We have been consistently writing, reminding, the readers that behind all the claims of a soft landing, the real economic data is still flashing red. Unfortunately, the recent events have shown this to be true and this week’s Market Sentiment Tracker gauges these indicators.

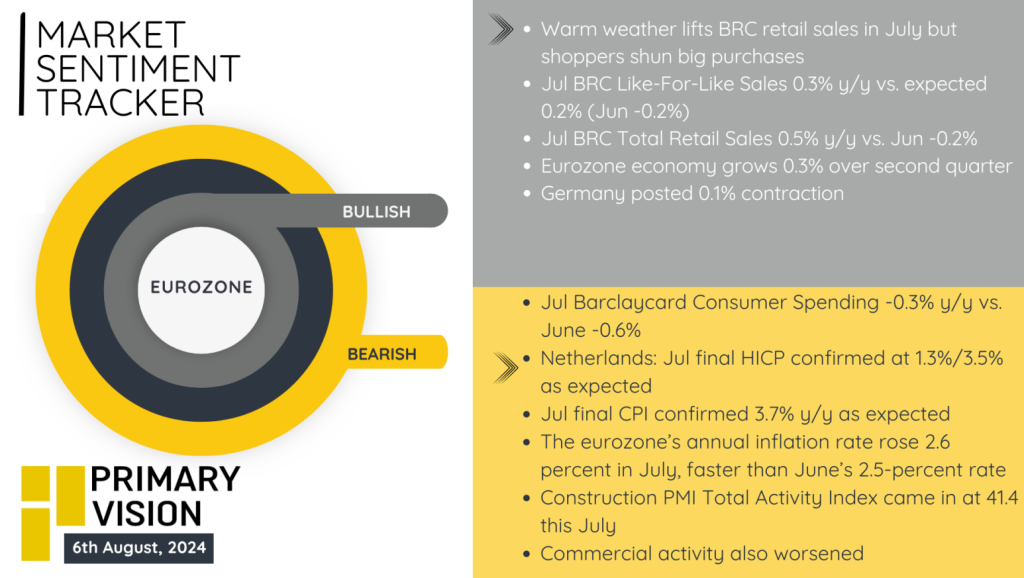

Eurozone – Stable with downside

The Eurozone’s retail sector experienced a mixed performance in July, buoyed by warm weather which led to a modest increase in sales. The British Retail Consortium (BRC) reported a 0.3% year-on-year rise in like-for-like sales and a 0.5% increase in total retail sales compared to June. However, consumer spending remains cautious, with Barclaycard data showing a -0.3% year-on-year decline. The Eurozone economy grew by 0.3% in the second quarter, indicating resilience despite Germany’s 0.1% contraction.

Inflationary pressures persist, with the Netherlands’ final Harmonised Index of Consumer Prices (HICP) confirmed at 1.3% month-on-month and 3.5% year-on-year, while the Eurozone’s annual inflation rate rose to 2.6% in July. Construction and commercial activities weakened, as evidenced by the Construction PMI Total Activity Index at 41.4, signaling a contraction in the sector. Overall, the region’s economic outlook remains cautious, with mixed signals from consumer spending and industrial activity.

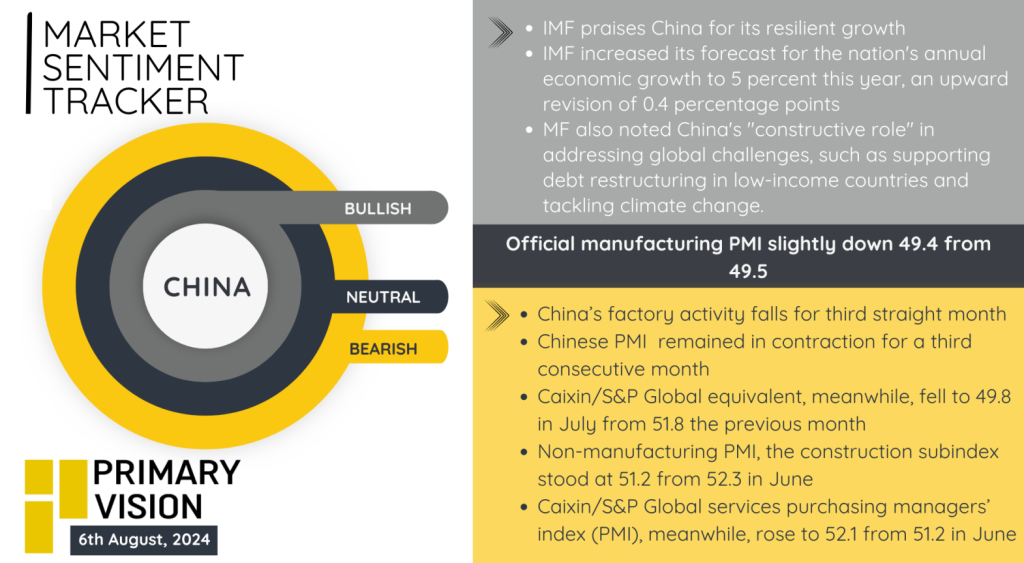

Chinese economy in trouble

China’s economic outlook presents a mixed picture. On the positive side, the IMF has praised China’s resilient growth, raising its forecast for annual economic growth to 5%, an upward revision of 0.4 percentage points. The IMF also acknowledged China’s constructive role in addressing global challenges, such as supporting debt restructuring in low-income countries and tackling climate change. However, challenges remain. China’s official manufacturing PMI dipped slightly to 49.4 from 49.5, indicating a contraction for the third consecutive month. The Caixin/S&P Global equivalent also fell to 49.8 in July from 51.8 in June, underscoring the ongoing struggles in the manufacturing sector. Additionally, the non-manufacturing PMI, particularly the construction subindex, dropped to 51.2 from 52.3 in June, highlighting a slowdown in construction activity.

On a brighter note, the Caixin/S&P Global services purchasing managers’ index (PMI) rose slightly to 52.1 from 51.2 in June, suggesting some resilience in the service sector. Overall, while China shows signs of resilience and constructive engagement globally, domestic manufacturing and construction sectors face persistent challenges.

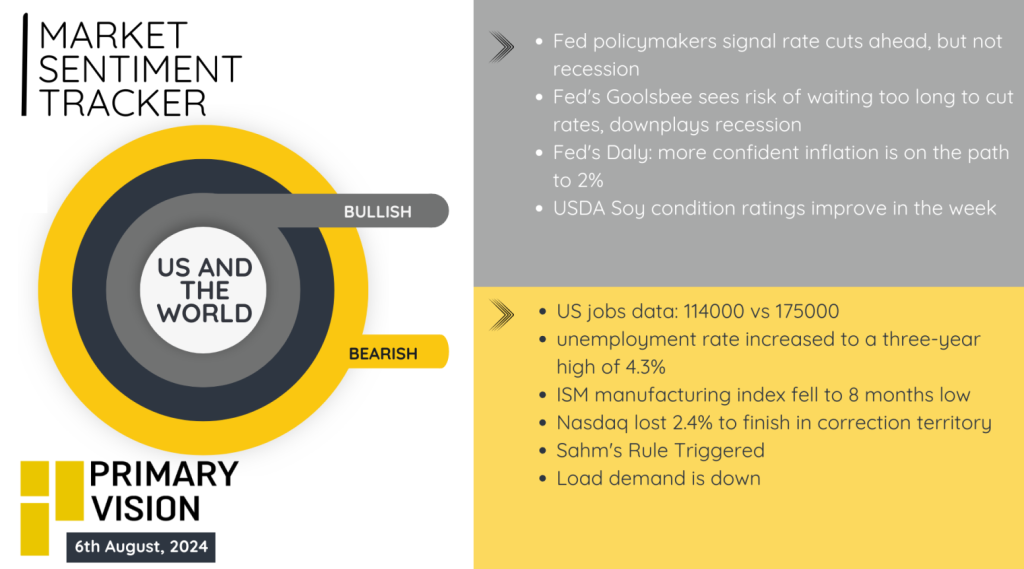

U.S. economy in trouble – fear index reaches high

Bearish indicators include US jobs data falling short of expectations with 114,000 jobs added versus the expected 175,000, and the unemployment rate climbing to a three-year high of 4.3%. The ISM manufacturing index also hit an eight-month low, while the Nasdaq dropped 2.4%, ending in correction territory. Additionally, Sahm’s Rule, which signals a recession when the three-month average of the unemployment rate rises half a percentage point above its low from the previous year, has been triggered, and load demand is down, highlighting economic strain.

On the bullish side, Fed policymakers signal forthcoming rate cuts without predicting a recession, with Fed’s Goolsbee emphasizing the risks of delaying rate cuts and downplaying recession fears. Fed’s Daly expressed increased confidence in the path to 2% inflation. Moreover, USDA soy condition ratings improved, suggesting some agricultural resilience. Overall, the data presents a nuanced picture of cautious optimism amidst economic challenges.