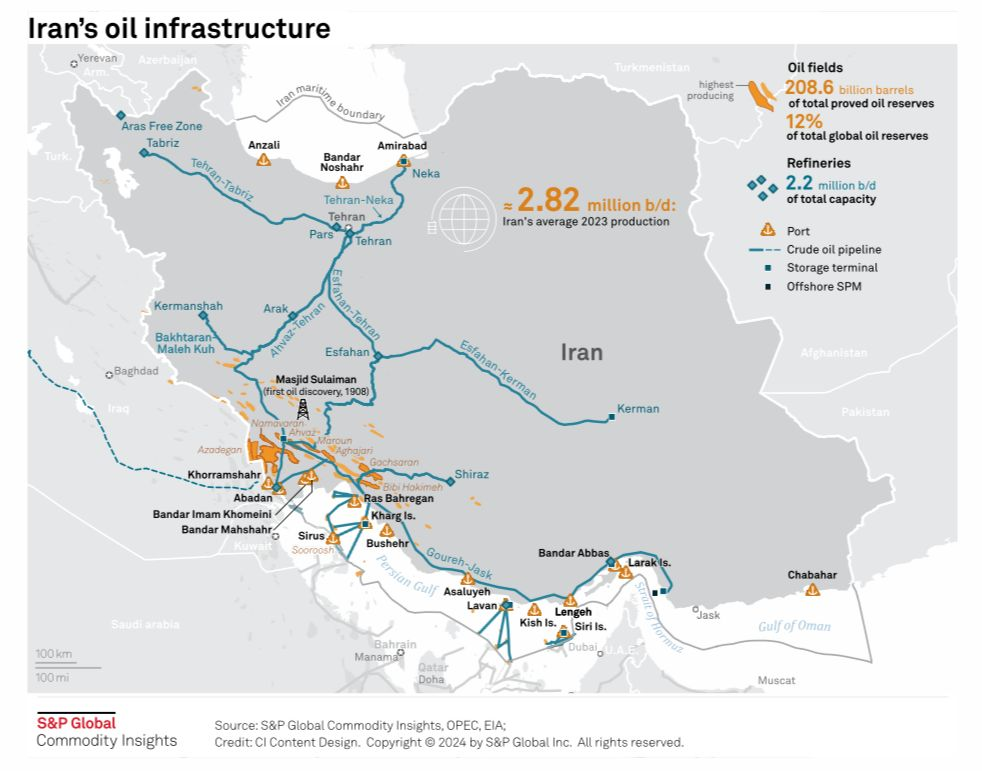

Iran’s Jask Port is increasingly becoming a focal point in the country’s oil export strategy, especially as tensions with Israel intensify. The port, located on the Gulf of Oman, is designed to handle up to 1 million barrels per day and offers a crucial alternative to the Strait of Hormuz, through which 90% of Iran’s oil traditionally flows. The significance of Jask has been underscored recently with its first-ever crude shipment outside the Persian Gulf. In late September 2024, a VLCC carrying 2 million barrels of crude departed from the Jask terminal, marking a major development. Satellite images and data from Kpler showed that this shipment, carried by the Iranian-owned Dune VLCC, made its way to China after passing through the Malacca Straits. This move allows Iran to reduce its reliance on the strategic but vulnerable Strait of Hormuz, mitigating some of the risks associated with that chokepoint.

Recent developments at Jask indicate that 11 of the terminal’s 20 planned crude storage tanks are now complete, providing 5.5 million barrels of storage capacity. Although this is a fraction of the terminal’s planned capacity of 20 million barrels, it highlights the progress Iran has made in building out the port’s infrastructure. However, the port still faces operational limitations. Only one of its three planned loading buoys is functional, restricting its loading capacity. Nonetheless, the terminal’s recent activity, including the loading of 2 million barrels between September 9 and 19, 2024, signals a shift in Iran’s export strategy as the country looks to increase oil flows while reducing its exposure to the volatile Persian Gulf.

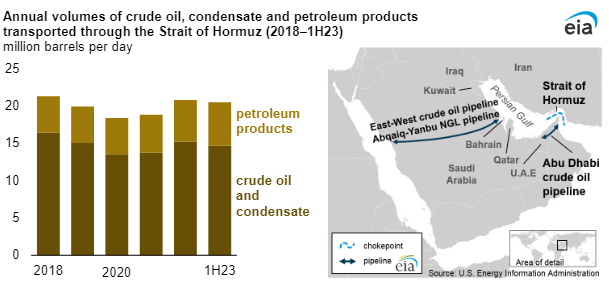

Iran’s oil export operations have always been deeply tied to the Strait of Hormuz, one of the most critical and politically sensitive chokepoints in global oil transportation. About 18 million barrels of oil pass through it daily, representing nearly one-third of global oil trade. But it’s not just Iran that is vulnerable to potential disruptions here. Every major Middle Eastern oil producer is at risk if tensions spill over and lead to military action or blockades. The completion of the Jask terminal, therefore, marks a crucial step for Iran, allowing it to mitigate some of the risks it faces if the Strait were ever disrupted. The timing couldn’t be more critical given the current geopolitical backdrop.

With the anticipation Israel responding to Iran’s missile attacks from earlier this month, the global oil market is on high alert. Iran’s decision to shift some of its export capacity to the Jask terminal could be seen as a preemptive move in anticipation of potential retaliatory strikes that may target its traditional Kharg Island terminal. The stakes are high. If Israel or its allies target Iranian oil infrastructure, it would send ripples through the global oil markets. Prices could skyrocket beyond $100 per barrel, as many experts have pointed out, depending on the scale of the damage and the severity of the escalation. However, so far Israel has confirmed not to attack Iran’s oil infrastructure but their military.

Interestingly, despite the escalating tensions, oil prices have seen a somewhat subdued response. Brent crude has hovered between $73 and $77, a range far below the $100 per barrel mark that many analysts anticipated. This is partly due to stable crude supplies from other regions, including Libya, which has been ramping up production faster than expected. Additionally, while Iran’s export loadings did slump immediately after its missile attacks, they’ve rebounded in recent weeks to a steady 1.3 million barrels per day. The world isn’t exactly running short on oil just yet, but this equilibrium could be precarious. As tensions between Israel and Iran continue to simmer, any further escalation could quickly destabilize the market.

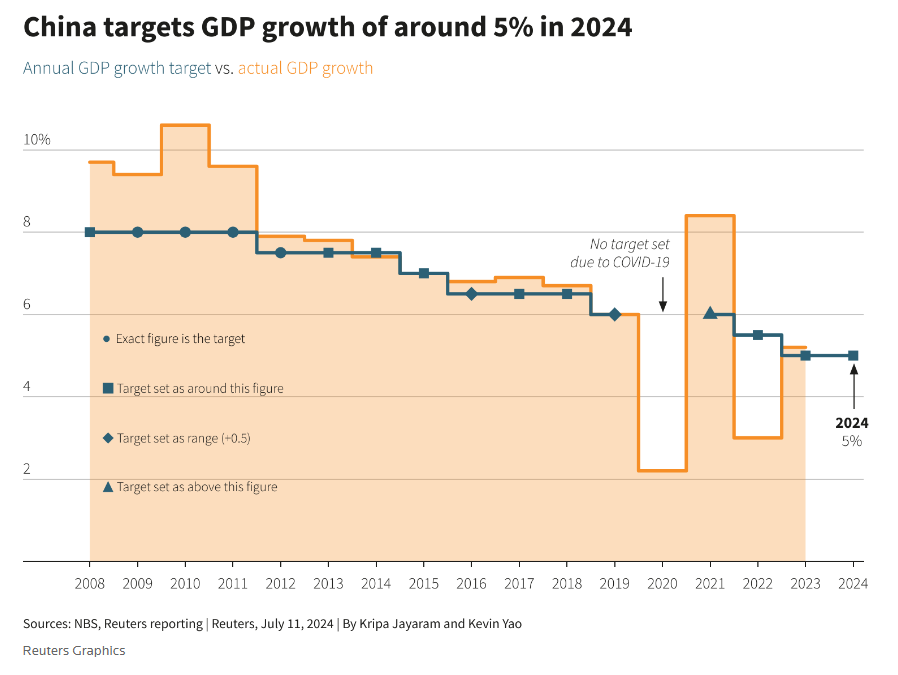

Looking at the broader market, the recent dip in oil prices—down 7% in response to eased concerns over an Israeli strike on Iranian oil infrastructure—highlights the delicate balance between supply and demand. On one hand, geopolitical risks continue to loom large, with even a small disruption in the Strait of Hormuz likely to have outsized consequences. On the other, weakening global demand, particularly from key consumers like China – about which we will talk about in further detail in our Market Sentiment Tracker this week- is putting downward pressure on prices. China’s refinery runs remain lower than anticipated despite recent stimulus measures, further dampening the outlook for global demand.

As things stand, the future of oil prices will largely hinge on geopolitical developments in the Middle East. While the immediate threat of supply disruption appears to have subsided for now, the risk remains ever-present. The next few weeks will be crucial in determining whether Iran’s Jask terminal becomes a pivotal asset in reshaping global oil flows or just another fleeting headline in the volatile world of energy markets. Iran’s ability to bypass the Strait of Hormuz with its Jask Port marks a significant geopolitical development, but the bigger question remains: can Iran maintain this advantage in the face of escalating regional tensions? As we await Israel’s next move, the world watches closely—oil markets are poised on a knife-edge, and even the smallest spark could send prices soaring.