United States

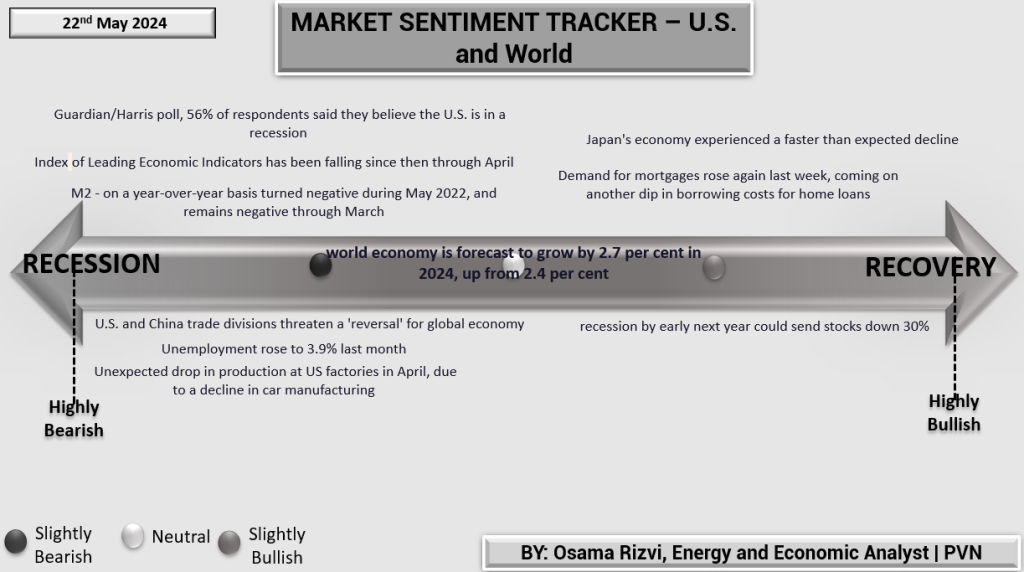

In the U.S., recessionary pressures loom large as mixed indicators paint a somber picture. A Guardian/Harris poll reveals that 56% of respondents believe the U.S. is already in a recession. The Index of Leading Economic Indicators has been in decline since May 2022, a clear signal of economic slowdown. The M2 money supply has turned negative year-over-year through March, highlighting liquidity issues.

Despite these challenges, the global economy is projected to grow by 2.7% in 2024, up from 2.4% in the previous year. However, U.S.-China trade tensions pose significant risks, threatening to reverse global economic gains. Unemployment in the U.S. rose to 3.9% last month, coupled with an unexpected drop in factory production, particularly in car manufacturing. The outlook remains grim, with fears of a potential recession by early next year, which could see stock markets tumble by 30%.

China

China’s economic outlook is equally fraught with challenges. The April Beige Book indicates that while consumers traveled, their spending remained restrained. The U.S.-China chip war escalation continues to strain economic relations, further intensified by President Biden’s imposition of higher tariffs on Chinese electric vehicles, chips, and other goods. The S&P analysts predict a 16% shrinkage in China’s primary residential market this year.

On the brighter side, China’s industrial output from major enterprises surged by 6.7% year-on-year in April, recovering from 4.5% in March. Retail sales of consumer goods grew by 2.3% from a year ago, and industrial output maintained its robust growth. Notably, new business activity hit its highest level since May last year, suggesting some resilience amid ongoing challenges. Overall, the economic sentiment remains cautiously balanced, with significant downside risks.

Europe

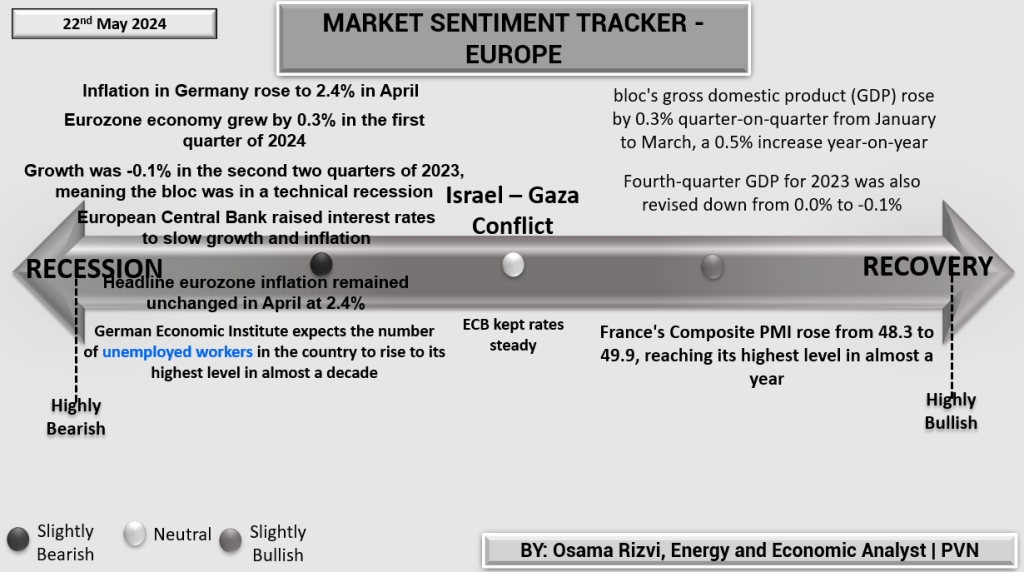

Europe’s economic environment reflects a similar pattern of tentative recovery amid persistent challenges. Inflation in Germany rose to 2.4% in April, and the Eurozone economy saw modest growth of 0.3% in the first quarter of 2024. This follows a technical recession in 2023, where growth was -0.1% in the last two quarters. The European Central Bank (ECB) has raised interest rates to curb inflation, which remains steady at 2.4% in April.

The German Economic Institute forecasts a rise in unemployment to its highest level in nearly a decade. Conversely, France shows signs of recovery with its Composite PMI increasing from 48.3 to 49.9, the highest in almost a year. The ECB’s monetary policy aims to navigate these mixed signals, balancing inflation control with growth stimulation.

Globally, the economic landscape is characterized by a blend of challenges and opportunities. The U.S. faces recessionary pressures with declining production and rising unemployment. China contends with trade tensions and a contracting residential market, despite strong industrial output. Europe shows tentative signs of recovery, particularly in France, amid persistent inflation and employment concerns in Germany. Policymakers across these regions must carefully manage these complex dynamics to sustain growth and stability amidst ongoing uncertainties.