• NOV focuses on market share maximization in the spares and aftermarket support markets

• In 2H 2022, North American drilling activity growth rates can moderate while the Eastern Hemisphere gathers momentum

• Pricing traction and marine and offshore sectors brighten the outlook

• Although cash flows are negative, robust liquidity and low leverage will cover its financial risks

Industry Activity And Strategies

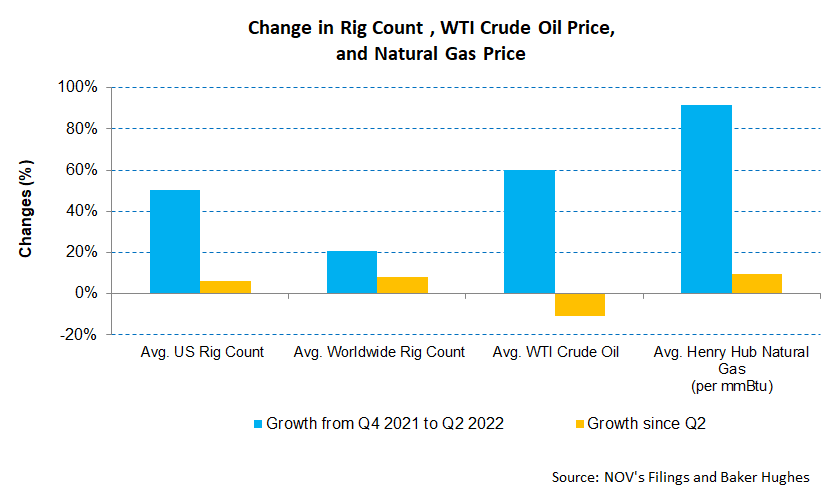

NOV’s management second the opinion shared by many oilfield services companies as it reiterated the oil and gas industry’s need to increase activity following the surge in demand. Although sharply higher oil and gas prices will support the energy production growth, the oilfield services industry faces different challenges. After years of underinvestment, it now sees a higher cost of capital, less drill bit capex, and greater expectations of return on capital would constrain the service providers. So, high labor costs and low-margin contracts signed during the pandemic will continue to plague its prospect.

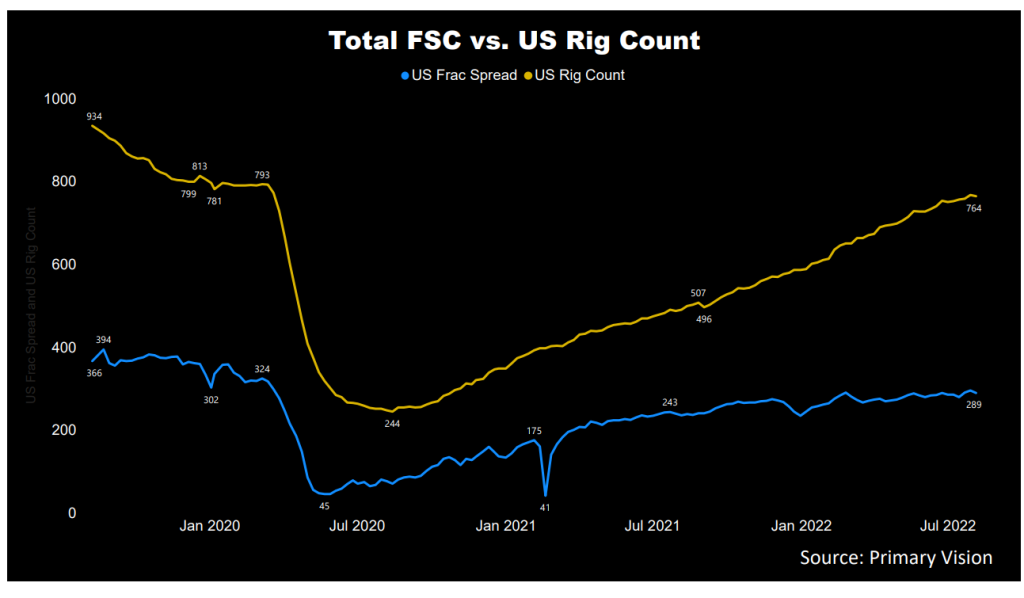

After persistently higher energy prices and drilling activities, the situation is about to change. The leading-edge day rates for super-spec Tier 1 onshore rigs have now exceeded $30,000 per day. Similarly, fracking prices have gone north. The oversupply of equipment is slowly diminishing while utilization rises. NOV looks to be entering the emerging upcycle when rigs, drill pipes, and pumps are seeing demand resurfacing. The US rig count, which increased steadily in Q2 (12% up), is consolidating in Q3. As estimated by Primary Vision, the frac spread count (or FSC) reached 289 by first week of August and has gone up by 24% since the end of 2021.

Strategically, NOV focuses on market share maximization in the spares and aftermarket support markets. It diversified geographically, spread its client base, and diversified across drilling and completion activities, oil and gas, and onshore and offshore. Its installed base presents revenue opportunities, including upgrades with new digital products and apps like the NOVOS operating systems and Max edge computing. Also, during the past up and down cycles, NOV cut costs aggressively, maintained a strong balance sheet. Its Rig Technology segment is going through a shift and is positioned to become a leading provider of offshore wind turbine installation vessel packages, which will offset its lower oilfield revenues.

The Near-Term Challenges

The 2020 energy market downturn forced oilfield services to adopt measures that are proving to be counter-productive in a re-emerging market. Laying off skilled workers to avoid maintenance expenditures, cannibalizing idled assets, and depleting stocks prevent fast growth in the current scenario. Low DUC inventory and lack of necessary opex can impede rapid production growth. Plus, the workforce and capital constraints can moderate the order level for NOV. It is also likely that a mild recession can ease the supply chain difficulties through lower demand, although it would not affect the multi-year upcycle.

The 2H2022 Outlook

The Wellbore Technologies segment will see steady growth in 2H 2022, although there will be regional variation. The management expects revenues in this segment to grow by 4%-7%, while the EBITDA margin can clock in the mid-30% range. North American drilling activity growth rates can moderate in the second half while the Eastern Hemisphere will gather more momentum. Pricing will get the traction that will offset the supply chain challenges and inflationary pressures.

The Completion & Production Solutions will benefit from the recovery in the marine and offshore sectors. Recently, the spread between low and high sulfur fuels has increased, resulting in higher demand for scrubbers. As of June 30, 2022, the backlog for capital equipment orders increased 44% from a year ago. However, supply chain disruptions and inflationary pressures can disrupt the growth trajectory. So, the segment revenue can grow by 1%-5% in 2H 2022 compared to 1H 2022.

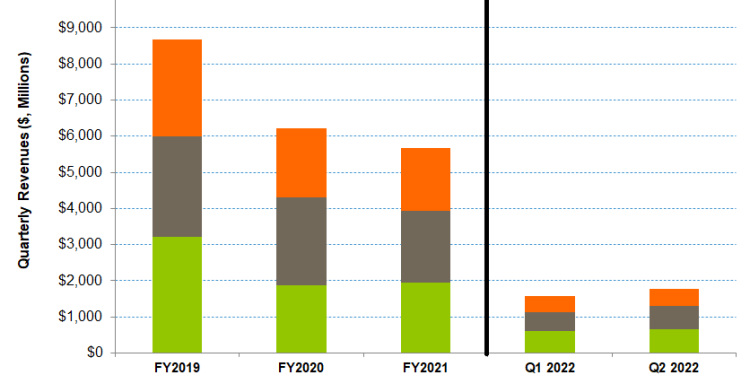

Q2 2022 Segment Performance Drivers

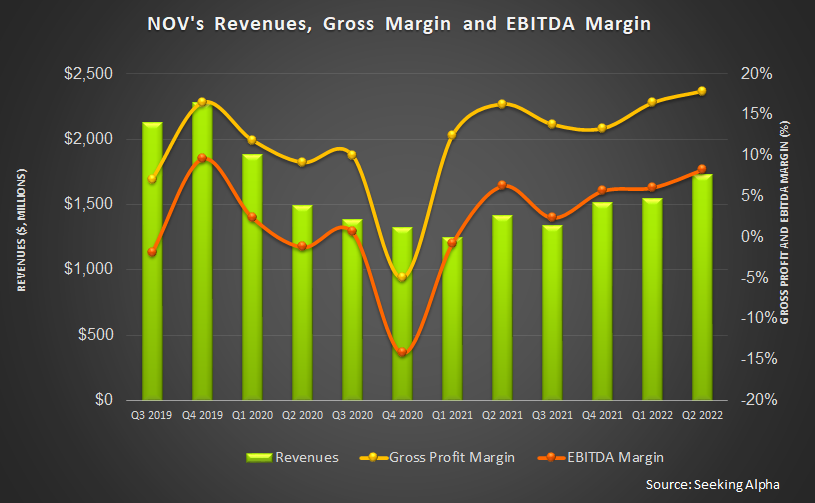

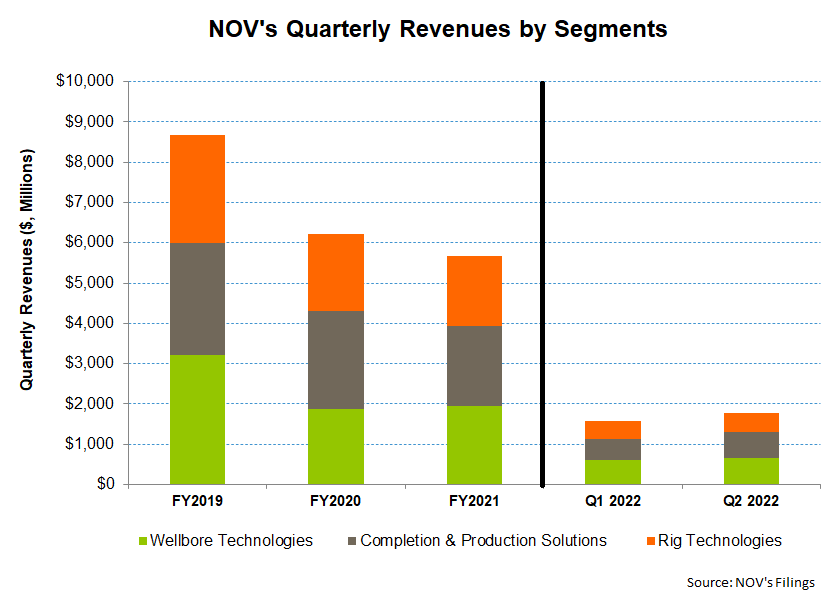

During Q2, NOV’s revenues increased by 11.5% compared to Q1 2022. Much of the growth emanated from the Completion & Production Solutions (or CAPS) segment, which saw revenues rising by 21% quarter-over-quarter. During this period, the segment also saw operating loss turning to a healthy profit. Because many oilfield services companies lag with the energy operators, the current rise in activities and energy prices will benefit NOV’s CAPS segment revenues and margin in the next few years. Because the CAPS segment offers production modules and conductor and flexible pipe to the offshore market, the segment will see the business growing significantly over the next few years. The segment backlog more than doubled over the past year and a half reflects this.

Revenues in the Wellbore Technologies segment increased by 10% quarter-over-quarter in Q2, while the operating profit doubled. In this segment, revenues are closely tied to global drilling activity. Also, products offered in this segment like drill pipe, shell shakers, tubular inspection, and coating recover fast. So, the revenues in this segment should benefit from the current upturn, although a loss in demand following the economic downturn can partially offset the rise.

The Rig Technologies segment saw only 5% topline growth and a significant recovery in operating profit in Q2. During Q2 saw a substantial rise in international activities, including jack-ups to work in the Arabian Gulf, drilling programs in West Africa, and new rig tenders in Guyana and Brazil. The segment also sees mix shifting to aftermarket support. In Q2, aftermarket support accounted for 53% of the sales mix. It also provides offshore wind turbine installation vessel packages. Higher revenues from this service helped offset lower oilfield revenues in this segment.

Dividend And Dividend Yield

NOV pays an annual dividend of $0.15 per share at the current rate. It translates to a 1.28% forward dividend yield. Schlumberger (SLB) pays a yearly dividend of $0.70, which equals a forward dividend yield of 1.93%.

Cash Flow Is Negative, But Liquidity Is Robust

As of June 30, 2022, NOV’s liquidity (cash and including revolving credit facility) was $3.2 billion. The company’s leverage (debt-to-equity) was 0.35x, in line with its peers’ (CHX, FTI, WHD) average.

NOV’s cash flow from operations (or CFO) remained negative in 1H 2022, starkly contrasting to the positive CFO a year ago. Although revenues increased in the past year, a significant rise in working capital requirements related to receivables, inventories, and accounts payable contributed to the fall in CFO. As a result, free cash flow was steeply negative. In Q1, management of the supply chain risk led to a significant inventory build-up, although deliveries from the vendors were on time. The additional inventory buffers can smooth the inventory and lower working capital requirements in Q3.

Learn about NOV’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.