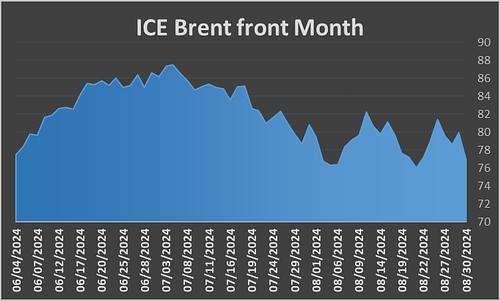

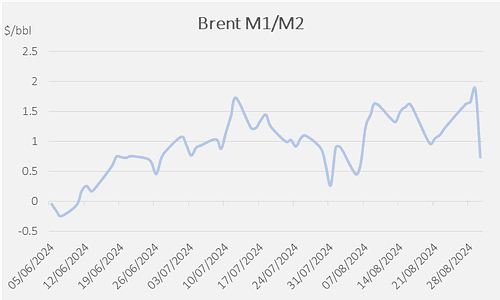

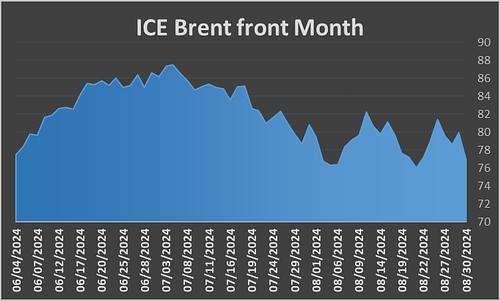

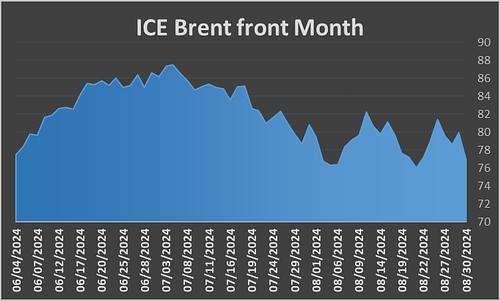

The crude markets are struggling to find a bid as demand issues remain front and center as rumors swirl regarding the OPEC+ voluntary cuts. There are some expectations that OPEC+ will announce a gradual easing of the cuts, but this is still not our base case. One of the things that OPEC loves to do is float a rumor to see how the market reacts. These “tests” are lovingly called tape bombs, but as we’ve said from day one, in order for OPEC+ to bring back volume- they will have to accept a sizeable decline in pricing. A full return would result in a price decline of $10+ with even a gradual return bringing the market down by $5-$7 at a minimum. OPEC+ decided to delay any potential cuts by two months, but as I’ve stated from the beginning of this year: all cuts will remain in place till at least Q1’25. The brent market fell below $73, which was our extended downside. We expect to see a bounce because crude ALWAYS overacts to the upside and downside of the pricing structure. The physical market doesn’t support a continued down move, and we should see a gradual move back to about $77. We believe that as the market prices in the OPEC+ extension pricing will recover a bit, but the biggest overhang remains demand. The demand side of the equation has deteriorated further, and we will move down our expectations for Sept to $74-$80 with the upper band no longer likely. As we progress through Oct- Dec, we will likely see more deterioration as refiners enter turn around season sooner putting us at about $73-$78.

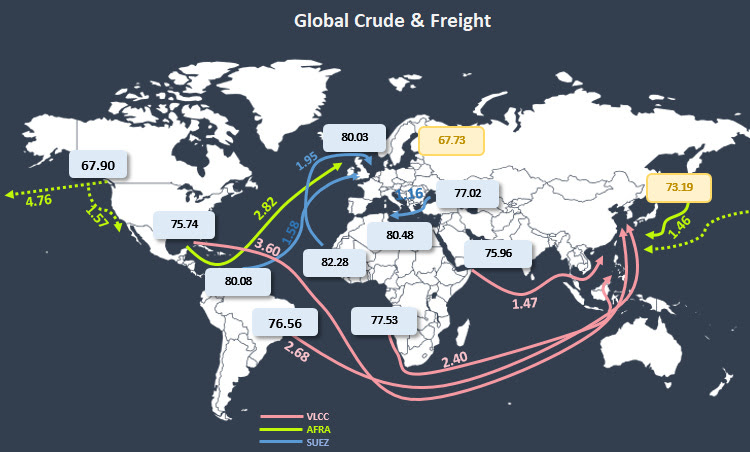

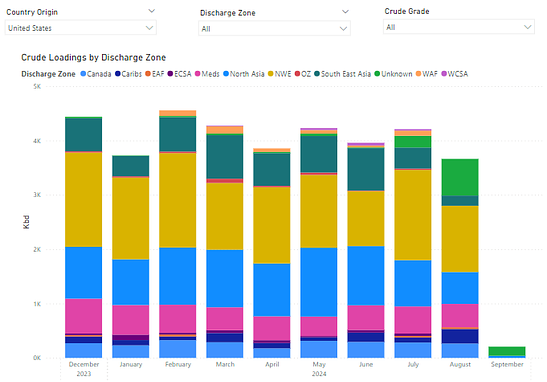

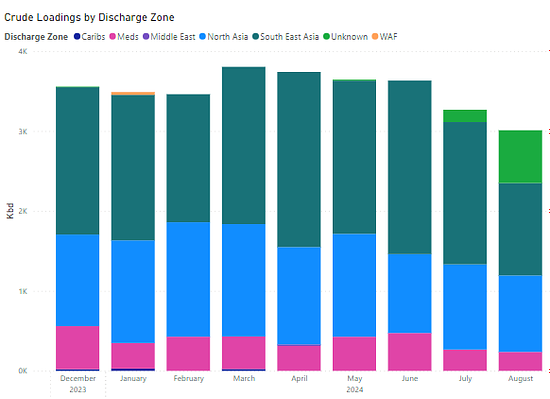

There’s been some movement on Dubai-Brent that should help some WTI cargoes move into the Asian markets. This is driven based on weakness in Brent (Europe) markets, so we should see some additional flows from the U.S. This won’t increase exports about 3.8M barrels a day because we are seeing a slowdown in flow to Europe, which will just be redirected to Asia.

The market is also back to the level that Russian flows become advantageous again, and we should see some increased buying from India and China. There was a lot of weakness from Russia into the market that caused them to “cut” exports, but it was more market driven vs political. The shift back to a “profitable” stance to buy Russian will pull more Urals back into the market.

The additional Russian barrels will leave more WAF in the market- specifically Angola. This will also put some pressure on ME flows as you can see some of the softness in Dubai already forming.

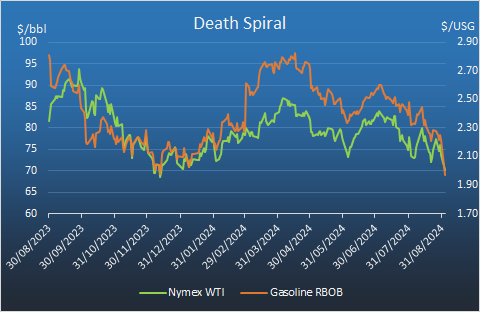

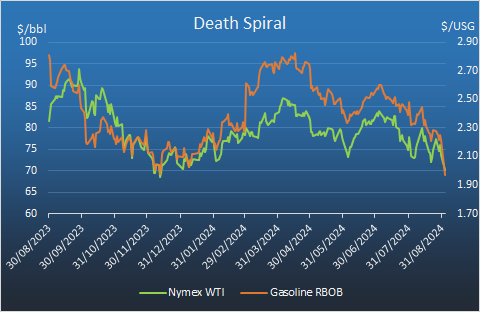

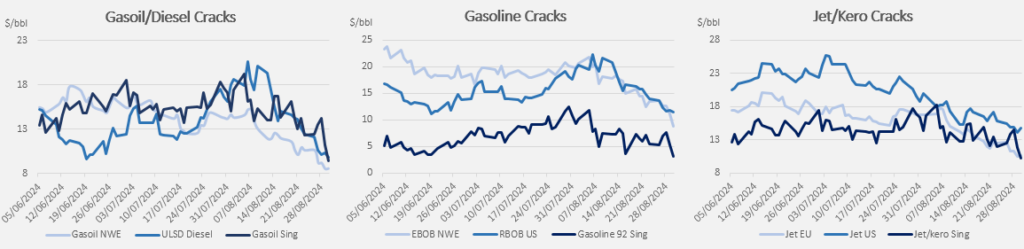

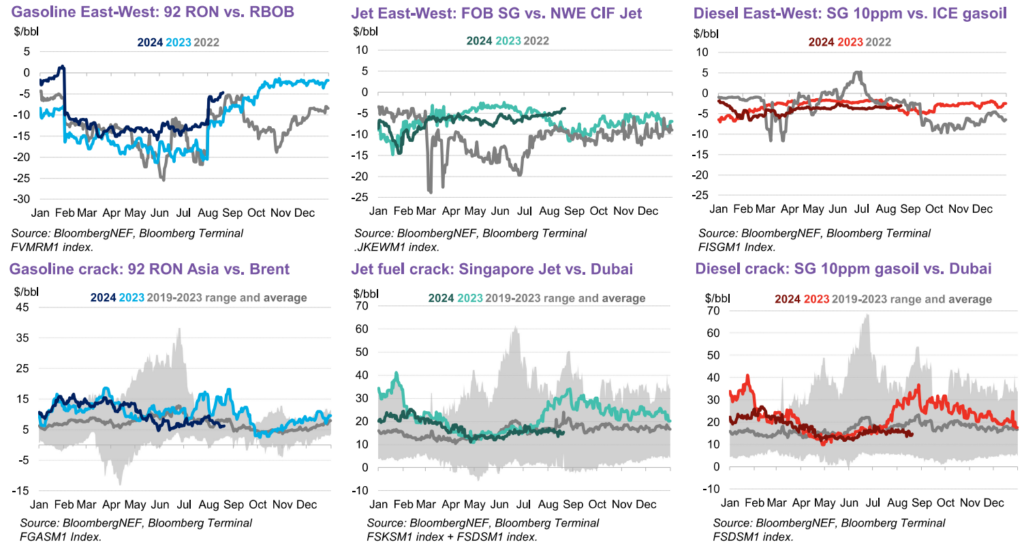

We’ve been discussing the issues with gasoline since May, and our view was that if July proved to be weak- it would result in a sizeable drop across gasoline crack spreads. Gasoil/middle distillate cracks were already struggling while gasoline had some strength- especially in the U.S. We now have gasoline falling rapidly around the world. but the U.S. has given up the crack spread MUCH faster than many. Asian crack spreads were already falling below break-evens for refiners, and it will usher in “faster” declines in run rates.

WAF flows have been fairly steady with little change in flows over the last few days. Given the shifts in physical flows, we don’t see much improvement for Angolan sales until there are some additional price cuts. Current differentials are still “elevated” against last month so there is still some premium to come out of the market. “WAF: WAF crude differentials were steady on Thursday with the number of unsold Nigerian and Angolan cargoes dwindling. Exxon was heard to have sold 2 million barrels of Qua Iboe to HPCL, some of which will likely come from a September cargo that was being offered at Dated Brent plus $2.75. Nigerian Bonny Light was offered at Dated Brent plus $2.50, steady from earlier this week. On Angolan cargoes, about 14 of October’s 35 cargoes are still unsold, a trader said, of which one is still thought to be Sonangol’s cargo of Mostarda that was last heard offered at Dated Brent minus $1.00.”

WTI continues to be the “preferred” volume given the current pricing metrics, and I think it speaks to the slowdown in exports and coming builds in PADD 3. Here is an example: “North Sea: Trafigura offered two WTI Midland cargoes(Sep 22-26, Sep 17-21), The lower of the offers at Dated Brent plus $1.41 on a FOB basis. Equinor sold BP an Oct 1-3 Johan Sverdrup cargo for at Dated Brent flat FOB Mongstad. The deal occurred at the same level as a trade in the previous session, when Equinor sold an Oct 3-5 cargo to BP. WTI remained the cheapest grade underpinning the benchmark on Thursday.”

We’ve talked about additional cuts coming from KSA on their OSPs, and they delivered what the market was expecting. The most important one to watch was Arab Light- especially to Asia with the expectation of a cut between $.50-$.70 a barrel. KSA cut to the higher end of the spectrum, which also helps indicate some near-term softness in demand.

- Saudi Aramco cuts the official selling price (OSP) for Arab light for the US by USD 0.10/bbl to USD 4.00/bbl above the benchmark (Argus Sour Crude Index) for the month of October

- Saudi Aramco cuts the official selling price (OSP) for Arab light for Europe by USD 0.80/bbl to USD 0.45/bbl above the benchmark (Brent Weighted Average) for the month of October

- Saudi Aramco cuts the official selling price (OSP) for Arab light for Asia by USD 0.70/bbl to USD 1.30/bbl above the benchmark (Oman/Dubai average) for the month of October

The biggest issue going forward will be demand as we head directly into a broader recession. The economic slowdown is going to be a hurdle for OPEC+ to bring back production in any meaningful way over the next few quarters.

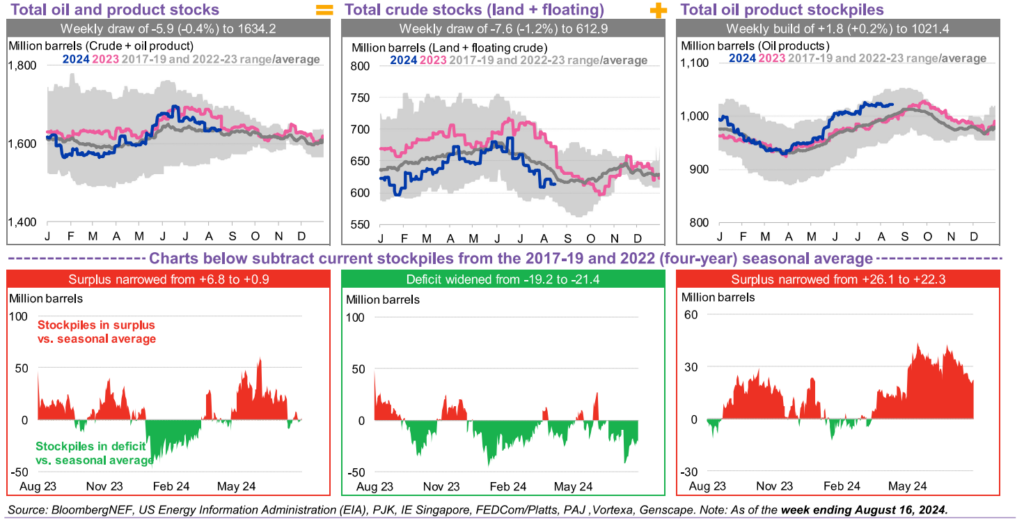

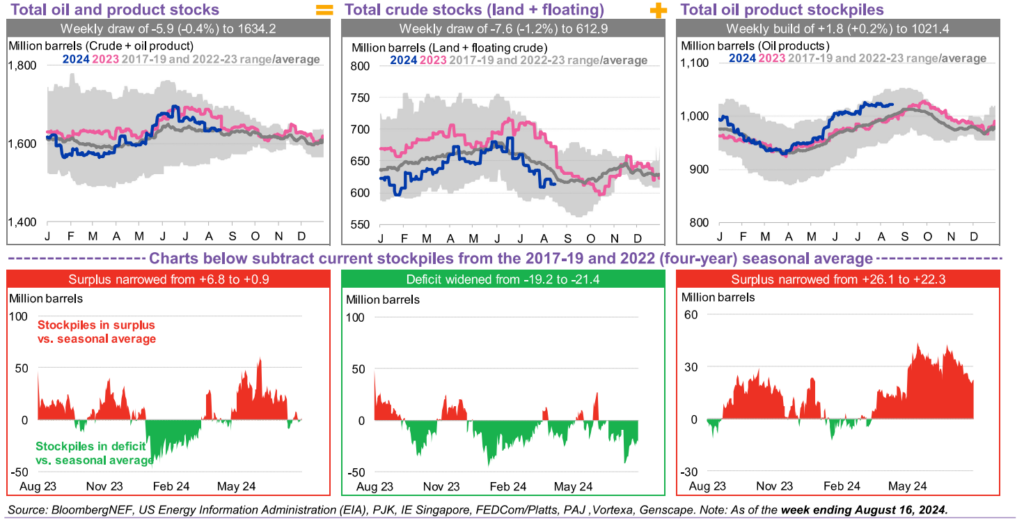

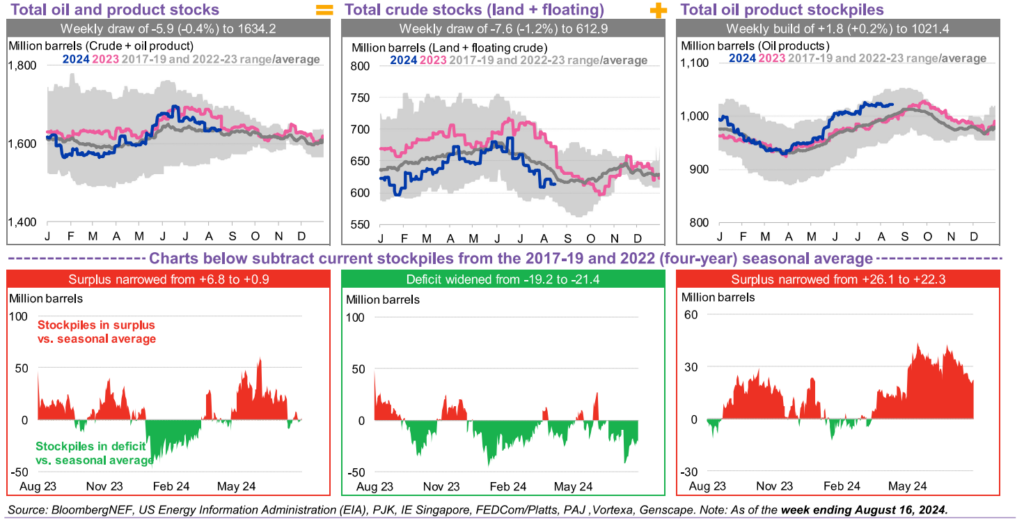

There are individuals out there talking about crude storage, but missing the fact that product storage has significantly changed- and not for the better. Refiners are in no hurry to purchase more crude and will likely cut runs “early” for turnaround. This will leave more crude in storage, and rapidly adjust the storage situation.

I think this chart puts into perspective the crude storage situation because it accounts for land and floating. You can also see the sizeable increase in products that remains WELL above seasonal norms with more builds incoming.

There also remains a large contingent of crude in the transit market, which will replenish a large part of whatever is pulled off the water- reducing floating storage. The shifts in Russian crude pricing will push more volume on the water and leave it in transit for a longer duration. The below chart shows that we remain near record levels for crude in transit- which I think the market ignored previously.

Oil prices had a floor because of the cuts, but if volume returns, storage will rise rapidly given the soft demand in the market. As we head into shoulder season, there will be more crude available for export out of the Middle East with the decline in power burn. There have been some pivots recently out of Iraq and Kazakhstan to reduce volumes, but it’s mostly maintenance and deferrals.

- “3 mil barrels of crude exports canceled, deferred: SOMO official

- Local consumption, Kurdistan production also set for declines

- Fellow overproducer Kazakhstan trims output through maintenance

- Iraq has cancelled a 1 million-barrel spot crude sale and will defer two more “in the coming days” in an effort to meet its OPEC+ compensation targets after overproducing its quota in the first half of the year, a senior official with state marketer SOMO said Aug. 29.

- The country overproduced its quota by hundreds of thousands of barrels per day between January and August, including by 251,000 b/d in July, according to an assessment by seven secondary sources, which includes the Platts OPEC Survey from Commodity Insights.

- The export cuts mark Iraq’s most serious effort to date to bring crude production in line with its current OPEC+ quota, and will be supplemented by lower refinery runs, less output in the semi-autonomous Kurdistan region and reduced crude burn in the power sector, totaling some 280,000 b/d, the senior official said in a briefing with independent secondary sources used by the group to monitor member compliance. Questions remain, however, over Baghdad’s capacity to constrain Kurdish output.”[1]

Iraq is trying to reduce their volumes to “make up” for overproduction, but it will fall flat as more crude is pushed into the export market. There are always two points to watch: production vs exports and crude vs products. A lot of times countries will talk about reducing production but still maintain exports or export less crude while exporting more products. It’s pivotal to watch both sides of the crude barrel to see what is really being done across the energy supply chain.

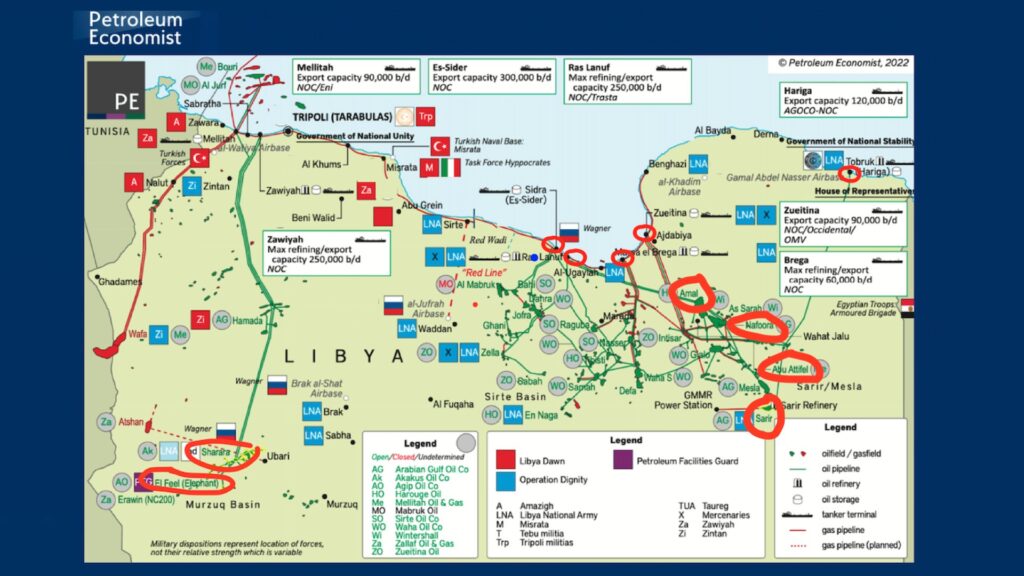

When we turn to Libya, the country is shutting down more capacity as all the Eastern ports have been blockaded. The below chart puts into perspective the five locations that have been shuttered: “Libya’s oil exports are basically offline this morning. All 5 eastern oil ports are shut, they handle 2/3 of exports. 6 oil fields shut or reduced output, including the 2 key fields in south-west. Central bank chief told Financial Times he has fled for his life.” Our base case is that Libyan production and export falls to about 250k-300k barrels a day as the issues get worse within the country. At the moment, crude is still being exported from the country out of storage, but this volume will diminish quickly as production is shuttered. From the 1.2M barrels that were produced in August, it currently sits at about 519k barrels per day, which will continue to decline to our target of 250k through September.

The issues keep spiraling out of control with more political back and forth between the Tripoli Prime Minister- Abdul Hamid Dbeibeh and the administration in eastern Libya- Khalifa Haftar (General Haftar). Kabir was seen as more loyal to Haftar, which created pressure as Dbeibeh is accused of using his armed forces to control the central bank: “The head of the Libyan central bank who controls billions of dollars in oil revenue said he and other senior bank staff had been forced to flee the country to “protect our lives” from potential attacks by armed militia.”[2]

“For Libya, the escalating power struggle poses serious risks. “There are many dangers,” said Kabir. “The oil shutdown will have a negative impact on the economy and the value of the dinar. Also, there are tensions between forces on the ground in Tripoli which support and oppose the measure [to remove him]. So I fear it could lead to fighting.” Kabir also said there were “valuable assets inside the central bank and we don’t know what is happening to them”. Under UN Security Council resolutions, only the central bank in Tripoli is authorised to control and disburse the oil revenues. The UN and the US have called for dialogue to resolve the crisis.”

There was a growing concern that Kabir was closer with Haftar and working behind the scenes to undermine Dbeibeh. This was the underlying excuse used to seize assets and displace the central bank governor. Over the weekend, there’s been rumors that some production is returning back to market, but I think it’s far too early to see barrels flowing again. The longer running issue will be the arrest warrant issued by Spain against Saddem Haftar- we provide a longer running breakdown at the bottom of this report.

There have been early indications that the GNU and Haftar have agreed on a deal framework that will be used to create a broader agreement. This will take time to iron out, but it at least creates a

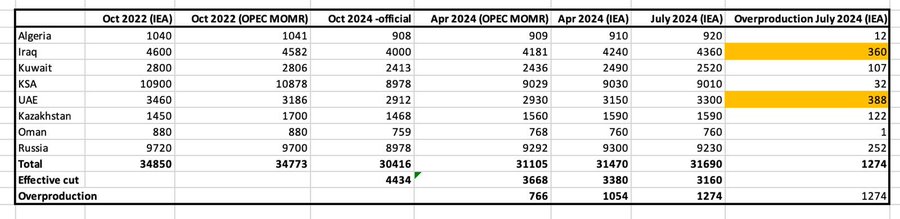

OPEC+ has been putting out rumors that the group will start bringing back barrels in October, but as always- there’s a caveat. They are essentially going to “increase” quotas to the level of current overproduction. This means there will be NO CHANGE to the actual barrels in the physical market, but rather just moving the “official” numbers to where current levels are in the market. “Reuters reported that several delegates within the OPEC+ coalition said they expect to add 543kbd of crude output in October as it gradually restores the crude output halted since late 2022.”

When Libya protests and political changes were happening, I immediately said- “just wait for the overproduction to come from the UAE and Iraq.” Whenever there’s a disruption in the region, those two countries will always start increasing their production or at least exports. Iraq will “absorb” more Iranian barrels to run it through Basrah, and the UAE will pick-up some additional production in the offshore space. We are also coming into Sept/ Fall turnaround where internal demand shrinks driven by reduced power burn. This always leaves more capacity for export.

The interesting backdrop is the new rules for the UAE that they are allowed to increase production as they bring new spare capacity online. If you remember our comments back in ‘20/’21, the UAE was angry about their larger share of the cuts versus what everyone had to do based on a percentage of spare capacity. The UAE has spent billions over the last decade to expand production, and they weren’t going to sit back and not make money on this CAPEX spend. The below figures from the IEA show the level of overproduction, and I can assure you- the UAE isn’t going to “make up” for the levels. Instead, OPEC+ could “increase” their cuts by the amount of overproduction. This will just move people into “compliance” while not actually changing the physical market.

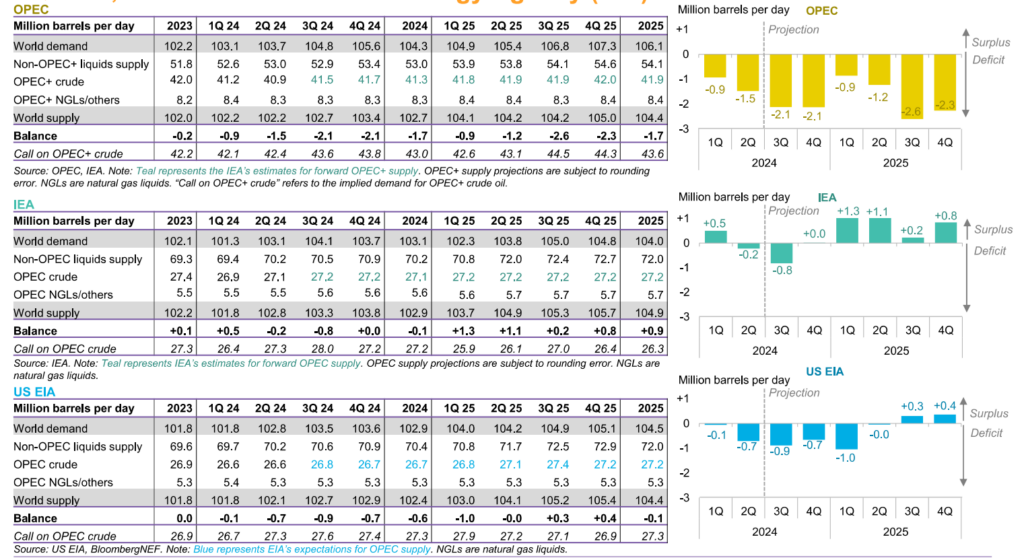

The IEA/EIA is a bit more realistic on demand, but even they are well above what we expect in the market. The economic data is showing a lot of cracks across the consumer and industrial complex, which will keep demand muted. We’ve already seen crack spreads weaken considerably with more downside likely on the gasoline side. So far, our views have played out, which will keep Brent crude futures stuck in the $77-$83 range- with the more likely tighter range sitting at $77-$80.

The rumors continue that Iraq will reduce exports by 190k barrels per day, but I still believe those are just wishful thinking. Russia is “claiming” they will cut production, but as I’ve said countless times, any time Russia is “cutting” is because of market dynamics (less demand) and not because they are trying to “make good” on their promise. Some of the other “cheaters” are going into sizeable maintenance in October, and they will use that time period to act like they are making up for their undercompliance.

The whole system continues to be smoke and mirrors that isn’t actually changing the physical market in the slightest.

The physical market has started to see some softness come back into pricing with the only real “strength” sitting around the Atlantic Basin. This was in response to adjustments from the Libya closures and force majeures. There was some pick-up in imports across China following a VERY slow July. We should see these levels continue into Sept as demand still remains lackluster in the region.

Pricing overall is just falling back to more normal levels following the Libya news.

Freight prices have weakened, which has enabled from some additional LatAm volumes into Asia as well as Russian ESPO blend. This has left more WAF in the market, and I expect to see some weakness in premiums for WAF to kick off Sept. August/ Sept sales were strong at the beginning of Aug but cooled rapidly as we hit the middle of last month with little bump higher. “Chinese oil firms snapped up 15mn bl of Brazilian crude but re-sold to Europe 3mn bl of Angolan crude that would have arrived in China in October taking advantage of higher differentials. Sinopec got 12mn bl of Russian ESPO last week. ESPO Blend premiums have risen ahead of the opening this month of Shandong’s new Yulong mega-refinery, which is expected to be a key buyer of the grade.”

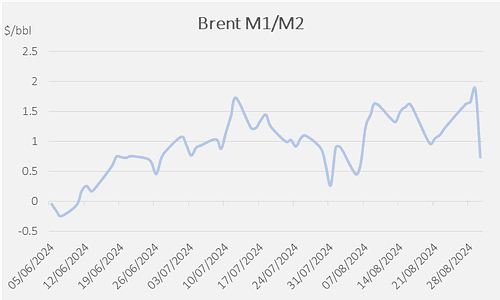

Chinese refiners are negotiating for higher export quotes for refined products through year end in order to help balance storage. “They initially hoped for export allowances of up to 12.5 million tons (100 million barrels) in September, but these hopes are rapidly diminishing, with market expectations now leaning towards a 7M ton batch or even less. Restricting product exports would, in turn, reduce refinery run rates which are already low. Chinese fuel demand has historically peaked in September-October but dismal government investment this year is dampening oil demand from the construction sector, hitting hard on gasoil.” According to Argus Media, Aramco may reduce the October price of its flagship Arab Light grade by around 50/70¢/bl from September. Some refiners said Aramco may even slash its Arab Light price by up to $1/bl if it anticipates weak Asian demand for medium sour crude to persist. As we started earlier, prices spiked due to some of the supply issues, but it quickly fell back with Dubai going from $1.4 to $.8 rapidly.

The arb from U.S. to Asia remains closed, and we are seeing a slowdown of exports into the Med. There was a brief reprieve following the initial Libyan news, but now it’s shifting to a bigger slowdown. Sept was always going to be stronger than August, but the buying interest is slow driven by maintenance and slower demand. This will leave more WTI in the market, which should drive down some of the differentials. KSA will likely keep competitive Arab light pricing into Asia in order to keep WTI from flowing East.

Russian volumes remain problematic, which is driven by market pressure.

The biggest issue, and the crux of the problems we’ve been discussing for a LONG TIME- is the demand problem at the refined product level. Refining margins have fallen across the board, and we don’t see things improving in the near term. The pressure will remain because of recent deliveries finally showing up after being purchased several weeks ago.

Europe saw some of the biggest increases last month from the ME and the U.S., which will keep the EU from purchasing much in September. This will leave more products in the market, and the ME will have to compete more aggressively to move volumes. The U.S. will likely see the most pressure because of these causing builds in PADD 3.

Gasoline will continue to flow into PADD1 from Europe, and while Europe became a dumping ground for gasoil/middle distillates in August- this will likely not continue in September purely because of current storage levels. There’s a huge amount od storage in Europe, and China is seeing a very similar problem, which is why the refiners pushed for bigger quota increases to close out 2024.

These issues across the refining world will continue to play out in the physical world, and pull down DFL and M1/M2. They have already given back a lot of their premium from the Israel and Libya geopolitical shifts.

Refining margins are under pressure around the world with more weakness coming from the gasoline side of the stack. Gasoil/middle distillate was already weak, but this should hold in at current levels through the next few weeks. Based on the whole stack though, we expect to see “early” turnarounds around the world for the fall maintenance season.

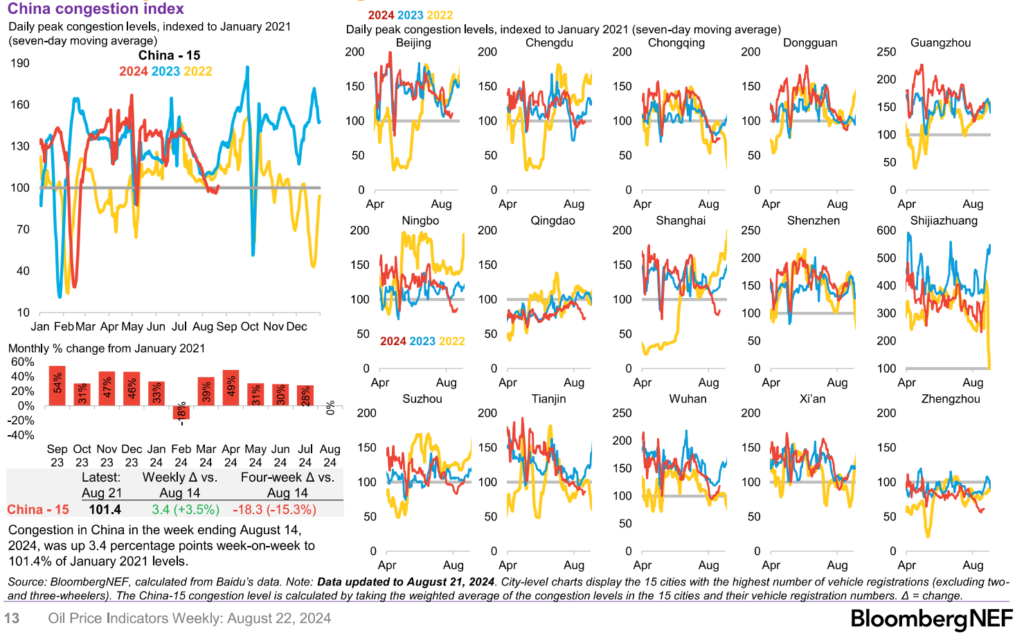

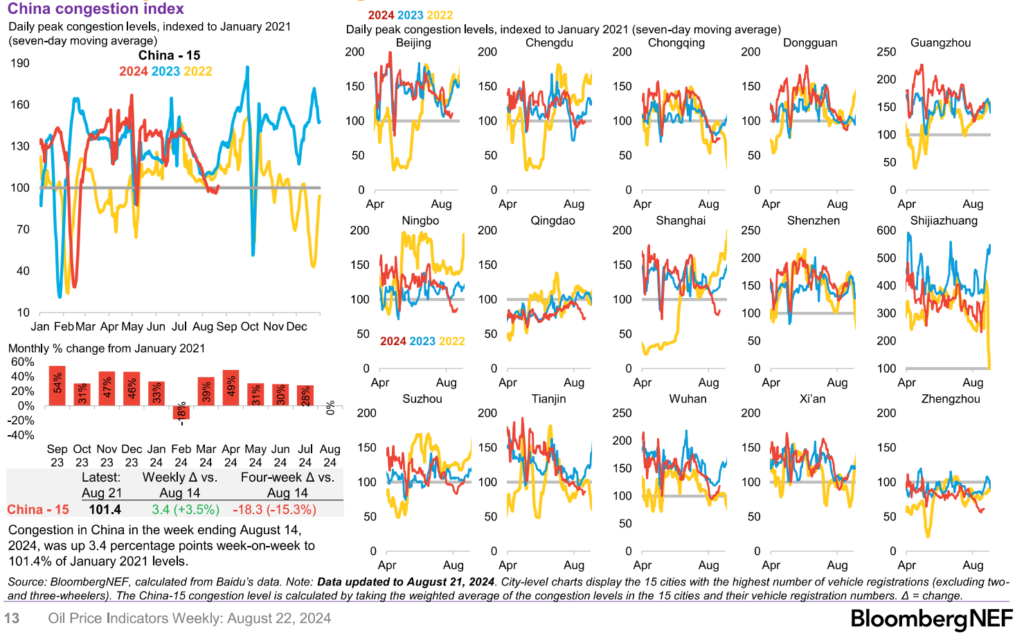

Chinese traffic has fallen below ‘22/’23, and it’s well below our expectation. There will definitely be a bounce back, but it will likely be well below the peak achieved last year. The lack of internal demand and a new mega facility coming online has been a big push for a step-up in export quotas.

The combination of low internal demand and tapped out quotas is keeping refinery activity very low in China, and we’ve heard that state-owned refiners are also reducing their run rates further through September. This will also make way for the new facility to come to market.

The below helps put into context why we think the biggest risk in the near term is gasoline as demand stays weak and it pulls down cracks.

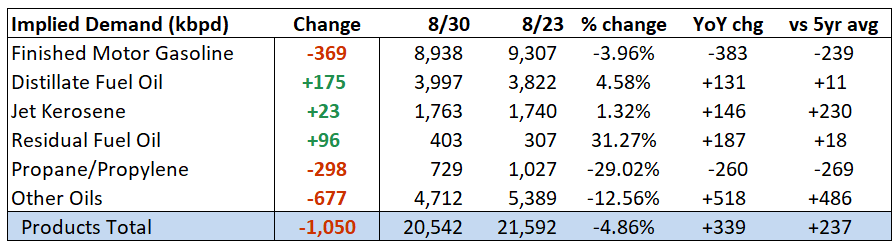

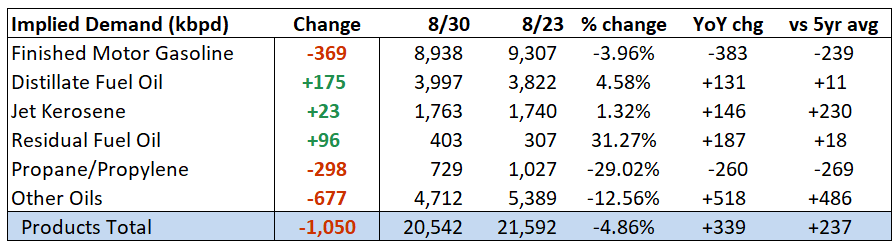

This past week was helped by Labor Day Weekend, but it still saw a very muted shift in broader demand. “According to GasBuddy data, weekly (Sun-Sat) US gasoline demand fell 0.3% from the previous week but was 0.5% above the four-week average. Friday saw the highest daily gasoline demand of any day so far in 2024.” The below gasoline implied demand figures already captured a muted shift of gasoline from blenders to retailers ahead of one of the biggest driving holidays of the year. Instead, it stayed very muted when we look at it across the 4-week rolling average.

When we look at the updated information capturing the full Labor Day weekend, you can see the muted demand carrying through. We are now shifting into the slower driving period and fell short of the “normal” levels by a wide margin. On the distillate front, there was some increases, but we see the demand paring back fairly quickly.

The close out of the driving season saw one of the weakest driving demand periods over the last decade, and it points to more pressure as the consumer struggles not only persist but get worse.

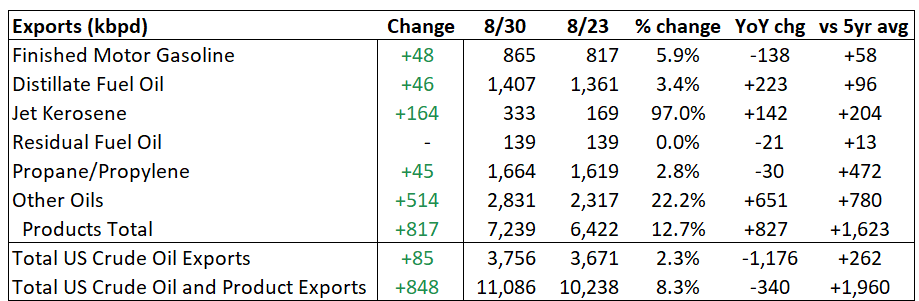

U.S. exports are going to come back into focal point as PADD3 struggles to move crude and products (especially disty) into the market. We’ve been expecting U.S. exports to hang around 3.7-3.8M barrels a day, and there was a bit of a spike driven by the pricing shifts from Libya. The adjustments have been made in the market, and now we are seeing some shifts back to norma

The below shows the stability in the export numbers that have remained around 3.7-3.8M barrels a day. There should be a small bump as additional volumes were purchased due to the Libyan disruption, but we’ve already seen those disruptions priced into the market. As refiners go into maintenance,

The crude markets will remain range bound over the next few months as OPEC+ tries to defend price and weakening demand becomes a much bigger issue. The refining market will be paramount when evaluating the price of crude and the underlying economic health of a region. The Middle East is going to struggle to place additional product, which will leave more competition in the market driving down crack spreads.

Libya Overview

Libya is facing a severe disruption in its crude production, largely due to escalating political tensions and internal conflicts. The key issues at play include the struggle for control of the Central Bank of Libya, the role of the National Oil Corporation (NOC), and the recent international arrest warrant issued for Saddam Haftar, the son of Libyan military leader Khalifa Hafta. These factors have not only crippled Libya’s oil output but also created a ripple effect on global crude markets.

Timeline of Key Events

- Early August: Protests erupted at the Sharara oil field, Libya’s largest, leading to a full halt in production by August 6, removing ~270,000 bpd from the global market

- Mid-August: The Government of National Unity (GNU) in Tripoli attempted to replace the Central Bank Governor, Sadiq Al-Kabir, exacerbating the rift between rival governments. The move was met with strong resistance from the eastern government based in Benghazi, which is aligned with Khalifa Haftar

- The eastern government is not internationally recognized, but controls most of Libya’s oil fields

- Source

- August 25: In response to the GNU’s actions, the eastern government declared a force majeure on all oil fields and export terminals under its control. This action effectively halted all Libyan oil production and exports

- August 28-30: NOC declared a state of force majeure at key oil export terminals

Key Issues and Players

- Saddam Haftar arrest warrant:

- An international arrest warrant was issued for Saddam Haftar by European authorities. Saddam is accused of serious human rights violations. This warrant has inflamed tensions within Libya, particularly between the forces loyal to Khalifa Haftar (Saddam’s father) in the east and the GNU in the west. Khalifa Haftar’s forces have responded by escalating their control over critical oil infrastructure, using it as leverage against the Tripoli-based government

- NOC and Central Bank Conflict:

- The NOC, led by Chairman Mustaga Sanalla, has been trying to remain neutral amidst the political turmoil. Its operations, however, have been severely disrupted due to the ongoing conflict between the GNU and the eastern government. The NOC’s declaration of force majeure at several oil fields and terminals underscores its inability to fulfill international contractual obligations, further straining Libya’s already fragile economy.

- The Central Bank of Libya has been another battleground, with the Tripoli government attempting to replace the long-standing Governor, Sadiq Al-Kabir, with its own appointee. This power struggle is intertwined with control over Libya’s vast oil revenues, which are managed by the Central Bank. The eastern government’s force majeure declaration can be seen as a retaliatory move to protect its financial interests.

- Support and Alliaces:

- Khalifa Haftar and the Eastern Government:

- Egypt:

- Provides consistent military (despite UN arms embargo) and political backing to Haftar

- Views Haftar as a bulwark against Islamist militias

- UAE:

- Provides Haftar with advances weaponry, such as drones, and financial support

- UAE involvement stems from its broader strategy to counter Islamist movements (views GNU as Islamist)

- Russia:

- Provides Haftar with diplomatic support, military training, and reportedly sending the Wagner Group to assist his forces

- Russia’s interest is driven by desire to secure military bases in the Mediterranean and control over lucrative oil contracts

- France:

- Officially supports a political solution in Libya, but France has been accused of backing Haftar due to its strategic interests in North Africa, paticularly in combating terrorism in the Sahel region. France’s support has been more covert, but includes intelligence assistance and some military coordination.

- Italy:

- They’ve actively been playing both sides regarding Haftar and the GNU. They ignored the arrest warrant issued by Spain against General Haftar’s son and have made some side agreements with Haftar.

- There biggest focus has been ending the flow of migrants from Libya across the Med to Italy.

- Egypt:

- Government of National Unity (GNU):

- Turkey:

- Most prominent backer of GNU, provides extensive military support including drones, armored vehicles, and troops. Turkey’s support is part of its broader strategy to expand influence in the Eastern Mediterranean, where it has conflicting interests with Egypt and the UAE. Turkey’s involvement is also tied to securing maritim rights through deals with the GNU

- Qatar:

- Supports GNU primarily due to its rivalry with the UAE and its support for political Islamist groups in the region. Qatar’s backing includes financial support and meida campaigns to bolster the GNU’s legitimacy.

- Italy:

- More balanced approach, but has leaned towards supporting the GNU, largely due to its proximity to Libya and concerns over migration and terrorism. Italy has provided medical and logistical support to the GNU and has pushed for a peaceful resolution that includes the GNU in a broader political framework.

- UN and Western Entities:

- GNU recognized by the UN and receives varying levels of support from Western countries including the US, UK, and Germany. These countries have provided diplomatic support, humanitarian aid, and in some cases, limited military assistance aimed at countering extremist groups in Libya

- Turkey:

- Khalifa Haftar and the Eastern Government:

What to expect going forward

- Continued Supply Disruptions

- Libya’s crude oil production has already dropped significantly. These disruptions are likely to persist as the political stalemate continues. If Haftar’s forces maintain their control over eastern oil fields and prevent exports, this could lead to prolonged outages.

- Short term impact: In the immediate future, these supply disruptions are likely to push crude oil prices higher. We have already seen crude prices increase since the beginning of this conflict.

- Long term impact: If the conflict continues or worsens, there could be long-term damage to Libya’s oil infrastructure. Prolonged shutdowns could lead to a deterioration of facilities and a loss of skilled labor, making it difficult for Libya to restore production quickly even if a political solution is found. This could remove a significant amount of oil from global markets for an extended period.

- Libya’s crude oil production has already dropped significantly. These disruptions are likely to persist as the political stalemate continues. If Haftar’s forces maintain their control over eastern oil fields and prevent exports, this could lead to prolonged outages.

- Price volatility

- The uncertainty surrounding Libya’s oil production is likely to contribute to increased volatility in global oil prices. Markets are already sensitive due to other factors such as sanctions on Russia, OPEC+ production cuts, and ongoing geopolitical tensions in the Middle East. Libya’s situation adds another layer of uncertainty, which traders are likely to price into future markets. The reduction in Libyan oil exports contributes to a tighter global oil supply, making markets more susceptible to price spikes from even minor disruptions elsewhere. This situation could lead to more volatile pricing and increase the cost of oil hedging for companies reliant on stable energy prices.

- Price outlook: Companies and countries may face higher costs due to increased volatility in oil prices. Brent and WTI crude prices have already seen increases, but could spike further if the situation in Libya deteriorates or if other supply risks materialize simultaneously.

- The uncertainty surrounding Libya’s oil production is likely to contribute to increased volatility in global oil prices. Markets are already sensitive due to other factors such as sanctions on Russia, OPEC+ production cuts, and ongoing geopolitical tensions in the Middle East. Libya’s situation adds another layer of uncertainty, which traders are likely to price into future markets. The reduction in Libyan oil exports contributes to a tighter global oil supply, making markets more susceptible to price spikes from even minor disruptions elsewhere. This situation could lead to more volatile pricing and increase the cost of oil hedging for companies reliant on stable energy prices.

- Strategic Shifts by Other Producers

- As Libya’s crude becomes less reliable, other major oil producers might adjust their output strategies to capitalize on higher prices or to stabilize the market. OPEC+ could consider revising its production targets to offset Libya’s lost output, although internal divisions within the group might complicate such decisions. For instance, Iraq recently decided to cut production to below their OPEC+ quota requirement of 4 million bpd after overproducing in recent months. There is potential for Saudi Arabia and other Gulf states to quickly ramp up output production to stabilize global markets; however, these decisions will be influences by broader geopolitical considerations and their own economic needs.

- Highers global oil prices could make US shale production more profitable, potentially leading to an increase in output from US producers. This could partially offset the loss of Libyan crude on global markets, although logistical and environmental constraints would likely limit how quickly US production can respond.

- Global Energy Security Concerns

- The ongoing instability in Libya underscores broader concerns about global energy security. With multiple key producers facing challenges––whether its due to political instability, sanctions, or natural disasters––there is growing anxiety about the reliability of global oil supplies. This could lead to increase strategic stockpiling by major economies.

- Strategic Reserve Utilization: Countries with strategic petroleum reserves (SPR) such as the US and China might draw on these reserves to mitigate the impact of price spikes. The SPRs use is typically reserved for severe disruptions though, so in this situation drawing from the SPR is unlikely, especially as Chinese demand has been weak recently. The use of SPRs is also only a temporary measure to prevent sharp price spikes, so their repeated use of time could diminish their effectiveness.

- Diversification of Supply Sources

- Countries heavily reliant on imports from volatile regions like the Middle East and North Africa may accelerate efforts to secure alternative suppliers or invest in infrastructure that can handle a more diversified import mix. As a direct consequence of Libya’s instability, countries may increasing seek to secure long-term contracts with more stable oil producers, such as those in North America, West Africa, or the North Sea. Additionally, there could be a renewed focus on enhancing relationships with key OPEC+ members that can provide more consistent output, even during geopolitical crises.

- The ongoing instability in Libya underscores broader concerns about global energy security. With multiple key producers facing challenges––whether its due to political instability, sanctions, or natural disasters––there is growing anxiety about the reliability of global oil supplies. This could lead to increase strategic stockpiling by major economies.

Conclusion

To date, Libya has experienced significant turmoil with the ongoing conflict between the GNU and Haftar. Key oil fields and export terminals have been shut down due to force majeure declarations, exacerbating global crude supply issues. As a result, Libya’s oil output has fallen, contributing to increased uncertainty and price volatility in global crude markets. The prolonged disruption of Libyan oil, coupled with the geopolitical tensions in other regions, is likely to keep oil prices in a fixed range with a clear floor. This will lead to further strategic shifts among oil producers and consumers as they try to stabilize the market in the long term.

I’ll be putting out a report focusing on our economic views heading into year end and early next year. It looks as though we are heading directly into a situation of additional economic pressure around the world.

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/082924-iraq-cancels-crude-loading-defers-two-more-to-help-opec-compliance

- https://www.ft.com/content/4609d260-2885-4baf-bb45-1af0fafdece1