In a world where headlines move markets in real time, the resurgence of trade wars is more than just a political talking point — it’s becoming one of the defining macroeconomic forces of 2025. Over the past week, global markets have responded to a new wave of U.S. tariffs announced by the Trump administration, rekindling tensions with major trading partners like China and the European Union.

If you’re trying to make sense of the data, you’re not alone. Investors, analysts, and policy makers are asking the same question: What do these escalating trade wars really mean for the global economy?

In this week’s Market Sentiment Tracker, we break down the latest economic signals from the U.S., Europe, and China — the three epicenters of this unfolding trade story. We examine bullish and bearish indicators, assess the real impact of tariffs, and explore what this might mean for growth, inflation, and asset prices going forward.

Let’s dive into the data — and look past the noise.

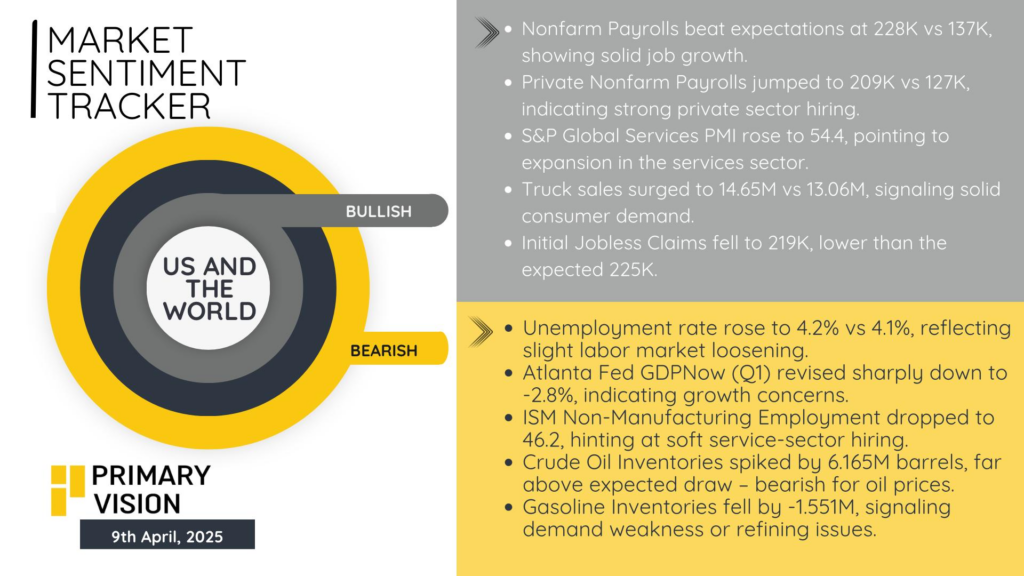

🇺🇸 United States – Beneath the Labor Strength, the Growth Engine Sputters

At first glance, the U.S. economy looks solid — job gains continue to surprise to the upside, and services activity remains firmly expansionary. But peel back the layers, and a more complicated picture emerges. The drop in ISM services employment, the unexpected rise in the unemployment rate, and the GDPNow downgrade all point to a labor market that may be peaking. Businesses are still hiring, but the pace is slowing and focused on fewer sectors. The consumer, meanwhile, is showing signs of fatigue — hinted at by a rise in inventories and soft gasoline demand. The bond market, which has been pricing in rate cuts, now has more fuel, especially with inflation appearing contained. But the real risk isn’t a policy mistake — it’s that the Fed may be too late to recognize a hard landing forming underneath a still-strong labor market. Equities could rally short term on rate cut hopes, but the fundamentals are starting to fray. This is a classic late-cycle setup: strong surface, weak undercurrent.

Impact of Tariffs:

The recent implementation of broad tariffs by the Trump administration has introduced significant economic headwinds. Economists warn of a potential shift towards stagflation—a scenario characterized by stagnant growth coupled with rising inflation. The Tax Foundation estimates that these tariffs could reduce U.S. GDP by 0.7% over the next decade and raise the average tariff rate to 16.5%, the highest since 1937. Consumers are likely to feel the pinch, with an anticipated 2.3% increase in price levels, equating to an average annual cost of $3,800 per household. Financial markets have reacted negatively, with significant stock market declines reflecting investor apprehension.

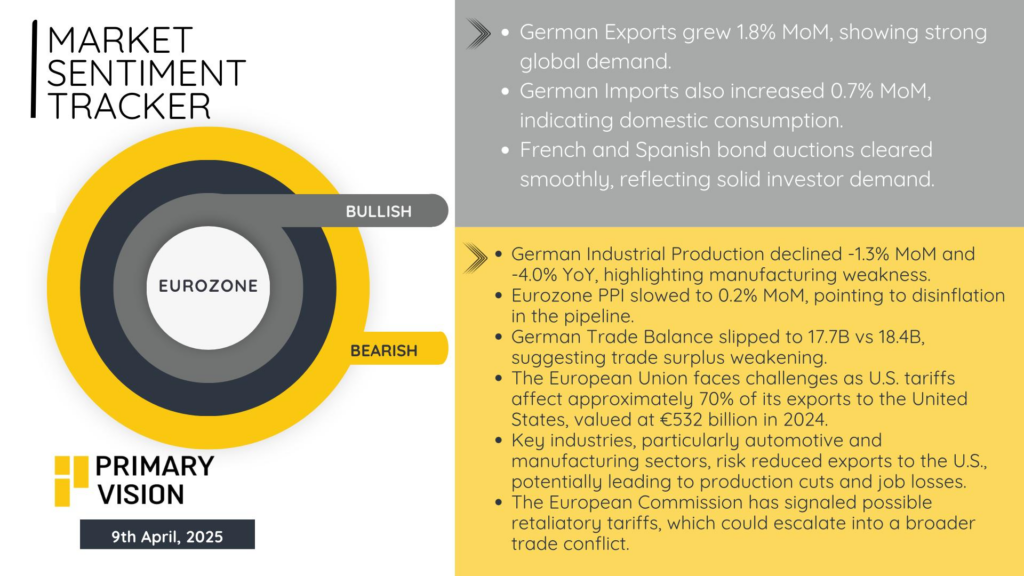

🇪🇺 Europe – A Slow Squeeze Between Disinflation and Demand Decay

Europe is quietly slipping into stagnation. Germany’s industrial decline isn’t just a temporary contraction — it’s part of a longer structural drag as global demand for manufactured goods weakens and domestic policy remains overly cautious. The mild uptick in exports is more of a statistical bounce than a trend, and import growth likely reflects energy stockpiling rather than true consumer strength. The real signal? Eurozone PPI near flat — inflation is fading fast, not because of policy success, but because demand is evaporating. Bond markets are calm for now, but that’s more a reflection of global risk-off positioning than confidence in European recovery. The ECB is stuck: policy is tight relative to the data, but easing could risk currency instability in a globally tightening environment. In essence, Europe isn’t just slowing — it’s drifting without direction, and that makes it hard for capital to commit with conviction.

Impact of Tariffs:

The European Union, a major trading partner of the U.S., faces substantial challenges due to the imposed tariffs. Key industries, particularly automotive and manufacturing sectors, are at risk of reduced exports to the U.S., potentially leading to production cuts and job losses. The European Commission has signaled the possibility of retaliatory tariffs, which could escalate into a broader trade conflict. The overall uncertainty surrounding U.S. trade policies could significantly impact European exporters and lead to slowed EU economic growth.

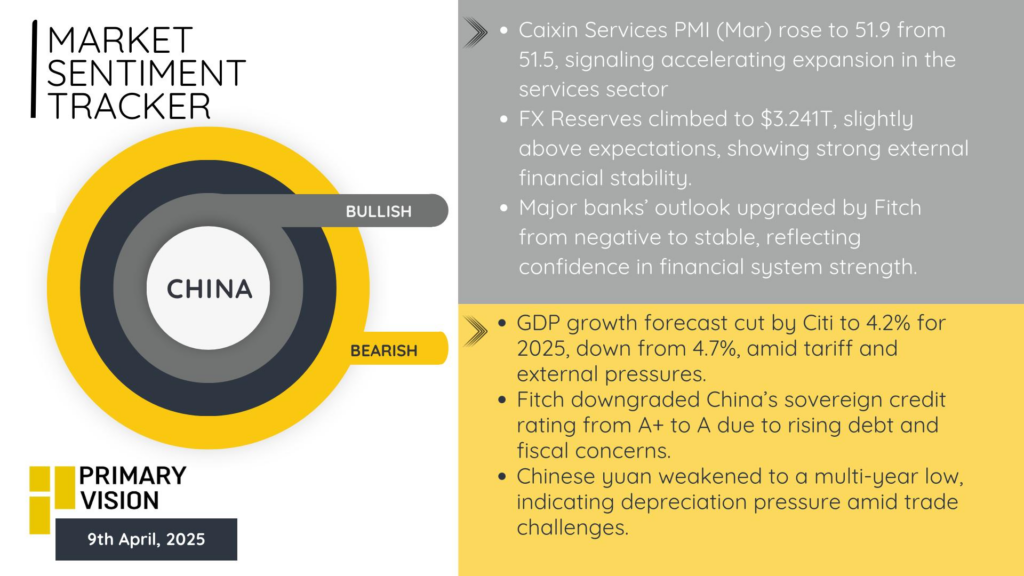

🇨🇳 China – Confidence Crisis at the Sovereign Level, Not the Street

China’s economic data offers a strange paradox. On the ground, services are growing, FX reserves are stable, and the banking sector is being buttressed by improved ratings. But above all this lies a more serious, almost psychological market issue: a crisis of confidence in the state itself. Fitch’s sovereign downgrade and the yuan’s weakness aren’t just reactions to debt levels — they’re signals that investors no longer see China’s fiscal and policy apparatus as predictable or credible under stress. The downgrade coinciding with geopolitical tension and weakening trade ties with the West only compounds the uncertainty. What makes this unique is that China still has tools — but markets are no longer confident they’ll be used decisively. The GDP downgrade from Citi reflects this: the economy can grow faster, but investors aren’t convinced it will. For markets, the risk isn’t collapse — it’s a prolonged underperformance driven by hesitation at the top. Until Beijing sends a clear, coordinated policy signal, capital will remain cautious, and undervaluation will stay justified.

Impact of Tariffs:

China has been a primary target of the Trump administration’s tariff strategy, with significant duties imposed on Chinese exports. In retaliation, China has implemented its own tariffs on U.S. goods, leading to an escalating trade war. These measures have the potential to disrupt supply chains, increase production costs, and dampen economic growth in both countries. The Economist Intelligence Unit projected a 0.5–2.5 percentage point reduction in China’s GDP growth from 2025 to 2027 due to these tariffs. The ongoing tariff exchange has heightened economic uncertainty in China, with investors wary of the prolonged nature.