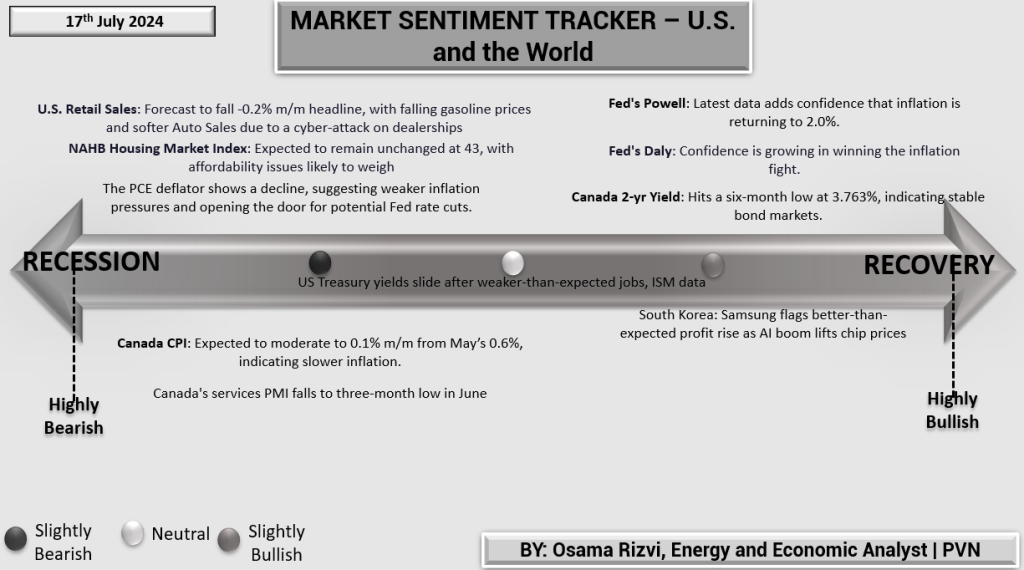

U.S. and the World

The U.S. economic landscape shows signs of strain. Retail sales are forecasted to fall by 0.2% month-on-month, impacted by lower gasoline prices and a cyber-attack affecting auto dealerships. The NAHB Housing Market Index remains at 43, reflecting ongoing affordability challenges. A decline in the PCE deflator indicates weaker inflation pressures, potentially opening the door for Fed rate cuts. U.S. Treasury yields have slipped following underwhelming jobs and ISM data. Canada’s CPI is expected to slow to 0.1% month-on-month from May’s 0.6%, and the services PMI has hit a three-month low in June. However, there are positive signs: Fed officials, including Powell and Daly, express growing confidence in achieving the 2.0% inflation target. The Canadian 2-year yield at a six-month low of 3.763% suggests bond market stability, while South Korea’s Samsung reports a robust profit increase driven by the AI boom in chip prices.

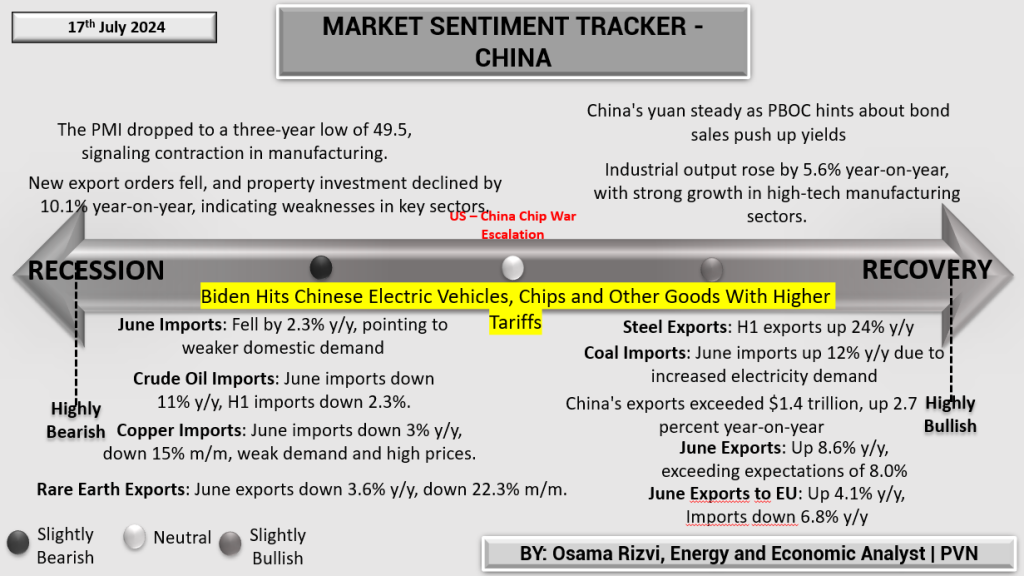

China

China’s economic indicators reveal a mixed scenario. On the downside, the PMI dropped to a three-year low of 49.5, indicating a contraction in manufacturing. New export orders and property investments declined by 10.1% year-on-year, reflecting weaknesses in key sectors. E-commerce sales fell during the 618 festival, and consumer confidence remains subdued. June saw a sharp decline in crude oil imports by 11%, and significant drops in copper and rare earth imports due to weak demand and high prices. Conversely, there are bullish signs: industrial output rose by 5.6% year-on-year, driven by high-tech manufacturing. Fixed-asset investment increased by 4% in the first five months of 2024, underscoring ongoing infrastructure development. China’s exports exceeded $1.4 trillion, growing by 2.7% year-on-year, indicating robust external trade activity.

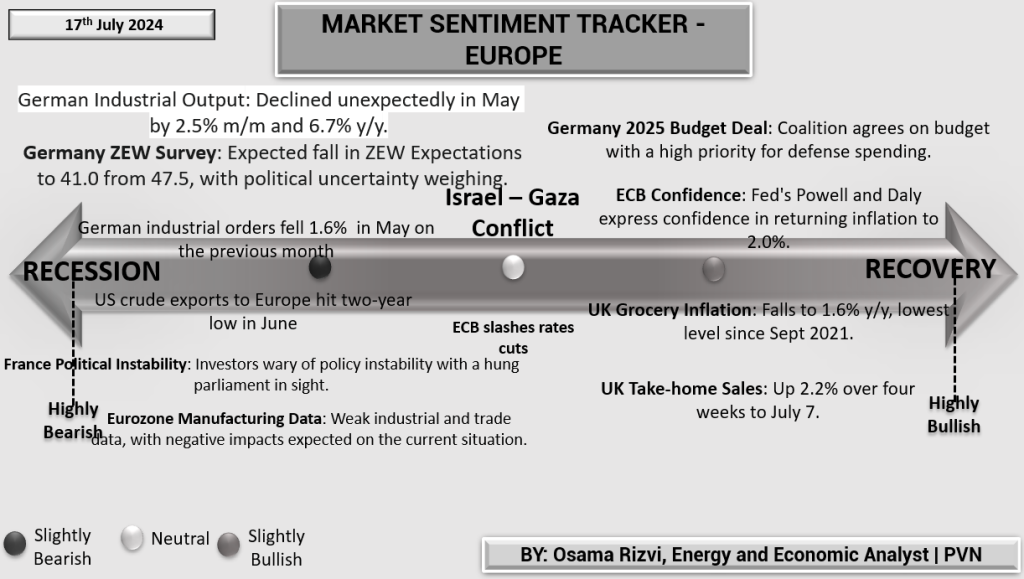

Europe

The Eurozone exhibits a complex economic picture. Germany’s industrial output declined unexpectedly in May, falling by 2.5% month-on-month and 6.7% year-on-year. The ZEW Survey predicts a drop in expectations to 41.0, influenced by political uncertainty. Industrial orders in Germany also fell by 1.6% in May. France faces political instability, with investor concerns about policy volatility. Despite these challenges, there are positive indicators: the Eurozone’s economy saw its third consecutive month of rising business activity, with the PMI reaching a 12-month high. Business confidence hit a 27-month high, suggesting optimism about the economic outlook. The ECB remains confident, with Fed’s Powell and Daly expressing assurance in achieving a 2.0% inflation rate. UK grocery inflation fell to 1.6% year-on-year, the lowest since September 2021, and take-home sales increased by 2.2% over four weeks to July 7.

These indicators reflect a world economy grappling with varied challenges and opportunities. The economy is still on weak footing. The direction of global monetary policy will truly determine the trajectory of the economy.