- Cross-selling and pricing hikes across multiple product lines will lead to KLX Energy Services’ operating margin improvement in Q3

- Free cash flow turned negative in 1H 2022, while capex can increase significantly in 2H 2022

- Despite that, the management aims to generate positive FCF in 2022

- KLXE’s financial risks remain high due to negative shareholders’ equity

Pricing Strategy And Industry Activity

As discussed in our previous iteration, oilfield equipment, and services demand has stayed elevated in the US. However, after Q2, the supply side garnered the highlight primarily because of a tight labor market. The labor market inflation with keep pricing in the oilfield services market high. In this environment, KLXE has been cross-selling and pulling through multiple product lines across the wells spud. The depth of its product and service offerings allows cross-selling and leveraging revenue synergy opportunities. Recently, it added capacity to coiled tubing, frac rentals, and wireline operations. Even though the energy price remains volatile, it will follow its returns-maximizing strategy and leverage its operational advantages. It will prioritize the deployment of assets based on free cash flow generation.

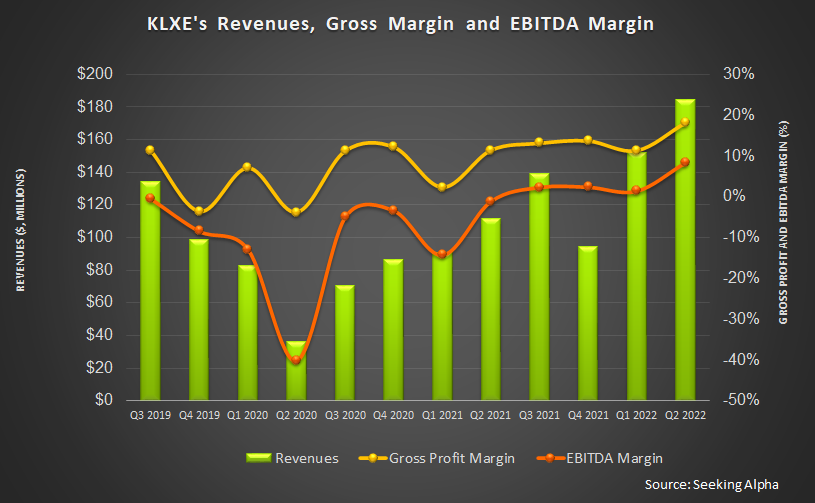

From Q1 to Q2, pricing across KLXE’s product service lines (except for one) increased by high-single to low double-digit percentages. As utilization improved, the management showed confidence in accelerating the pace of pricing improvements in Q2, going into Q3. The operating margin, too, can inflate in the short-to-medium term.

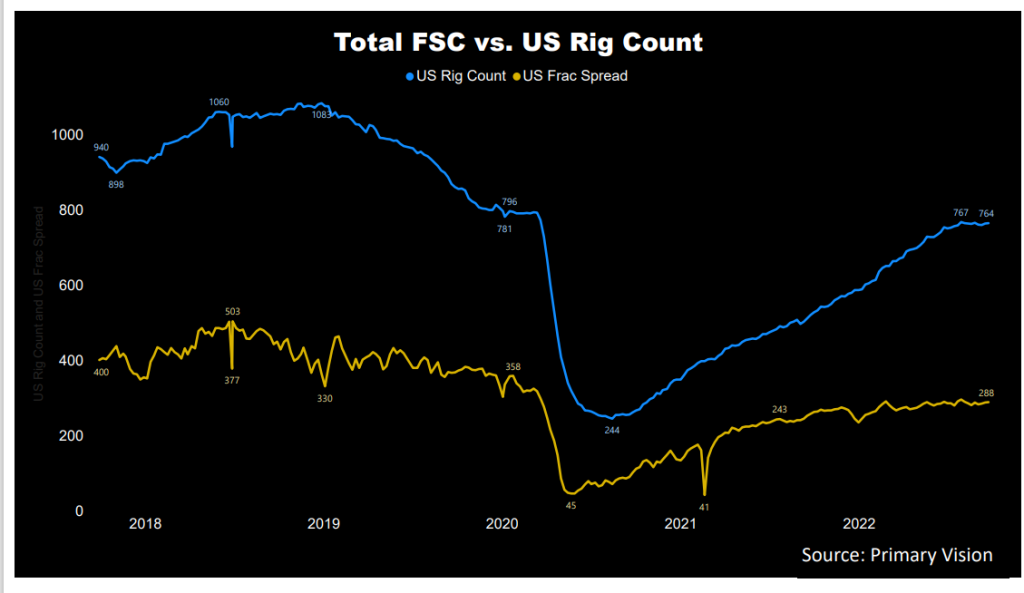

The crude oil price curve has flattened after a steep rise in early 2022./The US rig count has increased 30% year-to-date, despite a temporary pause in early Q3. As estimated by Primary Vision, the frac spread count increased by 23% and lagged behind the rig count’s growth.

The Q3 And FY2022 Outlook

The company exited June on a high note on the back of robust industry activity and net pricing improvements. It will likely carry the momentum in the top line and margin in Q3 and 2023. In Q3, the management expects revenues to grow by 9%-13% compared to Q2. The adjusted EBITDA margin can range between 10% and 12%.

In FY2022, it expects to record $740 million in revenues (at the guidance mid-point), which would be 56% higher than FY2021. It may also return to generating positive free cash flow by the end of 2022.

The Q2 Drivers And Segment Performance

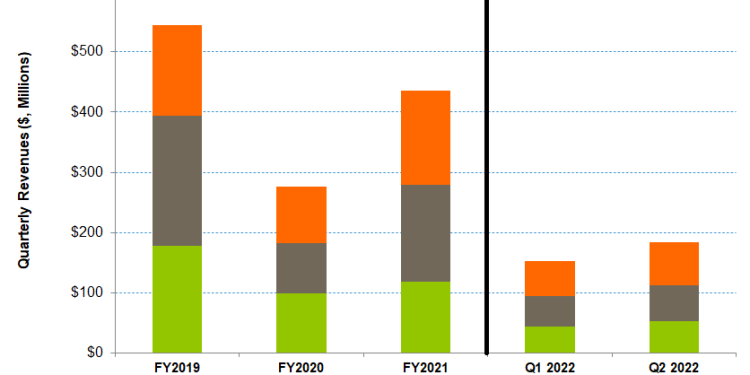

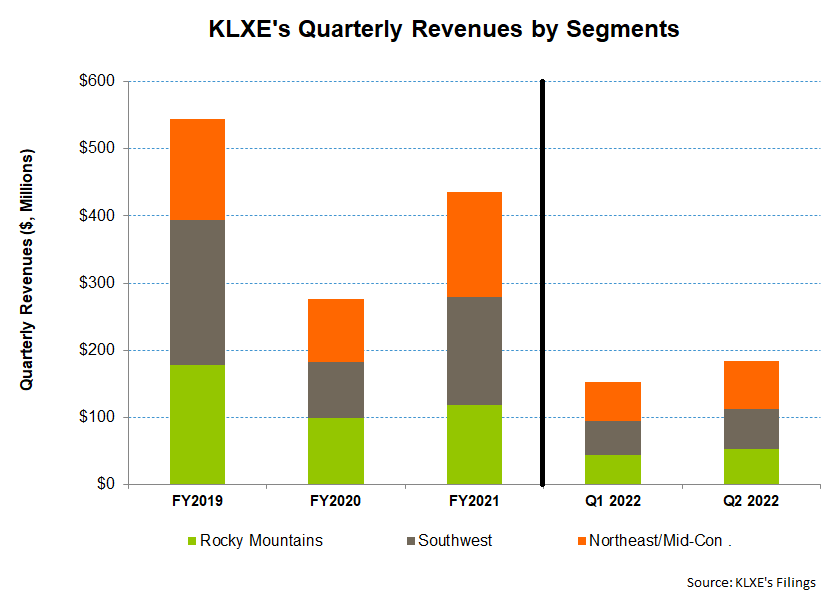

During Q2, the company’s revenues increased by 21% compared to Q1, as the core geographic market grew. As revenues increased, its gross margin and EBITDA margin expanded by 700 basis points each. Drilling, completion, production, and intervention products and services contributed 28%, 50%, 12%, and 10% to revenues in Q2.

Revenues in KLXE’s The Rocky segment increased 23% in Q2 compared to a quarter ago, driven by an increase in coiled tubing, directional drilling, rentals, fishing and wireline activities, and pricing. The adjusted operating loss in Q1 also turned into a profit in Q2 due primarily to better rentals, downhole products, and directional drilling performance.

Revenues in the Southwest segment increased by 16% in Q2 compared to a quarter ago, driven by similar pricing and activity improvement as in the Rockies segment. The adjusted operating loss in Q1 also turned into a profit in Q2.

Revenues in the Northeast and the Mid-Con increased by 25% in Q2 compared to a quarter ago, following better pricing in pressure pumping, rentals, coiled tubing, and accommodations. The outperformance in the financial result is reflected in the margin expansion in Q2 versus the previous quarter.

Cash Flows And Shareholder Equity Are Negative

As of June 30, 2022, KLXE’s available liquidity (cash and including revolving credit facility) was $56.6 million. The company’s total debt was relatively high ($295 million) as of that date. It expects to reduce its borrowings under the ABL facility in 2022. It may also refinance its revolving credit facility, which is due for maturity in 2023. Its shareholders’ equity has been negative for many quarters due to a vast accumulated deficit in the balance sheet. A negative shareholders’ equity is a source of risk and is viewed adversely by the investors.

KLXE’s cash flow from operations (or CFO) remained negative in Q1 2022, although it lessened compared to a year ago. Revenues increased in the past year, partially offsetting some of the effects of the significant working capital requirements on the CFO. So, free cash flow also turned negative. In FY2022, the management expects capex to increase by 130% compared to FY2021. Most of the capex rise would fall in 2H 2022 in 1H 2022.

Learn about KLXE’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.