U.S. and Global Overview

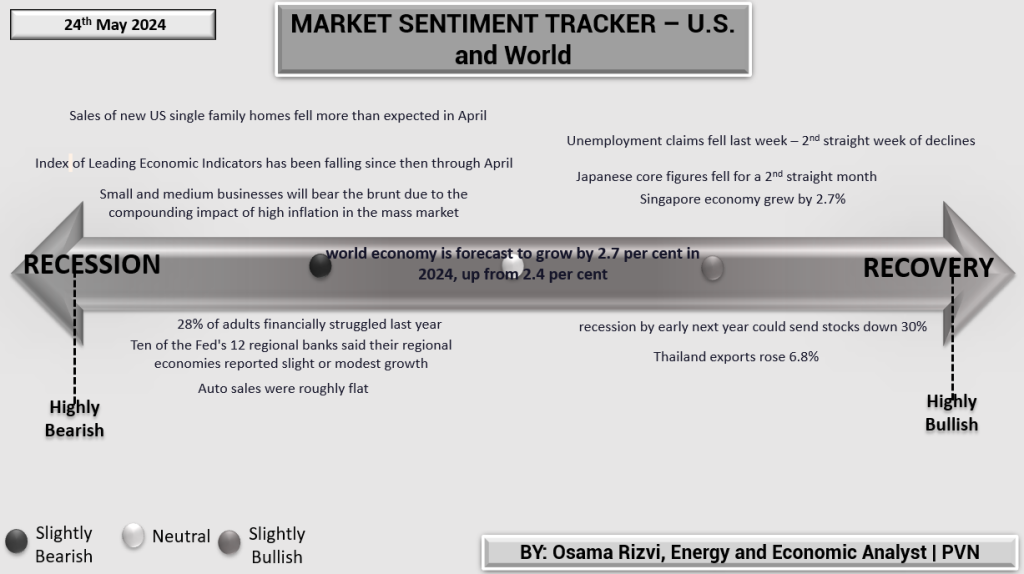

The Market Sentiment Tracker for the U.S. and World on May 24, 2024, reveals a complex economic landscape. The U.S. economy is facing mixed signals with significant weaknesses alongside some positive developments. Sales of new U.S. single-family homes declined more than expected in April, reflecting ongoing challenges in the housing market. The Index of Leading Economic Indicators has been falling since May 2022, indicating persistent economic difficulties.

Small and medium-sized businesses are expected to suffer the most from the compounding impact of high inflation, which continues to pressure the mass market. On the positive side, unemployment claims fell for the second consecutive week, suggesting some recovery in the labor market. Globally, the world economy is projected to grow by 2.7% in 2024, up from 2.4% in the previous forecast, pointing towards a gradual global recovery.

However, this optimism is tempered by regional challenges. Japan’s economy experienced a faster-than-expected decline, with core figures dropping for the second straight month. Meanwhile, Singapore’s economy grew by 2.7%, and Thailand’s exports increased by 6.8%, showcasing some regional resilience. Despite these pockets of growth, the broader economic outlook remains cautious, with the threat of a global recession by early next year, potentially causing a 30% drop in stocks.

China Overview

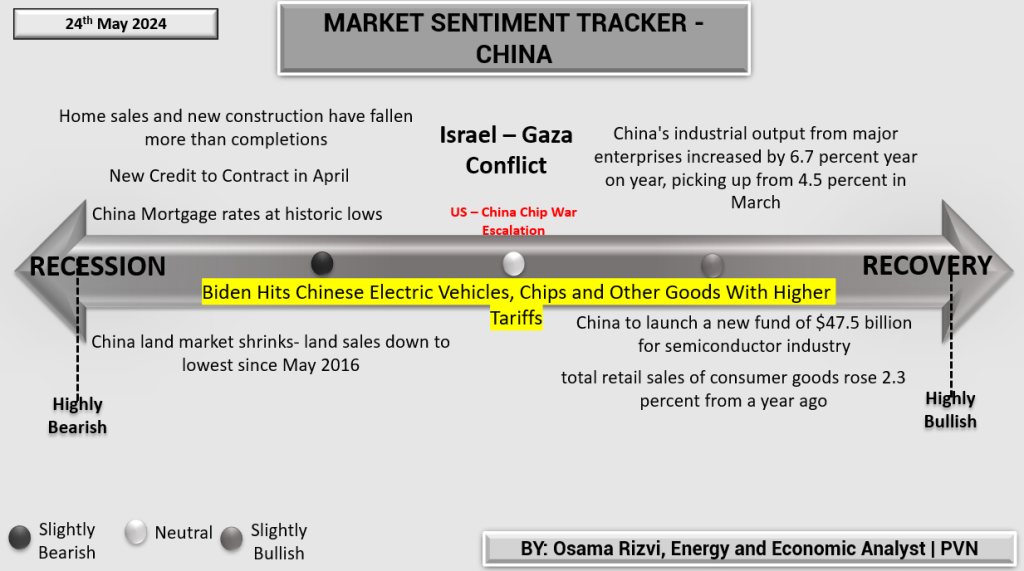

China’s economic landscape is similarly nuanced. The Market Sentiment Tracker for China highlights both growth and significant challenges. Home sales and new construction have fallen more than completions, with the land market shrinking to its lowest levels since May 2016. Mortgage rates are at historic lows, but new credit contracted in April, reflecting tighter financial conditions.

On a positive note, China’s industrial output from major enterprises increased by 6.7% year-on-year, picking up from 4.5% in March. The total retail sales of consumer goods rose by 2.3% compared to the previous year. Additionally, China is launching a new fund of $47.5 billion for the semiconductor industry, indicating strategic investment in critical sectors.

However, these positives are overshadowed by significant risks. The U.S.-China trade conflict continues to escalate, with the Biden administration imposing higher tariffs on Chinese electric vehicles, chips, and other goods. This trade war could have severe implications for both economies, adding to the uncertainty.

Overall, while there are signs of economic recovery and growth, substantial risks and challenges persist. The economic landscape remains uncertain, with a delicate balance between bearish and bullish sentiments.