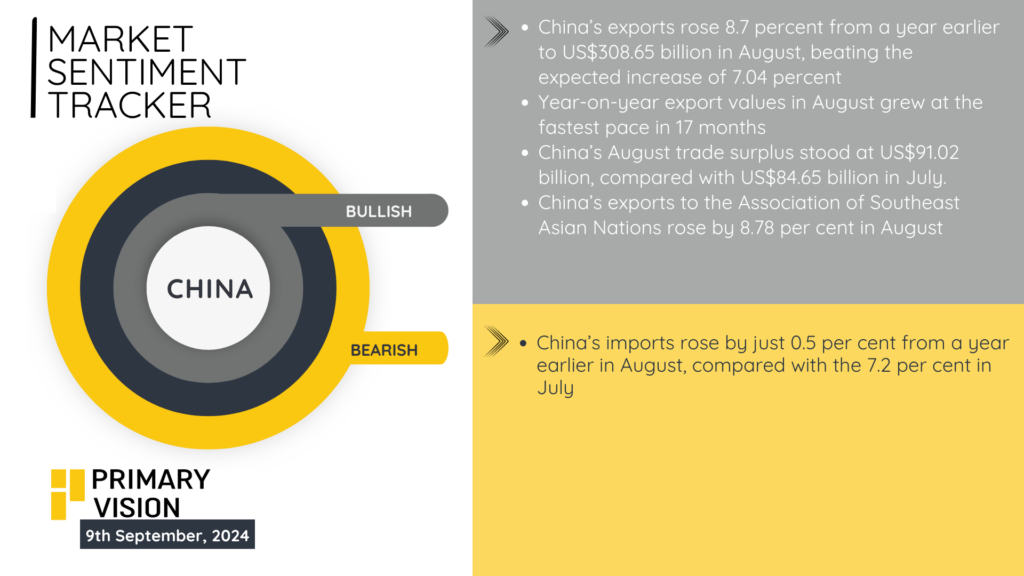

China’s export growth surged by 8.7% in August, reaching $308.65 billion, exceeding the forecasted 7.04%. This marks the fastest pace of export value increase in 17 months, as China’s trade surplus also swelled to $91.02 billion, up from $84.65 billion in July.

Exports to the Association of Southeast Asian Nations showed robust growth, rising by 8.78% in August. However, China’s import performance continued to lag, growing just 0.5% year-over-year, a sharp slowdown compared to July’s 7.2% increase. This highlights persistent challenges in domestic demand despite the robust export figures.

While external demand remains a driving force, the sluggish pace of imports underscores the imbalance within China’s economy, particularly as domestic consumption and industrial demand continue to struggle. These numbers suggest a complex economic environment where strong global trade momentum is contrasted by internal economic softness.

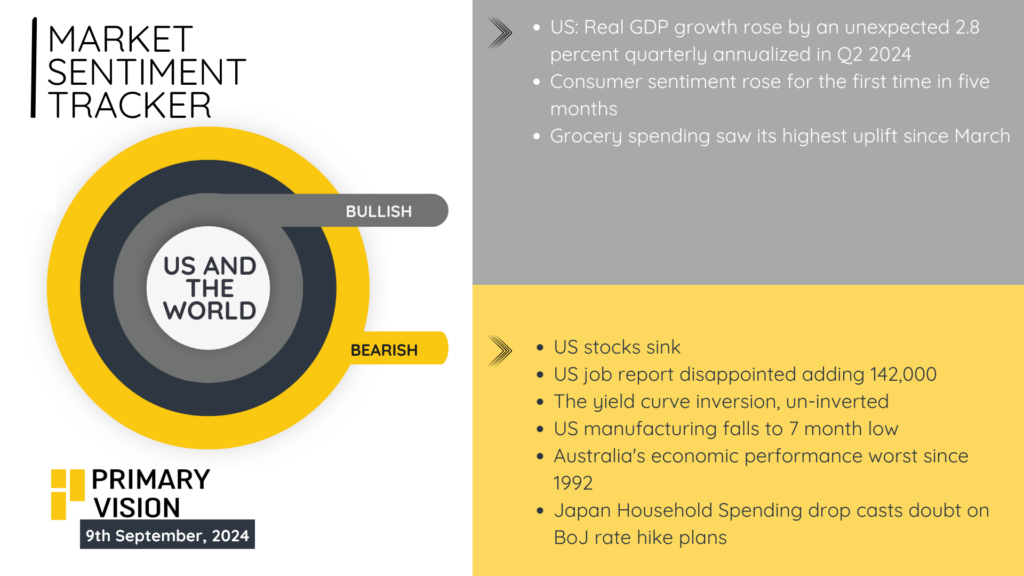

The U.S. economy surprised with a 2.8% annualized GDP growth in Q2 2024, surpassing expectations. Consumer sentiment showed signs of improvement, rising for the first time in five months, while grocery spending hit its highest level since March, signaling stronger consumer behavior. However, markets remain mixed as U.S. stocks slid and the jobs report underwhelmed, adding only 142,000 jobs, below expectations. Manufacturing fell to a seven-month low, adding concerns about the industrial sector’s outlook. Globally, Australia’s economy posted its worst performance since 1992, while Japan’s household spending slump raised doubts about the Bank of Japan’s future rate hike plans. The U.S. yield curve inversion briefly un-inverted, but lingering economic challenges remain, indicating uncertainty across multiple markets despite stronger-than-expected consumer-driven growth.

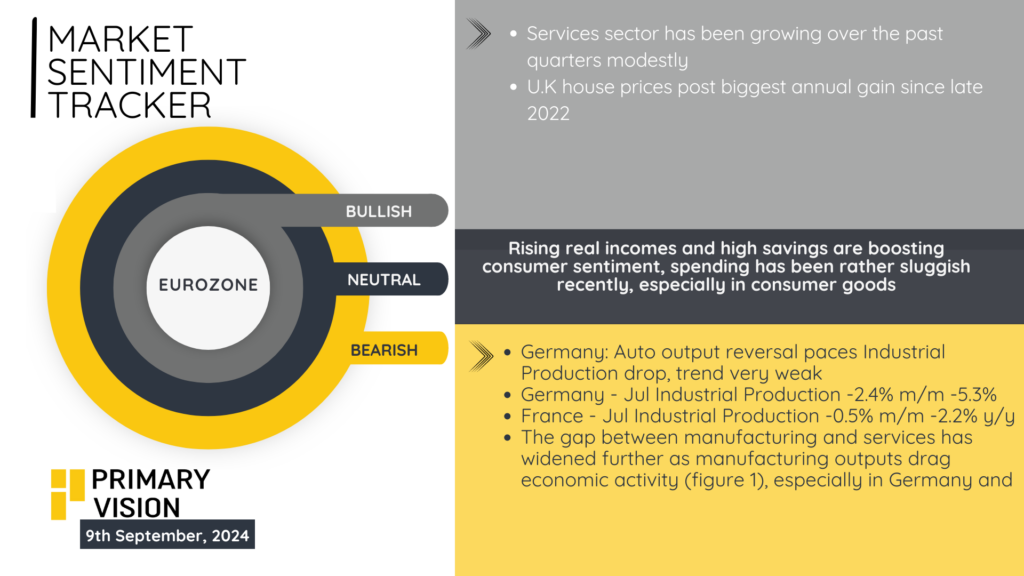

Germany’s auto output saw a sharp reversal, with industrial production dropping by -2.4% m/m in July and -5.3% y/y, indicating a weak trend for the country’s manufacturing sector. France also faced a decline in industrial production, down -0.5% m/m and -2.2% y/y, contributing to broader concerns about the Eurozone’s industrial health. The services sector has been a positive driver, growing modestly over the past few quarters, but the gap between manufacturing and services continues to widen. In the UK, house prices posted their biggest annual gain since late 2022, reflecting resilience in the housing market. While rising real incomes and savings are helping boost consumer sentiment, actual spending remains sluggish, particularly in consumer goods. Overall, the Eurozone is grappling with mixed signals: sluggish manufacturing dampens growth prospects, while the service sector and housing markets provide pockets of strength.

The 9th September MST reveals important insights that require more than a surface-level view. China’s sharp export rise of 8.7%—its fastest in 17 months—might appear encouraging, but when paired with a mere 0.5% import increase, it signals a critical issue: domestic demand is sputtering. This disconnect raises concerns over China’s economic resilience, as strong exports can only go so far in driving sustainable growth if local consumption lags.

In the U.S., the unexpectedly strong Q2 growth rate of 2.8% provides some relief, but a deeper dive into labor market data (142,000 jobs added vs. 175,000 expected) exposes cracks in the recovery. Paired with manufacturing falling to a 7-month low and the yield curve briefly un-inverting—a classic recession signal—the signs point toward a slowing pace of expansion.

Europe’s troubles are structural. The continued slump in Germany’s industrial production (-2.4% m/m) reflects deep issues within its manufacturing base. While the services sector has shown growth, the gap between manufacturing and services threatens the overall balance of the Eurozone’s economy. The imbalance will likely limit the region’s economic performance, with long-term implications for industrial recovery.