The global oil markets are experiencing a notable shift, as both physical and paper markets reflect an ample supply. Recent data indicates U.S. gas inventories were 647 billion cubic feet above the ten-year average as of May 10, a substantial 33%

increase, or 1.46 standard deviations above the norm. This abundant supply is placing pressure on gasoline prices and refining margins, with inventories depleting more slowly than usual for this time of year. U.S. gasoline inventories were only 1% below the ten-year seasonal average on May 10, down from a 3% deficit earlier, indicating a surplus that undermines bullish sentiments in the fuel markets.

Hedge funds and other money managers have responded to these trends by selling off significant quantities of gasoline futures and options, equivalent to 36 million barrels between April 9 and May 7. This selling spree extended to broader petroleum markets, with 143 million barrels sold in the six most important petroleum contracts over the same period. This substantial liquidation highlights the market’s bearish outlook amid plentiful supplies.

In the U.S., the oil rig count increased by one to 497, marking the first rise in four weeks, as reported by Baker Hughes. Concurrently, geopolitical tensions have resurfaced with a fire at Russia’s Tuapse oil refinery, attributed to Ukrainian drone attacks, introducing fresh supply uncertainties. Despite these tensions, U.S. crude prices saw a slight uptick, buoyed by data indicating a stabilizing job market, which may prompt the Federal Reserve to consider interest rate cuts by autumn. Lower interest rates are anticipated to stimulate economic activity, thereby boosting oil demand.

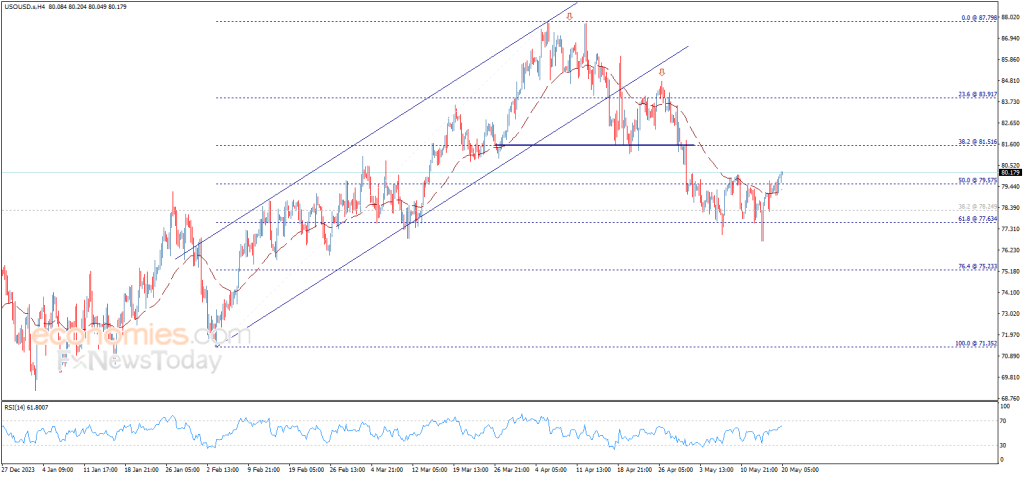

Source: Economies.com – “Crude oil price exits the sideways range”

The Energy Information Administration (EIA) reported a decline of 2.5 million barrels in U.S. crude stockpiles last week, driven by increased refining activity and fuel demand. Refinery runs rose by 307,000 barrels per day, raising utilization rates to 90.4% of capacity. Despite this drawdown, gasoline demand remains below seasonal norms, raising concerns ahead of the peak summer driving season. This anomaly in demand patterns could influence market dynamics as the industry braces for higher summer consumption.

On the global stage, divergent demand forecasts from major organizations underscore the prevailing uncertainty. The International Energy Agency (IEA) has revised its 2024 oil demand growth forecast down to 1.1 million barrels per day, citing weaker industrial activity. In contrast, OPEC forecasts a more optimistic 2.25 million barrels per day increase, highlighting a significant divergence in expectations. This discrepancy emphasizes the uncertainty surrounding future demand projections, posing a critical challenge for traders and policymakers alike.

The oil markets are navigating a complex landscape marked by ample supplies, strategic sell-offs, and conflicting demand forecasts. As the summer driving season approaches, all eyes will be on consumption patterns and the Federal Reserve’s monetary policy decisions, which could significantly influence market trajectories. The interplay between these factors will be crucial in shaping the short-term outlook for global oil markets.