Patteron-UTI’s Completion segment produced surprisingly solid results in Q1 as revenue from the hydraulic fracturing business increased. Pricing, however, remained weak. The management expects natural gas-heavy basins to drive growth in 2025. Share repurchases continued in Q1.

Industry Drivers And FY2025 Outlook: Patterson-UTI Energy’s (PTEN) management sees customer activity decline in the crude oil basins in the near term. However, it expects increased drilling and completion activity in natural gas basins in the medium to long term due to growing domestic demand and global demand for U.S. LNG.

Management expects higher demand for natural gas in the natural gas-heavy basin in places like Haynesville. Nearly 80% of its active frac spreads, including Emerald and dual fuel assets, are capable of using natural gas. The ratio may increase in 2025. In the completion activity, the management expects activity to stabilize in Q2, although gross profit may decline. In Drilling Services, too, gross profit may decline in Q2 following a reduction in average contracted revenue. Read more about PTEN in our previous article here.

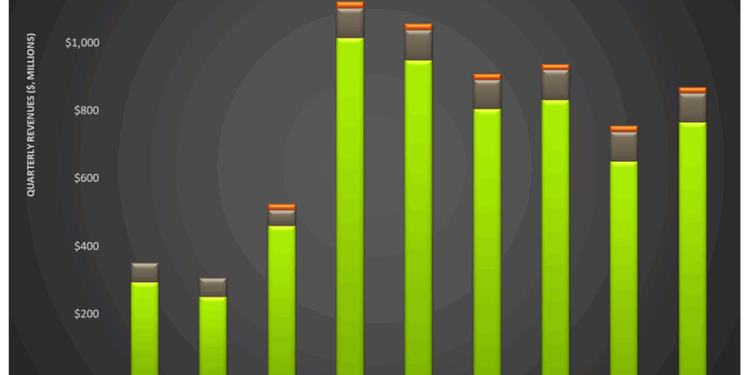

The Segment Results Analyzed: Quarter-over-quarter, PTEN’s revenues in the Drilling Services segment remained nearly unchanged (1% up) in Q1 2025. Average revenue per operating day and gross profit increased in Q1 compared to Q4’24. The resilience reflected the adoption of the APEX rig technology and the effects of performance-based pricing agreements.

Revenues from the Completion Services segment increased sharply by 18%, marking a reversal from the previous quarter. Adjusted gross profit also increased (by 14%) in Q1. The resetting of customer completion schedules and increased revenue from the hydraulic fracturing business improved the segment’s performance. However, pricing declined in Q1. Revenues from the Drilling Products segment decreased by 1%, quarter-over-quarter, while gross profit improved by 4%.

Cash Flows And Share Repurchase: PTEN’s cash flow from operations decreased by 43% in Q1 2025 compared to a year ago. Its FCF dipped by 67% during this period. It repurchased shares worth $20 million in Q1. The company currently has $741 million remaining for share repurchases.

Thanks for reading the PTEN Take Three, designed to give you three critical takeaways from PTEN’s earnings report. Soon, we will present a second update on PTEN earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-