The new year is here! In this update, Primary Vision looks at the global markets in general and the oil markets in particular to find out the key factors guiding the prices and trajectory of these markets.

1. MMV: Will U.S. oil production increase further? – PREMIUM

The U.S. shale sector will be subject to many developments as the gap between the policy direction of the current U.S, administration and the upcoming one along-with the priorities of the industry itself combined with the wider geopolitical and economic factors will make up for an exciting 2025. The consolidation and financial discipline are underscored by advances in technology and operational efficiency. According to the Energy Information Administration (EIA), productivity in shale wells has improved significantly, allowing producers to achieve higher output with fewer rigs. Read more about in this week’s Monday Macro View.

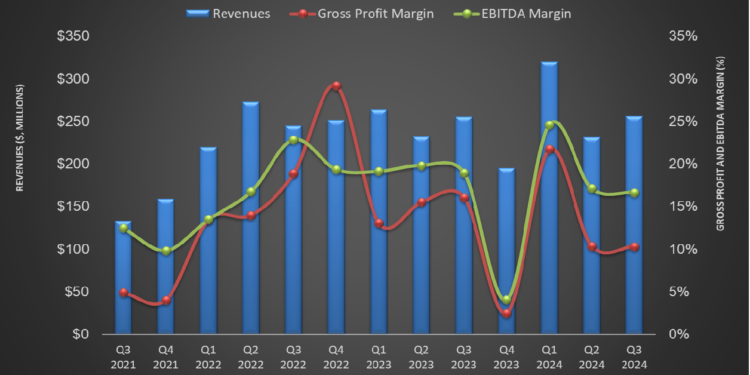

2. STEP ENERGYS ERVICES PERSPECTIVE in Q3 – KEY TAKEAWAYS – PREMIUM

STEP anticipates a worse-than-usual Q4 because the weakness of energy prices can trigger a steep capex drop for energy operators. Despite the recovery in natural gas prices, high gas storage levels in Canada and the US can decelerate drilling and completion plans. Find out Avik’s brilliant analysis to learn further about the oil field service industry.

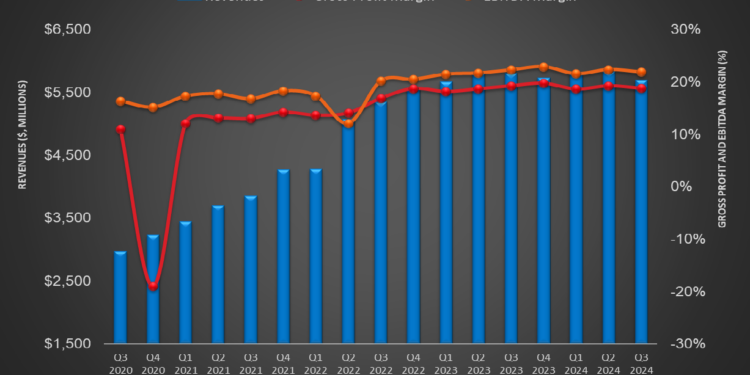

3. Halliburton’s Perspective: Q3 Takeaways – PREMIUM

The management of Halliburton expects revenue from its international business to grow by “low- to mid-single digits” compared to a 4% year-over-year growth in Q3. Growth can accelerate due to the robust performance in cementing, completion tools, and drilling fluids. To find more about what it means for this significant organization and industry as a whole, read Avik’s latest commentary.

4. MST: Is China’s Economy Improving? – PREMIUM

Pending home sales rose for the fourth straight month in November, reaching their highest level since early 2023, a testament to steady housing demand. China’s December indicators reveal that the country’s economy is improving but cautiously. The manufacturing Purchasing Managers’ Index (PMI) stayed just above neutral at 50.1, indicating modest sector expansion. The Eurozone’s economy has concluded on a rather challenging front. Inflation climbed to 2.4% in December, marking the third consecutive rise and surpassing the European Central Bank’s (ECB) target.

Read this article to stay up to date with the latest sentiment tracker.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co