Next week’s events are shaping up to be pivotal for the U.S. economy, and by extension, the global economic landscape. We’re standing at a crossroads: the upcoming U.S. presidential election, the Federal Reserve’s meeting on November 7, and the release of the recent jobs report have each set the stage for crucial shifts in economic policy and market sentiment. As we peer into 2025, these three intertwined themes provide a window into where we’re headed, especially considering how factors like job growth, inflation, and energy prices are interacting with geopolitical uncertainties.

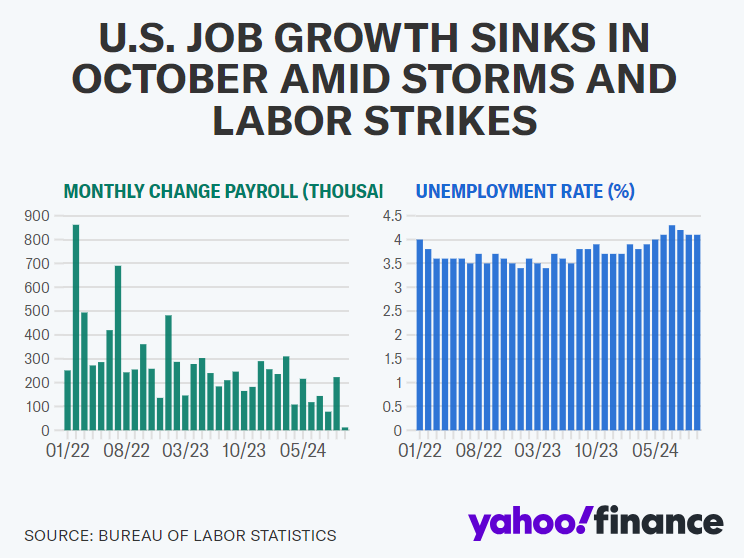

The October jobs report showed a sharp decline in job creation, with only 12,000 jobs added—a staggering drop from September’s 223,000. Economists had expected at least 100,000, so this number missed the mark by a wide margin. Unemployment stayed steady at 4.1%, which aligns with economist expectations, but the low job creation figure raises questions about the underlying health of the labor market. While part of the weak performance can be attributed to hurricanes Helene and Milton as well as the Boeing strike, which temporarily sidelined workers, the data presents a challenging snapshot. Brian Bethune, an economist at Boston College, suggested that without these disruptions, job creation would have been closer to 130,000.

However, it is important to note respondents who had jobs but weren’t working because of bad weather are still counted as employed. “The same goes for workers with jobs who are on strike. The survey those numbers are based on “is not designed to isolate effects from extreme weather events,” as per The Labor Department”.

Both political camps are keen to spin these figures to their advantage. Vice President Kamala Harris’s campaign is expected to underscore the stability in the unemployment rate and rising wages, framing it as a sign of resilience. On the other hand, former President Donald Trump has seized on the jobs miss, calling it evidence of economic mismanagement. This dynamic makes the election even more pivotal. Beyond campaign rhetoric, whoever wins will inherit an economy at a delicate juncture, where sustaining employment growth without overheating inflation will be a critical balancing act.

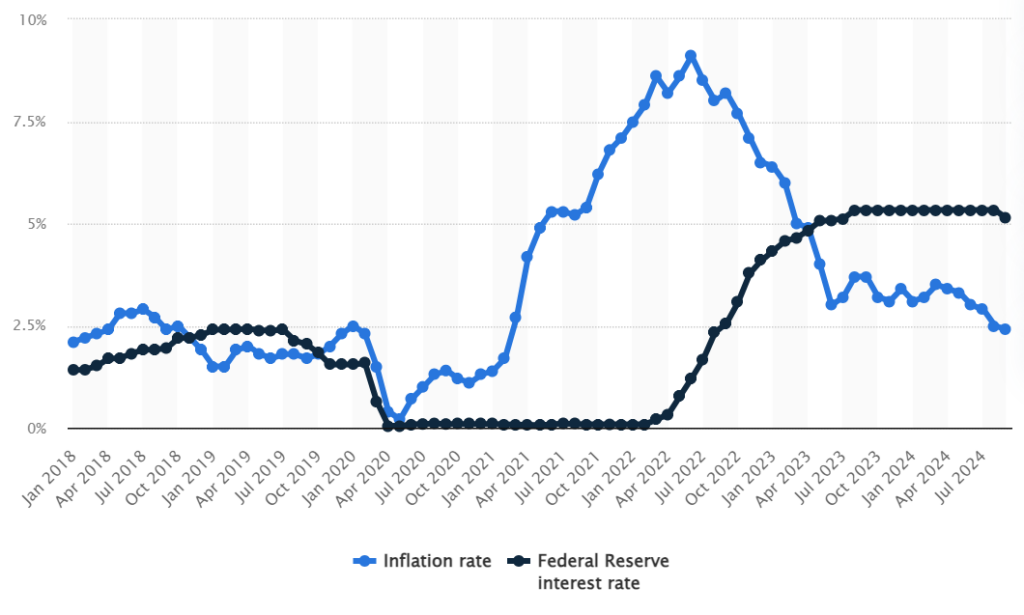

The Federal Reserve’s upcoming meeting will add another layer of complexity. Markets are anticipating a quarter-point rate cut, a move that could help stimulate growth by easing borrowing costs. With recent data pointing to a softening labor market, the Fed’s decision is likely to be cautious. A significant rate cut might help combat the slowdown in job creation, yet too aggressive a cut could stoke inflation—a risk given that wage growth has been steady. Average hourly earnings rose by 4% in October compared to a year earlier, up slightly from September’s 3.9%. This increase, while modest, signals that wage pressures still exist and that inflation could flare up if the Fed moves too fast on cuts.

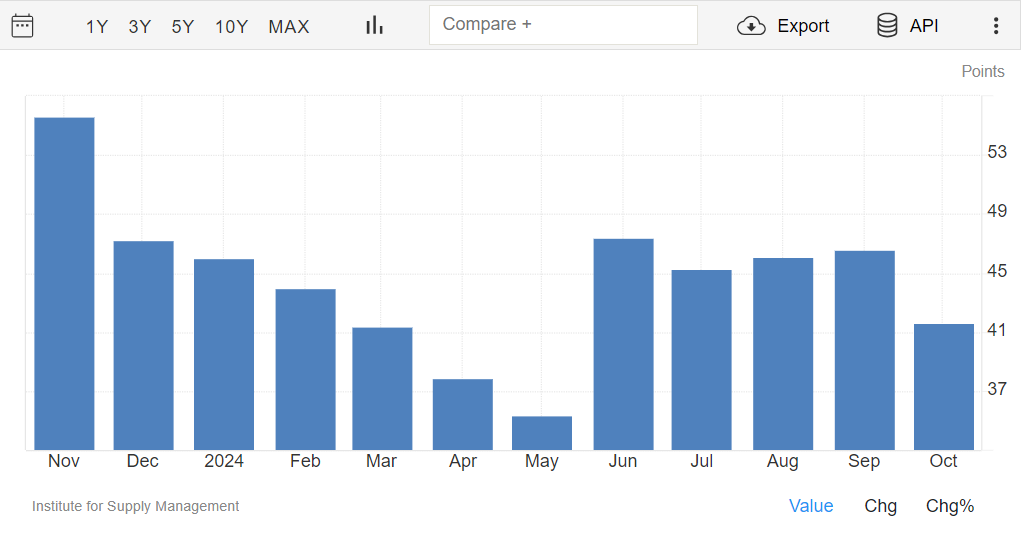

The Chicago Business Barometer, also known as the Chicago PMI, dropped to 41.6 in October, well below the breakeven level of 50 and missing the forecast of 46.8. This reading marks the 11th consecutive month of contraction for this indicator and reflects ongoing struggles in the manufacturing sector. The ISM factory index has shown similar signs of weakness, staying below 50 for most of the past two years. These indices are often early signals of shifts in economic momentum, and their prolonged slump hints that demand in the manufacturing sector remains tepid, partly dragged down by issues like the Boeing strike and reduced demand in industries reliant on heavy machinery and equipment.

In the oil markets, we’re also seeing forces that could shape inflation and growth in the coming months. OPEC+ is weighing a delay on its planned output increase scheduled for December, citing weak demand and rising supply as reasons to keep production restrained. The coalition, led by Saudi Arabia and Russia, had already postponed this increase once, and if it’s delayed again, we could see some support for oil prices, which have been struggling to stay above $70 per barrel. Brent crude, for instance, is trading around $72, close to its yearly lows, even with occasional gains driven by geopolitical jitters. A further delay by OPEC+ could provide price stability, which might ease inflationary pressures in energy-dependent sectors. However, if oil prices spike unexpectedly—say, due to geopolitical issues or supply constraints—the Fed may face greater challenges in curbing inflation while supporting growth.

Primary Vision’s Frac Spread count, a measure of active U.S. fracking operations, underscores the cooling trend in domestic oil production. As of the latest data, the current frac spread count stands at 232, down by 7 compared to the prior week and showing a year-on-year decline of 38. The fracking industry’s retrenchment reflects broader economic caution. Lower oil prices and cost-control efforts are leading companies to scale back operations, a move that could impact U.S. oil production levels into 2025. This trend aligns with the job market’s cooling, as energy sector layoffs and a slowing pace of drilling contribute to regional economic sluggishness, particularly in oil-reliant states like Texas and New Mexico.

Given all this, what should we make of these interwoven developments? The October jobs report, while disrupted by weather and strikes, highlights a labor market that’s showing signs of cooling after a strong post-pandemic recovery. The Fed, with its eye on long-term stability, faces the task of calibrating rates to prevent an economic slowdown while ensuring inflation doesn’t rise too sharply. The election next week only adds to the stakes, as the incoming administration will have to contend with a complex set of economic conditions that may limit their policy flexibility. Looking forward to 2025, it’s reasonable to expect a more subdued economic environment. We may see the Fed adopting a gradual rate-cutting path if job growth remains tepid and inflation pressures are contained. However, external factors like global demand for U.S. goods, geopolitical shocks in the oil markets, or further strikes in key industries could create volatility. In the oil sector, if OPEC+ continues to restrict supply to maintain prices, the domestic energy landscape may further consolidate as smaller shale players face financial pressures from subdued prices and lower drilling activity.

This moment feels like the calm before the storm. With the election around the corner and the Fed meeting on November 7, the economic policy direction for 2025 is still up in the air. Yet, one thing is clear: the choices made over the next few weeks will have lasting implications. The U.S. economy stands at a crossroads, where any misstep—be it in rate adjustments, fiscal policy, or international diplomacy—could reverberate across sectors and shape the economic narrative of 2025 and beyond. For businesses and investors alike, staying nimble and informed will be essential in navigating the uncertain road ahead.