The latest data from the International Energy Agency (IEA) reveals a complex picture for the global oil market, projecting lower demand growth and highlighting significant headwinds. According to the IEA’s monthly report, oil demand is expected to grow by 970,000 barrels per day in 2024 and 980,000 barrels per day in 2025, down from previous estimates of 1 million barrels per day. The slower growth is attributed to subpar economic performance, increased efficiencies, and the ongoing shift towards vehicle electrification.

In the second quarter of 2024, oil demand increased by 710,000 barrels per day year-over-year, marking the slowest growth since late 2022. Notably, China, a crucial market for global oil consumption, saw its consumption levels in April and May dip below those of the same period last year. This decline reflects the end of the country’s post-pandemic rebound and signals potential future demand challenges.

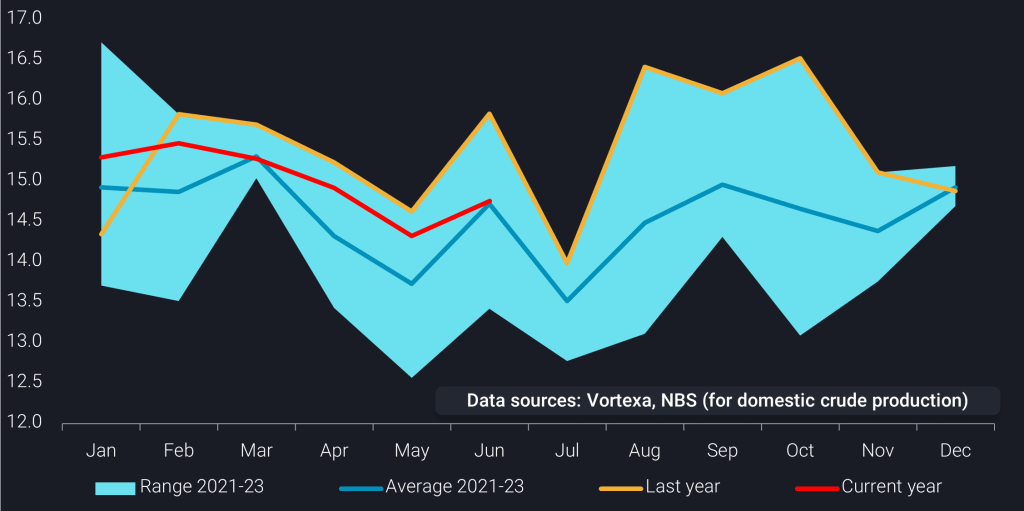

Despite the deceleration in demand, oil production continues to rise. Global supply increased by 910,000 barrels per day in the second quarter, driven primarily by non-OPEC+ producers like the U.S., Canada, Brazil, and Guyana. The IEA forecasts a further production increase of 770,000 barrels per day in the third quarter, with the U.S. leading the growth. This trend is expected to continue into 2025, with an average production growth of 1.8 million barrels per day, outpacing the demand growth and potentially leading to oversupply.

The global oil prices reflected these dynamics, with Brent crude averaging $85.15 and West Texas Intermediate (WTI) at $82.07 as of early July. Prices had recovered from six-month lows in June, bolstered by statements from OPEC+ officials about maintaining production cuts and ongoing geopolitical tensions. Despite these price recoveries, concerns over the health of the Chinese economy and the overall global demand for oil persist.

Oil inventories also rose, with global observed oil inventories increasing for the fourth consecutive month in May, reaching their highest levels since August 2021. Offshore inventories decreased, but onshore stocks built up significantly, hitting a 30-month high. Preliminary data indicates a drop in global oil stocks by 18.1 million barrels in June, dominated by crude oil drawdowns.

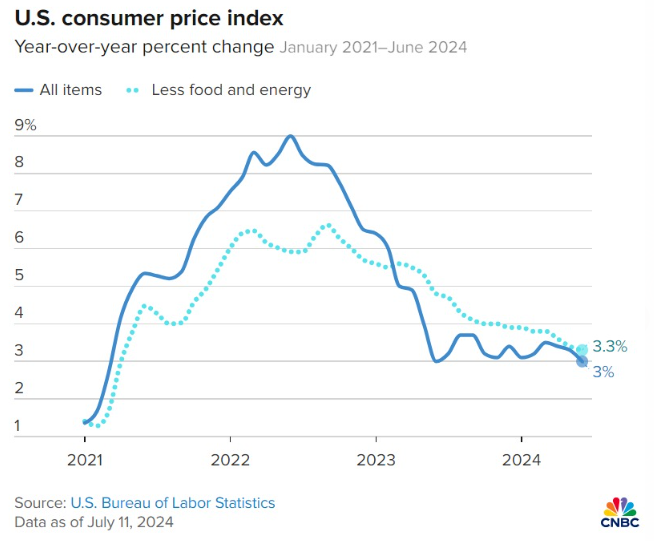

Turning to the U.S. market, recent Consumer Price Index (CPI) data offers a more optimistic view. The CPI fell by 0.1% from May to June, marking the first month-on-month decline since May 2020. This decline helped slow the annual inflation rate to 3%, down from 3.3% in May. Falling gas prices and drops in new and used car prices were major contributors to this decrease. The core CPI, which excludes energy and food prices, also slowed, rising just 0.1% from May, its slowest pace since August 2021. This moderation in inflation bolsters hopes for potential Federal Reserve rate cuts in the near future, which could alleviate borrowing costs.

Despite these encouraging signs, the broader economic sentiment remains cautious. Wall Street is increasingly confident that cooling inflation will allow the Federal Reserve to cut interest rates, possibly as early as September. However, the risk of a hard economic landing remains if the rate cuts do not materialize or if inflation pressures resurface.

The IEA’s report underscores the challenges and opportunities in the global oil market. While demand growth is slowing, supply continues to expand, driven by significant increases in production from the U.S. and other non-OPEC+ countries. The complex interplay of these factors, coupled with geopolitical tensions and economic uncertainties, will continue to shape the global oil landscape in the coming years.

The latest CPI data in the U.S. offers a glimpse of relief from the inflation pressures that have dominated the economic narrative for the past three years. However, the path forward remains uncertain, with the potential for further economic shifts as global and domestic factors play out. As always, close monitoring and strategic responses will be key to navigating this evolving landscape.