In the Q4’24 iteration of Patterson’s performance, we will discuss how PTEN continues to high-grade its assets while its operating rigs in the US have come down. Meanwhile, the company offers fully natural gas-powered frac equipment. It launched a new field gas technology and will serve mobile power in fracking along with drilling. The company’s Q4 financial results, however, were disappointing.

The Market Outlook

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q3 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. In 2025, PTEN’s management expects continued drilling and depletion activity in the major U.S. crude oil basins. Because of energy operators’ increasing focus on upgrading their equipment, PTEN expects its high-grade assets to outperform. The management also sees a clear indication of increased natural gas-directed drilling and completion activity that would take shape by 2025-end or 2026.

Frac’ing And Power Outlook

In this environment, the management is optimistic about natural gas-powered frac spreads and deploying new solutions. The Tier 4 dual fuel frac spreads can be more cost-effective than electric frac spreads because electric spreads have a higher capital cost of power generation. PTEN offers Emerald – a fully natural gas-powered frac equipment. It has operated more than 150,000 horsepower of Emerald at the start of 2025 and plans to increase it to 200,000 horsepower by mid-2025. The management believes nearly 80% of the active frac spreads can be powered by natural gas.

In the CNG Power and Fueling business, PTEN has recently launched a new field gas technology that improves gas quality and blending. Investors may note that the oilfield services industry plans to capitalize on the fast-growing power market, both inside and outside the oilfield. Patterson’s tryst with the power business started with drilling electrification long before the fracking sector. In drilling, it has utilized a total of 500 megawatts of mobile power. Similarly, in fracking-related operations, it utilizes nearly 150 megawatts of power.

Strategies And Outcome

One of Liberty’s strategies involves monetizing its value-based solutions. It focuses on improving efficiencies of the Drilling and Completion business, which will reduce well costs and increase returns. It manages its cost structure intensively so as to streamline our costs in alignment with current activity levels. Given the industry slowdown over the past couple of years, this part of the strategy has become more important. The final part of the action refers to capital allocation and shareholder returns. The management has made commitments to return at least 50% of FCF through dividends and share buybacks.

Based on these principles, PTEN concentrates on improving the efficiencies of its Tier 1 Apex rigs. It has invested in integrating automation and performance data analysis to drill a more efficient shale well. Its pursuit has resulted in extended laterals and faster drilling speed. By transitioning to an integrated commercial and operating model, it has combined the Tier 1 rigs with directional drilling downhole tools and ancillary services, including drill pipe rentals and electrical engineering.

Financials and Capex Plans

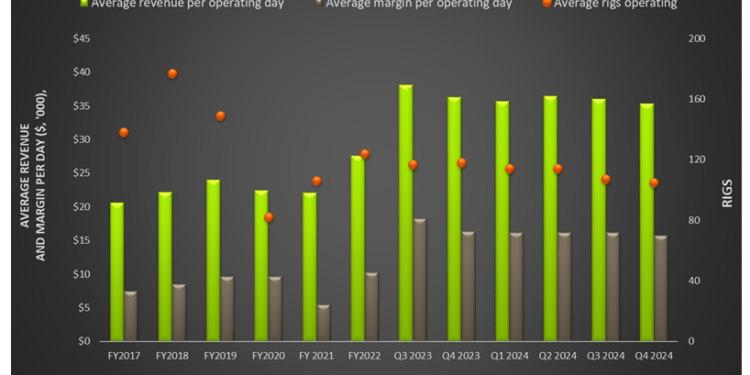

Quarter-over-quarter, PTEN’s revenues in the Drilling Services segment decreased by 3% in Q4 2024. Revenues from the Completion Services segment decreased steeply, by 22%, after it increased briefly in the previous quarter. Revenues from the Drilling Products segment decreased by 3%. PTEN’s FCF increased by 27% in FY2024 compared to a year ago.

During Q4, it returned $52 million to shareholders through dividends and repurchases. In FY2025, it plans to spend $600 million in capex, which would be 12% lower than FY2024. A part of the capex would be spent on next-generation drilling rig upgrades and natural gas-powered frac horsepower. The company does not have any long-term debt maturities until 2028.

Relative Valuation

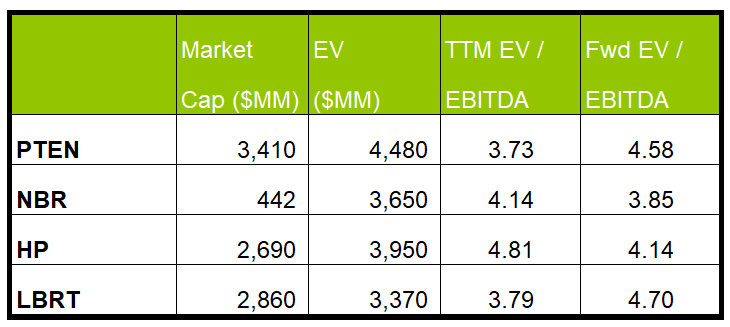

PTEN is currently trading at an EV/EBITDA multiple of 3.7x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 4.6x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.5x.

PTEN’s forward EV/EBITDA multiple is expected to expand versus the current EV/EBITDA. This contrasts the fall in the multiple for its peers because the company’s EBITDA is expected to decrease sharply compared to a rise in EBITDA for its peers in the next year. This typically results in a much lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (NBR, HP, and LBRT) average. So, the stock is reasonably valued, with a negative bias, versus its peers.

Final Commentary

In fracking, PTEN primarily focuses on natural gas-powered frac equipment. It has launched Tier 4 dual fuel frac spread Emerald. It also plans to capitalize on the fast-growing power market. It started with drilling electrification and later spawned into mobile fracking electrification. Over the past couple of years, it has invested in integrating automation and performance data analysis to drill more efficiently. In 2025, it will continue to invest in drilling rig upgrades and natural gas-powered frac horsepower.

However, in Q4, its revenues decreased following the slowdowns across the U.S. Completions market. It expects the Tier 1 high-spec drilling rig count to remain steady in Q4 and 2025. In FY2025, its capex plans are lower than in FY2024, hinting at a higher FCF. Recently, it has also refinanced debt and extended its maturities until 2028. The stock is reasonably valued, with a negative bias, versus its peers.

Premium/Monthly

————————————————————————————————————-