Markets are moving, but not in one clear direction. The U.S. is still holding up, but signs of a slowdown are creeping in, with services activity slipping and stocks taking a hit. The Eurozone is seeing some life in manufacturing, but deep-rooted labor and investment issues aren’t going away. Meanwhile, China is staying steady on policy, but the real estate sector remains a drag. Plenty of moving pieces—let’s break it down.

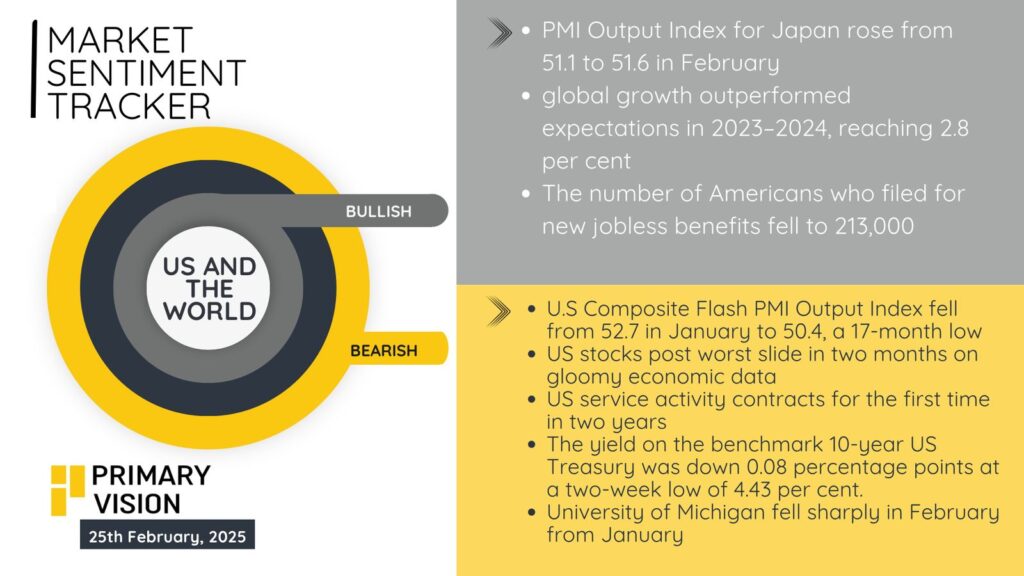

United States and the World

The broader global economy continues to hold up better than expected, with growth reaching 2.8% in 2023-24, outpacing forecasts. Japan’s PMI Output Index improved to 51.6 in February, signaling momentum in its economic recovery. Meanwhile, the U.S. labor market remains firm, with jobless claims falling to 213K, reinforcing confidence in employment stability.

But under the surface, cracks are widening. The U.S. Composite Flash PMI Output Index dropped to 50.4, the lowest in 17 months, while service sector activity contracted for the first time in two years. This weakness is feeding into markets, with U.S. stocks posting their worst slide in two months. The 10-year Treasury yield dipped to 4.43%, reflecting growing uncertainty. Consumer confidence also took a hit, with the University of Michigan index seeing a sharp drop in February. The economy isn’t rolling over yet, but the slowdown narrative is gaining traction.

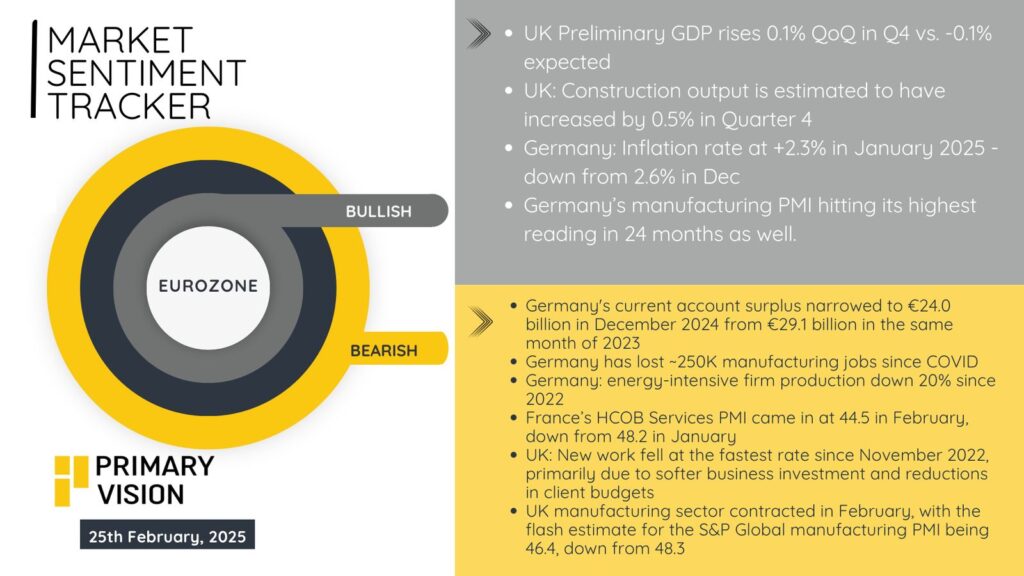

Eurozone

The Eurozone is seeing some bright spots, particularly in the UK and Germany. UK GDP surprised to the upside in Q4, rising 0.1% quarter-over-quarter against expectations of a -0.1% contraction. Construction output also edged up 0.5%. In Germany, inflation cooled to 2.3% in January from 2.6% in December, providing some relief for policymakers. A standout data point was Germany’s manufacturing PMI, which hit its highest reading in two years, suggesting a long-awaited industrial rebound may be underway.

That said, Europe’s biggest economy still faces deep-rooted challenges. Germany’s current account surplus shrank to €24 billion in December, reflecting weaker global trade demand. The country has lost around 250,000 manufacturing jobs since COVID, and energy-intensive production is still down 20% from 2022. France’s services PMI slumped to 44.5 in February, its lowest in months, showing persistent weakness in consumer demand. Meanwhile, the UK’s new work orders fell at the fastest rate since late 2022, highlighting budget constraints and softer business investment. The manufacturing sector is also struggling, with the UK’s flash PMI estimate dropping to 46.4 from 48.3. The Eurozone’s economy is showing resilience in pockets, but structural issues are far from resolved.

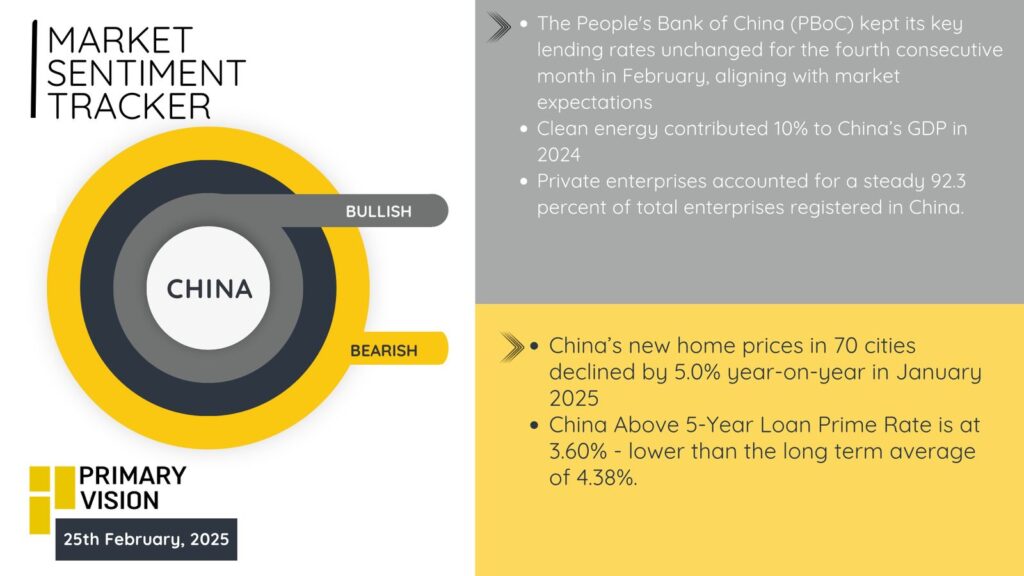

China

China is maintaining a steady hand on policy, with the PBoC keeping its key lending rates unchanged for the fourth straight month in February, matching market expectations. The country’s clean energy sector made up 10% of GDP in 2024, marking a significant shift in its economic model. Private enterprises remain the backbone of China’s economy, accounting for 92.3% of total registered businesses, underscoring strong domestic entrepreneurship.

Still, the property sector remains a significant drag. New home prices in 70 cities fell by 5.0% year-over-year in January, extending the downturn in real estate. The 5-year Loan Prime Rate stands at 3.60%, well below its long-term average of 4.38%, reflecting the central bank’s continued support for borrowing. While policy stability and structural adjustments are providing a buffer, the real estate correction remains a key risk to China’s broader economic outlook.

Final Take

The global economy is entering a critical phase. The U.S. continues to lead developed markets, but the rapid deceleration in services activity and growing market volatility suggest that growth may be peaking. While the labor market remains a strong pillar, weakening consumer sentiment and tightening financial conditions could cap upside momentum. The Fed’s policy stance will remain data-dependent, but inflation’s persistence above 2% complicates the case for aggressive rate cuts.

The Eurozone is experiencing a fragmented recovery. The long-awaited rebound in German manufacturing offers some relief, but broader economic momentum remains fragile. Persistent weaknesses in energy-intensive industries, declining business investment, and deteriorating employment conditions in key economies like France and the UK suggest that policy support alone won’t be enough to drive sustained expansion. Fiscal constraints in Germany and slow productivity gains across the bloc will continue to weigh on confidence.

China’s strategy remains anchored in policy stability and private sector-driven expansion, with clean energy and industrial credit supporting growth. However, the real estate sector remains a significant drag, as falling home prices highlight unresolved structural imbalances. Despite a resurgence in consumer spending post-Spring Festival, liquidity concerns are mounting, and the slowing M2 growth hints at constrained future stimulus capacity. China’s transition toward a consumption-led economy remains an uphill battle, and external trade pressures could exacerbate underlying vulnerabilities.

The overarching theme across all regions is that while growth has not collapsed, it is losing momentum. The U.S. faces an inflection point where financial conditions may tighten further, the Eurozone remains structurally constrained despite policy adjustments, and China must navigate its economic realignment without losing investor confidence. The months ahead will test the effectiveness of policy responses and determine whether this slowdown is cyclical or a signal of deeper structural shifts across global markets.