Industry Outlook

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q1 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

The hydraulic fracturing industry was at a crossroads with a stable crude oil price and a weakening natural gas price pulling in different directions. The sustained fragility in natural gas prices caused activity slowdowns in the levered basins. As a result, completion delays and lower utilization adversely impacted Northeast, Haynesville, and Eagle Ford operations. The crude oil markets have remained mostly stable, although most operators will unlikely increase their capex in 2024 compared to 2023. If the crude oil prices remain stable, we can expect rig additions in the Permian region in 2H 2024.

Northeastern Haynesville’s contribution to NINE’s portfolio has been significant in recent years. The lack of activity can lower its operating margin. However, NINE’s management is not unduly concerned about the decline of natural gas prices and expects a recovery in gas-directed activity in the medium and long term. So, it will continue to hold its assets in these regions when the recovery occurs.

NINE’s Outlook

Because returns from the crude market are currently higher, NIEN has supplemented its Permian operations with personnel from the Haynesville and Northeast locations. Its main focus has been coiled tubing and wirelines in the Permian. In Q2, utilization can decline in natural gas-dominant basins. It also expects pricing pressure in the cementing business.

In Q2, the company is estimated to generate revenues between $130 million and $140 million, 5% lower than in Q1 2024. In the long term, planned LNG projects will spring growth. It also expects adjusted EBITDA and our adjusted EBITDA margin to decrease. Because of the business diversity and asset-light business, NINE will look to offset the weaknesses in the US market by diversifying its revenue streams to completion tools in the international markets.

Re-fracking To Supplement Business

NINE currently tracks the changes in the re-fracking business and has made it a part of its regular business. In fact, it is one of the select companies in the US that offers this solution. The company estimates that it saw growth in this niche segment in FY2023. It is “looking at it from a production capacity,” says the management.

Q1 Financials

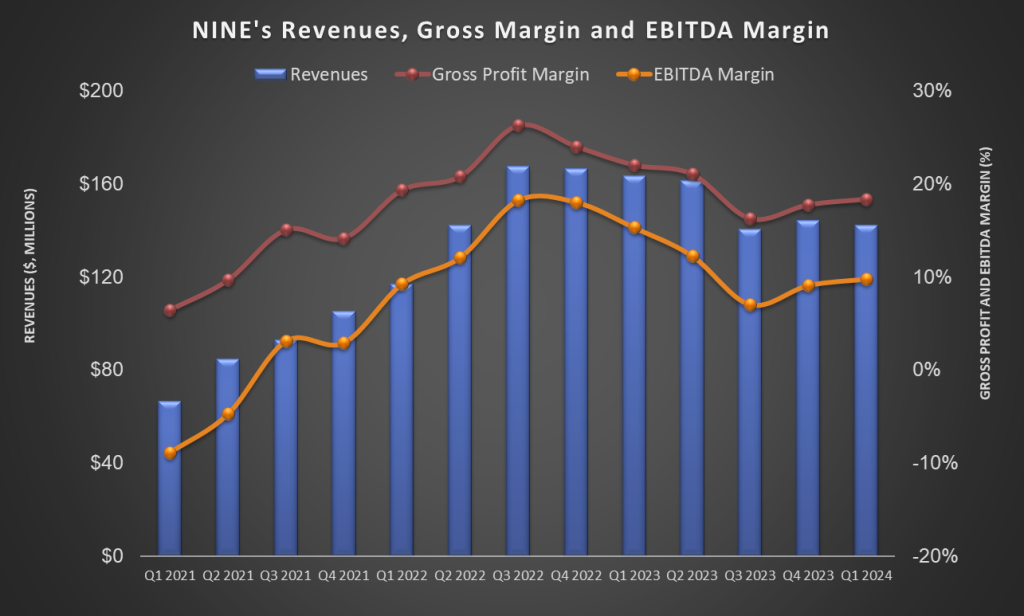

Quarter-over-quarter, NINE’s revenues decreased marginally, by 1.4%, in Q1, while its adjusted EBITDA margin expanded by 60 basis points. It continued to record net loss, but the loss lessened to $8.3 million from $10.3 million a quarter ago.

NINE’s cash flow from operations turned negative in Q1 2024 following a dip in accounts receivable collections. This led to its free cash flow turning negative in Q1 2024. Due to negative shareholders’ equity, its debt-to-equity remained negative as of March 31, 2024. So, a high net debt ($309 million), negative cash flows, and negative equity render the stock financially risky. Its liquidity was $37.5 million as of March 31. The company has debt repayments and interest payments due in the coming quarters. So its cash balance can dip further.

Relative Valuation

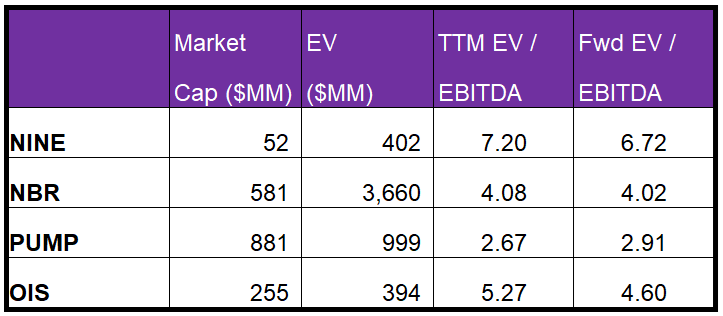

NINE is currently trading at an EV/EBITDA multiple of 7.2x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 6.7x.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to contract more steeply than its peers. This implies that its EBITDA is expected to decrease compared to a rise more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than peers’ (NBR, PUMP, and OIS) average. So, the stock is reasonably valued versus its peers.

Final Commentary

Nine’s operations in the natural gas-heavy basins like Northeast, Haynesville, and the Eagle Ford are likely to witness low utilization, which can pull down its operating profit in the near term. Its cementing business has also been weak in recent times. However, this did not prompt any significant asset pullback from these regions. Rather, the company moved personnel to crude oil-rich areas like the Permian to exploit the activity growth. It also expects a recovery in natural gas prices in the medium term.

NINE has an asset-light business model, and diversity has allowed it to stabilize its top line. NINE’s cash flows deteriorated steeply in Q1 2024. Also, the stock is financially risky due to negative shareholders’ equity. The stock is reasonably valued versus its peers.