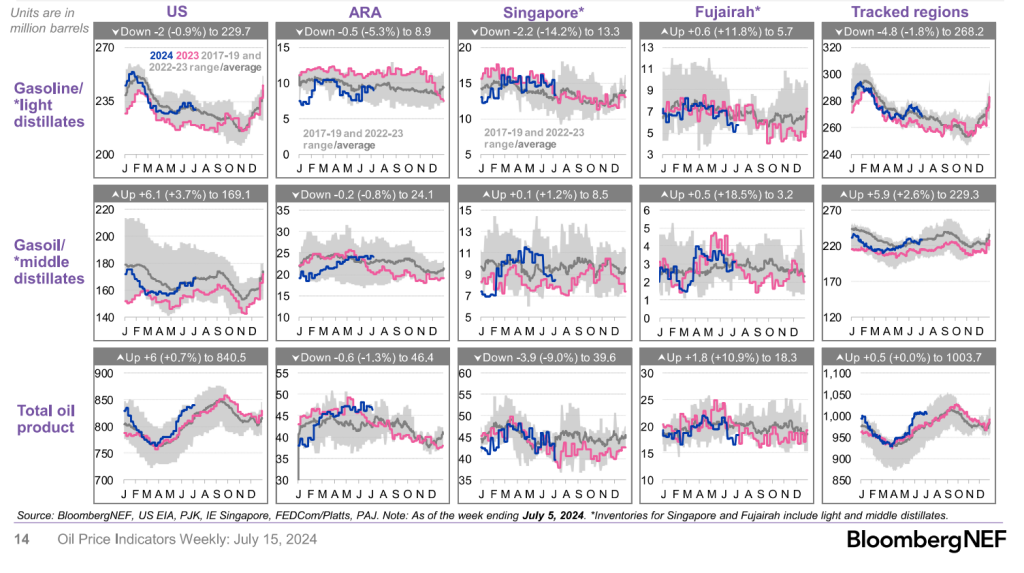

The energy markets remain mixed with some positive hope for a strong driving season and growing Chinese demand while the physical market softened a bit. Refined products have been struggling around the world, but the market is finally catching up to the oversupply. Russia has been pushing more into storage as crack spreads shifted lower again. The U.S. has been the strongest region for cracks, but they have fallen to the lowest level in six months. This should be the STRONGEST period of the year, but instead we are seeing a lot of weakness across the board. Refined products are well above last year and closer to the seasonal average. Crack spreads are weakening as builds persist, which will reduce broader run rates. We’ve already seen run rates diminish in key areas, and this will persist well into August pushing additional economic run cuts and early turn arounds. The reduction of refinery throughput will leave more crude in the water and storage.

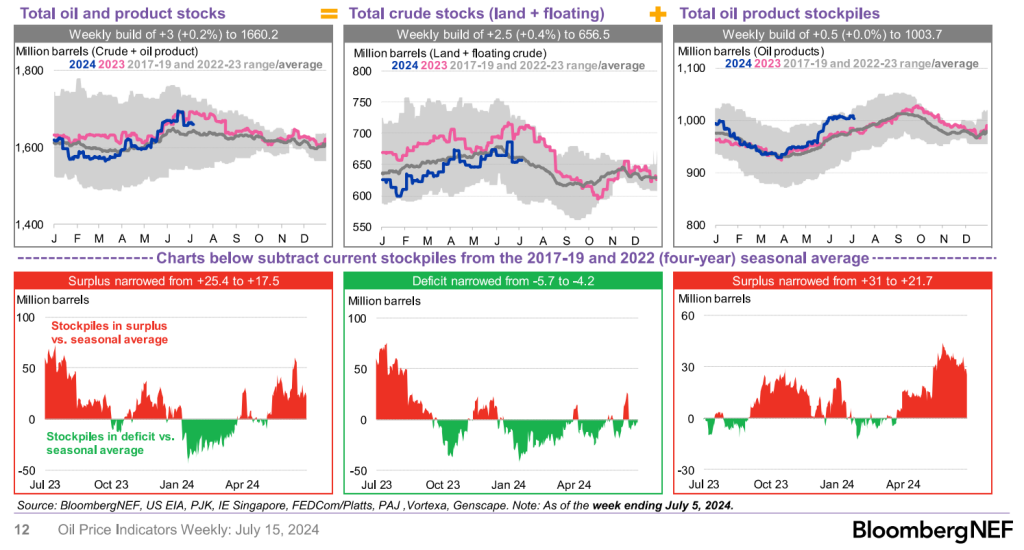

Floating crude and crude in transit has remained elevated as total oil products around the world shift higher once again.

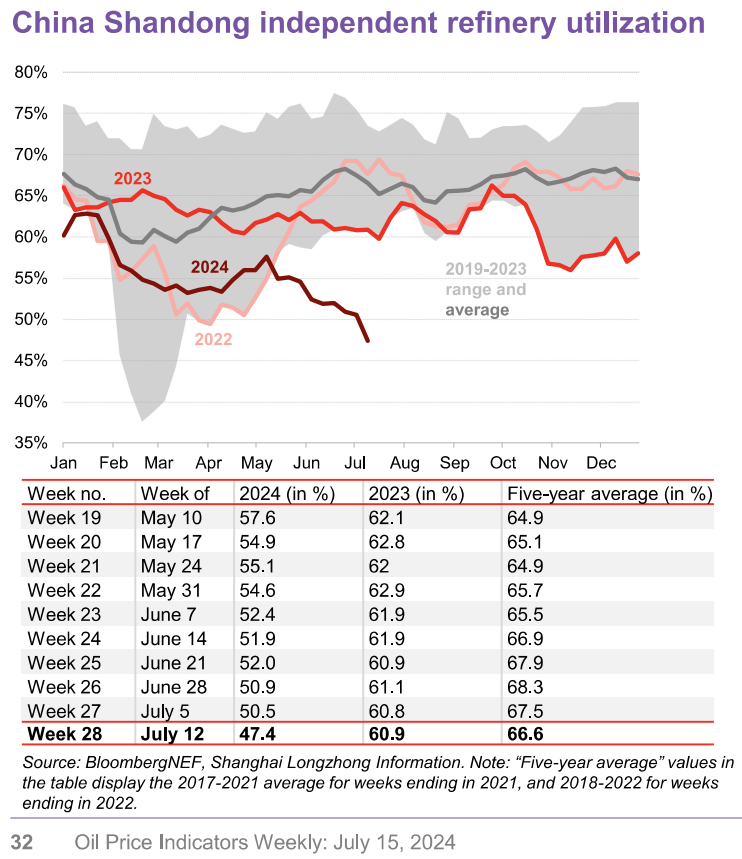

Refinery run rates in China have hit a new seasonal low, and there is little we see showing an adjustment is on the horizon.

Instead, demand is following 2023 movements, but I expect to see China hold to the current 2024 levels. I don’t think there will be the same decline as last year, but I also don’t see the same increase as we’ve seen in previous years as we head into Sept/Oct.

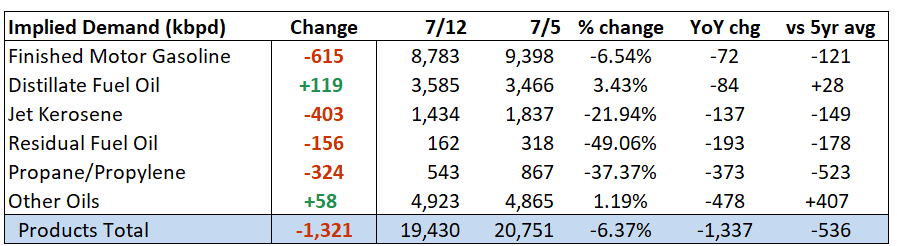

The U.S. isn’t consuming anything close to what it has in the past across gasoline and other mobility fuels. Our gasoline consumption should be averaging 9.5-9.6M barrels a day with spikes to 9.8-9.9. Instead, we are averaging something well below 9M barrels a day.

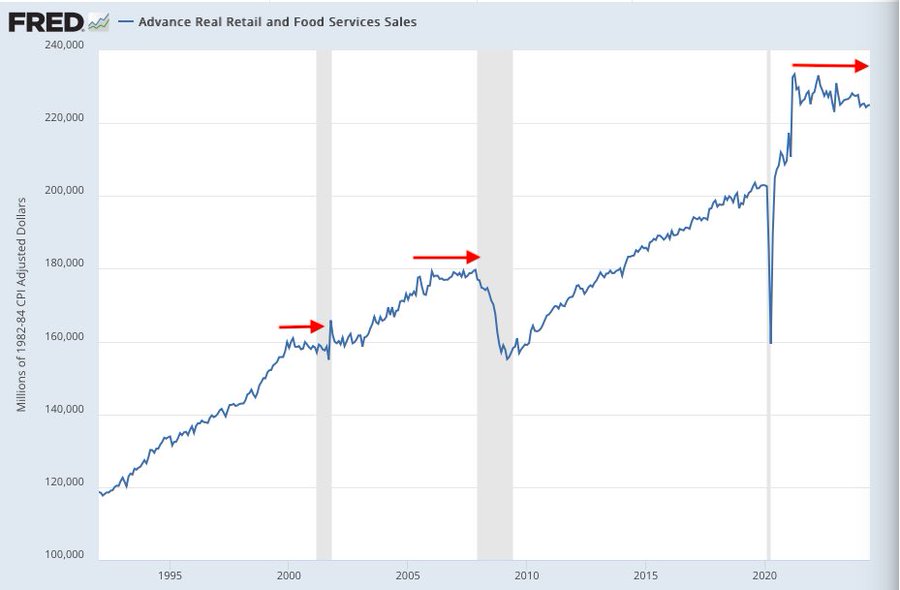

The below chart helps put into perspective where we sit versus the pre-covid levels.

As we Patrick De Haan from GasBuddy put it: “Reality: we’re in peak gasoline demand season and we’re failing to hit 9 million barrels of gasoline demand per day, and according to GasBuddy data, have hit that level just ONCE this year.” Remember- the implied demand number is just looking at blenders releasing barrels to retail- so it’s less retail facing as GasBuddy. If you smooth out the 2024 numbers, it would be very similar and is tracking exactly what we predicted- gasoline demand would struggle to break 9M barrels a day.

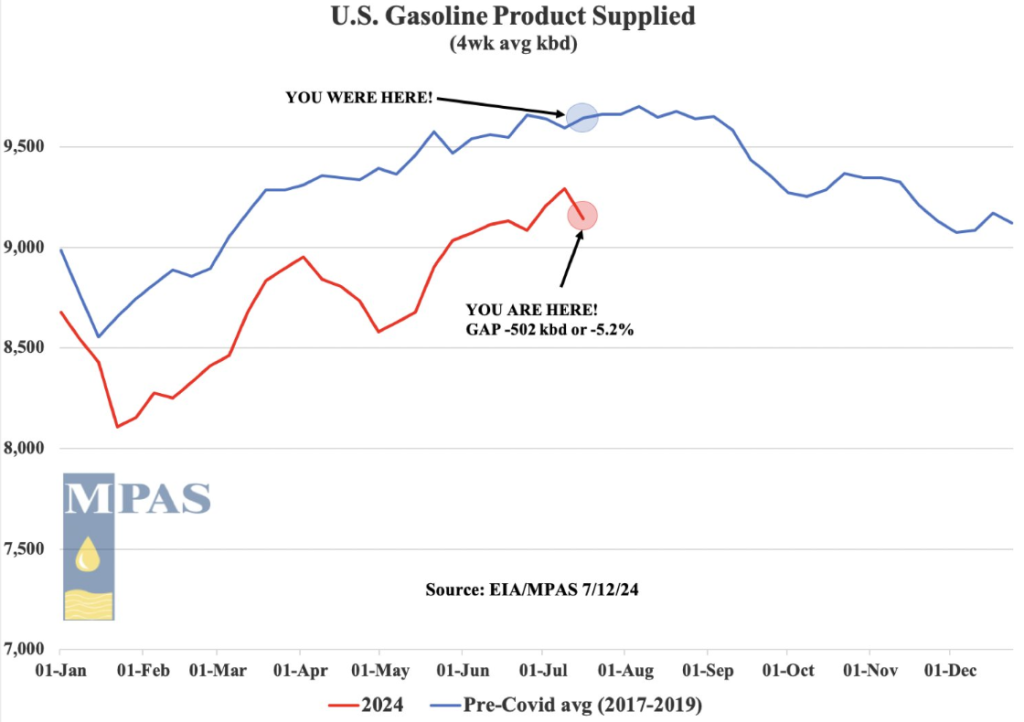

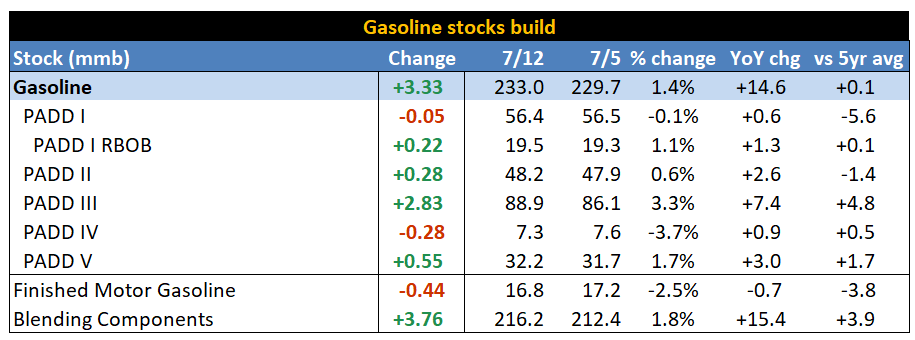

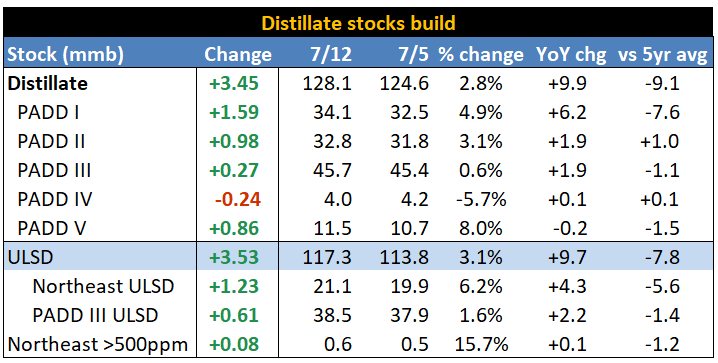

This has resulted in a sizable build across all products, and as exports struggle and imports ramp- we will see bigger builds across the product landscape. This will force more refinery run cuts and sooner and impact broader demand for crude.

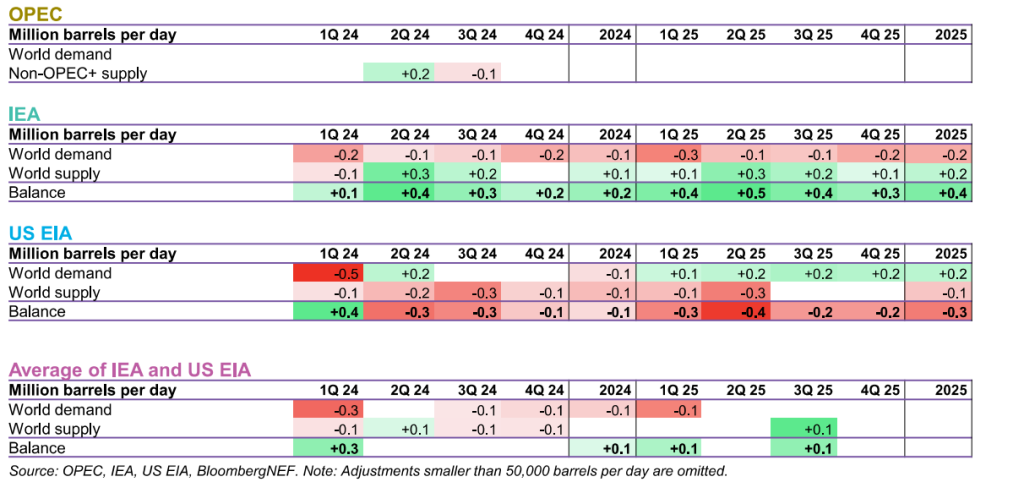

The shifts in the refining market are going to leave more crude in storage, which is going to be a problem for year-end storage estimates. Many companies believed Q3’24 was going to see strong demand, which would help draw down excess volumes in the market. The shift in demand is going to flip the storage estimates into positive territory as we approach August. We ‘ve already seen some sizeable revisions for Q1 that showed a sizeable drop in demand, which I believe carries through Q2/Q3 at the least. This will leave a positive balance.

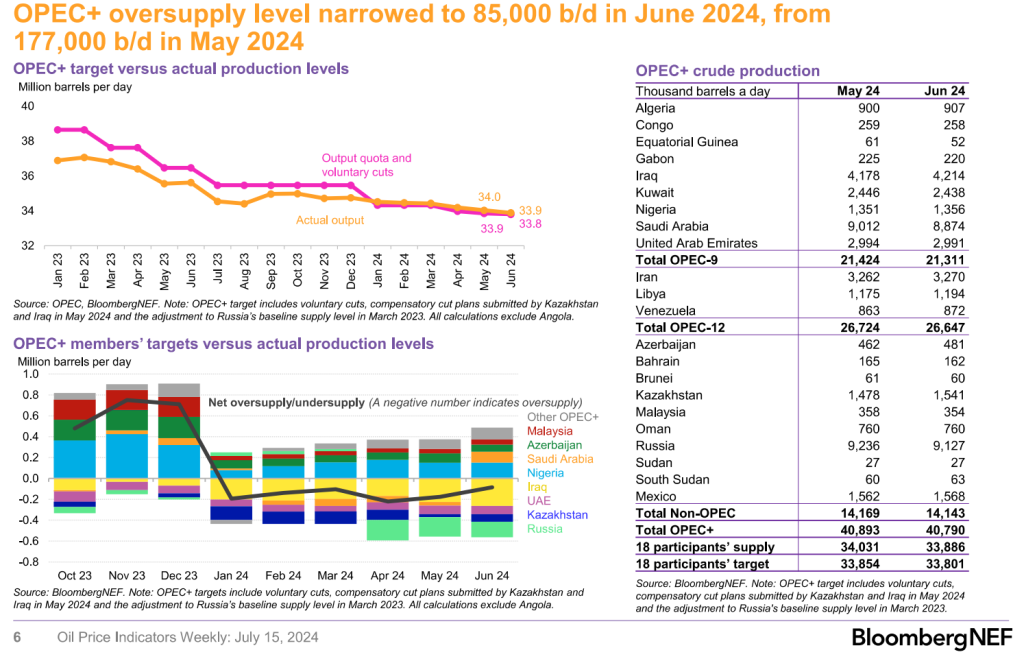

Production from some of the OPEC+ nations has slowed, but we’ve still seen a sizeable amount of crude and refined products hit the market. There’s been an increase in regional power burn across the Middle East, and an increase in refinery run rates in Russia shifting the exports from crude to refined products- specifically distillate. Iraq sales have slowed a bit as KSA cut OSPs, but even with the reductions- there’s still production over current negotiated levels. There’s also been a sizeable increase in product exports, which has led to the sizeable oversupply of product in the market.

North Sea: Forties slips on sale. Total Energies sold Forties to Chevron Aug 2-4 at dated Brent plus 90 cents. Equinor bid Forties Aug 13-15 at dated Brent plus 60 cents. Forties was last sold by BP to Gunvor on Wednesday for a cargo Aug 4-6 at dated plus $1.00.

West Africa has seen a lot of weakness from June into July, and our view was that prices would fall to clear the excess. Now that some of Nigerian has moved, we are seeing prices stabilize a bit. Given the overhang heading into August, it’s unlikely to see an increase, but the market has found a comfortable clearing price at the moment to get the crude into the market- especially Angola into Asia (China).

WAF: The differential is stabilizing on Monday as Angolan crude for August-loading finds buyers. Around 11 cargoes of August-loading Angolan crude remain unsold, down from Friday’s estimate of at least 15 in a slow-selling month as Chinese buying remains muted.

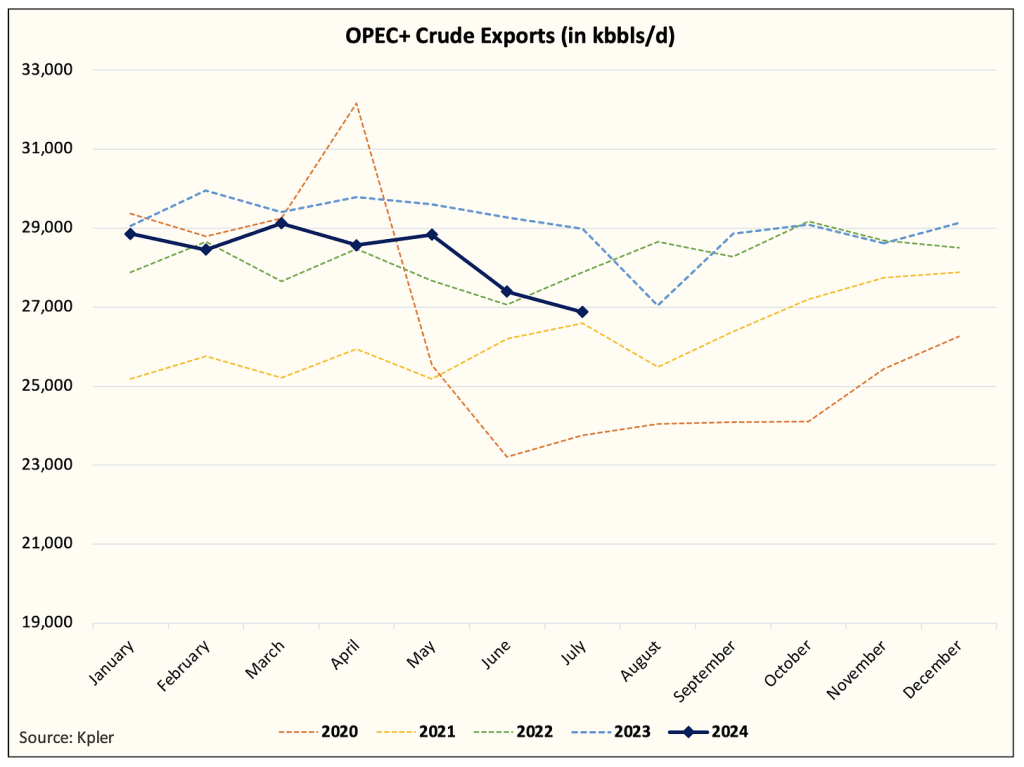

Saudi Aramco cut OSPs to Asia in order to accelerate some crude moves, which is so far playing out. Saudi Aramco’s August allocation to Chinese refiners is likely to be similar to May, rebounding from June/July levels. So far. Rongsheng and Sinopec increased their allocation versus July, which will see August coming in stronger. The below chart shows how crude exports from OPEC+ countries have slowed, but based on the Russian data and KSA sales- this should see a bounce in August.

Even as some things improve on the crude side, the refined products market still remains very oversupplied with more product flowing into storage from Russia. They’ve been sending even more ULSD into storage across Singapore and West Africa. A lack of demand in West of Suez markets also pushed more flow from Russia into Asia, and with the current arbs, it’s unlikely to see a shift.

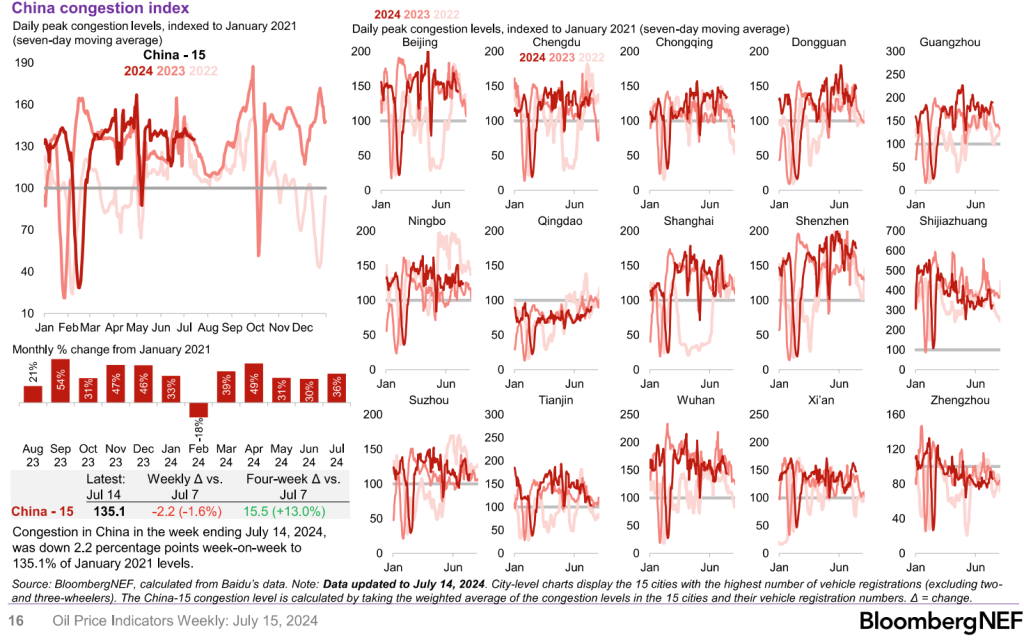

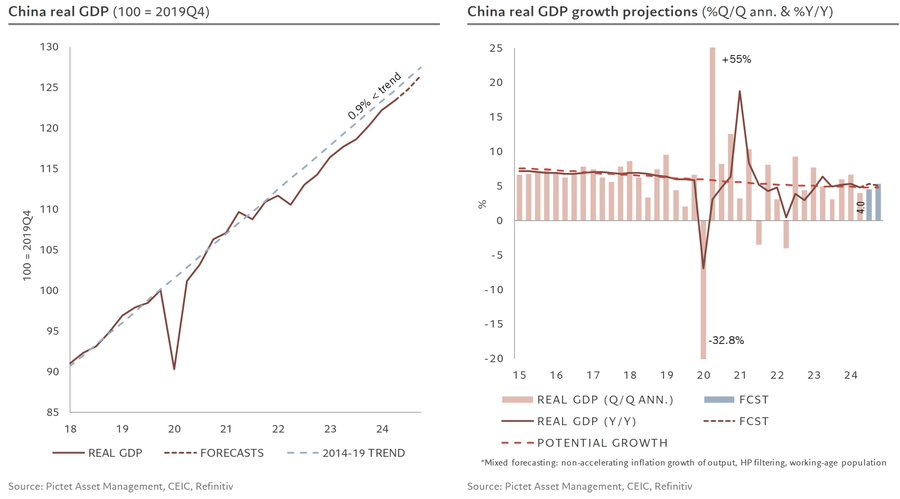

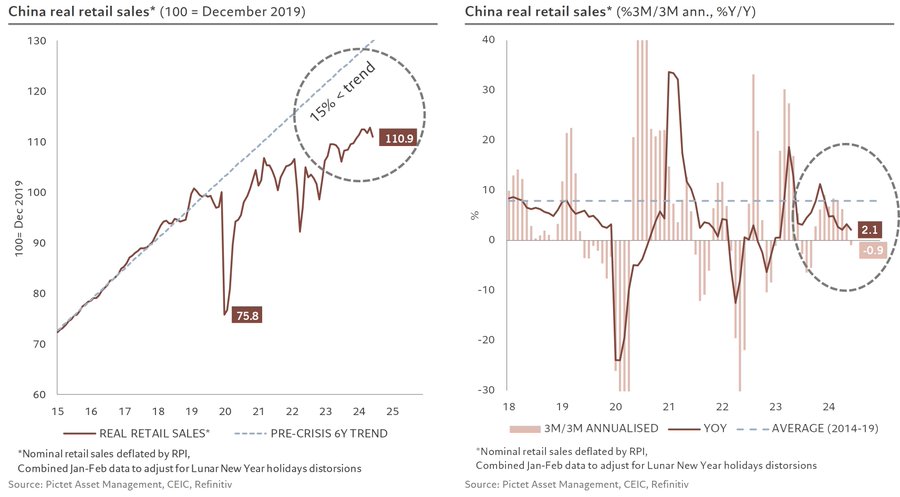

The Chinese data came in much weaker than expectations, and I don’t see much to turn the tide higher over the next few months.

- China‘s GDP grew 4.7% y/y in Q2, vs previous 5.3%, expected 5.1%

- China‘s retail sales grew 2% y/y in Jun, slowing from prev 3.7%, vs expected 3.3%

- Industrial output grew 5.3% y/y in Jun, slowing from prev 5.6%, vs expected 5%

- Fixed-asset investment grew 3.9% y/y in Jan-Jun, in line with expectation, vs 4% for Jan – May

I think Michael Pettis (@michaelxpettis) does a great job of breaking down the issues in the recent Chinese data. I’ve done countless shows and insights regarding the problems of slowing imports and what that means for the future of exports. The local economy/consumption continues to be a problem so China turns to the export market. The retail sales data showed just how weak spending is internally, which was also confirmed by the CPI data.

The export focus is also becoming more politically charged as countries talk about tariffs and other measures to limit Chinese exports. This is a growing problem as the CCP focuses on the “wrong” part of the economy. They are tripling down on the industrial/infrastructure complex with a focus on exports and not driving local consumption.

“It’s hard to find anything good in today’s data release, but I think much of this was prefigured in Friday’s trade data. While most analysts saw trade as “mixed”, with China’s higher-than-expected exports in June as a good thing and its lower-than-expected imports as a bad thing, I argued that what really mattered was the sharp decline in imports, which in turn was what drove the surge in exports. If you produce more than you can absorb domestically, you have no choice but to export the rest.

The terrible import numbers (along with June’s CPI deflation) were reflected in today’s retail sales numbers, which were up year on year in June by a very disappointing 2.0%. This compares with an unexpectedly high 5.3% increase in industrial output. It is clear that China continues to place all its focus on boosting the supply side of the economy, even as the demand side becomes a bigger and bigger drag on growth. We saw this in today’s GDP numbers. Q2’s GDP grew a very disappointing 4.7% year on year, It grew by 0.7% quarter on quarter, which is an annualized 3.1%. As usual, it’s worth reminding that what matters in China is not the extent of GDP growth but rather its quality, for which the consumption and business investment share is a proxy.

The data released today (and over all of 2024) suggests that the quality has been low, especially the consumption share. Business investment was a little better, but driven mainly by surging exports, which are becoming an increasing concern for the rest of the world. By now most economic advisors in China recognize the problem, and are proposing or recommending demand-side solutions, but this is proving to be much harder than expected. For now Beijing seems to have neither the institutional ability nor the political will to implement the income redistribution that will be required to raise the consumption share of GDP sustainably. Until that happens, China will still be dependent on non-productive investment and an increasingly-resented trade surplus to drive growth.

But there is something they can do. In March I argued that Beijing would have little choice this year but to engineer a fiscal boost to consumption. Most analysts disagreed, saying this could never happen because Xi is unalterably opposed to any form of “welfarism”. I argued however that while this kind of stimulus isn’t sustainable, Beijing would have no other way to meet the 2024 GDP growth target, and so we would likely see this fiscal boost in Q3 or early Q4. I think the likelihood of that happening has become stronger than ever.”

China’s Q2 econ data was bleak.

Per data released by the stats bureau (NBS) on Monday:

- Real GDP grew 4.7% y/y in Q2, down from 5.3% in Q1

- On a seasonally adjusted quarter-on-quarter basis, GDP grew a shoddy 0.7%, the slowest q/q growth rate since zero-COVID ended in late 2022

We’re not just concerned about sluggish growth, but also low-quality growth.

- China’s supply side comfortably outstripped domestic demand, with industrial value-added growing 6.0% y/y so far this year, while retail sales rose just 3.7%.

- Meanwhile, the NBS consumer confidence index has fallen to its lowest level in 10 months.

- And the contribution of final consumption to GDP growth in Q2 – including government and private spending – fell from the previous quarter.

Weak demand means economy-wide prices are falling, hammering GDP growth in nominal terms.

- Nominal GDP – which incorporates price effects – only grew 3.97% y/y in Q2.

- This is the fifth consecutive quarter that nominal growth has remained below real growth.

The NBS doesn’t publish data for quarter-on-quarter nominal growth – but given the GDP deflator was negative, it’s likely that q/q nominal growth was flat.

- Let that sink in: Between Q1 and Q2, the economy likely didn’t grow in nominal terms.

- Get smart: It’s clear long-term weakness in consumption, consumer confidence, and the property sector will not be resolved without a bigger, more comprehensive policy support package.

The most important point of the above is the fact that there was likely NO GROWTH in nominal terms from Q1 to Q2. This comes at a time as product demand points to more unseasonable slowdowns.

Retail sales volumes contributed to the slowdown, as they contracted in June, leading to a Q2 contraction of 0.9% q/q ann. This is a pivotal segment for the future growth of China that was faltering well before COVID as you can see throughout 2019.

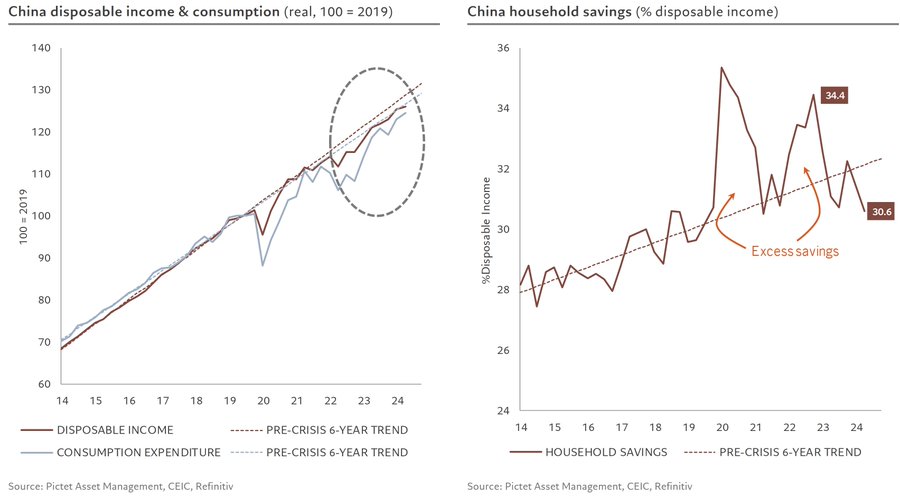

There are still some bright spots- specifically around services that are the main driver of consumption. That said, total consumer spending, which includes services, continues to be the main driver of Chinese activity, evolving only a few 2% below its pre-pandemic trend, with growth for the quarter of 4.8% ann., albeit decelerating sharply since Q1 (13%).

China did see some reduction of “excess savings,” but these are still overstated because it doesn’t reflect the losses from real estate. It also shows that the market isn’t offering the “deals” people need to spend. Instead, they had to pull out of savings to do various activities and cover expenses.

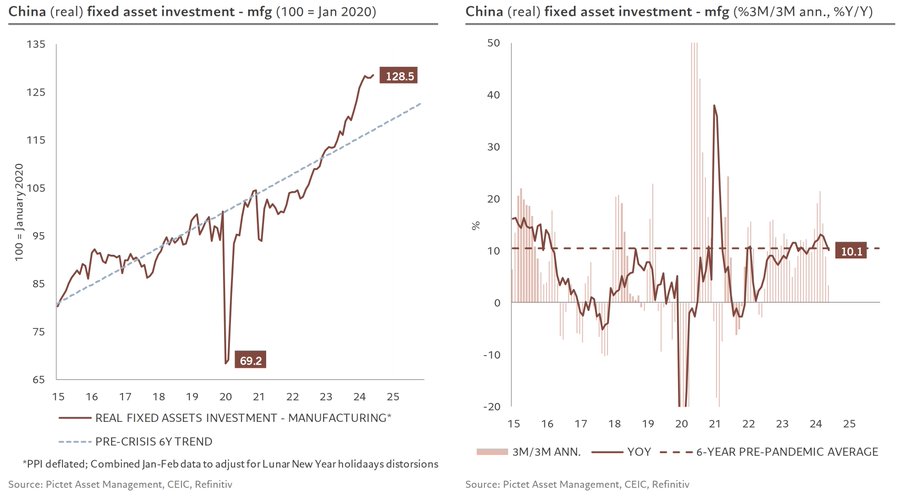

The CCP and PBoC continue to only focus on real investment by way of infrastructure and industrial. This is a very tired playbook that is experiencing the brunt of the “Law of Diminishing Returns.” We aren’t seeing the same uplift to the economy as once before even as investment has accelerated in a huge way. The below chart puts into perspective just the amount that has been invested over the last few years without seeing a positive change in the real estate or consumer markets. Real investment spending continues to be largely driven by the manufacturing sector, particularly in the renewable energies sector, even though growth in this sector also slowed during Q2.

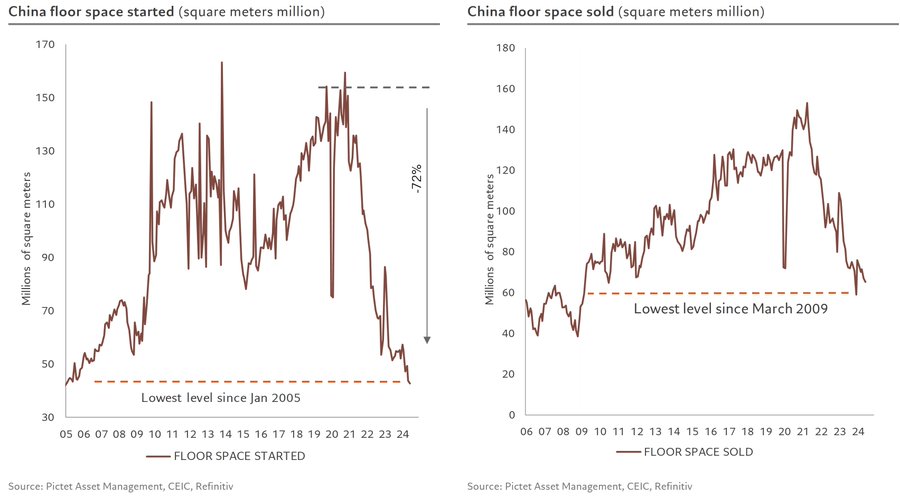

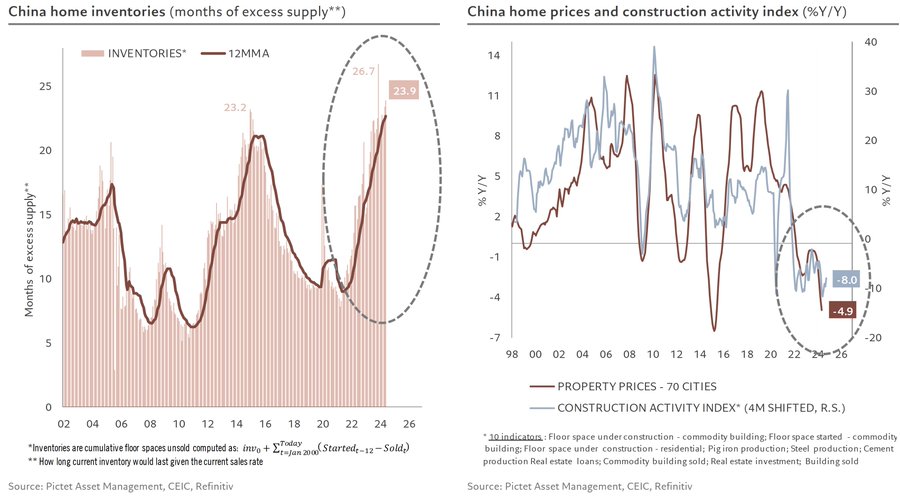

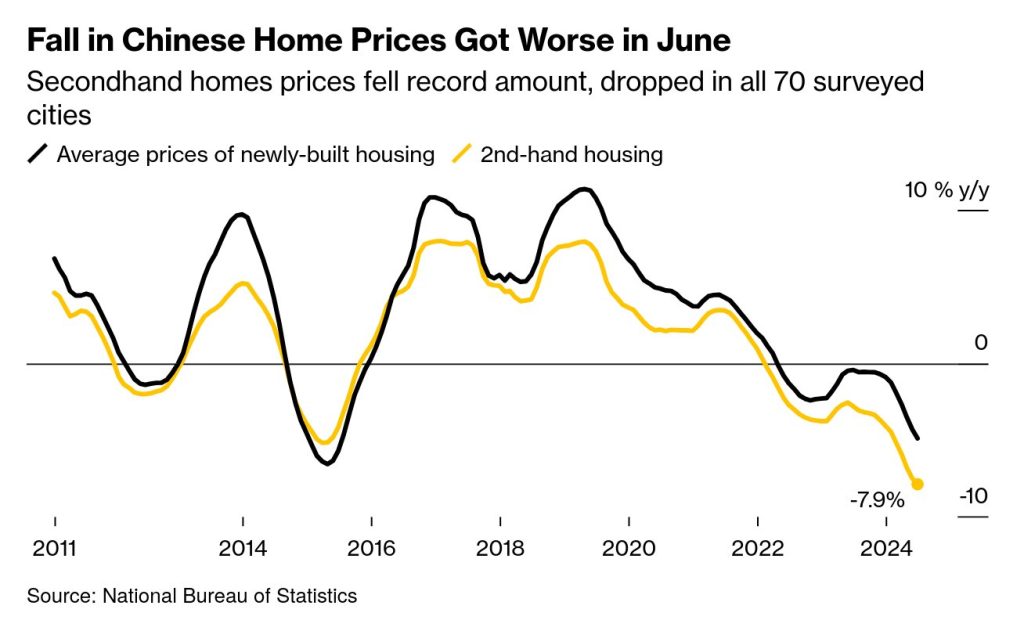

The CCP and PBoC have tried to drum up support in the real estate sector, but the overbuild is just far above what can be absorbed. We’ve said the real estate sector was facing structural problems, and there was going to be significant pain to clear up the issues. “Despite a series of support measures in recent months, the real estate market still shows no signs of stabilizing. On the contrary, the supply of residential space has fallen to new lows since January 2005, while demand has fallen a little further.

As a result, unsold floor spaces remain high at nearly 24 months at current sales rates and continues to weigh on house prices, whose contraction of 4.9% y/y continues to follow our construction activity index, whose y/y contraction is still significant but is narrowing.

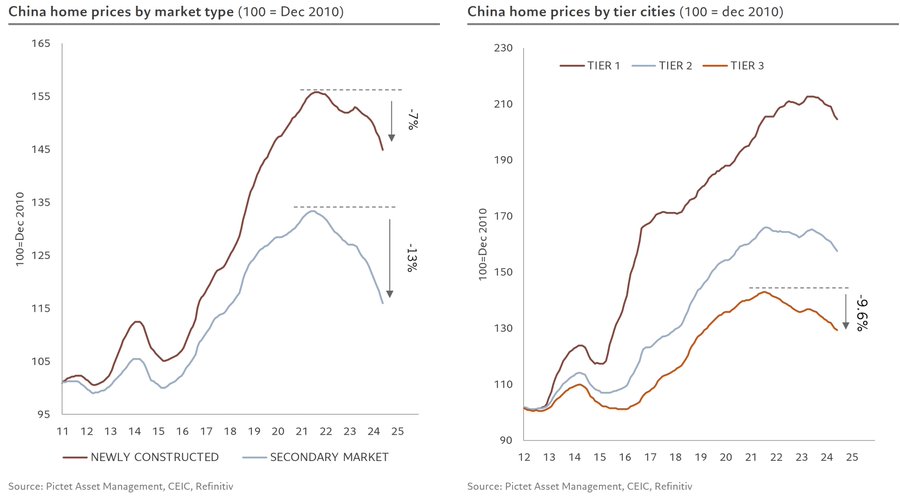

The fall in property prices has been broadly based, and remained most pronounced in the secondary market (-13% since the peak) and tier 3 cities (-9.6%).

The below chart gives a slightly different look at home prices when reviewing new and constructed. It gives a slightly better view:

The economic concerns have expanded into the Plenum communique, which means there will be more to come in the next few weeks. The CCP is turning even more attention to the issues, which isn’t surprising but the question becomes- “what will they do about it?” Here is a good breakdown from Trivium:

The communique contained no major surprises or indications of any earth-shattering reforms.

Hope is not lost: Don’t read too much into the communique.

- These documents tend to not be very illuminating.

- The Plenum “decisions,” which will be released in the coming days, will provide us the important details on where Xi Jinping plans to take the economy over the next decade.

This is interesting: The communique discusses the current state of the economy. Specifically, it says:

- “The plenum analyzed the current situation and tasks, and emphasized that [we must] unswervingly realize the annual economic and social development goals.”

That’s weird: Plenums are about planning for the medium and long term. Discussing the short term outlook marks a major departure from past plenums.

Our take: The leadership is clearly worried about the still struggling economy.

- That means we could see more aggressive policy interventions coming out from the econ-focused Politburo meeting at the end of the month.

Don’t forget 2013: When the 2013 Third Plenum communique was released, the disappointment was palpable.

- When the 2013 decisions were released a few days later, the breadth and ambition of the proposed reforms took everybody by surprise.

We could very well see the same thing happen again this year.

In the meantime, we do have some initial reactions to the communique.

First, we were struck by the fact that the top leadership discussed the current state of the economy at the Plenum. That is unprecedented, and indicates to us that the leadership is increasingly worried about the struggling economy.

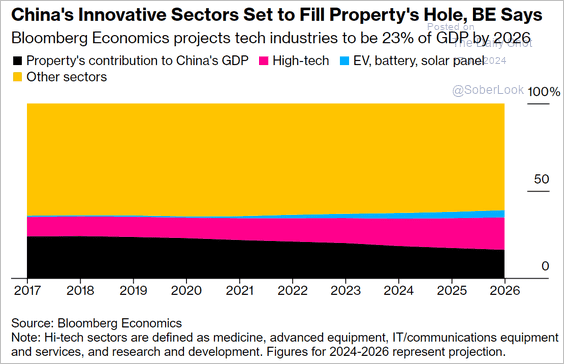

Second, developing technological capabilities is the alpha and omega of economic policy. Compared to the 2013 reform plan, the new reform plan adds an entirely new section on boosting the country’s ability to innovate.

Third, national security is also increasingly top of mind for the leadership. The new reform plan will also contain a new section on “modernizing the national security system.”

Fourth, fiscal reforms may not be as extensive as anticipated. Whereas fiscal reforms got their own dedicated section in the 2013 reform plan, in the current plan they are just a subsection of a broader section on improving macroeconomic management.

Fifth, reforms to elevate the private sector didn’t happen. Despite intense lobbying over the past year to end the distinction between the private and state-owned sectors (thus giving them equal status), the communique makes a clear distinction between the “public economy” and “non-public economy.”

Sixth, China remains pro-trade and pro-globalization. Despite rising protectionism in most advanced economies, the communique indicates that China will further liberalize its trade and investment regimes.

Get smart: The communique does not indicate big changes in the overall direction of economic policy. That’s mixed news for foreign businesses.

- On the one hand, China’s economy will continue to become more market-oriented, and the business environment will continue to improve.

- But the increased focus on national security also means that the Party will be focused on limiting dependence on foreign companies in many industries.

The fact that Trivium calls back to 2013 is a big deal because a lot of shifts happened following pivots in economic growth. It saw a huge push into infrastructure and real estate supported by subsidized loans and special purpose bonds. China will remain focused on technology and expanding their build out into AI and microchips.

The fourth and fifth are going to be interesting because reforms are a MUST to help adjust the structural problems in the real estate and broader market. The fifth focused on the private sector is interesting because Xi is the biggest driver of “unwinding” the Deng view of “Let some get rich.” There was hope that the new policies around IP in ’16-’18 would result in more growth, but it was quickly unwound in ’19 when the economy started to flounder.

It’s important to note that the Chinese economy has been struggling since 2019, and it took post COVID and real estate to really show the broader issues in the market. China relies heavily on the export market (as we discussed above) so it’s no surprise to see them push the export market. The problem is the global economy is saturated with “stuff”, and the shift to near-shoring and onshoring is going to put more pressure on Chinese exports.

There is a global shift on “national security” grounds and “protecting local producers” that will weigh on Chinese exports and ability to import. We are moving into a period of more tariffs and “protectionism” that will slow global trade. This is good to a degree, but problematic when it’s taken too far. It’s important to guard against “dumping” and “unfair business practices,” but you don’t want to turn to isolationism. There needs to be a balance because free trade is paramount to a successful global economy.

As economies struggle, it always leads to political uncertainty. As more military assets move into a region or run live-fire exercises, there is a risk of accidents and escalation. It’s imperative to have a hotline to communicate directly to defuse the situation and avoid a broader issue.

“On Tuesday, the AP reported that China and the Philippines had established a hotline between their presidential offices to manage geopolitical tensions.

Some context: Sino-Philippines ties have deteriorated badly in recent months following several violent incidents over disputed shoals in the South China Sea

- These episodes have prompted the two sides to hold discussions on how to reduce tensions and the risk of armed conflict.

There’s more: At a press conference at last week’s NATO summit, US President Joe Biden said he and Xi had come to a similar agreement (SCMP):

- “We set up a new mechanism. There’s a direct line between Xi and me, and our military has direct access to one another, and they contact one another when we have problems.”

The US Defense Department also said it would work with China to launch a crisis communications working group by year-end.

Get smart: As geopolitical fault lines widen, there’s a real risk of an unforeseen incident escalating into something much, much worse.

- Improved communication between leaders should help prevent a nightmare scenario, but they will not resolve the underlying tensions.”

I expect to see a lot about Chinese economic reform coming out in the next few days/ weeks. The PBoC has been very careful to limit the amount of new liquidity injections into the market, and we don’t see that pivoting anytime soon. The stimulus has failed to materialize in additional retail sales or repair in the real estate market, and additional spending won’t drive any real change in consumption. Xi continues to push the pivot to tech, but that is going to get much harder as other countries pull back from investing technology within China.

“Yet a major hurdle stands in their way. Chinese consumers haven’t yet bought into the hype, with confidence in the economy far behind pre-Covid levels — as shown by June’s weak retail sales numbers. What’s more, the flood of cheap electric vehicles and solar panels onto global markets — a key reason the economy has been so resilient — has sparked a protectionist response from governments in the US and Europe who worry about a whole new wave of job losses at the hands of China’s industrial might.”[1]

The article highlights some success, but says it won’t materialize in a meaningful way for another several years. As the local consumer remains stuck and exports slow, it will be difficult to continue growing the tech sector in a meaningful way. It requires an outlet as well as investment that is slowing on all accounts.

As we turn to the U.S., there is more weakness emerging from the recent data.

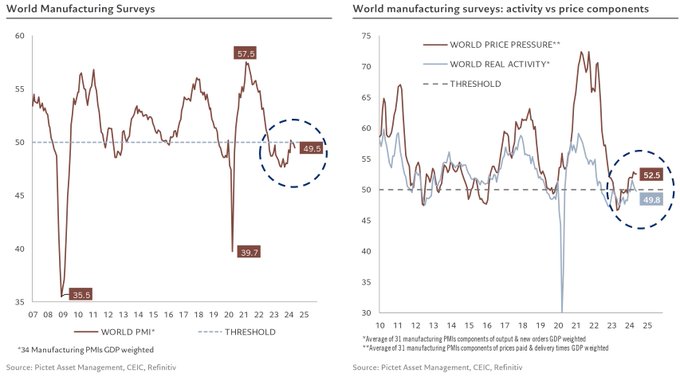

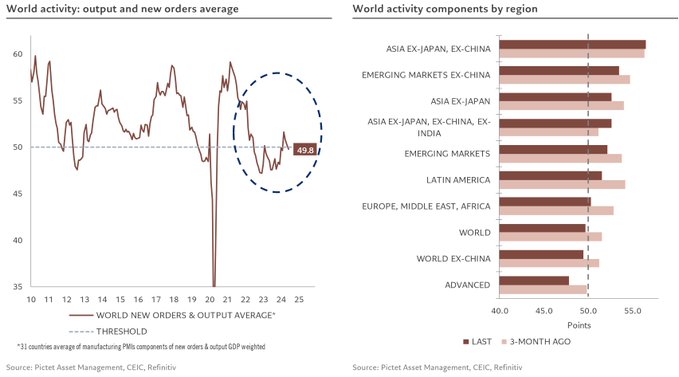

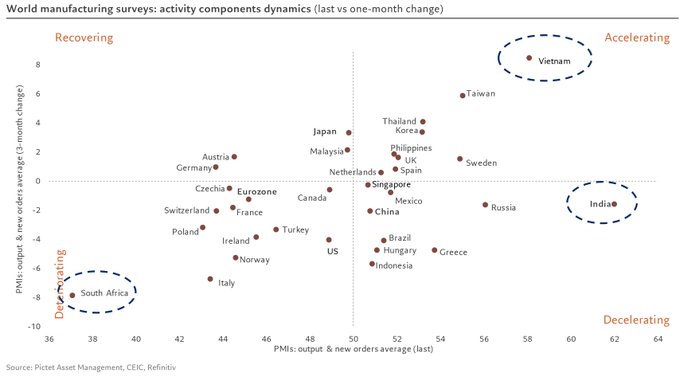

After temporarily crossing the 50 threshold, the global manufacturing PMI fell further below it to 49.5 in June from 49.9 in May. The main activity components fell by 0.3pt below the 50 threshold, while inflation components were little changed

There was also a broad slowdown in activity across the global complex: “After a nice rebound that began in Oct 23, activity components fell a bit further in June to lower levels than 3 months ago in most regions. EM remain well ahead of DM, led by Asia and in particular Asia ex-China, with a PMI of over 56, compared with 47.9 for DM.” Developed markets continue to struggle across the board, and as Chinese PMI missed estimates- we will see more slowdowns across the board in July and August.

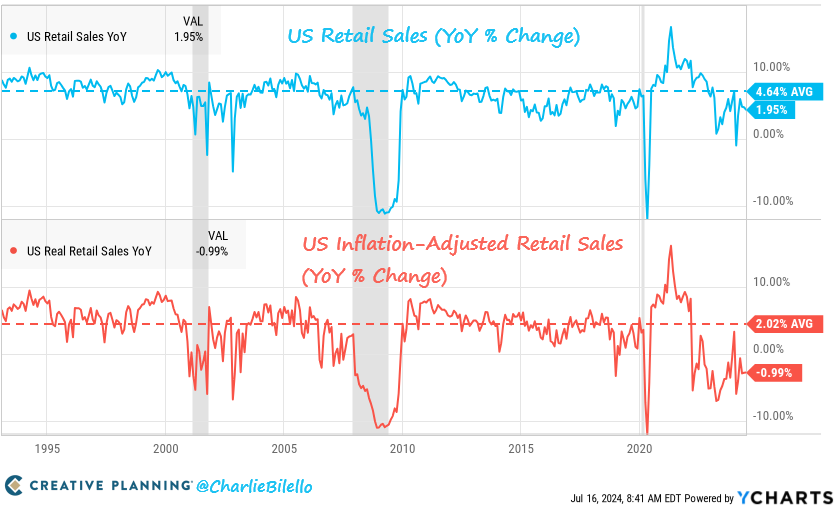

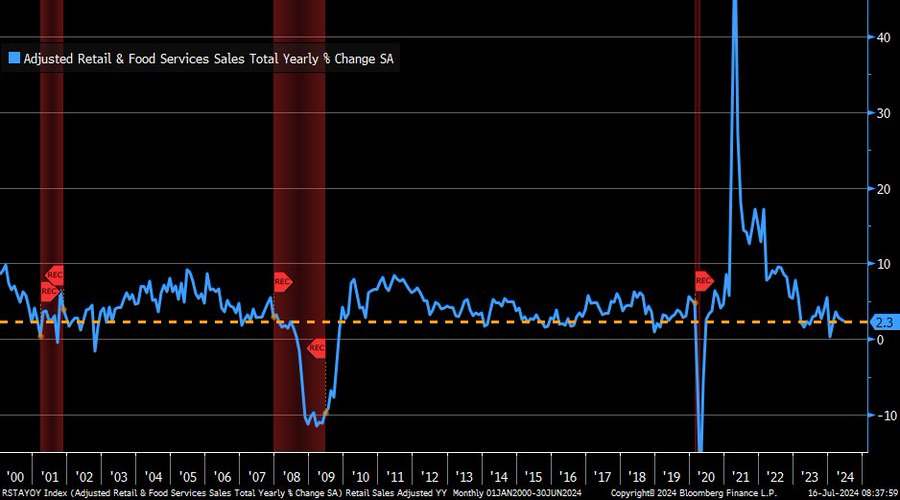

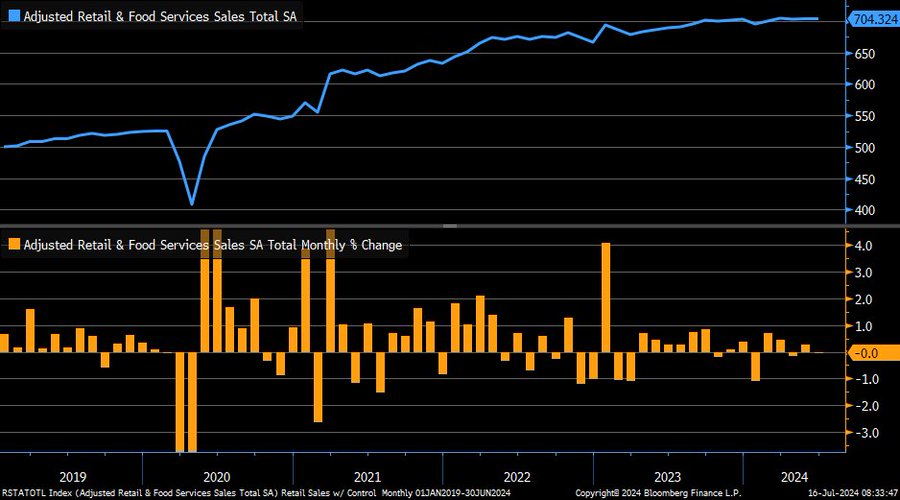

U.S. retail sales showed a nice “spike”, but when you dig into the numbers it tells a very different story.

-

- A very generous seasonal adjustment factor was at play. The raw NSA data actually showed retail sales plunging -5.6% MoM in June, the worst drubbing in a decade and tied for the

- US Retail Sales increased 2% over the last year but after adjusting for higher prices they were down 1%. Both of these numbers came in well below the historical averages of +4.6% nominal and +2.0% real. The US consumer appears to be pulling back.

In year/year terms, nominal retail sales increased by 2.3% in June (toward lower end of historical range).

June retail sales 0% vs. -0.3% est. & +0.3% prior (rev up from +0.1%) … sales ex autos and gas +0.8% vs. +0.2% est. & +0.3% prior (rev up from +0.1%); control group +0.9% vs. +0.2% est. & +0.4% prior. The control group had a huge spike, and it will be interesting to see if there’s a revision given the huge seasonal adjustment factor,

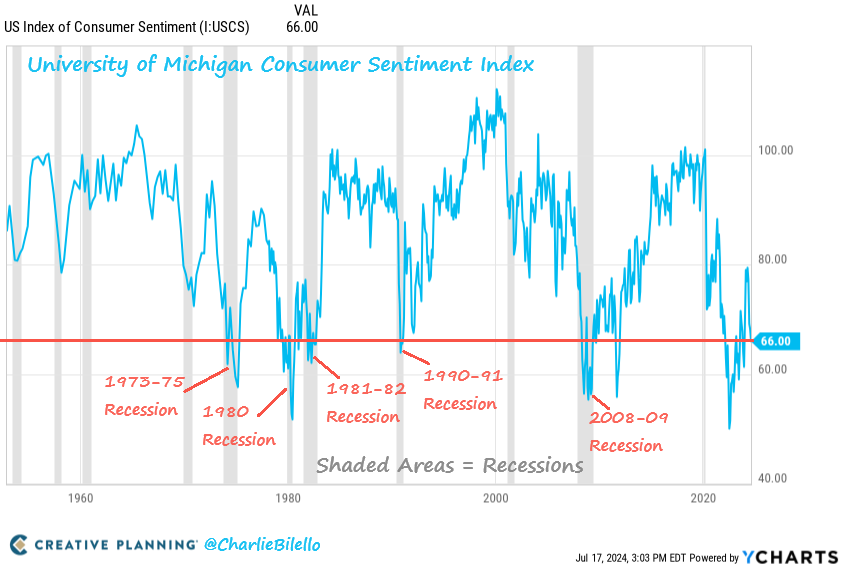

When we pivot over to consumer sentiment and credit cards, the data is much weaker and supports a slower than normal summer season. “US Consumer Sentiment has nosedived to its lowest point of the year and is at levels which in the past have been associated with recessions or bear markets. Unprecedented to see such a strong stock market (S&P 500 +20% YTD, 38 all-time highs) coincide with such a low reading.”

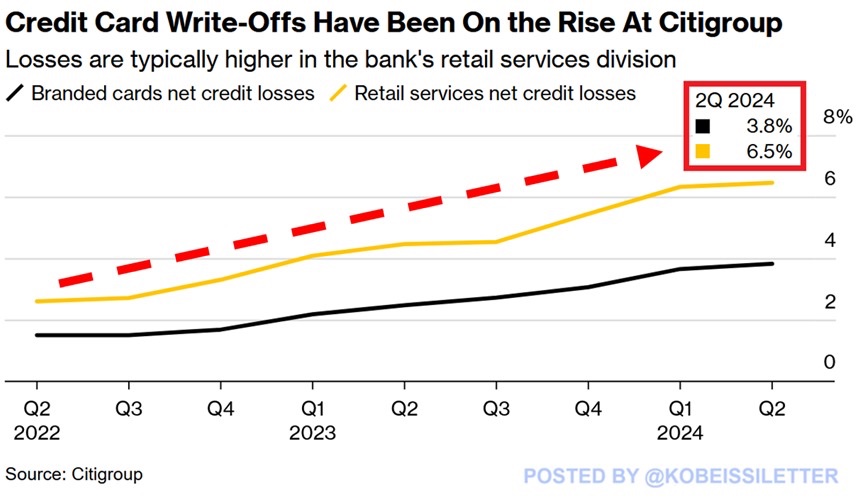

US consumer credit card write-offs at Citibank hit 6.5%, the highest since at least Q2 2022. The percentage of net credit losses at the retail services division has more than DOUBLED in just 2 years. With $2.1 trillion of excess savings depleted since 2021, consumers are struggling to pay off credit card debt. As a result, Citigroup has started shuttering unused credit card accounts and raising its capacity for collecting bad debts to manage its losses. Meanwhile, Wells Fargo and JP Morgan net charge-offs from their credit card businesses jumped 60% in Q2 2024 this year. US consumers are struggling to pay off debt.

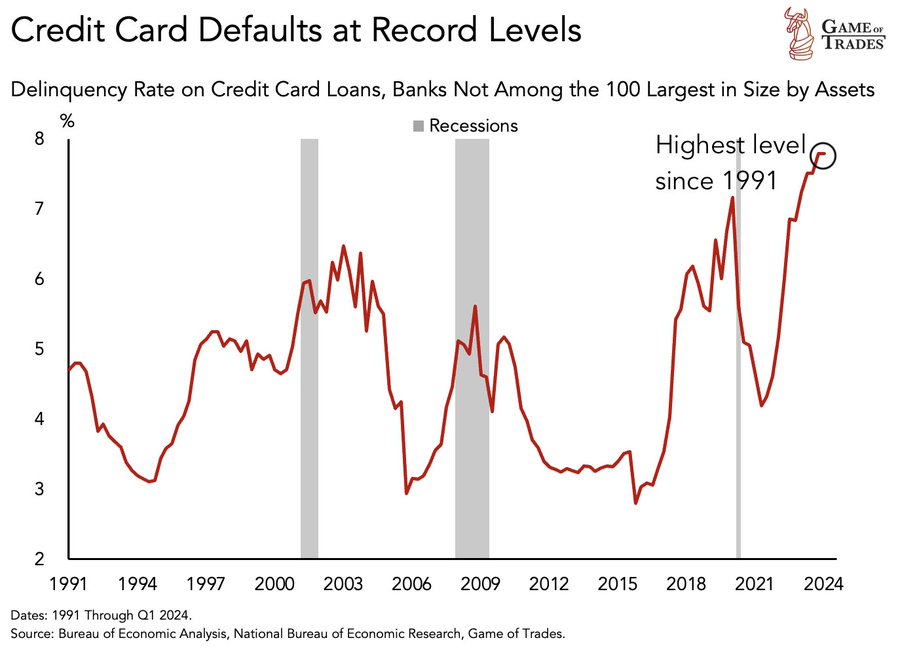

Credit card defaults from small lenders hit RECORD highs Crossing even the Dot Com bubble & Financial Crisis peaks Consumers are nearing trouble.

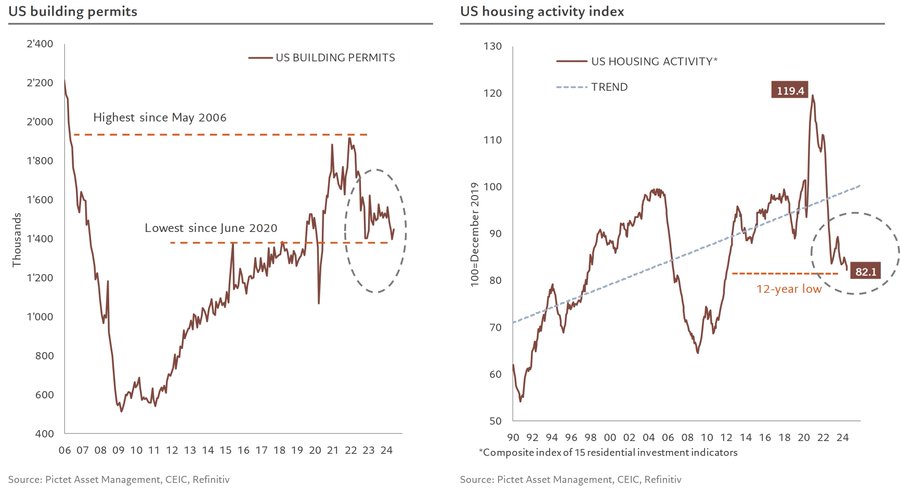

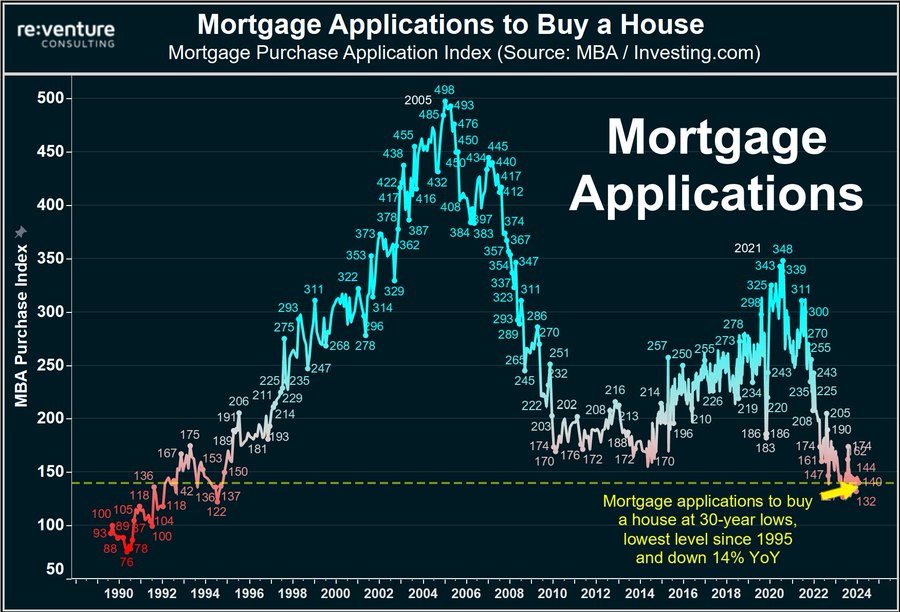

All the while, the housing and real estate market continues to struggle with additional price cuts and slowing activity. Despite the rebound in housing starts and building permits – barely visible on the graph – our US real estate activity indicator has fallen to new lows for over 12 years, with 10 out of 15 indicators down.

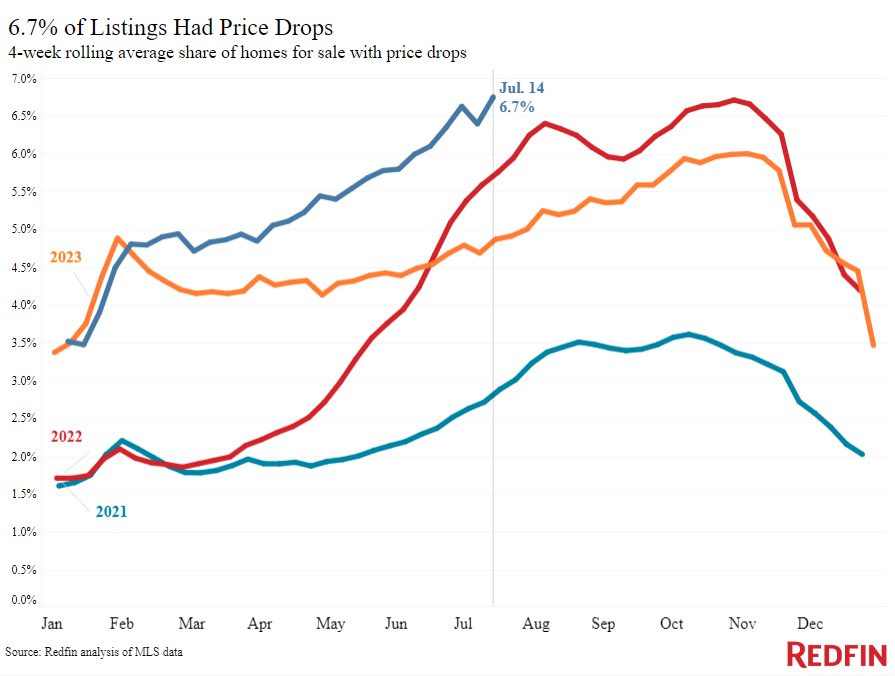

In level terms, number of home listings with price drops has risen to highest on record … year/year change in rolling 4-week average up to +6.7% per Redfin.

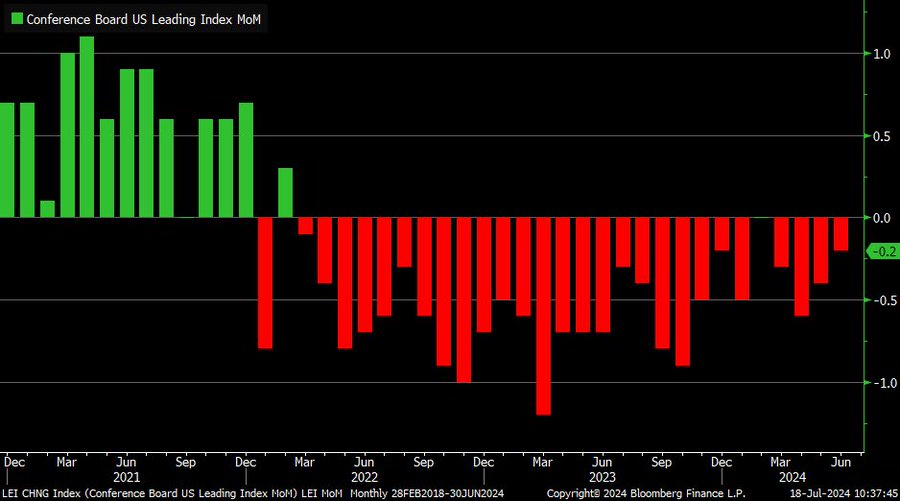

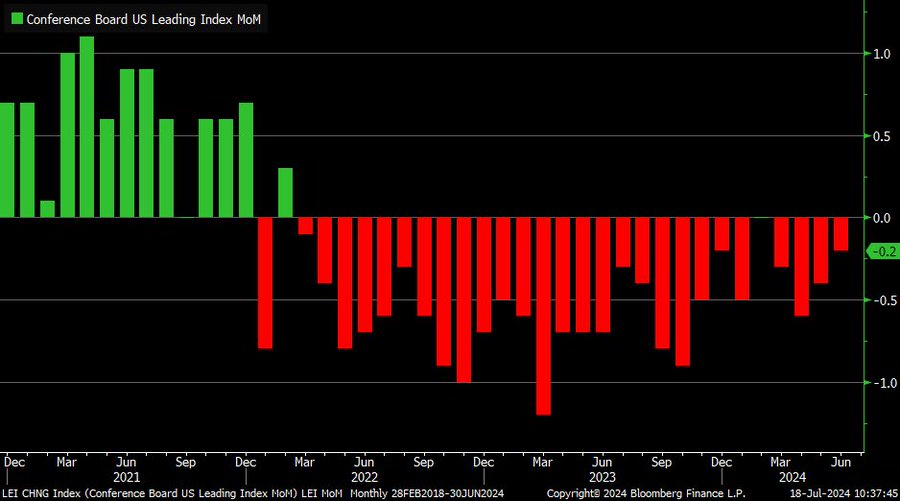

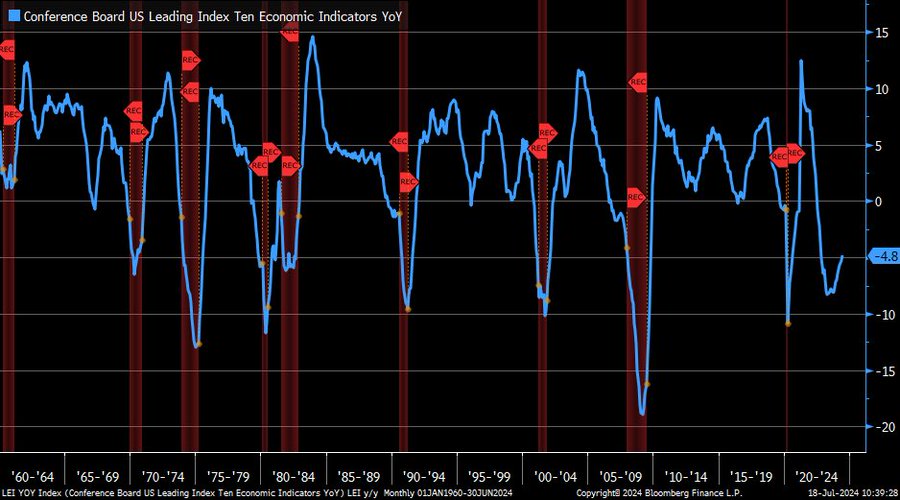

So it’s no surprise to see this: Conference Board’s Leading Economic Index (LEI) fell by 0.2% month/month in June … a continued improvement relative to prior months, but still in negative territory (index has not risen since February 2022).

The bright spots in the U.S. was some trend changes. Year/year change in Conference Board Leading Economic Index stayed in negative territory in June, but trend has continued to improve.

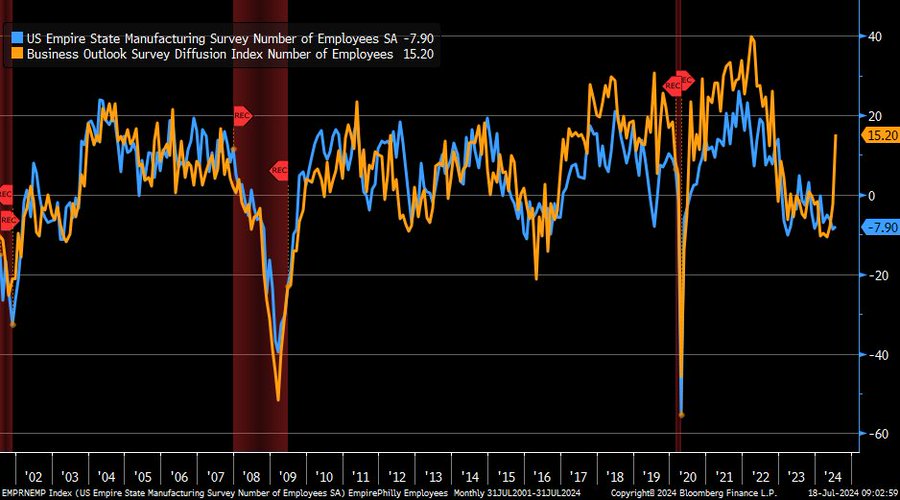

The other was a break in the phily Fed versus Empire. Totally different stories being told by Philly Fed (orange) and Empire (blue) Manufacturing Indexes in July when it comes to employment. These numbers can have one off spikes, so it will be important to see if theirs follow through on Philly.

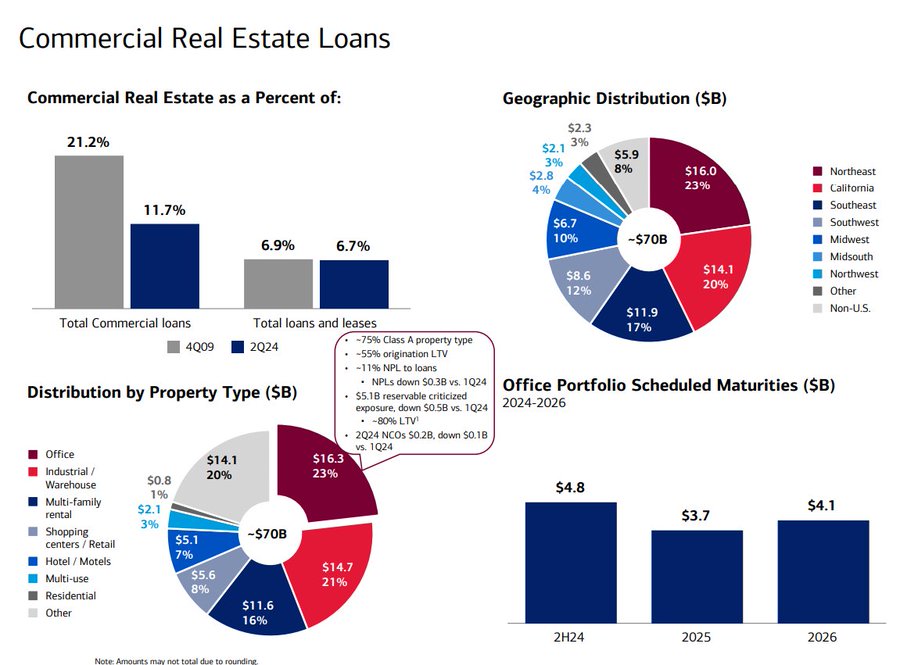

I think the housing market is finally catching up to the market, which we have been talking about for years at this point. This opens up a lot of risk within the banking industry that could cause a much bigger problem longer term.

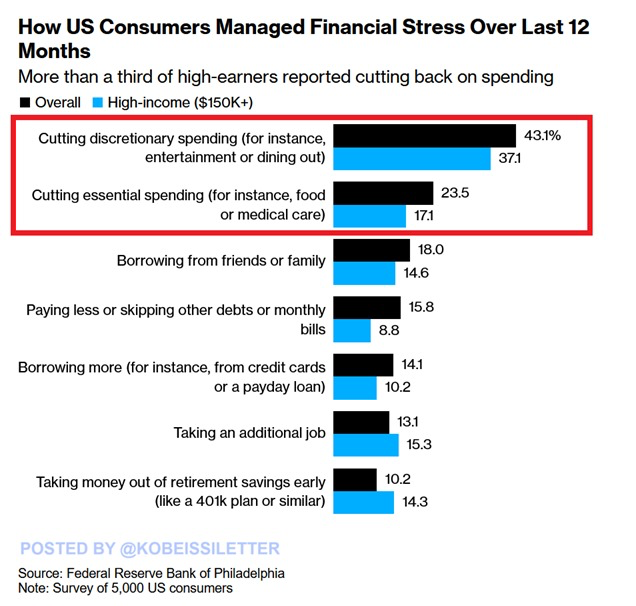

More than 33% of US consumers are now worried about making ends meet over the next 6 months. This includes 30% of Americans earning $150,000 or more annually, according to the Fed survey of 5,000 respondents. Over the last 12 months, 43% of all surveyed consumers and 37% of high-income individuals cut their discretionary spending. The worst part? 1 out of 3 Americans with salaries of less than $40,000 a year have trouble paying their bills. Consumers across all income groups are feeling the pain of inflation.

Banks keeps shoving CRE loss tsunami under the rug. BofA has $16.3BN in office exposure, and $12.6BN in upcoming office maturities in the next 2.5 years. Banks are increasingly exposed to CRE, RE, consumer credit, and corporate bankruptcies/ restructuring.

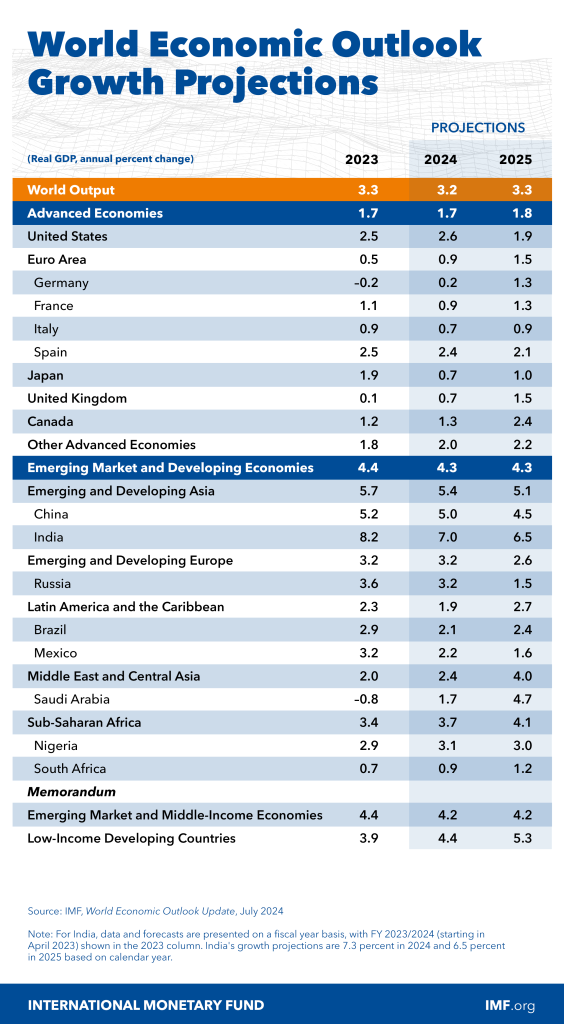

The IMF put out some their recent World Economic Outlook, but they are starting to get more cautious on growth as inflation remains a sticking point. If you remember, I did countless videos and insights talking about how inflation was being grossly underappreciated regarding how it impacts growth. The market still has an unwavering view that the central banks can contain rates, but the fact that we keep setting quarterly records in debt is going to make this very difficult.

I believe that the issues will take years to clear, and the core pillar of why I thought this was “a lost decade.” These are structural problems that will impede growth, and the starting point remains Japan. The BoJ is actively trying to protect the Yen, but it’s draining resources to continue backstopping the pressure.

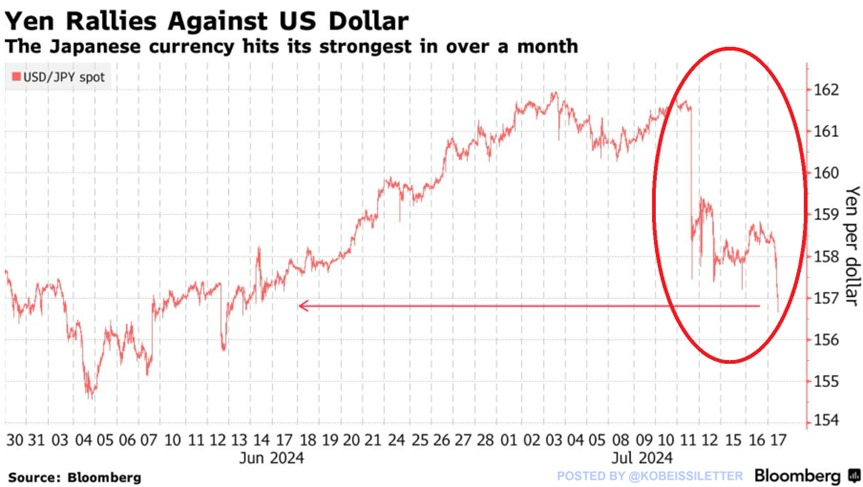

The Japanese Yen is up against the US dollar to its strongest level since mid-June. The USD-JPY currency pair is down over 3% since Thursday after hitting a 38-year high following another round of intervention by Japan’s Ministry of Finance. Japanese authorities reportedly spent $22 billion on Thursday and Friday to prop up the yen, according to Bloomberg. This comes after Japan spent a record $62 billion to support the currency between April 26th and May 29th. Over the last 12 months, the Yen has declined by ~12% and has been the worst-performing currency of G10. The Yen appears to be in trouble.

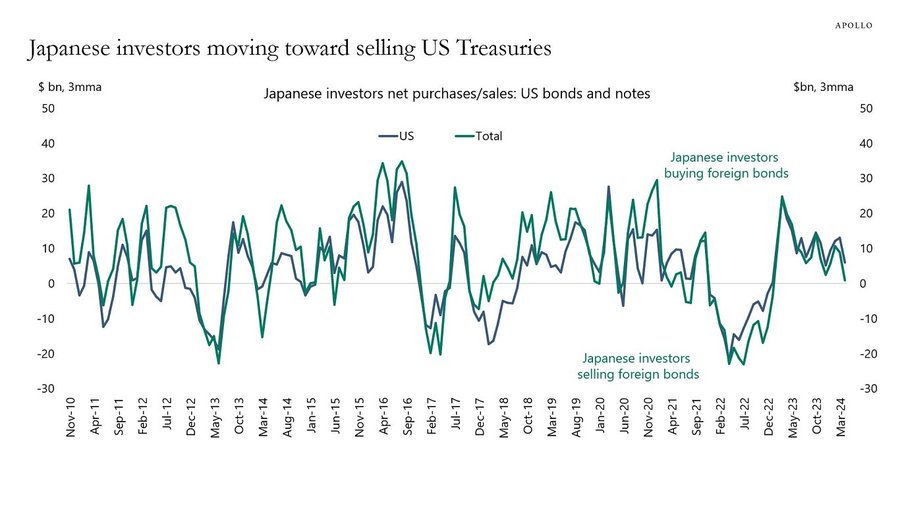

As the shifts continue, the U.S. needs a consistent buyer of an ever growing amount of treasuries. This is slowing down as the pressure builds, and the BoJ liquidates positions to sell dollars and buy yen.

The market continues to underestimate the issues that are pervasive around the world- especially Japan and central bank/ fiscal policies.

- https://www.bloomberg.com/news/features/2024-07-15/evs-solar-tech-sectors-help-xi-jinping-s-china-navigate-property-slump