Halliburton, one of the most prominent names in oilfield services, is navigating a period of transition marked by softer North American activity and shifting global demand. The company’s recent financial results illustrate both the challenges and opportunities within the oil and gas sector as operators contend with market oversupply, constrained budgets, and regional disparities in activity levels. The same trend can also be observed in Primary Vision’s Frac Spread Count. This article tries to provide our readers with a bigger picture using some key data points.

The fourth quarter of 2024 proved challenging for Halliburton, with North American revenue falling by 9% to $2.2 billion, reflecting reduced completion and production (C&P) activity. Pressure pumping and stimulation services, core components of the company’s offerings in the region, saw notable declines. The company’s D&E (Drilling and Evaluation) segment also reported weaker results due to reduced well construction activity in the region. Despite this, Halliburton offset some of the softness in North America with a 2.4% increase in international revenue, totaling $3.41 billion for the quarter. Growth in markets such as the Middle East and Africa—driven by artificial lift activity, stimulation services, and completion tool sales—helped mitigate the impact of weaker results in its home region. Net income for the year declined 5.6%, reaching $2.01 billion, underscoring the challenges posed by reduced activity in North America and Latin America. Despite these pressures, Halliburton generated $2.6 billion in free cash flow in 2024, returning $1.6 billion to shareholders through dividends and share buybacks—an achievement that CEO Jeff Miller highlighted as a testament to the company’s disciplined approach. (For detailed outlook please see our analyst, Avik Chowdhury’s article: HALLIBURTON – Q4 Take Three).

A closer look at Halliburton’s performance reveals a stark contrast between its regional operations. North America, which accounts for 39% of the company’s revenue, continues to face headwinds from oversupply concerns and restrained capital spending by operators. This has led to a significant slowdown in activity, with many service providers grappling with lower utilization rates and pricing pressures. Halliburton’s C&P segment, which includes its pressure pumping business, declined by 4.2% in the fourth quarter, reflecting these challenges. In contrast, its international operations benefited from increased activity in the Middle East, Africa, and the North Sea, where demand for artificial lift systems, fluid services, and completion tools remains strong.

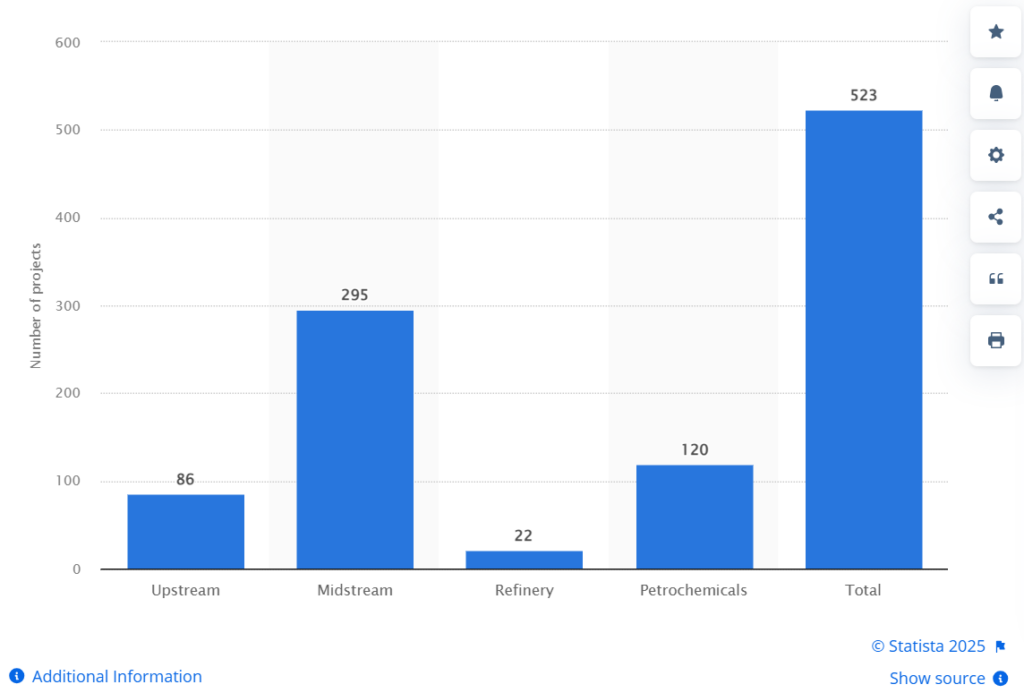

Source: STATISTA – Forecast number of oil and gas projects planned in North America between 2022 and 2026, by sector

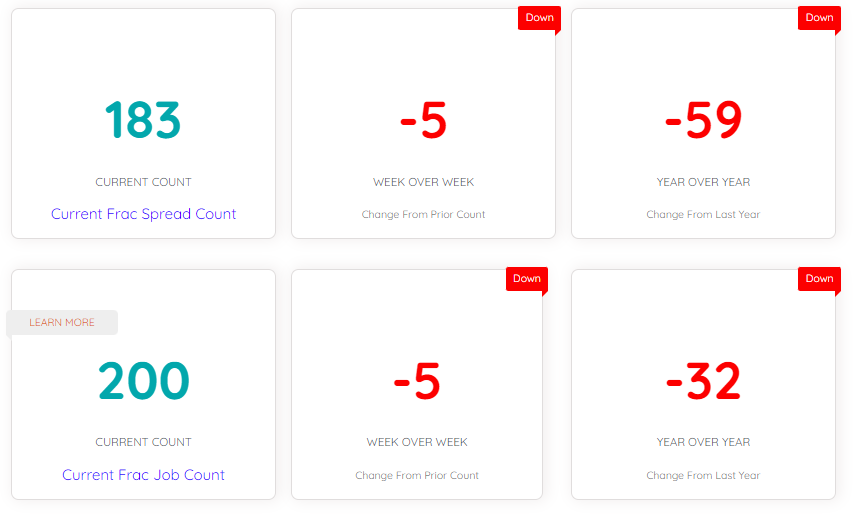

The latest Frac Spread Count (FSC) data, combined with the above financial performance metrics and market insights, puts the challenges faced by companies like Halliburton in perspective. The FSC, currently stands at 183, reflecting a week-over-week decline of 5 spreads and a significant year-over-year drop of 59 spreads. This decline underscores the pressure on North American activity, which remains a cornerstone of Halliburton’s operations. Furthermore, a significant reduction in active spreads across key basins like the Permian and Appalachian, combined with subdued operator spending, has led to decreased demand for completion and production services. The current count of 188 active frac spreads signals a sluggish operational environment, further complicated by pricing pressures and constrained budgets.

Source: Primary Vision – Frac Spread Count

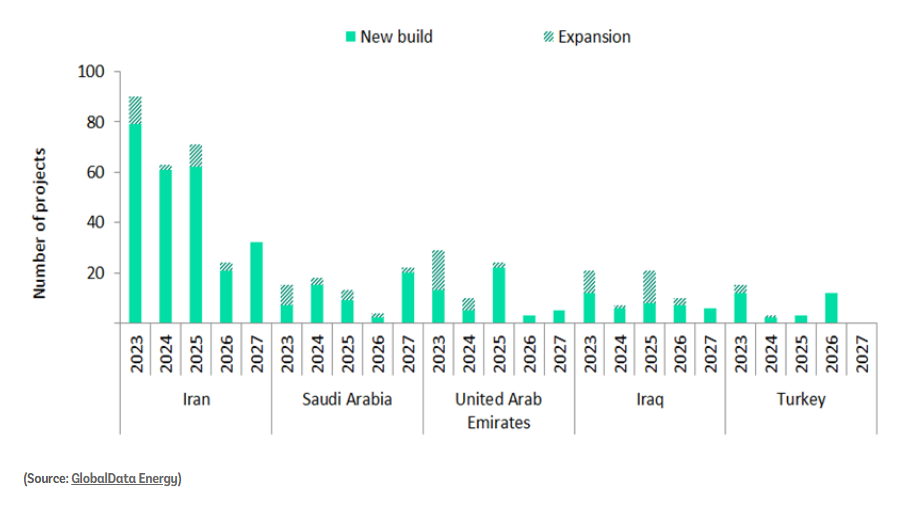

But the company is also looking outside America to compensate for its loss. One of the company’s most notable recent moves is its agreement with the Iraqi government to develop the Nahr Bin Omar and Sindbad oilfields in Basra. This project marks a significant step in Halliburton’s strategy to expand its footprint in high-growth international markets. By leveraging integrated field management services and the EPCM model, Halliburton positions itself as a key partner in Iraq’s energy sector, which continues to invest heavily in production capacity. Such international initiatives provide a counterbalance to the sluggish North American market, ensuring the company remains competitive on a global scale. Halliburton’s strategic focus on technology and efficiency also plays a critical role in maintaining its competitive edge. Advanced completion tools, artificial lift systems, and digital solutions are central to its efforts to drive operational excellence and reduce costs for clients. These innovations are increasingly important as operators demand higher efficiency to navigate budget constraints and unpredictable market conditions.

Despite these strengths, Halliburton faces significant challenges as it looks to 2025. The company has signaled a “sequentially softer” outlook for North America, echoing similar sentiments from its rival, Schlumberger. The pressure pumping business, a cornerstone of Halliburton’s North American operations, is particularly vulnerable to reduced activity levels and pricing pressures. While the company’s international portfolio offers some insulation, the bifurcation between its regional markets underscores the need for strategic adaptability. Halliburton’s ability to balance these dynamics will define its performance in the coming year. Its focus on maintaining strong cash flow, optimizing operations, and investing in international growth positions the company well to navigate the challenges ahead. However, the broader market environment remains uncertain, and sustained success will require both agility and innovation.

Halliburton’s result are symptomatic of a wider trend in the U.S. oil industry. As the year progress, we have an even more difficult situation to make sense of as open ended conflicts, a supply overhang and soft oil demand will make wild swings in the oil prices frequent and intense. Oil prices have a direct influence on not only traders but OFS companies as well and as an extension determine the trajectory of expansion in the industry. Stay tuned with Primary Vision to continue to learn about these developments in real time!