As Q1 2025 draws to a close, global markets are staring at a landscape shaped less by clear trends and more by contrasts. The United States appears sturdy on the surface but is showing signs of strain underneath. Europe, meanwhile, is caught in a tug-of-war between inflation that won’t let up and growth that won’t pick up. Across the Pacific, China has delivered a stronger-than-expected economic performance, but not without its own structural worries. In an environment where regional economies are drifting apart in pace and tone, investors, policymakers, and businesses are left asking the same question: are these shifts temporary, or are we entering a new phase of global divergence?

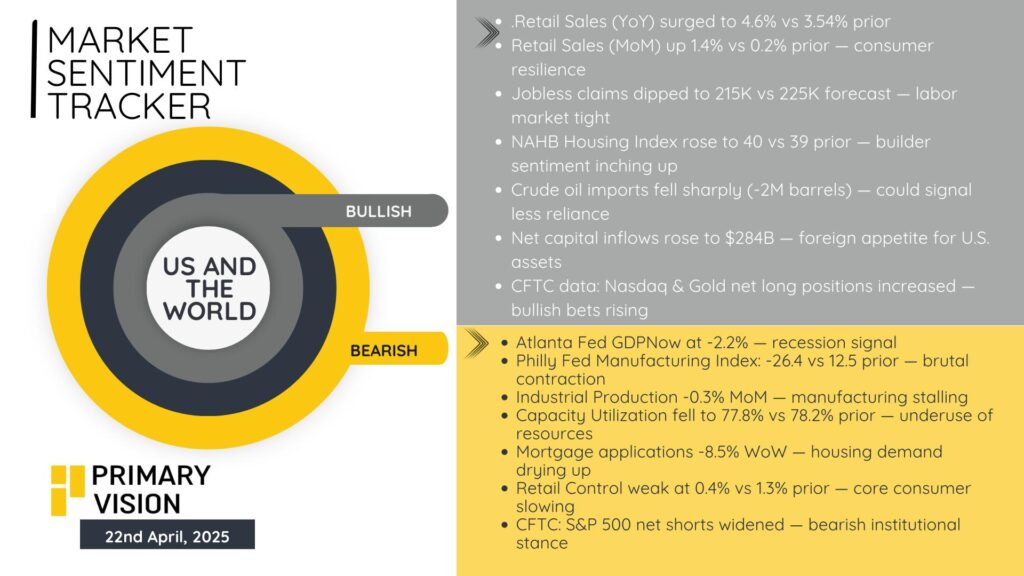

🇺🇸 United States

Headline strength masks weakening depth. Retail sales rose 1.4% MoM in March and 4.6% YoY, surprising to the upside and reinforcing the consumer narrative. However, that strength is narrowing: core retail control (0.4%) missed forecasts and housing is cracking — housing starts dropped 11.4% MoM, erasing months of gains. Manufacturing is also flashing red: Philly Fed Manufacturing Index collapsed to –26.4, its lowest since mid-pandemic levels. The Atlanta Fed GDPNow model predicts –2.2% growth for Q1, marking a technical warning, especially when juxtaposed with continued Fed tightness and fading fiscal tailwinds. Industrial production fell –0.3% in March, reversing February’s +0.8%. Add to this the speculative positioning: CFTC data shows net short exposure in the S&P 500 and natural gas, a sign of institutional hedging.

➡️ The U.S. consumer has been the engine, but the rest of the vehicle — capex, housing, manufacturing — is losing traction. If employment or inflation dynamics shift, the Fed won’t have room to pivot fast enough. We are late-cycle, and the cracks are becoming structural.

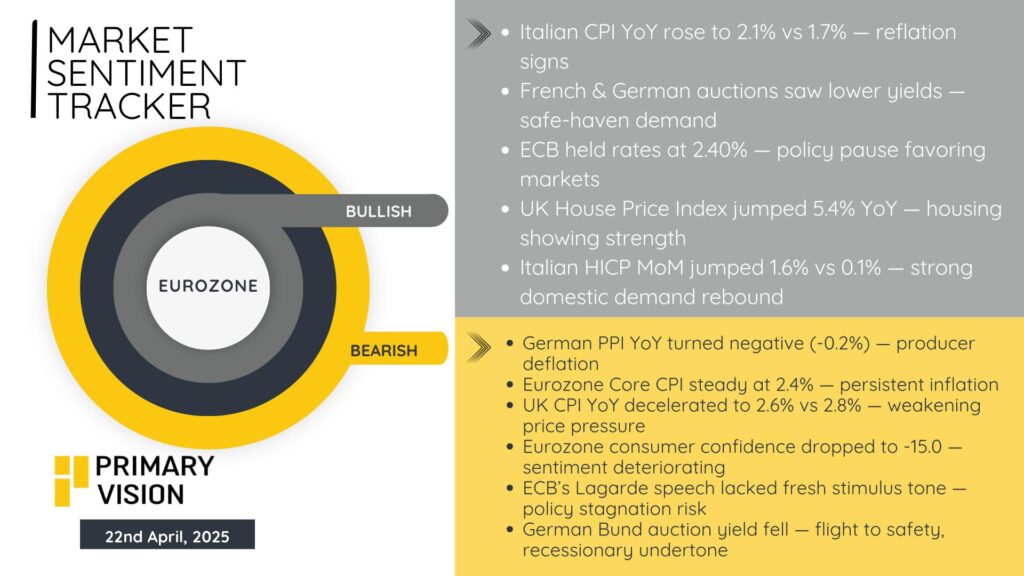

🇪🇺 Eurozone

While the U.S. might be flirting with a slowdown, the Eurozone is arguably already in one. Growth remains limp and uneven: German PPI fell –0.7% MoM and –0.2% YoY, reflecting margin compression and weak producer pricing power. Consumer sentiment slid again to –15.0 in April, and the ECB held rates at 2.40%, suggesting it’s cornered by stagflation-lite conditions. Inflation is proving stubborn: core CPI sits at 2.4% YoY, barely budging despite a year of policy tightening. But growth is not catching up — Italy’s CPI is rising again (2.1% YoY), yet industrial output remains weak, and Germany’s latest Bund auctions show yield compression, as markets rotate toward safety.

➡️ The Eurozone is stuck in an economic holding pattern — inflation not low enough to cut, growth too soft to tighten. This is classic stagnation. Investors see it too: sovereign bond demand is rising while risk sentiment fades. If Q2 business activity doesn’t rebound, the ECB may be forced to choose between credibility and stimulus.

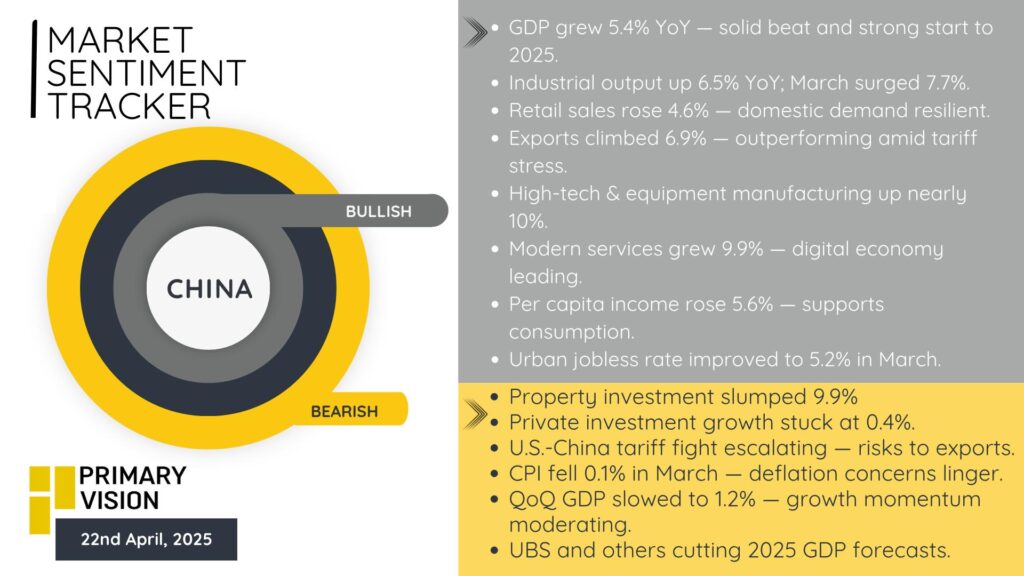

🇨🇳 China

China’s Q1 performance surprised: GDP grew 5.4% YoY, outpacing consensus (~4.9%) and underscoring the country’s post-COVID reopening potential. Industrial output surged 6.5% YoY, with March alone jumping 7.7%. Retail sales climbed 4.6%, while exports grew 6.9%, highlighting the ability to navigate tariff headwinds — at least for now. But the rally is narrow and policy-driven. Property investment dropped –9.9% YoY, showing the real estate sector remains in distress. Private investment rose just 0.4%, indicating business sentiment remains fragile. Meanwhile, CPI declined –0.1% in March, hinting at lingering deflationary pressures — a stark contrast to the West’s inflation dilemma.

➡️ China is outperforming in Q1, but its growth appears heavily concentrated in state-supported sectors — high-tech, infrastructure, and heavy industry. The private sector remains on pause. Without a pickup in domestic confidence and consumption, this bounce risks becoming a policy mirage. Tariff escalation with the U.S. is also a dark cloud.