Industry Outlook

We discussed our initial thoughts about NOV’s (NOV) Q1 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. In 2024, NOV’s management expects US energy activities to remain soft, followed by a natural gas export-led recovery. However, international and offshore activity will lead to the charge as US activities lack the punch. The company also expects drilling activity to remain steady over the next several years. With this backdrop, NOV’s management expects to generate strong annual free cash flow over the next several years.

Segment Outlook

In the Energy Products and Services segment, the company expects the end markets to perform strongly, leading to higher demand for oil and gas products in the Middle East. There has also been an increase in orders for flexible pipe and composite tanks in the Permian. So, in Q2, revenues in this segment are expected to grow by 1%-5% compared to Q2 2023. It is also expected to record an EBITDA of $180 million-$190 million, which is 6% higher than Q1.

In the Energy Equipment segment, the trend in the new pressure pumping equipment bookings has been soft. On the other hand, the interest in alternative energy equipment has been robust. In particular, there is a steady rise in demand for e-frac and CNG units where the backlog remains healthy, leading to improved shipments of DGB and e-frac units. Demand from Africa, Europe, and the Middle East has been impressive in international markets. Based on the improved outlook, NOV plans to replace the lower-margin contracts with higher-margin projects. This should significantly improve its margins in 2025. In Q2 2024, it expects year-over-year revenues to increase by 1%-5%. It is also expected to record an EBITDA of $135 million-$145 million, which is 17.6% higher than Q1.

Backlog

NOV’s Energy Equipment segment backlog of $3.96 billion primarily comprises contracted longer-cycle manufacturing and project work. However, the backlog declined 5% during Q1. At the start of Q2, it won a contract exceeding $250 million for energy equipment for offshore work in Latin America. The outlook for capital equipment orders has also been high. The stable energy prices and increased exploration activities in new basins led to growing offshore activity.

The company expects the momentum to drive offshore FIDs by over $100 billion per year. FPSOs ordered in the next five years are expected to rise by 50% compared to the previous five years. You can read more about the company’s recent key projects in our article here.

International Outlook

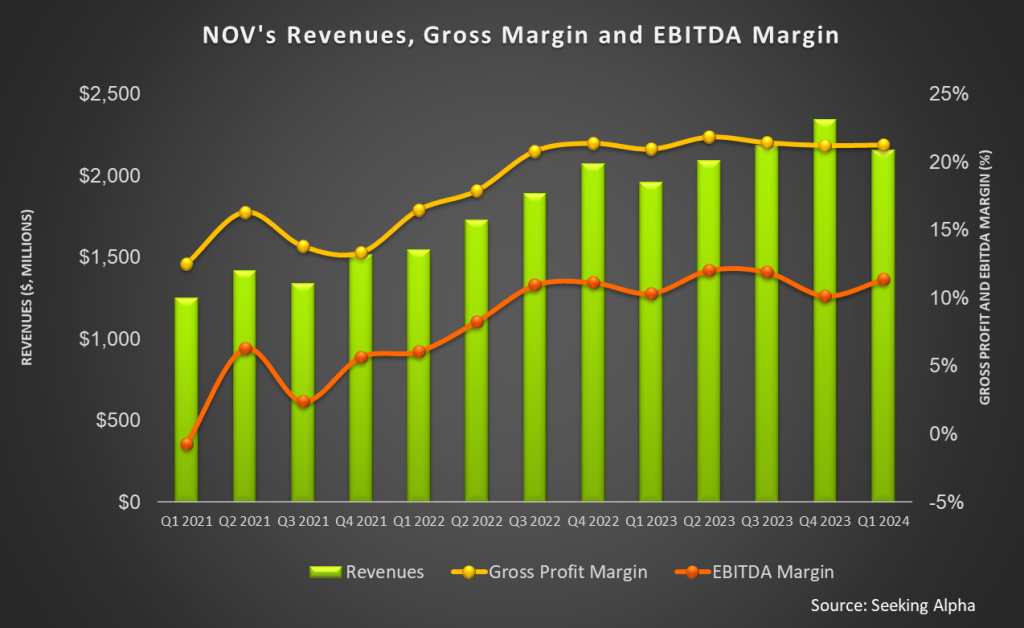

In the Middle East, the growth of unconventional energy developments has given the company enough confidence to expand its return of the capital program significantly. It now plans to increase its dividend by 50%. It has also authorized a $1 billion share repurchase program. Following the rise in oilfield activity in key offshore and international markets, NOV’s EBITDA margins can reach “into the 14% to 15% range” by the end of 2024. It will also generate more cash as working capital normalizes.

To boost profitability, it has restructured its operating segments, consolidated some manufacturing locations, centralized supply chain functions, and strengthened marketing coordination. As a result of these initiatives announced in July 2023, it can save $75 million in costs, a third of which has already been achieved. The savings from cost reduction can accelerate in Q2.

Acquisition Benefits

In January, NOV acquired Extract Companies, which provides electric submersible pumping services. This will enable operators to extend their well profiles from 2-mile laterals to 3-mile lateral, leading to higher initial gross volumes produced through each wellhead. The acquisition also complemented its artificial lift choke, separation, pumping, and processing product portfolio. With this acquisition, NOV can deploy its Max edge computing platform to artificial lift and production optimization. The Max edge platform also extends to Max completions. From Q4 2023 to Q1 2024, revenues from the Max family of products increased by 35%, while it increased by 2.5x from a year earlier.

Q1 Financial Results

In FY2024, NOV’s planned capex can increase by 17% compared to FY2023. Its investment opportunities lie in commercializing the technologies it deployed over the last several years. Such technological benefits can range from $50 million to $150 million per year. The company expects to increase its dividend by 50% beginning in June 2024. It plans to return at least 50% of its excess free cash flow to shareholders through a steady base dividend, stock buybacks, and a supplemental dividend. It will repurchase shares under a new $1 billion, three-year share repurchase program.

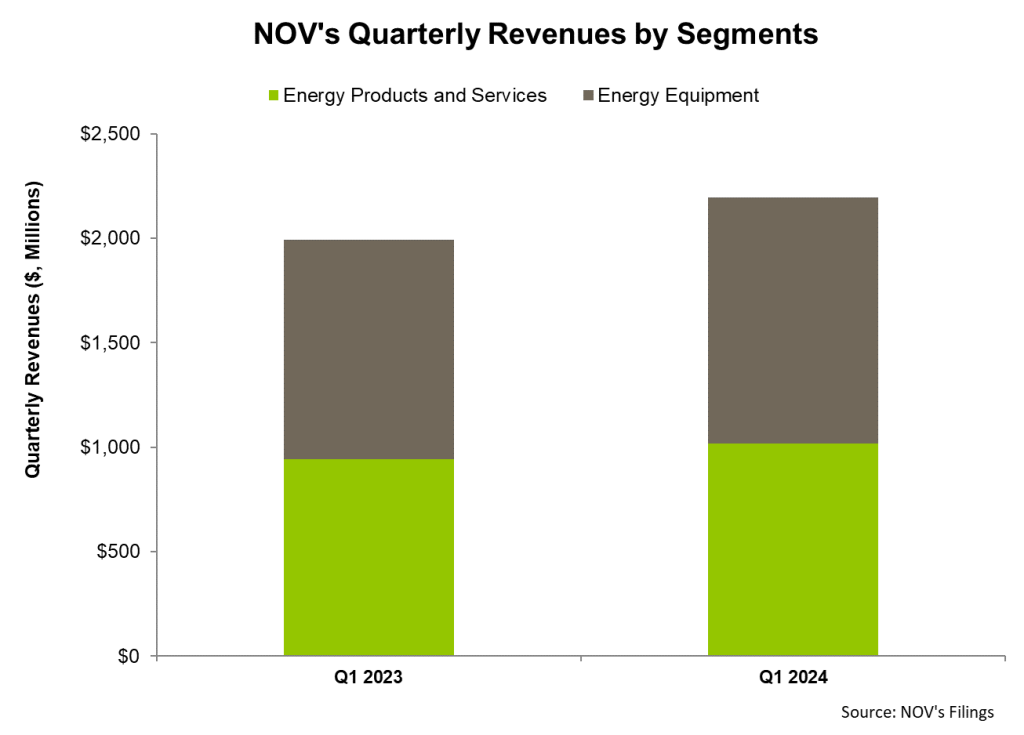

The Energy Equipment segment witnessed 12% year-over-year revenue growth, while the Energy Products and Services segment revenue increased by 8%. The Energy Equipment segment saw operating income rise (34% up) from Q1 2023 to Q1 2024. NOV’s cash flows remained negative in Q1 2024 but improved compared to a year ago. Its working capital increased in Q1 due primarily to the decrease in accrued liabilities.

Relative Valuation

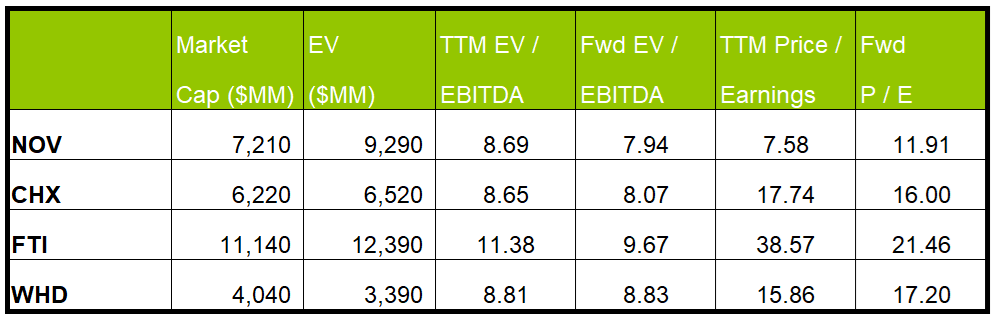

NOV is currently trading at an EV/EBITDA multiple of 8.7x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.9x. The current multiple is lower than its five-year average EV/EBITDA multiple of 30.3x.

NOV’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers because its EBITDA is expected to increase more sharply next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is slightly lower than its peers’ (CHX, FTI, and WHD) average. So, the stock is undervalued versus its peers.

Final Commentary

NOV’s management is optimistic about international and offshore activity growth, although it does not expect US energy activities to recover soon. Increased flexible pipe and composite tank orders should improve its Permian and Middle East sales. A steady rise in demand for e-frac and CNG units can lead to improved shipments of DGB and e-frac units. The company will replace the lower-margin contracts with higher-margin projects. In early Q2, it won a significant contract in offshore work in Latin America. A spurt in international offshore FIDs is encouraging.

Also, combining the acquired electric submersible pumping services and the Max edge computing platform boosted revenues from the Max family of products. The growth of unconventional energy developments and the commercialization of the technologies it deployed over the last several years have brightened its opportunities to expand the return of the capital program. It now expects to increase its dividend by 50%, although its cash flows remained negative in Q1 2024. The stock is relatively undervalued compared to its peers.