BoJ’s recent announcement is more significant than Powell’s Jackson Hole speech for a number of reasons that are deeply intertwined with the current global economic landscape, especially given the context of potential recessionary pressures. Japan, with its historically low interest rates, has been a linchpin of global financial markets through the carry trade—a strategy where investors borrow in a currency with low interest rates, like the yen, and invest in assets denominated in currencies with higher yields. This strategy has helped fuel global asset bubbles and has been a critical source of liquidity for financial markets. Now, with the Bank of Japan signaling that rate hikes are firmly on the table, the global economic implications could be profound.

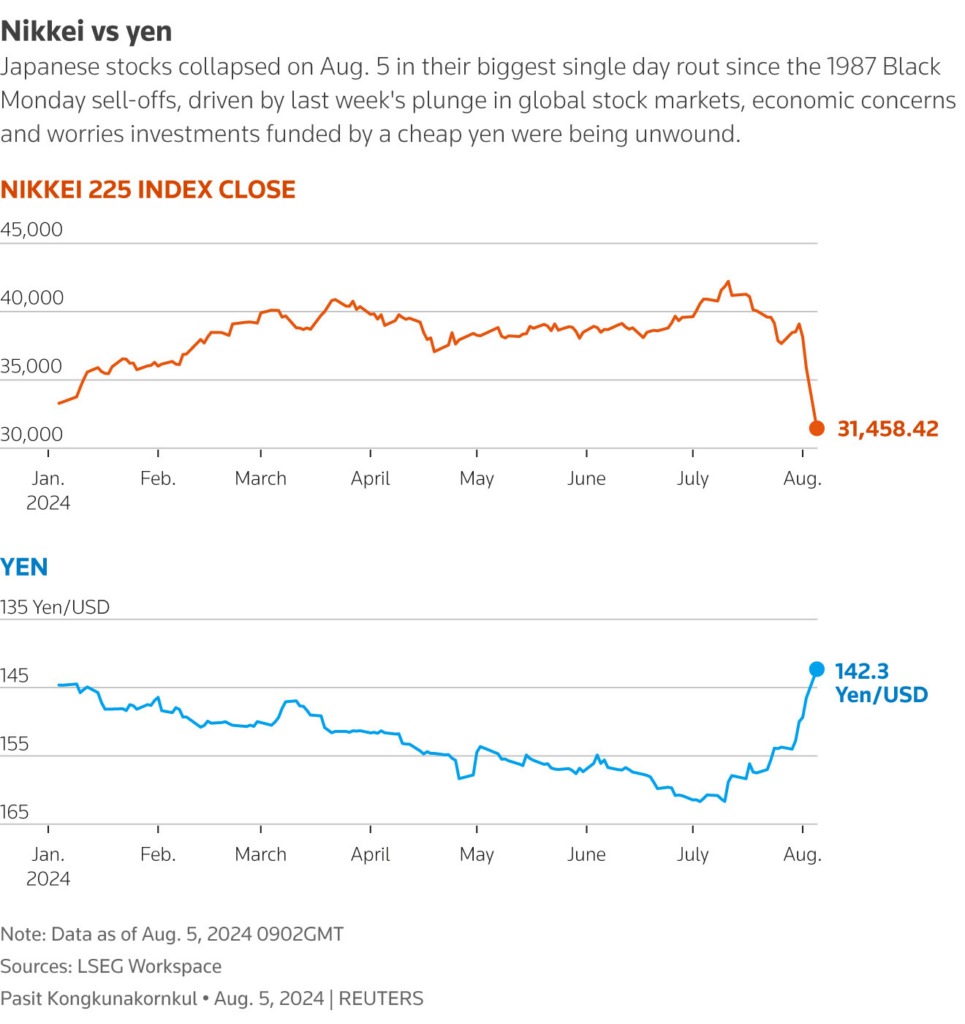

The last time the Bank of Japan increased its interest rate by a mere 0.25%, the global markets reacted with panic. This was not just a reaction to a minor rate hike; it was a recognition of the potential unwinding of the massive carry trade that has been built up over the last decade. To put this into perspective, the size of the carry trade is enormous—$20 trillion, or 505% of Japan’s GDP, has been funneled into global markets using the Japanese government’s balance sheet, according to Deutsche Bank. Additionally, Japanese investors’ net international investments stand at $3.4 trillion, and Japanese banks’ foreign lending data adds another $1 trillion to this complex web of financial interdependence.

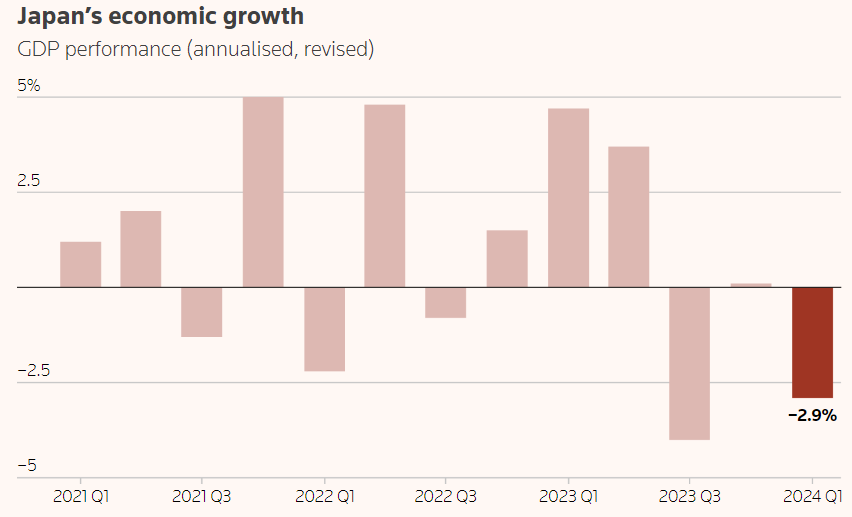

The Bank of Japan’s recent statement, reaffirming that rate hikes are on the table, carries more weight than the Fed’s current stance because of this backdrop. While the Federal Reserve is navigating its own set of challenges, including the need to balance inflation with slowing economic growth, the BoJ is at a different juncture. Japan’s overall consumer inflation in July stayed above the BoJ’s 2% target, with a 2.8% year-on-year rise driven by increasing energy bills. This persistent inflation, coupled with wage growth, adds pressure on the BoJ to act, especially after Governor Kazuo Ueda’s recent hawkish comments.

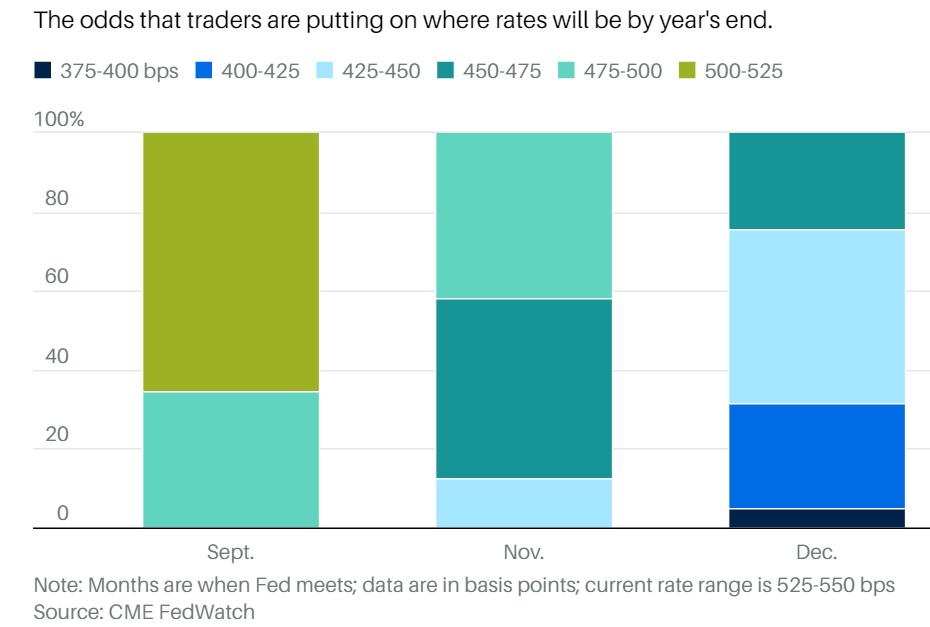

The potential implications of BoJ’s policy shifts are vast. A move towards higher interest rates in Japan, even by a small margin, could trigger a massive unwinding of the carry trade. Investors who have borrowed in yen to invest in higher-yielding assets around the world may be forced to unwind these positions, leading to a sell-off in global markets. The last time this happened, when rates were adjusted to just 0.25%, the markets entered a state of turbulence. With the BoJ potentially moving towards a 1% rate increase, as they strengthen the yen while the U.S. Fed might cut rates over the next 12 months, the global financial system could face significant strain. The market reacted strongly to the initial 0.25% move, and a potential 3% swing would likely have an even more dramatic impact.

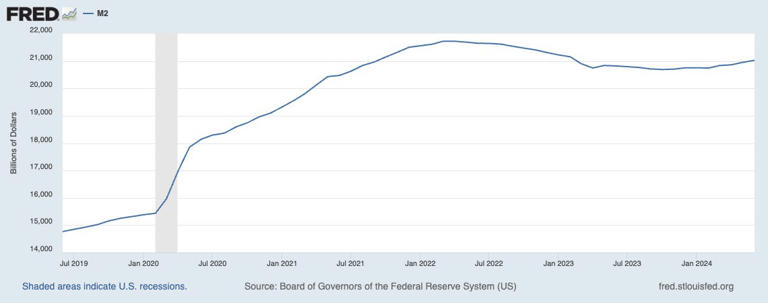

The situation in Japan is not occurring in isolation. Recessionary signals are flashing across the global economy, with the U.S. showing increasing signs of cooling. Steve Hanke, a veteran economist, has pointed out that the U.S. is likely headed for a recession by early 2025, based on the contraction in the M2 money supply—a signal that has only been seen four times since 1913, each time followed by a recession or depression. The money supply in the U.S. has fallen by 3% from its peak in 2022, a significant drop that typically precedes economic downturns. The U.S. job market has also shown signs of weakening, with the unemployment rate spiking to 4.3% in July, its highest level since the pandemic, further indicating economic stress.

Source: FRED – The M2 money supply has contracted for most of the past 2 years. Federal Reserve

Adding to these pressures, consumer spending in the U.S. has slowed, and sectors like housing and manufacturing are already in a downturn. Retail sales have decelerated, and manufacturing activity has contracted for the 20th month out of the past 21, according to the Institute for Supply Management. These microeconomic indicators align with the broader macroeconomic picture of a slowing economy heading towards recession, as pointed out by Hanke. In this context, the BoJ’s potential rate hikes could exacerbate these existing global recessionary pressures. If Japan moves forward with increasing rates while the Fed is cutting rates, the divergence in monetary policies between two of the world’s largest economies could lead to significant volatility in currency markets, disrupt global capital flows, and heighten financial instability. The repercussions could be far-reaching, affecting everything from emerging markets, which rely heavily on foreign investment, to the stability of the global financial system itself.

Moreover, China, another major player in the global economy, is already experiencing significant economic challenges. Recent data has shown a sharp decline in new home prices, the fastest in nine years, coupled with slowing industrial output and rising unemployment. These factors have led Chinese refineries to reduce crude processing rates, reflecting weak fuel demand and raising concerns about global oil consumption. In response, both OPEC and the International Energy Agency have revised their demand forecasts downward for 2024 and 2025, citing weaker-than-expected Chinese consumption. As global demand concerns mount, especially with China’s slowdown, the prospect of Japan tightening its monetary policy further adds to the uncertainty. The combination of reduced global liquidity, potential unwinding of the carry trade, and existing recessionary pressures in key economies like the U.S. and China could create a perfect storm for the global economy.

The BoJ’s recent announcement is more consequential than Powell’s Jackson Hole speech because it signals a potential shift in global financial dynamics that could have far-reaching implications. As the BoJ navigates its policy path, the global economy stands on the precipice of significant change, with the potential for increased volatility and economic disruption in the months ahead. The world will be watching closely, as even a slight misstep could set off a chain reaction across global markets, exacerbating the already growing recessionary pressures.