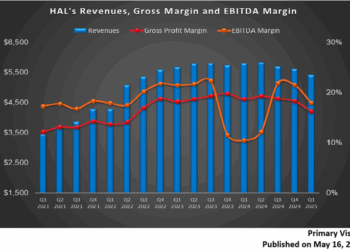

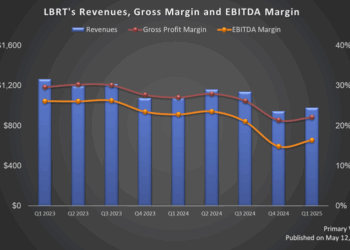

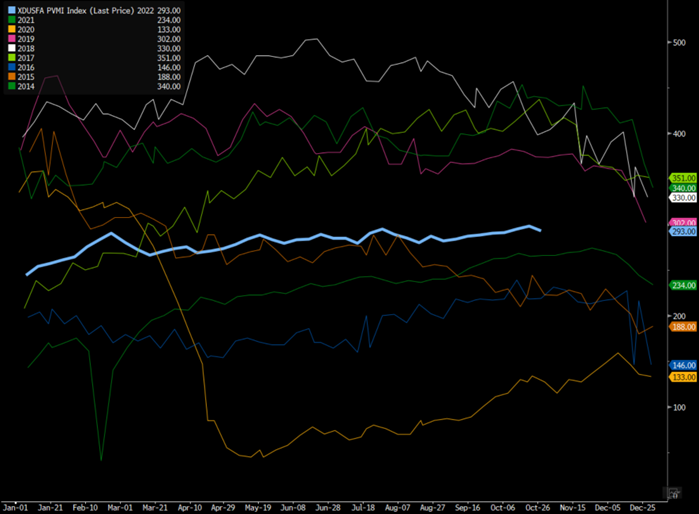

Frac spread count showed an increase of five coming to a total of 295 spreads active in the market. As we described last week, the seasonality of activity kicks in reducing completions through year end. There may be one more increase taking us to 297 or 300 active spreads but that will quickly drop off as activity diminishes into year end. We expect it to look similar to 2021 and 2017 where completions will slow from Thanksgiving to New Year’s but not at the same rate it has in previous years. This is driven by the fact that we are mostly maxed out on spare equipment, and we are starting from a lower base which will keep things fairly consistent throughout the year.

The below chart on seasonality shows the decline, but we expect to be closer to 2017 and 2021.

Next week we will discuss more on the NGL front as we head into peak winter season.

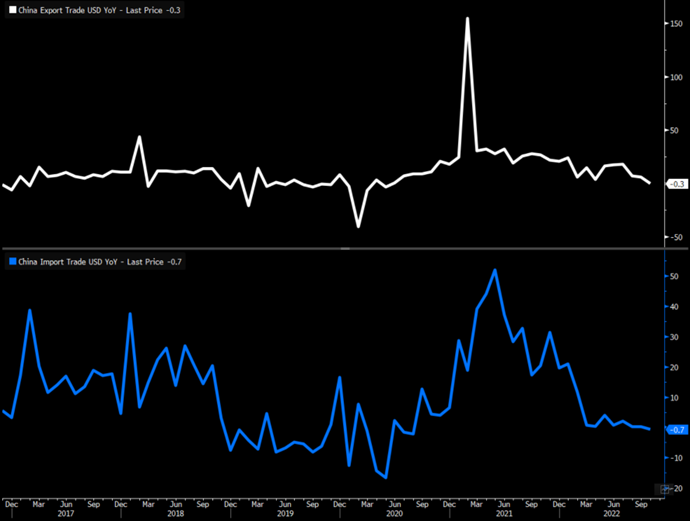

We have described time and time again that that China won’t be abandoning the zero COVID policy. After the communist Congress, the CCP has been directing more around control and less about economic growth. The trade balance is just another example of a growing problem for the Chinese economy. Imports and exports both missed expectations and when US dollar adjusted are firmly negative. As we have described in the past imports are a very good indication of future exports especially in a country like China that is a net exporting nation. Typically, an exporting nation needs to import both raw materials and intermediate goods that they use to assemble into the final product. This just means that as imports rise it’s typically a good indicator of future export growth.

The above data shows that trade is now a growing overhang for economic growth. In the past, the positive trade balance provided 27% of economic growth and since the Chinese economy has grown it now accounts for between 15 and 17% growth. Even with diminished value exports are a key market driver for the local economy. “Outbound shipments recorded their first y/y fall since May 2020. And that print was significantly worse than the 4.5% y/y increase that analysts were expecting.”

I think this is a great description of the Chinese export machine given by Trivium:

Exports have been hit by a combination of:

- A drop in overseas demand as western household’s grapple with the cost-of-living crisis and sales of pandemic-related goods slow

- Disruption to manufacturing production in China due to COVID restrictions

And as the engine of export growth shuts down, domestic demand shows little sign of reviving:

- The 0.7% y/y drop in imports last month was the first decline since August 2020.

Get smart: The Chinese economy is like a plane that’s losing power in both engines and it’s not clear that officials can pilot it to a smooth landing.

- That’s why we continue to be concerned about the sustainability of the economic recovery in Q3, even as China’s economic managers seem largely unperturbed.

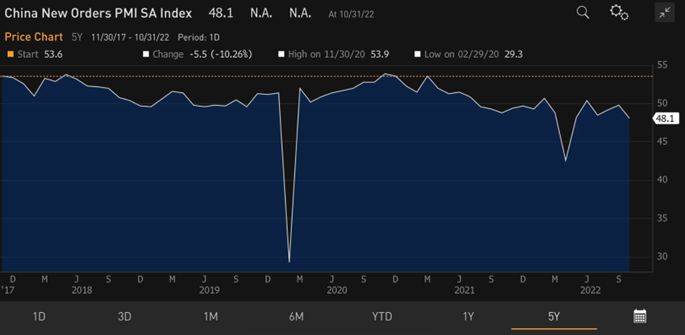

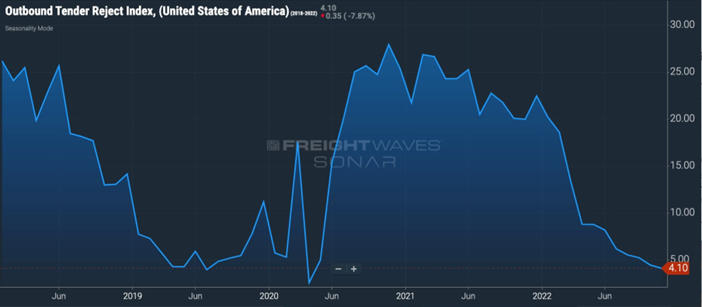

The U.S. is a key consumer of Chinese goods but based on the recent trade data- the slowdown of exports into the U.S. is ACCELERATING to the downside. The below measures container volume loadings at the port of origin. The current volume drop in the U.S. container imports is only going to get worse based on the below chart. There is another drop coming as TEUs move to another cycle low after a very soft bump in October. Typically, October is the busiest month of the year as companies ramp up for the holiday season, but this past Oct was well below previous years. Essentially, the volume drop at US ports is not a blip, but rather the start of a much steeper decline.

China new orders in the PMI index front runs the above chart by about 3 months. This points to some key drivers- Chinese export headwinds are going to grow, and U.S. volumes will continue to diminish putting pressure on trucking. This also supports the theme of a bigger slowdown in the U.S. over the next few quarters.

Tender rejections have now fallen to 4.1% and based on the current trend- we will likely see it dip below 4% next week. It’s also important to note: tender rejections normally increase this time of year due to peak season surges and drivers staying home for the holidays. This will be something to keep an eye on as we head toward Thanksgiving. We have discussed in previous write ups that trucking companies are already moving to a point of below breakeven which means that they are already losing money on the margin.

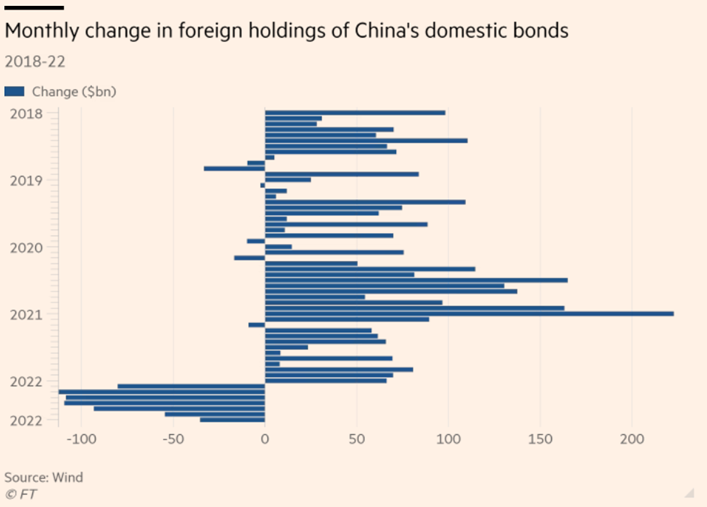

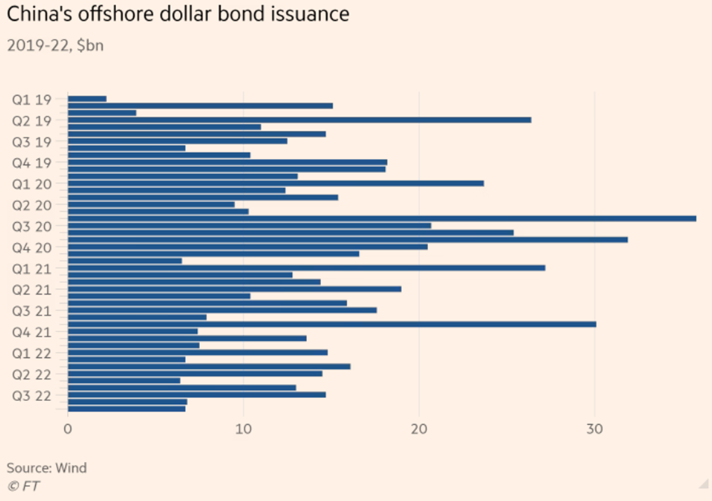

Another key factor to watch is foreign reserves because the market is focusing on the $3 trillion mark. China has been hovering with foreign reserves just over that key hurdle rate that the market is currently focused. This reserve has been important for underlying collateral at local banks issuing different bombs. As collateral concerns have grown, we have seen foreign holders avoid Chinese domestic bonds. This has put additional funding pressure on local companies unable to access new capital.

Data is only slightly better for offshore dollar bond issuance where the large players are still avoiding new Chinese debt. The question has come back to coverage ratios and underlying collateral protecting the fixed income asset.

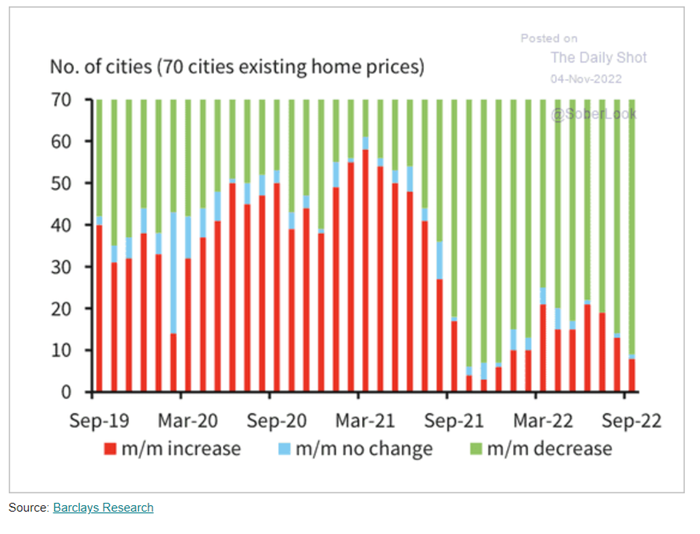

Home prices have dropped again in China after seeing some reprieve in the middle of the year, but as pressure mounts on rates and economic growth- they have reversed again. Investors are steering clear of the Chinese bond markets driven by concerns over coverage ratios, weakening economic fundamentals, and new Xi policies driving party cohesion and not growth.

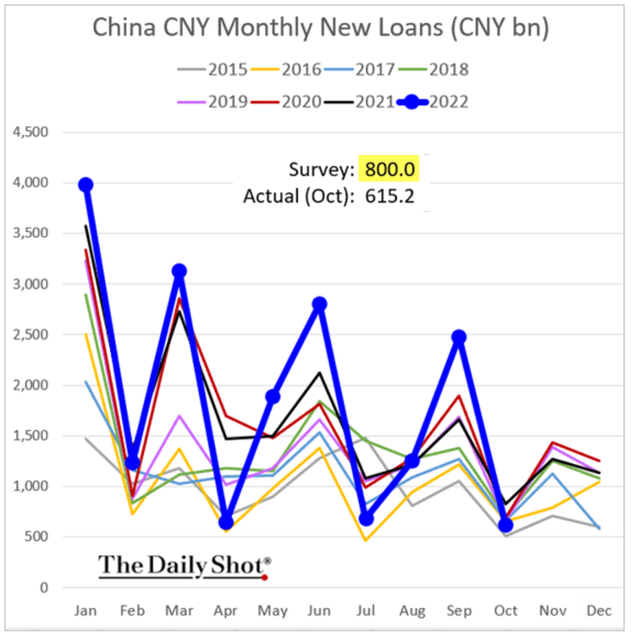

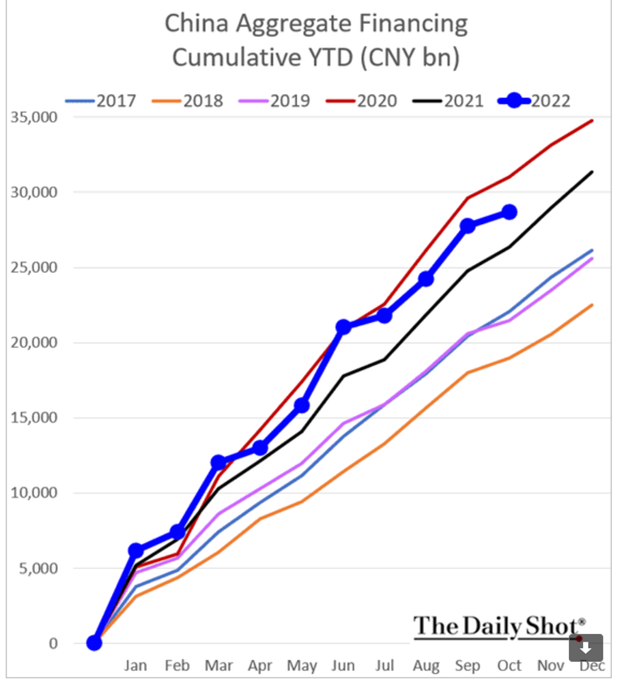

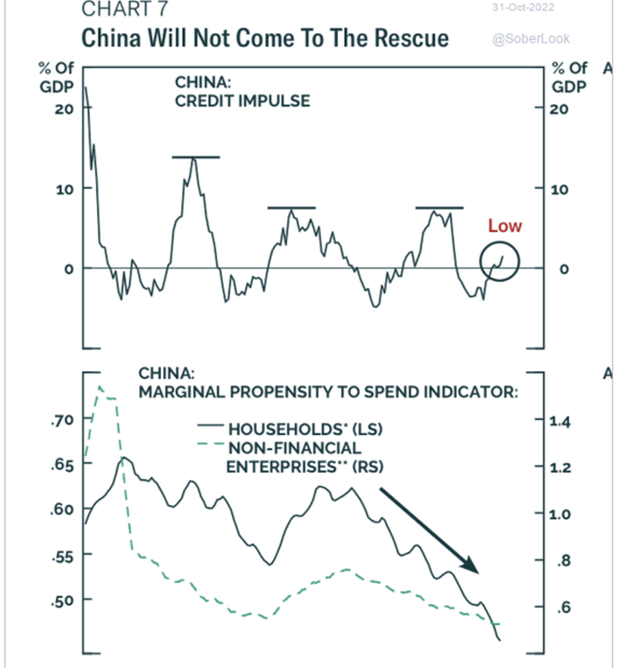

As we have shown in the past, when exports dip the CCP will dump more money into the economy through infrastructure lending and spending. As we showed through credit impulses, there has been no movement of new capital into the system. The most recent data on loans and monetary growth support this big decline in underlying demand for debt. It’s important to recognize that this is normally a time when loans drop off, but you can see that it has dropped to a much lower point than historics. Another key point is that this takes the CCP off the trend of where it was in 2020.

The actual loan growth is probably lower when you consider that on the audit for 2021 actual loan movement fell well below what was reported. Based on current dynamics and datasets, demand for loans is probably even lower than it was in 2021.

The below chart helps to show how the credit impulse has remained depressed and the marginal propensity to spend has diminished across both households and non-financial enterprises. It will only get worse over the coming few months as employment drops and economic expansion comes under further distress.

To put more pressure on growth we have an update on the zero COVID policy from China. There are two important pieces to the zero COVID policy- one from the Politburo and the other communicated down to the provincial governments. One is going to look at the general theme and the other will be ways to implement the zero COVID policy. Trivium did a great job summarizing these shifts:

“The latest: On Thursday, the Politburo Standing Committee (PBSC), China’s top decision-making body, held a meeting to discuss COVID policy.

Spoiler alert! The PBSC reiterated its commitment to zero-COVID (Xinhua):

“[We will] unswervingly implement the general policy of ‘dynamic clearing’ [aka zero-COVID].”

Officials also reiterated the dual goals that they have pushed since the PBSC meeting in March:

“[We will] protect people’s lives and health to the greatest extent possible and minimize the impact of the epidemic on economic and social development.”

No matter how big of a contradiction many of us might see between these two goals, China’s leaders remain committed to squaring the circle.

That said, in this meeting, the PBSC did begin to place an increased emphasis on reducing the socio-economic fallout of the harshest elements of the containment policy:

First, they dropped the requirement stated in both March and May that officials must “strictly” implement COVID containment measures.

Second, for the first time, they explicitly told officials to remove some restrictions once COVID-19 outbreaks are contained – and as quickly as possible.

And third, they indicated that 20 specific adjustments to the policy would be issued imminently – which happened promptly on Friday.

The money quote:

“[We will] take more resolute and decisive measures…to restore normal [business] production and living order as soon as possible.”

Get smart: The key development from this meeting was a slight, but quite apparent, shift in mindset among China’s senior leaders – to focus more on containing the fallout of the zero-COVID policy itself.

This is an important signal and may well tip off a series of small-step adjustments to “optimize” the policy further over the next several months.

But, but, but: We continue to counsel caution in how quickly these changes will come to fruition – and meaningfully impact overall virus containment efforts.”

The above announcement was followed closely by the National Health commission’s release of 20 measure adjustments to the COVID control framework:

First, fewer people are likely to be put under lockdown; and lockdowns will be lifted faster (Xinhua):

- Going forward, only individual apartment buildings with COVID cases will be locked down during outbreaks, as opposed to the previous practice of locking down entire apartment complexes.

- Additionally, residents will be allowed leave lockdown after five days of no new cases emerging (down from ten days, previously).

Second, fewer people will be packed off to quarantine camps.

- Authorities will stop tracking down and quarantining “secondary” COVID contacts – i.e. individuals who have been in contact with a direct contact of an infected person.

Third, quarantine times will be reduced:

- Centralized quarantine periods for inbound travelers have been cut to five days from seven days, followed by three days of home isolation.

- Centralized quarantine periods for “first tier” (i.e. direct) contacts of infected individuals were also cut from seven to five days.

Get smart: Each of the adjustments is very slight. Still, taken together, they represent a marked adjustment to policy.

- But, but, but: Despite these adjustments, officials were also crystal clear that the overall zero-COVID policy, and the no.1 priority of protecting people’s health, remains firmly in place.

Even as the Chinese attempt reopening strategy, there is more pressure on the underlying economy driven by the slowdown in underlying trade. The local consumer has continued to struggle even from pre COVID so there is a very little chance that the local populace will be able to offset the loss of global trade.

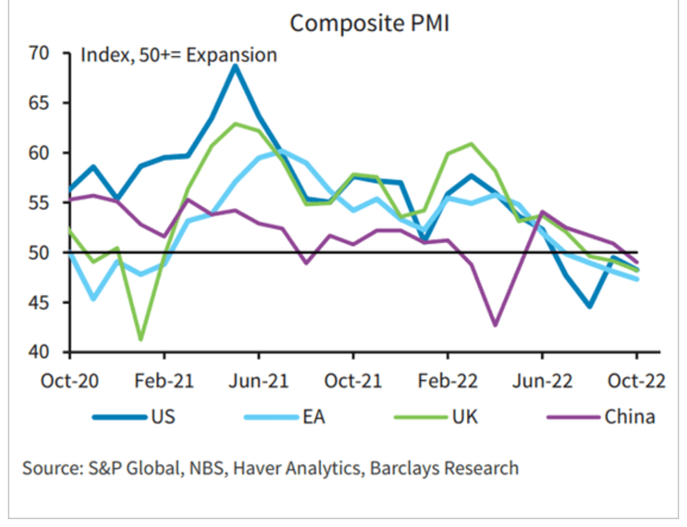

Given the importance of the Chinese manufacturing and assembly to the global supply chain, the leading data points to more problems for the Chinese economy.

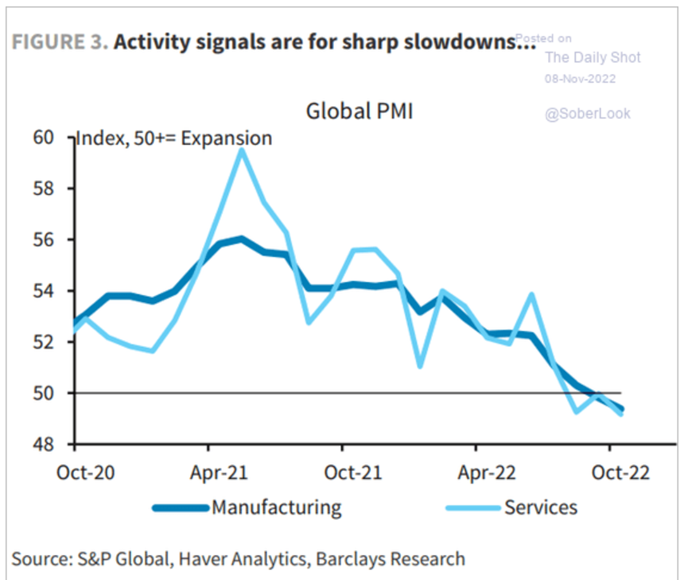

The above data sets point to an additional contraction in manufacturing and services which you can see is not limited to one region. The slowdown is broad in scope and it’s hitting all sides of the economy.

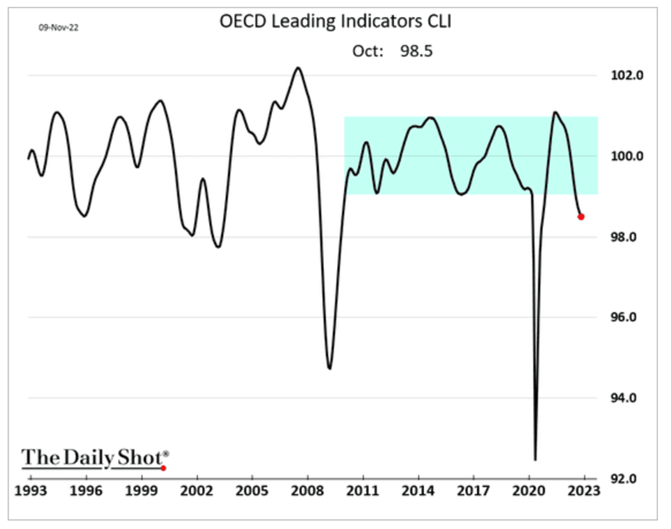

The most recent leading indicator for the OECD is showing a steeper move into contraction.

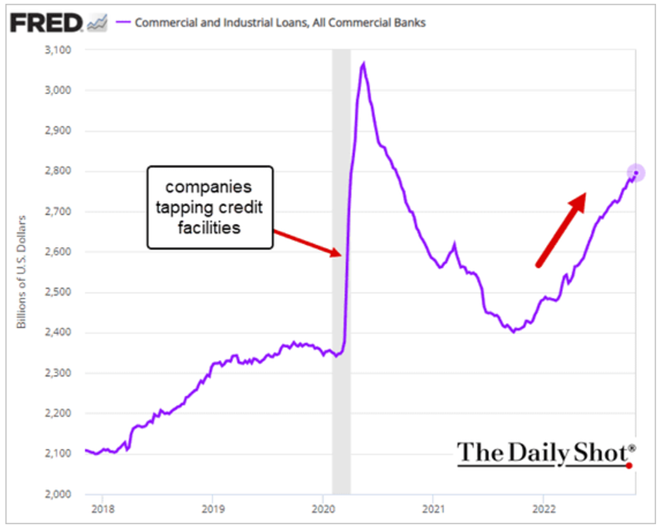

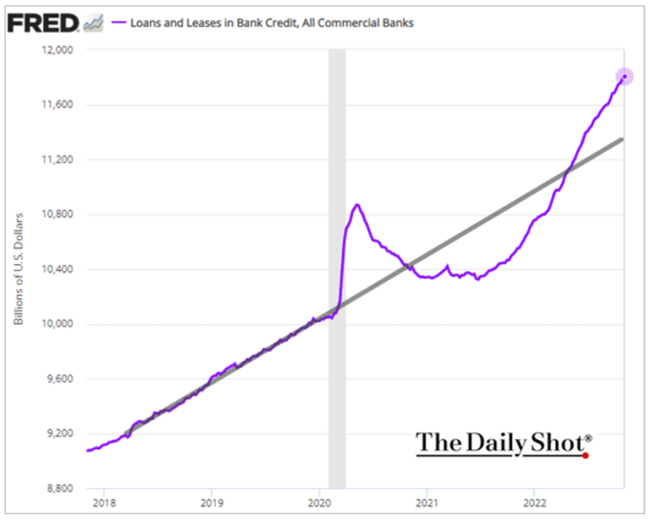

As this plays out, companies are tapping into their credit facilities at an ever-increasing rate to bridge rising costs and supplement for a difficult bond market.

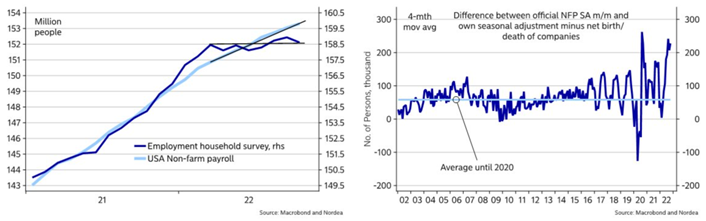

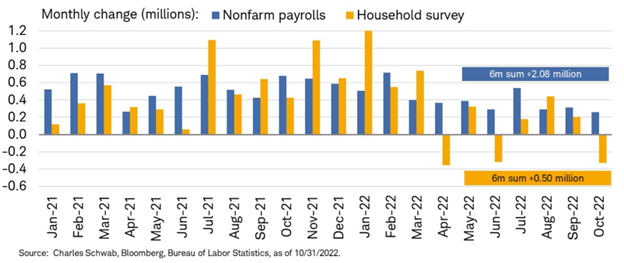

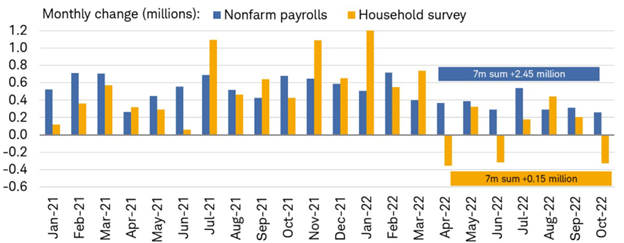

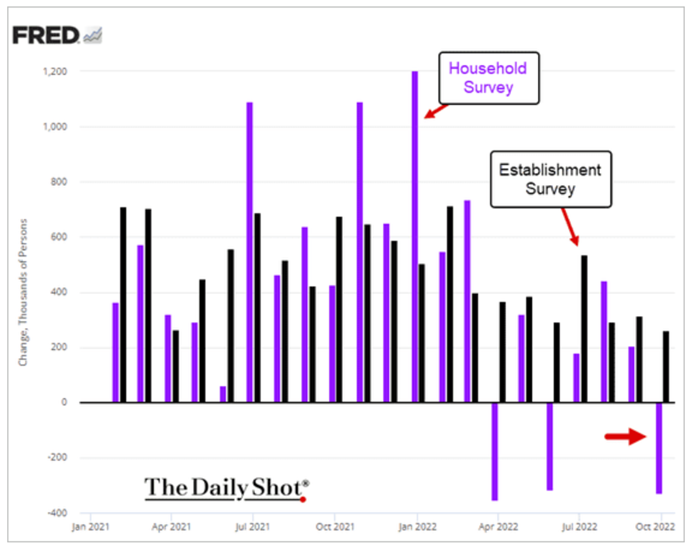

An increasing use of revolvers is the first step when company margins get squeezed, capex gets cut, investments diminished, and layoffs quickly follow. These are a big problem for the economy when you consider the consumer weakening, companies investing less, and export slowing. 2023 is shaping up to be a very sloppy year. Jobs market in the US is showing some differentiating signals that we want to look at in terms of which one matters most as we go forward. There is a lot of disconnect between what the non-farm payroll is showing and what the household survey is representing. Essentially, the NFP is starting to look a bit odd. Households are basically saying that there has been no employment growth since March of this year while the non-farm payroll shows an increase of 2.5 million. In the past, there have been disconnects but this is one of the largest we’ve had and we’re not sure when we’ll get a makeup number. It’s important to understand what the definition of each metric and how it’s calculated. “Employment estimates from the payroll survey are a count of jobs, while the household survey provides an estimate of the number of employed people. If a person changes jobs and is on the payrolls of two employers during the same reference. Both jobs would be counted in the payroll survey estimates. The household survey on the other hand will simply reflect one employed person in its measure. in periods of high turnover or large amounts of people changing jobs, accepting buyouts, or being laid off and getting a new job quickly- you can see months with more double counting vs what is usual.

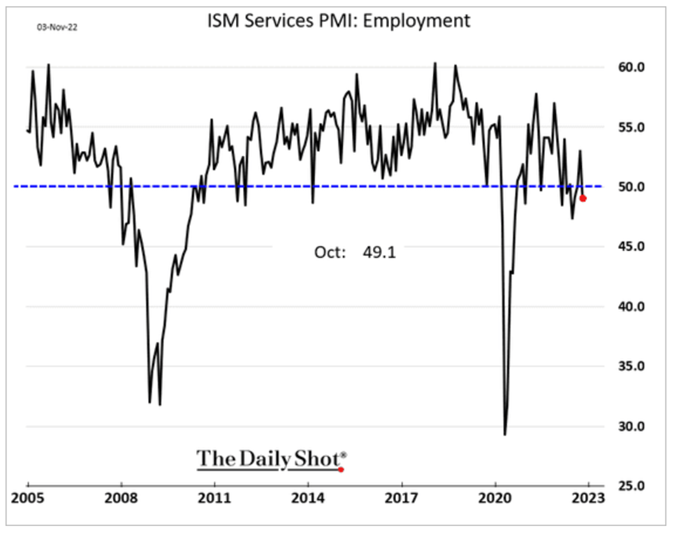

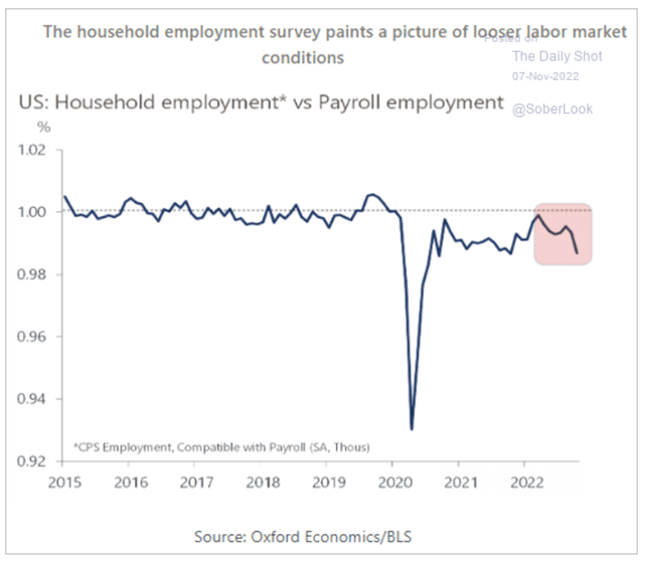

None of this is a perfect science as each one uses different metrics to measure what the actual employment is per household. Given the drop-in participation rate, it seems that it is likely that we’ve had employment closer to the household survey versus the steady increase on the non-farm payroll side. The answer probably lies somewhere in the middle especially when you look at what the regional fed data has been showing us which is a decline in both workweek and employment. The below data point shows that ISM services has seen employment move into contraction over the last month. Obviously things have been very volatile given the way the market has reacted but you can see that the trend has been lower over the last few months.

When we look through our history you can see that there’s always been a disconnect between nonfarm payrolls and the household survey. It’s another reason that we like to look at the six-month average when comparing the two because typically you have these balance out over a period of time. “ Similar to June and April, another divergence in October between nonfarm payroll and household survey metrics, with latter going negative.” Another odd component is the disconnect between the birth death model which estimates births and deaths of businesses was plus 455,000 last month. if we just consider the recent headlines of META, other tech entities, as well as financial institutions laying off workers it’s unlikely that we have seen this kind of expansion.

When we go back an extra month you can see that there is still a broad disconnect between the non-farm payrolls and the household survey.

The chart above accounts for the first decline in this cycle for household survey employment. Typically, the NFP is a poor way of tracking trend changes while typically the household survey has been better at showing pivots and the underlying numbers. You can see in the chart below that the household survey greatly outpaced the NFP at the very beginning and now we are seeing the opposite to the downside.

Even if you factor in the lower household survey, things still remain fairly robust given what the economic data tells us.

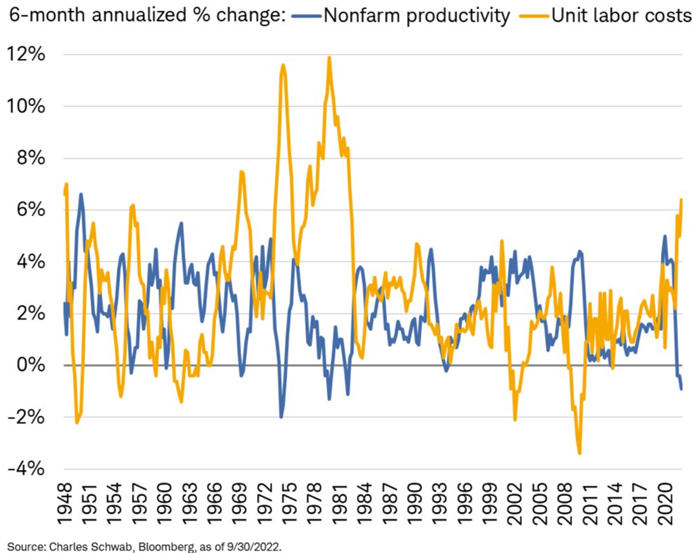

Another important point is the unfriendly trend for non-farm productivity and unit labor costs. This is one of the worst shifts that we’ve seen since the great financial crisis and before that you have to go back to the 1980s. Productivity has diminished while unit labor costs have exploded putting additional pressure on corporations. The below chart looks at the six month annualized percent change for non-farm productivity and labor costs.

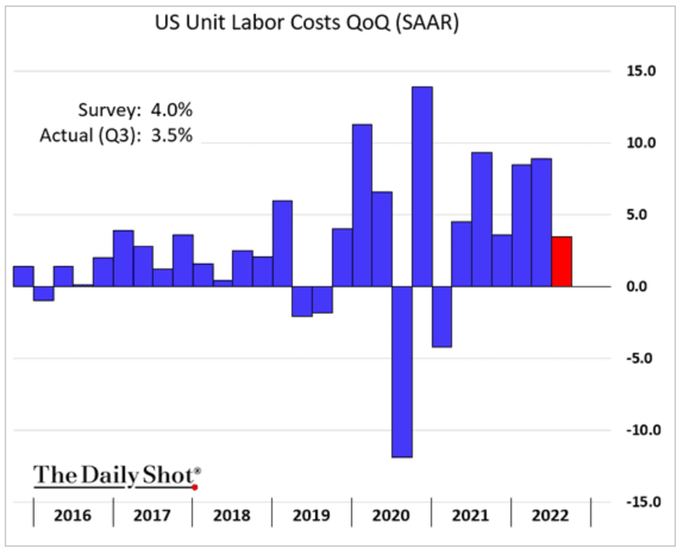

The above also starts to materialize when there is growing stagnation in the underlying economy. We have started to see unit labor costs come down while still expanding they’re expanding at a slower rate. Even at their peak it was never enough to cover the rising inflation and living expenses workers are facing.

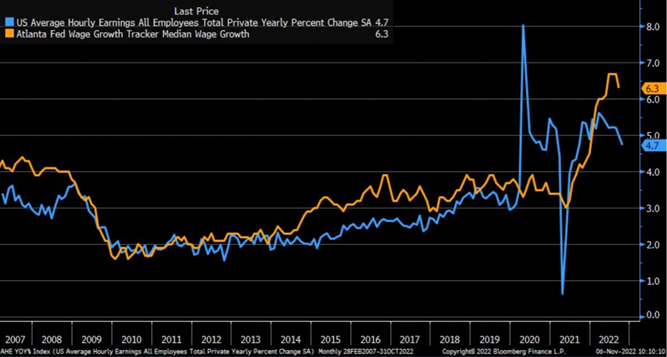

Some of this is showing up in slower growth in average hourly earnings when you look at the wage metrics from the Atlanta fed. This just shows that wage growth has slowed even as inflation continues to grind higher.

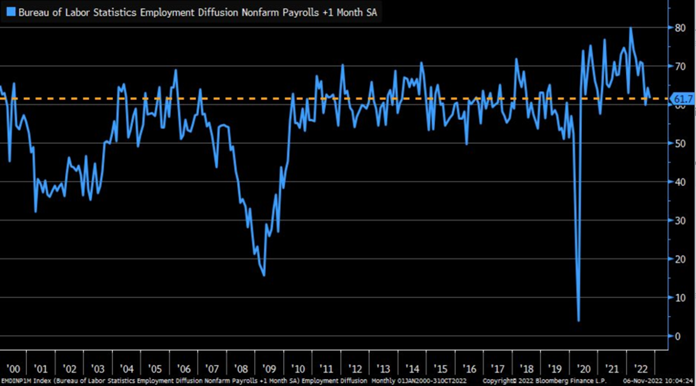

Another key factor is employment diffusion or the breadth of industries creating jobs has eased back to the long-term average. This is not something that is a concern yet, but you can see that the drop has been drastic and based on what companies have announced will only continue to worsen.

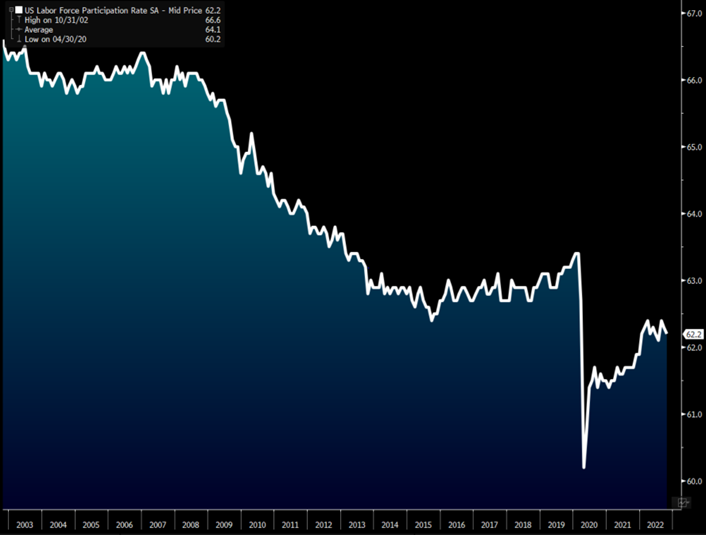

The biggest overarching concern remains the drop-in US labor force participation rate showing shift in the demographic as well as people who remain unwilling to go back to work. As productivity stays depressed and the amount of people participating in the workforce diminishes, wages will have staying power at an elevated level.

With wages stuck higher, we will see corporation Trying to offset the additional cost by keeping their prices elevated. This is just a long way of saying stagflation is here and only becoming worse.