In our recent ECON show we talk about a number of issues. One of them is Stagflation. Another is deflation and the possibility of it occuring. We however think that stagflation will precede any such development. But the most important development that I believe will have long term effects is the looming energy crisis.

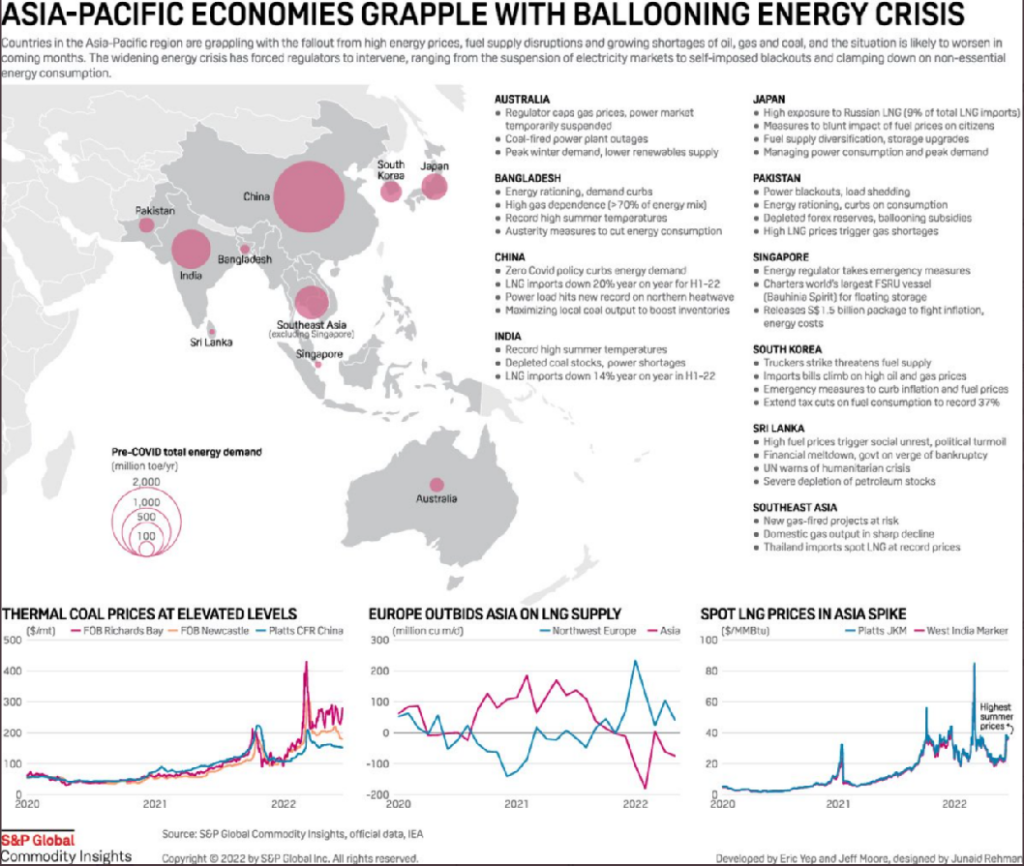

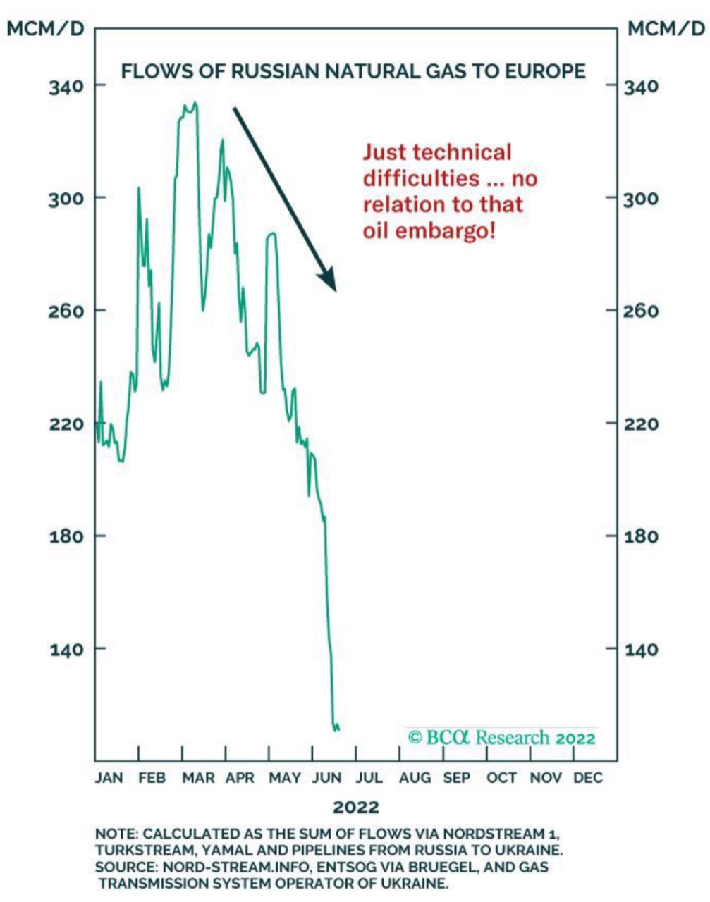

Due to the sanctions on Russia and because of some technical reason (that I explain in this article here) the gas supply from Nord Stream 1 has been cut to Europe and resultantly the later has called for emergency measures as IEA anticipates that Germany can face severe gas shortages. The country will move to gas rationing when that happens which essentially means low or no supply to the industry. This will create all sorts of problems for the economy but we will cover it in a different post. Amongst other effects one of the recent one has been that LNG is getting expensive? Why? Because everyone is trying to get their hand on it Europe especially. As a result, Asia Pacific is paying dearly or not at all (because of the high costs) for LNG shipments. Others are shifting to different resources such as Pakistan that imported fuel oil (its import hitting 4 years high) due to LNG being expensive. This is being repeated in other Asia Pacific countries. Pakistan, for instance, is facing upto 16 hours of electricity blackouts and for the month of July, the PM has announced, it will get worse. Why? Because we were only able to secure a single contract of LNG from Qatar (LNG is used for, inter alia, electricity generation in Pakistan and worldwide. This article explains more uses). Have a look at this infographic below:

An amazing work by S&P Platts as always! You can see the price spike in LNG in the Asian region. Also, that Europe is outbidding Asia on LNG contracts. An interesting thing, ironic as well, is that thermal coal prices are near historic highs. I called it ironic as post COP26, the world tried to end its reliance on coal but now, Germany is restarting its coal plants! Energy security and energy transitions have both received a reality check. Here is another interesting chart:

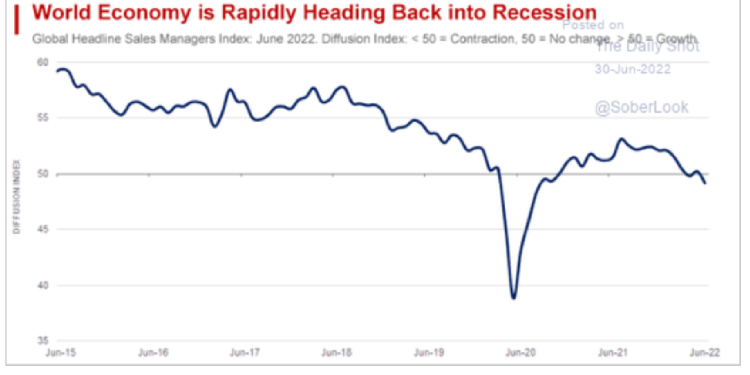

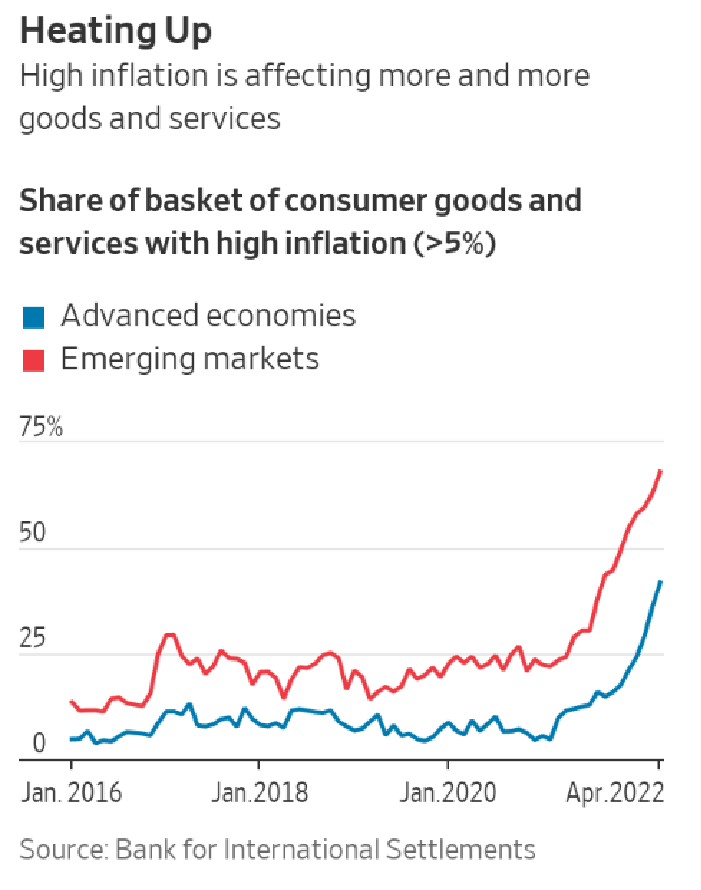

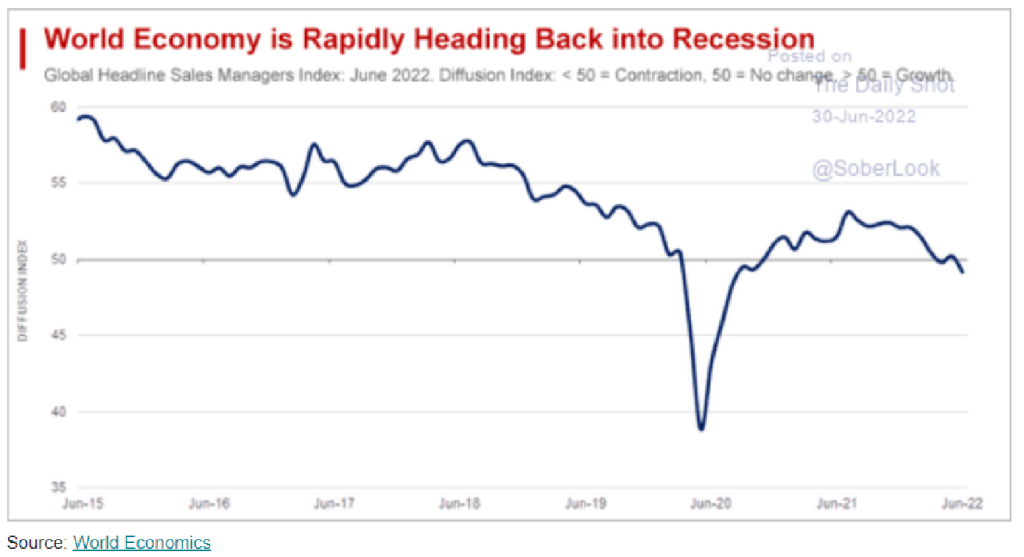

Besides this, the global recessionary fears keeps piling up. Inflation is rising but now fears of a global downturn might effect it. People are talking about deflation, however, we believe it will not happen as quickly as being anticipated maintaining that inflation is sticky and stagflation will persist.

The charts below are very interesting.

And this comes as no suprise and has been well established:

A brief thought on oil prices: Oil prices are stuck between recession and supply crunch fears. Time will tell which factor dominates the other. Falling spare capacity of OPEC/KSA is, however, a very genuine and important concern.

That’s all for this week. Tune in the next one as we dig deeper into more data points!