For this week’s Monday Macro View, we will delve into the latest developments in the U.S. oil industry. The narrative surrounding U.S. oil production and the potential impact of Vice-President Kamala Harris’s energy policies is gaining significant attention, especially in light of recent data and market trends.

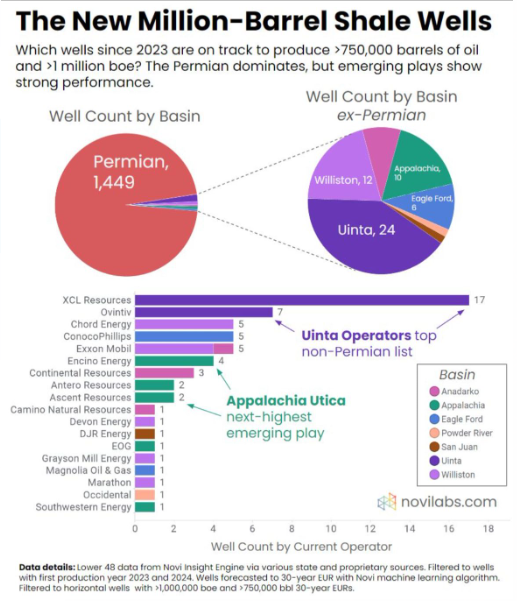

U.S. oil production has shown remarkable resilience and growth, with 2024 unconventional wells on track to be the most productive ever. Operators have increased per-well productivity for four straight quarters, up 16% since the 2023 Q1 low. This productivity surge is largely due to longer laterals, high-grading, and improved well designs. In 2024 Q1, operators drilled oil wells averaging over 10,000 feet in length for the first time, adding nearly 600 feet on average over the past year. This marks a significant trend change, even when normalizing productivity by lateral length. Operators have also brought online fewer wells each quarter since 2023 Q2 as prices drove activity lower. During this period of slowing activity, operators have focused on better locations, leading to an increase in the fraction of Permian wells from 59% at the start of 2023 to 63% today. Similar per-well production improvements are evident across most basins, particularly in the Denver-Julesburg, Williston, and Anadarko basins.

Emerging plays have proven highly productive. In 2023, the average Appalachian Utica well outperformed the average Permian well by 7%, and the average Uinta well was 14% better. This trend comes alongside strong performance within the Permian from emerging zones like the Jo Mill, Dean, and Barnett. Furthermore, average inter-well spacing has increased from 599 feet in 2021 to 696 feet in 2024. This move to slightly wider spacing aligns with the strategy of turning high-graded inventory into productive assets, ensuring Tier 2-equivalent performance to Tier 1 while maintaining cost-efficiency when prices are low. The unconventional sector has not collapsed as many anticipated. Operators continue to innovate in well design, new play development, and spacing, balancing productivity with economic viability during periods of declining activity. These innovations act as a counterweight to market volatility, ensuring sustained productivity even during consolidation phases.

Kamala Harris’s potential presidency brings another dimension to the U.S. oil landscape. Harris is known for her aggressive stance on environmental accountability for large oil companies. As California attorney general, she initiated several changes in environmental and clean energy initiatives, filed lawsuits against fossil fuel companies, and advocated for reducing greenhouse gas emissions. Harris has also supported the EPA’s regulations to control emissions from power plants and oil and gas activities. Harris’s energy policy stance includes a history of opposing offshore oil exploration, supporting California’s Low Carbon Fuel Standard, and advocating for a cap-and-trade program. Her push for a ban on fracking and criticism of offshore oil exploration indicate a more stringent regulatory environment for the oil industry under her potential administration. This could lead to increased compliance costs and operational constraints for oil companies.

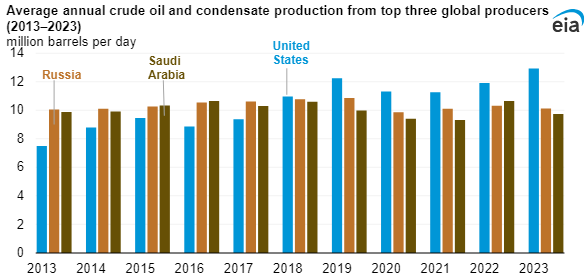

Source: Energy Information Administration

Now that Joe Biden has withdrawn from his re-election bid, Harris is poised to be the Democratic Party’s nominee. Her past actions and public statements suggest a shift towards more stringent energy policies. This includes endorsing California’s cap-and-trade scheme, opposing Trump’s energy plans, and co-sponsoring the Green New Deal. Harris’s opposition to fracking, although moderated during her vice-presidential tenure, underscores her commitment to stringent environmental policies. Harris’s presidency could mean no new leases on federal lands, restrictions on natural gas pipelines, and increased green subsidies for corporations. The oil and gas industry might face legal challenges for climate-related activities. This potential policy shift could significantly impact the industry’s operational landscape, increasing regulatory compliance and shifting focus towards sustainable practices.

The resilience of the U.S. oil industry, marked by technological advancements and strategic operational shifts, will be tested under a Harris administration. The industry’s ability to adapt to stringent regulations and environmental accountability measures will determine its future trajectory. While the innovations in well design and productivity have positioned the U.S. oil industry as a global leader, the impending policy shifts could redefine its operational framework.