The message by Jerome Powell’s in his speech at Jackson Hole was uneqivocal – Fed will not pivot any time soon. The one time reading of a slightly less CPI figure spread rumors or expectations that the central bank will start going easy and might not raise interest rates or slow it. However, the resolve that was highlighted at Jackson Hole was to keep at it “until the job is done“. He also categorically shunned any possibility of a ‘neutral’ as according to the chairman it “was not a place to stop or pause”. Furthermore, these words tell us about the chances of rate cuts in the coming year(s): ““Restoring price stability will likely require maintaining a restrictive policy stance for some time”. All in all it was a highly hawkish speech and market reacted to it. In just eight minutes Jerome Powell’s speech wiped off about $78 billion from America’s richest.

For those more perceptive, his speech was not much surprising. Inflation has proven to be sticky and we at Primary Vision have been saying that from months. Such a stance by Fed’s chairman spells trouble for emerging markets as rising interest rates by Fed can puts downward pressure on other currencies; rising debt servicing costs and making imports expensive that subsequently puts a dent in the country’s reserves, further devaluing its currency.

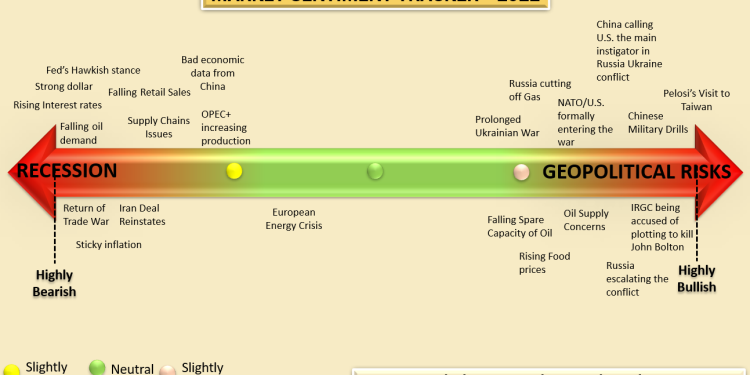

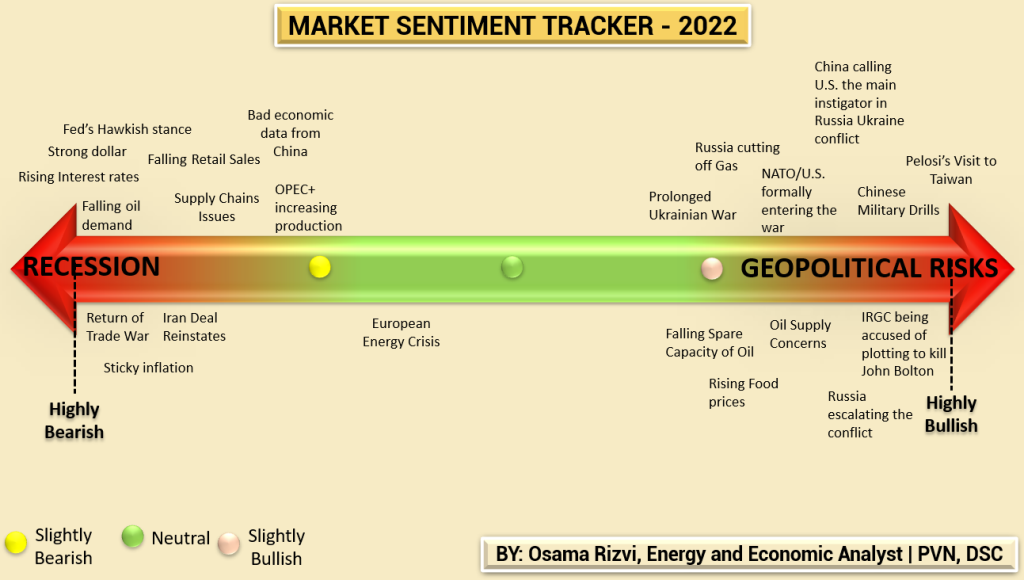

But there are other developments in the pipeline as well that can tip the sentiments the other way. For this purpose, I designed a Market Sentiment Tracker. The idea is in its infancy but might be a good way to look at the developments and its effect on overall direction of the market. Mark was kind enough to give me a shoutout in the first segment of our recent EIA show, where he discuss how different developments can shift moods.

Here are some thoughts behind this: Every news coming out lately can be put in one of the following domains – recession and geopolitical risks. For example, the discussion above will eventually feed into recessionary debate, raising concern of global economic growth and might have a bearish effect on market sentiment. Similarly, when U.S. blamed IRGC for plotting to kill John Bolton or Pelosi’s visit to Taiwan or chances of further escalation in Ukrainian war, all of these can be put together as geopolitical risk factors and hence will have a bullish effect on markets.

Therefore, it was almost that there was a continuum where Recessionary fears are on one side and Geopolitical risk factors on the other and all the news items can be put along the continuum; some leaning towards the bearish side while other on the bullish. By putting together a number of news item of, say, last month, one can see which side populates the most and therefore, the market outlook might tilt to that side.

In my upcoming articles, I will add more to this and we will also be doing updates of this tracker.

So far, as you can see above, the sides seem balanced. Also, many news item might be bullish per se but might feed into the recessionary side of the tracker which makes this more interesting and mimicking the difficulty in charting the market terrain.

This also shows that volatility remains high. There are so many variables that can go either way therefore it is wise to practice caution in both trading and analysis.