As we head into the weekend, Brent futures fell to just below $73 and the bottom of our range. We expected to see a sizeable drop once the concerns of an Israeli retaliatory attack faded a bit. Israel will still likely respond in the next seven days or so, but they had to wait for some equipment to get into place- THAAD being one of them. While the geopolitical theater remains, the physical market has weakened further with pricing showing additional softness in demand. This also comes at a time when Libya is back to full exports and CPC returned from maintenance. These shifts in the market will put pressure on U.S. exports- mainly distillate and crude. We expect to see crude exports averaging between 3.7-3.8M barrels a day and distillate shifting to around 1M barrels a day with downside to about 800k barrels.

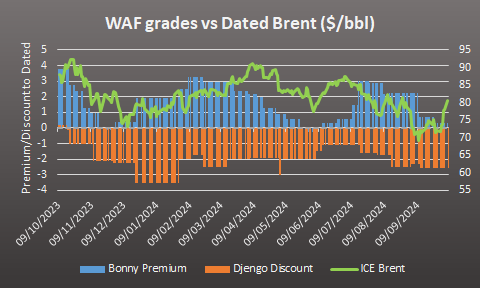

There will have to be a much bigger discount in WTI in order to move additional cargoes into he market. The North Sea is showing some additional pressure after companies- IE Glencore- tried to flip a cargo. The highlighted cargo is the same on they bought from Shell at dated -.05 after it was marketed at +.45.

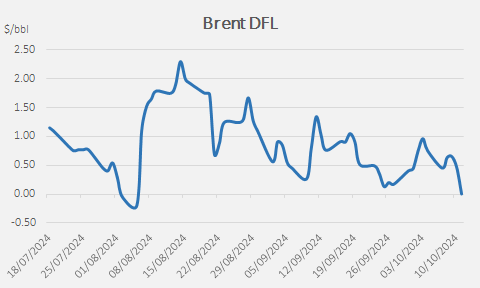

There are a lot of offers in the market, but no one is willing to purchase at this point. We will need to see some additional reductions in pricing to incentivize buyers in the near term. The prompt was in contango a few days ago, and the last time it happened in August there was a quick bounce. As we sit in turnaround season and struggling demand, it will be difficult to see a strong bounce, but there should be enough to get us back to above $0- just not by a lot.

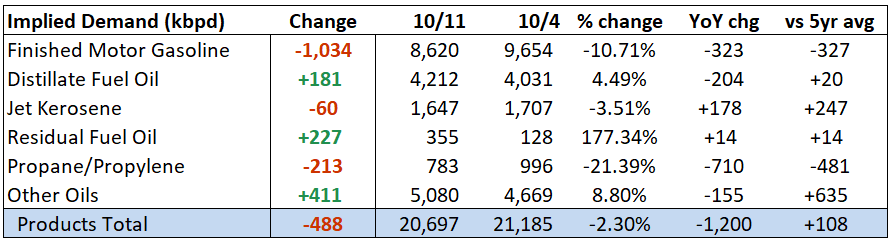

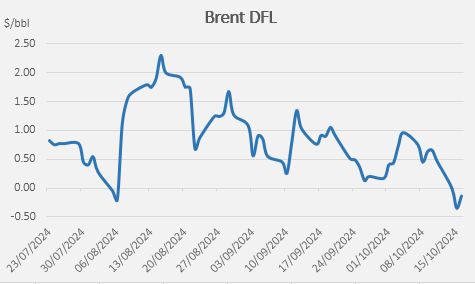

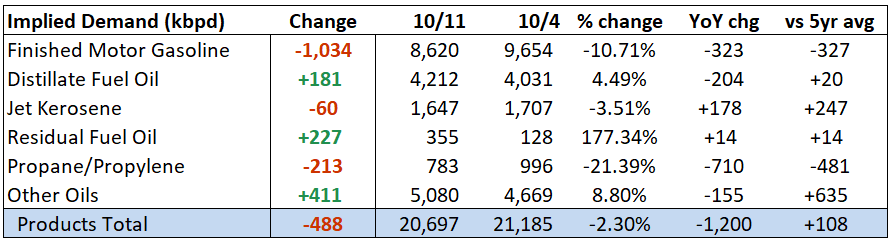

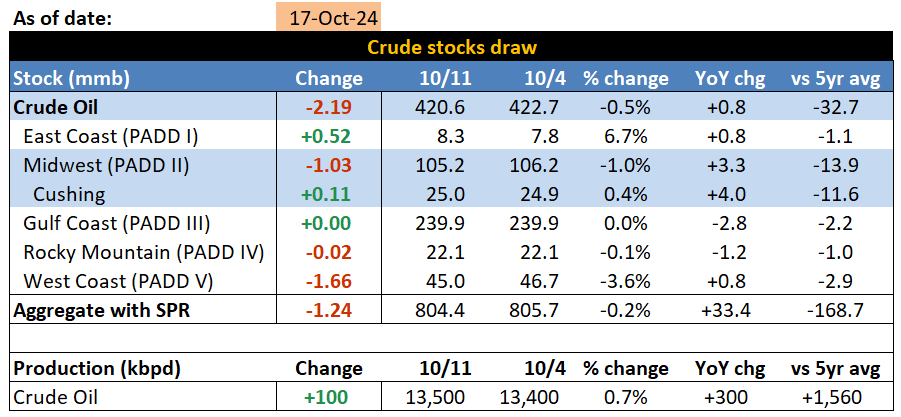

The U.S. had a decent EIA number with some make-up data following the shifts in the GoM and weather-related pivots. The same can be said about the demand side that saw gasoline demand fall to a level we were expecting of around 8.6-8.7M barrels a day of demand. As we go forward, there will be additional pressure to the downside with a likely level of about 8.3-8.4M barrels a day. Ther impacts of several hurricanes will act as an anchor pulling down gasoline demand. “GasBuddy data (Sun-Sat) saw a big drop and we model demand fell below 8mbpd.”

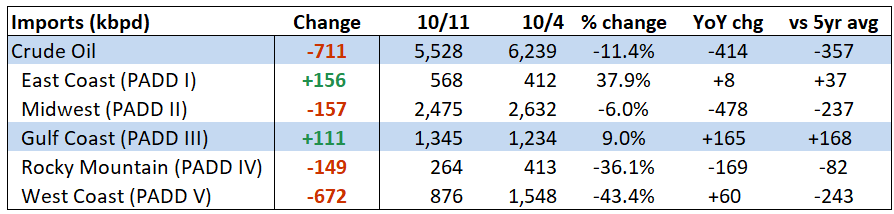

On the crude storage side, we saw a big drop in imports and a bump in runs that helped draw down some levels. PADD 5 saw the largest drop in imports, which correlated with a drop in storage.

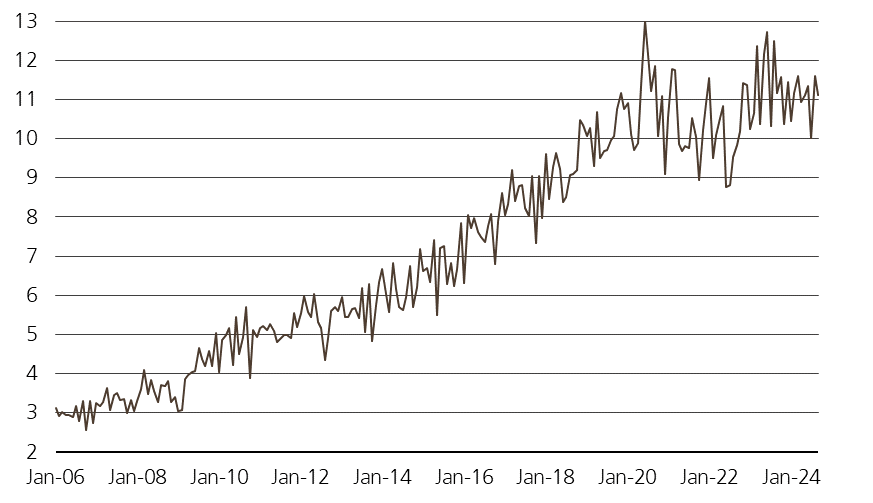

The bigger factor here is the move up in U.S. crude production, and this is the level we believe we exit. There is some potential for upside into 13.7M barrels a day, but I don’t believe we will see that level until Q1’25. We will still see upside, but the “hard stop” will likely be 14.1-14.3M barrels a day for a multitude of reasons.

- Limited pipe capacity to move barrels

- Limited export capacity to get barrels into the market.

- The U.S. refiners have maxed out their ability to run light sweet crude (shale oil), so every new incremental barrel has to be exported

- The global market is not paying the same premiums for light, sweet crude so there is limited incentive to increase production to sell into an already struggling global market.

As Florida gas stations “refill” post hurricane, we will see some draws in the system- especially in PADD 1- but these will be short lived. The demand in the U.S. isn’t there to support draws, and we will start to see builds fairly quickly. The same can be said about distillate given the overwhelming level of weakness in the economic backdrop and slowing demand.

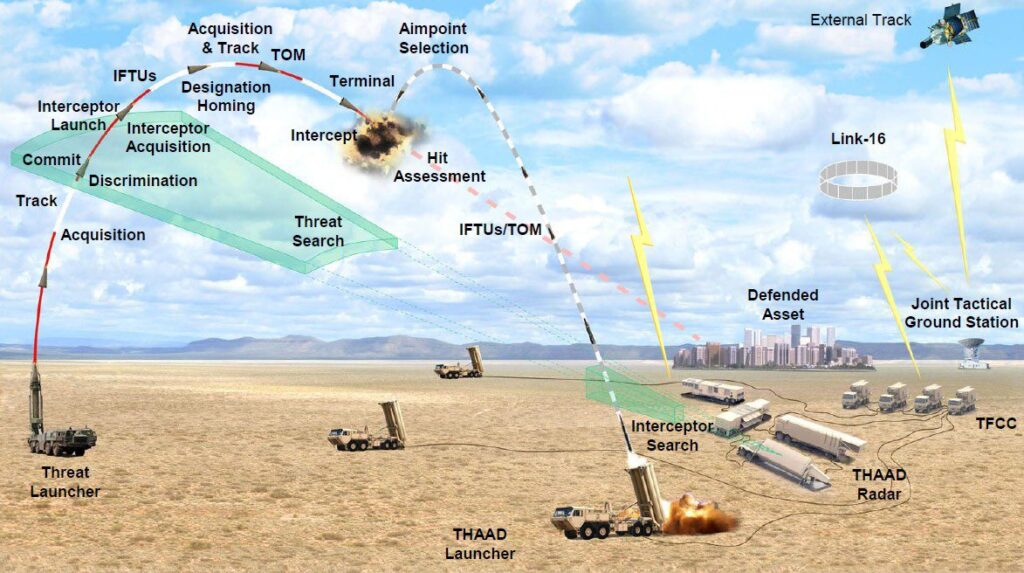

The energy markets bounced Wed following an increase in geopolitical concerns when Israel reiterated all options are on the table against Iran. The market interpreted the commentary to mean that Israel will strike energy assets. There has been some recent clarification to keep them on the list, but I don’t believe this will be struck. It would be better for Israel to strike IRGC coastal assets, arms depots, facilities building missiles/drones, and ancillary nuclear capacity. There was already a huge cyber-attack across the nuclear complex, and this is probably step one of a multi-step process. Israel provided a “list” of potential targets, but I pretty sure they aren’t going to make openly public their intended targets. They have kept many entities in the dark to maintain operational integrity for the mission.

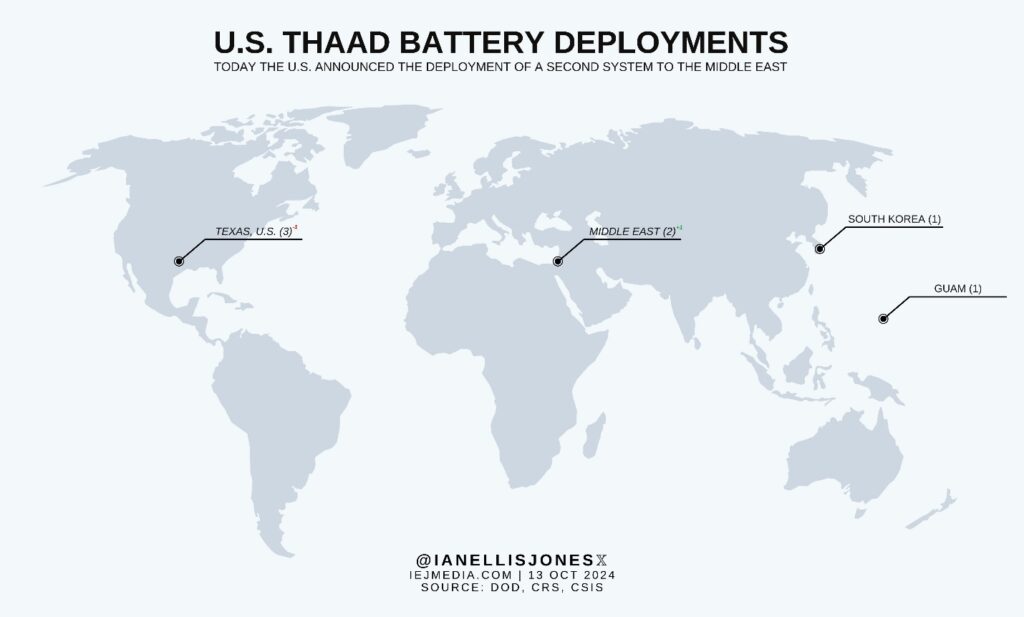

The U.S. has also sent over a THAAD (Terminal High Altitude Area Defense) system, which also brings a contingent of U.S. military forces to operate it. This will act as a “trip force” while also maintaining operational integrity for the THAAD system.

“New — the U.S. authorized the deployment of a Terminal High-Altitude Area Defense (THAAD) battery + associated crew of U.S. military personnel to Israel. The U.S. currently has 7 THAAD batteries, & this is the 2nd time a system has been deployed to the region since 7 October.” Below is the current deployment of what is publicly known.

These assets will provide additional cover for Israeli assets in the event of a counterattack from Iran. This is also happening as the Israeli military continues to establish a front in Southern Lebanon to eliminate critical Hezbollah infrastructure near the border.

The crude futures markets have settled down a bit following a sizeable run up ahead of the weekend, but I think the geopolitical premiums will slowly leak out of the market. There will still be some premiums in the market, but it will fade over the next few days. If Israel avoids striking energy assets, I expect to see a sizeable drop in the futures market geopolitical premium.

While the futures market show a sizeable jump, the physical market is still very underwhelmed with the geopolitical circus. The physical market has shown very little concern, and points to a “balanced” brent market around $74-$76. We are still keeping our range of $73-$77, but it will likely settle with an average of $75 as the geopolitical uncertainty calms.

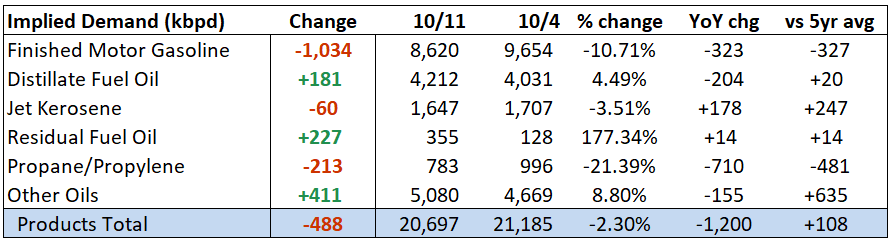

Dated swaps and Brent spreads certainly are not indicative of any physical tightness in the oil markets:

- CFDs (Rolls): 14-18/10 Dec +54 (+35)

- 21-25/10 Dec +19 (+30)

- 28-01/11 Dec -11 (+15)

- Dec/Jan 52

- Jan/Feb 48

- Feb/Mar 39

- Dec24/Dec25 368

- Dec25/Dec26 175

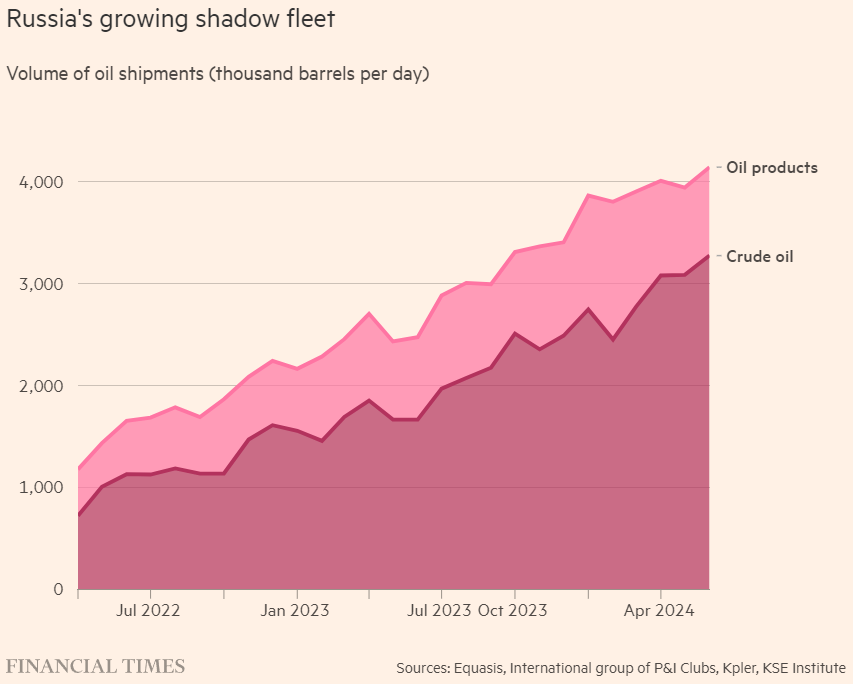

There was a view that Russia was going to reduce their crude exports, but it’s unlikely to see a big reduction in total flow. Russia’s October Crude Exports Set to Jump ‘…Transneft, which includes shipments through ports and direct pipeline deliveries, were close to 4.2 mbd in the first eight days of the month, a surge of over 300,000 b/d compared with the full September result…’

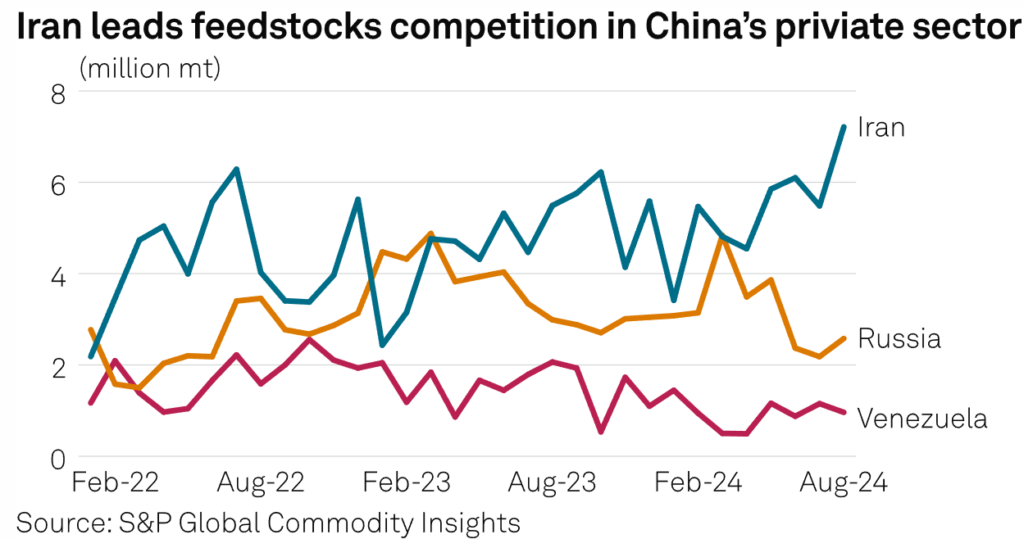

India has also picked up a few additional cargoes from VZ as they avoid Iranian barrels, which are flowing into China at a steady clip. But, with renewed focus on Iranian

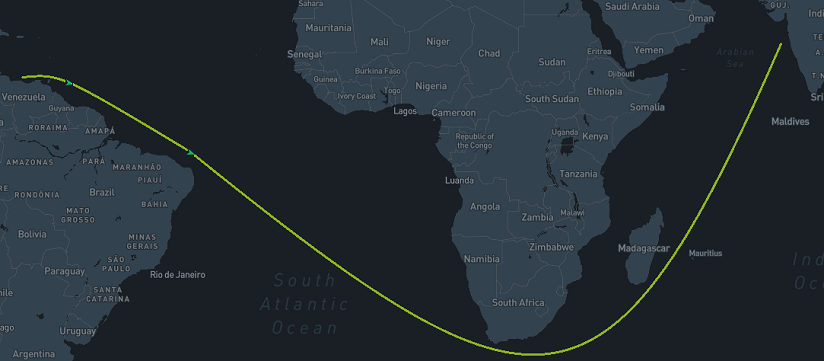

The Iranian “dark fleet” is standing by to load, but a large part of their capacity was shifted away from Iran for fear of retaliation. The dark fleet is also experiencing a big increase in cost as sanctions rose across their vessels. “”Most of those vessels shuttled to China with Iranian barrels,” said a Shandong-based trade source with knowledge of the Iranian flows to China. “With 23 vessels being sanctioned at one go, it is going to be challenging for dealers to find alternative carriers and redo administration works,” said Sijia Sun, associate director for downstream research and analysis at Commodity Insights. “The sudden reduction in vessel availability to carry Iranian crudes could lead to two outcomes — first, supplies to China will fall short, and second, freight rates for vessels for China will rise.”[1] “But generally speaking, the access to those ghost ships has narrowed, with the new sanctions,” a second China-based trade source said. “It takes time to rearrange the logistics and to bring flows back to the usual levels.” Russia has remained China’s top crude supplier so far in 2024, with 2.16 million b/d deliveries over January-September, accounting for a 19.6% market share, data from China’s General Administration of Customs showed.” These additional costs will hit Chine the hardest as they’ve been the main buyers of Iranian barrels. This makes Russia and VZ more economic- especially as Russia is in the process of keeping their refiner runs lower and exports rising.

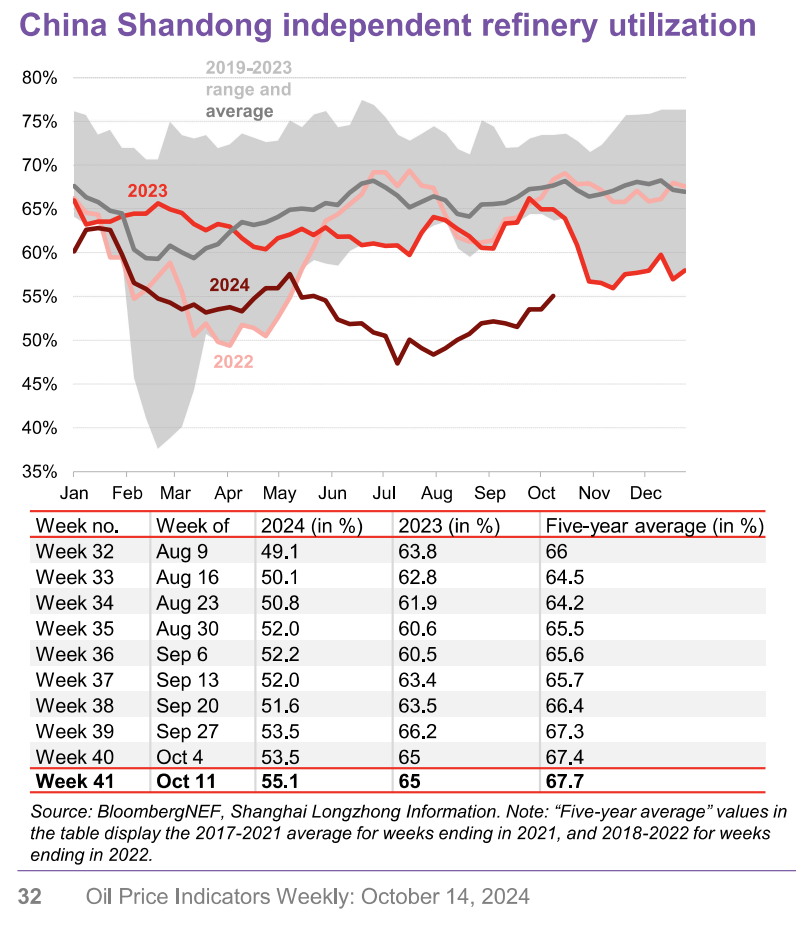

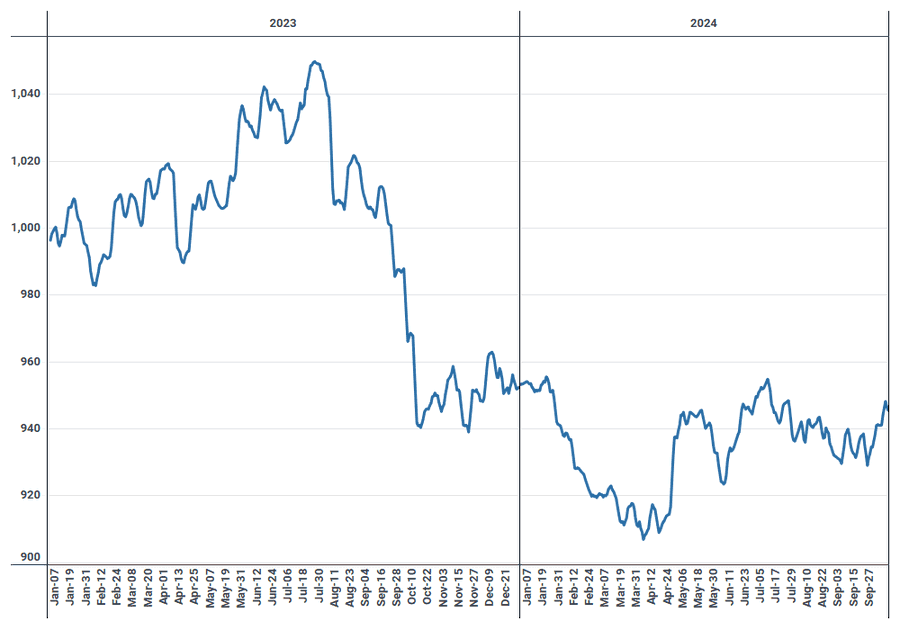

“Independent refineries’ margins in Shandong for processing imported crudes slumped 63.1% week on week to Yuan 115 per metric ton ($2.12 b/d) as of Oct. 10, because of rising crude benchmark prices in the international market, according to local information provider Oilchem. The refineries are estimated to have about 1.44 million b/d of crude import quotas for the fourth quarter, falling about 400,000 b/d from average crude inflows of 1.84 million b/d over January-September, according to Commodity Insights.” As we’ve been discussing, the Shandong refiners (teapots) will be under the most pressure, which has been the case over the last year. The pressure has shown up throughout the year with very depressed run rates- even against historical averages.

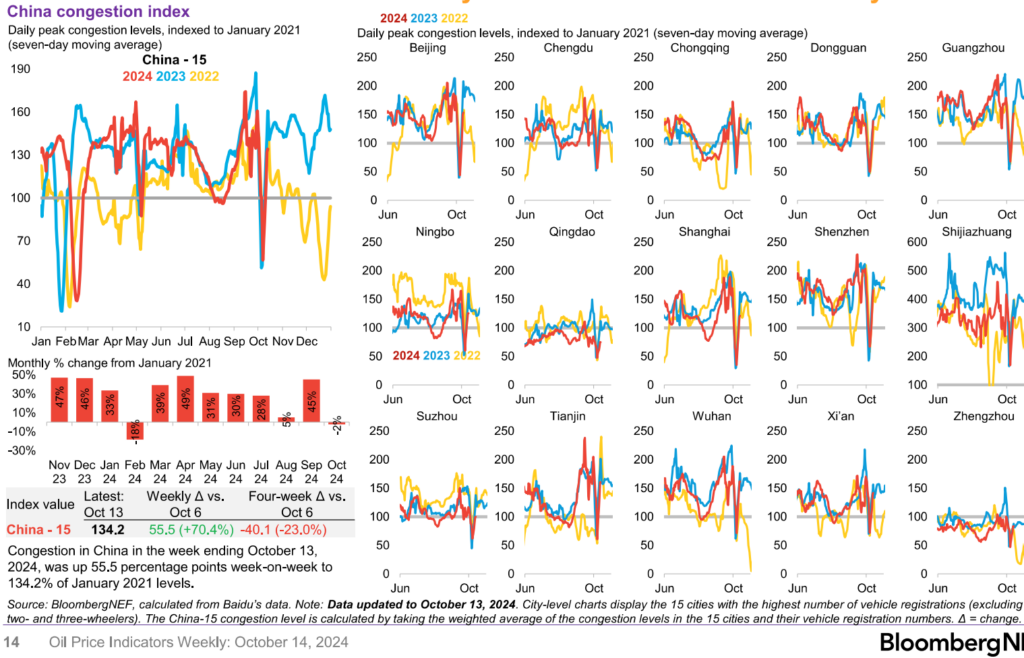

We expected to see a muted bounce in Chinese demand following the holiday season, and thought we would see something similar or slightly below 2023 levels. This is so far playing out.

The sluggish demand has shown up again in Brent DFL- keeping any geopolitical noise muted as there remains more than enough barrels in the market. There are a lot of cargoes offered in the North Sea window with little to no takers. I think the market is telling you all you need to know about underlying physical demand.

For those that have followed us for years, won’t be surprised the amount we discuss WAF cargoes as a bellwether for the broader market. They are typically the swing supplier for Europe (Nigeria) and China (Angola). WAF grades differentials as a forward indicator of European demand, and these things didn’t cope with the rally in flat prices- Nothing changed.

The Russian shadow fleet rising is going to keep buyers (China and India) away from the rising cost of the Iranian barrels. “The volume of Russian oil transported by poorly maintained and underinsured tankers has increased from 2.4mn barrels per day in June 2023 to 4.1mn in June 2024, according to a report published by the Kyiv School of Economics (KSE) on Monday. The trend comes as the US, Canada, Japan and European allies increasingly targeted global insurers and ship owners in a bid to crack down on Moscow’s ability to generate revenues for its war in Ukraine. They also added to the sanctions list companies and individual vessels associated with the Russian shadow fleet. “Sanctions on tankers have been quite effective but the designation campaign has been too limited to actually rein in Russia’s shadow fleet,” said Benjamin Hilgenstock, one of the authors of the KSE report.”[2] While it makes it harder, it isn’t impossible because the receiving country can “self-insure” the cargoes being transported. This eliminates the need for USD denominated insurance and helps skirt some of the key pieces of the sanctions.

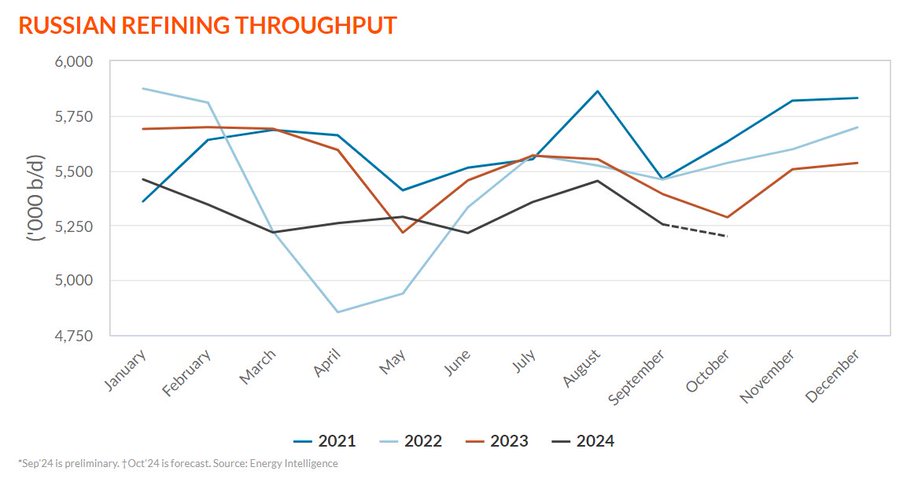

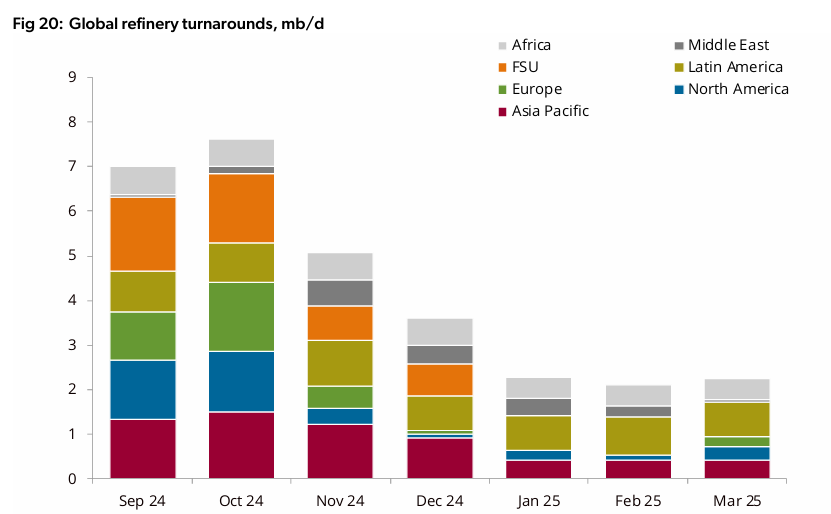

As Russia focuses more on crude and less on oil products, it will help keep differentials flat and falling even as some geopolitical risks rise. When we look at global refinery turnarounds: Russia has more offline refining capacity than previously expected. Russian October crude exports will increase as surplus crude is diverted to exports. October is ALWAYS maintenance season- but the size of Russian downtime will put a decent amount of crude on the water.

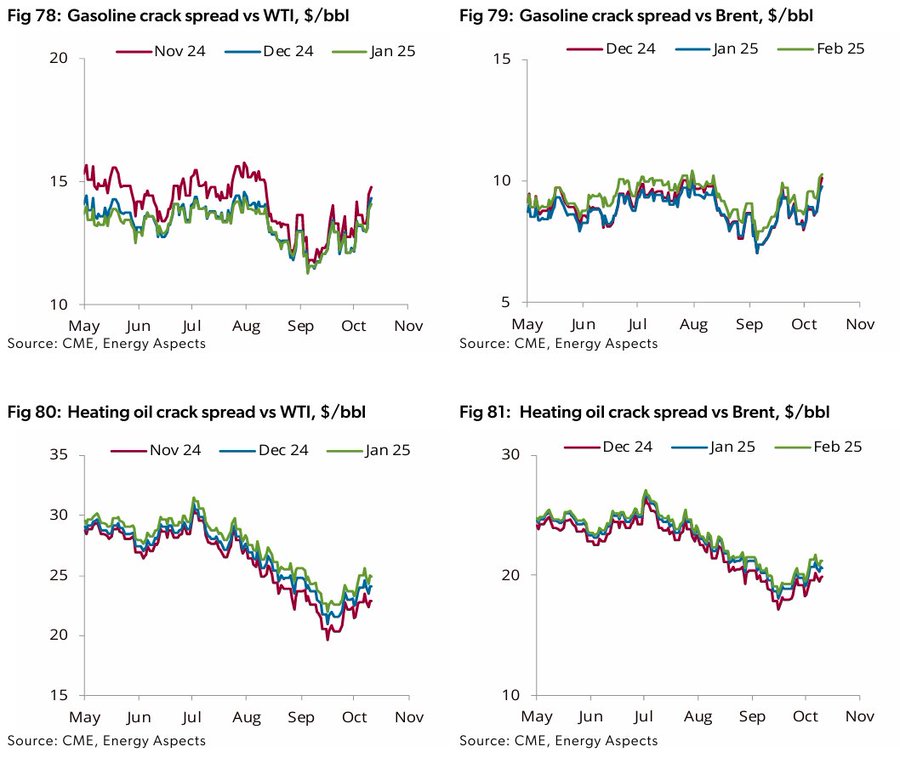

In our base case for refining activity, we expected to see additional refinery run cuts. Said another way, we expected to see refiners cut further than just for maintenance and likely stay at reduced numbers for an extended period of time. So far, this has played out (as you can see above), and this will likely stay the case longer. It has helped pull some crack spreads higher, but we don’t see appreciation- more just stabilizing cracks.

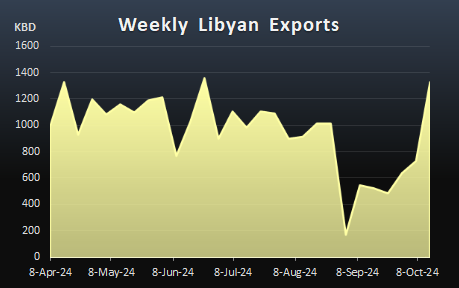

The one event that could keep pressure meaningfully higher on geopolitics is if Iran tries to shut down the Strait of Homurz. This isn’t something that I believe to be likely, but it would create a shock to the market in terms of differentials and physical pricing. Even an Israel strike on Iranian energy assets would have limited impact- especially with the amount of Russian crude hitting the market. There is also a growing number of Libyan exports coming to the market- or just coming back to levels shuttered by the political fiasco and protests. As we highlighted when it first happened, our base case was barrels back into the market by Oct 15th… we were VERY close!

We’ve been very consistent with our view that OPEC was overstating demand, and they have continuously taken down their estimates.

- They made a third cut in 2024 oil demand growth forecast

- Cuts view on Chinese demand growth to 580,000 bpd

- IEA to publish updated forecasts on Tuesday[3]

I believe that OPEC is still overstating demand as global economic pressures mount- especially in China and the U.S. “On Monday, OPEC in a monthly report said world oil demand will rise by 1.93 million barrels per day (bpd) in 2024, down from growth of 2.03 million bpd it expected last month. Until August, OPEC had kept the forecast unchanged since it was first made in July 2023.China accounted for the bulk of the 2024 downgrade. OPEC trimmed its Chinese growth forecast to 580,000 bpd from 650,000 bpd. While government stimulus measures will support fourth-quarter demand, oil use is facing headwinds from economic challenges and moves towards cleaner fuels, OPEC said.”[4] We’ve been very consistent in our view that diesel is the biggest bellwether that has more downside. It’s also a key reason that OPEC+ will struggle to bring any of the cuts back to market this year. I’ve said from the day the OPEC+ cuts were announced that it would be YEARS before they could bring back volume without impacting prices. I still hold to this view, and I don’t believe we see a single barrel before AT LEAST end of Q1’25.

There has been constant “hope” that Chinese stimulus would “save the day,” and bring significant growth in demand. We’ve been consistent FROM DAY ONE that stimulus into China would fall flat because of the law of diminishing returns. The economic headwinds persist for many reasons, and you can see that in the crude imports as well. Activity has essentially fallen, and even with the expansion of refining capacity- it hasn’t resulted in a meaningful shift higher in total demand. Now that the Chinese government issued its latest round of export quotas- not much has really changed in any meaningful way. “China: crude imports were at 11.11mbpd in September, vs 11.61mbpd in August 24, 11.18mbpd in September 23, 9.83mbpd in September 22, 10.03mbpd in September 21 and 11.85mbpd in September 20 – customs office.”

Chinese onshore stocks and volume heading to the region isn’t going to incentivize any rapid purchases. There has been “hope” that the stimulus packages would be enough to drive additional crude demand, but as we have repeatedly said- it will all fall flat.

Overall, the crude markets will remain in a holding pattern with little to drive it in either direction. Refinery run cuts will put more crude in storage, but we have more than enough room to see some builds in the system. Geopolitics and the OPEC+ agreement will keep the floor in brent while the demand side and slowing refinery utilization will keep us capped.

There’s been a significant amount written about the recent stimulus, and the fact it will fall flat. The law of diminishing returns is actively playing out in the market, and I expect to see Chinese stimulus have very little benefits to the local economy. I think the below from Trivium sums up the stimulus talk in China:

Stimulus disappointment

It’s been a busy couple of weeks for China’s regulators. In quick succession there have been press conferences hosted by the economic planner (NDRC), Ministry of Finance (MoF), and housing ministry (MoHURD).

- Yet none of them have delivered what everyone’s waiting for: stimulus.

Of course, as is always the case, the devils in the detail – and the regulators left out a lot of detail.

In this flash talk, Trivium Co-founder Andrew Polk and Dinny McMahon, Head of China Markets Research, discuss what was announced at the MoF and MoHURD press conferences.

- They then get into the potential shape of what the stimulus package will look like, and what they’re hoping for.

The long and short of their solution is to fix their current debt and leverage situation with MORE debt and leverage. This just makes the issue exponentially worse without addressing the core issue. Trivium had a great breakdown of the Saturday press release:

Unexpectedly, China’s finance ministry (MoF) used its Saturday press conference to focus on local government debt, rather than fiscal stimulus.

ICYDK: All eyes were on Saturday’s MoF presser, in the hopes it would deliver a fiscal stimulus package.

- It didn’t.

Instead, Finance Minister Lan Fo’an pledged a one-off “relatively large” issuance of central government debt to help pay off local government hidden debt, describing it as “the most powerful measure to support debt reduction in recent years.”

Lan said the measure would:

- “Greatly reduce the pressure on local debt, free up more resources for economic development, [and] boost the confidence of business entities.”

Lan didn’t say how much Beijing would deploy, but noted that MoF has so far cleared local governments to issue RMB 1.2 trillion of special purpose bond (SPBs) to pay down “hidden debts,” like those of local government financing vehicles.

- Lan implied the new program will be significantly bigger.

- He also said local governments can continue allocating some SPBs toward paying down hidden debts.

- Local authorities can also use SPBs to buy back idle land and acquire developers’ unsold housing inventory.

Additionally, Lan said MoF will issue special treasury bonds to replenish the core tier-one capital of China’s big six commercial banks.

Get smart: The collapse of land sales has left local governments desperately short of cash, so many have resorted to austerity policies.

- The central government is now looking to flip the script, but it seems to be slow rolling the announcement of a concrete support package.

Get smarter: Markets were hoping for a clear and concrete fiscal stimulus plan, which the MoF presser failed to deliver.

Our take: The economy needs more help.

- It’s unclear exactly when Beijing will deliver it, but all signs still point to a fiscal package coming soon.

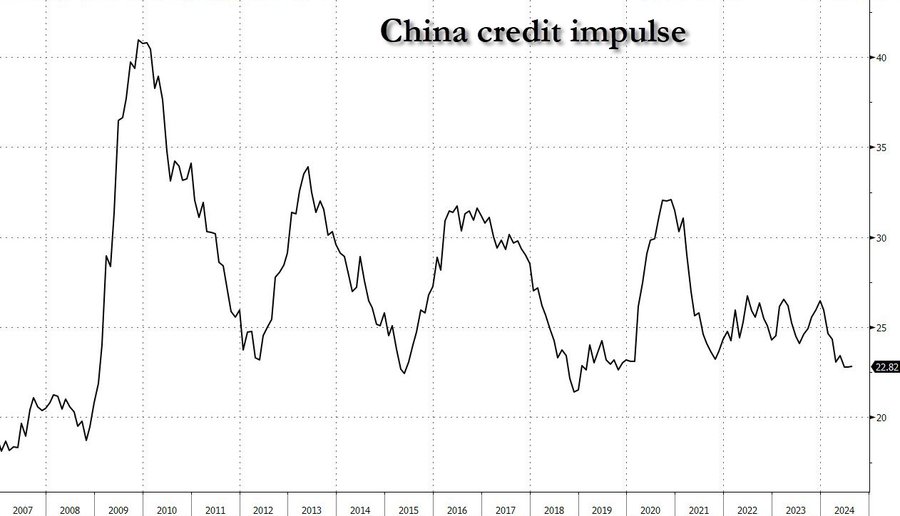

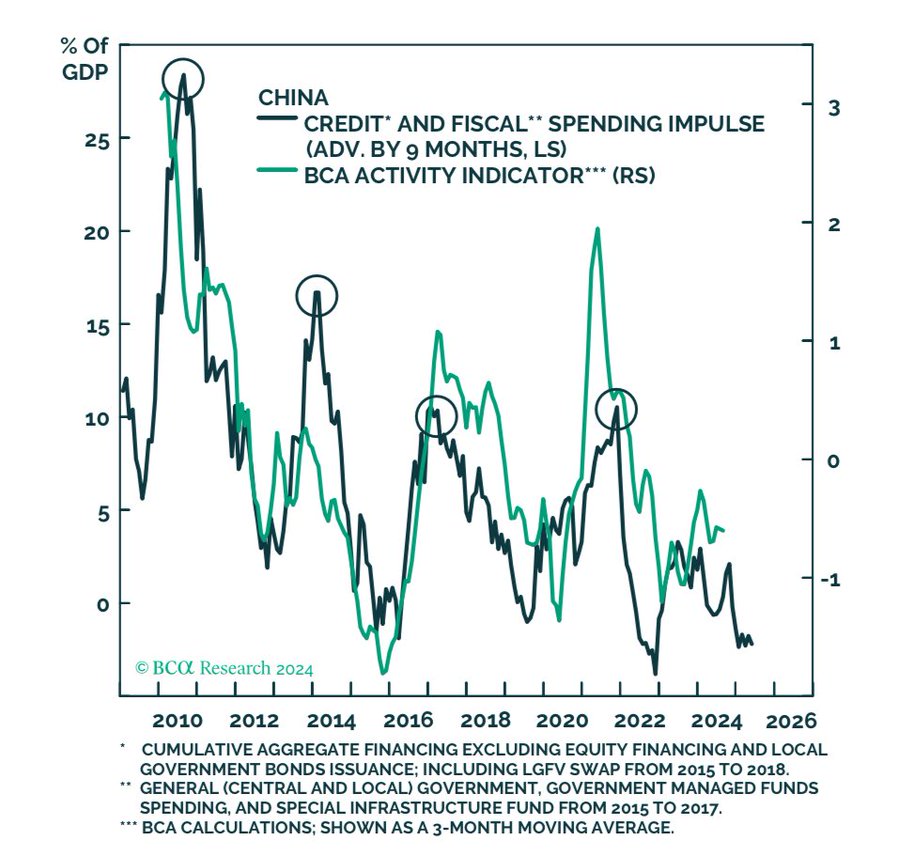

Credit impulses in China are showing underlying pressure in the stimulating the economy because consumers and companies are still grossly over levered. No matter how much the PBoC or CCP tries to reduce rates- they can’t get people to borrow.

When you overlay these levels with activity, you can see that activity will likely be pulled LOWER. The problem remains the focus on MORE debt, which isn’t being demanded. The CCP and PBoC have tried cutting rates and incentivizing additional update of bonds and leverage, but because every balance sheet is grossly levered- it won’t result in additional borrowing.

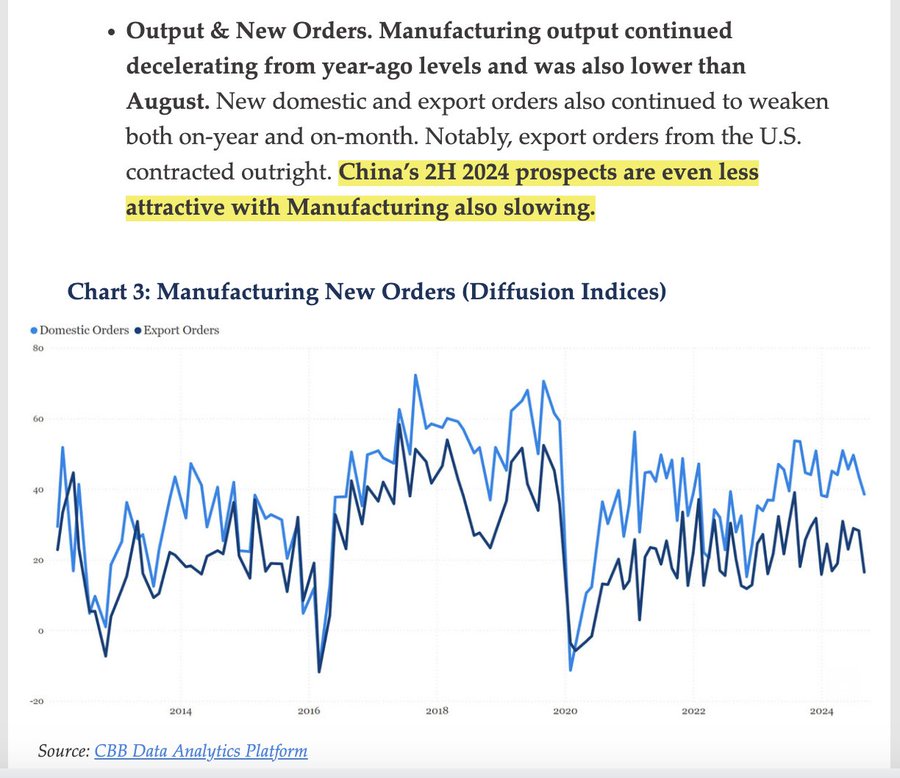

It isn’t surprising to see manufacturing output falling flat and decelerating further as we closed out the summer. As China Beige Book’s September flash data release said: “Manufacturing output continued decelerating from year-ago levels and was also lower than August. New domestic and export orders also continued to weaken both on-year and on-month.” We’ve been talking extensively about the global slowdown, which will impact exports from China. As the dollar strengthens and CNY weakens, it will help prop up some exports, but the broader issue will be underlying demand. As the global economy struggles, it will inherently pull down exports regardless of pricing.

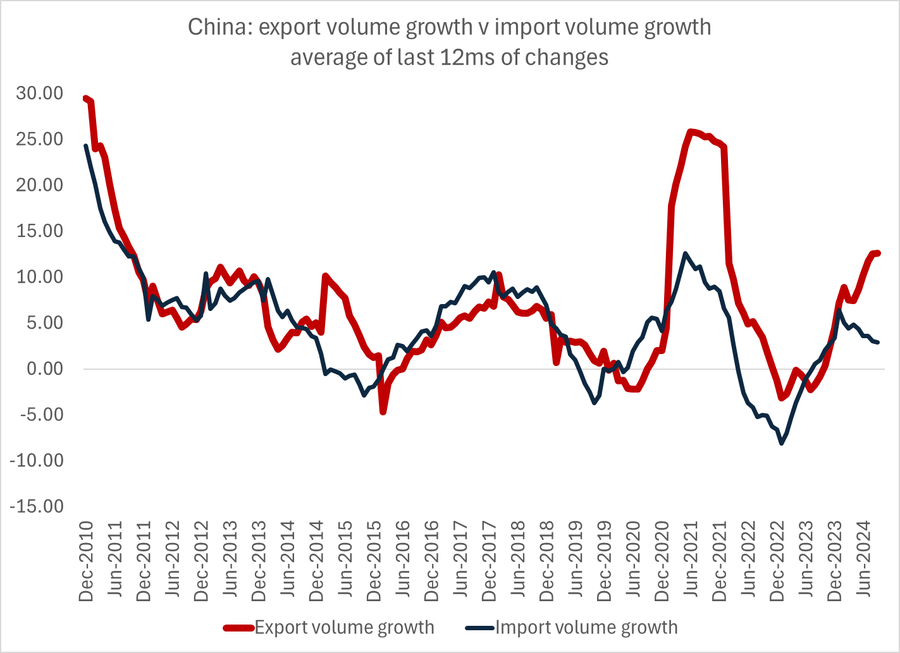

“China’s export growth unexpectedly slowed in September, curbing a trade rebound that has been a bright spot for a weakening economy that policymakers are relying on manufacturing to power.” The discounts between USD and CNY helped some recovery in September especially as the world prepares for the Christmas shopping season. BUT- the imports data shows the overarching problem with internal Chinese consumer demand, and the pop in exports will be inherently short lived. As export prices are falling (they likely fell 6% y/y in September), actual export volumes are much stronger than the headline dollar number. According to Brad Setser, he gets a ~ 9% increase in export volumes in September- which will be likely be shortlived.

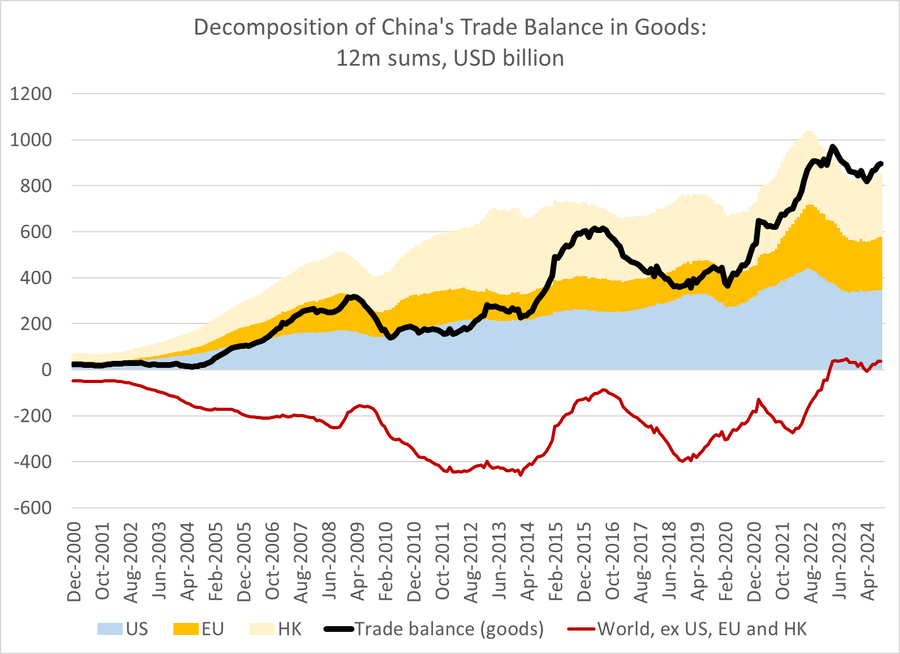

The gap between export and import volume remains close to 10 pp — which implies a huge contribution from exports to real growth for 2024. Estimated volume growth in q3 was around 12% while import volumes were flat. This is a huge problem when you look at the longevity of exports supporting the economy or helping the CCP achieve their targeted GDP growth number.

This will help drive a surplus, but pivoting it into meaningful growth or GDP support- is proving much harder given the TYPE of growth they are trying to achieve. It’s also coming under pressure as countries look for ways to limit imports from China with tariffs and other means of impediment.

I think Michael Pettis does a good job in breaking down issues with stimulus and critiques some views regarding stimulus:

“Teng Tai, a prominent Chinse economist, supports Liu Shijin’s proposal for a RMB 10 trillion (8% of 2024’s expected GDP) stimulus to expand domestic demand, suggesting RMB 10 trillion may even be on the low side. “However,” he adds, “from a structural perspective, I suggest that the 10 trillion yuan plan to expand domestic demand should still focus on expanding residents’ consumption. Otherwise, if most of it is divided up by various localities under the inertia of the system and used to continue to expand investment expenditure, the result will not only be a low macro multiplier, but also a new oversupply, which is not conducive to ensuring the continued economic prosperity.” In my opinion he is right. Given that the multiplier for yet more supply-side stimulus is probably below one, as he sees to suggest, the result is likely to be that China’s total debt rises faster than reported GDP (and much faster than economic value creation). And if the stimulus is implemented through local governments, because of what Teng politely calls “inertia”, it will almost certainly be used to support the same old investment projects that have bankrupted local governments. With private sector investment constrained mainly by weak domestic consumption, however, the multiplier for demand-side stimulus is likely to be much higher than one, although I doubt it is as high as 3, as he suggests. Teng goes on to say: “Considering the urgency of expanding domestic demand and the actual situation of insufficient structural domestic demand, the 10 trillion economic stimulus plans should not expand investment, but should mainly provide consumption subsidies to residents in various ways.” Where I might disagree with Teng is that while I think a large demand-side stimulus would certainly help in the short term and would certainly help far more than more supply-side stimulus, I don’t think it is sustainable. In the medium-term China still urgently needs a major (and politically difficult) structural shift in the way income is distributed. Nonetheless it is well worth reading Teng’s essay. I think it tells us a lot about how the debate in China is advancing.”

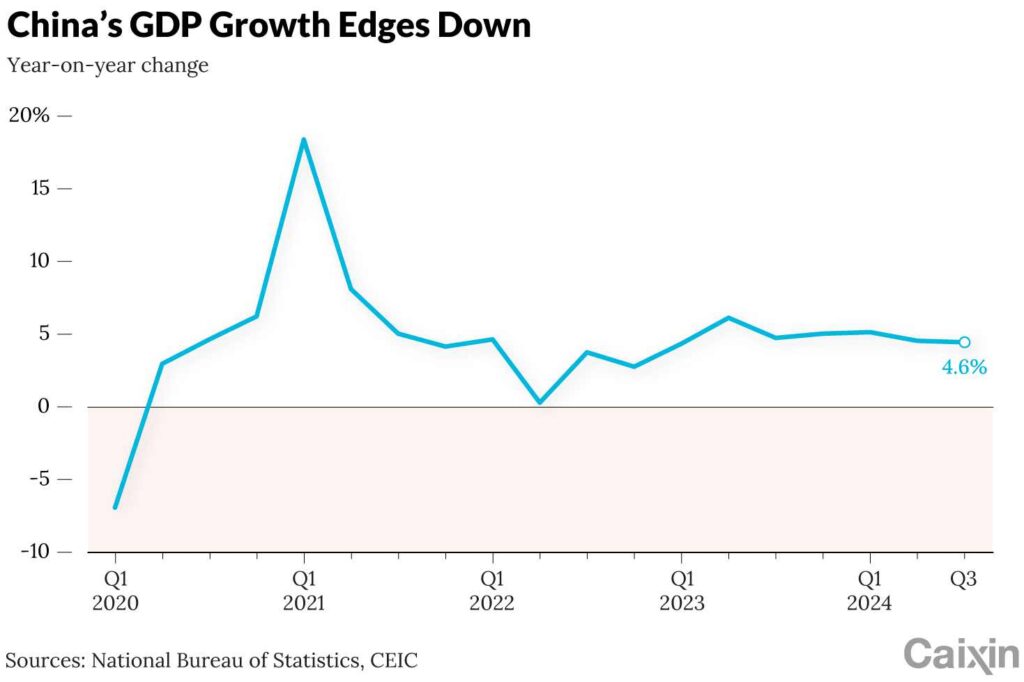

China just announced additional economic data today that still showed things to be a bit flat. “China’s economy expanded 4.6% year-on-year in the third quarter, official data showed Friday, the weakest pace in six quarters, as the depressed property sector and sluggish investment outweighed an improvement in consumption and industrial output. The GDP growth figure, released by the National Bureau of Statistics (NBS), compared with the average estimate of 4.4% in a Caixin survey of economists and a 4.7% pace in the second quarter, taking the year-on-year increase in the first nine months to 4.8%. Premier Li Qiang in March set a target of “around 5%” for 2024.[5]”

It’s difficult for the PBoC and CCP to launch a wave of unfettered stimulus with activity tracking “around” their target of 5%. I expect to see some additional support sporadically, but this keeps any sizeable adjustment on the sidelines- not that I think it would work.

The below is a summary from Caixin and Michael Petitis- mixed in with my thoughts. For those that have been following us, this has been our underlying base case when it comes to Chinese activity.

China’s problem continues to be not the level of growth in economic activity (i.e. GDP) but rather the quality of that activity. China’s real GDP in 2024-Q3 grew by 4.6% year on year, versus 5.5% in Q1 and 4.7% in Q2. During the first three quarters of the year it grew by 4.8%. This suggests that Beijing should be able to achieve their targeted “about 5%”without a major last-minute stimulus. The good news is that household income grew in line with GDP. The bad news is that the main proxies for consumption continued to struggle. Retail sales grew by 3.2% in September, and by 3.3% in the first three quarters of 2024, versus industrial output growth of 5.4% in September and of 5.8% during the first three quarters (driven mainly by manufacturing). The gap between what China produces and what it consumes continues to grow, and it can only be bridged by more investment or larger trade surpluses. The story has been repeated and confirmed in the trade data. In September the value of exports in RMB terms was up 1.6% while the value of imports was down 0.5%. In the first three quarters, exports were up 6.2% , while imports were up 4.1%. China needs net external demand. All of this implies that China’s economy is still driven too much by questionable investment and a rising trade surplus, and not enough by sustainable domestic demand. That’s why I’ve argued that the only way to maintain GDP growth much above 2-3% is with a worsening of the country’s balance sheet. That’s also why I’ve long argued that that the lower the GDP growth rate Beijing is willing to accept, the better for China’s medium-term adjustment, even if that disappoints markets in the short term.

Growth in household income and expenditure also slowed in Q3.

- Real disposable incomes grew by 4.1% y/y, down from 4.2% in Q2.

- Consumption expenditure grew by 2.7% y/y, down from 4.9% in Q2.

That said, amidst the broadly negative data, there were some more positive aspects:

- Household propensity to consume in the first nine months of the year was 66.7%, the highest rate since 2019.

- Meanwhile, monthly indicators for September suggest the economy may be starting to stabilize.

Get smart: GDP data is backward looking, and today’s print affirms what we already knew – China’s economy has performed disastrously over the past few months.

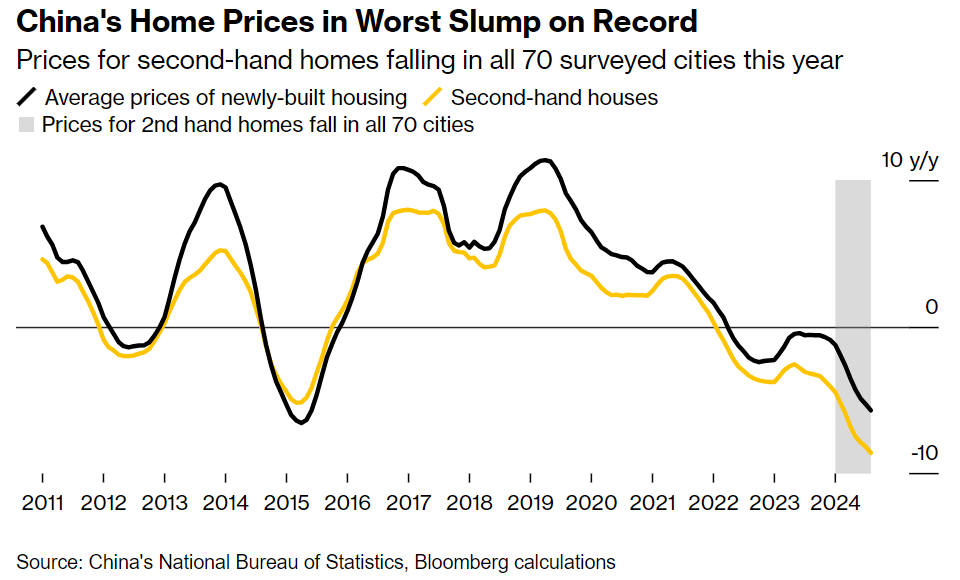

- However, the economy will be able to limp towards its annual growth target of “around 5%,” buoyed by the upcoming fiscal stimulus, and tentative signs of a property market stabilization.

China has also pledged more support to the housing sector: “China’s pledge to nearly double the loan quota for unfinished residential projects to 4 trillion yuan ($562 billion) fell short of market expectations, causing property shares to retreat as investors looked for stronger policies. The government set the new year-end target for loans to so-called “white-list” property projects after disbursing 2.23 trillion yuan as of Oct. 16. The measure, aimed at ensuring home completion, was part of a basket of initiatives announced during a Thursday briefing. The plans underwhelmed, with some analysts calling them “incremental.” A Bloomberg gauge of property stocks in Hong Kong fell more than 8%, with Chinese stocks surrendering earlier gains.[6]”

The problem with the markets view of massive stimulus is the sheer amount of debt that lives on the Chinese balance sheet.

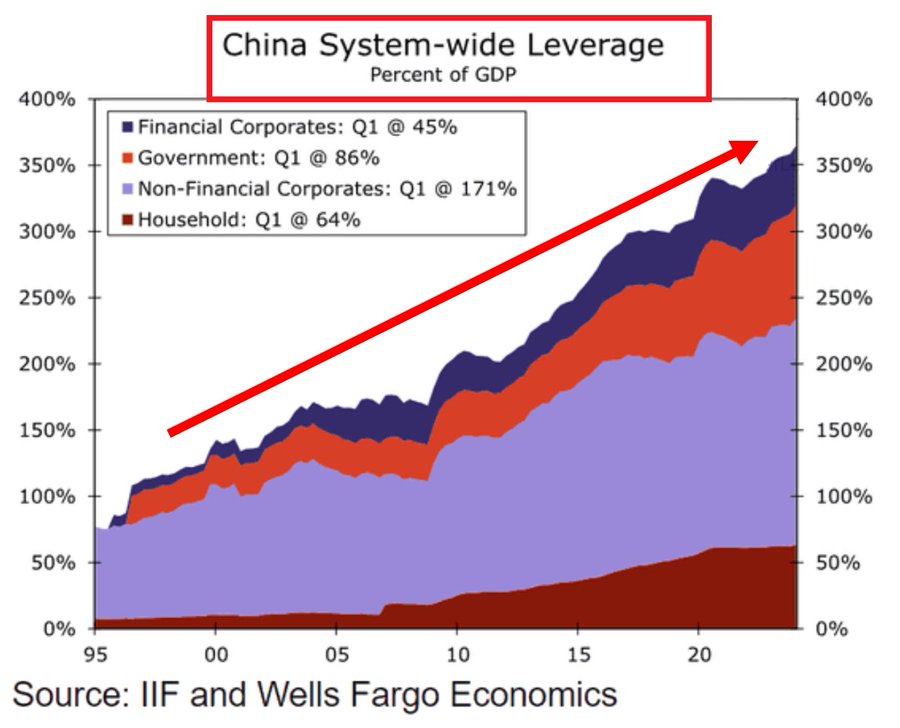

China’s debt-to-GDP ratio hit a MASSIVE 366% in Q1 2024, a new record.

- Since 2008, the ratio has more than DOUBLED.

- Breakdown:

- Non-Financial Corporates: 171%

- Government 86%

- Households: 64%

- Financial Corporates: 45%

Even with this huge debt, China cannot achieve a 5% GDP growth target.

The above chart helps to demonstrate the amount of stimulus that’s been deployed over the decades, and the reason we believe that the law of diminishing returns is hitting directly. This limits the efficacy of stimulus to the point that any new leverage actually causes ore damage. I will have a report out next week discussing this exact point with examples.

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/101424-us-sanctions-on-iran-to-tighten-china-crude-flows-raise-shipping-costs

- https://www.ft.com/content/fbad4462-5ed8-4f75-80d7-79459607277c

- https://www.reuters.com/markets/commodities/opec-cuts-2024-2025-global-oil-demand-growth-view-again-2024-10-14/

- https://www.reuters.com/markets/commodities/opec-cuts-2024-2025-global-oil-demand-growth-view-again-2024-10-14/

- https://www.caixinglobal.com/2024-10-18/chinas-third-quarter-gdp-102246544.html

- https://www.bloomberg.com/news/articles/2024-10-17/china-to-expand-support-for-unfinished-projects-to-562-billion