The energy markets remain range bound, but maintaining their volatile shifts between $71-$76. There was a strong bounce off the lows following the Israel strike against Iran, but this has since cooled off keeping us between $72-$73. We expect the market to average the $71-$76 range to hold through the end of the year with the average being about $73. As we’ve been saying for months, Israel wasn’t going to attack Iran’s oil and gas or exporting assets. These are still off the table in our opinion with many other high value targets in focus. The strike on Iran disabled most of their anti-aircraft and anti-missile defenses (Russian made S-300s and S-400s), while also striking key IRGC complexes and a missile factory. When we outlined how Israel would strike, this was the base case outlined. By eliminating many Iranian defenses, Israel should be able to deter a certain number of future attacks. It’s unlikely to stop them completely, but it could limit Iran’s actions within Israel. There have also been rumors about a ceasefire being negotiated that could push Hezbollah back beyond the Litani River. So far, there hasn’t been any confirmation, but it has been thrown around as a potential outcome.

The geopolitical theater will remain front and center, but it has cooled a bit taking some of the premium with it. We don’t see much getting put back into it over the next few weeks, and this will shift Brent a bit lower. We’ve taken our range for Brent in Nov a bit lower to about $71-$76 with an average price of $73 expected. Demand is the biggest threat that we don’t see getting any better in the near term. This will keep crude futures capped with a bit more downside likely to come into the market. There will be enough uncertainty to keep this range intact heading into December, but the biggest unknown is Q1’25- especially January. We expect Israel to continue striking Iranian proxies in Syria and Lebanon, but it’s unlikely we see a direct attack on Iran at this point. This will help “calm” the geopolitical risk, and we expect to see Trump remain hawkish on Iranian policy.

Russia made waves with their response to the storm shadow missile attack against Russian and North Korean officers. The Ukraine missile strike was launched deep into Russian territory and took out a fortified position. Russian responded by launching intermediate range ICBMs with conventional warheads as well as several supersonic missiles. Some of the ICBMs were 30/40 year old assets that failed to detonate with the warhead actually breaking apart and landing as inert masses. These launches and following threats were enough to spook the market, but I think this is Russia trying to use marketing/threats to remain relevant. They are running out of munitions and manpower, which is part of the reason North Korean soldiers and military assets are in country.

Israel already eliminated the majority of Iran’s “advanced” anti-missile/air defense, which were S-300 and S-400s. Trump showed their limitations back in 2017 with his Patriot missile launch in Syria, and Israel used that information to destroy Iran’s protection. Russia isn’t in a position to distribute additional units to Iran, so they are now sitting exposed to attacks while Russian equipment losses credibility. In an attempt to stay relevant, Russia launched several ICBMs with the older technology failing miserably.

Putin is KGB through and through, and his ability to stay relevant on the world stage is impressive given the actual state of their military. He always used the fog of war and weakened adversaries to appear strong and relevant, helping to propagate the myth of “Russian Might.” You never want to underestimate your adversary, but the weakness in naval assets, miscues in strategy, failed mechanical equipment, and inability to obtain air superiority in Ukraine shouldn’t be ignored. Has Russian military made advances- absolutely- but have them been decisive victories- absolutely not. The market will fade off this recent pop, but this won’t be the last we heard from the Russian/Ukraine front. It’s unlikely anything big happens prior to a Trump inauguration.

On a side note, we’ve seen several Chinese entities that were reselling assets to Russia completely stop following Trump’s election. This was something that I saw firsthand, but it became public information over the last few weeks. Many of these Chinese firms have family and business ties in the U.S., and they don’t want to risk these relationships with sanctions for reselling to Russia. This cut off vital flow of equipment, which was likely part of the reason Putin made a deal with North Korea. It was a “backhanded” way to get Chinese equipment into Russia.

I continue to hold to the belief that the Middle East is likely closer to long term peace than any other time over the last 40 years. I know this sounds insane, but the generational dynamics and pivots are real. The Iranian Revolutionary drive that took power in 1979 are aging out (dying) while a large part of the new generations want something very different. Proxies are experiencing heavy losses while cash flows have been turned off and equipment hard to obtain. Don’t get lost in the headlines and fearmongering… the world isn’t about to head into WW3- we are probably further away from it versus 2022.

Trump has officially won the white house with the Senate and House both with republican majorities. While “Drill Baby Drill” was the mantra coming into the election, we’ve highlighted how there will be little change to the current production profile. The main reason being the limitation on pipeline and export capacity, U.S. refiners already running max light, and slowing global demand for U.S. crude. Every new barrel of crude production in the U.S. has to be exported with a large portion of it heading to Europe. The European economy is abysmal, and we don’t see this adjusting any time soon.

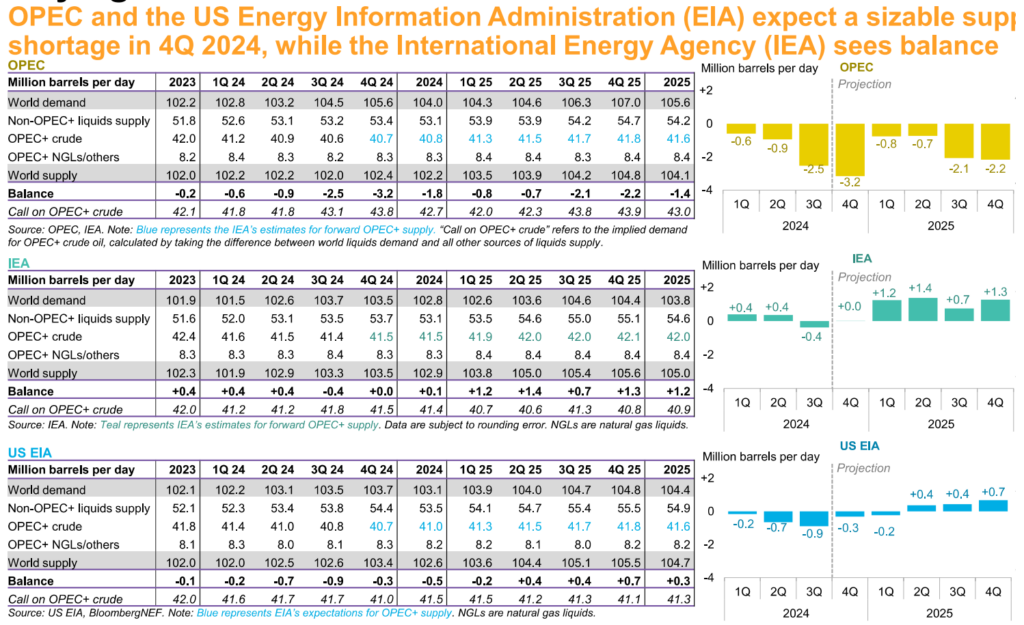

Global crude demand isn’t improving anytime soon, and OPEC continues to overstate demand this year and next.

- OPEC cuts 2024 global oil demand growth forecast to 1.82 million bpd (prev. Forecast 1.93 million bpd)

- Monthly oil report OPEC cuts 2025 global oil demand growth forecast to 1.54 million bpd (prev. Forecast 1.64 million bpd)

- OPEC says its crude oil production averaged 26.53 million bpd in October 2024, up 466,000 bpd from Sept led by Libya

The view that crude demand grew 1.82M barrels a day is just not reality given where total flows and refining run cuts. It clearly wasn’t 1.93M barrels per day, but we will see another sizeable drop in these estimates. OPEC is also holding steady on their expectations for 2025 growth, but this is also something we don’t see as a likely scenario given the economic backdrop. When we look at the two largest economies in the world- U.S and China- it doesn’t bode well for the next level of buying. We believe the IEA is probably closer to the true number (which pains me to say), but these expectations of crude demand growth aren’t based on economic or refining reality.

The below chart gives a slightly different perspective, but both have shown a shift in demand at least for 2025. I still think all of them are overstating demand at this point, but it will take time to see some of these reductions to filter through expectations.

Several big banks- GS and JPM so far have increased their pricing forecasts for next year, which flies in the face of current refining economics and macroeconomic drivers. OPEC+ is still sitting on several million barrels a day of production while demand factors deteriorate further. Stimulus, especially in China, has fallen flat at every turn with little to change their structural problems. I think OPEC+ delaying their ramp should be indictive of problems ahead.

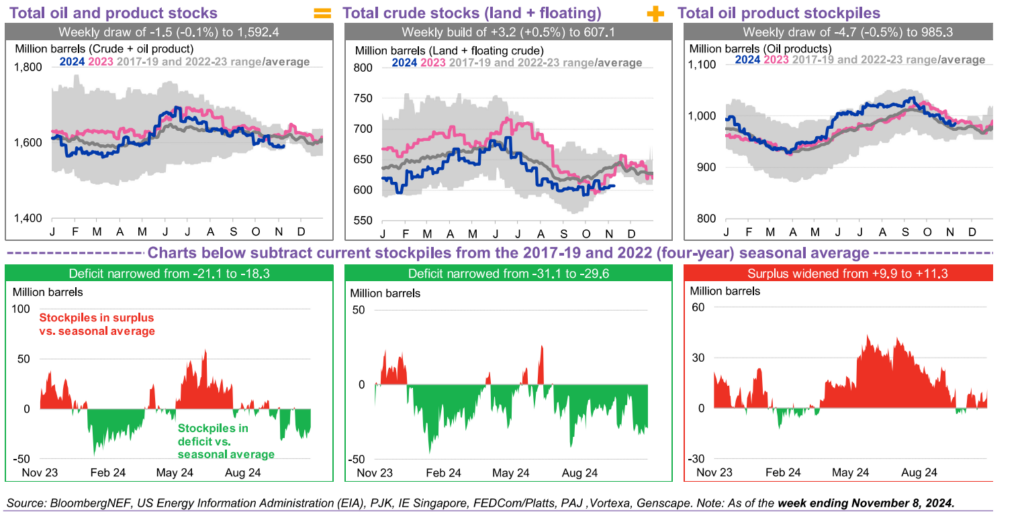

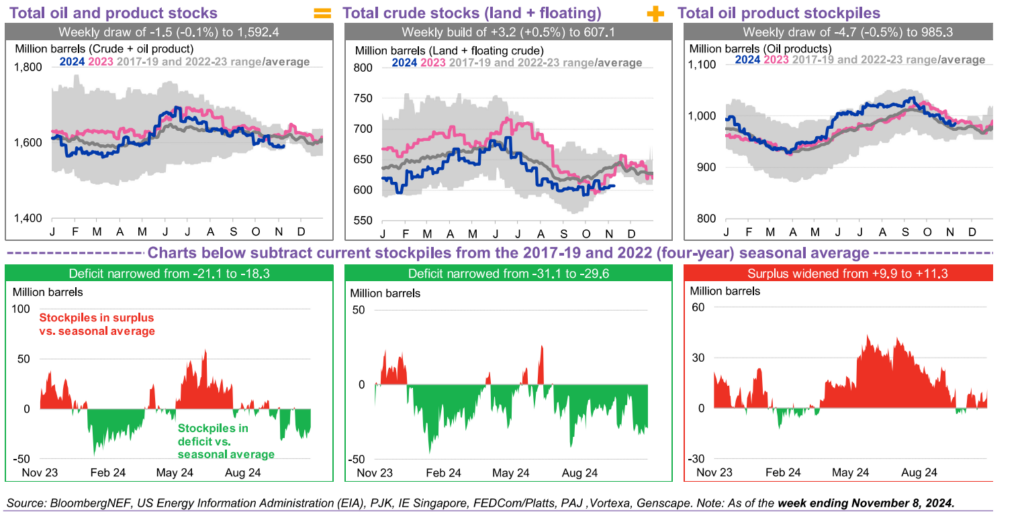

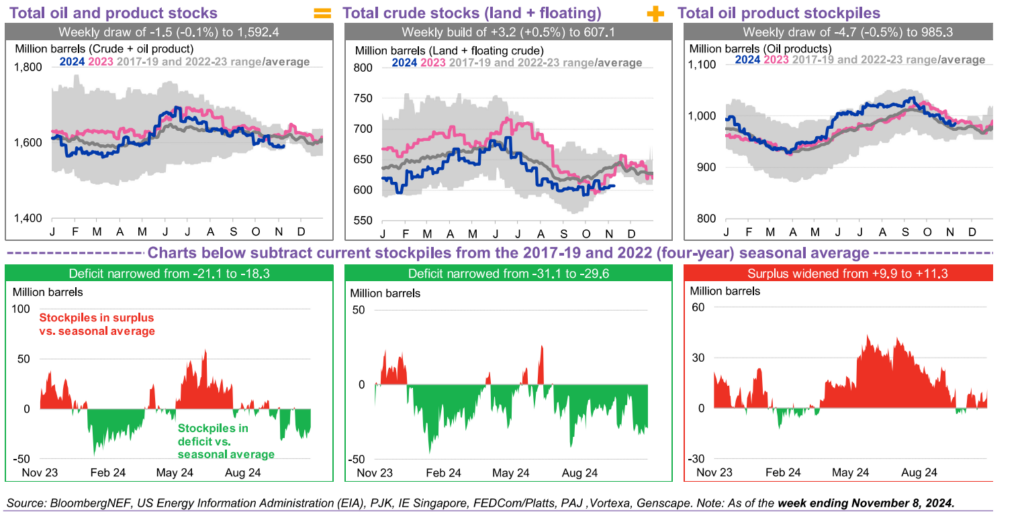

OPEC+ has delayed their ramp from December into next year, and we expect the organization to delay much further into 2025. We don’t believe KSA has the political support to increase the cuts, but it is a possibility- just an unlikely outcome. Libya has brought back their full amount of exports with Russia still pushing out a sizeable amount as the refiners remain in turnaround. There has been a shift higher in storage across both crude and products, which is inline with our expectations. We believe that the product side will stay elevated, but the cut in runs will push more crude into storage.

It’s important not to confuse some strengthening in refining margins as increased demand but rather economic run cuts or reduced supply. Refiners are trying to protect margins, and we’ve seen a sizeable reduction in throughput happening in Europe, Korea, and SE Asia. This is going to keep pressure on refining runs, and will push more crude into storage. The below shows the current breakdown with more products building as additional crude sits in transit. This will push crude storage higher, but to a point to hold flat pricing. The recent contango shift was purely just a roll of contracts and less about actual storage levels.

There is more crude in transit, which will help push floating and eventually onshore storage higher. WAF has struggled to clear with even more left in the market even as January loadings come out early next week. “WAF: The number of unsold cargoes from the Nigerian and Angolan December loading programs has decreased this week, around 25-30 Nigerian December cargoes remain unsold. 15 cargoes from the December Angolan loading program remain unsold, down from around 18 at the end of last week.” We don’t see these sales accelerating anytime soon, and this will keep pressure on light-sweet sales.

The crude markets saw a flip into contango, but it was driven more by the roll versus a structural change in the market. Demand still remains very soft, but supply is also being held back under the OPEC+ deal. The current shifts in the market should push OSPs lower from KSA, and it should keep the recent North Sea purchase to a one off. Today’s contango in WTI is because of rolling positions to Jan as volumes dropped and open interest is already dead in December’s contract. This is likely a good entry point for a quick bounce higher.

On the floating side, we’ve seen some sizeable increase in the East of Suez with more to follow in Asia. The Middle East increases is showing some pressure on sales, but we expect to see some decent OSP cuts by KSA to help move some of these standard barrels.

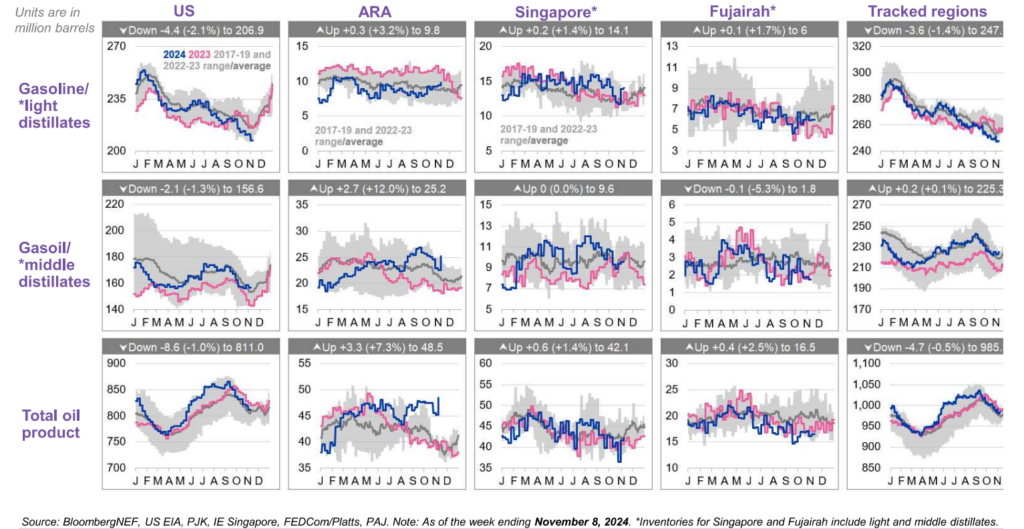

The key areas to watch on product right now are ARA and Singapore, which have seen HUGE spikes in storage- especially in ARA. This big oversupply in Europe is going to slow exports from the U.S. and shift Atlantic Basin volumes out of Europe and directly into U.S. storage. Singapore is also seeing a strong reversal, and this is even as refinery runs remain depressed. The slow down in Europe and Singapore will also leave more product in Fujairah, and result in some increases in middle disty.

China continues to disappoint on the demand front, and I don’t see this changing into next year. I would say- next year will be just as weak- if not worse.

The weakness in China is playing out plainly in the refining side of the equation. Runs remain at seasonal record lows, and refiners have been front running 2025 import quotas hoping for extra or additional. Instead, they will likely be forced to scale back purchases as runs don’t accelerate. A large part of purchases have ended up in the SPR, and without a pick up in runs- China will scale back buying. Historically, they tend to do this often in Nov/Dec, and more often than not- it ends with a big drop in purchases in Jan/Feb.

I just want to dispel some recent comments about China playing “4-D Chess” by issuing dollar denominated bonds through KSA. This wasn’t some sort of great phenomenon to corner the USD market or take control of the dollar from the U.S. (which is insane given we control Fed wires). The Saudi market is DESPERATE for IPOs and bond issuance, and they will provide a ton of support. Investors only able to deploy in KSA or incentivized to be in country- will oversubscribe heavily. China saw an opportunity to get a massively oversubscribed bond offering, which would keep yield capped. This enabled China to bring in needed USD to shore up collateral, rebuild depleted USD holdings, and direct investment capacity. I would expect them to target additional fund raising through these methods, which isn’t because they are trying to “take control of USD flows.” If anything, it helps keep the dollar strong- which helps the U.S. purchase exports from China.

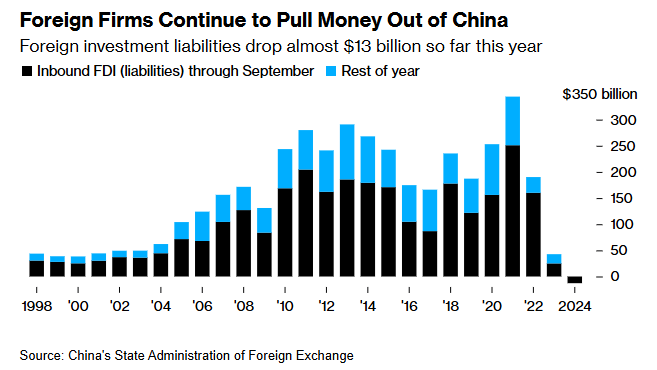

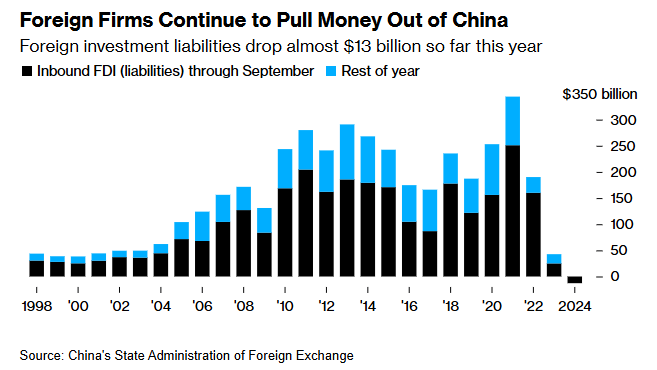

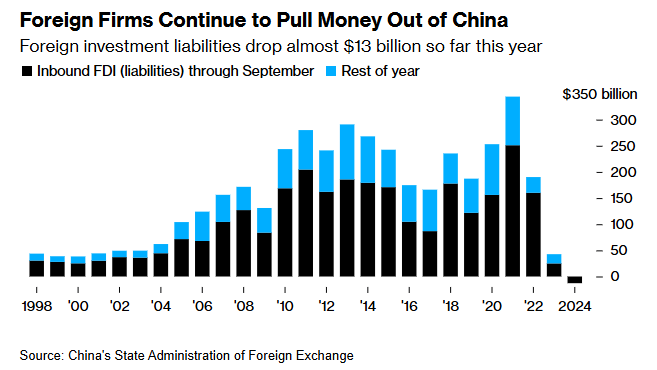

It’s also important to remember that foreign firms are pulling money out of China, and a large part of this capital is based in USD.

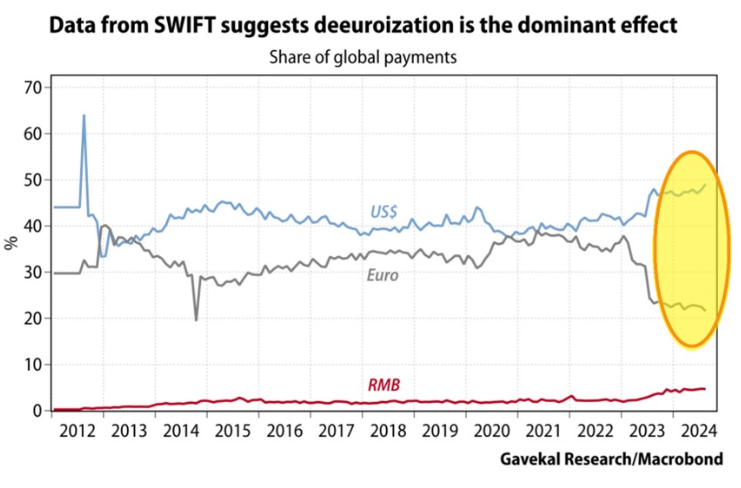

The dollar continues to find strength as well as increasing its strength as a form of payment. USD is now used in 49.1% of global payments, which is the highest level in more than 12 years. We don’t see this changing in the foreseeable future- especially when key countries are looking to increase their holdings versus reducing them.

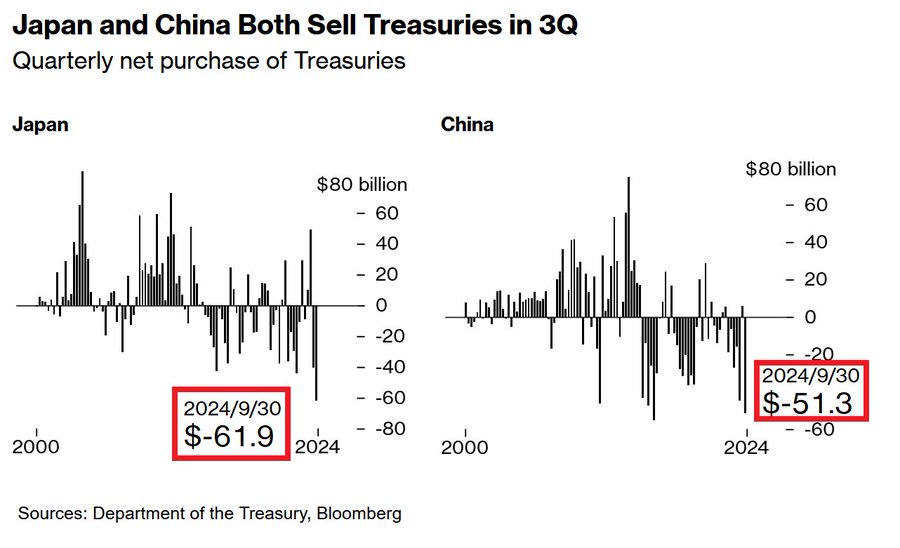

It’s also important to appreciate that China and Japan have been net sellers of US Treasuries, which isn’t some sort of insane chess move. Rather, it’s a means of pulling forward USD to help stabilize a struggling economy. China needs collateral to stand behind a structurally struggling real estate sector while Japan faces inflation risk and a devaluation of Yen.

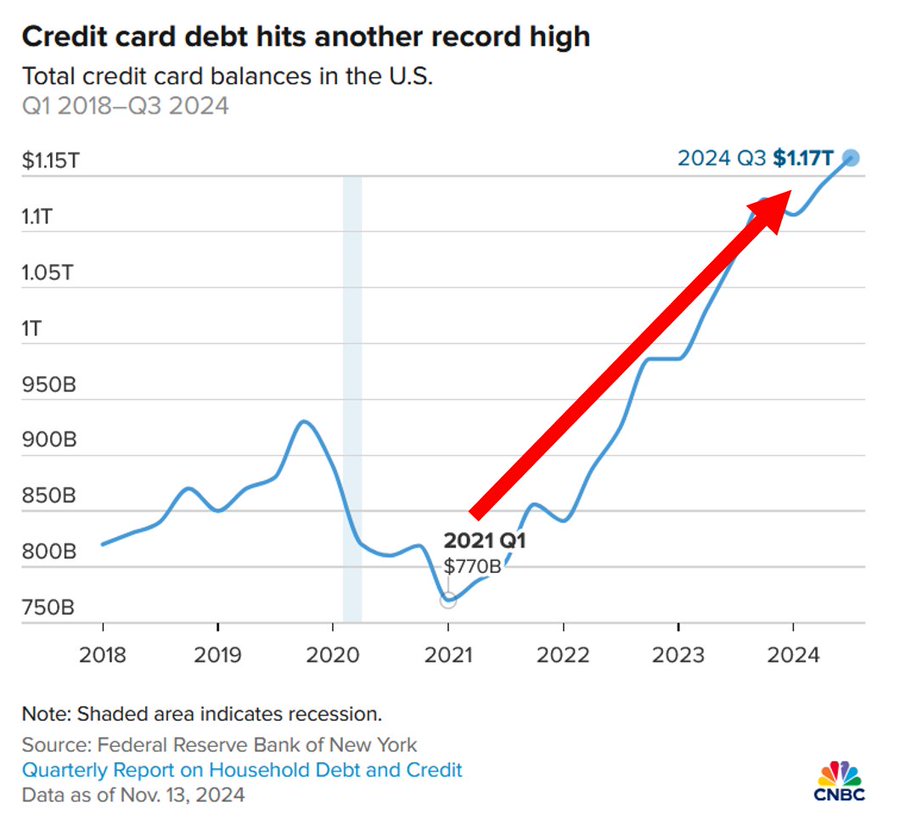

The U.S consumer continues to get pummeled with higher prices and more struggles across the board.

- Credit card debt rose by $24 BILLION in Q3 2024 and hit $1.17 TRILLION, a new record.

- Credit card debt SKYROCKETED $400 billion over the last 3 years.

- All while $2.3 TRILLION in excess savings have been spent.

We have continuously pushed back on the view that excess savings reached these levels. Our view has been that the excess savings were burn through by the middle of 2022, otherwise, we wouldn’t have seen this level or pace of CC debt being added. You can see when excess savings really ran out because CC debt EXPLODED, and if there was this huge level of savings- the pace of CC debt additions would have been more gradual.

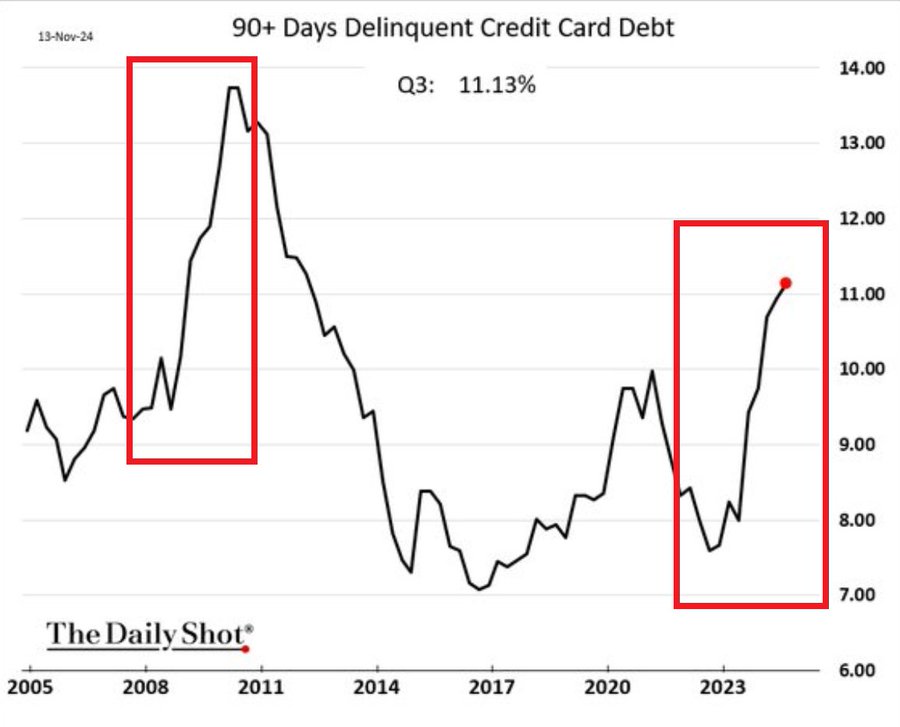

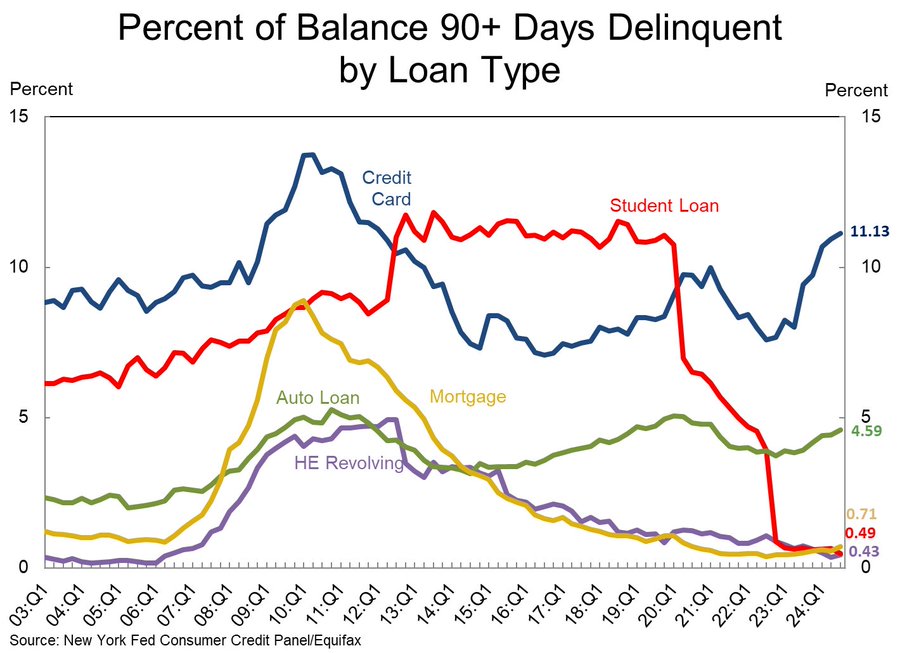

Even as the debt accumulated, people would have been able to manage minimum payments to avoid delinquency. Instead, the share of credit card balances being seriously delinquent (90+ days) spiked to 11.13%, the highest in 13 years. This is the fastest pace since the Financial Crisis, and it doesn’t include the “Buy Now and Pay Later” backdrop.

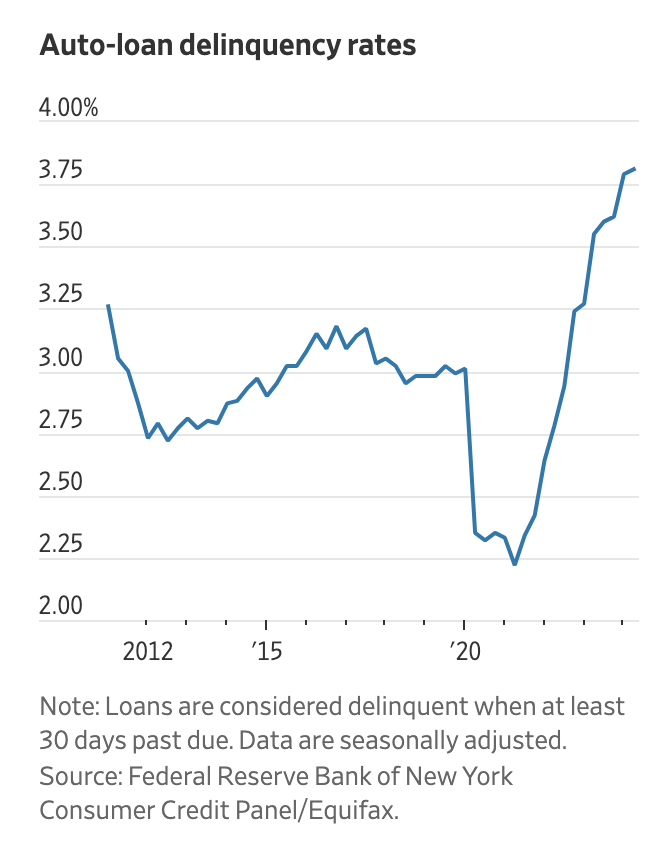

The key levels to watch for delinquencies this time around are CC and auto loans. Mortgage rates are mostly locked in and much lower levels, but the ones that have flexed the most will continue to pressure consumer balance sheets. The compounding nature of CC rates will only send this much higher and rapidly.

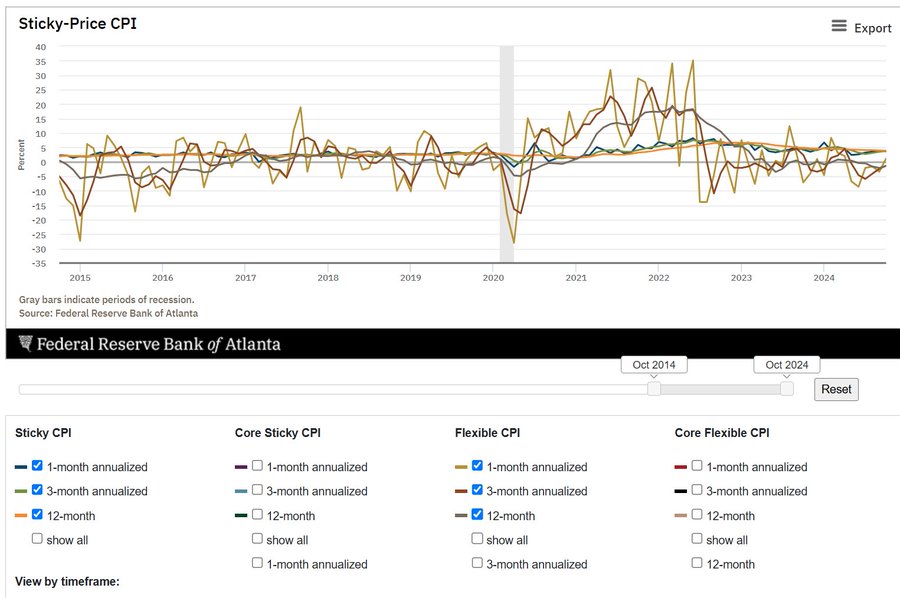

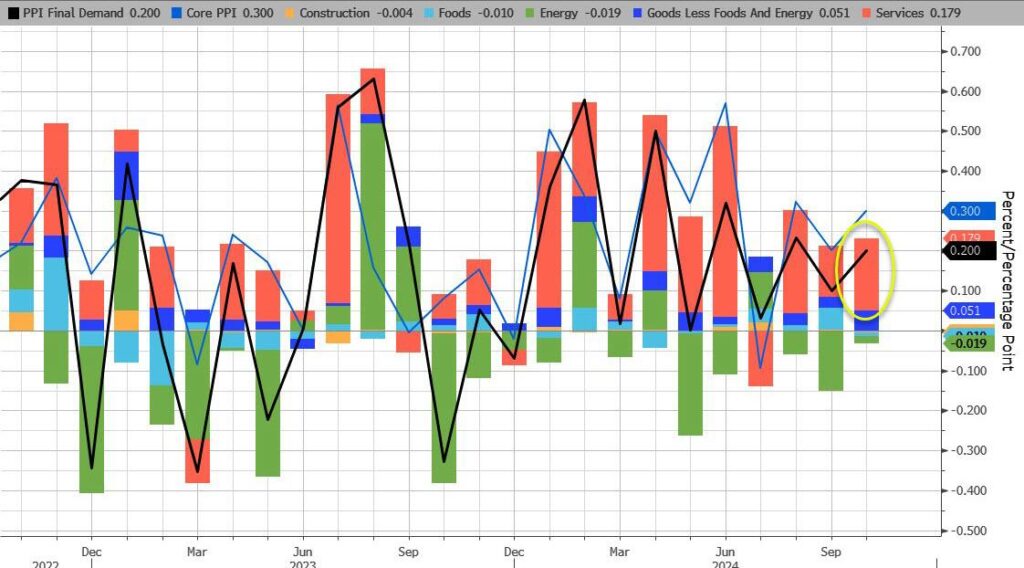

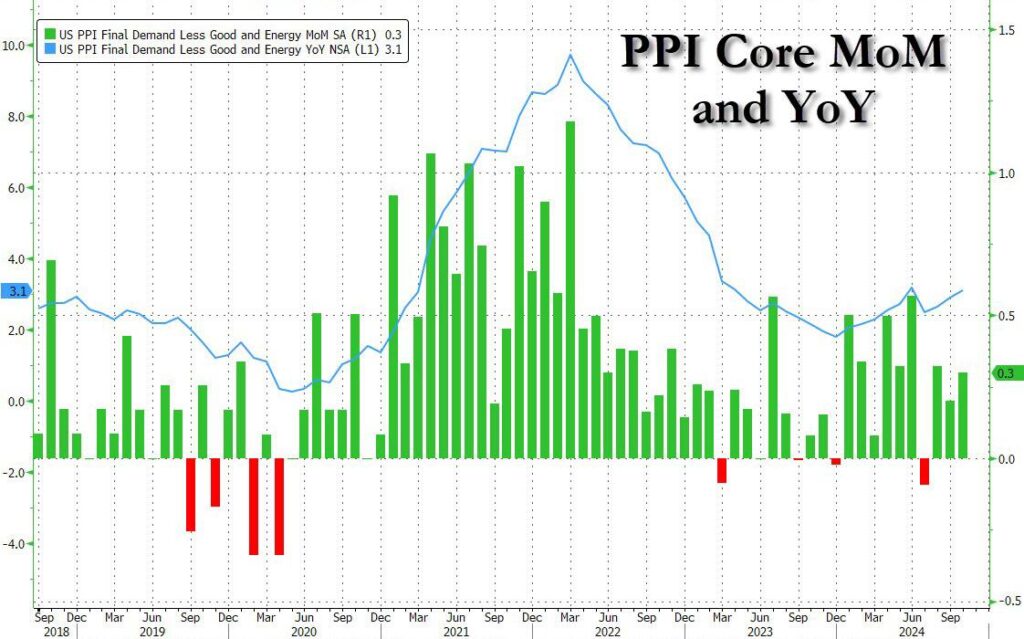

The inflation (CPI) and PPI data don’t talk to any easing levels of inflation. Sticky inflation hasn’t budged while slowly drifting higher, but the bigger issue is the flexible inflation shifting higher. Given the current Fed rate cuts, we expect to see this ramp higher over the next few quarters. PPI is a great leading indicator for the trend across consumer inflation. “Starting at the top, headline PPI rose 0.2% MoM (in line with the +0.2% expected) but September was revised higher from 0.0% to 0.1%; meanwhile on an annual basis, headline PPI rose 2.4%, higher than the 2.3% expected, with the last month also revised higher from 1.8% to 1.9%.”

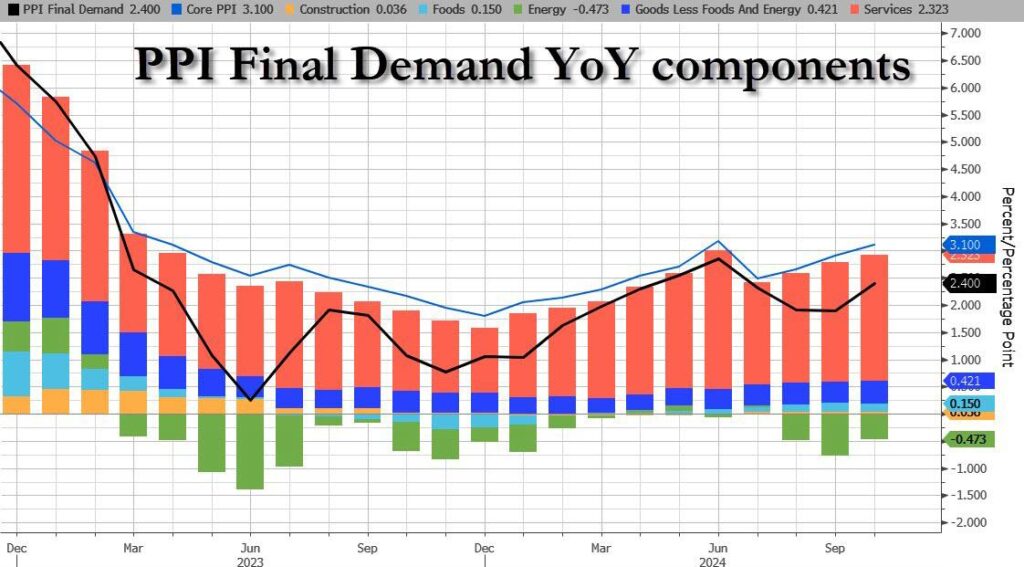

The PPI pull is only intensifying when you look at services pushing higher once again. This is going to keep “sticky” inflation very elevated, and likely lead to another push higher as we head into Q1’25.

The final demand numbers are also starting to pivot higher, which is a big problem when you look at “core” as well.

We are firmly in a problematic position when we look at how final demand, service, and core PPI are shifting around.

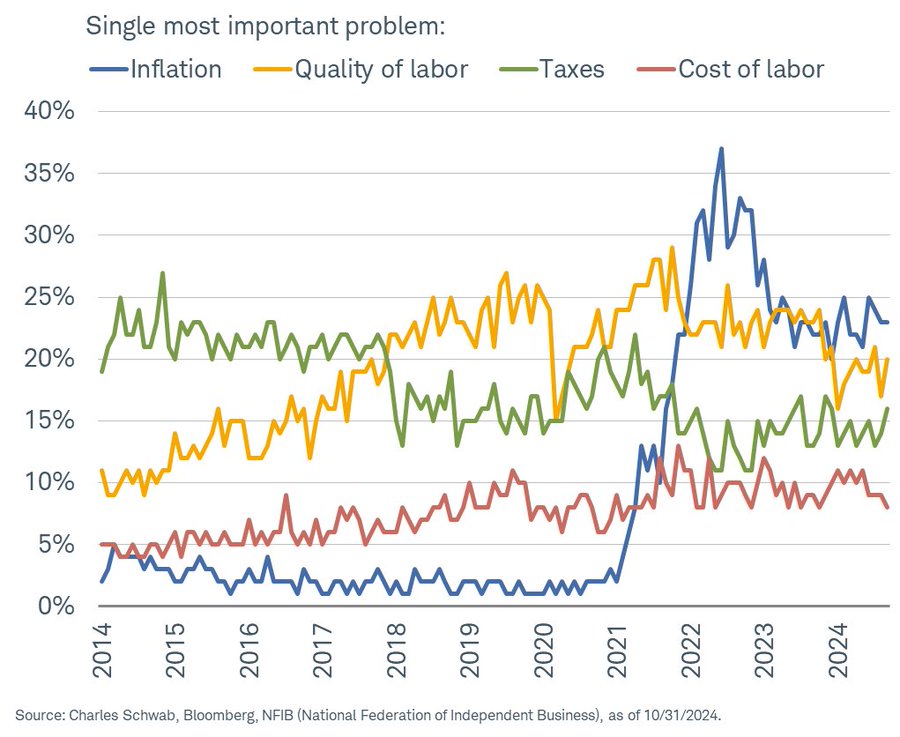

Small businesses are still calling out inflation as the largest issue facing their businesses, and it isn’t really even close at this point. After 4 years, inflation still remains the main problem they face, which is usually passed through to the final consumer.

The market is overestimating the consumer as issues pile up across the board. Auto loan delinquencies have hit a new high and taken out the high from 2008.

Even as demand slows, we still see inflationary pressures given the amount of liquidity still dumping into the market. This is appearing in so many different areas- including PPI, prices received, and shipping costs.

The concerns in the market are only getting bigger as U.S. bond auctions weaken further driving up yields. We’ve seen recent auctions blow through the tails with falling interest in terms of bid-to-cover. The equity markets continue to ignore the risk that is being flagged by the bond markets, and I think there will be a sizeable shift in the market as we head into 2025.

Going forward- I will look to write more often but shorter reports to help those that are time crunched. Hopefully this makes it easier to consume, and please reach out with other ideas or views to make these more impactful.