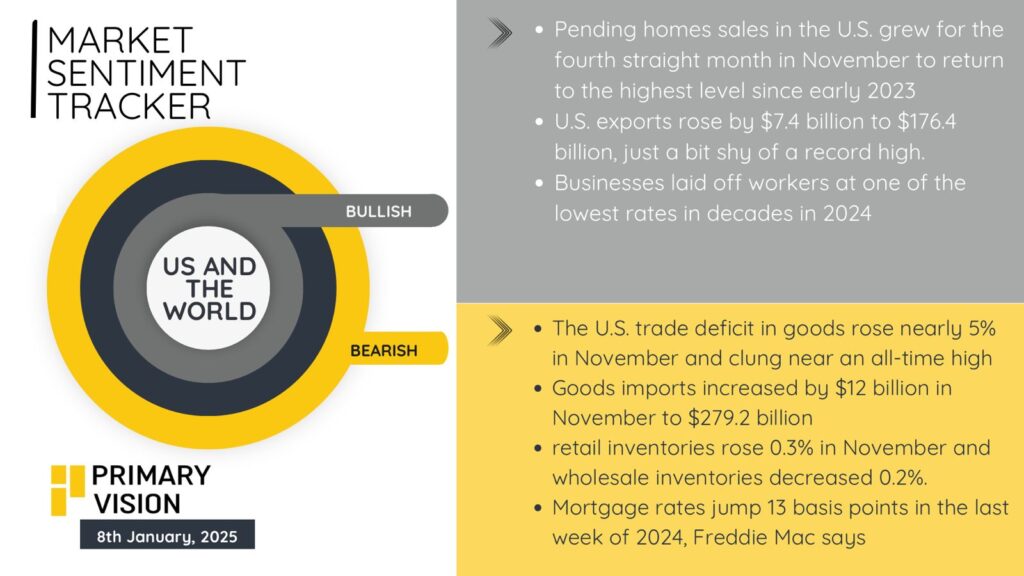

United States

Pending home sales rose for the fourth straight month in November, reaching their highest level since early 2023, a testament to steady housing demand.

Exports jumped by $7.4 billion, hitting $176.4 billion, approaching record highs, while layoffs remained at historically low rates, signaling robust labor market conditions. However, challenges persist. The U.S. trade deficit in goods surged nearly 5% in November, hovering near all-time highs. Goods imports climbed by $12 billion, totaling $279.2 billion, reflecting higher consumer and business activity but also increasing external dependencies. Retail inventories nudged up by 0.3%, while wholesale inventories dipped 0.2%, hinting at supply chain adjustments. Mortgage rates spiked 13 basis points in December’s last week, posing risks to housing affordability. Overall, while consumer and export sectors drive optimism, external trade imbalances and rising borrowing costs adds uncertainty.

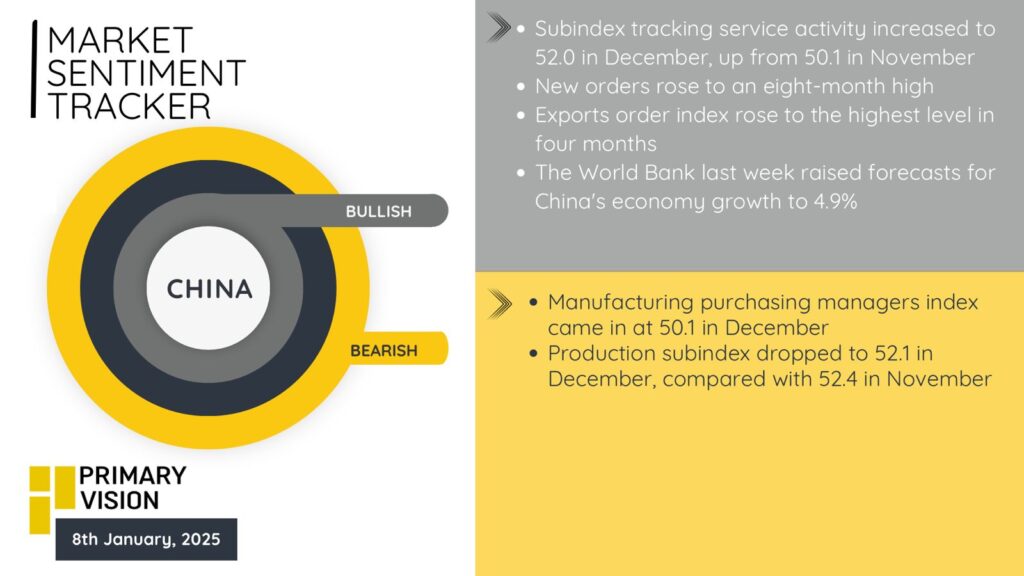

China

China’s December indicators reveal that the country’s economy is improving but cautiously. The manufacturing Purchasing Managers’ Index (PMI) stayed just above neutral at 50.1, indicating modest sector expansion. Service activity saw a boost, with its subindex rising to 52.0 from 50.1 in November, reflecting increased domestic demand. Exports gained momentum, as the export order index hit a four-month peak, while new orders touched an eight-month high. The World Bank recently raised its growth forecast for China’s 2025 GDP to 4.9%, underscoring confidence in recovery efforts. However, not all data inspire optimism. The production subindex declined slightly to 52.1, down from 52.4 in November, suggesting constraints in manufacturing output growth. Policymakers may need to balance cautious optimism with proactive interventions to sustain this trajectory.

EUROPE

The Eurozone’s economy has concluded on a rather challenging front. Inflation climbed to 2.4% in December, marking the third consecutive rise and surpassing the European Central Bank’s (ECB) target. This uptick, driven by higher energy costs and persistent services expenses, has led to speculation that the ECB may adopt a more gradual approach to monetary easing. Germany, the bloc’s largest economy, reported a 2.6% inflation rate in December, exceeding expectations and complicating potential interest rate cuts. Despite this, the Eurozone’s GDP grew by 0.4% in the third quarter, with household consumption rising by 0.7%, indicating resilient consumer spending. However, challenges persist. The manufacturing sector continues to contract, with the Purchasing Managers’ Index (PMI) remaining below the growth threshold at 49.6 in December. Additionally, political instability and potential trade tensions pose risks to the economic outlook.