The threat of imposition of tariffs on oil imports from key trading partners like Canada, Mexico, and China is reshaping the dynamics of crude flows and refining economics in North America. While such a development has been put on hold, these tariffs, which range from 10% to 25%, particularly target heavy and sour crude, a critical feedstock for U.S. refiners can significantly impact U.S. energy security and have reverberations across the global oil markets.

As explained by Mark Rossano in his Insights for Primary Vision, the U.S. refining sector heavily relies on heavy/sour crude, with over 50% of the country’s 18 million barrels per day refining capacity designed to process such grades. This dependency means that tariffs on approximately 5.3 million barrels per day of heavy crude from countries like Canada, Mexico, Colombia, and Venezuela are significantly raising costs for refiners. For instance, a $70 barrel of Western Canadian Select (WCS) crude subject to a 25% tariff jumps to $88, adding an estimated $0.22 to $0.30 per gallon to gasoline prices, and around $0.40 when taxes are included. This surge in costs inevitably squeezes refining margins and has the potential to shift global crude trade flows.

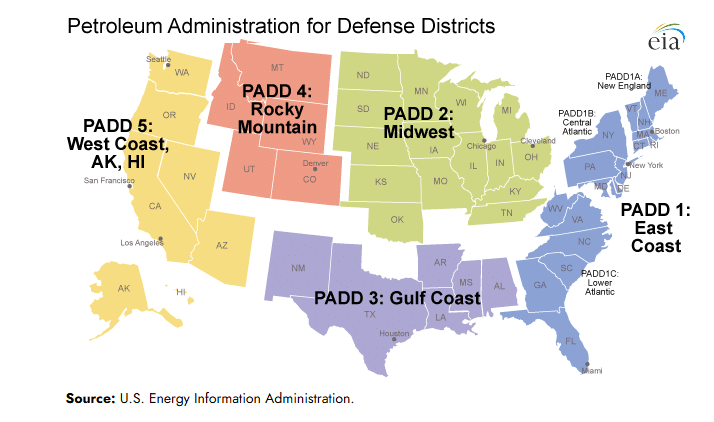

Refiners are already adjusting their crude slates to mitigate these costs. In PADDs 2 and 4, which have a combined refining capacity of 4.8 million barrels per day and run at 90% utilization, the crude mix historically leaned heavily on Canadian imports—about 3 million barrels per day. However, faced with tariffs, refiners are recalibrating their operations, potentially reducing Canadian crude demand by nearly 2.3 million barrels per day, equivalent to about 50% of Canada’s exports to the U.S. This reduction is not just a reflection of tariff costs but also an adaptive response to optimize refining margins under new market conditions. Beyond the refinery gate, the ripple effect extends to drilling and completion activity. Higher input costs for refiners mean tighter margins for integrated energy companies, many of which operate both upstream and downstream assets. This financial strain can lead to reduced capital expenditures on new drilling projects, directly affecting the demand for fracking services.

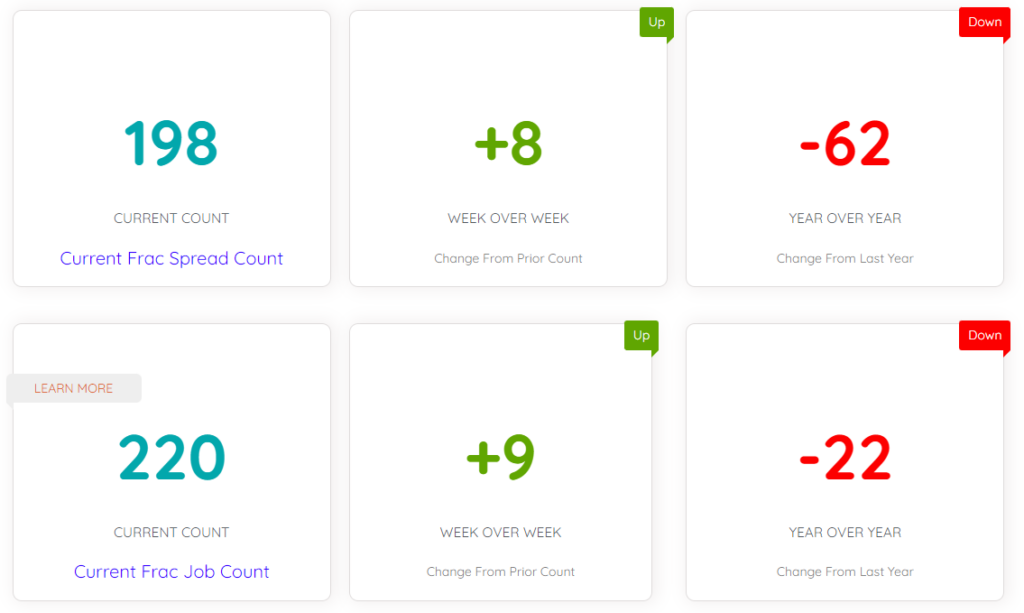

The reconfiguration of crude imports will have broader implications for frac spread count (FSC), as well. Historically, FSC has been closely tied to oil price fluctuations, with higher prices typically driving increased fracking activity. However, the current tariff environment introduces new variables into this relationship. The anticipated reduction in heavy crude imports may incentivize more domestic light crude production to fill the gap, potentially supporting fracking activity in the short term. Yet, the increased cost burden on refiners could dampen overall crude demand, exerting downward pressure on prices and, by extension, on fracking economics. It should also be noted that currently 39% of crude utilized by U.S. refineries is imported

How much leverage Canada has?

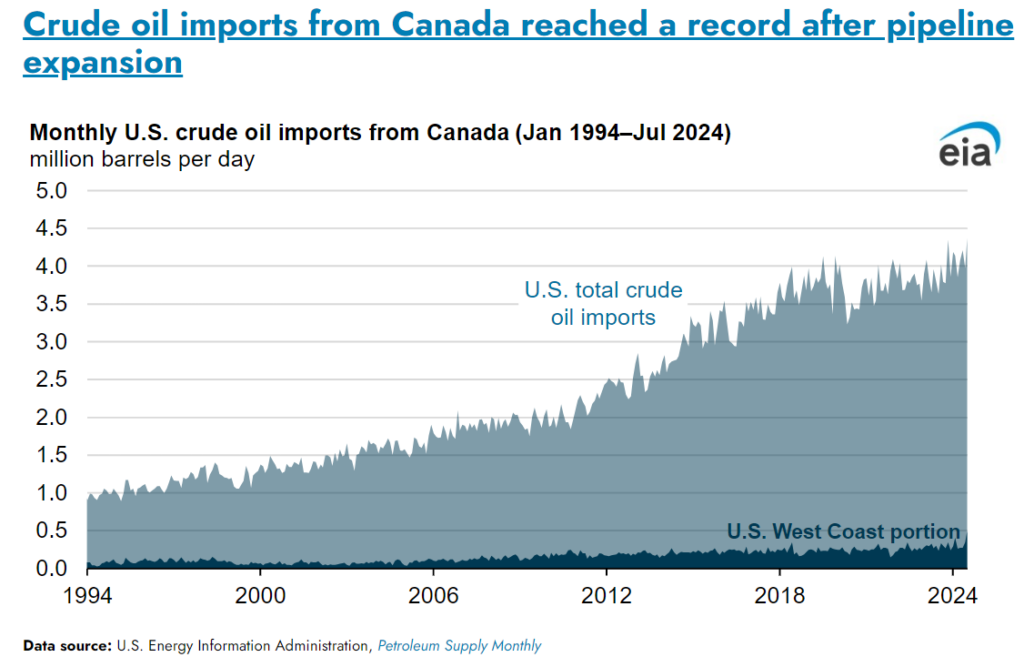

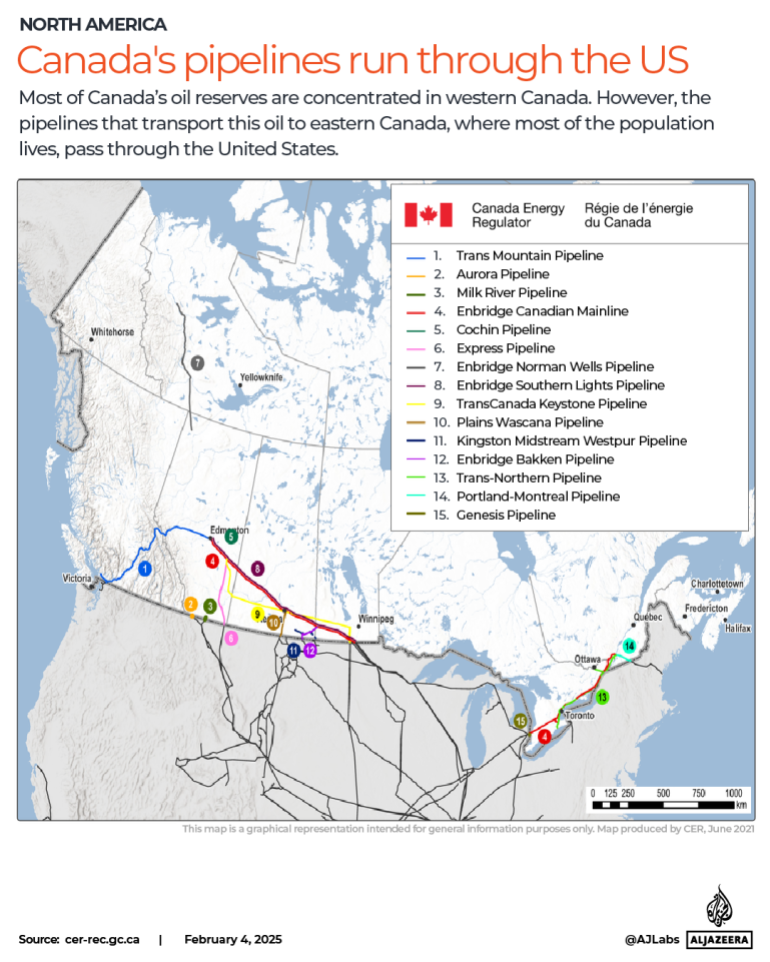

While Canada theoretically has the authority to stop the flow of crude oil to the United States in response to tariffs, its leverage is limited due to the deep economic interdependence between the two countries. Almost all of Canada’s crude oil exports—around 97%—are sent to the U.S., making the U.S. Canada’s largest energy customer. Cutting off this supply would severely impact Canada’s economy, as the oil sector is a major economic driver. Additionally, Canada’s pipeline infrastructure is integrated with the U.S., with pipelines carrying oil not only to American refineries but also through U.S. territory to reach eastern Canadian provinces. This means halting oil exports could disrupt Canada’s own supply chain. Legal and constitutional complexities also arise, as oil production falls under provincial jurisdiction, and the 1977 U.S.-Canada transit pipelines agreement restricts interference with cross-border energy flow. While alternative export routes to Asia exist, they are limited compared to the scale of U.S. demand. Thus, although Canada could technically stop oil exports, the economic, legal, and logistical consequences would likely outweigh any potential gains in trade negotiations.

Some reports say that the imposition of tariffs on oil imports from key suppliers such as Canada, Mexico, and China is poised to significantly disrupt North American crude flows. According to Wood Mackenzie, a 25% tariff on Mexican oil could redirect approximately 600,000 barrels per day from the U.S. to alternative markets in Europe and Asia. Similarly, a 10% tariff on Canadian oil would primarily affect shipments to the U.S. midcontinent and Gulf Coast, regions heavily reliant on Canadian supply due to limited access to alternative heavy crude sources. The Trans Mountain Pipeline expansion offers Canada an avenue to increase exports to Asia, potentially reducing its dependence on the U.S. market. Goldman Sachs suggests that Canadian oil producers might bear the majority of the tariff burden, potentially facing a $3 to $4 per barrel wider-than-normal discount on their crude, given limited alternative export markets. Consequently, U.S. consumers of refined products could experience an additional $2 to $3 per barrel increase in costs.

In the context of U.S.-China trade tensions, the imposition of retaliatory tariffs by Beijing is not going to have that much of an impact as China currently imports around 166,000 barrels per day from the U.S.

Primary Vision’s FSC data will be instrumental in tracking these shifts. If domestic producers ramp up activity to compensate for reduced imports, we could see localized increases in FSC, particularly in regions like the Permian Basin. However, if broader market uncertainties and cost pressures prevail, the net effect might be a stabilization or even a decline in FSC, reflecting a cautious industry approach amid global trade tensions. However, one thing is certain. Like in any other sector, a trade war in energy will have adverse impact on the U.S. consumers and businesses that might be paying more for many refined products. Hopefully, saner heads will prevail.