The global economy stands on uncertain ground as we enter the second half of 2024 and approach 2025, with mixed signals and persistent challenges shaping the outlook. Despite widespread expectations of a recession, several factors have kept such a downturn at bay so far, however, the recent jobs report and stock market sell-off have elevated the fears of an upcoming recession anew.

But you (the reader) and I both have so far survived. Like us million others are fighting this battle where the expenses continue to increase against an adamantly sticky wage. But still the world continues to run. This article tries to address, if not address, this same question. Will there be a recession? Are we already living in a recession? Is there a hidden recession in place? How the current economic conditions are impacting the common man?

To find out I interviewed a few people in Pakistan and following are some of their insights – that may speak to the theme of recession better than many financial papers out there. I will continue to interview people from various countries so that you can read the actual, on the grounds reality and make an informed decision about the recession that always seem to be in the making.

I spoke to the security guard outside my office here in Lahore to learn about his financial travails after the fact that there has been over 100% increase in electricity prices. The food inflation in Pakistan touched 52% last year and an average citizen spends more than 51% of their income on basic food items and this was before the stellar in increase in UN FAO’s Food Price Index. As such these unfortunate developments must have a strong bearing on the lives of the workers receiving minimum wage. “I can barely meet both ends meet. The monthly grocery eats more than 60% of my salary. Even though I do not have an air-conditioner in my house (because I cannot afford it and which is a cause of great nuisance as the heatwave in the country has reached unprecedented levels) the electricity bill I received last month was shocking (he added jokingly).” The electricity/energy crisis in Pakistan has exacerbated over the previous few months due to ballooning payments being made to Independent Power Producers (IPPs) to whom we have to pay “capacity payments”. This means whether we use the produced electricity or not, thanks to the take-or-pay clause in the contracts signed with them, the government has to pay them the promised money. Last year the total payment to IPPs was a whopping PKR 2 trillion or $7.2 billion.

A very good friend of mine who works a decent job at a bank has now started to think about leaving the country in search of better opportunities abroad (we will discuss the economic conditions in other countries in another article). He tells me how despite earning a decent sum, the recent inflation feeding into an already worsening Cost of Living Crisis, has made him lost his savings as well. Owing a car adds extra cost while dinning out has become a luxury. A dinner at an average eatery used to cost anywhere between PKR 1000 ($3.51) – PKR 1500 ($5.26) which has now jumped to PKR 2500 $8.77 – PKR 4000 ($14.47). The difference between first range and second represnts more than a 160% percentage increase in average cost!

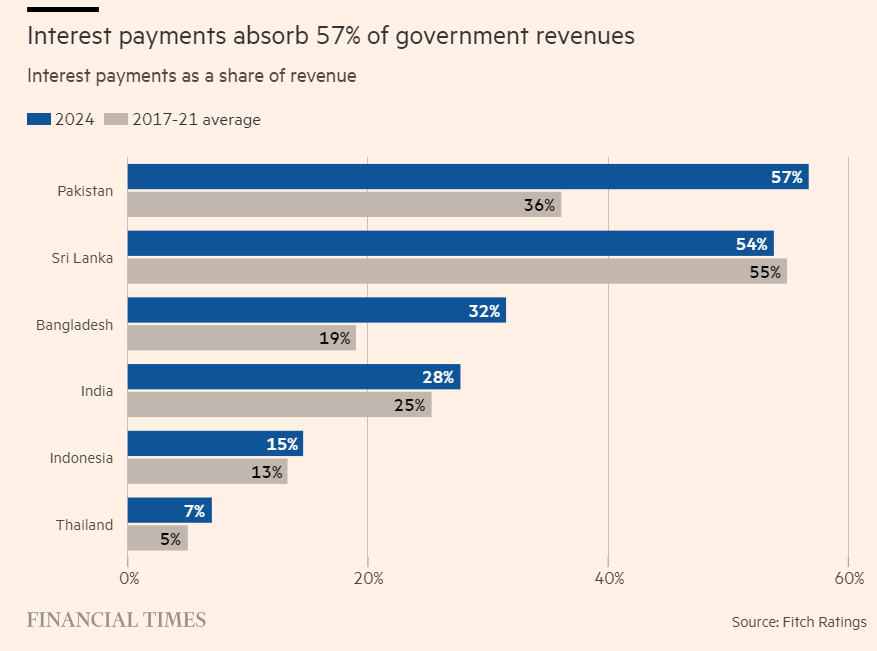

The ongoing Cost of Living crisis continues to worsen. The Pakistani government is attempting to navigate fiscal and monetary policy adjustments to meet the IMF’s conditions for securing a bailout package. The government is concerned about the socio-economic impact of these austerity measures, especially on the lower-income population. As the negotiations continue, there is growing uncertainty about the future of Pakistan’s economy, with concerns that failing to secure IMF support could lead to a further deterioration of the country’s financial stability.

The irony is that the future economic conditions of the security guard and my friend at the bank depends as much as on Pakistan’s economy as it does on what will happen in the Federal Reserve Bank of America. As they say “our dollar, your problem”. The global monetary policy tightening has played a key role in determining the exchange rates on this side of the world and it’ll be a theme that will continue to have its bearing on the EMDEs.

It seems while there has not been any announcement of a technical recession, a different type of it, is already underway. The country has not filed bankruptcy but if you are receiving electricity bills that eat up 60% of your monthly income and food price inflation that costs you more than 51% of your salary, then the individuals and households are already in deficit – bankrupted.

We turn to the U.S. in the next article and find out what is happening there?!

Note: The names of the people interviewed were kept confidential as per their request. The interviews were done in Urud (national language) and were translated into English later on.