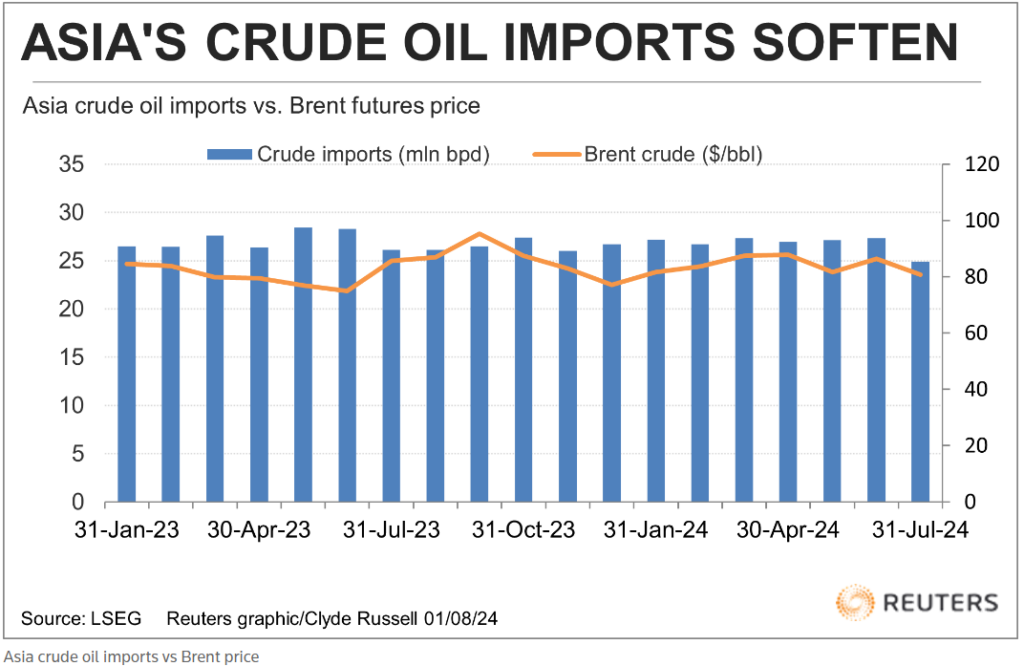

The global oil markets have been anything but predictable lately, and recent developments in Asia’s crude oil imports reflect the complex dynamics at play. After hitting a two-year low in July, Asia’s crude oil imports rebounded in August, rising to 26.74 million barrels per day (bpd) from July’s 24.56 million bpd. This increase, while notable, comes with a caveat: July’s figures were the weakest since 2022, making August’s recovery more of a return to form than a surge.

China, the world’s largest crude importer, played a significant role in this recovery, with imports climbing to 11.02 million bpd in August from July’s 9.97 million bpd. This uptick is partly due to Chinese refineries ramping up purchases to build stockpiles ahead of winter, a common practice in the third quarter. Additionally, the lower global oil prices during the purchase window for August deliveries likely encouraged increased buying. Brent futures, for instance, dropped from a high of $92.18 per barrel in April to a low of $76.76 in June, providing a more favorable environment for imports.

India, Asia’s second-largest crude buyer, also saw a modest increase in imports, reaching 4.83 million bpd in August, up from 4.58 million bpd in July. However, the monsoon season likely tempered some of the appetite among Indian refiners, particularly those focused on exports, given the soft regional demand for products like gasoline and diesel. South Korea and Japan, the third and fourth largest importers in Asia, also saw increases in their crude imports in August, reflecting a similar trend of stockpiling ahead of winter.

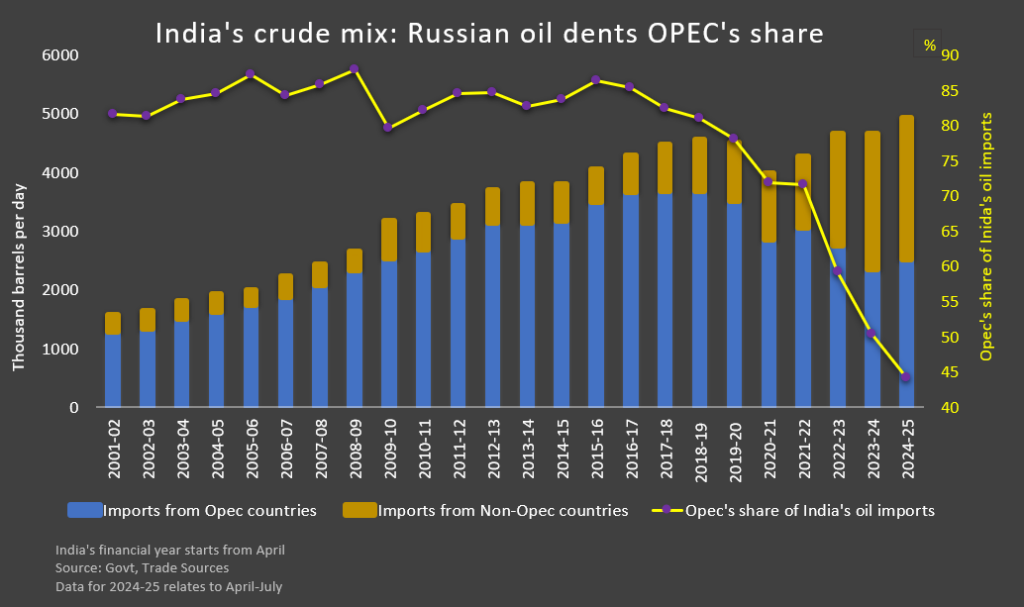

On the supply side, Saudi Arabia, the world’s largest oil exporter, saw its exports to Asia recover in August, with shipments rising to 4.89 million bpd from 4.60 million bpd in July. This recovery was likely supported by Saudi Aramco’s decision to lower its official selling prices (OSPs) for August-loading cargoes. Meanwhile, imports from Russia to Asia dipped slightly to 3.60 million bpd in August from 3.71 million bpd in July, with India reducing its intake of Russian crude.

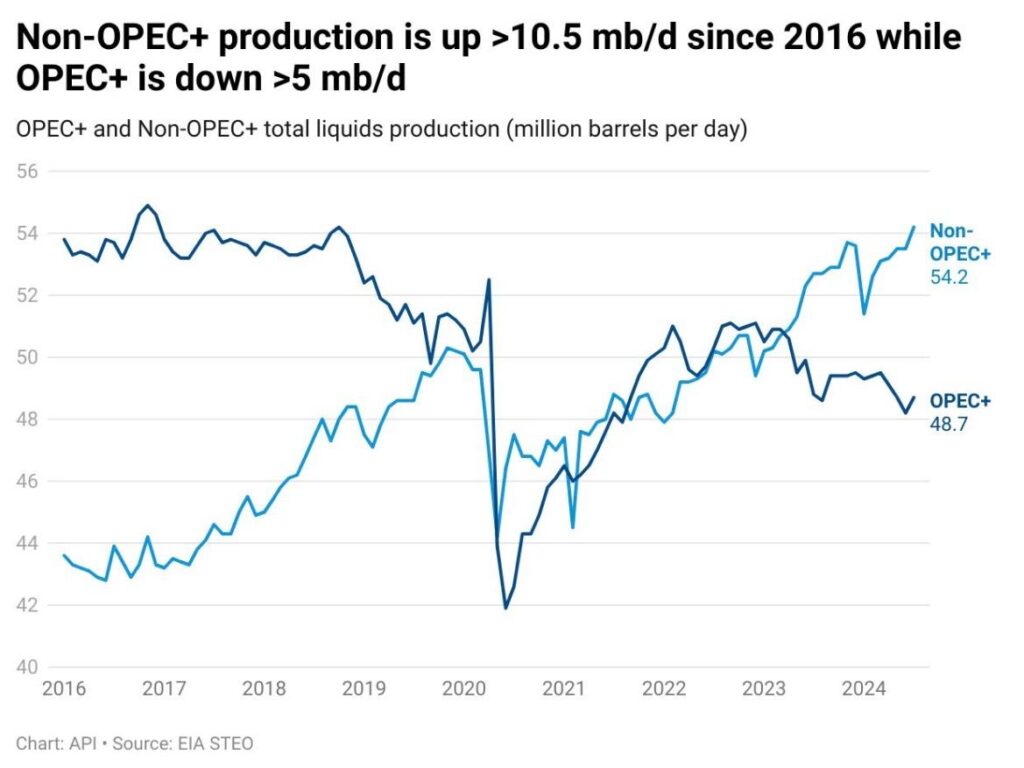

The fluctuations in Asia’s crude imports are just a symptom of the broader problems that global oil markets face. As we look ahead to 2025, the Organization of the Petroleum Exporting Countries (OPEC) faces significant hurdles in maintaining market balance. Analysts from DNB Markets have pointed out that the oil market is likely to flip to moderate oversupply in 2025, even if OPEC extends its existing production cuts. Non-OPEC supply growth, particularly from the United States and Brazil, has been robust, with a year-over-year increase of 3.2 million bpd in 2023. While this growth is expected to slow, it will still average 1.5 million bpd annually in 2024 and 2025, potentially outpacing global demand growth.

On the demand side, the outlook remains subdued. Global oil demand growth has slowed significantly, with only a 0.9 mb/d increase year-to-date in 2024 compared to 2.1 mb/d in 2023. This slowdown is attributed to sluggish global GDP growth, a softening Chinese economy, and the fading impact of the post-pandemic recovery. Analysts estimate that global oil demand growth will slow to 0.95 mb/d year-over-year in 2024 and 0.98 mb/d in 2025. These dynamics leave OPEC with limited options. If the organization proceeds with its planned unwinding of 2.2 mb/d of production cuts in 2025, it risks triggering a significant oversupply and pushing Brent oil prices down to USD 60–70 per barrel. In a worst-case scenario, OPEC might even be forced into a full-fledged price war, further driving prices below $60 per barrel.

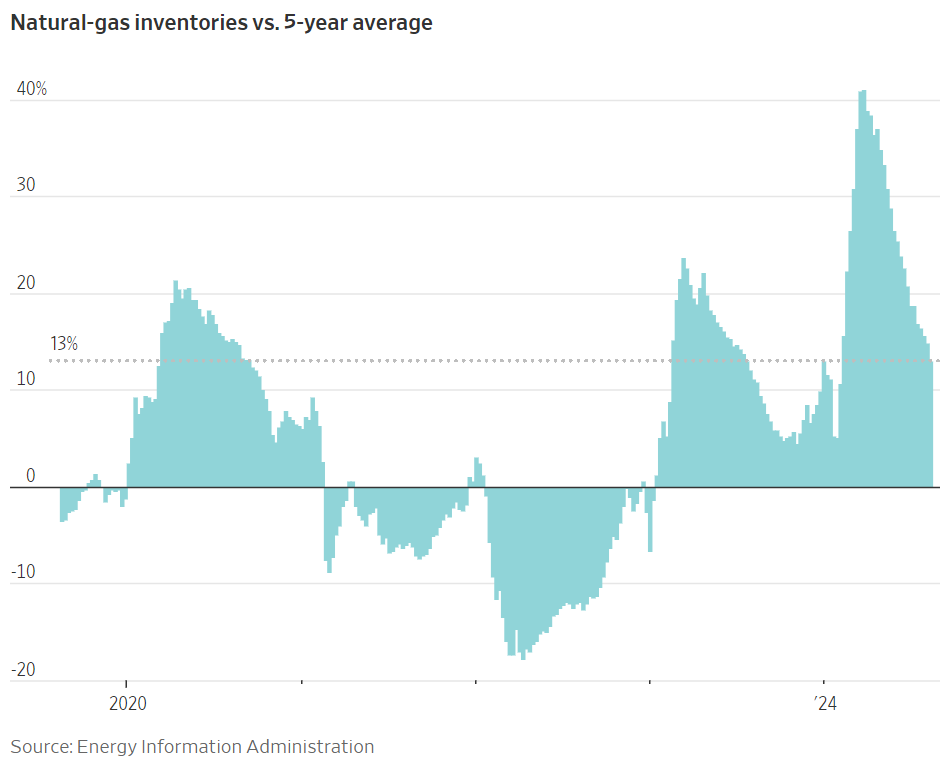

Adding to the market’s complexity, fears of a U.S. economic hard landing have erased gains from recent supply disruptions, such as the Libya oil shutdown. Despite an initial surge in crude prices, with Brent crude reaching $81.47 per barrel, prices have since pulled back, reflecting ongoing concerns about the U.S. economy. The potential for a hard landing, characterized by a sharp slowdown in economic activity, continues to weigh on the market, overshadowing supply-side disruptions. Natural gas markets have also been mixed, with European prices holding steady due to supply concerns related to Norway’s annual maintenance and the Ukraine-Russia conflict. However, U.S. natural gas prices have weakened, with front-month Henry Hub falling below $2 per million British thermal units (mmBtu) for the first time, reflecting declining cooling demand and stable inventories.

As we approach 2025, OPEC+ faces the challenge of balancing production cuts with the risk of oversupply, while market participants remain vigilant to the potential for economic disruptions in major economies like the U.S. In the coming months, the story of oil will that be of oversupply versus a slow demand. I do not think that there is enough economic momentum to turn this the other way soon.