- Nine Energy Service’s pricing will remain steady in Q4, and the net effect is expected to be positive in Q1 2023.

- It aims to improve free cash flow generation while lowering labor and capital needs.

- Although the potential market growth is low, growth can accelerate due to the company’s differentiated service line offerings.

- Negative shareholders’ equity is a cause for concern, but positive free cash flow generation can moderate the risk level.

Pricing Strategy And Industry Outlook

We discussed Nine Energy’s strategies and drivers in our previous article. After Q3, the company’s management sees upward pressure on its pricing because of the limited availability of OFS equipment, while incremental rig activity keeps the demand side on. Higher pricing should benefit the company’s profitability in 2023. In this environment, the company plans to focus on completion tools and cementing, which had a decent performance in Q3. It looks to improve free cash flow generation while lowering labor and capital needs through allocating risk in a cyclical business. It has started commercializing tools that some of its largest customers use to improve free cash flow.

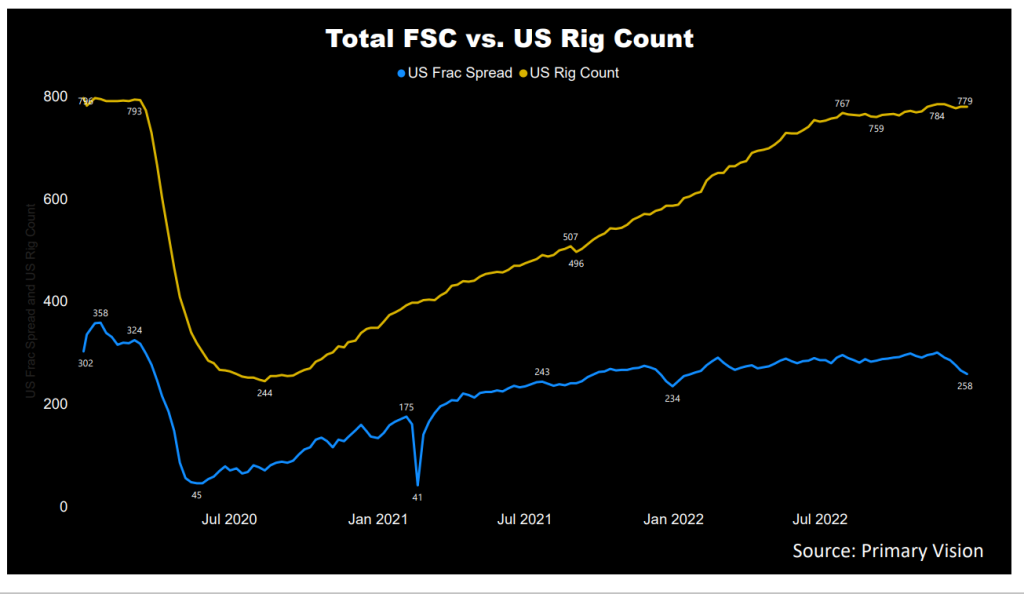

However, seasonality and energy operators’ budget exhaustion can hurt the company’s performance in Q4. In Q3, much of its growth came from pricing hikes in cementing and coiled tubing volume increase. While pricing will remain steady in Q4, the net effect is expected to be positive in Q1 2023. According to the EIA, completions activities were flat quarter over-quarter in Q3 and new wells drilled increased by 6%. The active frac spread count went up ~13% in 2022. However, it has decreased by 11% since September-end, according to Primary Vision’s estimates, which suggests a growth moderation in the near term.

The Q4 Forecast

Based on the expected pricing hike in early 2023, in Q4 2022, the company’s revenues can remain steady (at the guidance mid-point) compared to Q3. In Q1 2023, the management expects the topline growth to pick up due to its revenue diversity and the geographic and product-based spread. Although the potential market growth is low, the service line growth can accelerate due to the company’s impressive differentiation in this business. With a focus on electrification, the company plans to convert four additional wireline units to electric in 2023.

The Dissolvable Plugs Growth Trajectory

Dissolvable plugs are environmentally friendly and lower emissions compared to traditional drill-out services. Scalability and quality control has been a key differentiator. NINE’s management estimates it is among the four largest players, which share 75% of the market together. The management also forecasts that the US dissolvable market will grow by 35% in 2023. With 20% of the market share, it seeks to develop its international market, providing increasing growth opportunities. In Norway, the company recently completed and received API-Q1 certification for a multi-cycle barrier valve from a NOC. It received ~$10 million in purchase orders with opportunities to obtain additional orders.

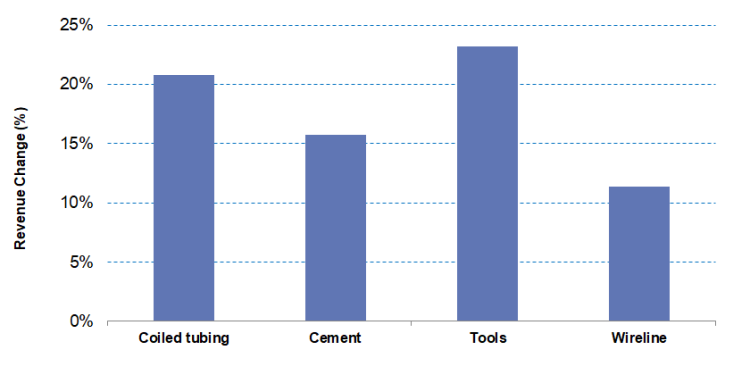

What Were The Q3 Drivers?

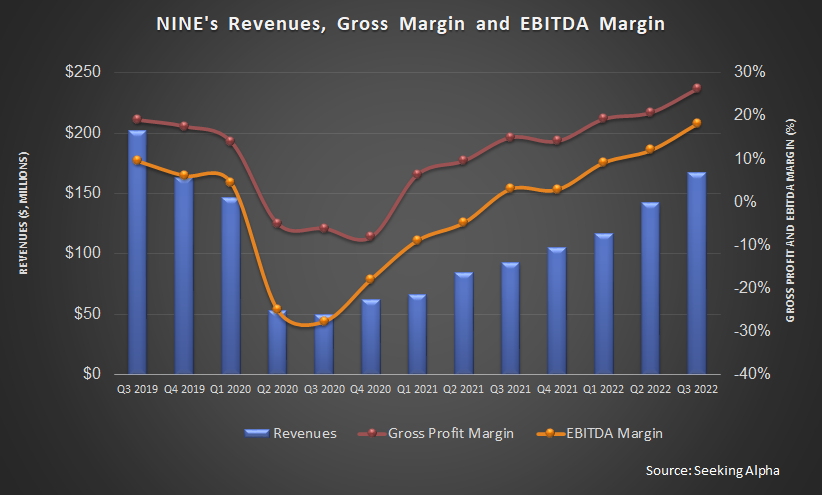

In Q3 2022, the company’s total revenues increased by 17.5% compared to Q2. Division-wise, its cementing revenues increased by 21% quarter over quarter in Q2. Technical and capital barriers helped the company command premium pricing, leading to higher revenues in Q3. Since Q4 2020, cementing pricing has increased by 58%. NINE has expanded its market share to 20%. However, cementing jobs decreased by 2%, while the average blended revenue per job increased by 18% in Q3. The company’s management expects to stabilize the margin by deploying forward-leaning slurries to help overcome supply shortages in the coming quarters.

In Coiled tubing, revenues increased by 21% in Q3 due to price traction. This led to a 61% higher coiled tubing day rate and 180% higher days worked in the past year.

The revenue growth in the Wireline business was steady (11% up quarter-over-quarter) in Q3. Since 2022, revenue per stage has increased by ~28%. The challenges to implementing the price hikes due to the extensive competition have recently been relented.

Cash Flows And Liquidity

As of September 30, 2022, NINE had $88 million in liquidity. Its shareholders’ equity, which has been negative owing to significant net losses over the past two years, made a partial recovery as net income lessened negative shareholders’ equity. However, its balance sheet is still substantially risky and may limit growth prospects.

In 9M 2022, NINE’s cash flow from operations (or CFO) turned positive compared to a negative CFO a year ago. Assuming $30 million in annual capital expenditures, the company estimates it would generate $64 million of free cash flow before changes in net working capital. With a net debt to adjusted EBITDA of approximately 2.4x, it plans to refinance its capital structure in 2023.

Learn about NINE’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.