Oil prices and global markets are concerned due to what is going on in China…

The news coming out of the second largest economy is not promising. Covid cases are on the rise and it has triggered protests across China that were only recently resolved. Mobility in the country remains low and the future GDP estimates are not good. All of this presents a new challenge to an already recessionary environment being fuelled with tigheting monetary policy across the world with countries entering recession one after another.

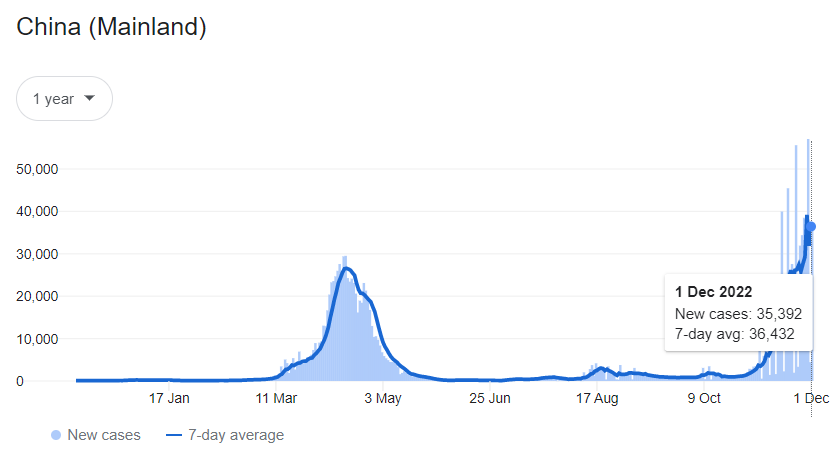

Covid cases in China continue to increase and might have surpassed the peak level seen in April.

But the recent curbs resulted in sever protests with risk of it spreading across the country. After riots between civilians and hazmut-wearing men in Guangzhou, the government decided to lift the restrictions that appeased the brewing unrest. But that might not be a good news after all given the second order consequences of this policy. Most of the elderly and vulnerable will get sick in the coming weeks and as an article in the New York Times rightly point, there will be a surge in cases and in the worse case deaths too. In addition to that the nu,ber of vaccines administered on a daily basis have also fallen to the lowest while critical apparatus like beds and testing equipments face supply challenges. Two third of the older population in China is vaccinated but only a 40 percent have received a booster dose.

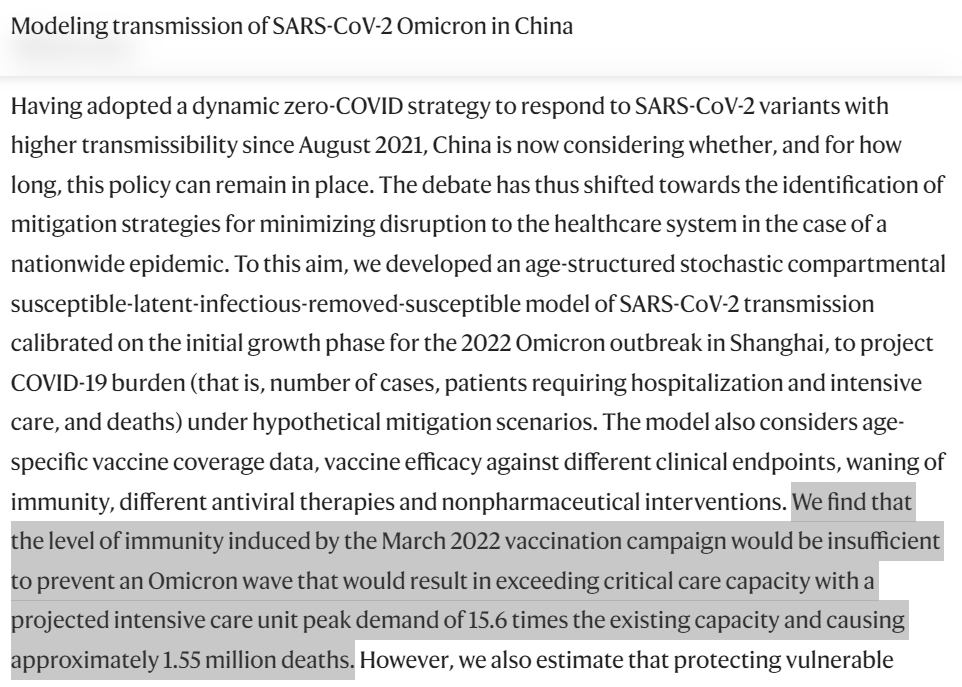

A study said that there can be an unmanageable rise in covid cases if China let go of its zero-covid policy – the study estimates 1.6 million additional deaths.

Also, there is uncertainty regarding the lifting of restrictions and how will the government handle the above mentioned developments?

All of this amounts to growing concerns regarding the prospects of China’s economy. IMF chief has already warned of a shock if cases grew and that its gdp will grow the lowest in three decades. Mobility in China has remained well below pre covid times. Traffic in Beijing is down 45 percent YoY and 35 percent in Guangzhou. According to an estimate, areas that account for almost 20 percent of the country’s GDP is in lockdown posing serious threat regarding China’s growth. The Purchasing Manager’s Index (PMI) fell 0.9 percent to 49.2 percent and its oil imports declined for the first 3 quarters falling 4.3 percent YoY. Another indicator i.e. retail sales also show downward trend. According to the latest data by China’s National Bureau of Statistics (NBS) retail figures slowed down 0.5 percent in the month of October. Dining revenue also faced downward pressure falling 8.1 percent versus last October. JP Morgan has already reduced it GDP forecast to 2.7 percent from 3.4 percent. While the IMF has cut down China’s GDP forecast to 3.2 percent in 2022 versus 8.1 percent in 2021.

In the coming days we will see a fall in oil prices as news coming from China will continue to dampen any optimism regarding global economy. Beware and take positions accordingly.