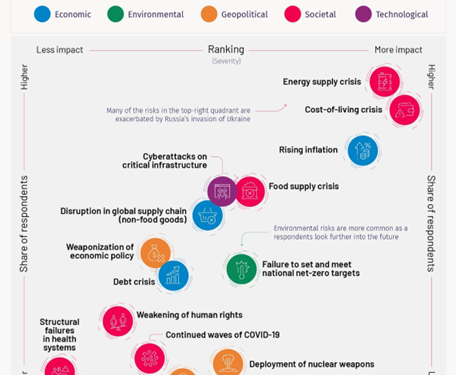

We have been very adamant about the problems facing the world today- including broad food issues, supply chain bottlenecks, energy supply limitations, and rising inflation hitting every facet of life. We now have an update for “The Top Global Risks in 2023,” and we aren’t surprised to see our main concerns developing over the last 3 years appearing as the top 4/5. Cyberattacks are a real concern as we saw it shut down the colonial pipeline for several weeks as just one of many examples. The world is short molecules and other pivotal commodities that is creating more volatile and supply chains susceptible to shocks. Stagflation is a real problem that we face as inflationary pressures remain as the economy weakens further. The dark horse in this race will be the debt crisis, which is being overlooked by some in the market. We spoke last year how the BoJ was going to be forced to raise the ceiling on the 10-year bond, which has now happened twice. The market keeps pushing harder against it, and eventually the BoJ will be forced to yield. This will create a cascading impact on the rest of the world beginning in Asia. The inflation and employment data in the U.S. is going to keep the Fed on pace to raise rates further and likely put us between 5%-5.25% for all of 2023. This will increase pressure on Emerging Markets that are feeling a growing amount of economic pain. We have outlined this over the last few months, but the bigger problems are going to expand in 2023.

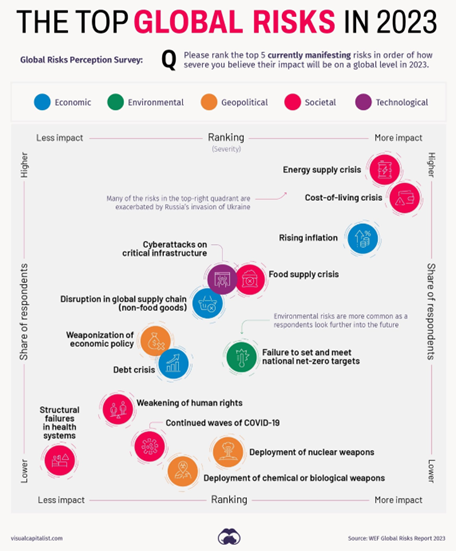

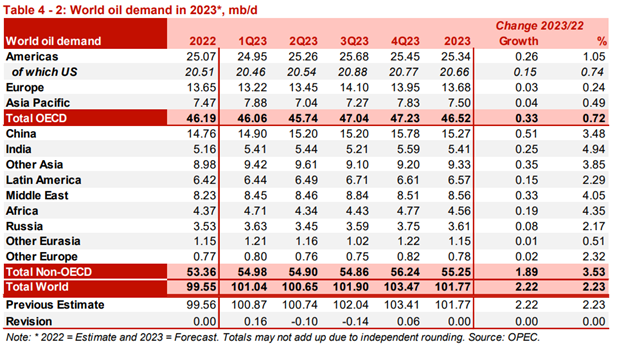

OPEC put out their most recent data for December, which supports our recent commentary regarding supply vs quota. The growth in supply was minimal at 91k barrels a day driven by West Africa and Libya with the Middle East being fairly flat month over month. We saw (again) the decline in Venezuela production as CVX works on trying to increase production. Chevron did import the first cargo since 2019, but we don’t see a step up in production for a few quarters.

“Chevron’s Pascagoula refinery in Mississippi received 236,892 barrels of heavy sour Boscan crude on Wednesday, according to US Customs data.

- Oil on board of the vessel Kerala, the first Venezuelan shipment to arrive in US since May 2019, comes after US eased sanctions by allowing Chevron to resume production and exports of crude in the country”

OPEC+ producing below their quotas is the biggest driver for crude prices remaining at these elevated levels. Demand is going to remain under pressure as the global economy pulls back, but as supply remains constrained it will stay elevated- while range bound.

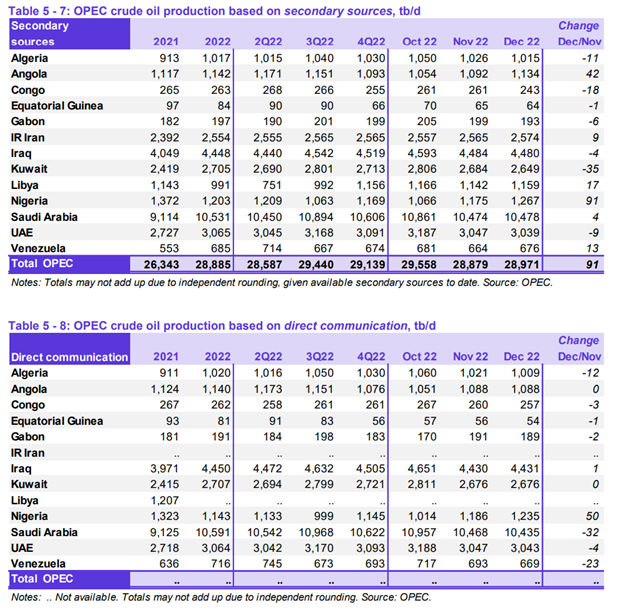

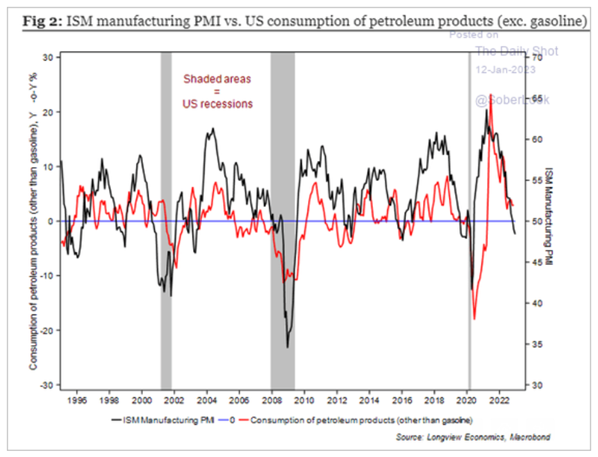

Demand estimates were reduced slightly, but the growth in petrochemical facilities around the world will help insulate some of these estimates. We are seeing a steady rise of NGL (natural gas liquid) demand that will help support some of the demand flows. It will help offset some of the declines in distillate and gasoline demand as we get a reduction in those products. We believe these estimates are still too high, but we likely won’t see the same level of decline that we got during the 2008 financial crisis.

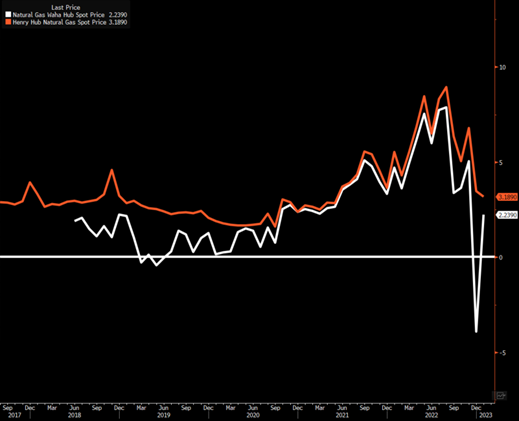

There are many factors that come into play when you look at the profitability of company that derives value from a commodity. Source rock, location, differentials, type of product… so many things to evaluate when we discuss profitability. There are various trading centers for different types of products, and one that you will hear us talk about often is WAHA as activity in the Permian increases. Henry Hub is the uniform place that people quote natural gas prices, but there are various pricing centers for natural gas that will adjust the profitability of a company. There are many issues facing Waha, but the two biggest are- increases in volume and bottlenecks on takeaway. There is a shortage of pipelines taking natural gas out of the region while a large part of U.S. completion activity takes place in the Permian.

Companies exposed to Waha will make less money than E&Ps that can sell product at Henry Hub or Perryville or Transco. The Permian is in a prime spot for crude oil takeaway, which remains the biggest factor for the region. Natural gas isn’t the focus, but it can become a headwind for companies that produce “lighter” crude. This typically results in an increase of natural gas that has to be sold, and the Delaware basin has a VERY high liquids level. As wells age, the oil gets “lighter” and more natural gas is produced.

Natural gas liquids will prove to be a great place to be over the long term, but in the near term- we have had a surge in production with falling demand. The discount for natural gas liquids has increased with petrochemical utilization dropping significantly.

We are also heading into a growing global recession that will inherently pull-down broader oil demand. When we layer in manufacturing data, you can see that as activity dips so does the demand for petroleum products- specifically distillates. As refiners cut runs, it will leave more crude in the market and drive-up storage in many key regions. One of those regions happens to be PADD 3 (Gulf of Mexico) where Devon sells the lion share of its ultra-light, sweet crude.

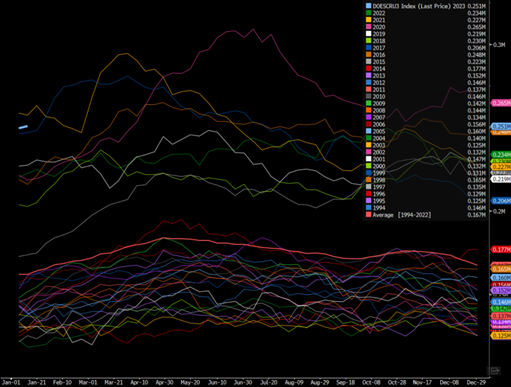

Saudi Arabia and Russia are competing to sell crude in Asia, which will drive down the demand for U.S. flows into the region. We will see volumes remain competitive into Europe, but as refiners slow activity along seasonal lines- it will create a slowdown in demand. The U.S. just reported the second most crude in PADD 3 storage going back to the last 30 years, and we see more builds rising over the next month and a half. The only time PADD 3 had more crude in it was 2021, and based on the import patterns and seasonality- we will likely outpace 2021.

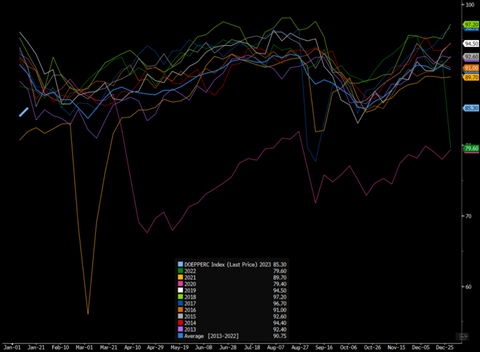

Another big headwind is the drop in refining activity as demand wanes. We will likely see some additional recovery of refining activity back to about 90% utilization rate, but that will still fall far below the “normal” levels of activity.

E&Ps are seeing more competition from local producers in the region, pricing pressure on key takeaway regions, and an unfavorable macro backdrop. They are also facing a rise in completion costs driven by labor, equipment, and material shortages. Steel prices are still at record levels by a wide margin as the availability of horsepower remains hindered.

Completion crews are also harder and harder to come by as equipment shortfalls remain pervasive across the U.S. There are only about 315 crews available to work, but they are also dispersed across the U.S. The Permian is much closer to fully sold out, which causes a bidding war to have oilfield service companies come to your acreage. Even after the seasonal slowdown, Permian activity remains near the highs, and there will be a continuous shortfall of equipment well into 2024/2025.

The limitations on takeaway capacity from the Permian keeps product stuck in the region with limited pricing power. As supply remains elevated and demand wanes, realized prices will come under more pressure. Mont Belvieu a key pricing point for natural gas liquids saw a nice bump in the near term, but we see additional pressure on pricing in the near term. There is usually a seasonal bump that benefits the region, but petrochemical demand still remains WELL below normal.

The rise in supply and drop in demand has resulted in a multi-year high storage backdrop for propane, and will impact pricing over the next several months.

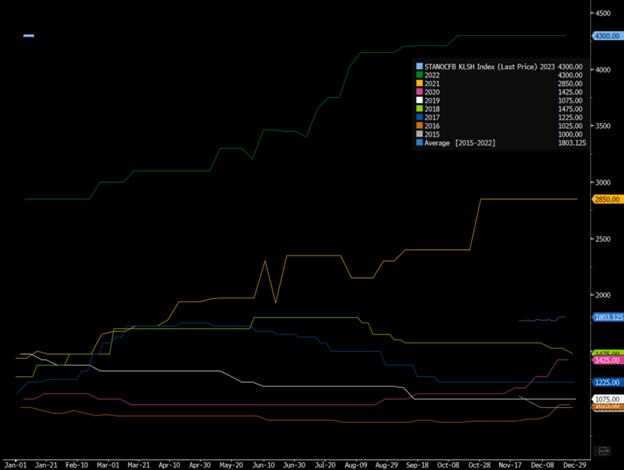

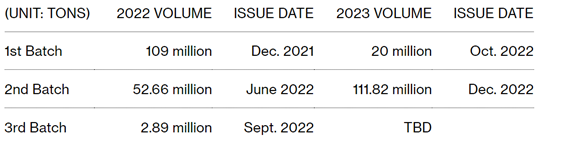

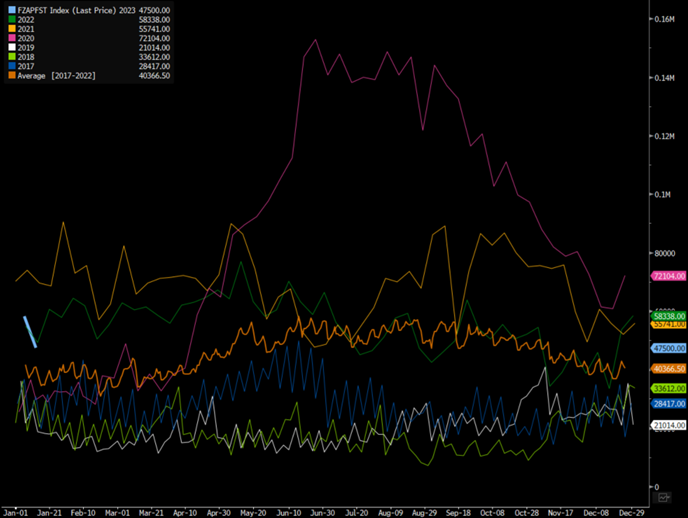

WTI crude pricing is going to remain range bound, and right now we are at the top of the range. The market “narrative” is built around a reopening China boosting total crude demand. The problem with this thesis is the general volumes building up in the market. China increased the import quotas with a sizeable bump between 2022 and 2023, but a lot of the crude was purchased ahead of the announcement.

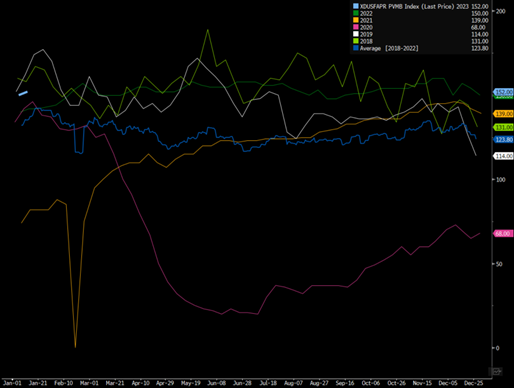

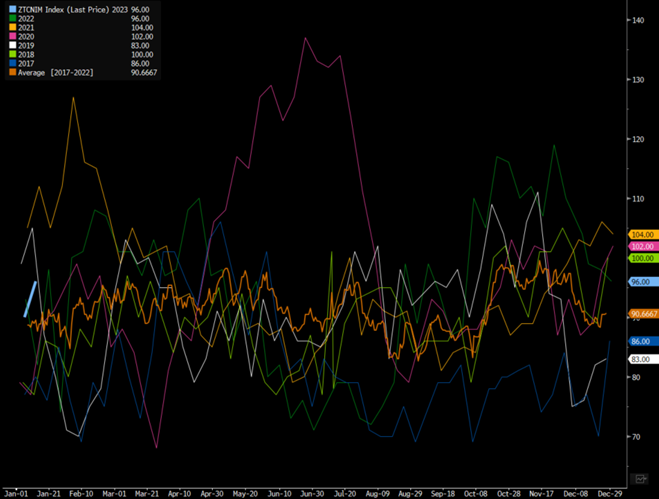

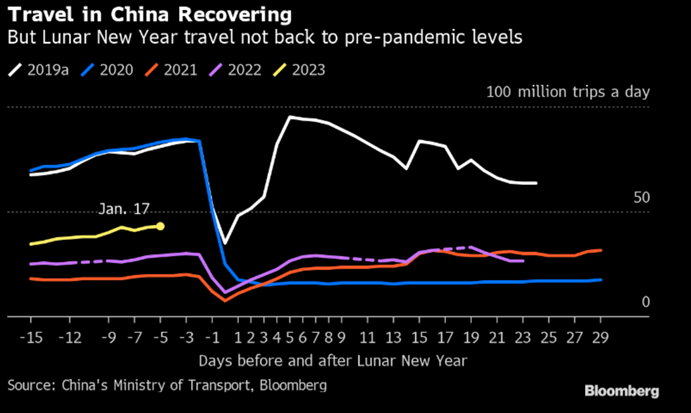

Super tanker purchased surged last year and has so far maintained a normal trajectory in the new year. There was a lot of hope put on Lunar New Year, but so far we have seen a weaker than normal travel schedule.

It’s well above 2021 and 2022, but still well below the “normal” spike in activity. This is happening at a time when China has a near record amount of crude and refined products in storage. The level of activity is going to keep a lot of that product locked up in storage and promote additional exports into the market. “The government has released 18.99 million tonnes of quotas to cover mostly gasoline, diesel and jet fuel exports, up 46% versus 13 million tonnes allotted a year earlier, reported by consultancies JLC and Longzhong, both of which have closely tracked Beijing’s fuel quota policy in recent years.”[1]

The increase in exports was meant to promote an increase in refining activity to balance their markets. This offers up an opportunity for refiners to fill a rise in internal demand and export the excess to balance out storage a bit better.

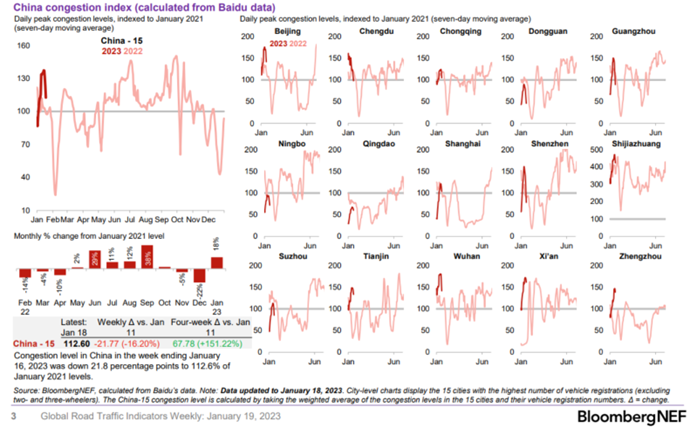

China had a bit of a bump that has faded quickly as less people travel as COVID cases keep movements limited. This will push more product into the export market and result in another spike in storage within key markets.

Asia is still sitting on an abnormal amount of crude in floating storage with more arriving daily as the super tankers show up on the coast. As Russian sanctions ramp again, even more product will be directed into the region putting another layer of pressure on the region.

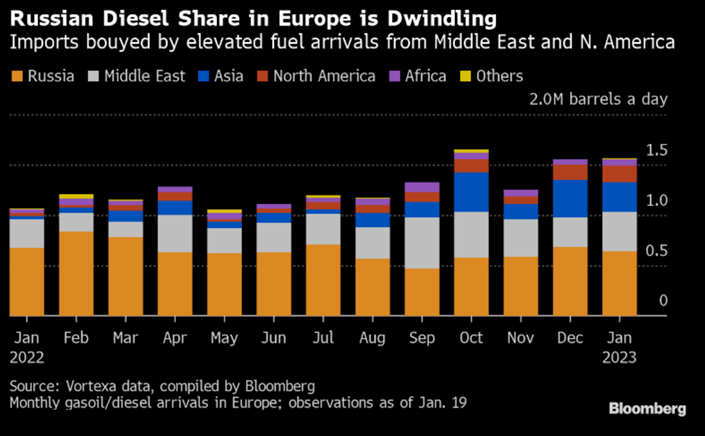

There will be at least 600k barrels a day of Russian diesel that will have to find a new home. European purchases surged as they absorbed as much as possible before sanctions kick in on Feb 5th. These barrels that were initially being purchased by Europe will now flow into Asia and the Middle East pushing up storage and putting pressure on local crack spreads.

According to Bloomberg, “Diesel-type fuel cargoes originating from Russian ports are set to fall to about 637,000 barrels a day this month. The drop in Russian flows is likely to be outpaced by an increase in supplies from the Middle East and North America, a trend that probably will deepen after Feb. 5 when the EU bans almost all imports of Moscow’s oil products as a punishment for the war in Ukraine. Mideast arrivals in Europe in January are set to reach a three-month high at about 397,000 barrels a day. Imports from the Americas, mainly the US, are set to surge to more than 164,000 barrels a day, the highest since October 2020, according to Vortexa Ltd. data.“Early indications for the first half of January show that Europe will be well supplied with seaborne diesel imports despite a drop in volumes from Russia since December,” said Pamela Munger, a senior market analyst at Vortexa. “

These shifting flows are going to reverberate throughout the system as Russian volume displaces normal trade channels and results in builds. Asia is facing an increase of Russian and Chinese exports that will put pressure on crack spreads and result in economic run cuts in Asia. This will reduce crude demand in the region so even if Chinese demand increases- it will be offset by a reduction in demand for the rest of the area.

The market continues to “ignore” recessionary fears, and now is a time to capitalize before it’s too late.

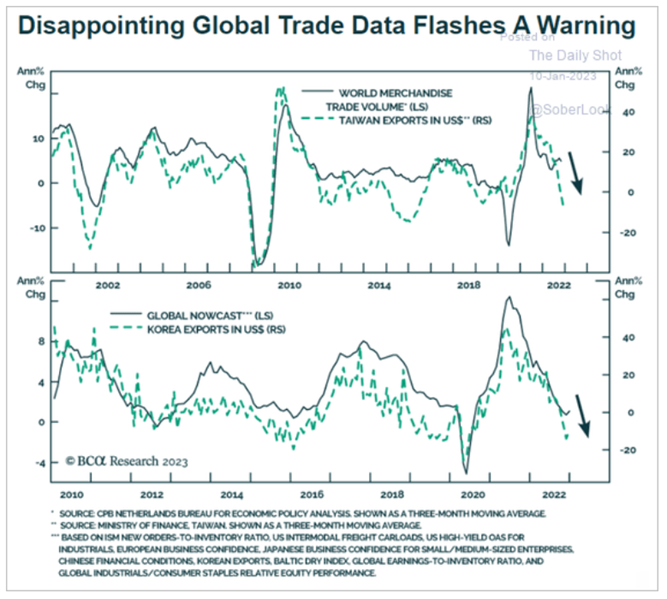

China is also reopening into a weakening economic backdrop, and something MUCH different than the other times lockdowns ended. The last time China reopened the market was experiencing one of the worst inventory shortages in our history resulting in a massive surge of new orders. The shipping/trucking market skyrocketed, and exports shifted higher. We are now in an environment where inventories are considered “too high”, global trade is slowing, and the global consumer is spending less. When we look at key leading indicators on exports, we can see a big shift in flows, and this is still at the very early stages of the decline. The below key data points are a warning signal that less product is moving into the market, but more importantly, less will be coming to the U.S. As less “stuff” comes to our ports, it means that shipping, trucking, and rail companies will have a reduced amount of containers to move throughout the United States.

Even as some of the consumer confidence data finds a floor, it’s still at the lowest level going back to the 1970’s. When you layer the OECD data with recent U.S. economic information, we are still at the infancy of consumer pressure and slowing retail sales.

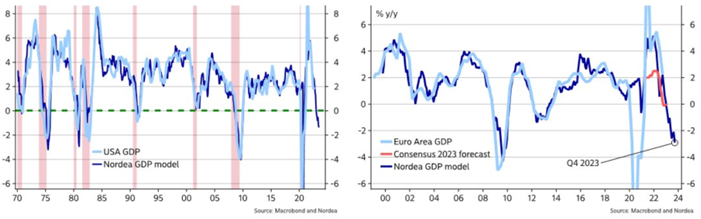

It’s important to not be fooled by recent price action causing some of the biggest names on Wall St to “pivot” to the view that we will have a “soft landing” or “no recession at all.” January flows are normal positive even as the economic data deteriorates to the point that a recession is already in progress. I think Nordea does a great job of highlighting how Europe and the U.S. are still in a steep contraction even if stock prices jumped. If anything, it provides a great entry point to short overvalued names or cyclicals relying on the consumer or housing… or in our case- both.

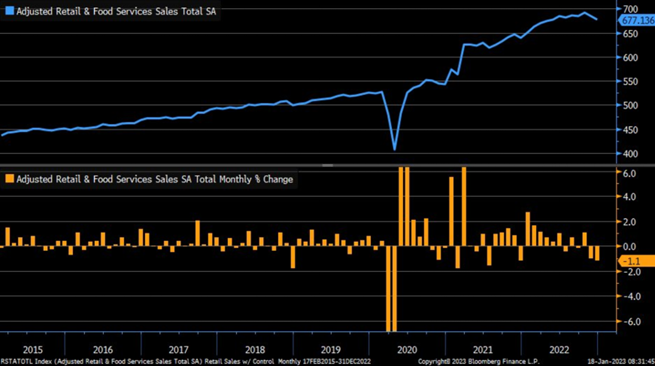

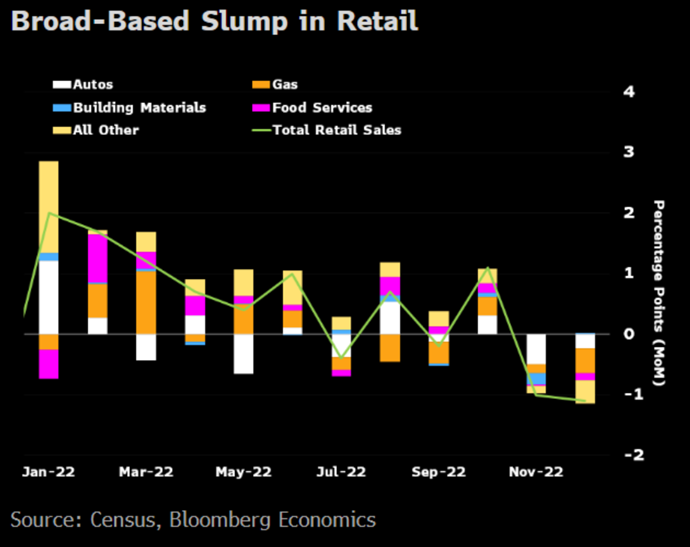

Retail sales as a whole declined in December more than estimates, which is also a peak time for buying given the holiday season. December retail sales -1.1% m/m vs. -0.9% est. & -1% in prior month (rev down from -0.6%); sales ex-auto -1.1% vs. -0.5% est. & -0.6% prior (rev down from -0.2%) … control group -0.7% vs. -0.3% est. & -0.2% prior. While the top line number missed estimates, it’s important to note that the control group also missed by a wide margin. These are sales that aren’t as “flexible” and are key to the consumers everyday life.

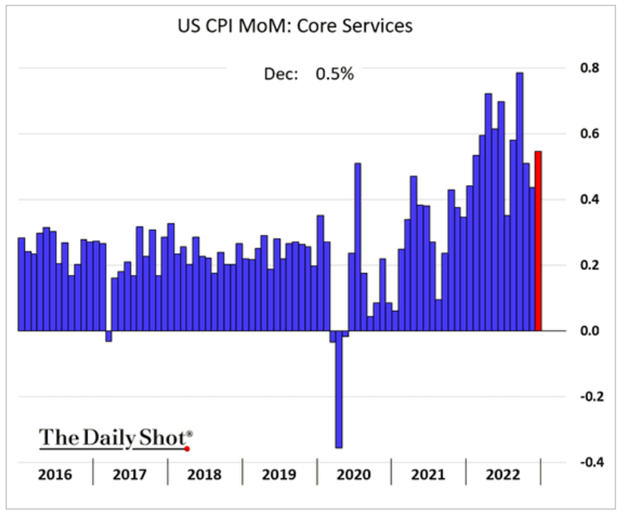

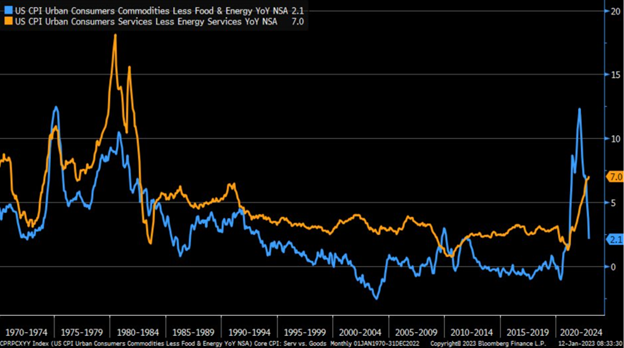

Control-group sales used to calculate gross domestic product — which exclude food services, auto dealers, building-material stores and gasoline stations — declined 0.7% in December. The consensus expected a 0.3% pullback. They were up 1.9% on a quarterly annualized basis, far weaker than 7.4% prior. No matter how you slice the data, it is showing a very ugly shift in the consumer and one that will weigh on economic activity throughout 2023. When you adjust core sales for inflation, it gets even worse and instead of being down .7%- it’s down 1%. The below chart puts into perspective how high core services has gone in comparison to the headline data- while core goods has been the driver of the decline. Sticky inflation > Flexible inflation

It’s also worth noting that the miss was also broad based and helps support the view that this isn’t some “one off” driven by a declining in a specific area. Instead, it shows that the consumer is pulling back across all facets of their spending.

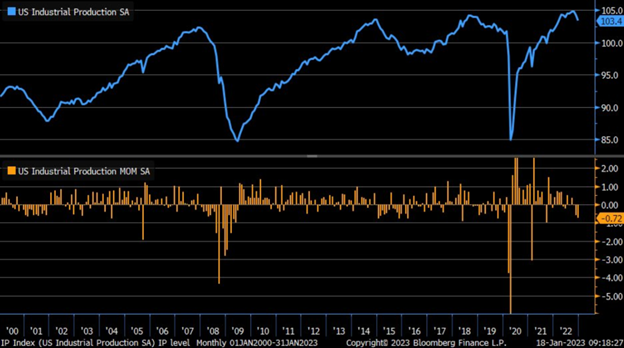

Logistic companies also have to move product for industrial companies and general manufacturing. All of which took another turn lower with some of the slowdowns now accelerating. December industrial production -0.7% m/m vs. -0.1% est. & -0.6% prior (rev down from -0.2%) … manufacturing production -1.3% vs. -0.2% est. & -1.1% prior (rev down from -0.6%).

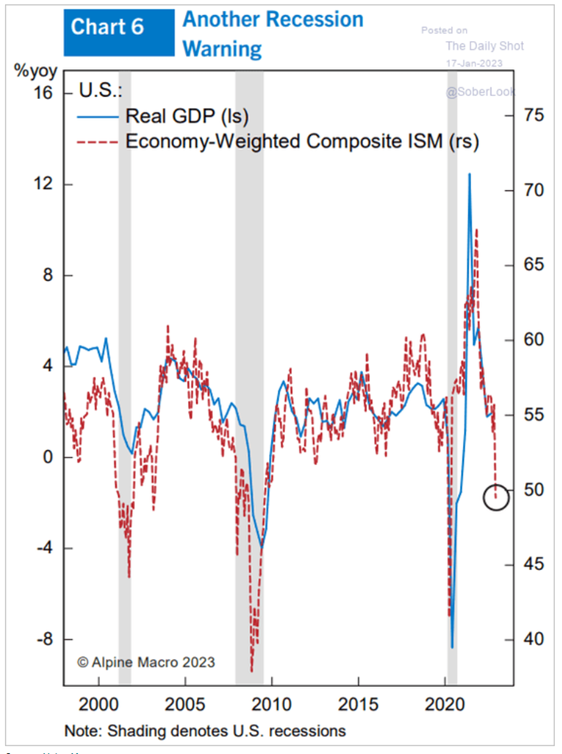

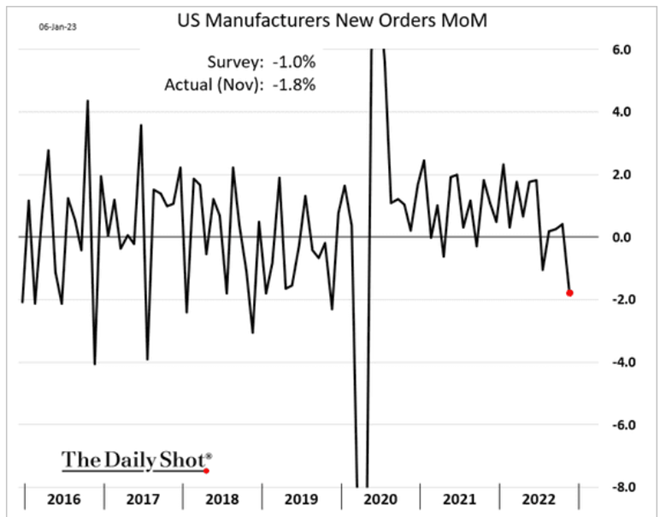

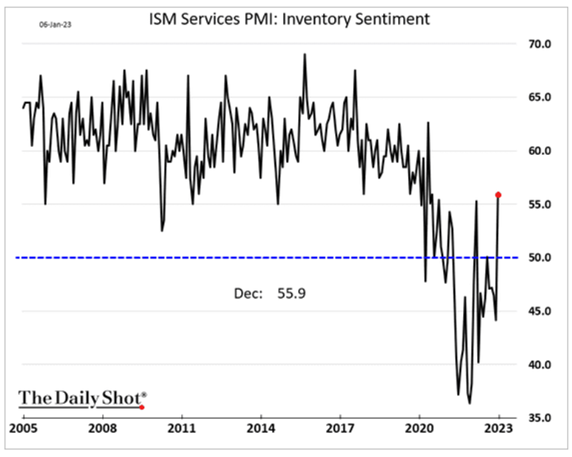

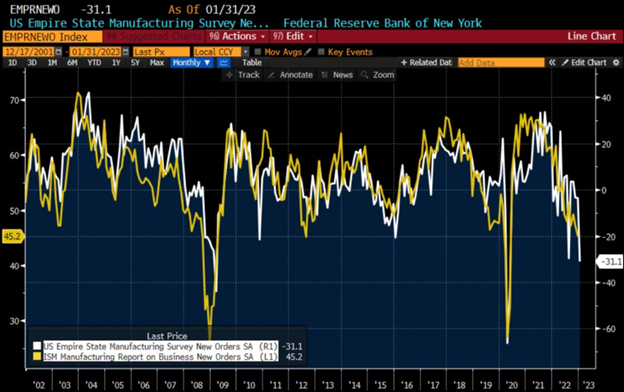

Even with these reductions, we are still at very elevated levels and are JUST starting to see a pivot to the downside. We are on track for three straight quarters of declines in retail sales alongside two successive negative production numbers, which only happen in a recession. The ISM data in services and manufacturing is already showing data points well below 50, which is a signal of contraction. The current data is showing a reduction in economic activity, but you might be thinking- what about the leading indicators? Well, new orders have rolled over further with U.S. manufacturing orders showing another decline to the downside.

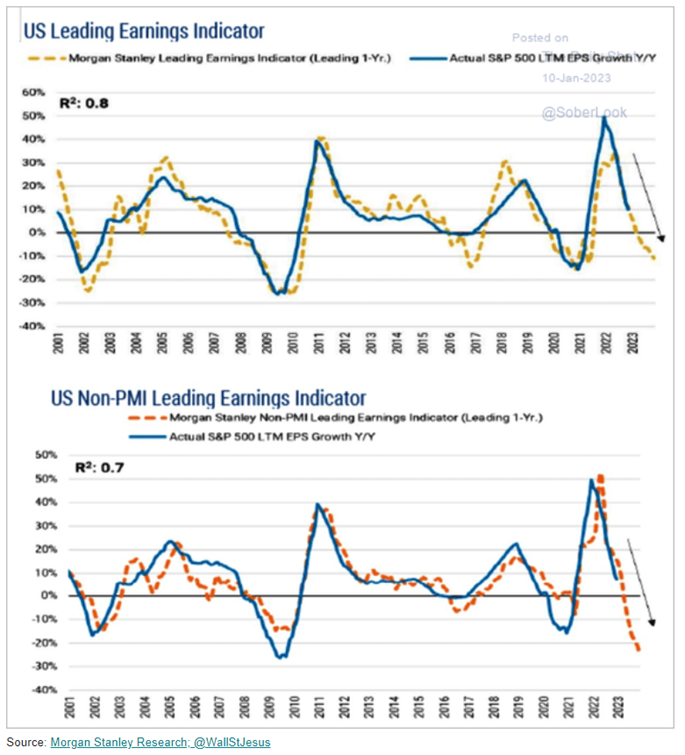

It doesn’t matter what type of leading indicator your use- they are all telling the same story. Each one might have a different pace or varying depth of the slowdown, but they are all telling a very consistent story. We aren’t on a strong footing when it comes to economic growth.

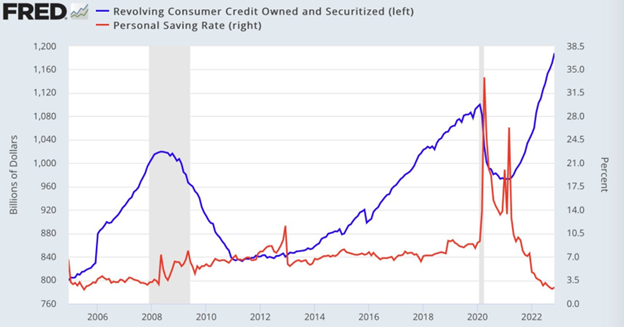

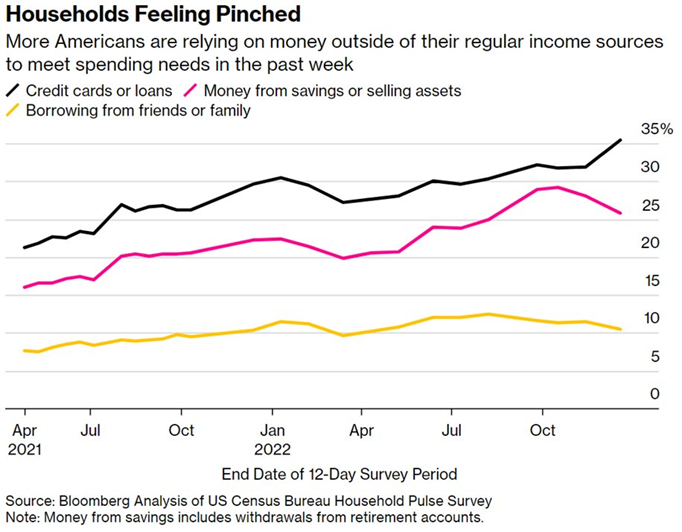

I am sure you have heard the commentary that the U.S. consumer is flush with cash and sitting on a massive amount of savings. My question is- are these the type of data sets that show a strong cash position? We have a SURGE in revolving credit (credit card debt) while savings rates have imploded. Essentially- people are using credit cards for a record amount of purchase.

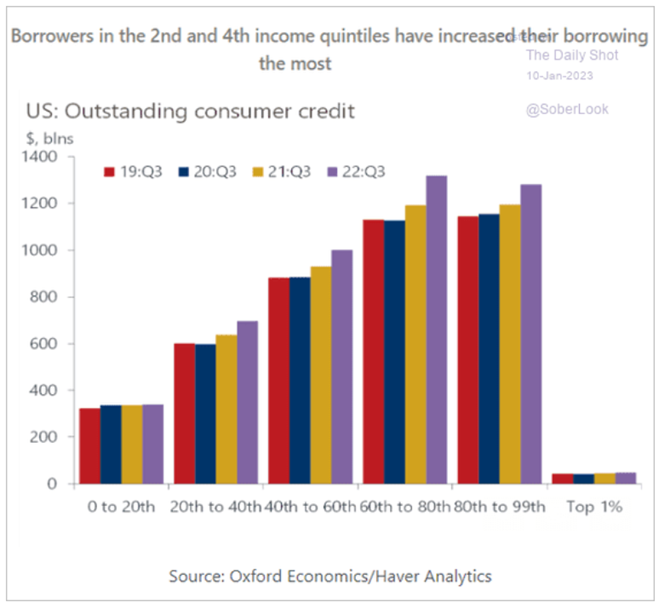

Outstanding credit is increasing at every income quintile- with the BIGGEST increases from the 40th up to the 99th percentile. This is the area quoted as having the largest savings cushion- but yet their outstanding credit card debt is increasing?

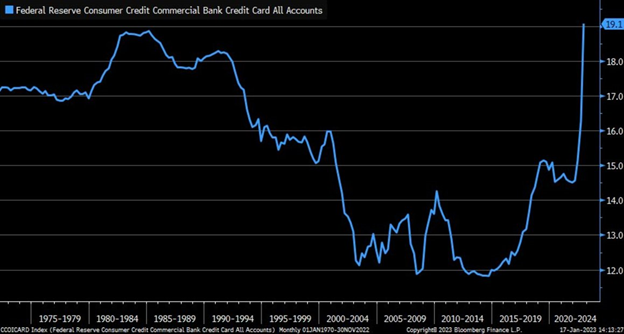

If a person has so much money in savings, why would they increase outstand credit card debt with the highest interest rates IN HISTORY! We took out the 1985 peak for credit card interest rates.

Here is another look at the increase in credit cards or loans:

We have car loan delinquencies at the highest level since 2009, which is being driven by a record amount of car loans while the car itself has seen it’s value collapse.

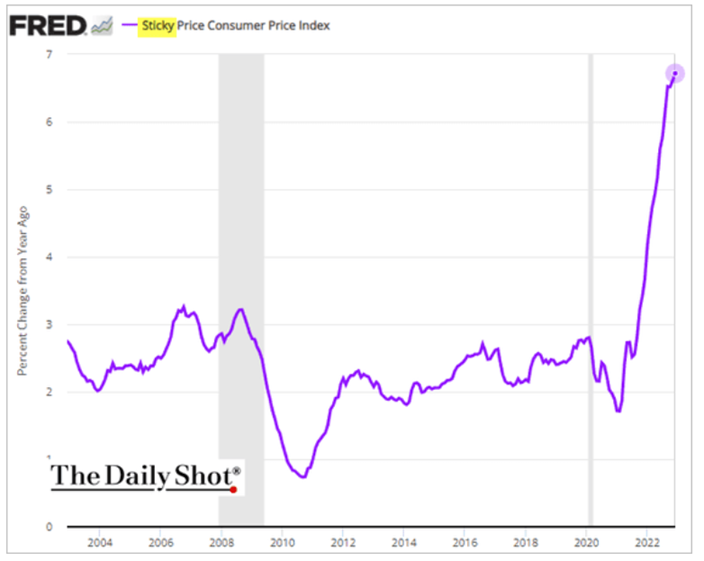

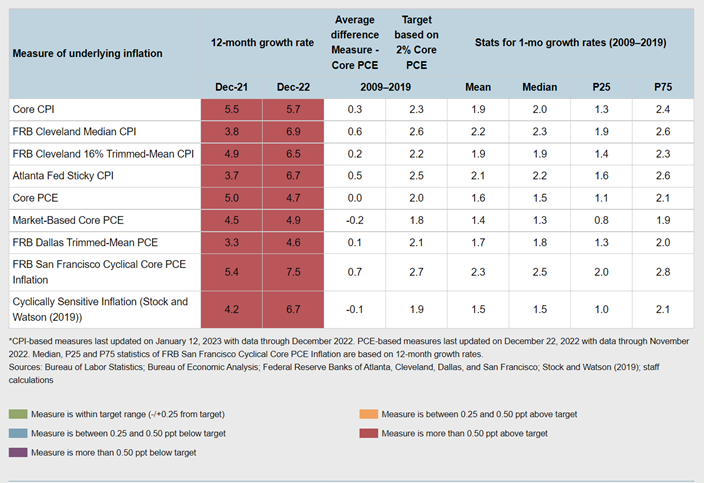

The consumer is clearly feeling the pain, and the issues aren’t going to go away when you look at inflation. It’s important to discern the difference between headline numbers and core/sticky inflation. The consumer is still feeling pain as core inflation rises further and sticky prices drive higher.

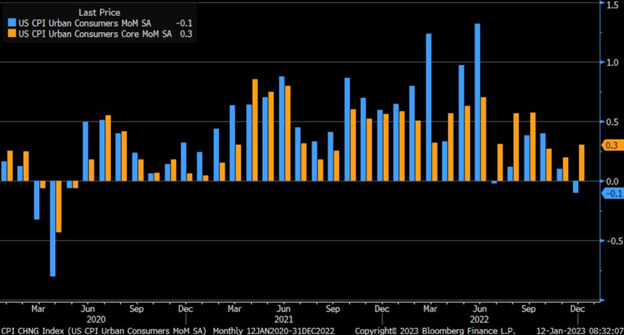

So even though there was a small decline m/m in the headline number- the core number is still driving higher: December headline CPI -0.1% m/m (largest monthly drop since early 2020) vs. -0.1% est. & +0.1% prior … core CPI +0.3% vs. +0.3% est. & +0.2% prior.

When we look at other measures of inflation, you can still see further appreciation of inflation. FRB Cleveland Median/ Trimmed Mean/ Sticky- all point to core CPI still facing more appreciation higher.

The biggest drive of the decline in CPI has been “commodities” or “physical goods” while services has been driving much much higher. The issue is- 70% of household spending is on services and not goods. We had a surge in the purchase of “stuff” when the government was pushing out cash, but as the government has turned off the spigot and wages drift lower that has dropped through a floor. The problem is- service pricing is “sticky” while commodities/goods is “flexible.” This is going to keep prices for the consumer and the core/sticky calculation very elevated and a huge problem for many consumers.

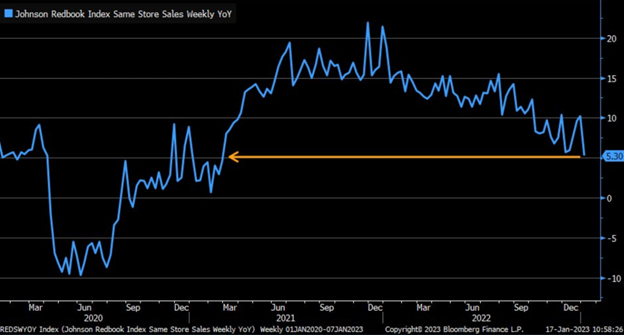

All of these factors are impacting spending and the most recent data in January pointed to a continued slowdown, which is inline with our expectations.

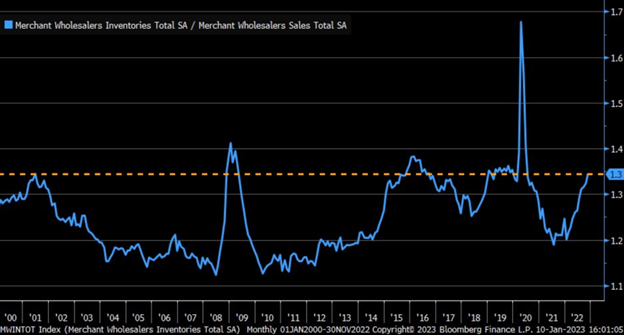

This is being confirmed by a shift higher in inventories.

We are back to the average from the pre-pandemic.

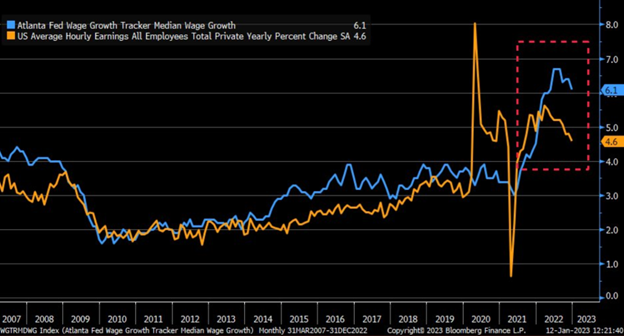

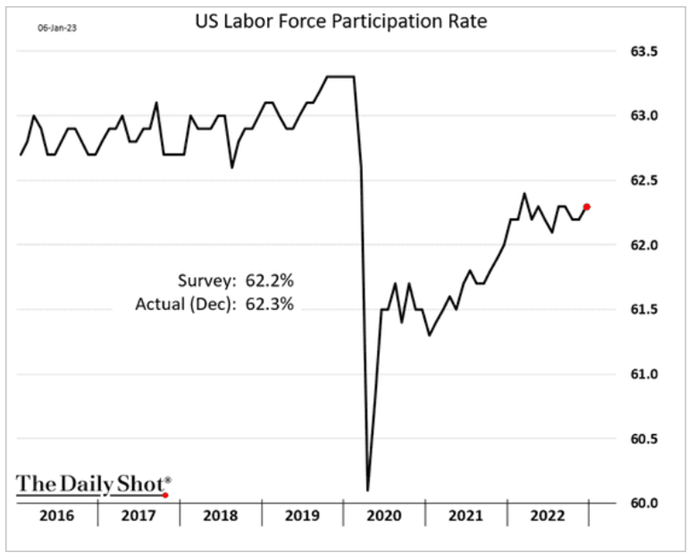

All the while wages are starting to slip lower, but it’s happening much slower driven by lack of job participation rate. The slowing economy will “pull” down wages, but it will be at a much slower pace given the lack of job seekers, which will in turn keep inflation elevated. The question becomes what drops first- inflation or wages. If inflation drops first- it will be a benefit for the consumer because real wages will raise and spending power grows. If it’s the opposite or they fall at the same time, the consumer still loses their purchasing power with more headwinds to spending.

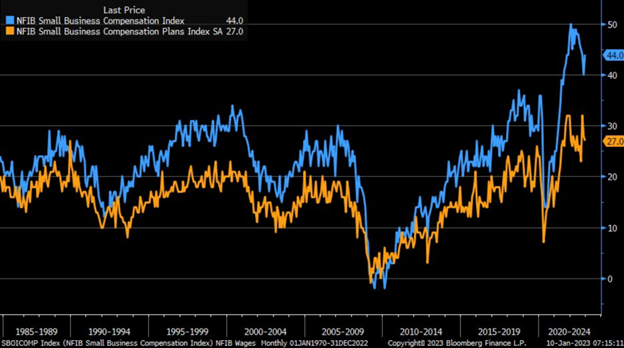

Here are some charts showing compensation- things have fallen but at a VERY slow pace and from all-time highs.

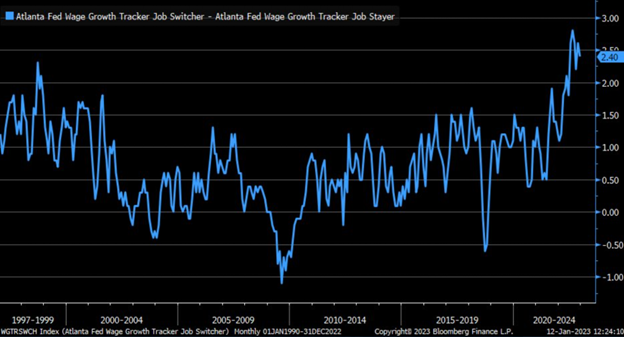

Job switchers continue to find increase in wages, which is also driven by the lack of job seeking activity.

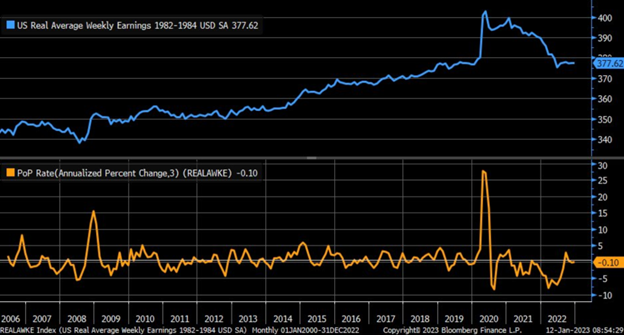

We have seen some improvement in real wages, but you can still see it’s firmly in negative territory.

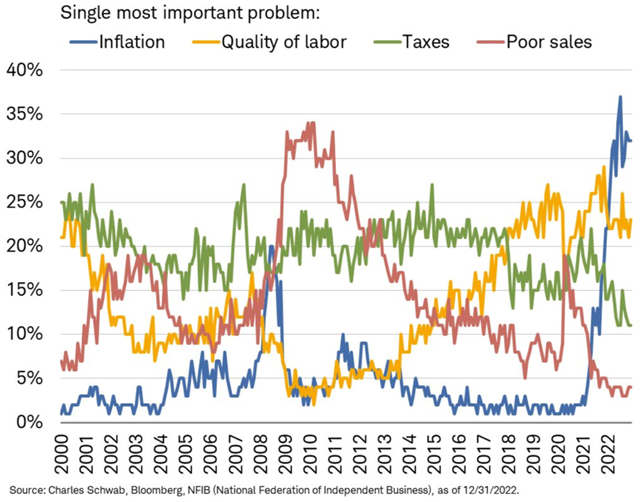

I think this chart really helps drive home that inflation and quality of labor remains a huge driver of problems for all businesses- especially small companies.

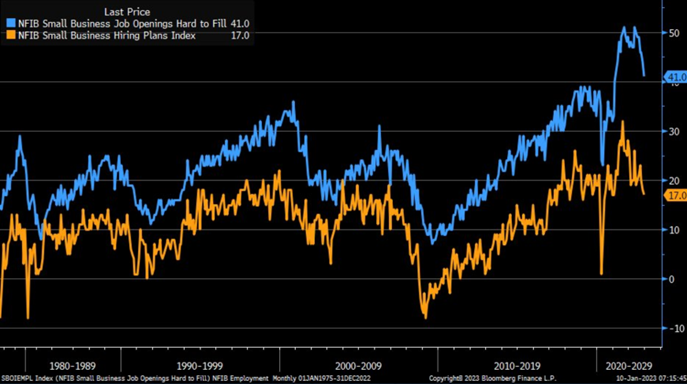

We have hiring plans slowing, BUT it remains difficult to fill jobs, which will keep wages higher.

We are still FAR below pre-covid levels, which is a big problem for the Fed and will keep rates moving higher while creating headaches for companies.

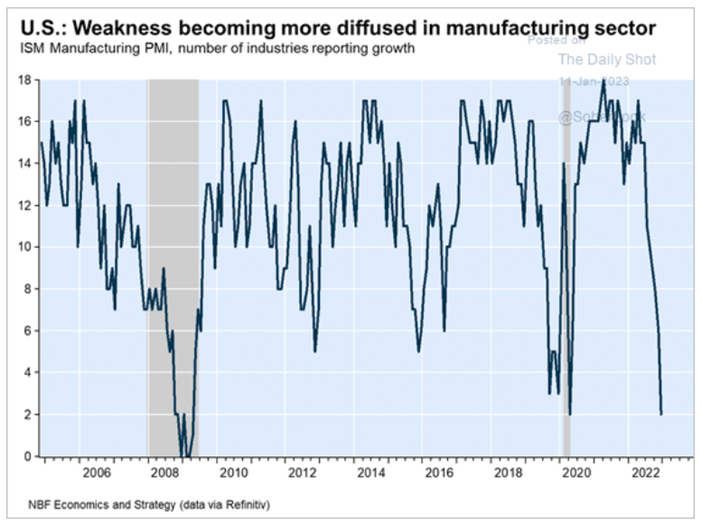

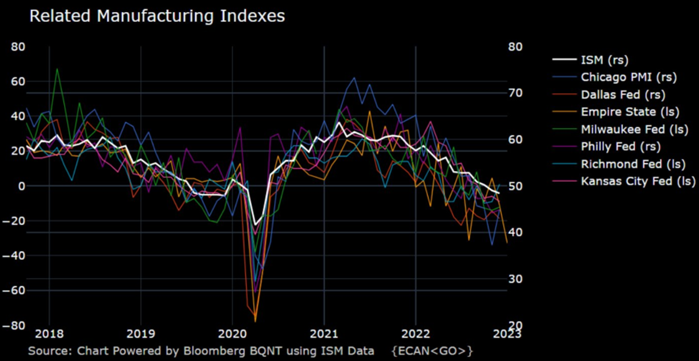

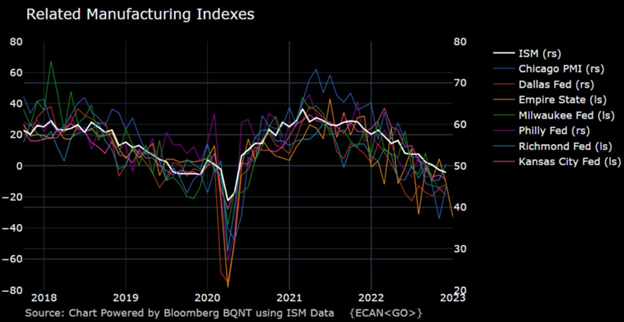

This is all culminating in a broad slowdown across the U.S. The weakness in manufacturing has spread across the broad sector as inventories rise and consumers slow.

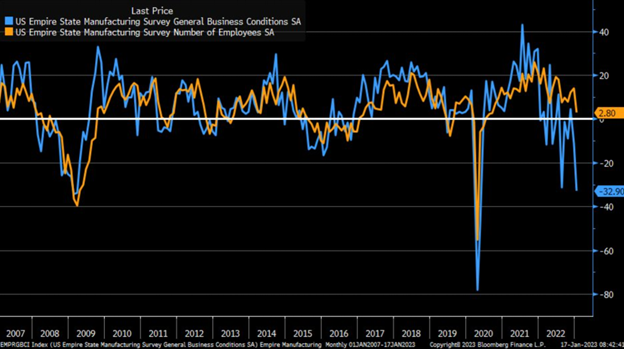

The first round of Fed regional data is showing the issues: January Empire Manufacturing Index plunged to -32.9 vs. -8.6 est. & -11.2 prior; new orders sank to -31.1

All of these indicators will bounce around, but they are heading in the same direction with little pivot into expansion.

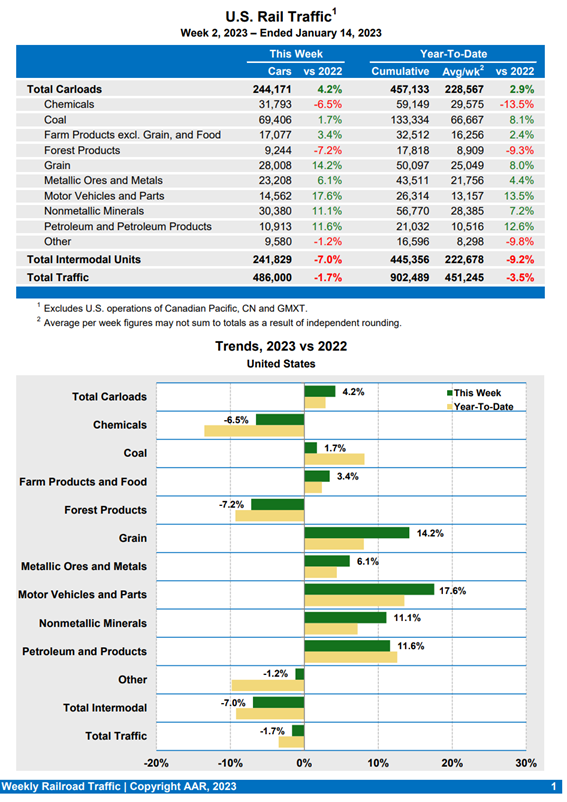

All of this is going to drive DOWN the need for intermodal activity within the U.S. We see more downside risk to the intermodal world as well as chemical shipments dropping through a floor. The coal, grain, base metal, and petroleum/products will remain strong, but companies exposed to intermodal will get impacted the most. Cyclical companies in general will come under increasing pressure as the economy finds little footing in the near to medium term.

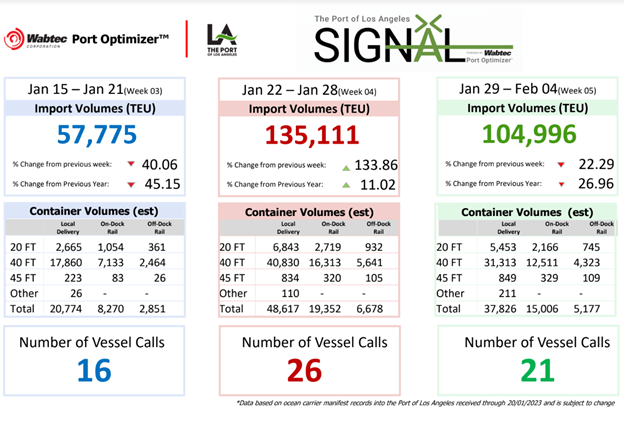

Port calls into the U.S. continue to weaken, and we see extensive pressure to across the shipping space.

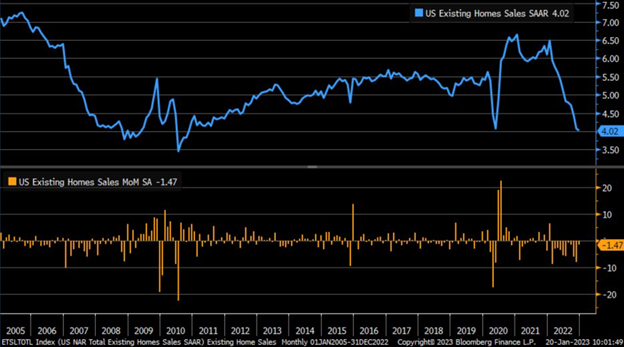

Flows are set to drop considerably as inventories are saturated and consumers slow their spending. We believe this is an excellent opportunity to capitalize on the economic slowdown that is gaining traction. Housing has fallen again, which will also result in less “stuff” traveling by rail and truck.

As all related manufacturing indexes move lower, there is going to be more pressure on the U.S. which will also impact China’s reopening.

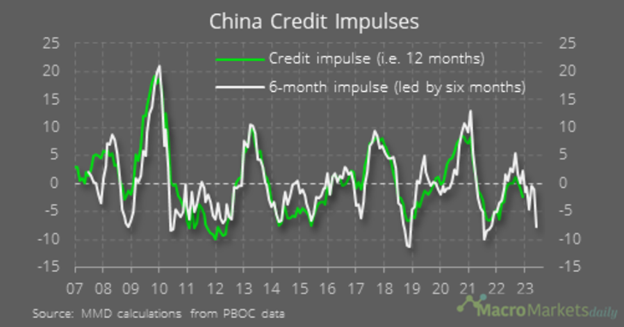

Credit impulses in China have failed to turn higher, and we will keep a maximum amount of pressure on “stimulus” in the region. We believe the market continues to over estimate the Chinese reopening story as they are opening in a slowing economy.

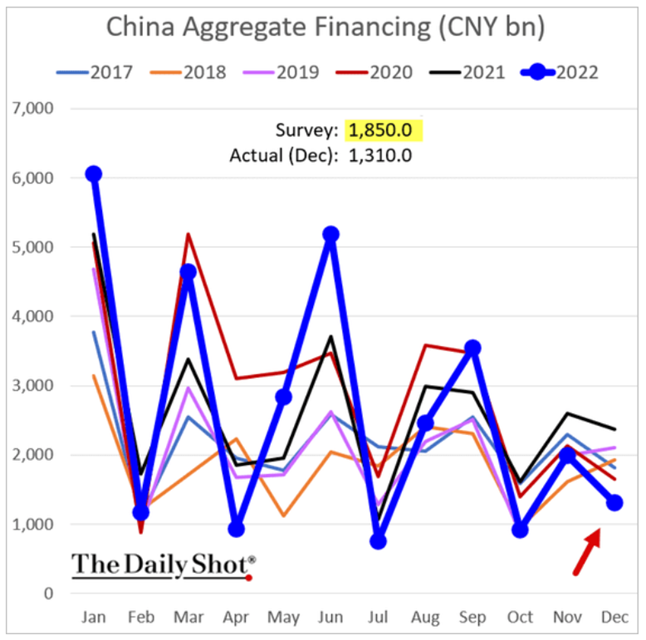

Aggregate financing closed out the year struggling with more pressure building in 2023 with limited demand for real estate risk.

There is also going to be more concern around private companies as Xi is sending more “cadres” to sit inside the companies.

What a gift for new year! The Party is delivering top-notch officials right to your door.

On Tuesday, Shaanxi Daily reported that the provincial organization department recently sent cadres to 25 large private companies in the province to run Party affairs as first secretaries of their Party branches.

Who’s the crew? These “outstanding young cadres” are from province-level departments, including a section chief of the Shaanxi Statistics Bureau (People.cn).

- The assignments are for one year.

- Top performers will be fast-tracked for promotion.

Their task is twofold:

- Promote Party-building inside the companies

- Help the firms grow by resolving policy challenges

Beijing has long sought to expand the Party’s presence within private business, but sending in full-time officials to run Party affairs marks an escalation.

- Previous efforts focused on requiring private firms to set up Party groups, and assigning part-time instructors on Party-building.

Get smart: Some private companies may manage to flip their Party cadres into (helpful) government relation assets.

Get smarter: Although a few firms may be able to leverage this initiative to their benefit, more broadly this will further dampen business confidence and cast doubts on Xi’s expressions of support for the private sector.

This follows closely to Xi using the “Golden Share Rule” to manage two Alibaba subsidiaries.

State investors have taken a “golden share” in two Alibaba subsidiaries, raising concerns that the government wants to meddle even more in the tech giant’s businesses.

- That’s according to an FT report published Friday.

Some context: Under a golden share arrangement, a state-owned entity takes a 1% stake in a media company in return for a seat on the board and veto power over certain decisions.

- It’s all a bit murky, but the aim of the setup is to give the entity more direct oversight over the media platform’s content moderation practices (while generally avoiding meddling in broader business operations and decisionmaking).

More context: The structure is nothing new.

- Media platforms ByteDance, Weibo, and Kuaishou have golden share arrangements.

Alibaba’s subsidiaries seem to have entered the same arrangement as the companies above. A check of the Qichacha corporate database revealed:

- The China Internet Investment Fund – administered by the internet regulator (CAC) – and Zhejiang Media Group (ZMG) – owned by Zhejiang province, have, respectively, taken a 1% stake in two Alibaba subsidiaries – news platform UC News and video streaming platform Youku.

- A mid-level propaganda official from CAC, Zhou Mo, has joined UC News’ board, and a manager from ZMG, Jin Jun, has joined Youku’s board.

Get smart: Alibaba’s media platforms won’t be the last to hand over a golden share.

- All tech media platforms will eventually have to sign on.

Get smarter: So far, golden shares haven’t touched tech platforms’ non-media subsidiaries which suggests that, for now, Beijing is staying faithful to its original intention.

- We’ll start worrying if golden shares start popping up beyond the media business.

If you layer that as well with the concerns that already exist with Common Prosperity- Xi is going to struggle to find ways to drive economic growth.

A quick refresher:

- Businesses have been freaking out ever since Xi Jinping put his Common Prosperity (CP) initiative to reduce inequality at the top of the economic agenda in August 2021.

- There was genuine fear that CP would mean a massive, state-led redistribution effort that would see more government intervention in the economy and businesses “encouraged” to give away a large chunk of their profits.

On Tuesday, at the World Economic Forum in Davos, Liu enunciated a vision of CP that is more Reagan than Mao (WEF):

- “Common prosperity is by no means a synonym of egalitarianism or welfarism.”

- “As China grows, all Chinese people will be better off, but that doesn’t mean their incomes and level of prosperity have to be the same.”

- “That is to say, there will be equal opportunities, but no guarantee of equal outcomes.”

Get smart: Liberals like Liu want to use CP to carry out market-oriented reforms.

Get smarter: Liu’s been shaping economic policy for 10 years. But he’s about to retire – and there is no guarantee that his successor will be so liberal.

This is all happening as the birth rate “officially” turns negative, but as we have highlighted to readers- we believe it actually kicked off in 2020/2021. We will discuss this more next week and some of the long term trends impacting the global markets.