Recently, Chevron made headlines where it announced that half of its Permian completions in 2025 will use “triple frac” technology which signals that what used to be experimental is becoming operational standard. It’s also a reminder that the innovation frontier in shale is increasingly defined not by exploration but by efficiency at scale.

Chevron’s triple frac technique, which simultaneously fractures three wells from the same pad, is aimed at compressing completion timelines by 50%, while reducing overall costs. The company hasn’t given away too much of the underlying methodology, but we know from similar deployments by companies like Devon and EOG that simultaneous multi-well fracturing (simul-frac) and zipper-frac strategies have helped reduce idle pump time, lower transition losses between stages, and optimize fluid and proppant logistics. Chevron says it plans to apply this across at least 50% of its 2025 completions—a massive scale-up from past years. The company The company has already observed notable efficiency gains, including 25% fewer pump hours, a 31% reduction in friction reducer usage, and a 30% decrease in cycle times, culminating in an average 8% reduction in pad costs.

Let’s put that into context. In a traditional zipper frac, two wells on the same pad are alternately stimulated in a sequence to reduce equipment idle time. Simul-fracs take it a step further by stimulating two wells at the same time, which demands precise pressure control and coordinated logistics. Triple fracs are essentially a scale-out of this design, requiring not just triple the horsepower but also a high level of control to avoid fracture hits and manage pressure distribution across all three laterals. To get this right, operators like Chevron are deploying advanced real-time pressure monitoring systems, fiber optics, and AI-driven fracture modeling to predict stress shadowing and control cluster efficiency.

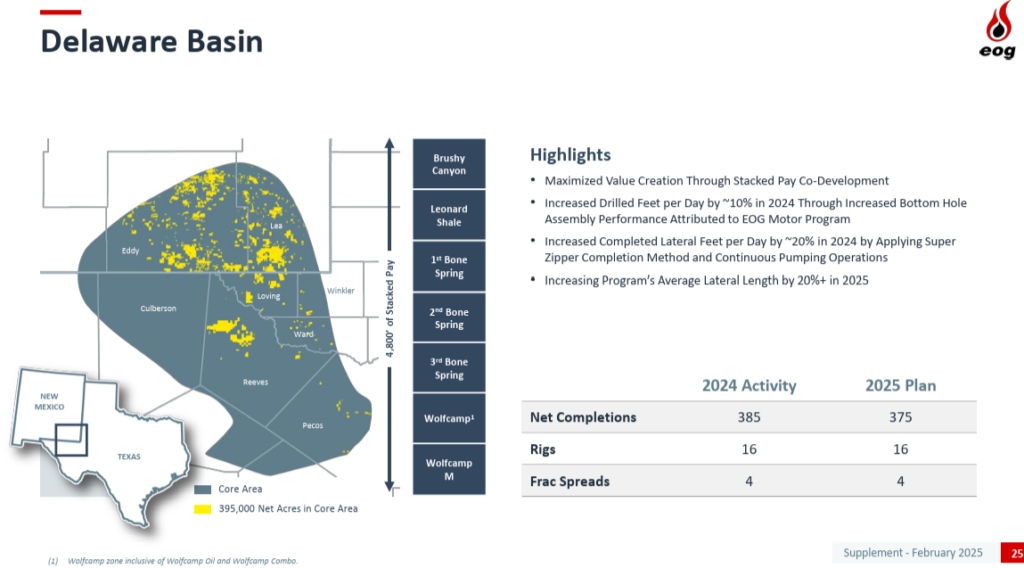

But triple frac’ing is not the only way that operators are using to increase efficiency. EOG Resources has achieved this using extended lateral drilling. Building upon prior successes, EOG is increasing average lateral lengths by over 5% in 2025. In the Delaware Basin, the company plans to drill more than 70 three-mile lateral wells, up from the initial forecast of 50. In the Eagle Ford, EOG set a new lateral length record with the Aspen A 1H well, featuring a lateral length exceeding 22,000 feet. Devon Energy has achieved significant operational efficiencies through the adoption of simul-frac techniques in the Delaware Basin, enhancing completion rates by 12% and drilling efficiencies by 14% in 2024. These improvements have enabled the company to reduce its rig count while maintaining production levels.

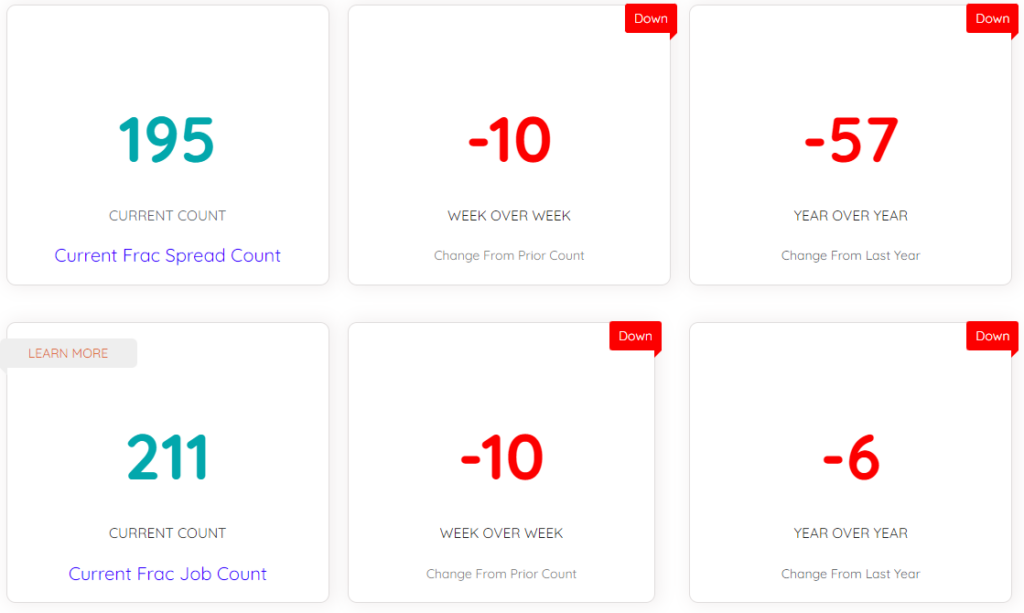

Our Frac Spread Count and Frac Job Count are also showing the same trend. The recent data shows the impact of recent downturn in prices and the overall policy uncertainty especially when it comes to Frac Spread Count. But when we look at the Frac Job Count (referring to the actual number of completions) we see that it is holding fairly strong with as compared to previous year. It shows while rigs, frac spreads have been falling the actual completions are still strong. It further cements the aforesaid discussion.

While simul-frac adoption has grown significantly—now used by over 23% of U.S. operators as of 2024—it comes with trade-offs. A recent ARMA/OnePetro study highlights that simultaneous fracturing increases the risk of fracture-driven interactions and stress shadowing, which can complicate fracture geometry and reduce effectiveness if not carefully modeled. Despite these risks, the technique continues to gain ground due to its potential to boost efficiency by more than 30%, especially when paired with geomechanical modeling and real-time diagnostics. Of course, these techniques aren’t without risks. Triple frac jobs require massive amounts of horsepower and high levels of coordination across logistics, safety, and environmental management. The service sector needs to have the capacity, both in fleet configuration and personnel, to execute these jobs without failure. And not every geology can support triple fracs; you need uniform rock pressure, minimal natural faulting, and high confidence in your reservoir model.

But the direction is clear. Operators are increasingly stacking innovation at the completion stage to extend the life of high-quality acreage. Triple fracs, simul-fracs, and modified zipper fracs are all part of a toolkit that’s enabling companies to maintain or grow output with fewer spreads and lower capex. There’s a bigger story too. These methods contribute directly to ESG performance. Fewer days on site mean lower emissions from idle fleets. Fewer trips per well mean reduced diesel usage and less congestion. And using fiber-optic monitoring to dial in your fracture geometry also minimizes water and proppant waste, hitting both sustainability and cost metrics at once.

Completion design used to be a back-office engineering discussion. Now, it’s front and center in the shale profitability conversation. Chevron’s move is one example, but it’s emblematic of an industry that’s decided to get more out of less—not by throttling back, but by getting smarter. And with the pressure on for returns, expect more operators to follow suit. In 2025, it’s not just how many wells you drill—it’s how you complete them that counts.