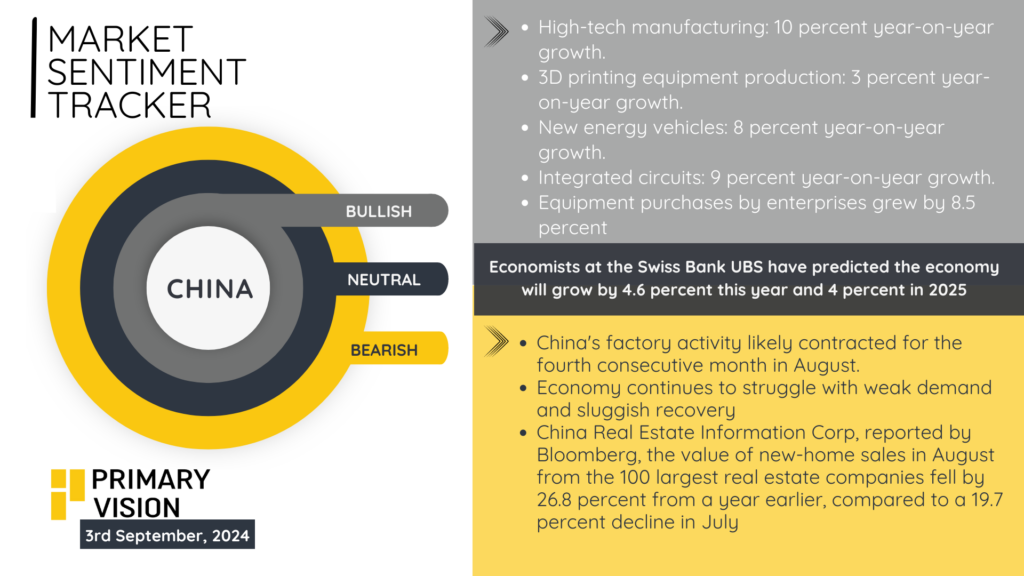

China’s economic landscape remains fraught with challenges, as factory activity is set to contract for the fourth consecutive month in August. Weak demand and sluggish recovery dominate the narrative, despite growth in high-tech manufacturing sectors like integrated circuits (9% y/y), 3D printing (3% y/y), and new energy vehicles (8% y/y). However, equipment purchases by enterprises grew at 8.5%, signaling some resilience. The real estate sector continues to struggle, with the value of new home sales from the 100 largest real estate companies plunging by 26.8% y/y in August, a sharper decline than July’s 19.7%. UBS economists predict that the economy will grow by 4.6% this year and 4% in 2025, but the weak factory output and persistent demand issues put these targets at risk.

While China’s cutting-edge industries show signs of strength, it will be a delicate balance between technological growth and overcoming broader economic stagnation.

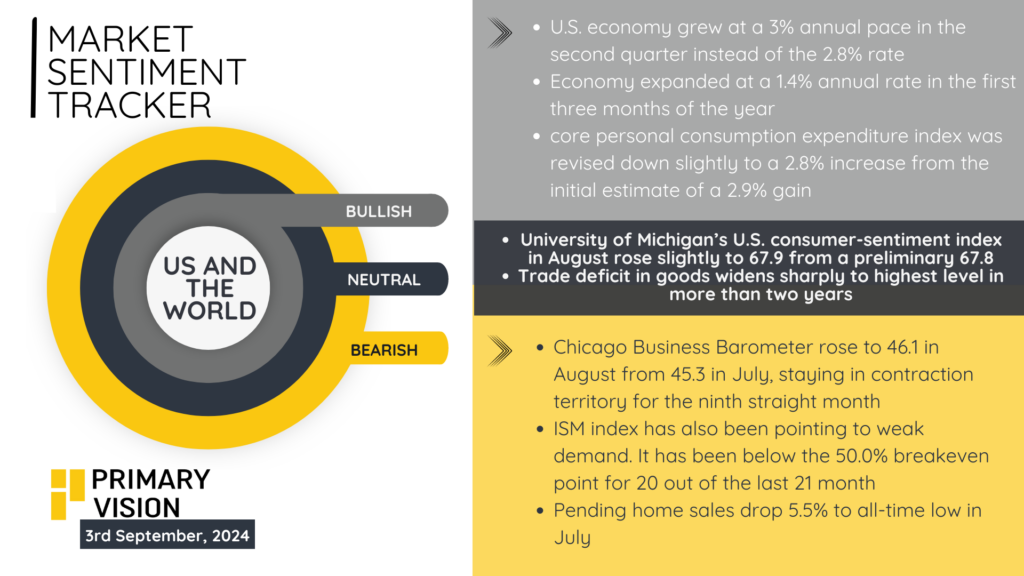

The U.S. economy grew at a 3% annual rate in the second quarter, slightly revised from the earlier 2.8% figure. However, the Chicago Business Barometer rose only marginally to 46.1 in August from 45.3 in July, remaining below the 50-point mark for the ninth consecutive month, indicating persistent contraction in the manufacturing sector. Pending home sales also slumped by 5.5% in July, marking an all-time low.

Meanwhile, the ISM index has stayed below the critical 50.0% breakeven point for 20 out of the last 21 months, signaling weak demand across the board. The core personal consumption expenditure index was revised down slightly to 2.8% from the prior 2.9%. Consumer sentiment showed some resilience, with the University of Michigan’s index ticking up slightly to 67.9 in August from 67.8 in July. However, the trade deficit in goods surged to the highest level in two years, adding to concerns about economic sustainability moving forward.

We are waiting for the data for Eurozone and will update it accordingly.