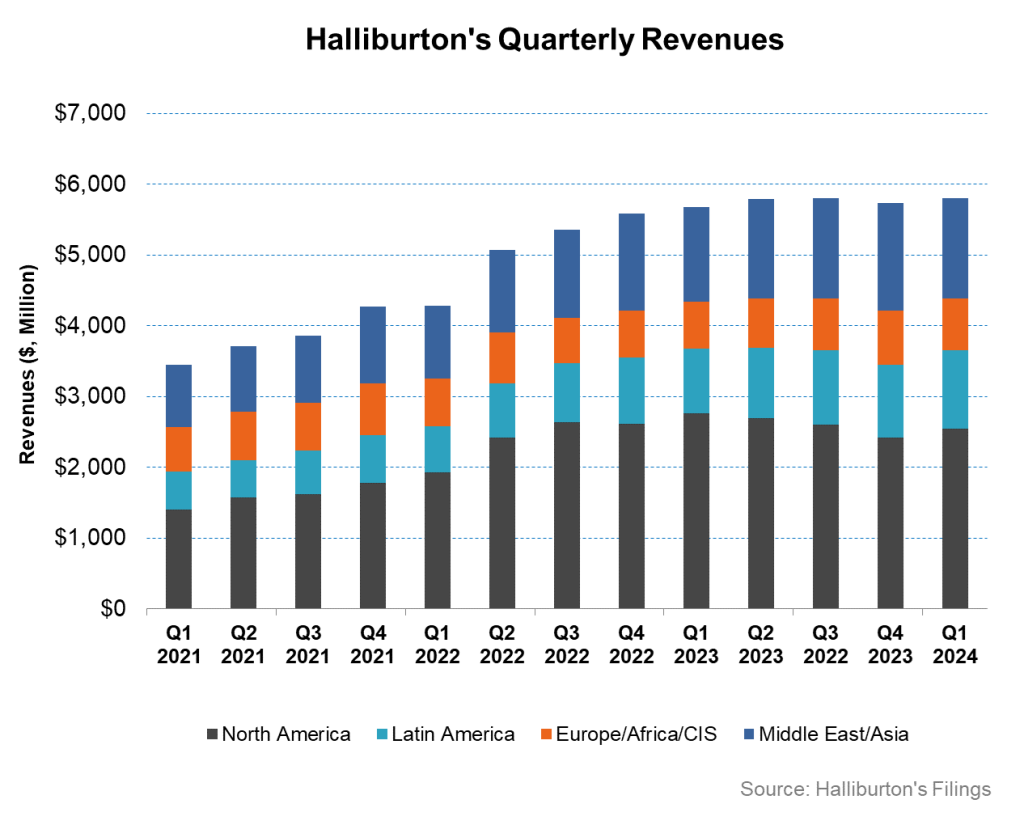

In North America, onshore completion activity recovered in Q1 after bottoming out in Q4 2023. For the rest of 2024, activity levels should stabilize as energy operators execute their long-term investment plans. We expect demand from LNG expansions to lead to a recovery in natural gas activity. In this scenario, Halliburton aims to maximize value in North America by strengthening the ZEUS platform and the directional drilling system. The company’s sees growth in the ZEUS platform, including electrification, automation, and subsurface diagnostics. Overall, HAL’s revenues and margins should remain flat in North America in FY2024 compared to FY2023.

International Market Outlook

While international revenue grew by 12% year-over-year in Q1, HAL’s management expects FY2024 revenue from international operations to increase in the “low double-digits.” Also, due to the tightness in the equipment market, HAL can see margin expansion in FY2024. Technological advancements should play a critical part in the company’s margin growth. The company’s introduction of new technologies includes EarthStar X logging-while-drilling system and Reservoir Xaminer Formation Sampling Service. Artificial lift technology is expected to generate profitable growth in various international geographies. It plans to leverage its brand in electric submersible pumping internationally.

In completion, the company’s advantage lies in providing end-to-end solutions. The new version of its iCruise Rotary Steerable System has been engineered for the North American unconventional market. This business is built on an asset-light sales and rental model that increases the addressable market. As a result, its iCruise footage drilled in North America more than doubled over last year. It estimates that it captured ~20% market share in Kuwait with over 700 ESP (Electrical submersible pumps) installs.

HAL’s Q2 forecast

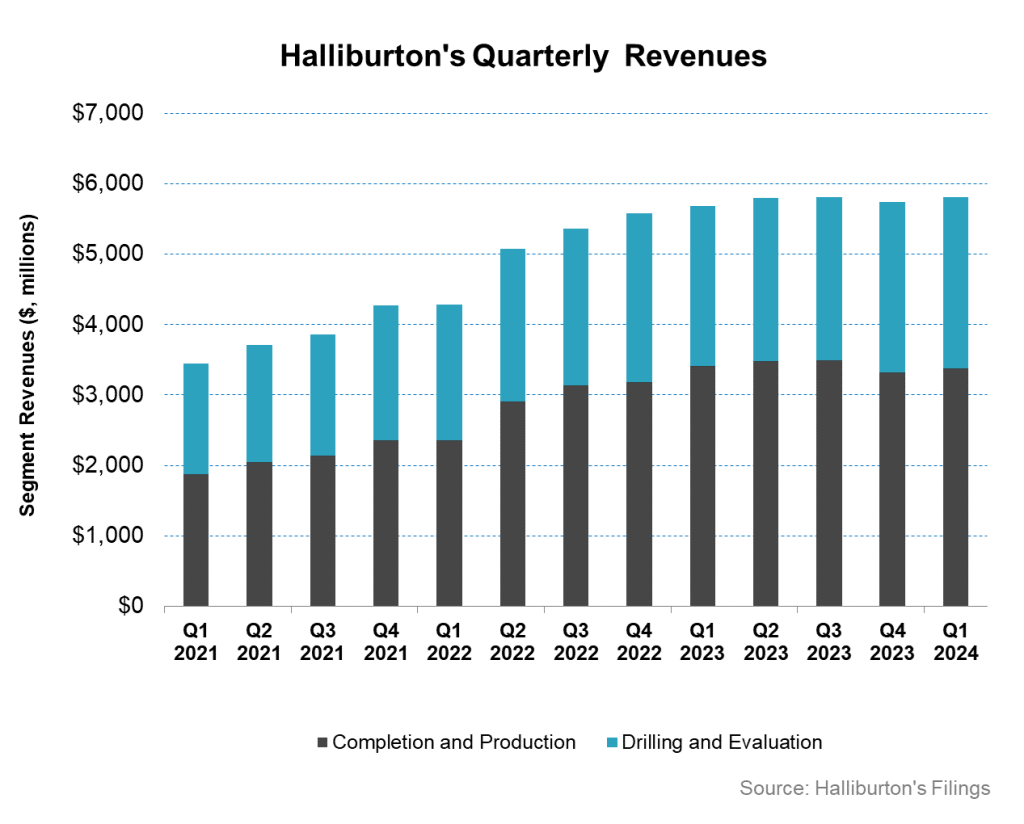

In Q2 2024, Halliburton expects revenues from the Drilling & Evaluation division to increase by 1%-3% while its operating margin can improve by 25 to 75 basis points. The Completion & Production division revenue can go up 2%-4% in Q2 compared to Q1. Operating margins in this segment can also increase by 25 to 75 basis points.

The company’s North American revenue and margin can remain flat despite lower activity levels. However, revenues from international operations can grow at “low double digits.”

Key Q1 Metrics

We already discussed HAL’s Q1 2024 financial performance, cash flows, and balance sheet in our Halliburton: Q1 TAKE THREE article. Quarter-over-quarter, the rise in revenues in the company’s Completion and Production operating segment was higher than the Drilling and Evaluation segment in Q1.

HAL’s cash flow from operations strengthened robustly (3x up) in Q1 2024 compared to a year ago. It generated $157 million in FCF in Q1 2024. In FY2024, it expects its capex-to-revenue to remain unchanged at 6%. During Q1, it repurchased ~$250 million of common stock. A healthy FCF generation will likely allow HAL to carry out share repurchase in FY2024.

Relative Valuation

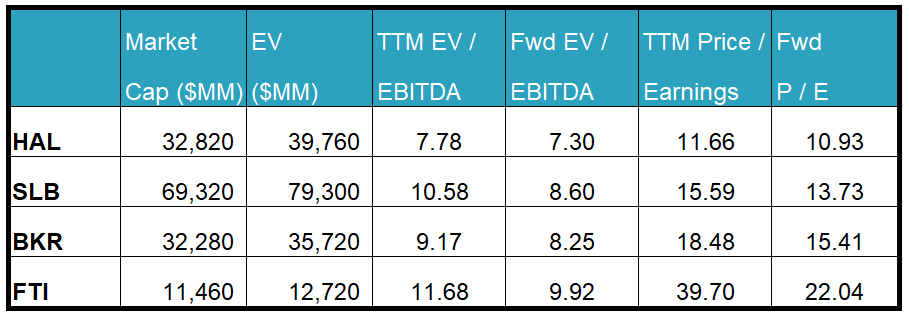

Halliburton is currently trading at an EV-to-adjusted EBITDA multiple of 7.8x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.3x. The current multiple is lower than its five-year average EV/EBITDA multiple of 11.2x.

HAL’s forward EV-to-EBITDA multiple contraction versus the adjusted current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (SLB, BKR, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

In 2024, HAL expects activity levels to stabilize as energy operators execute long-term investment plans. The company will maximize value in North America through strengthening the ZEUS platform and directional drilling. The prospect is better in HAL’s international market, where the tightness in the equipment market will lead to margin expansion during the year. HAL will enhance its margin profile by introducing new technologies such as logging-while-drilling, artificial lift technology, and Rotary Steerable System.

In Q2, while North America’s revenue and margin remain flat, international operations revenues can grow. With steady cash flows, shareholder returns can improve through share repurchase. The stock is reasonably valued versus its peers at this level.