Quick update- frac spread count fell inline with seasonal norms so there really hasn’t been much change to report. Everything is moving along our expectations, but even as things cool- the cost of operations in the oil patch remain robust. This is not something we expect to improve over the next few quarters given the steel and labor situation. The real estate/housing sector dipping hard will be good (in the long term) for steel pipe- but in the interim- prices will stay elevated. Even as they pull back, pricing is so high a reduction in prices will still remain at extremes. The Permian will see some bigger drops over the next few weeks, but some of the other larger basins are already running at lower numbers- so the drop off won’t be as severe as previous seasonal cycles.

On an operational update, Canadian heavy crude’s discount to WTI widens $1 to $15/bbl at US trading hub of Cushing, Oklahoma, market participants said.

- Discount widens as TC Energy plans restart of one leg of shuttered Keystone oil pipeline beginning Dec. 10, according to people familiar with the matter

- NOTE: Co. declared force majeure on shipments on 600k b/d line on Thursday after 14k bbl of crude spilled in Kansas, prompting shutdown

Saudi Arabia and China met in KSA, and came out with some very “aggressive” commentary. The most important comment is the last one- essentially discussing the “end to the petrodollar.” I have heard since at least 2006 how the US Dollar was going to be replaced. As long as the U.S. Navy sails the seas and patriot missiles protect KSA assets, the US dollar isn’t going anywhere. The Yuan and Chinese economy are in a terrible place with more weakness to come- especially on the debt and currency side. I am by no means saying the US Dollar doesn’t have its problems- but jumping from USD to Yuan only leads to more problems… not less. I think people continue to overestimate the Chinese economy, and the issues of massive spending, wasteful building, and huge debt loads (with little collateral) keeps the likelihood of a broad adoption unlikely. Let alone the strength, size, and influence of the U.S Navy- so everyone can talk a great game- but the US Dollar survives this round.

- “China will continue to firmly support the GCC countries in maintaining their own security… and build a collective security framework for the Gulf,” Xi said on Friday at the start of the China-GCC summit.

- “China will continue to import large quantities of crude oil from GCC countries on an ongoing basis,” he said, also vowing to expand other areas of energy cooperation including liquefied natural gas imports.

- Additionally, Xi said China would make full use of a Shanghai-based platform “to carry out RMB [yuan] settlement of oil and gas trade” — a move that, if Gulf countries participate, could weaken the global dominance of the US dollar.

I do believe that the next Bretton Woods will see the USD lose some influence with currencies backed more by “hard assets and commodities” gaining some relevance. But a weakening of the USD hold as the reserve currency is by NO MEANS a replacement… more to come on this fun topic.

The above will result in a drawdown in PADDs 2 and 3, and help the Gulf Coast draw down crude in storage which is always the name of the game during tax season. Typically, PADD 3 sees outsized draws in late November and all of December as companies reduce their crude in storage. This is to reduce their tax bills by limiting imports/ maximizing exports/ and increasing runs to turn crude into product. In January, we normally get outsized builds as the companies reverse the drops from December- it’s always a wild ride in these two months for movements in PADD3.

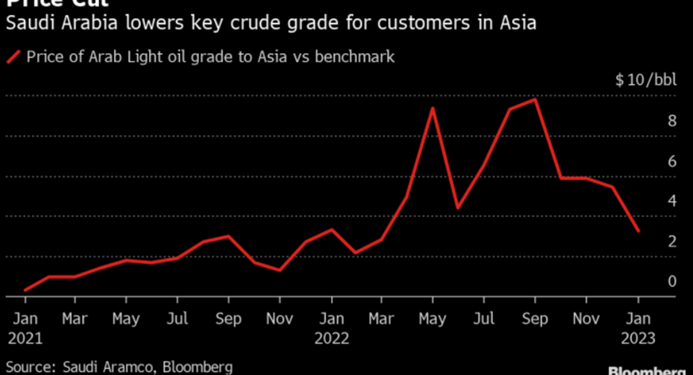

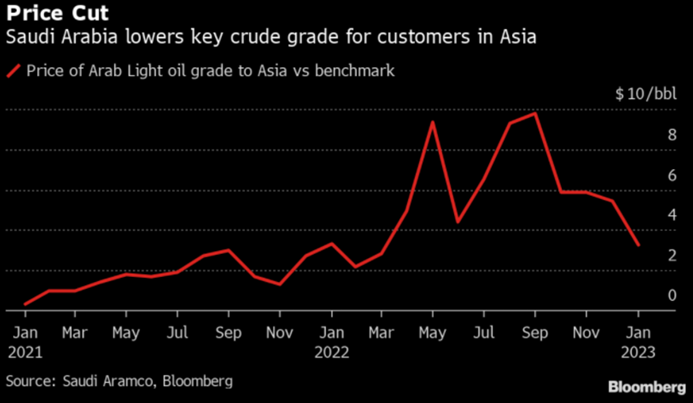

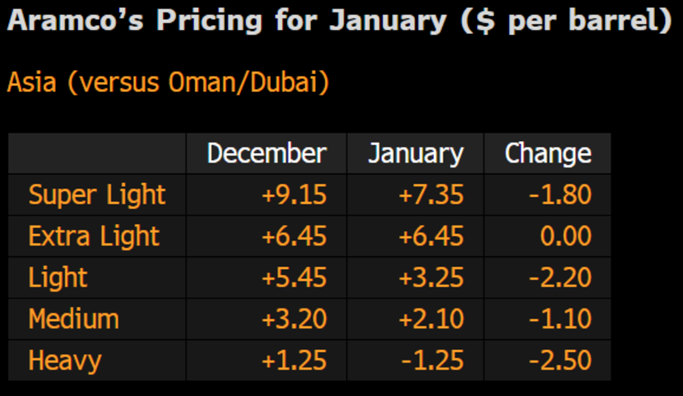

Saudi Aramco rolled out OSP (official selling price) cuts, but not the degree necessary to clear the glut in the floating market. They also cut prices for Europe, but left everything unchanged heading into the U.S. markets. Europe isn’t a buyer of Middle East crude at these prices given flows from Libya, CPC, and the U.S.- all of which also remain more competitive vs Saudi.

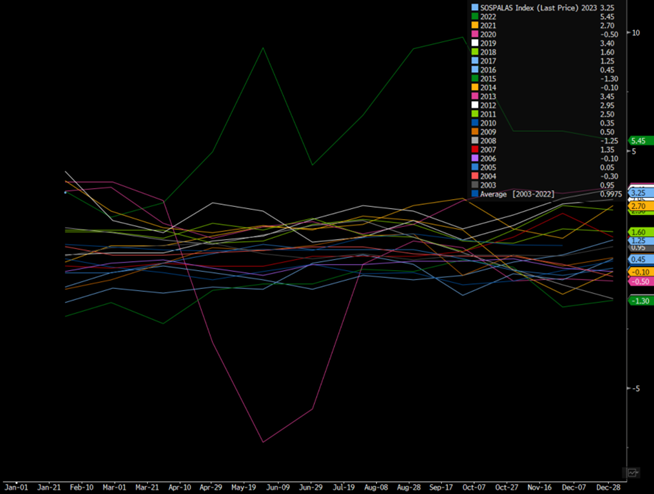

Even as prices fall, it’s important to put into context where it is in relation to historics. The premium to Oman/Dubai is back to levels from 2013/2019, but still at the top of the range. You can see that small blue dot on the left hand side, where things have gotten “closer” to normal but still priced at a premium.

Middle East Arab Light Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

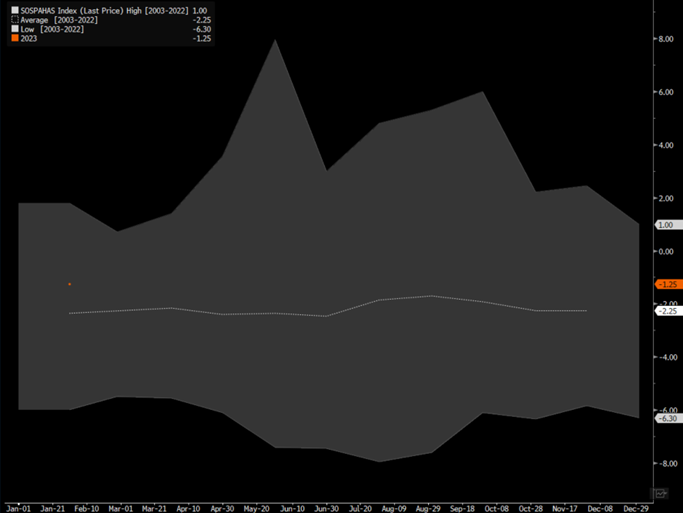

When we look at the heavier side, the price is now back to $1.25 BELOW Oman/Dubai, which is much closer to the historical average looking back over the last 20 years. This should provide some relief for refiners in Asia trying to protect crack spreads as they soften across gasoline and diesel. The chart below has the little orange dot on the left-hand side, but you can see it is MUCH closer to the “normal” discounts from previous years. It’s just off the 20 year average, and this is margin that can be passed down to the refiner.

Middle East Arab Heavy Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

Floating storage and refinery crack spreads (specifically in Asia) will be a good bellwether to see how demand is holding up with some of these broader discounts.

The U.S. is still exporting 3.8-3.9M barrels a day so the need of Extra light/light is minimal, but it would have been beneficial to see a cut to the Medium and Heavy side of the barrel. These barrels will likely move into Asia instead, and put even more pressure on the West African market flowing into Asia.

Europe saw some minor cuts, but nothing that would meaningfully change the flow of crude into their markets. CPC is loading at a 2 year high, Libya is putting out about 1M barrels a day, and U.S. crude is still priced well to take out any broader Middle East Demand. “CPC Blend loadings for December revised higher to 1.53m b/d, the most in more than two years.”

CPC FINAL PROGRAM:

- CPC crude loadings for this month were revised up to 5.996m tons from the terminal near Russia’s Black Sea port of Novorossiysk

- Equates to 1.53m b/d, the most since March 2020, compared with 1.43m b/d for November

- The preliminary plan released on Nov. 11 had shown 5.876m tons, or 1.5m b/d for December

We also saw Libya slash it’s own OSP to the lowest since May 2020, which will help them retain all of their demand and keep Middle East flow at bay. “Libya set its Es Sider OSP for December at a discount of $2.85/bbl to Dated Brent, according to a price list seen by Bloomberg.”

- This is the lowest since May 2020, compared with +15c for November

- Sharara OSP was set at Dated -$1.70/bbl, vs +$1.30 for November

CPC flows are facing some struggles in the near term as insurance rules for cargoes going through the Turkish straits with about 26 tankers carrying about 23M barrels of Caspian CPC are unable to pass. The tankers have to prove insurance, port of loading, and type of crude in order to move through the Bosphorus Straits. This is creating a lot of bottlenecks, which is hindering some flows in the near term.

The U.S. has maintained something around 3.8-3.9M barrels a day of flows into Europe, which will remain elevated as we head into year end. Saudi Arabia kept all prices into America the same, which makes sense for light because we are exporting so much of it. On the other hand, reducing the OSPs for medium and heavy into the U.S. would be a big benefit for increasing flows. I think this was a mistake that will limit flows from the Middle East, and still keep cargoes stuck in the floating market without much of a home through January.

It’s important to point out that the pivot started back in 2014 (and likely a bit before) was for the GCC nations (Gulf Cooperation Council) countries to expand their refining and petrochemical capacity. Kuwait is the most recent to bring on additional capacity. “Kuwait has invested tens of billions of dollars upgrading and building new refineries in recent years. That will enable it to boost exports of diesel and jet fuel to Europe in 2023, Sheikh Nawaf said. Those shipments will go a small way toward replacing flows of refined oil from Russia, which the European Union is set to ban from February as part of measures to punish Moscow for its invasion of Ukraine. Kuwait exported its first jet fuel from the new Al-Zour refinery last month. The facility is designed to be able to process 615,000 barrels a day, making it one of the biggest refineries in the world. It is meant to be finished early next year, taking Kuwait’s total refining capacity to about 1.5 million barrels a day. “It’s not going to be so much crude as product” when it comes to sales to Europe, the CEO said. An increase in Middle Eastern exports of diesel and other products to Europe is likely to be “permanent,” he said, with Russia forced to focus more on Asian markets.”

Saudi Arabia and UAE have also taken a similar path with more coming over the course of this decade.

Saudi Arabia Sharpens Petrochemicals Focus in Energy Transition

- Kingdom intends to use 4m b/d oil for chemical-making by 2030

- Energy transition will drive demand for petrochemicals: Aramco

“Saudi Arabia plans to allocate more than a third of its current oil output to chemical production by 2030 in a bid to squeeze more value from its barrels as the world shifts toward a low-carbon economy. The biggest crude exporter aims to convert 4 million barrels a day into higher-value products such as plastics and fertilizers by the end of the decade, Aramco Chief Executive Officer Amin Nasser said at an event in Riyadh Tuesday. It’s a shift that will require huge investment in its petrochemicals facilities. The kingdom also wants to ensure there’s demand for oil even if crude-buying nations reduce consumption in favor of less-polluting alternatives to reduce their greenhouse gas emissions. “Under a net-zero scenario, petrochemicals could still account for more than half of total global oil demand by 2050,” Nasser said. Eventually, Saudi Arabia wants to sell all of its crude output as oil products or petrochemicals, energy minister Abdulaziz bin Salman said at the same event.”

The shift is going to continue to pull crude off the water and increase the amount of product that is being moved throughout the world. This was the pivot that was set in motion years ago, which is shifting the way product moves around the world.

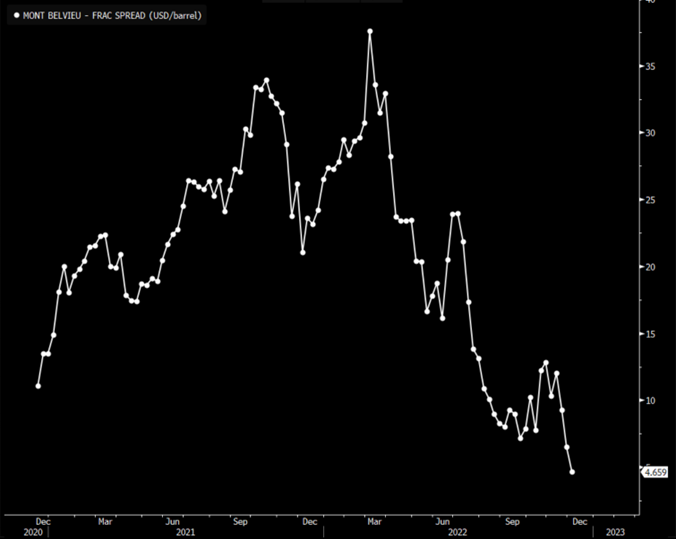

An interesting benefit for the U.S. is the change in the flows of NGLs (natural gas liquids) because more of it will be consumed internally. This provides a golden opportunity for the U.S. over the coming years, and is another reason we have been (and remain) so bullish liquids demand growth over the next decade and beyond. In the near term, pricing is going to get hit as U.S. demand weakens with petrochemical demand slowing considerably. This has sent the “Frac Spread”- the one calculating the NGL barrel- has fallen to new lows on the back of increased supply and falling internal demand.

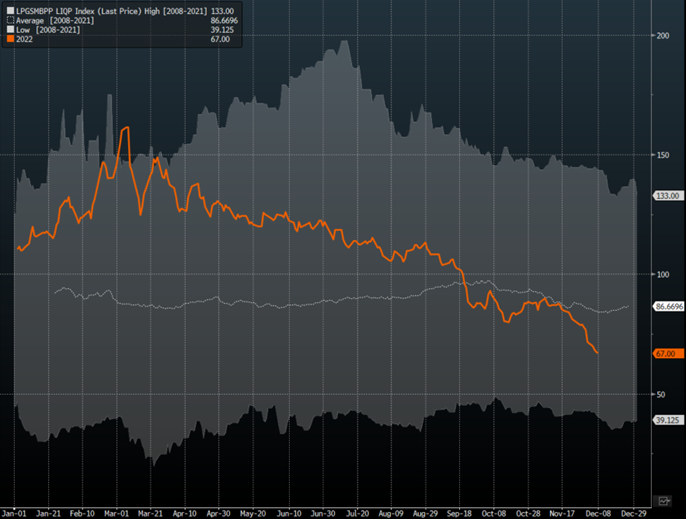

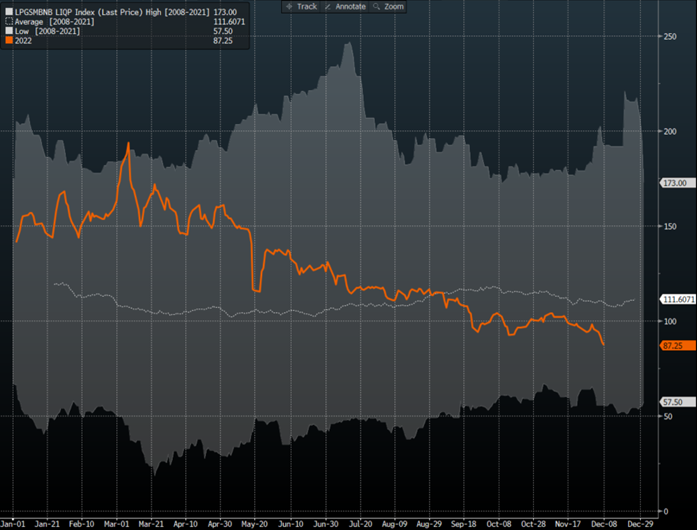

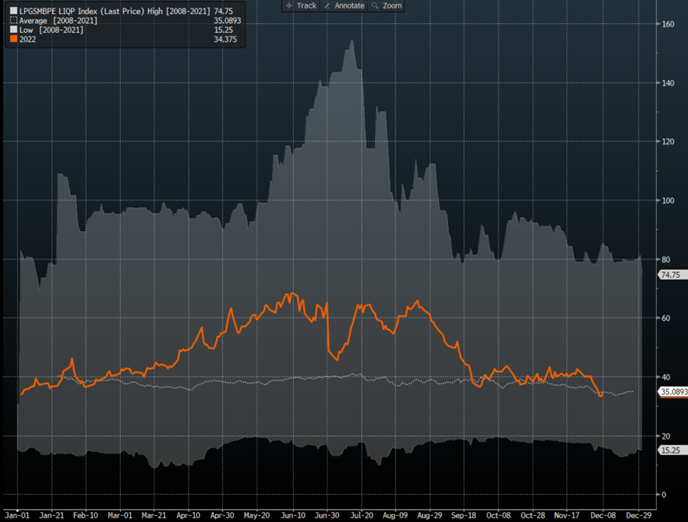

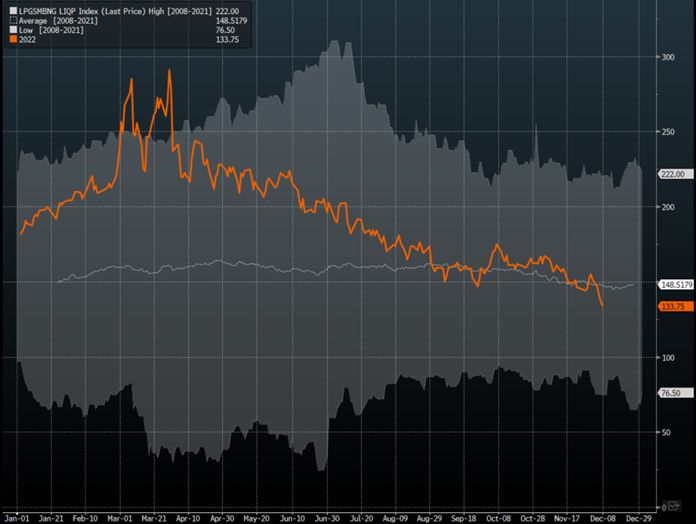

We expect pressure to persist as the global economy slows, which is a very important bellwether for chemical demand. When we break it into the pieces, the prices have fallen, but not to the same degree depending on the product. The support is driven by the international markets because even as propane demand within the U.S. falls- international demand remains at a very strong level. This is keeping U.S. exports at record highs, and with OPEC+ (more importantly Saudi Arabia) limiting production- it also cuts their exports into the market. This leaves countries/companies scrambling to find product, and the U.S. has more than enough supply to support the demand in the world. With the fall in domestic demand and supply increases, it also promotes more exports as prices remain fairly soft.

North American Spot LPGs/NGLs Propane Price/Mont Belvieu LST

North American Spot LPGs/NGLs Normal Butane Price/Mont Belvieu LST

North American Spot LPGs/NGLs Iso-Butane Price/Mont Belvieu Texas LST

North American Spot LPGs/NGLs Purity Ethane Price/Mont Belvieu non-LST

North American Spot LPGs/NGLs Natural Gasoline Price/Mont Belvieu non-LST

Even as prices fall, many of the “pieces” are still over the 5-year average in price even if they have fallen against the 14-year average. The support is being driven by ethane, which is finding a home in the natural gas stream as Henry Hub remains over $6, new ethane crackers come online, and exports staying at record levels.

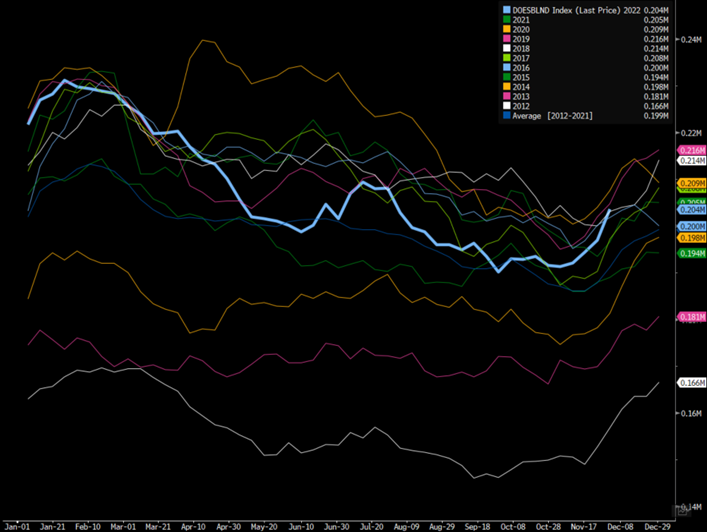

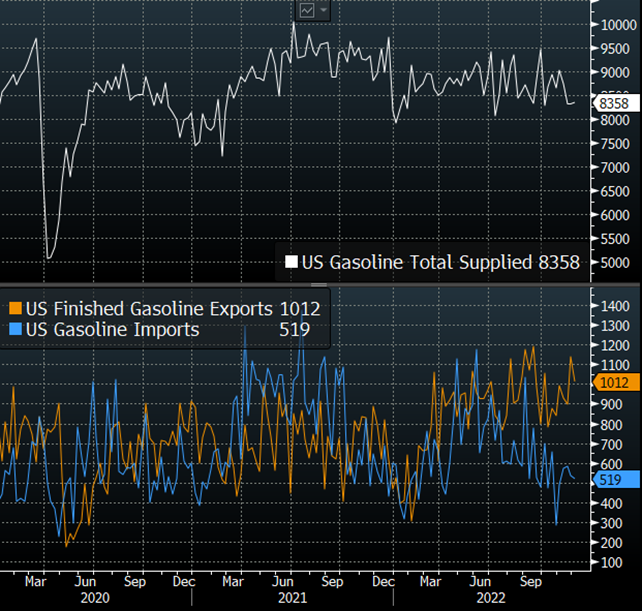

As petrochemical demand diminishes (and stays very depressed), it will support more naphtha and NGLs into the gasoline pool that shows up as “blending components.” It’s why we have been expecting a big surge in blending component storage, which has seen a big acceleration. The big bump in blending storage is also coming on the back of slowing demand as we have seen in the gasoline data sets each week from the EIA.

DOE Blending Components Total Inventory Data

This is also coming on the back as gasoline demand remans at a decade low (outside 2020 of course), and we don’t see much of a bounce as the shift in driving remains. The “flexible schedule” and “work from home” shift has reduced Mon-Fri demand by about 20% while weekends remains seasonally normally. The loss of the work week will keep us limited, and now as prices remains historically elevated, consumers weaken, and we usher in a recession- demand doesn’t have much support to the upside.

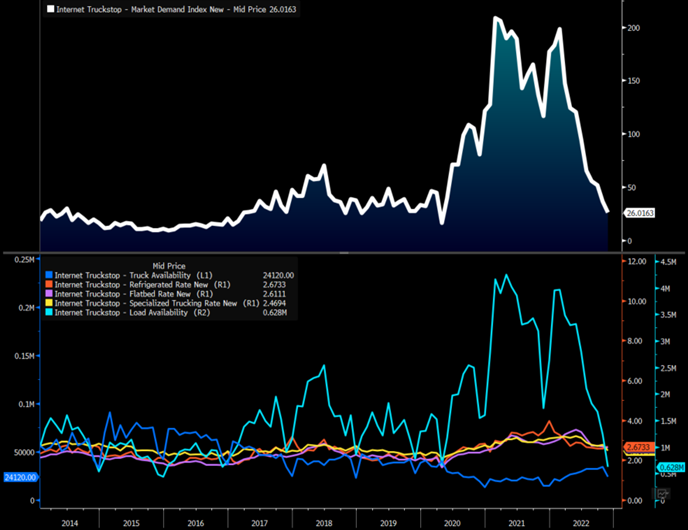

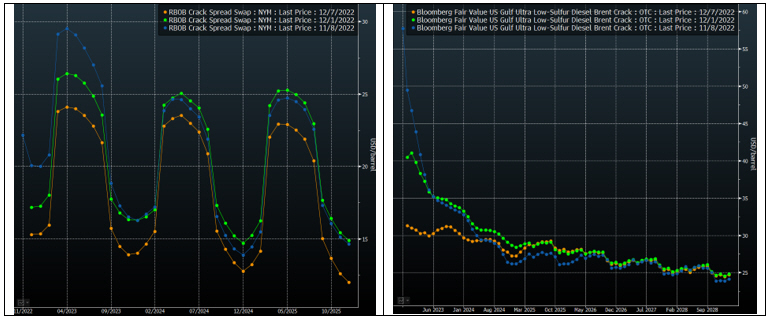

On the trucking side, activity has absolutely imploded, and we don’t see a recovery on the near-term horizon. This will be a huge overhang for diesel, and we will have to rely more on the heating oil season and exports to support diesel. Storage is still very short globally, which will help support pricing. The problem becomes: “Can the disty crack support the gasoline crack?”

We expect the distillate crack to remain positive, but we expect the gasoline crack to go negative (or further to the downside)- which could impact run rates. The biggest risk to run rates remains in Asia, which is why it will be important to see what OSPs do throughout Q1’23 on the medium and heavy side.

Energy Crisis Is Over – Diesel Is Back Under $40-a-barrel

If you read the title and immediately clenched your teeth, welcome. If you did not, I have a bargain of a bridge for sale over the former site of Philadelphia Energy Solutions.

In all seriousness, US crack spreads dropped sharply over the past month as inventory levels rose, driving a lot of analysts to run a victory lap over the end of the energy crisis. But just like the premature demise of European natural gas and power prices, cracks are likely in a head fake, at least for diesel.

Yes, we saw a massive build in inventories in PADDs 1 and 3 in the last reporting period (6.16 million barrels total). Yes, refiners are running at 95% utilization. Yes, a recession is imminent globally if not already here.

But, and it’s a big “but”, we haven’t really solved the refinery issues and they may get worse before they get better. Here are four reasons to be bullish diesel:

- China is reopening and while they may not get back to their pre-pandemic selves, there’s certainly pent-up demand for refined products, especially as the Lunar New Year comes around in January;

- Europe’s bushido moment won’t last forever, as Germany and others can’t continue to force economic run-cuts of energy at smelters, chemical plants and refiners forever;

- Europe’s refiners will, however, face the pain of much higher energy and natural gas prices come January. The UK’s lack of wind is a small warning bell that the pain of energy insecurity has just started. At this rate, Punxsutawney Phil’s cousin, Rheinland Kurt, may dig himself a deeper, warmer hole rather than look for his shadow come February;

- The US consumer is still getting credit and spending money. Look at Black Friday and spending levels.

The supply side is also supportive of wider crack spreads. Medium and heavy sours remain in short supply, limiting diesel yield for most of the world’s refiners. Russian Urals are still making their way around the world, but that may not last for long if Brent prices dip closer to $70-a-barrel, pushing Urals to the $40s and (potentially) Vladimir Putin to Caracas.

Gasoline on the other hand…

Crack spreads for gasoline are plummeting and the signs are not super supportive.

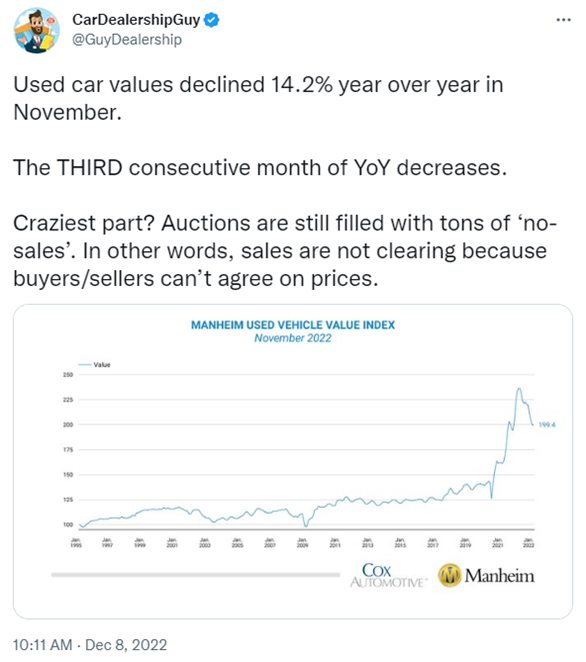

Used car prices falling by at 14.2% are just one factor that shows consumers are opting drive less than they were at the height of the pandemic. Another critical data point is the slowdown in the housing market. We may call it summer driving season, but do you really drive a lot more in the summer than in the winter? Sure, we take that trip to Cape May, Galveston or, if you’re brave, Orlando, but it’s not really the average Jane and Joe that drive a sharp increase in consumption. One major component of gasoline consumption is the housing market, which as your neighborhood agent may have told you, in shambles.

The consumer is still spending, but seems like the exorbitant car prices are leading them away from cars and into other spending, food, health and childcare, chief amongst them.

There’s plenty of gasoline supply in the world and the US is increasingly reliant on the export market to avoid significant build in domestic inventories. The effect of Tier 3 gasoline regulations in 2020 was masked by the drop in consumption due to COVID, but it’s now much clearer and it’s pushing the US to break records in gasoline exports.

The resurgence of China may help ease some of that glut as we see Singapore light ends drop, but we are still far from normalized levels. Other emerging markets are struggling and may feel even more pressure as King Dollar remains a headwind against most developing economies.

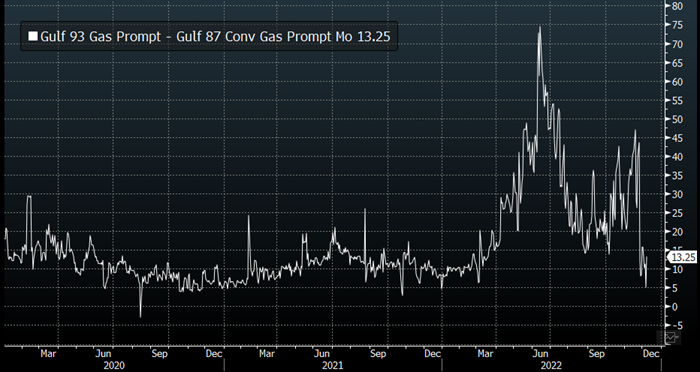

Also of note is the apparent end of the octane trade, which shot up because of Tier 3 regulations. The process to reduce sulfur in most cases leads to octane destruction, creating lower quality gasoline, which the US cannot consume. US refiners have not made significant investments in alkylation and desulfurization units needed to circumvent the issue leading to the surge in lower-quality gasoline exports and octane prices. But, as the car market signals a massive correction, especially at the high-end, high-octane markets, that trade may subside, for now. Still, the issues are far from solved, with most refiners dedicating capex dollars to renewable diesel, rather than refining improvements.

We will follow up on renewable diesel later, there’s a story to be told there.

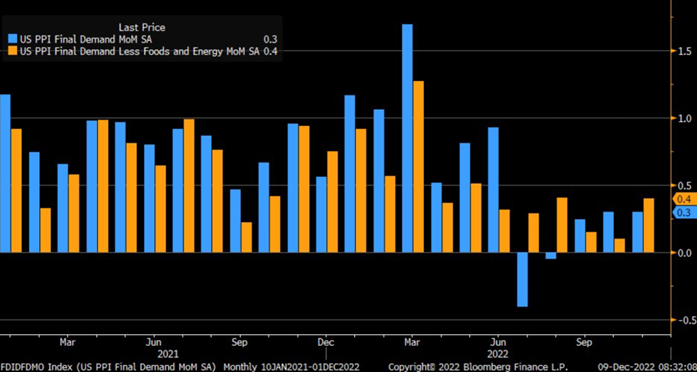

I think it’s important to kick off by looking at the Fed. The recent PPI and wages data is going to support our view of another two increase of .50% each. “November PPI +0.3% m/m vs. +0.2% est. & +0.3% in prior month (rev up from +0.2%); core +0.4% vs. +0.2% est. & +0.1% prior (rev up from 0%) … notable that trend for core was moving down from August thru October, but reversed higher in November”.

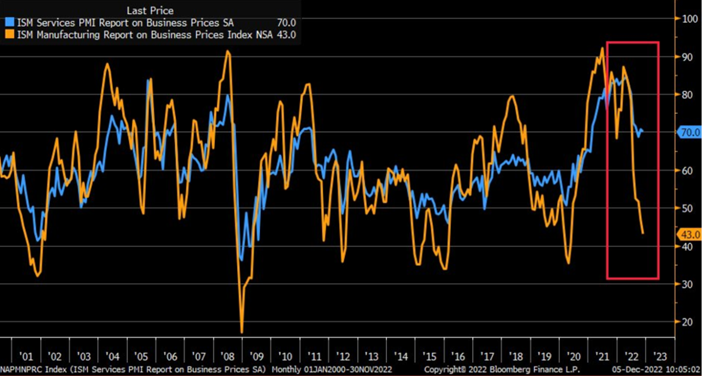

The shift between Manufacturing prices vs Service is another example of how inflation isn’t going anywhere- especially when you consider the stickiness behind service cost.

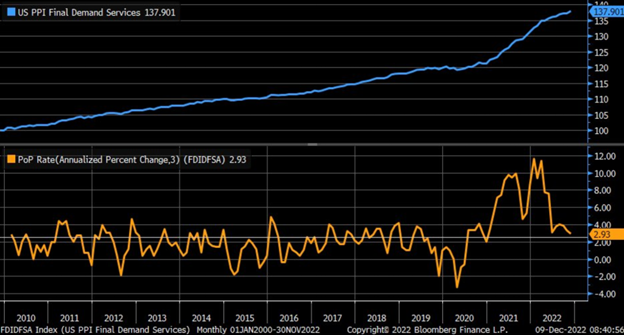

We have been highlighting for a long time now that the core side of the equation was not only going to keep rising (albeit at a slower rate of change) BUT that it would reaccelerate as service cost inflation continued to move higher. The other problem is- service cost inflation is MUCH sticker vs manufacturing/industrial inflation. PPI is a key leading indicator for the move in CPI as PPI looks down the supply chain and we can see another pick up.

The below chart specifically looks at how the spike in Service PPI remains elevated and supports our view of a stagflationary backdrop. “Services component within PPI final demand #inflation increased in November but 3-month annualized % change has eased to +2.9% (slowest since end of 2020)”- even as it eases- we see it trending back up. We have been spot on with the view that the rate of change would slow but remain positive.

When we look at the year over year- the comps are getting harder so we are going to see a drop- but this DOES NOT mean inflation is falling. It just means we are not growing at the same rate as last year. “November PPI #inflation +7.4% y/y vs. +7.2% est. & +8.1% prior (rev up from +8%); core PPI +6.2% vs. +5.9% est. & +6.8% prior (rev up from +6.7%).”

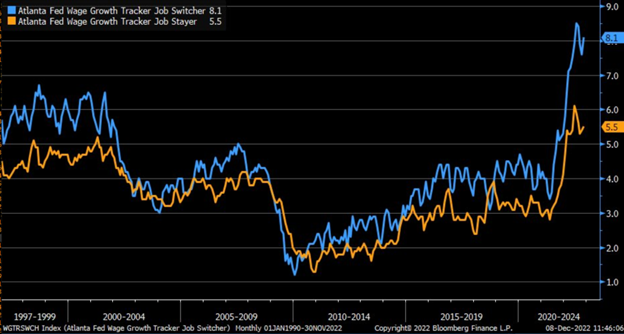

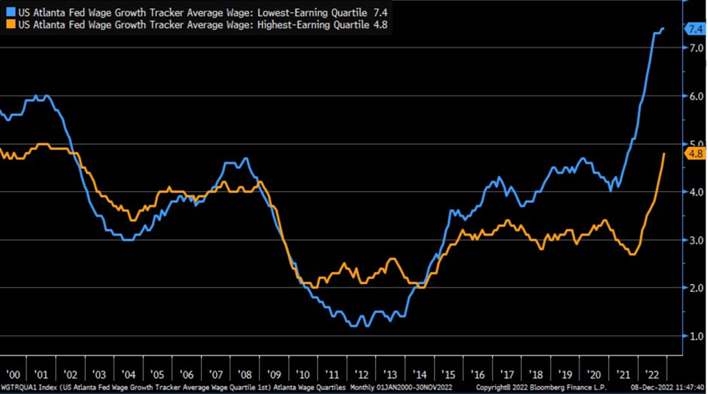

When we pivot to wage growth, you can see another move higher this past month, which is actually a problem for the Fed. “Wage growth remains strong for lowest-earning quartile tracked by the Atlanta Fed (blue), but pace of growth continues to accelerate for highest-earning quartile (orange), now at fastest since 2001.” Wage growth is actually a problem for the Fed because it is a tailwind for inflation, which can also lead to a much bigger issue- a wage spiral. Something else to point out: the pace of wage growth reaccelerated in November for both job switchers (blue) and job stayers (orange) per Atlanta Fed.

The big issue is the one above with wage growth actually bouncing higher- we don’t see it moving higher- but rather sitting at the current levels. This is another driving force behind stagflation and prices remaining elevated at the corporate level. Companies still need to attract talent, and with labor force participation rate so low- we aren’t going to see a meaningful drop in wages.

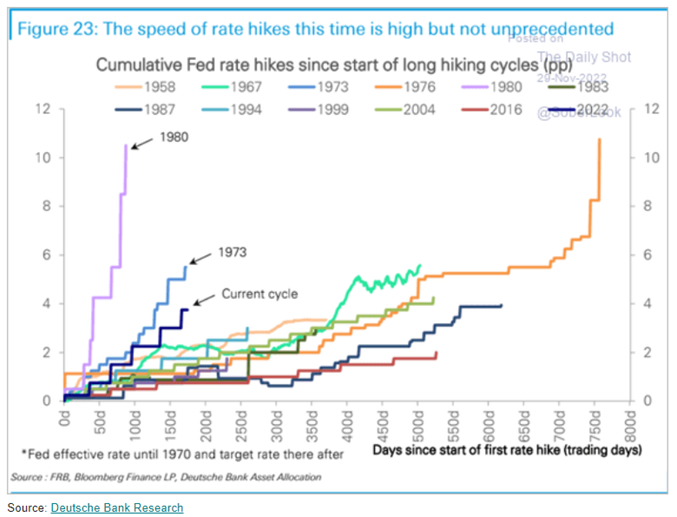

I have openly discussed my “dislike” for the Fed and JPow, but I think they are taking a smart approach to the increase in rates. If we look at similar rising periods- 1980/ 1973/ 1976- we are moving at a steady increase in order to bring inflation and employment/wages shift in alignment. When we look at 1973- the Fed was aggressive in order to get ahead of inflation, but started to cut rates WAYYY too soon- which resulted in the raise in 1976. When you look at ’76- the pace was much too slow- which resulted in the need for a massive spike because the pace was wrong. When you look at 2022- we are moving at an accelerated pace that is more aggressive to ’76 but not quite to the same degree in 1973. Volcker has actively talked about how he “wished” he went a bit slower on the raise, stopped sooner, but held longer at 17% instead of above 20%. We are now tracking perfectly to move to about 5%-5.25%, and able to sit there for an extended period of time with my base case into 2024. When you look at inflation, wages, and employment- there is continued support up to 5.25%.

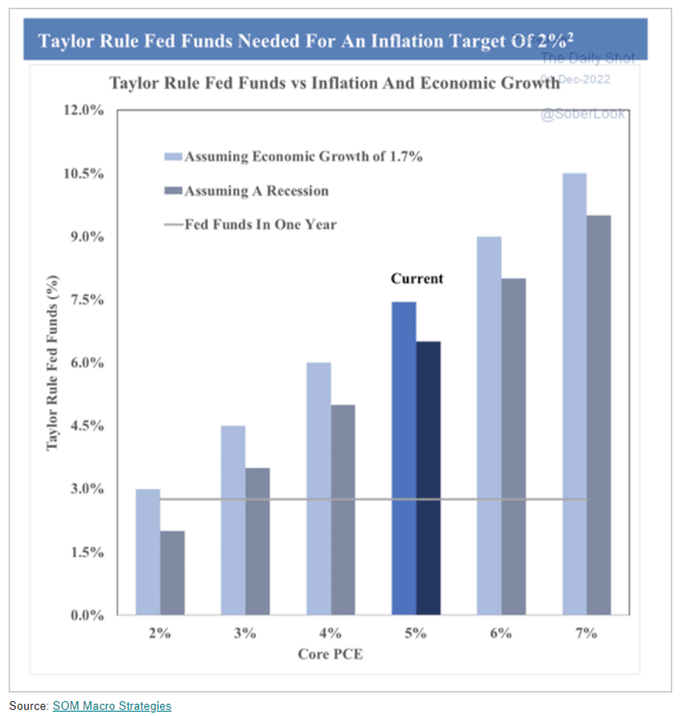

When you factor in the Taylor Rule, at the current economic and inflation levels shows we should be at around 7.5%. We are on pace to get to about 5.25%, and instead of running all the way to 7.5% and creating more strain in the market- we can “pause” for an extended period at just over 5%. This is a good balance that I believe the Fed is looking to strike between economic slowdowns vs more aggressive action.

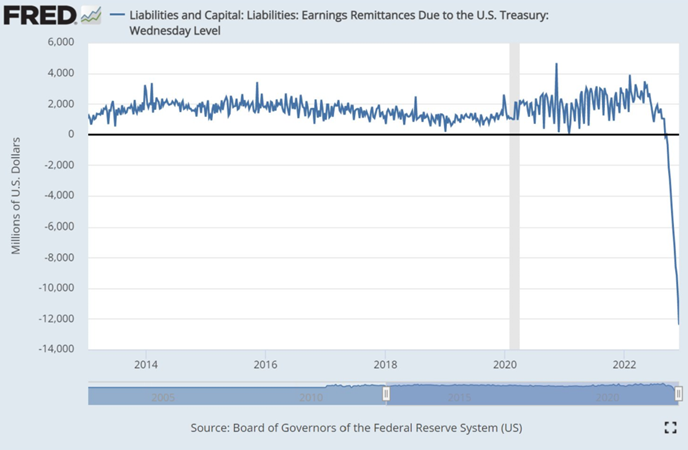

When we turn to the profitability of the Fed, there has been a huge slowdown in value at the Fed level. The below chart shows that the Fed is losing about $12B, which is a problem when you consider the excess cash gets sent to the treasury. The way the accounting works- the Fed uses these proceeds to pay for its operation. As the Fed accumulates losses, it prints money to pay for its existence, and once it returns to profitability- it works off the accrued losses. Once it has “earned back” the losses- it begins to send the excess cash back into the Treasury. The sheer size of the Fed’s balance sheet and exposure to rate-based instruments means they will NOT be turning a profit any time soon. Instead, the treasury has lost an important cash stream that won’t be returning quickly. It is also another place that the Fed will have to “print” and another way that shrinking liquidity will be difficult. The U.S. is clearly not an Emerging Market- but when a country/ populace/ global investor loses confidence in a country/currency- it all starts with a chart that looks like that at the central bank.

Here is a good summary from the Brookings Institute regarding the above chart:

“In the course of making monetary policy and issuing currency, the Federal Reserve accumulates a portfolio of Treasury and agency securities, which earn interest. Its liabilities consist primarily of currency outstanding, which of course pays no interest, deposits of the U.S. Treasury, which also pay no interest, and reserve deposits of banks and repo borrowing from money market funds and other lenders, both of which do pay interest. Normally, the interest the Fed earns on its securities greatly exceeds the interest it pays to banks and money funds, and the Fed meets its expenses from the surplus and remits the rest to the Treasury.

In response to the COVID pandemic, the Federal Reserve used quantitative easing (QE) – that is, large-scale purchases of Treasury securities and agency mortgage-backed securities – both to support market functioning and to ease financial conditions and strengthen the economic recovery. Its securities portfolio grew from less than $4 trillion to $8.5 trillion between March 2020 and March 2022.[1] Over the same period, currency expanded from $1.8 trillion to $2.3 trillion, and the Treasury’s account at the Fed rose from $0.4 trillion to $0.6 trillion. Despite the more modest growth in the Fed’s noninterest liabilities, the interest earnings on the Fed’s securities holdings increased much more than the interest paid on its liabilities, and the Fed’s remittances to the Treasury rose from $55 billion in 2019 to $87 billion in 2020 and $109 billion in 2021.

If the Fed booked a loss in a given year, it would have no profits to remit to the Treasury. Under the Fed’s accounting rules, it would then accumulate a “deferred asset” equal to its cumulative losses. Once the Fed returned to profitability, it would retain profits to pay down the deferred asset. Only once the deferred asset had been reduced to zero – that is, once the Fed had retained earnings offsetting its earlier losses – would the Fed resume remitting profits to the Treasury. (For details, see Carpenter et al (2015)).”

When we turn again to the consumer, “U.S. household wealth fell by $400 billion in the third quarter as a drop in U.S. stock prices outpaced gains in real estate values, a Federal Reserve report showed on Friday. Household net worth declined to $143.3 trillion at the end of September from $143.7 trillion at the end of June, the Fed’s quarterly snapshot of the national balance sheet showed. It was the third consecutive quarter household wealth has declined.”

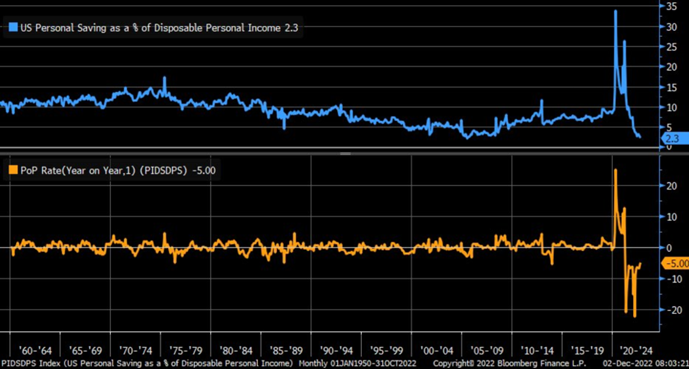

This has been reflected with a huge drop in the savings rate, which at the lowest since 2005 and before that one of the lowest of all times.

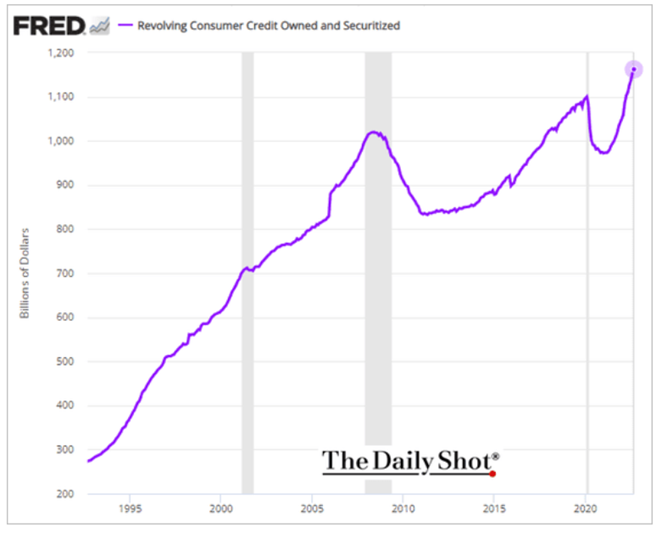

Consumers are using more and more credit to cover the additional cost of living, which has resulted in another new record of credit card debt.

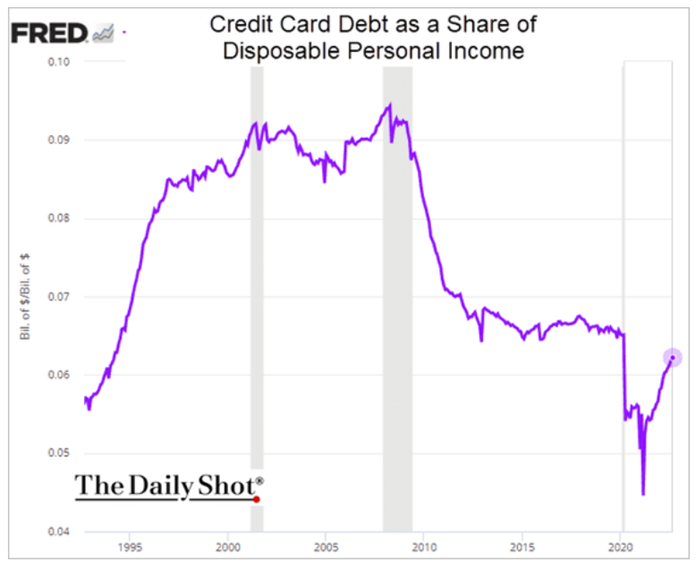

As savings dwindle, it puts more pressure on consumption and the pace in which people spend. As a part of disposable income, credit card debt is still low but rising rapidly as wage growth (should) decline and savings move to nothing.

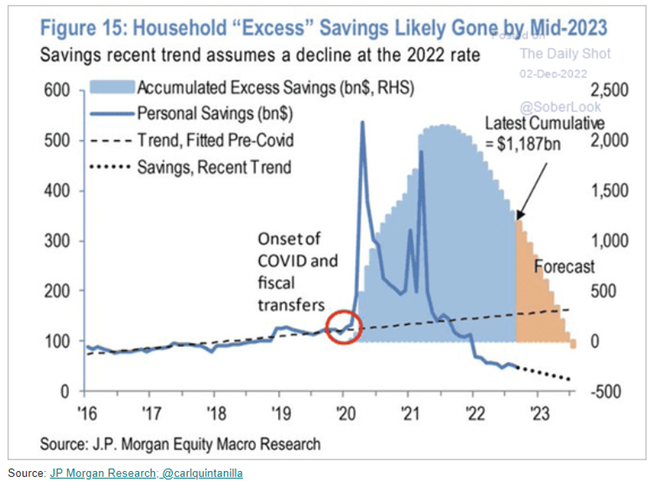

A lot of investors look at the cumulative savings value- but the bottom 85% of Americans have already burned through the excess savings (lower 50% much faster) built during COVID. The top 15% of Americans won’t be pushing the excess capacity into the market anytime soon, and when you consider the charts lopsided nature- it actually points to a bigger problem. It assumes that ALL savings are used up by the middle of 2023- but if the top 15% or so remain positive- it means the steep drop is driven by a largely negative lower majority of Americans.

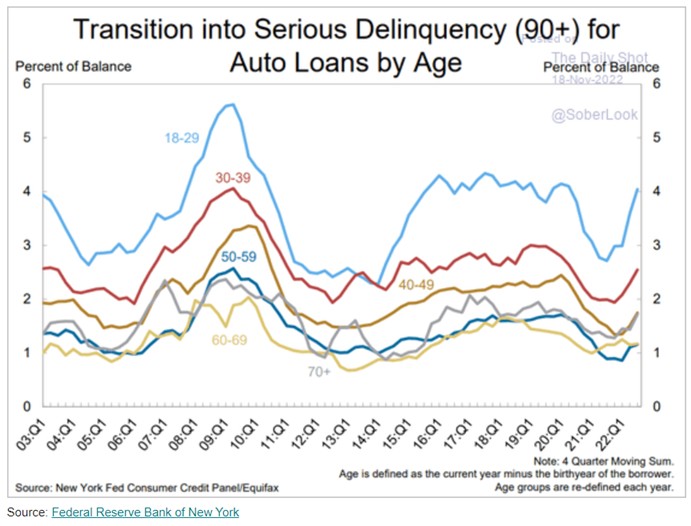

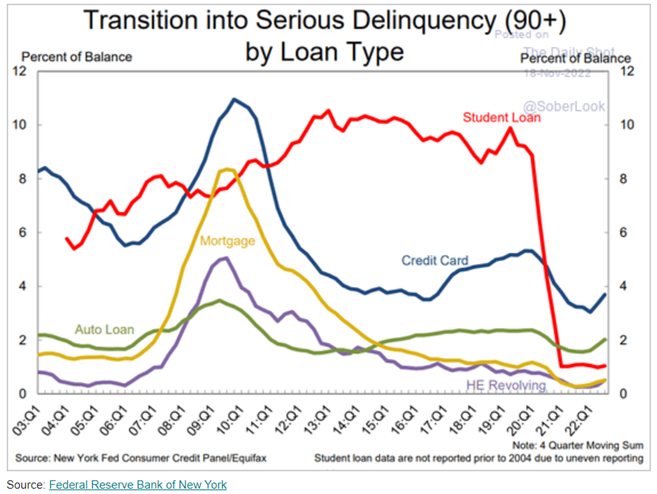

We are already starting to see that stress crop up on the delinquency front. It all starts out slow, but as we saw in 2008 things can ramp rapidly.

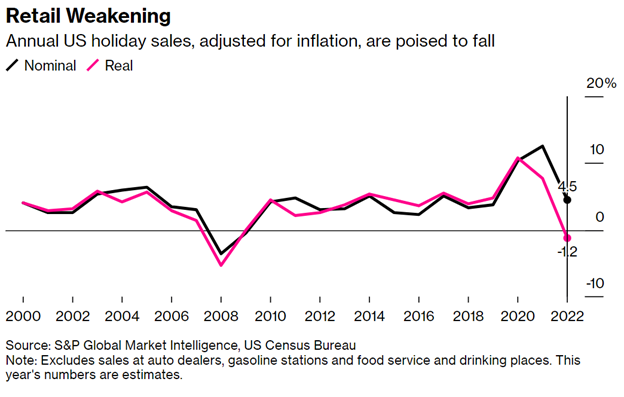

The early expectations for the holiday retail season shows a big weakness in the “real sales” levels. We expect a very weak holiday spending, which sets up for a big problem as we head into Q1’23. As the consumer slows- especially in the U.S.- it will push our GDP numbers into recessionary territory and cause the global economy to dip even further into contraction.

Next week- we are going to go indepth on the Emerging Market and Chinese slowdown. There are a lot of expectations that China coming back will absorb a lot of crude cargoes, but their economic situation still remains dire. Global manufacturing has moved deeper into contraction, and we don’t see a swift move higher any time soon. Emerging Markets are starting to feel the sting of the OECD countries now in contraction and slowing orders impacting things significantly. They have already been liquidating US treasuries to pull in dollars, and the ability to keep doing that is limited. More to come!