DVN Acquires Grayson Mill

On July 8, Devon Energy (DVN), one of the largest US energy producers and private operator Grayson Mill Energy, announced an agreement. DVN will acquire Grayson’s Williston Basin business for $5 billion. The transaction will be financed by $3.25 billion of cash and $1.75 billion of DVN’s stock. Following the news break on July 8, DVN moved by -1.1%. DVN primarily operates in Anadarko, Permian, Powder River, and Western Gulf, while Grayson Mill operates in the Williston Basin. The asset acquisition is expected to be completed by Q3 2024.

Production Growth Estimates

Assuming $80 per barrel of oil, the transaction was valued at ~4x EBITDAX (Earnings before interest, taxes, depreciation (or depletion), amortization, and exploration expense – a key metric for energy producers) and an estimated FCF yield (free cash flow per share) of 15%. Post-acquisition, DVN will have an average crude oil production of 375,000 barrels per day. Total production (crude oil, natural gas, and NGL combined) will reach an average of 765,000 oil-equivalent barrels (Boe) per day.

The asset acquisition in Williston will add 307,000 net acres to DVN’s acreage. The acquired property is expected to produce 100,000 Boe per day in 2025. These production activities will likely translate into $50 million in average annual cash flow savings through operational efficiencies and marketing synergies. In the Williston Shale Basin, Grayson operates in Three Forks and Bakken Shale, with 500 gross locations and 300 refrac opportunities. The company estimates that the acquired assets have an inventory life of up to 10 years.

Transaction Synergies

Besides the upstream opportunities, Grayson Mill also brings midstream infrastructure with 950 miles of gathering systems, disposal wells, and crude storage terminals. Midstream alone can add $125 million to Devon’s annual EBITDAX. At the time of the closing of the transaction, DVN’s net debt-to-EBITDAX ratio will be 1x. DVN can reduce its debt by $2.5 billion within the next two years by allocating up to 30% of its annual FCF. Plus, it will provide scope for forward integration through better pricing and multiple end-use markets. DVN had a total long-term debt of $6.1 billion as of March 31. Its debt-to-equity was 0.50 as of that date.

Based on the expected improvement in cash flows, DVN increased its share repurchase authorization by 67% to $5 billion through 2026. The acquisition is expected to be accretive to its dividend payout.

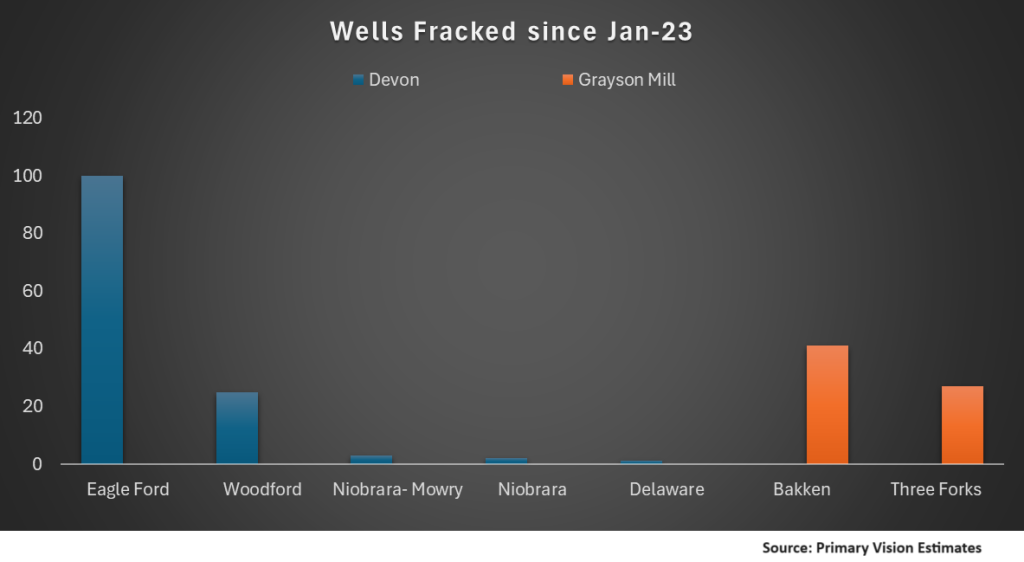

A Comparison of Shale Plays

Since 2023, Devon has been primarily active and fracked completion wells in the Eagle Ford, Woodford, and Niobrara, according to Primary Vision. Grayson Mill operated mainly in the Williston (Three Forks and Bakken). Devon’s leading well counts were in the Eagle Ford (100 wells), followed by Woodford (25). Grayson Mill has been a key fracker in Three Forks (41 wells) and Bakken (27) since 2023.

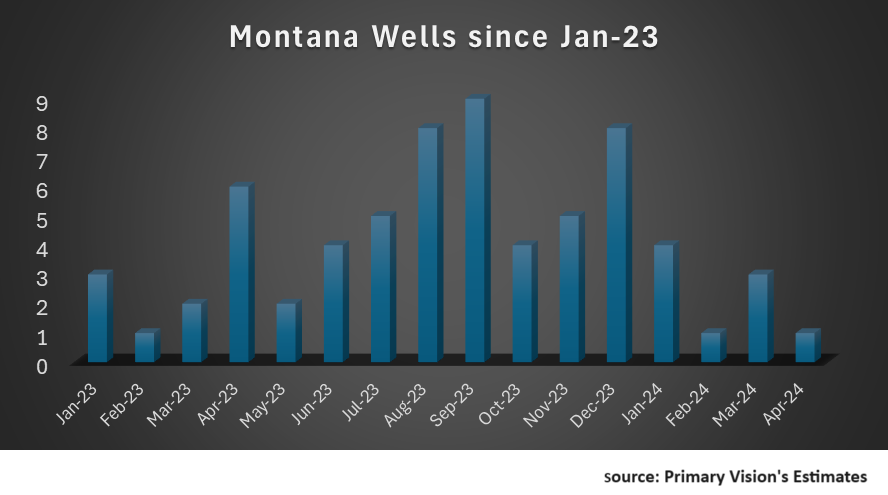

Interestingly, Grayson also operated in Montana, which does not fall under the key energy-producing states in the US. It shares borders with North Dakota, which houses the Williston Basin. In Montana, the total number of wells fracked by operators was steady at a low count in early 2023 but showed some growth in 2H 2023. According to the EIA, Montana holds less than 1% of the US total proved crude oil reserves. It has four refineries with a combined crude oil processing capacity of about 205,000 barrels per day.

Analyzing DVN’s Performance And Outlook

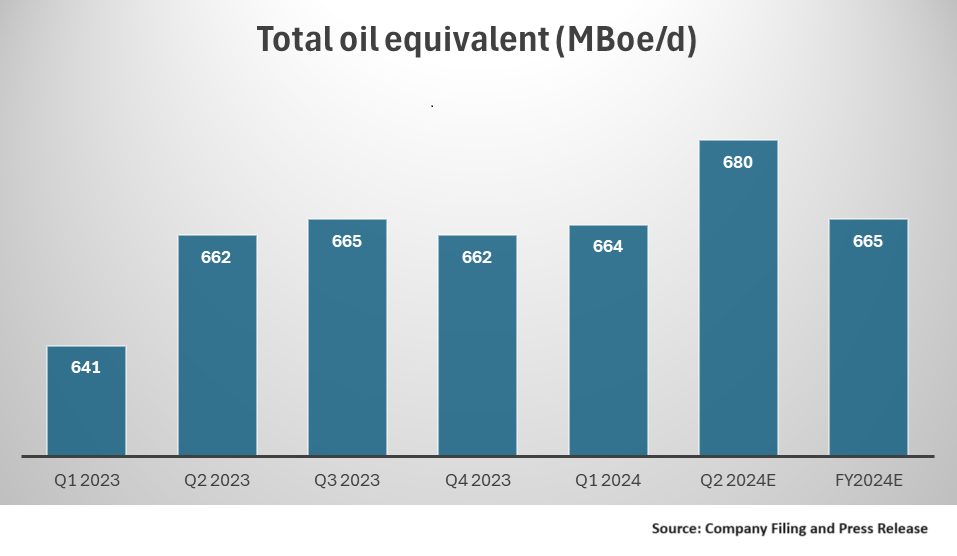

In Q1, DVN’s total energy production exceeded prior guidance by 4%, primarily led by a 5% rise in Delaware basin production. Year-over-year, the Delaware Basin well productivity increased by 20% in Q1. The Delaware Basin accounted for 66% of the companywide production. The company operated 24 drilling rigs and seven frac spreads across its operations. As a result, it placed 102 gross operated wells online. Despite the production stability, from Q4 2023 to Q1 2024, DVN’s revenues and EBITDAX decreased by 13% and 5%, respectively. During this period, its average realized prices (per Boe) declined by 3%.

In Q2, DVN expects total energy production (MBoe/d) to increase by 2%. This incremental production would be achieved without increased capital spending as a testimony to its increasing efficiency. In FY2023, its capex decreased by 23%. In FY2024, the company projects capex to decline further by 13%. However, much of the capex is geared at 1H 2024, and the front loading can lead to a rise in production in Q2, although lower capex in 2H 2024 can lower production in the second half, resulting in 2024 production remaining unchanged.

Relative Valuation

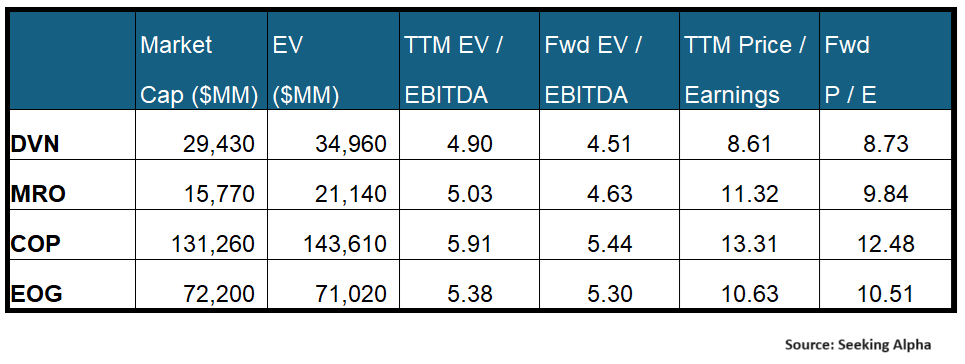

DVN’s forward EV/EBITDA multiple versus the current EV/EBITDA is expected to contract more sharply than its peers. This implies that Devon’s EBITDA is expected to rise more sharply than its peers in the next year. This should typically result in a higher EV/EBITDA multiple than its peers. However, DVN’s EV/EBITDA multiple (4.9x) is lower than its peers’ (MRO, COP, and EOG) average. So, DVN appears to be undervalued compared to its peers. COP’s current EV/EBITDA multiple is at a discount to its five-year average.

What’s The Take On The Acquisition?

The acquisition will bolster DVN’s Williston Basin operations, tripling in-basin production and increasing basin acreage by 2.5x. Because Grayson Mill has a more balanced oil-gas production ratio, the proforma company’s oil-gas mix will fall from 62% (for DVN) to 57%. Not just in production, Grayson’s exposure to the midstream sector will uplift the merged company’s margin as the midstream business adds $125 million in EBITDAX annually. With 10% cash flow per share growth and 15% improvement in FCF generation, the transaction will be accretive to share buyback capabilities and dividend payout. As of March 31, DVN has increased authorization of share repurchase by 67% to $5 billion. It has also initiated a debt reduction program amounting to $2.5 billion, targeting to bring net debt/EBITDAX to less than 1x.

But Devon’s performance has been under par in recent times. Although its oil equivalent energy production has remained tight since 2023, it did not translate into resilient financial performance. In fact, its revenues and EBITDAX fell in Q1 2024 compared to a quarter earlier. One of the reasons for the deterioration is the fall in natural gas prices. Now, with even higher exposure to natural gas prices from Grayson’s natural gas-heavy Basins, its near-term performance looks slightly vulnerable. Also, the company’s capex declined significantly in 2023 and will likely fall further in 2024. So, we think the acquisition has to go through a lean patch even though the quality of the assets acquired appears robust and should boost Devon’s performance in the medium-to-long term.