Saudi officially came out and reduced their OSPs (official selling prices) inline with our expectations EXCEPT when it comes to the U.S. We were expecting to see cuts across the board, especially in the U.S. The U.S. is in need of heavier barrels, and a reduction in OSPs would have enabled some additional buying. Instead, Saudi cut rates going into Europe and Asia where they face competition coming from multiple fronts. In Asia, Russian Urals and ESPO barrels remain well below market rates, which will impact the purchase of lighter barrels, but we do expect to see a steady increase of heavy crude purchases. Many refiners have been running a lighter slate, but as distillate margins remain elevated vs gasoline- refiners will look to make the slate a bit heavier. Saudi cut heavy crude OSPs into Asia by a sizeable amount, which will help flows into the region. It will also provide support to Asian refinery margins, because typically any OSP “discount” goes straight to the refiner’s margin. Refiners outside of China are going to need support as Chinese assets ramp up and take advantage of the new export quotas. “The Chinese government has issued around 18.99 million mt (151 million barrels) of export quotas for clean oil products and 8 million mt (50.8 million barrels) for fuel oil in its first batch for 2023, several sources with knowledge of the matter told S&P Global Commodity Insights Jan. 3. The clean product quotas for exporting gasoline, gasoil and jet fuel are higher by 46% from 13 million mt issued in the same batch for 2022 with Sinopec as the top quota holder as usual. Overall, the total allocation in 2022 was 37.25 million mt.” As this product flows into the market, it will put pressure on refiners in Asia, which could cause economic run cuts. The distillate crack will be the key one to watch because it’s the key driver to how hard the refiners will run. Given the refined product storage situation and Chinese exports, refiners will benefit from switching to a heavier slate. KSA cutting heavy crude more into Asia will help support purchases of a heavier slate.

Even as KSA got more aggressive with the cuts on light crude into Asia, Med, and Europe- it will be difficult for them to compete against Russian glows into Asia. We have also seen an increase of flows of CPC into the European markets, increases in Norway, and Libya steady at over 1M barrels a day. Even with the cut, U.S. crudes are still very competitive which will limit demand into the European theater. Urals averaged just over $50 last month, which is still WELL below what KSA is offering and will limit the amount of flows to just term contracts. On the heavy side, they cut far enough to see additional flows into Asia and some into Europe as refiners go heavier into peak winter runs. The below charts will give you a sense of where the cuts are vs historics.

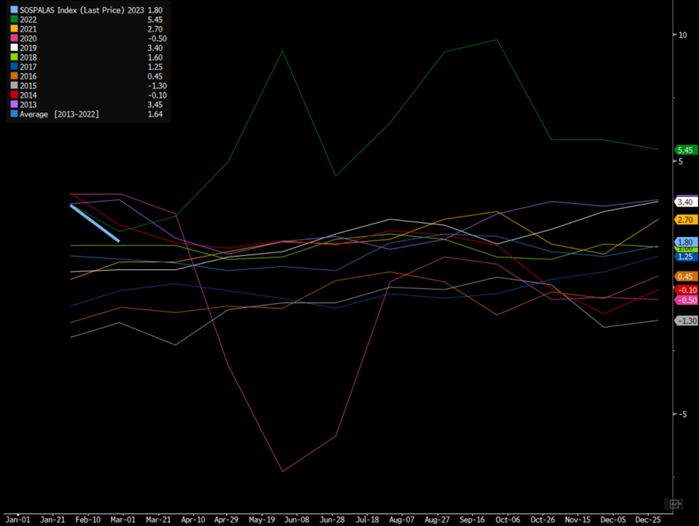

Middle East Arab Light Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

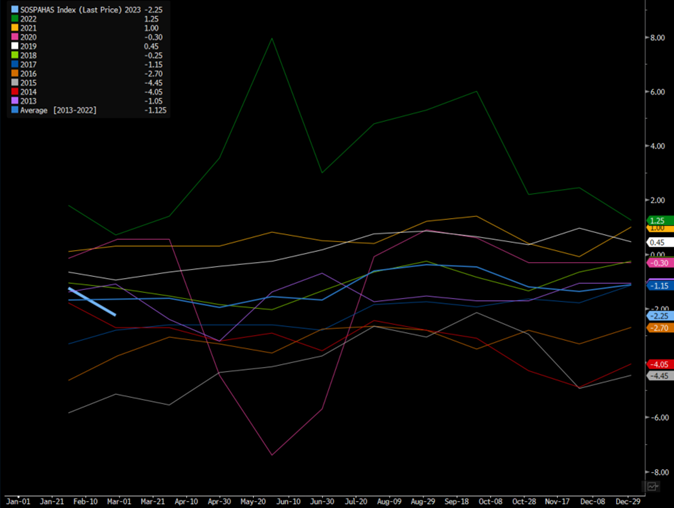

Middle East Arab Heavy Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

The above shows the steepness in the cuts against the last 10 years, and you can see the difference between light and heavy.

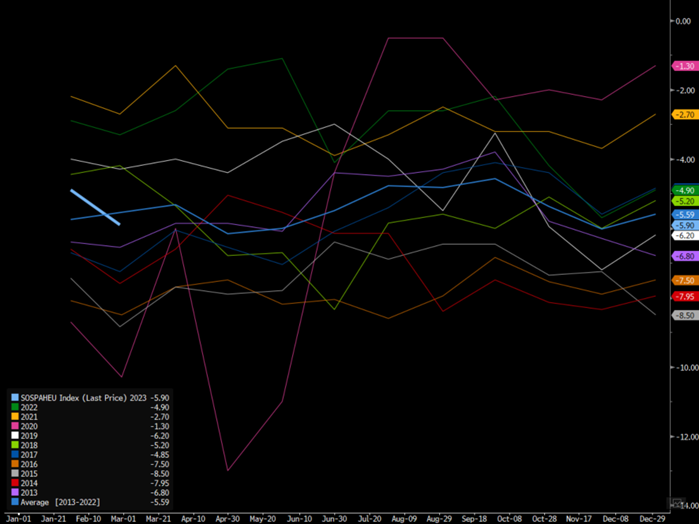

The same can be said when looking at the European splits.

Middle East Arab Heavy Crude Saudi Arabia to NWE vs BWAVE Spread

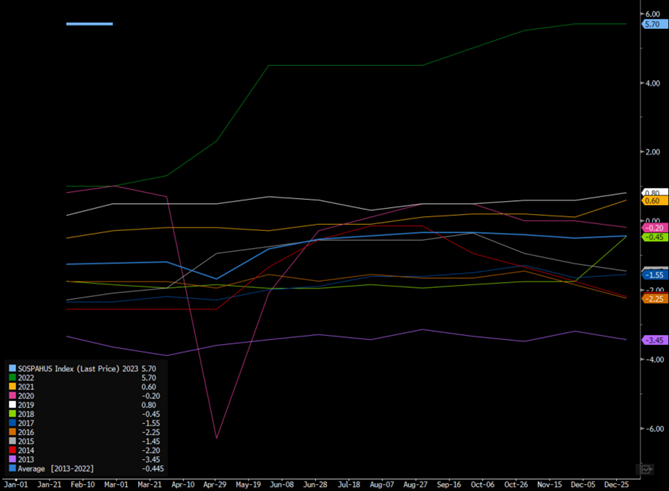

The problem with the KSA strategy is ignoring the U.S. markets. There is no need to compete on the light end into the U.S., but by keeping heavy spreads so elevated into the U.S.- you stop all flows heading into a key market. The limitations of flows into Europe and Asia on the light and even medium side will keep floating storage elevated in the Middle East. The below chart puts into perspective how rich KSA is into the U.S.

Middle East Arab Heavy Crude Saudi Arabia to US vs ASCI Spread

Even with the cuts by KSA on the light side into Europe and the Med, we don’t see that impacting U.S. crude exports. The cut on the light side into Asia will reduce purchases from the U.S., but the demand from Europe will be enough to keep us at about 3.7M-3.8M barrels a day into the market. India, South Korea, and Japan have been decent sized buyers of U.S. crude, and the cut by KSA will help close that arbitrage. SK and Japan aren’t buyers of Russian Urals or ESPO, so the cut by KSA will move crude into those markets while India and China remain buyers of Russian crude.

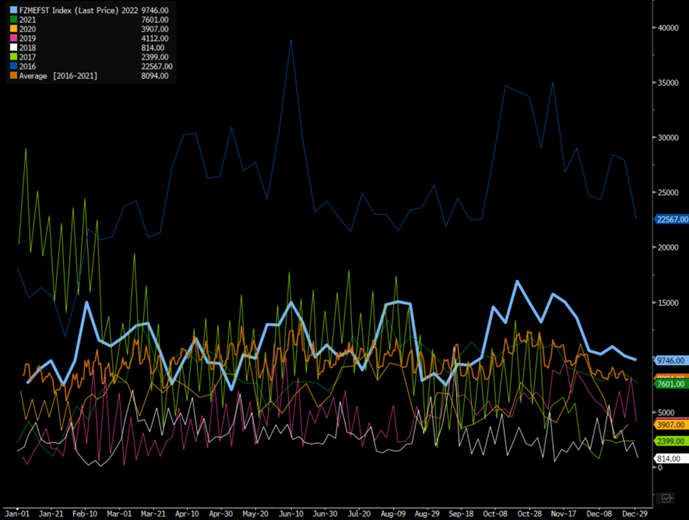

The below chart puts into perspective just how elevated floating storage is to kick off the new year. We don’t see a huge shift in the near term of the storage situation, which will be important to watch for future OSP cuts.

MIDDLE EAST CRUDE OIL FLOATING STORAGE

OPEC flows rose slightly as in December vs November driven by West Africa. Nigeria was the biggest driver of the bump, but these numbers are still well below OPEC quotas. This just means that any OPEC+ “cut” would be in name only because they are still over 1.5M barrels a day below allotments. A large part of that is driven by Russia and West Africa, which is also helping to keep a floor in crude futures. If OPEC+ was actually producing at quotas given the economic backdrop, crude prices would be about $10 lower.

As we progress through January, we don’t see a big shift above the Dec numbers. Based on the tanker tracking data, we see things fairly stable with a potential bump of about 100k barrels a day. So in a market with demand of around 100M, you are looking at a rounding error.

Saudi December exports were stable as well, and we don’t see a huge change in January. There could be a bigger bump in February following the reduction of OSPs.

There still remains a huge amount of crude sitting in the water between “in-transit” and “floating storage”, which see persisting throughout 2023. The Russian sanctions will put more crude on the water and for longer periods of time (miles per ton) as flows head east instead of west.

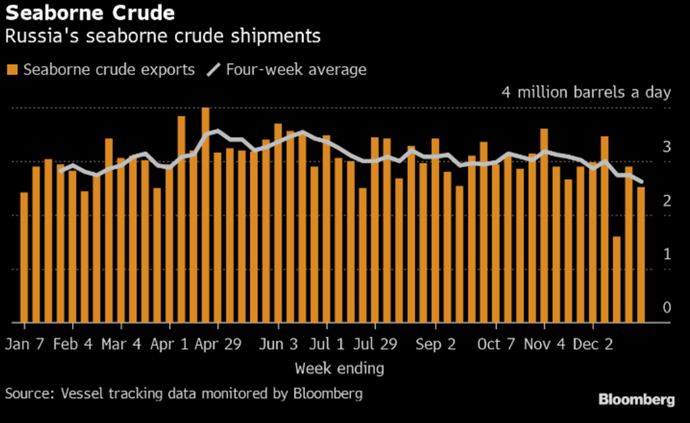

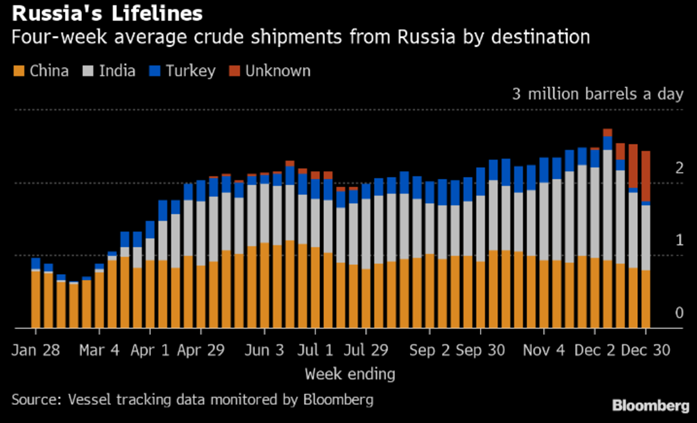

Russian flows slowed down into year-end as many offtakers were already saturated with Urals and ESPO. We see additional purchases picking up in Jan and Feb, which will keep Russian flows fairly stable throughout Q1.

Russia continues to send volumes into the Asian markets pre-emptively as well as trying to “disguise” the end buyer. There has been an increase of “unknown” buyers as volumes move into Asia ahead of buyers and to help protect some identities.

Supertankers into China slowed into year end but that was after a big surge in buying that kicked off in October and lasted into the beginning of December. This put way more crude in floating storage, and provides a cushion for China as activity picks up following the end of lockdowns. We still believe that China “underwhelms” on internal demand given the economic backdrop, but it will still provide some relief in the near term.

China Supertanker Crude Imports

The below chart showing Asian floating storage puts into perspective just how much crude is waiting offshore. This doesn’t include the big increase in onshore storage, which was being built up over the last few quarters as refinery run rates remained depressed.

ASIAN FLOATING STORAGE

As the economic backdrop weakens, there will be more pressure on crude pricing. So far differentials have remained balanced with some increases and other decreases depending on grade.

PLATTS:

- Vitol withdrew an offer of 300k bbl of Nigeria’s Brass on a CFR Augusta basis for Jan. 12-20 arrival at $6/bbl more than Dated Brent: person monitoring Platts; cargo loaded from tanker Neptune Moon

- Declined from +$6.20/bbl on Jan. 3, +$6.35 on Dec. 29, +$6.40 on Dec. 28, +$6.50 on Dec. 23

SPOT MARKET:

- Djeno differentials are set to gain support in the current trading cycle for February loading from lower freight rates, a more favorable Brent structure and the prospect of Chinese demand returning as the country opens up, according to traders

- OIL BAROMETERS: Brent Spread Slumps; 50-Day MA Break Fails

- February trades yet to emerge; January’s Djeno cargoes cleared last month at levels below Dated Brent -$6.50/bbl: traders

Average price for Russia’s Urals crude fell to $50.47 a barrel last month, the lowest since December 2020, according to Finance Ministry’s statement.

- That’s a 24% drop from November and almost a 31% decrease from a year ago

CASPIAN CPC TANKER TRACKER:

- Observed flows of Caspian CPC Blend crude rose last month to the most since February, with shipments to the Mediterranean at the highest in more than four years

- About 5.88m tons, or 1.5m b/d, of CPC Blend were lifted in December, highest since February, and compared with 5.67m tons, or 1.49m b/d, in November

PLATTS:

- Mercuria offered Forties at Dated +80c/bbl, CIF Rotterdam for Jan. 18-22 or Jan. 22-26: trader monitoring Platts window

- Compares with +$1.55 for its previous offer on Wednesday

- Shell bid Forties for Feb. 2-4 at Dated -50c, FOB

- BP withdrew offer for Forties for Jan. 22-24 at Dated -40c, FOB

Vitol offered Gabon’s Rabi Light crude on Platts at a deeper discount than in mid-December. Spain’s imports of crude from Nigeria in November plummeted to the lowest level in more than six years.

PLATTS:

- Vitol offered 430k bbl of Rabi Light on CFR Rotterdam basis for Jan. 7-15 arrival at $7.15/bbl less than Dated Brent: person monitoring window

- The company offered the same grade, earlier dates, at -$6/bbl on Dec. 16

The shifts in grades and differentials will keep floating storage elevated and government sanctions on Russia will maintain a large amounts of crude in transit.

Global Crude Oil on Water

Many emerging market countries kicked off the new year by raising gasoline and diesel prices. There are many areas around the world that subsidize their fuel prices and set prices. As we moved into 2023, we have seen nations starting to “mark to market” fuel prices to the current oil price. Emerging markets are going to struggle more in 2023 as manufacturing slows, central banks have to maintain a rate rising cycle, and fiscal support diminishes.

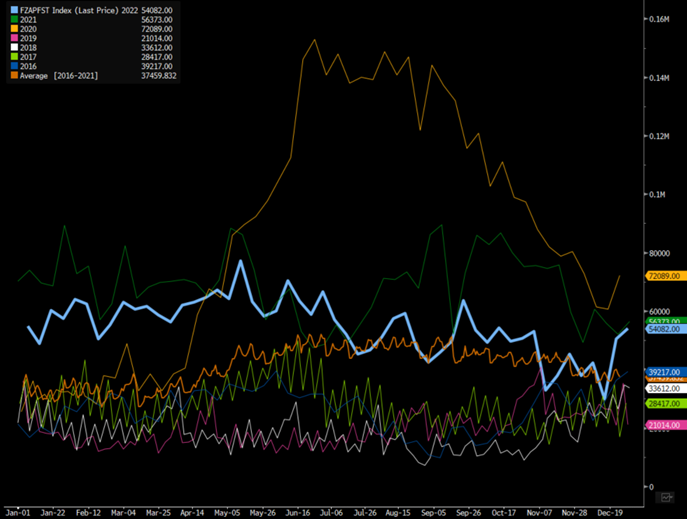

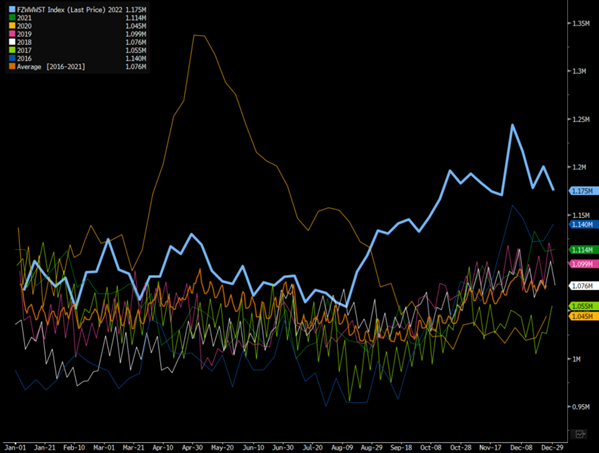

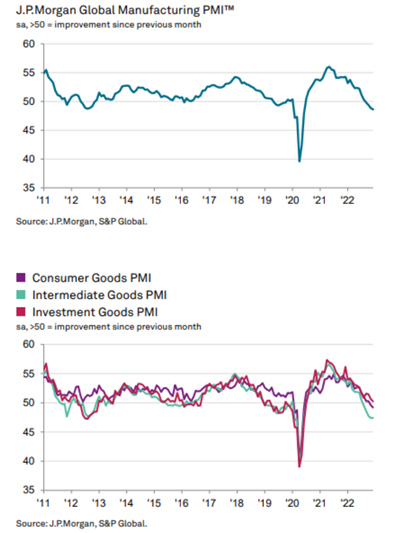

The leading indicators for manufacturing all point to additional headwinds when we factor in new orders and new export business. These are important pillars for all markets, but more so for the Emerging markets and export-oriented economies.

The world dumped an absurd amount of liquidity into the market from 2020-2022, but we have been seeing “easy” monetary policy since 2008. This has culminated with the largest synchronized rate rising cycle in history with more pain ahead. All of this points to an expensive cost of capital, reduced CAPEX, and ultimately a drop in diesel demand. The problem is- as demand wanes so does supply, and which one wins out for the month or quarter will vary wildly.

European economic activity is set to slow further as rates move higher across the region. The ECB will push rates higher and all of the ARM (adjustable rate mortgages) will “re-rate” higher hitting the wealthy in the region. Even as demand slows, we are seeing more run cuts from European refiners all while CPC flows move back to the highs. “Observed flows of Caspian CPC Blend crude from the terminal near Russia’s Black Sea port of Novorossiysk rose last month to the most since February, with shipments to the Mediterranean at the highest in more than four years.

- About 5.88m tons, or 1.5m b/d, of CPC Blend were lifted in December, according to port agent reports and ship-tracking data compiled by Bloomberg

- The daily volume was the highest since February, and compared with 5.67m tons, or 1.49m b/d, in November”

CPC and Libyan flows will remain elevated throughout Q1 and help supplement the loss of Russian crude as demand diminishes in the background.

We expect Brent to trade range bound with the first line of support around $82, but a lot of staying power between $78.50-$80. It’s unlikely to make any real sustained move above $86 throughout January or Q1’23. The buying levels would be sub-$80, and we would be sellers above $85. China is sitting on a significant amount of crude in storage, and they have already been buying up a lot of cargoes over the last 6 weeks or so. We expect to see additional pressure on purchases in January, which will push physical prices lower and put Brent into a fairly tight range.

WTI is going to suffer a similar fate- there is stronger support at $74, but it will likely hold $76 in the near term. We don’t see any sustained moves above $80- so we would be buyers at $74 and sellers above $80 to capture the volatility. Volatility is going to be the name of the game as we have bullish and bearish cases jockeying for position. Even as the “micro” has some bullish backdrops, such as a potential OPEC+ cut- the macro picture continues to deteriorate from an economic and trade perspective. Two charts that I think are very important is the global shift in “real wages.” Paychecks in 2022 fell for the first time going back to 2006, and it’s unlikely to get any better as we usher in stagnation for the next few quarters.

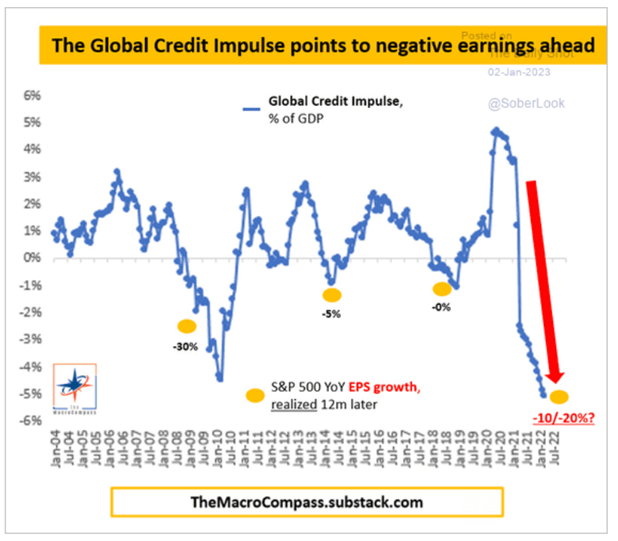

This is all happening as credit impulses implode around the world and drag down global GDP with it. These two key components point to a slowing consumer, slashed corporate CAPEX, and a broad slowdown. The recession is now upon us all, and the macro will keep crude prices pinned lower with a ceiling. The bullish side (the floor) remains the lack of new supply coming to market, and with a rise in the cost of capital and the new “windfall oil taxes”- we aren’t going to get any new supply anytime soon!

As liquidity is drained from the market, we are going to see an earnings recession only gain speed throughout Q1’23.

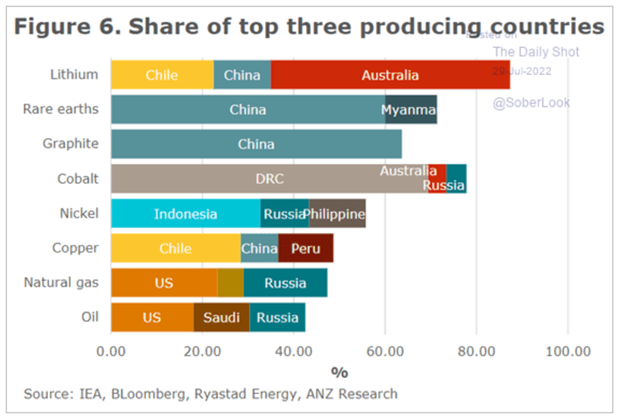

We are living during an interesting time with a strange amalgamation of weakening demand as a global recession kicks off, but the world is increasingly short supply in some key commodities. Copper is one of the pivotal base metals that the average person takes for granted. It’s used in everything from electrical wires and generators to everyday appliances. It is also one of the most important ingredients for the green transition with a huge amount being consumed by electric vehicles, wind turbines, and solar farms. But, funny enough, some of the countries responsible for mining it has reduced activity because of the ESG implications. Essentially, the countries producing copper are saying it isn’t environmentally friendly to extract it from the ground. One of (if not) the most important raw material for the energy transition has been deemed “unclean.”

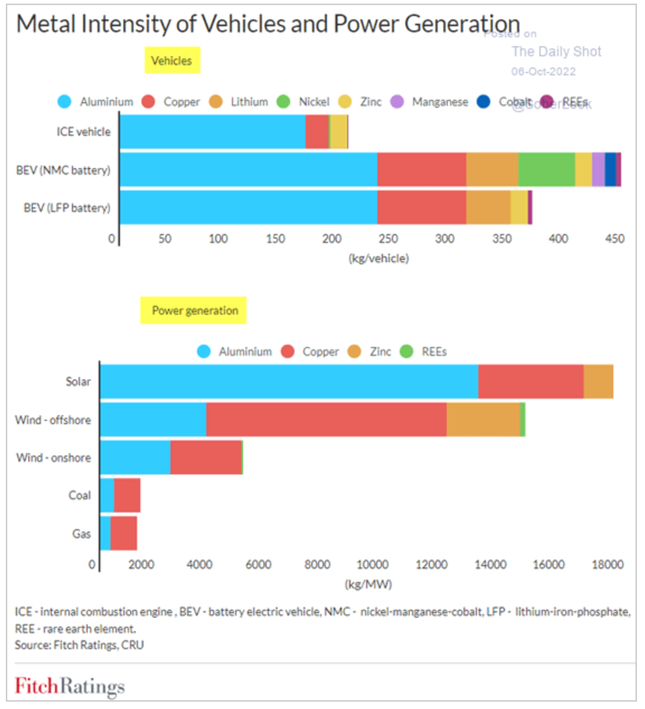

Two of the most important materials in these conversions are aluminum and copper, both of which consume a significant amount of electricity and diesel to extract from the ground and process. The below chart helps put into perspective just how important each commodity is for the energy transition to take place.

It also increases our reliance on China even more because of their responsibility for refining the raw materials. This is a perfect example of “green washing.” We extract the raw material in an emerging market (Chile) and have it sent to China to be processed. About 65% of China’s grid is powered by coal- or said another way- China’s use of coal for power would be enough to cover the full electricity needs in the U.S. Essentially, China is using fossil fuels and “less than desirable” methods to process raw materials. This enables to green transition companies to buy the intermediary goods and claim use them to create “green” products. If we do cradle to grave analysis, I think we can all agree that many of these products are far less “green” than the marketing would imply.

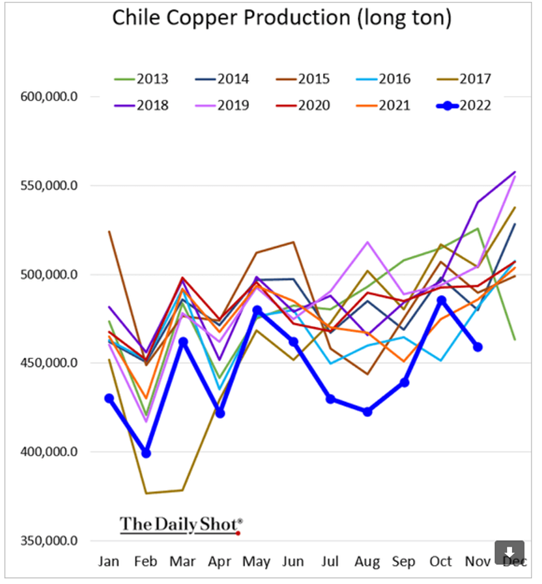

Chile is one of the most important countries in the world when it comes to copper production. They are the largest producer in the world, but the current governments is looking to curb investment and expansion of production.

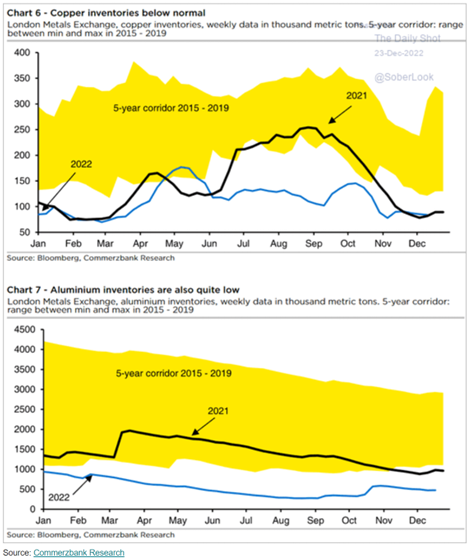

Even as the world slips into a recession, we still need raw materials for our everyday lives, and so far, governments around the world are increasing subsidies for green technology and supporting the energy transition. This will provide a strong tailwind for long term demand for key raw materials, such as copper and aluminum. The slowdown in housing is an important headwind that can’t be ignored because it is also a huge consumer of raw materials. But, even with housing slowing, storage of these key commodities are at multi-year lows.

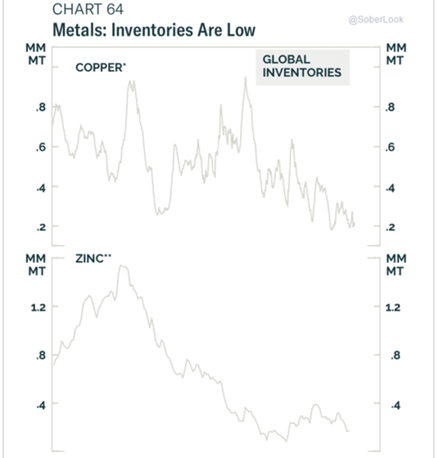

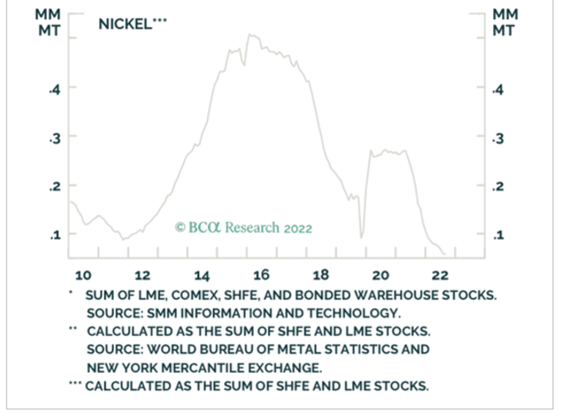

The below chart puts into perspective just how low the world is in copper inventories.

It’s important to consider that copper inventories have dropped through a floor even as housing and manufacturing has slowed considerably. There is still some active demand from housing because we still have a significant amount under construction, which has helped maintain demand even as new permits have fallen through a floor. The problem is- even as demand slows- we are getting a huge move down in supply. Chile is the largest producer of copper in the world, but they are currently producing at the lowest level going back to 2013.

When we factor in slow production and multi-decade lows in global inventories, there is going to be a lot of pricing support even in the face of a recession. There are still homes to be built- a record remain under construction, and we still have a record amount of 5+ multi-family buildings still being built. We expect this to be near term support, but as the homes are completed- we don’t expect terrible data going forward. But as production remains low and global storage at the lowest level since 2010, there is a lot of stability in current commodity pricing.

As headwinds grow for new mines, it makes the current ones all that more important and valuable. Energy infrastructure around the world is in shambles with shortfalls and aging assets around the world across all facets of our everyday lives. We have seen firsthand the issues with our grid and available dispatchable electricity. Any of the solutions from new natural gas fired to wind turbines all require a significant amount of copper. Countries will also need to run new power lines, which are… you guessed it… FILLED with copper. We have ignored our aging infrastructure for decades, and it has to be addressed today. The “Inflation Reduction Act” (which will do everything BUT reduce inflation) and the “Build Back Better” bill haven’t even begun to deploy cash into the U.S. markets. This will provide another tailwind for spending across various green initiatives and other infrastructure projects that all consumer a significant number of base metals.

As grids around the world are expanded, repaired, rebuilt- copper will be at the forefront of the boom. When you marry that with commentary from the CEO from FCX: “Global Copper inventories remain at historical levels. You see production reports from producers across the globe, reporting challenges in meeting their production targets. And the industry is facing increasingly challenges in developing new suppliers. In the current environment, stretch supply chains, production shortfalls are becoming commonplace and cost curves are rising.”

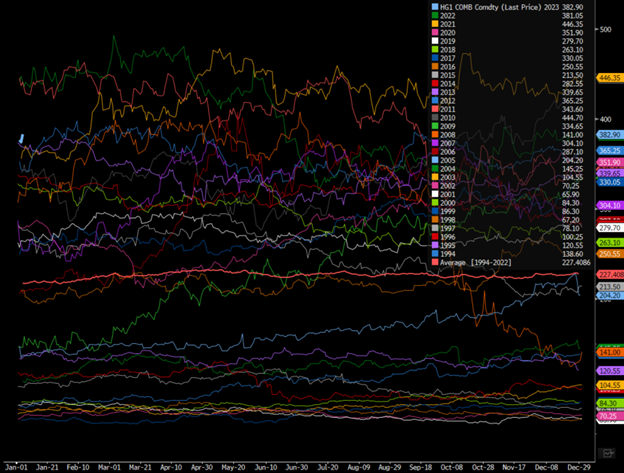

Copper prices are kicking off the year with a bang, and while there are obvious headwinds- the medium to long term trend is moving in their favor. The Freeport management is very aware of the headwinds ahead: “The macroeconomic sentiment continues to be weak and you all see that in your everyday lives. On the other hand, the fundamental physical copper market is strikingly tight, globally right now. The macroeconomic situation is driven by the strengthening US dollar, the Fed and Central Banks tightening, concerns about China dealing with COVID in its property section and then the serious problems in Europe coming out of the Ukraine situation, and how that’s affecting energy prices and economic outlook.”

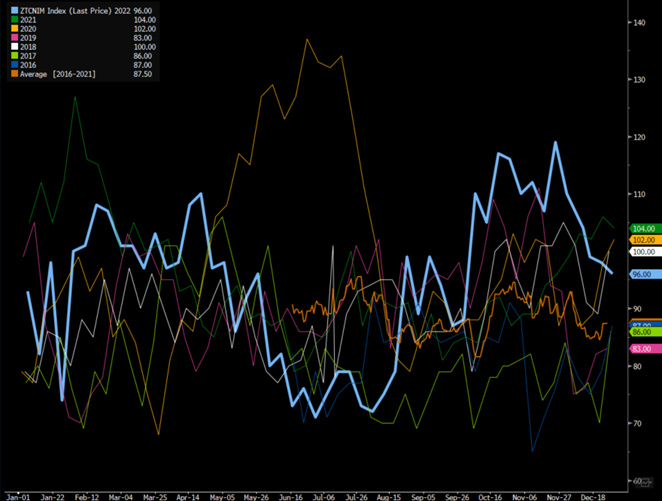

Seasonally Adjusted Copper Futures Price

China is in the process of reopening, and even though it will be WELL below market expectations- it still provides a positive tailwind for production. In my opinion, as China reopens it will help offset slowdowns in the ASEAN nations which has started to pick-up steam. Just by China moving back to a more “normal” operation vs strict lockdowns will provide a boost to demand. It will not be huge given the global recession, slowdown in trade, and their housing issues- but they will have to purchase new supplies to get factories back to somewhat normal operations. This will help put a floor in pricing even as manufacturing worsens in other areas of the world.