Frac Spread And Strategies

Our short article discussed our initial thoughts about ProFrac Holding’s (ACDC) Q2 2024 performance a few weeks ago. This article will dive deeper into the industry and its current outlook. The recent slowdown in drilling and completion activity in the natural gas basins affected the company’s operations. The recent spate of M&A and consolidation encourages larger operators to collaborate with service companies that deliver scale efficiency. The company increased its market share in West Texas – its largest operating region. It will also look to benefit from the recovery in natural gas basins.

In June, ACDC acquired Advanced Stimulation Technologies, a small frack service provider. The acquisition enhanced its earnings profile and improved its position in one of the most active onshore regions in the US. The company will invest in next-generation equipment that enables diesel substitution, utilizing natural gas as the primary fuel source. It will also focus on e-fleets and dual fuel pumps. Currently, 70% of the company’s active fleets include e-fleet or natural gas-capable equipment. ACDC’s average active fleet declined in Q2. Although the price declines are expected to continue into Q3, ACDC’s management expects that volumes will trough and will likely start to recover in Q3.

Explaining Diversification Strategies

ACDC follows a vertically integrated, customer-centric strategy and actively looks for alternative power generation. Grid constraints and AI-driven computing power requirements determine the demand for power generation in various end markets. Diesel substitution at wellhead and next-generation e-fleets helped diversify its power generation services. It will also improve efficiencies based on pump hours per active fleet. The company witnessed lower utilization in Q2 but expects utilization to improve in Q3.

To improve utilization and profitability in the mining services, it plans to idle a mine in Louisiana and implement automation across its mines to increase operating leverage. Proppants operations will benefit from its vertically integrated platform. As market conditions improve, Alpine Silica (ProFrac’s proppant production segment) is positioned to produce higher throughput, higher utilization, and lower cost per ton.

A Q2 Financial Discussion

From Q1 to Q2, ACDC’s revenues from the Manufacturing and Other segments improved (29% and 14% up, respectively), while its revenues from Proppant Production (11% down) and Stimulation services (2% down) fell. Quarter-over-quarter, the company’s adjusted EBITDA margin shrank by 410 basis points as operators reduced drilling and completion activity in natural gas basins. The company’s free cash flow declined steeply in 1H 2024 over a year ago.

Of the $1.2 billion of debt, the majority will not mature until January 2029, which means its financial risks are low in the near term. ACDC’s leverage (debt-to-equity) deteriorated to 0.98x as of June 30, 2024, compared to 0.81x on March 31. It had $161 million of liquidity as of June 30.

Relative Valuation

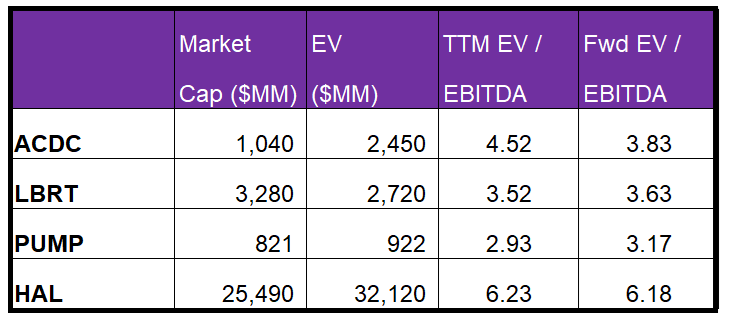

ACDC is currently trading at an EV/EBITDA multiple of 4.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.8x.

ACDC’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a much higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is slightly higher than its peers’ (LBRT, PUMP, and HAL) average. So, the stock is reasonably valued, with a positive bias, compared to its peers.

Final Commentary

Lower natural gas prices and drilling & completion activities adversely affected ACDC’s outlook. It appears that ACDC’s average active fleet declined in Q2, while pricing declines are expected to extend into Q3. It also idled a mine in Louisiana to improve utilization and profitability. The company has focused more intensely on West Texas to offset the effect. It has been investing in next-generation equipment that enables diesel substitution, including -fleet or natural gas-capable equipment. In June, it acquired Advanced Stimulation Technologies to strengthen its position in one of the most active regions in the US onshore.

ACDC witnessed lower utilization in Q2 but expects utilization to improve in Q3. Its free cash flow declined steeply in 1H 2024 over a year ago. Although its debt level is high, financial risks are low in the near term as it has no near-term debt maturity. Compared to its peers, the stock is reasonably valued, with a positive bias.

Premium/Monthly

————————————————————————————————————-