We still hold to our $73-$77 price target because the physical market doesn’t support the current rally above $77. Just as the physical market didn’t support the drop to $71- the physical market is essentially anchoring the Brent crude market to a $75 average with some swings in between. The slowing demand in the region helps balance the loss of CPC, gain of Libya, and slowdown of Iranian exports. Net/net there hasn’t been much change in physical crude availability, which has kept the physical reaction fairly muted. There was a sizeable spike in the geopolitical premium as we discuss below, but the physical market has barely flinched. This is why we believe that futures prices will fall back within our range and settle at around $75 over the near term.

The energy market saw a big spike in prices following the Iranian missile attack against Israel, and Israel eliminating several entities within Lebanon and destroying an ammo depot in Syria. We’ve been expecting an Iranian attack to happen, and it took much longer to transpire than we initially expected. But, the attack was strategic in a way to show “force” while not causing any meaningful damage or loss of life. There are reports that the attack was made up of 180 missiles with a large portion being shot down by KSA, Jordan, U.S., Israel, and other allies in the region. The problem was the overwhelming volume that resulted in multiple successful strikes.

The missile strike coincided with a ground offensive into Southern Lebanon, and we don’t see a slowdown in the ongoing battles around Lebanon. “The decision to begin a ground offensive in Lebanon came after almost a year of rocket, missiles and drone attacks by Hezbollah. This included more than 7,500 rockets launched at Israel between October 2023 and August 2024. In the wake of the first attacks on Oct. 8 of last year, Israel evacuated communities along the northern border, including the city of Kiryat Shmona; more than 60,000 Israelis remain displaced, with no way to return home as long as the Hezbollah attacks continued.”[1] Israel struck at the new leader of Hezbollah Hashim Safi al-Din when he was meeting with senior military leadership. There hasn’t been any confirmation of his death, but it would be only several days of him taking control following the assassination of Hassan Nashrallah.

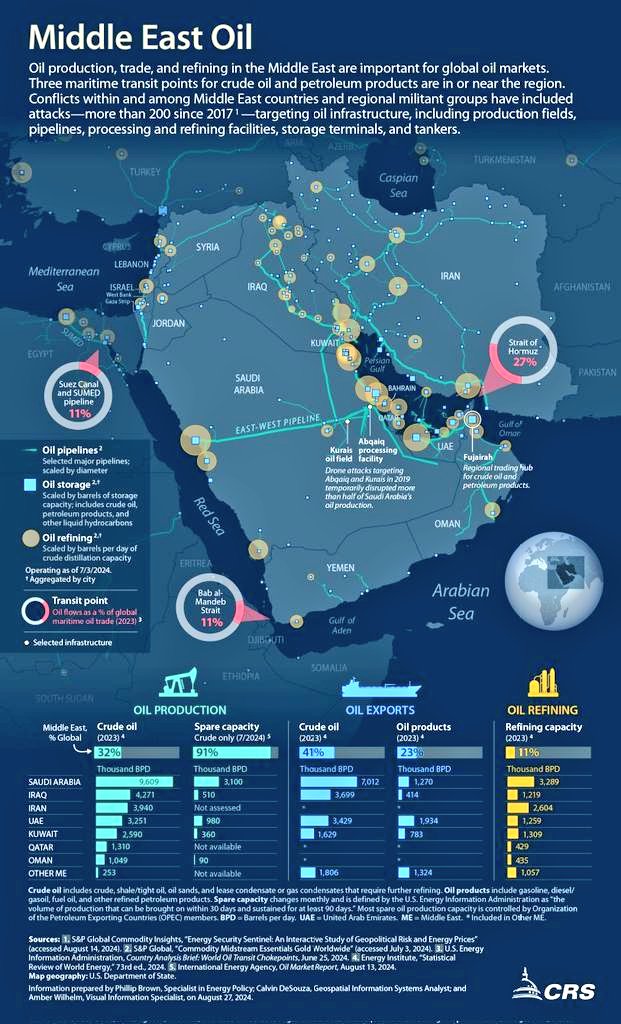

There has been talk about potential impacts to Iran’s crude assets, which we believe is highly unlikely. But, it’s important to understand where these assets are located so you can identify what is hit during the Israeli response.

Israel will likely respond to Iran in some form directly within their country, but I want to stress that it will be HIGHLY UNLIKELY they strike crude exporting or producing assets or refining. The last thing Israel wants to do is unify the country against them, but rather use the local populaces desire to shake the regime to their advantage. By striking energy assets, you risk the chance of civilian deaths and other collateral damage. When the regime falls (which it will), you want the people to be able to generate revenue, and the easiest way to do that is through energy flows. A worthwhile endeavor for Israel would be the crippling of Iran’s nuclear program. This doesn’t have to be completely destroyed but rather “disabled” would create enough of a response without sparking broad local support. Israel could also strategically target IRGC coastal bases, naval ports, and radar stations as a show of force. There have been rumors swirling that Iran has reached out to Pakistan to acquire additional ballistic missile material, but this is VERY unlikely to have happened and if it was, VERY unlikely Pakistan would fulfill the request. Pakistan gets a significant amount of their monetary support from the GCC (KSA) and IMF, and if they provided ballistic assets to Iran- that money flow would stop almost instantly.

Israel has also been striking Muslim Brotherhood leadership in Lebanon, which helps Egypt while providing another blackeye to Turkey and Qatar. Qatar has been very quiet throughout this whole ordeal because they have found themselves on the wrong side of history multiple times. I don’t see them getting very active in their commentary, especially as Israel has gotten more aggressive in their Syrian targets. They struck a Russian airport following the delivery of new equipment destined for Lebanon, which will continue to happen as Israel expands their operation in the country,

Another thing that is grossly overblown is the shuttering of the Strait of Hormuz. Iran wouldn’t risk doing that because it would create huge impacts for others in the region and spark a much bigger response outside of just Israel. India has already stopped buying Iranian crude in any meaningful way following Houthi attacks against the Indian navy and flagged ships.

- Iran produced 3,906mbpd crude oil/condensate in 2023 and refined 2.578mbpd.

- They exported around 1.3mbpd of crude oil and condensate, which was mainly sold to China.

- China added 1.11mbpd to inventories in 2024

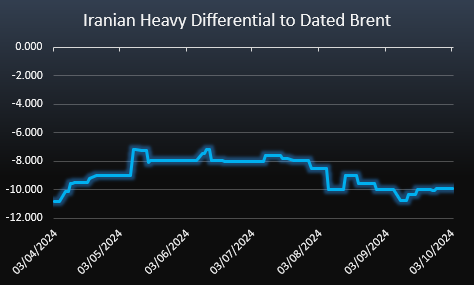

Libya is also bringing back crude faster than we expected, which will help soften any slowdown in Iranian exports. Out of precaution, Iran sent any tankers near their ports into the open water and slowed any returning vessels. This took their exports essentially to zero as a precaution ahead of an Israeli response. Libya coming back online helps defer some of these risks, but we do have CPC moving to their lowest levels in several years for turnaround that is expected to last 2 weeks. “Kazakhstan will see its largest oil-output cuts under the OPEC+ agreement in October, as scheduled maintenance will halt production at the Kashagan field, the energy ministry said.” Repair work at the Kashagan oilfield has been postponed until Oct. 7. The maintenance work on the 400,000 barrel per day field is expected to require operations to be halted for 28 days.

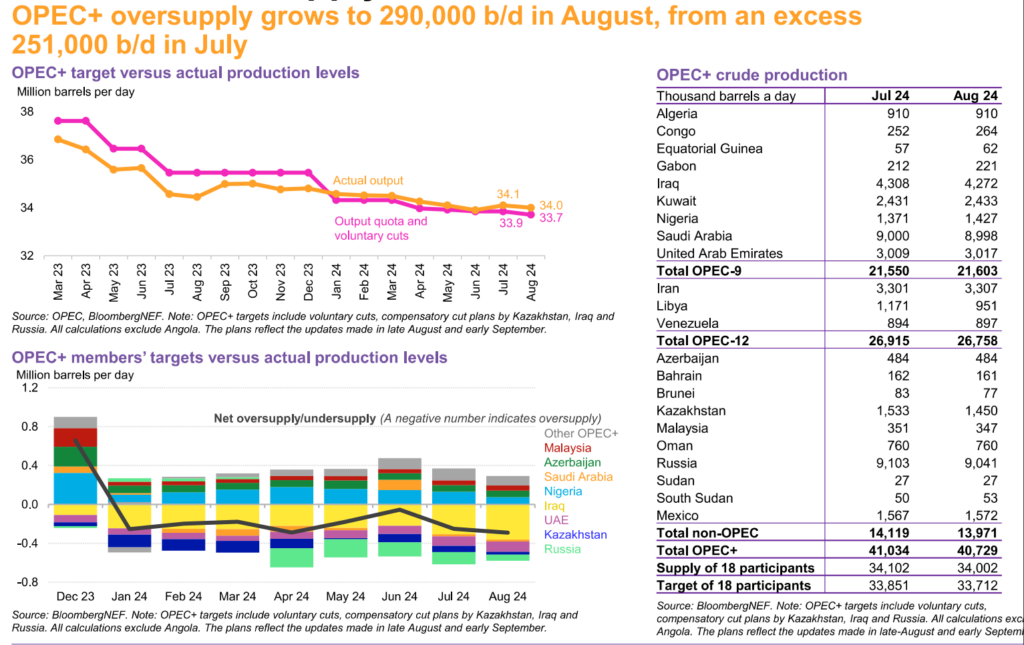

OPEC+ “compliance” is purely being achieved due to maintenance and not because cheating countries are looking to be good stewards of the agreement. We are likely going to see a similar- if not larger- oversupply in September, but it will pull back in October with maintenance work.

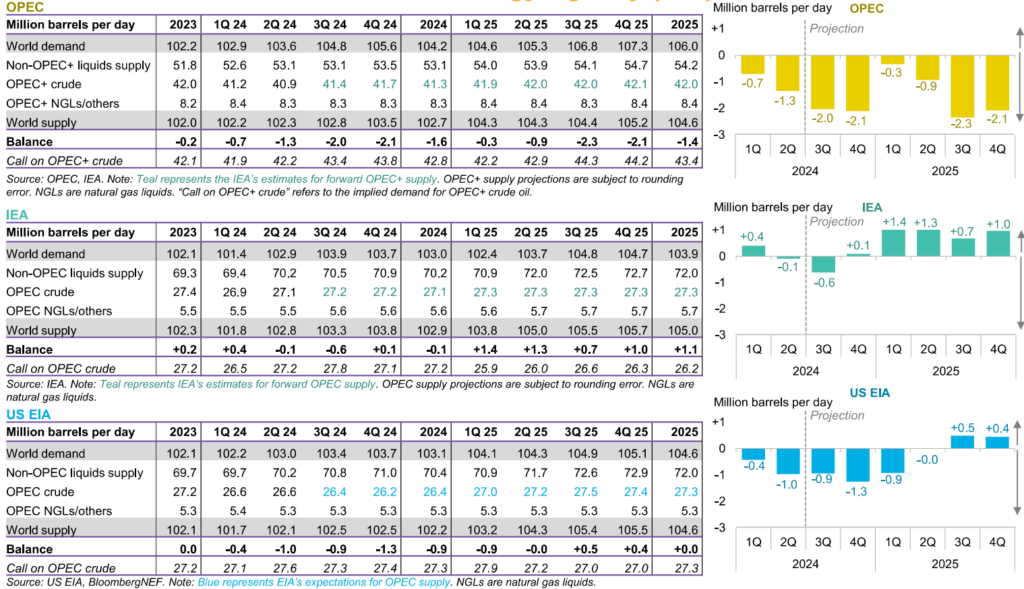

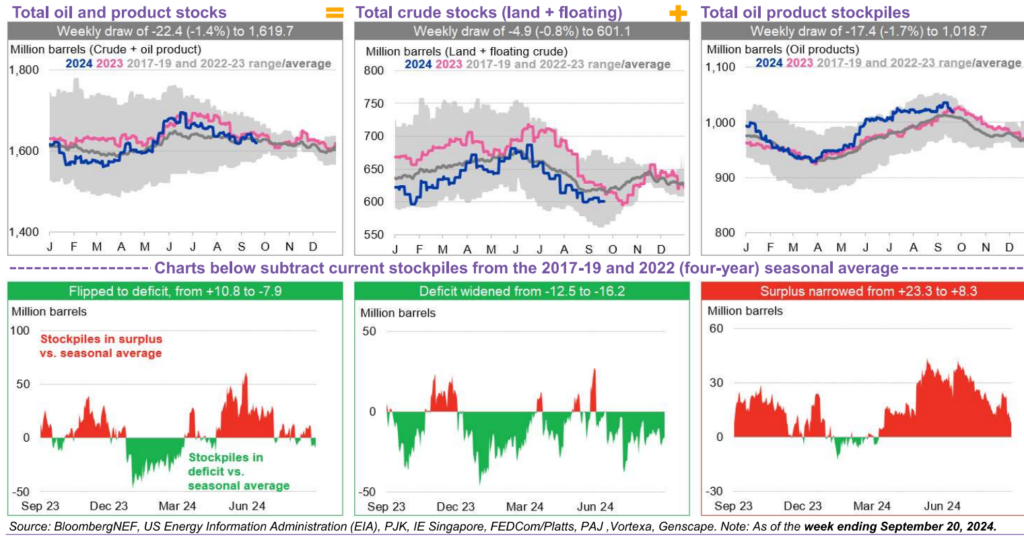

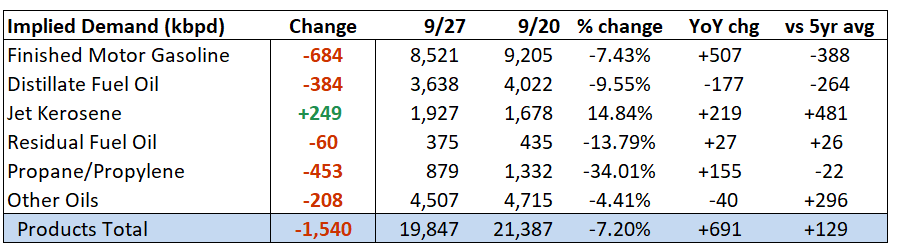

Some of the agencies out there have some bullish 4Q’24 storage numbers regarding crude balances, but we believe the demand side is overblown to the upside. The market continues to ignore the economic pressures in the market, and the broad slowdowns that are hitting a lot of key industrial markets. We’ve already seen broad pressure in the gasoline markets, but the biggest concern going forward is the distillate/ gasoil market. This is where we expect the most weakness, which will result in additional refining run cuts keeping crude demand muted.

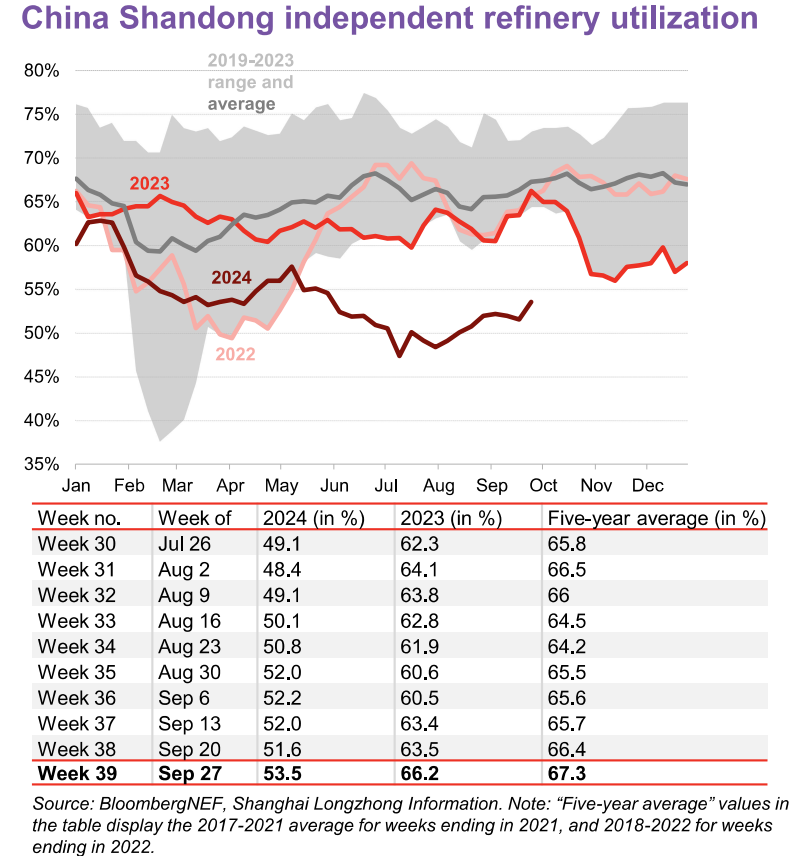

Shandong facilities have already faced significant pressure from limited internal demand and capped export capacity into the global market. Even if they could export, the demand abroad (specifically Singapore) has been very slow keeping cracks under pressure. There is typically a bounce in Shandong refining output this time of year, and this period is no different just from a MUCH lower level. Based on the current dynamics, we don’t expect to see any real pivot in the market to drive teapots to close this gap. If anything, we expect to see more pressure to the downside just as state-owned refiners drift from about 80% utilization rate to 77%.

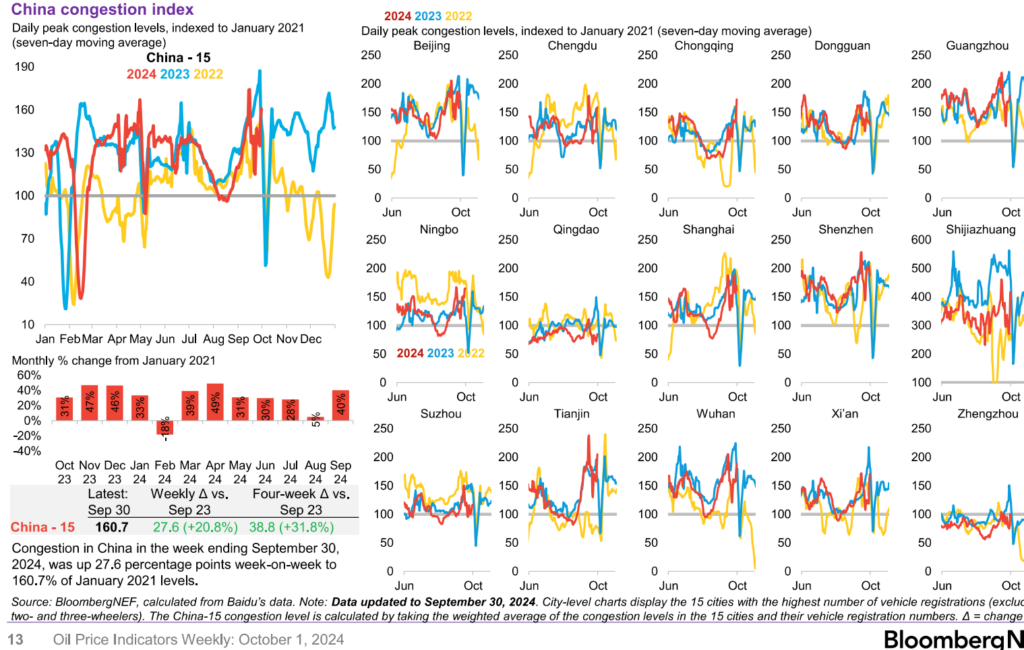

There has already been broad run cuts in Singapore, Korea, and other Asian nations, which provided some support for distillate cracks in the near term. Chinese activity remains under pressure when compared to previous years. The holiday saw some additional travel, but we expect things to track closely to 2023 (without the huge spike down).

A loss of Iranian barrels would create an even bigger problem for teapots who are the largest buyers of Iranian product. A loss in this steeply discounted crude grade would force more pressure.

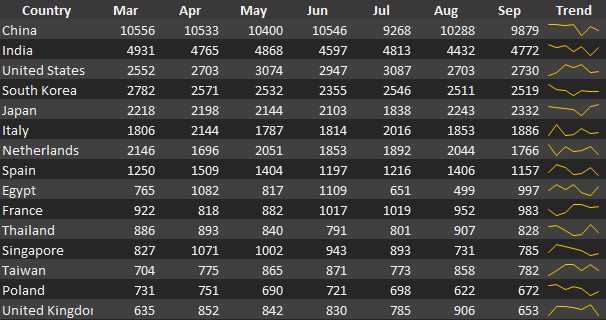

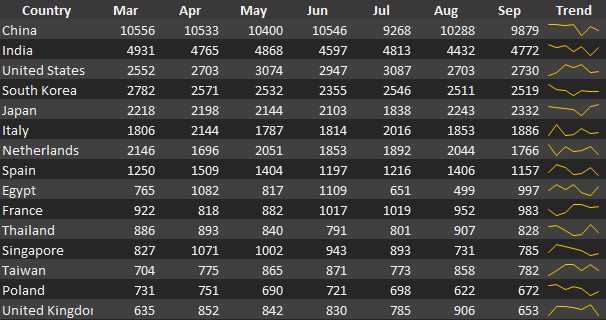

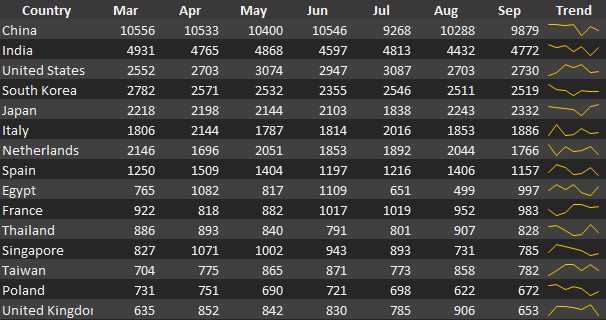

When we look at broad crude imports for September, you can see the underlying pressure. The September numbers were very disappointing, especially when you consider a large part of this crude would be consumed as product in the winter months. This is why the physical market barely reacted to Libya blockade and Iran’s attacks- there isn’t a shortage in the floating market.

What we did discuss the last few weeks was the physical market getting back to some level of “normalcy.” This also supports our view that October imports will resemble something closer to August.

I think the Brent DFL number gives a much better view of how flat or “limited’ the fear has been in the broader physical market. I don’t see the price to continue to move higher, but rather “Flatline” in this pricing structure.

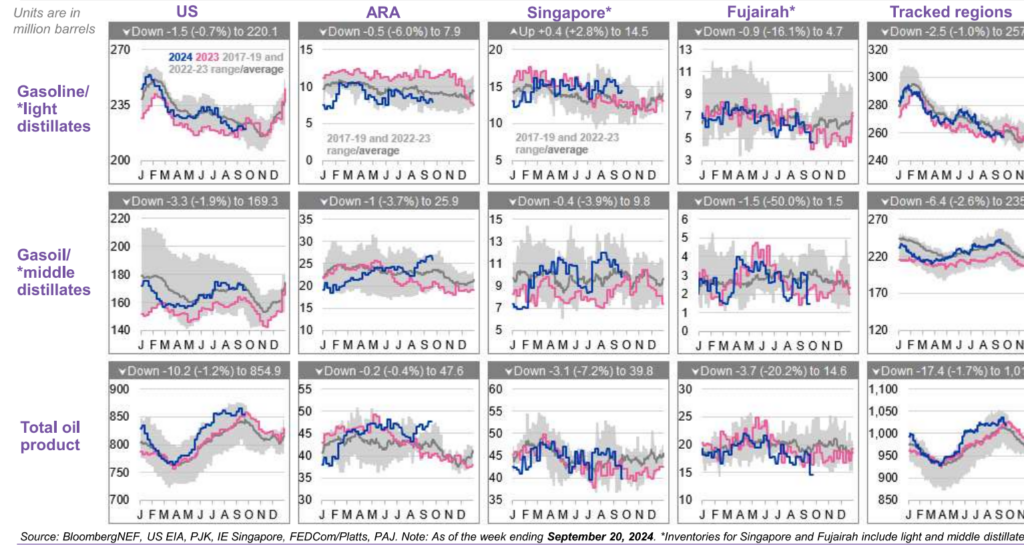

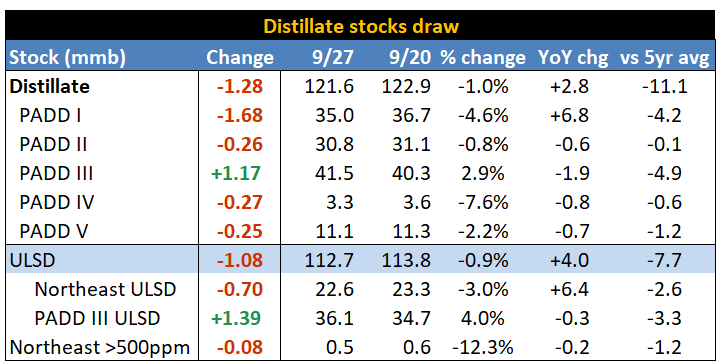

When we look at the product market, gasoil/ middle distillate is showing some additional problems. Flows have accelerated out of Fujairah heading into the Atlantic Basin, which will put pressure on U.S. exports. We expect to see a sizeable build in PADD3 for disty as ARA is showing a much bigger issue. Singapore is sitting at a fairly comfortable number, but we expect that to start increasing as well as flows accelerated out of Fujairah. There has also been a pick-up in Middle Eastern refinery run rates, which will also bring more storage into the region replacing what’s been exported.

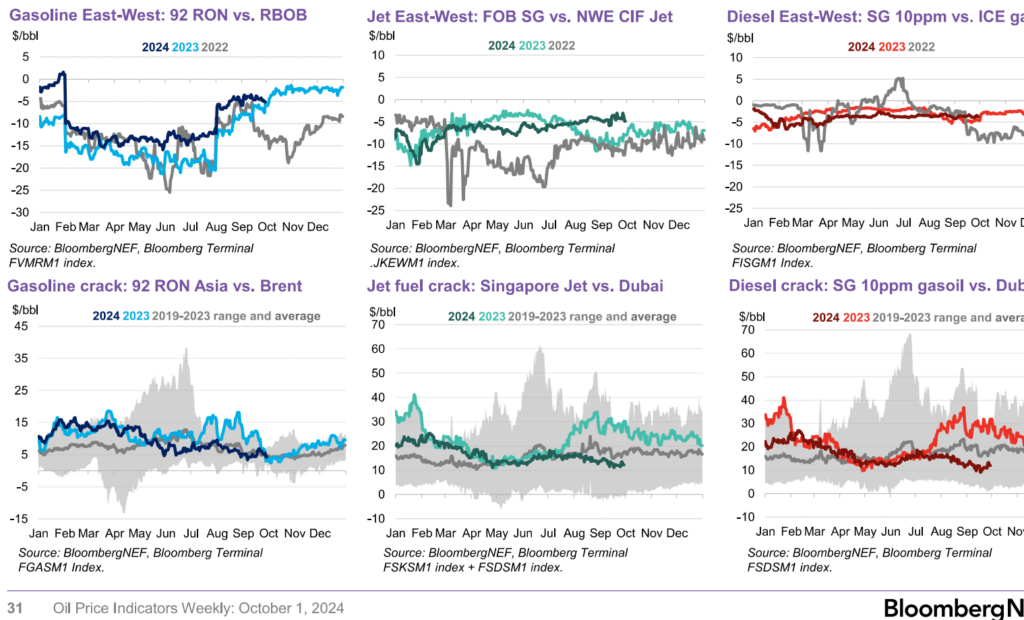

This will push crack spreads lower with more pressure in gasoline while diesel cracks weaken to below 2023 and towards the low end of the curve vs Dubai.

The shifts in the physical market is going to be important to watch in Brent vs Dubai. The Iranian uncertainty pushed Dubai higher, but we haven’t seen much change out of other regions. Murban and Brent will trend lower as geopolitical fears get priced in and fade.

On a board basis, we are in a “normal place when it comes to crude and products together. The broad product overhang will slow the demand for crude driven by reduced refinery runs and “crude in transit” being pulled into storage.

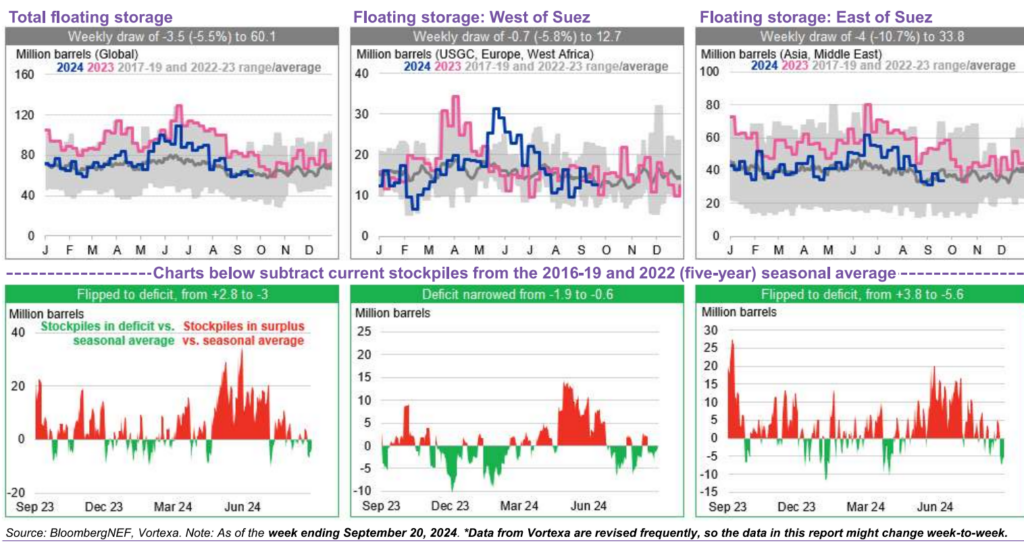

Floating storage is hovering around the 5-year average, but this is also something that is going to trend higher over the next few weeks as refiners head into a deeper or “earlier” turnaround.

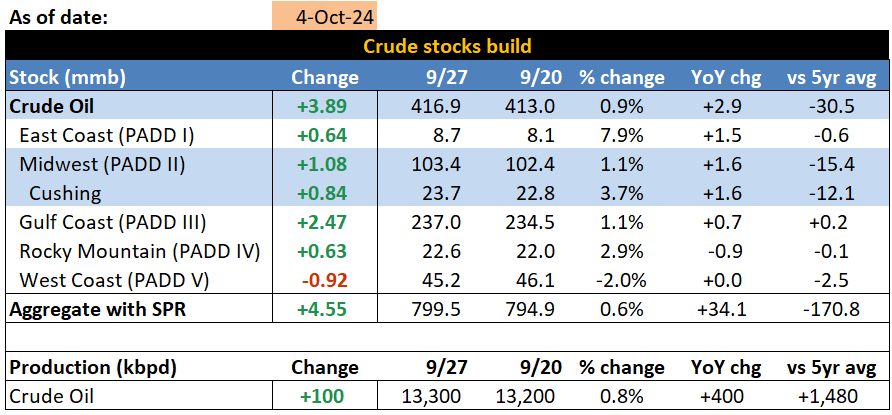

When we turn just to the U.S., you can see builds starting, which will likely accelerate driven by PADD 3.

The driver of the builds will be the slowing pace of exports- especially into Europe. The GoM to Asian arb has already been closed, which leaves U.S’s only hope to be Europe. This is a key reason I believe exports will remain between 3.7-3.8M barrels a day.

The exports for distillate are also set to take another drop driven by the ARA builds and additional cargoes coming from the Middle East. We still have 2, (possibly 3) VLCCs fully laden with gasoil bound for Europe.

There was also a sizeable drop in demand back to the ranges we highlighted the other week. “According to GasBuddy data, weekly (Sun-Sat) US gasoline demand fell 0.5% from the week prior and was 2.8% below the four week average. We model US gasoline demand at 8.605mbpd.” We’ve been discussing an 8.5-8.6M barrel a day gasoline demand number, and this is where we will likely live over the next week or two. There will be more downside over the next month in line with seasonal slowdowns, but as you can see from the 5-year average- we will continue to be below normal levels.

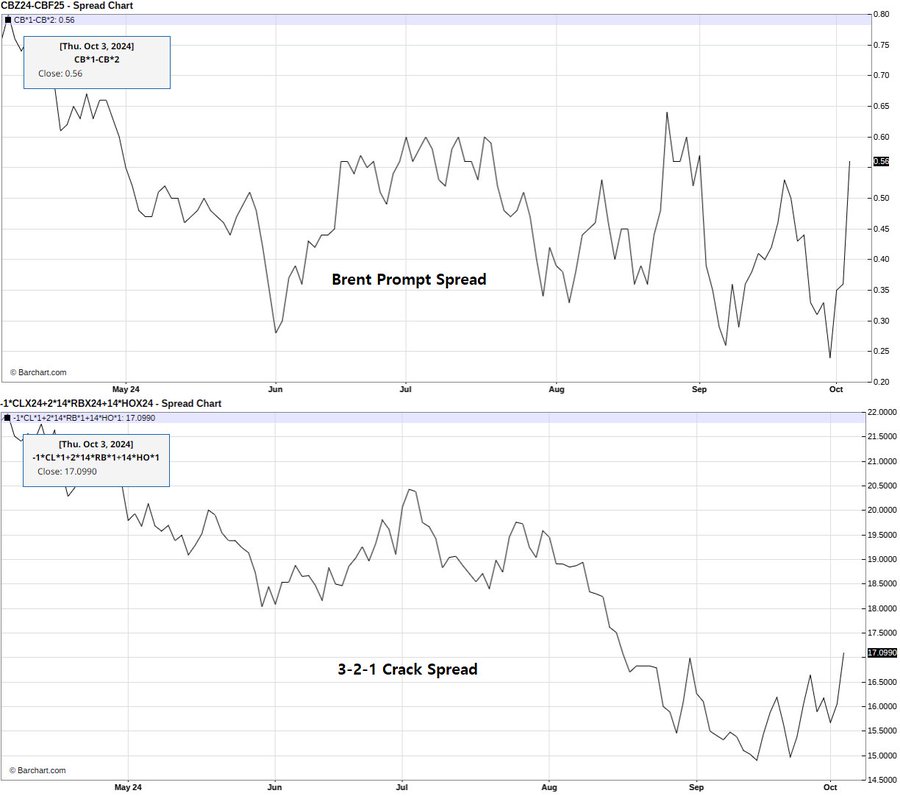

The biggest thing to watch on a global basis is distillate, and I think we start to see rapid builds in the U.S. We some stabilization in global crack spreads, but I believe things will weaken quickly driven by slowing demand and exports.

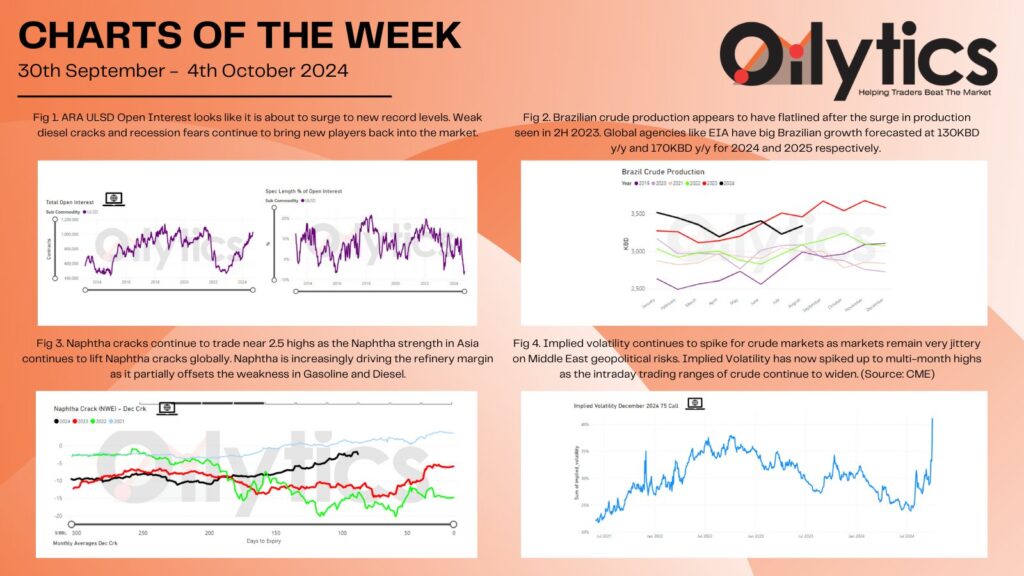

Overall, the energy markets became overly complicit on the geopolitical side as open interest crashed across the board. We expected to see some additional interest enter the market, and the geopolitical risk ushered in rapid volatility.

The physical crude market will help anchor some of this rapid acceleration which also happened in crack spreads/ Brent prompt.

As we talked about above the Brent DFL- is showing how this will shake out with Brent futures pulling back to around $75 with our range $73-$77 still holding firm. “North Sea: BP offered a November Ekofisk cargo at Dated Brent plus $1.75, 20 cents higher than an offer on Tuesday, equal to roughly Dated Brent plus 58 cents after allowing for the Platts quality premium. Mercuria bid WTI Midland at Dated Brent plus $2.25, lower than the last known deal traded last week at Dated Brent plus $2.75 CIF Rotterdam.” Here is a sample of some slowing or cooling pricing activity.

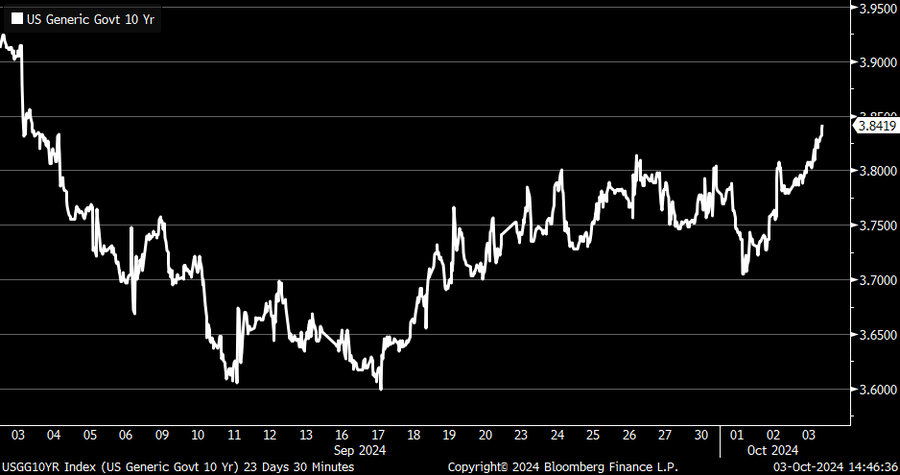

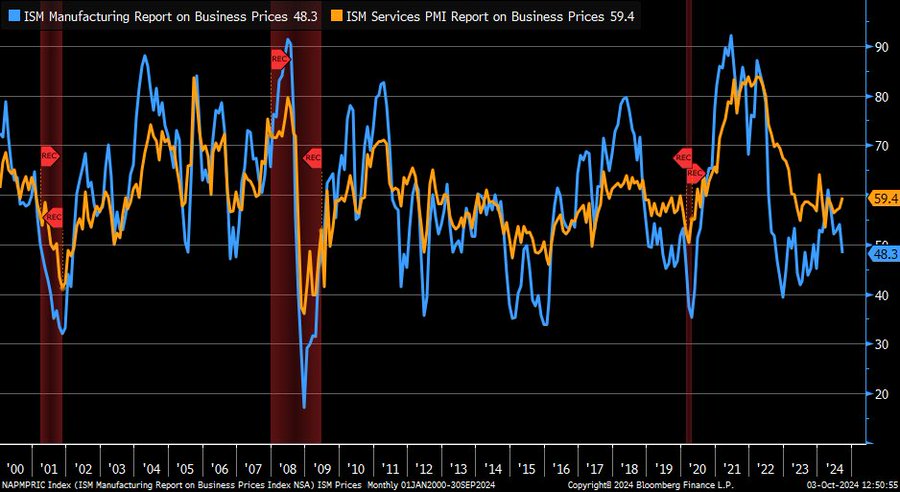

Next week- we will put out another report with a bigger focus on the economy as U.S. inflation shifts higher with services showing more growth as manufacturing falls further. The below chart helps to show how inflationary fears also helped to pull WTI prices higher, but this WTI pull will slow as builds accelerate in PADD 3.

I will want to discuss how the 10yr treasury keeps shifting higher and will continue to move higher over the next few months. A Fed Funds Rate Cut will NEVER be enough to offset the sheer amount of paper that has been pushed into the market.

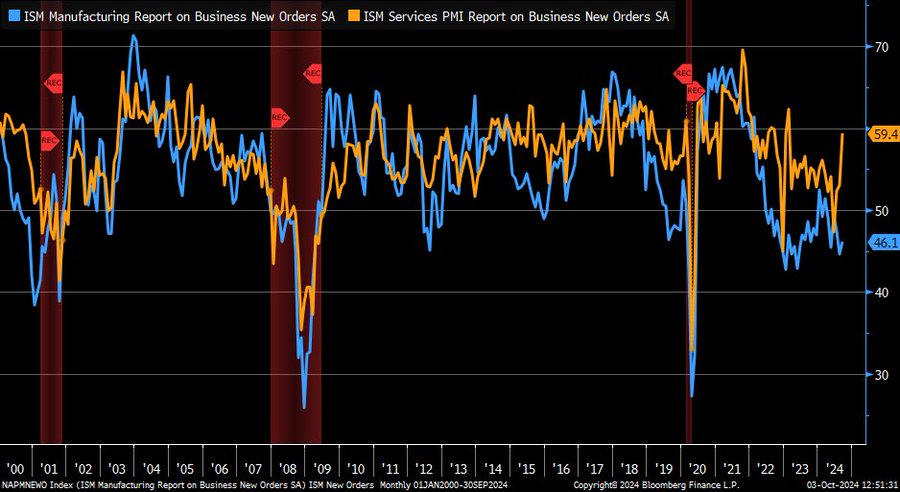

Inflation is already showing the pressure to the upside as prices paid surged higher in services:

US ISM Services Index Sep: 54.9 (est 51.7; prev 51.5)

- Prices Paid: 59.4 (est 56.0; prev 57.3)

- Employment: 48.1 (est 50.0; prev 50.2)

- New Orders: 59.4 (est 52.5; prev 53.0)

We are firmly moving into another inflationary/stagflation push with a broad deviation in services vs manufacturing. “Huge gap between ISM Services (orange) and Manufacturing (blue) when it comes to new orders components … former soaring while latter still stuck in contraction”

The bifurcation in prices paid doesn’t hit consumers the same way because many of the “sticky inflationary items” fall under the service side of the equation.

This will give us a lot to talk about next week!