OPEC+ has once again adjusted its strategy to navigate the turbulent waters of global oil demand. Initially, the group planned to ease production cuts starting October 1, then pushed this back to January 1. Now, the goalpost has shifted further to April 2025. The weak Chinese and U.S. economies will remain the biggest overhang as we head into next year. The Eurozone’s GDP growth inched up marginally in Q3, with Spain growing by 0.8% and France by 0.4%. However, exports declined 1.5%, reflecting weakening demand. Many more updates to read in this latest newsletter!

1. MMV: OPEC+ Production Cuts Explained and What Comes Next? – PREMIUM

OPEC+ has once again adjusted its strategy to navigate the turbulent waters of global oil demand. Initially, the group planned to ease production cuts starting October 1, then pushed this back to January 1. Now, the goalpost has shifted further to April 2025, with the unwinding set to stretch over 18 months.Demand forecasts for 2024 have been repeatedly revised downward, with OPEC’s November report now projecting a growth of 1.82 million bpd, down from an initial estimate of 2.25 million bpd.

Read the article above to learn about this in more detail.

2. PRIMARY VISION INSIGHTS – ENTERPRISE

The energy markets reacted briefly to the OPEC+ news of a delayed production returning to the market. We’ve been at the front of the line discussing how these cuts were going to be very difficult to bring back to the market. We will see a very range bound 2025 with little ability to send crude pricing much higher. The risk remains to the downside given the economic backdrop in the market, and I don’t believe there is enough political will within OPEC+ to cut further.

Read Mark Rossano’s Insights to get some brilliant takeaways regarding the global oil markets.

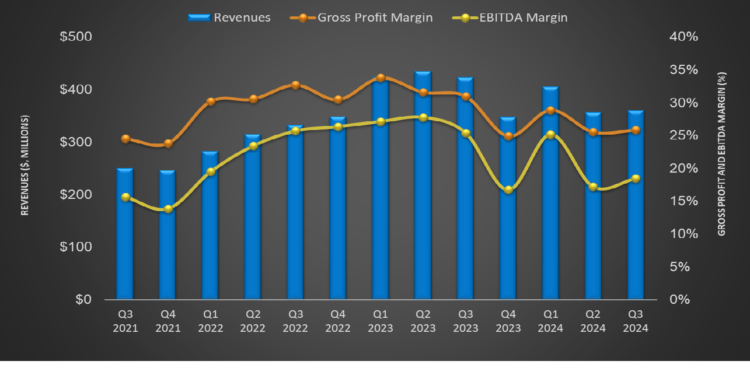

3. ProPetro’s Perspective: Q3 Takeaways – PREMIUM

This article, written by our brilliant analyst Avik Chowdhury, delves deeper into the industry and its current outlook. After Q3, PUMP had 14 hydraulic fracturing frac spreads and will keep it unchanged in Q4. It will also maintain seven Tier IV DGB dual-fuel. DGB fleets will accelerate diesel displacement. PUMP has continued to deploy the rollout of its FORCE electric frac fleets since August 2023. Click the image above to read it in detail.

4. MST: U.S. Economy Poised for a Soft Landing? – PREMIUM

The U.S. economy looks strong. On the positive side, job creation remains solid, with an average of 173,000 new jobs per month since September and a notable 227,000 jobs added in November.China’s exports surged by 6.7% year-on-year in November, with shipments to the U.S. rising 8%, signaling strong external demand. Manufacturing and services PMI data suggest steady activity.The Eurozone’s GDP growth inched up marginally in Q3, with Spain growing by 0.8% and France by 0.4%. However, exports declined 1.5%, reflecting weakening demand. Germany’s GDP eked out a 0.1% gain, missing expectations, while Italy’s manufacturing struggles weigh on sentiment.

Read this article to stay up to date with the latest sentiment tracker.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co