Markets aren’t just reacting to numbers—they’re reacting to narratives, and right now, the story is anything but straightforward. The Eurozone is juggling rate cuts with stubborn structural issues, the U.S. is walking a tightrope between solid job growth and fresh inflation threats, and China’s rebound feels strong on the surface but fragile underneath. This week’s Market Sentiment Tracker breaks down the noise, cuts through the headlines, and gets to the heart of what’s really driving the global economy. Buckle up—because beneath the data, there’s a bigger story unfolding.

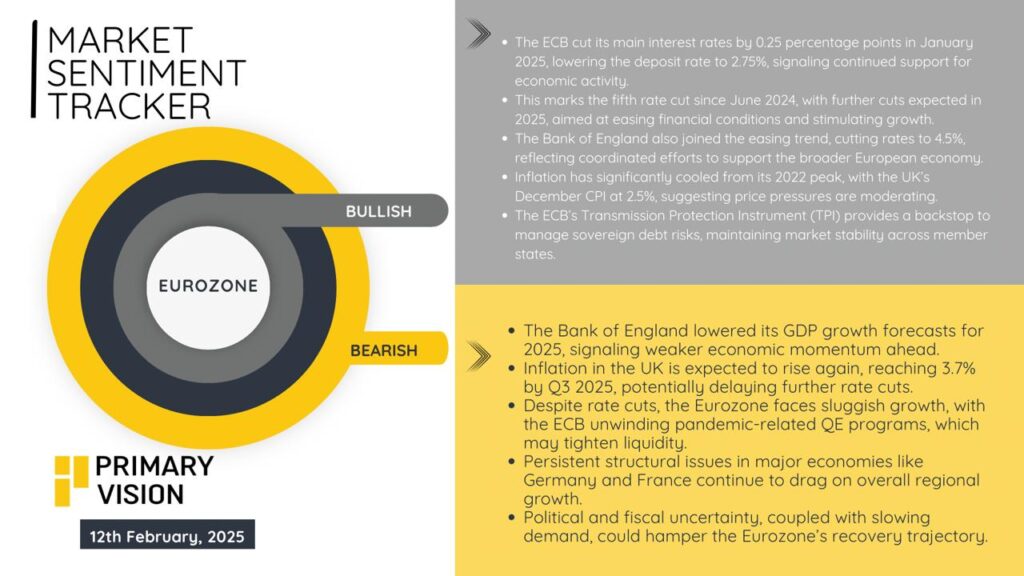

Eurozone

The Eurozone is trying to catch its breath, but the road to recovery is anything but smooth. The ECB’s latest 0.25% rate cut, bringing the deposit rate down to 2.75%, marks the fifth since mid-2024. It’s clear they’re leaning hard into easing financial conditions to spark some growth. Inflation has cooled from its peak, with the UK’s CPI at 2.5%, giving policymakers some breathing room. The ECB’s Transmission Protection Instrument is also doing the heavy lifting, keeping sovereign debt risks in check.

But let’s not get carried away. The Bank of England slashed its 2025 GDP growth forecast, and inflation is expected to creep back up to 3.7% by Q3, which could stall any aggressive rate-cut plans. Structural issues in Germany and France continue to drag on growth, and the ECB unwinding its pandemic-era QE could tighten liquidity just when it’s needed most. Add political uncertainty to the mix, and the Eurozone’s path looks shaky at best.

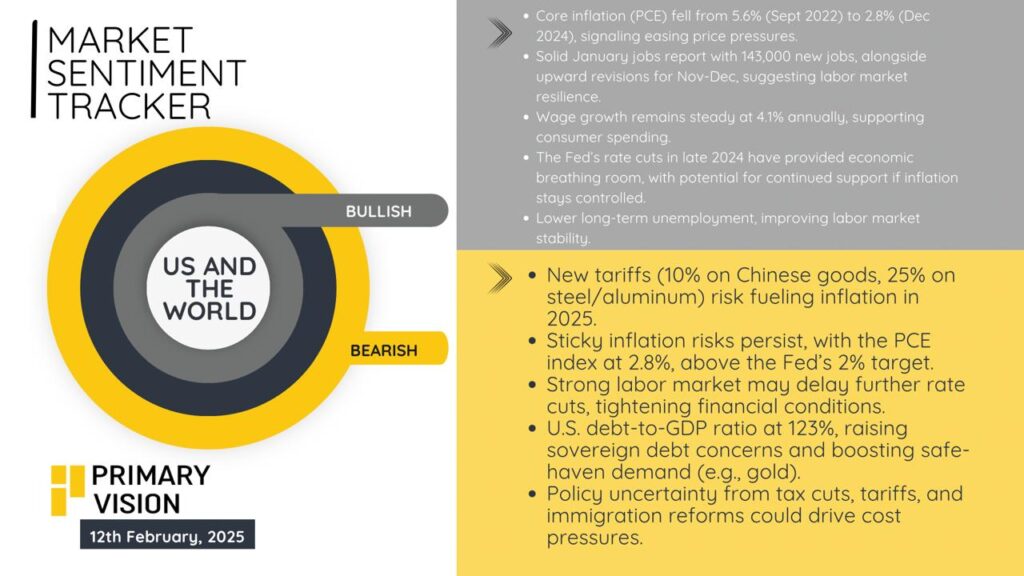

United States

The U.S. economy is holding up, but cracks are starting to show. Core inflation has cooled from 5.6% in 2022 to 2.8% at the end of 2024—not quite the Fed’s 2% target, but it’s progress. The January jobs report was solid, with 143,000 new jobs and positive revisions for late 2024, showing the labor market still has some fight left. Wage growth is steady at 4.1%, which is great for consumer spending, and the Fed’s rate cuts in late 2024 provided some much-needed breathing space.

But here’s the catch: new tariffs—10% on Chinese goods, 25% on steel and aluminum—are a fresh inflationary headache for 2025. Inflation remains sticky, with the PCE index stubbornly above target. A strong labor market could delay further rate cuts, keeping financial conditions tight. The U.S. debt-to-GDP ratio is sitting at 123%, raising the risk of debt concerns bubbling up. And with policy uncertainty around tariffs, tax cuts, and immigration, the economic outlook feels like walking a tightrope.

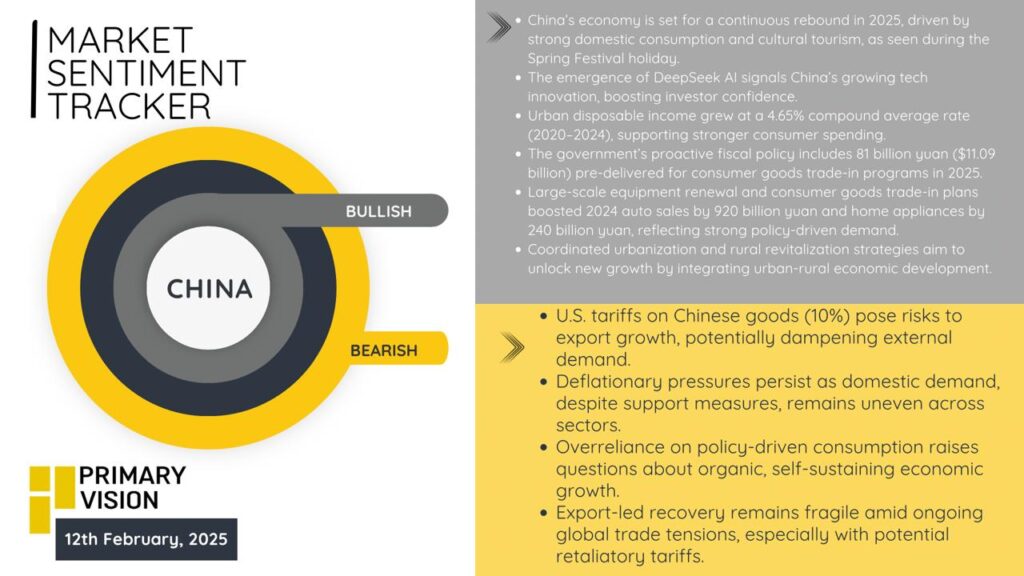

China

China’s economy is gearing up for a rebound in 2025, and it’s got the numbers to back it up. The Spring Festival holiday showed strong domestic spending, and the rise of DeepSeek AI signals that China’s tech game is gaining momentum. Urban disposable income grew at a healthy 4.65% annual rate from 2020 to 2024, and the government isn’t holding back on stimulus—81 billion yuan ($11 billion) pre-delivered for consumer goods trade-ins in 2025. Last year’s trade-in scheme alone boosted auto sales by 920 billion yuan and home appliances by 240 billion yuan. The push for urban-rural integration is also opening new growth channels.

But it’s not all smooth sailing. U.S. tariffs on Chinese goods (10%) threaten to hit export growth hard, adding external pressure. Deflation risks are still lingering, and domestic demand, despite the stimulus, isn’t firing on all cylinders. Heavy reliance on policy-driven consumption raises questions about the sustainability of this growth. Plus, China’s export-led recovery feels fragile in the face of global trade tensions, especially with the threat of retaliatory tariffs looming.