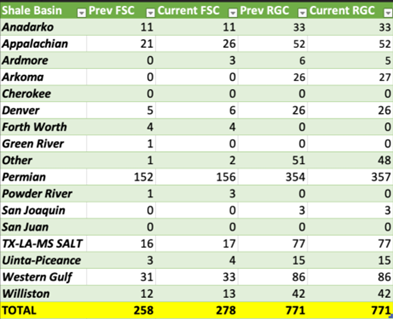

We finally had the big push in completion activity that we have been calling for on a seasonal level. The Permian saw the bounce we expected and will likely cross 160 within the next 2 weeks. Appalachia had a nice pop that was driven by seasonality and some updated data we received in the region. Ardmore had a nice increase as well, and we will see an increase in the other smaller basins over the next few weeks. The smaller areas come in spurts to maintain current volumes, so it’s normal to see them come on and off in waves. The level of intensity can vary, but the increases/decreases are fairly well timed based on seasonality. The Western Gulf and TX-LA-Salt are also going to see some steady increases over the next few weeks as activity normalizes following the holiday slowdown.

We expect to get to about 283-285 spreads as we head into next week as February typically sees a nice bounce of activity- especially in the smaller basins. The important piece to watch will be the intensity of the polar vortex/weather that is expected to move further into the U.S. Any weather issues will be short-lived, but could create some near term disruptions as ice impacts accessibility and water availability. You might be surprised to learn that frac’ing in North Dakota they are well equipped for the cold vs West Texas! As we saw with Uri, it caused a broad standstill in activity, but within 3 weeks everything was back in working order. These are items we track just to keep clients abreast of potential issues, but broadly speaking we see steady movement of activity back to about 295-300 spreads into the Spring thaw.

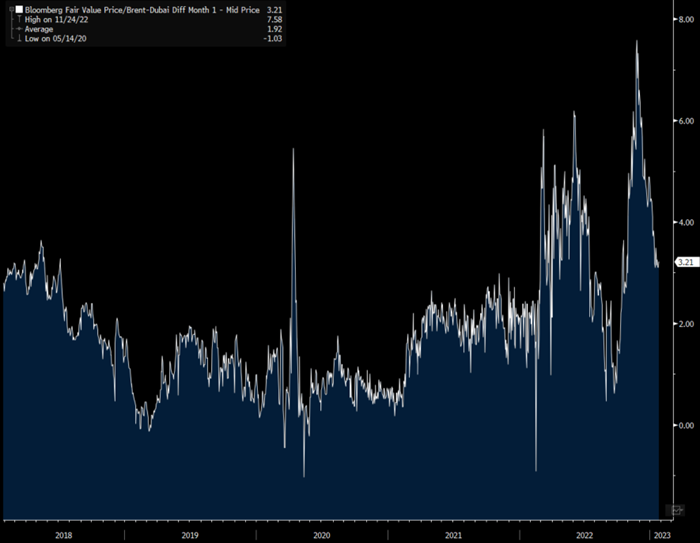

There is growing pressure on “Official Selling Prices” (OSPs) coming out of the Middle East that will likely require another cut from Saudi Arabia for March loadings. Even with the recent reductions, there has been a steady rise of storage in the region even as China increased some purchases. The only two times it was higher was the OPEC price war that was kicked off in Nov ’14.

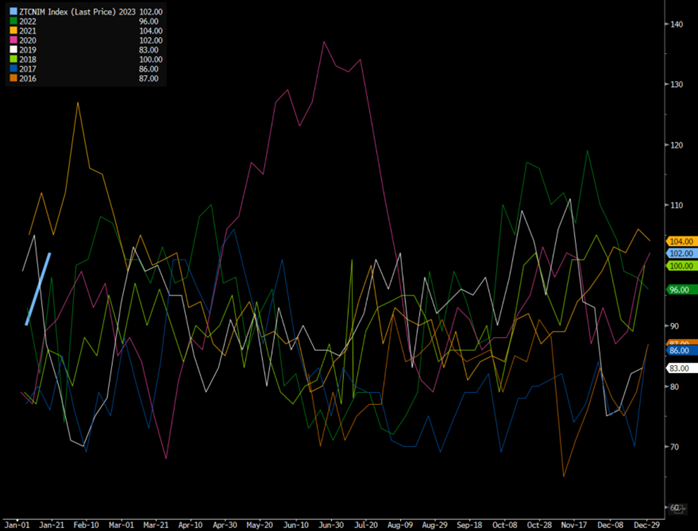

Middle East Crude Oil Floating Storage

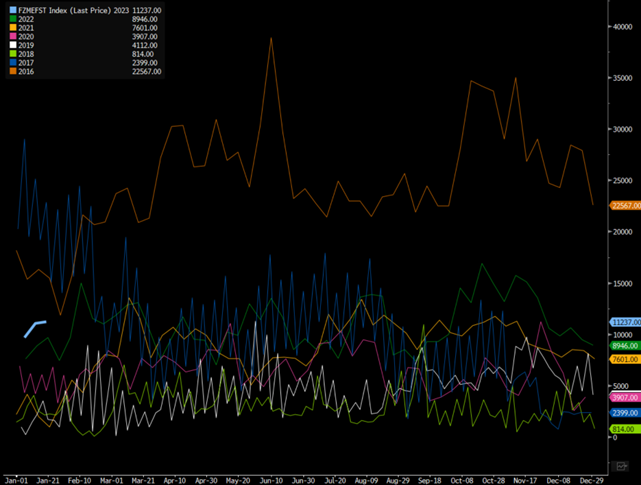

The discount of Dubai vs Brent has narrowed considerably from the highs, which is also making West African cargoes a bit more competitive. It’s still clearly cheap vs historics, but the competitive nature of the current market with cheap Urals and ESPO sloshing around keeps Middle Eastern crude purchases limited.

Brent vs Dubai Spread

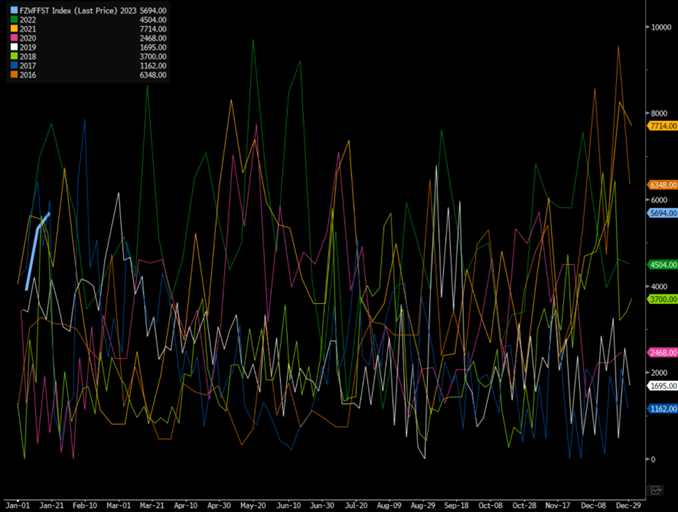

Even with the additional purchases of WAF crudes, the region is still sitting on an elevated amount of crude in storage. The rise in storage even came after a bigger increase in purchases from Asia- especially China. “West Africa’s crude exports to Asia are set to increase in January to the highest level since September, as smaller buyers such as South Korea and Taiwan made their first purchases from the region in months.”

West African Floating Crude Storage

47 cargoes of crude are due to load for Asia this month, equating to 1.4m b/d, according to Bloomberg estimates compiled from a survey of traders, loading programs and vessel-tracking data.

- Gains from a revised 1.3m b/d in December, comprising 43 shipments including partial cargoes of Gabon crude

- State-owned oil refiners in China and India are the biggest buyers; other purchasers include Indonesia’s Pertamina, Taiwan’s CPC, South Korea’s Hyundai

NOTE: West African arbitrage flows to Asia have been pressured in recent months by a wide Brent-Dubai spread, which discouraged flows from the Atlantic in favor of East of Suez barrels for some buyers; the spread has been trending narrower since early December, reaching a one-year low of $3.56/bbl earlier this month

Even with this increase in buying, there has been a steady build of floating cargoes. Nigeria also increased their OSP’s, but it’s important to look at the normal strategy in the region. KSA doesn’t discount OSPs, but Nigeria and other WAF nations will discount pricing if nothing clears. There is a typical strategy of starting “higher” and discounting it back until cargoes begin to sell. This is a tried and true strategy, and given current flows- we don’t see pricing sticking at these levels.

- Qua Iboe crude OSP in February increased to Dated +95c/bbl from +55c/bbl in January, which was the lowest in a year

- OSP also lifted for Forcados crude to +$1.25/bbl in February from +92c/bbl in January

There was a sizeable increase in buying out of China to kick off January, but it has cooled off as Lunar New year came into full swing. We expect buying to be right around 2022 levels throughout Feb/March as activity picks up on the refining side. This is driven by export quotas and growing demand internally as the country continues their path of reopening.

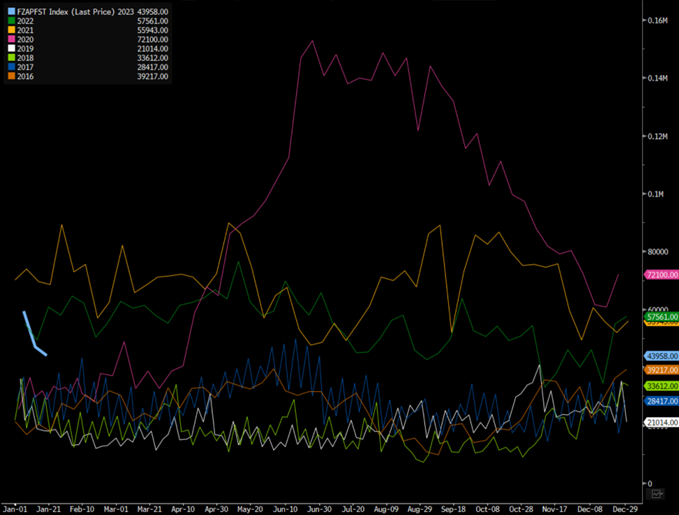

Supertankers Signaling China

There already remains an elevated amount of crude in onshore and floating storage, which will buffer the upper end of the expectations currently in the market. We expect a bit of a slower purchasing cycle vs the rest of the market driven by what is already sailing into the region, and the amount in floating storage.

Floating Crude Storage in Asia

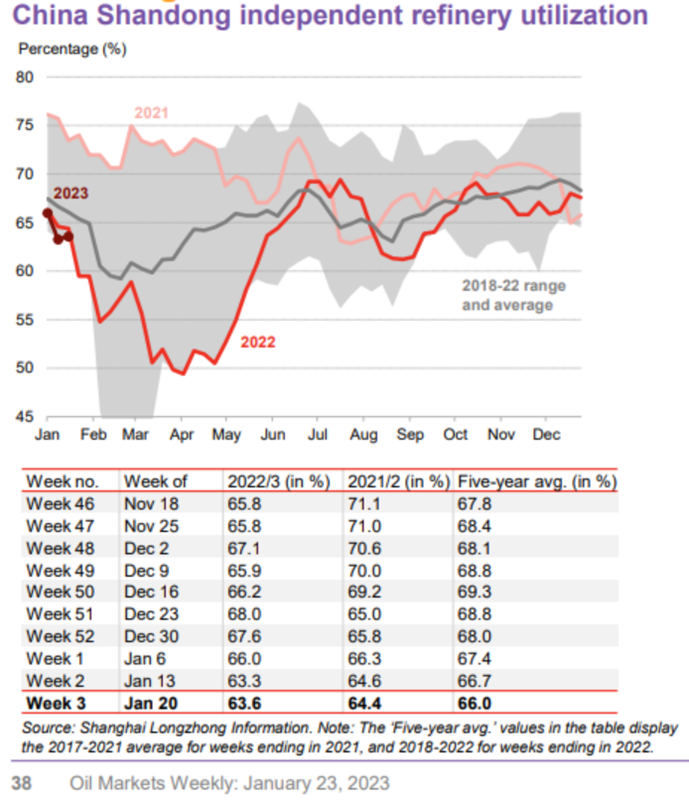

There has already been a small bump in refining activity, which should increase is a bit as Lunar New Year Travel comes to a close.

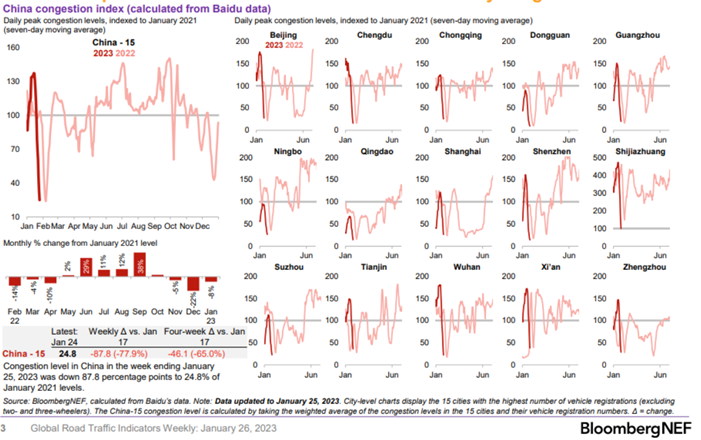

It’s important to look at what Lunar New Year demand looks like following the official reopening of the country. Traffic jumped above 2022 levels and has so far followed closely with last year. The below charts put into perspective some of the biggest cities, and the shifts in activity that has taken place against last year’s data. It’s fairly inline against previous spikes, but the whole nation so far has bounced above last 2022 and 2021.

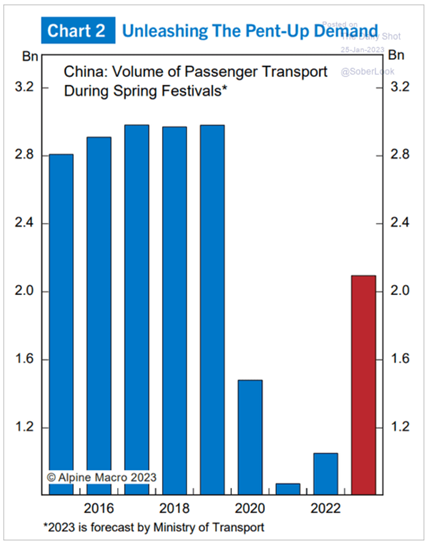

We have been very adamant that activity was going to improve, BUT it was still going to be well below pre-pandemic levels and fall short of market expectations. On Tuesday, the transport ministry (MoT) released data on the first nine days of the Lunar New Year (LNY) travel rush, showing a substantial rebound:

- Travel increased by 47.7% y/y, reaching 52% of the pre-pandemic level.

Some context: Travel over the LNY holiday season – which lasts 40 days – is often described as the world’s largest annual human migration, when millions of people working in larger cities return home to celebrate with families.

- This year, the period lasts from January 7 to February 15.

The MoT’s on the same page with us: On January 6, the ministry forecast that travel over the whole 40-day period will increase 99.5% y/y, hitting 70.3% of the pre-pandemic level. We still see activity growth ABOVE the red bar, but as we have reiterated- there are many headwinds facing the growth of Chinese demand, which we will cover in more detail later in the write-up.

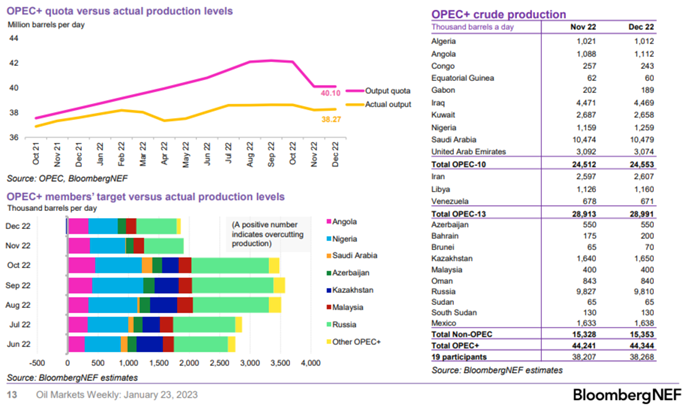

When we look at the current crude markets, it’s important to look at the disconnect that remains between “actual output” vs “output quotas.” OPEC+ continues to produce WELL below their allotments and given the elevated amount of crude oil in floating storage- why would they increase? If the goal is to protect price, the global economy (demand) has been slowing as floating storage and crude oil on the water increases around the world. We don’t see a meaningful increase in the near term, and the below colored bar chart gives you an idea of who is trying the lion share of the decline: Russia, Nigeria, and Angola. I find it funny that Nigeria talks about increasing their production to 2.2M barrels a day, but yet they struggle to clear 1.25M barrels a day. Any “cut” that would happen at the next OPEC+ meeting would just close the gap between actual and allowed outputs- BUT it would do NOTHING to adjust the current physical market.

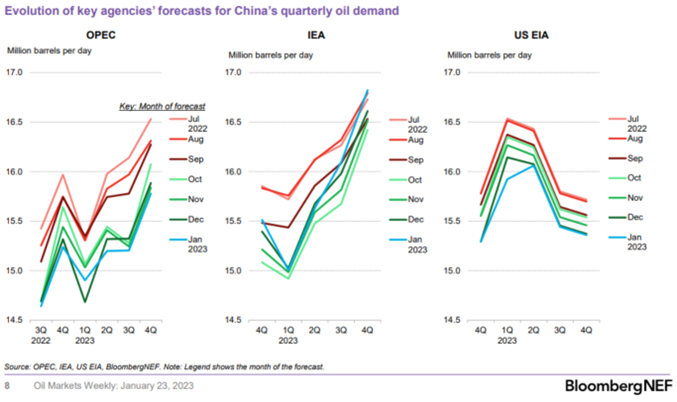

There have been some pivots on estimates for global crude markets in Q1:

“Global oil markets face a bigger surplus this quarter than previously expected, with demand still constrained despite China’s bid to reopen its economy from Covid lockdowns. World supplies will exceed consumption by roughly 1 million barrels a day in the first three months of the year, the International Energy Agency said in a monthly report. While the organization made a modest upgrade to its outlook for China after the easing of restrictions, it doesn’t expect to see annual demand growth there until the second quarter. “As China faces a challenging winter, its exit path will unquestionably be bumpy and drawn-out,” the Paris-based adviser said. “Hardship and disruptions therefore look set to prevail in the near-term” in the country.”

Even with the above assumptions, the market has started to price in a reopening China with varied estimates of what kind of growth we should expect. We are more in agreement with OPEC on their estimates of Chinese demand, and it’s interesting to see the IEA providing such cautious commentary when they are expecting the largest increase In Chinese demand compared to the other reports.

We believe there will be an increase, but we believe the bounce will be measured because of economic headwinds.

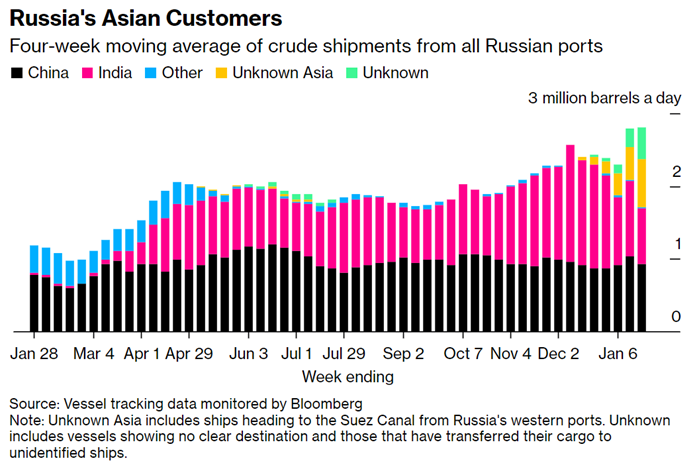

There is also a lot crude that is being “disguised” as Malaysian as well as moving into the market through a surge in ship-to-ship transfers. “Under the G-7 program, ships engaged in ship-to-ship transfers are allowed to use industry standard insurance as long as the cargoes on board are sold at or below $60. Ship-to-ship transfers are a routine part of oil trading and those that are taking place are doing so in full view of satellite tracking systems. Locations, such as Ceuta, a Spanish city on the north coast of Africa, and Greece’s southern city Kalamata, are once again becoming hotspots. The transfers should also keep ice-strengthened tankers from straying too far from Russia’s Baltic Sea. Such vessels are needed in wintry conditions and the further they sail, the longer it takes for them to get back. Most Russian Urals crude has been getting transported thousands of miles to Asia on relatively small tankers due to the European boycott. That stretched the fleet, pushing up freight rates for smaller tankers that aren’t so well suited to long-distance trading. So far a total of five very large crude carriers, or VLCCs, the industry’s largest mainstream vessels, are likely to be involved in Urals STS transfers. Three completed these maneuvers at Ceuta and sailed to Asia. Two more VLCCs are waiting at Ceuta while at least 6 Aframaxes, which have roughly a third the transportation capacity of VLCCs, are expected to arrive at the site by the end of this month after loading Urals from Baltic ports.”

STS is nothing new to the market, but the loopholes provided just increase the amount of crude available to the global market.

This is pushing more product into the Asian markets where Russia’s main buyers are present. These flows are trying to be “hidden” through flags of “unknown destination”, but it’s also a way for Russia to send volume pre-emptively knowing those markets are their most common users.

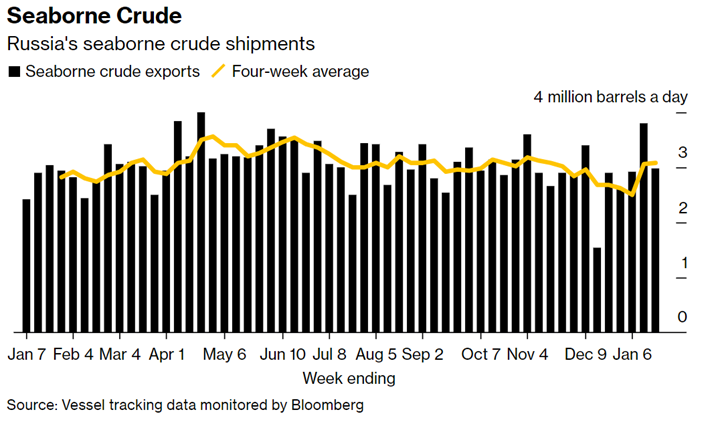

The use of more STS will also create more “lumpiness” in the data because of the structure of the process. We still see them maintaining about 3M barrels a day along their 12 months average.

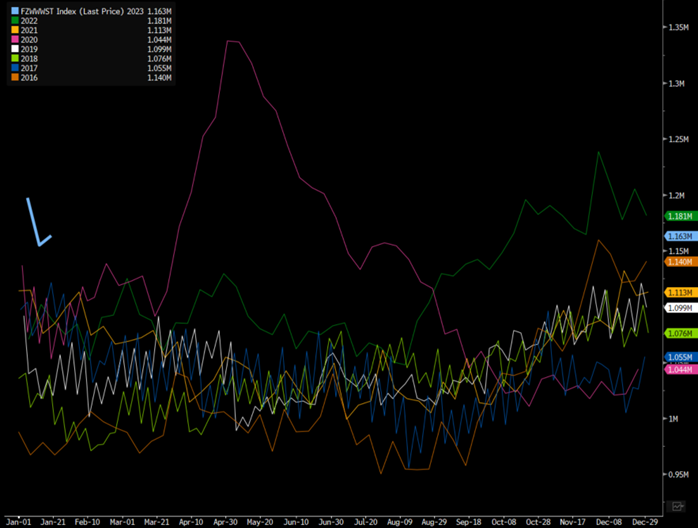

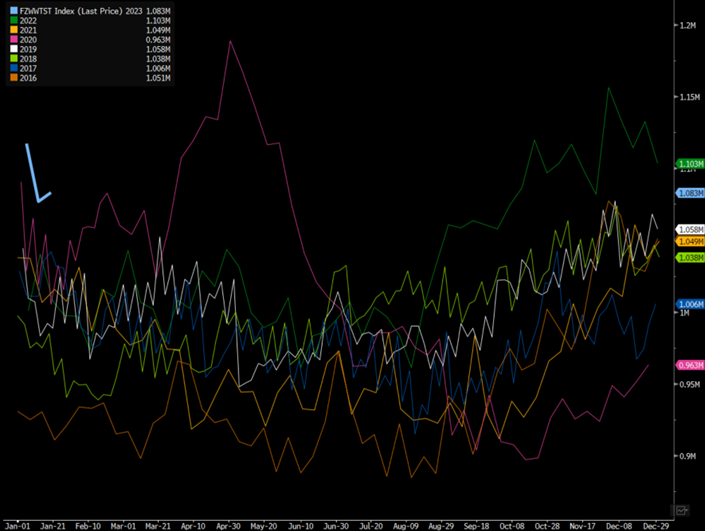

Miles per ton will continue to move higher and maintain a record amount of crude on the water and in-transit.

Global Crude Oil on Water

Crude Oil in Transit

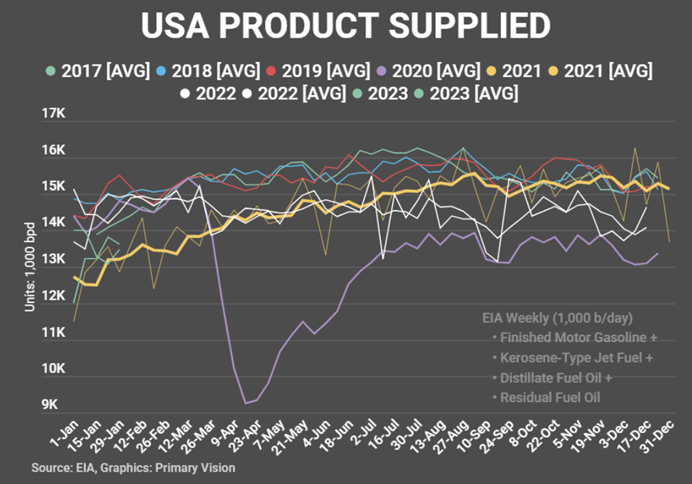

U.S. demand remains underwhelming driven by trucking, weather, and consumer weakness. We don’t see any of that changing in a meaningful way in the near term. There is always an increase in demand over the next few weeks driven by vacations (spring and February break) and improving weather. The problem is- it will be very underwhelming driven by headwinds across all mobility fuels.

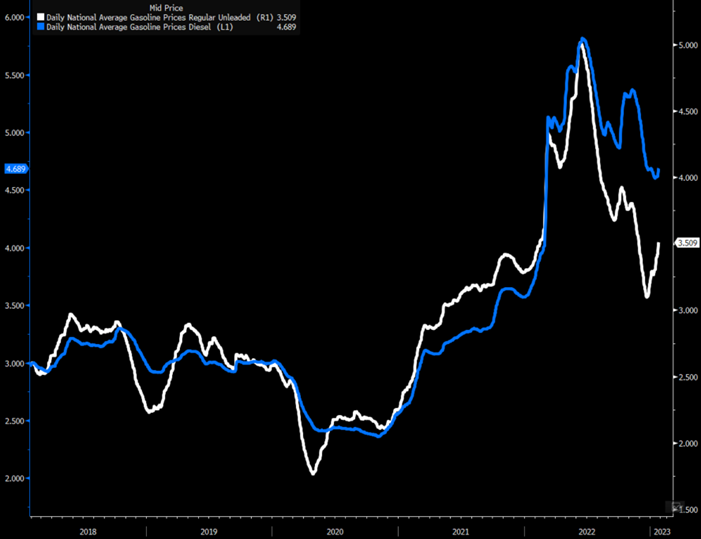

You can see the steady rise of demand, but it will be well below 2017-2019 and 2022 levels. The trucking uplift isn’t coming this time around, which will cap demand. On the driving side, we are going to see demand continuously disappoint driven by flexible schedules and more efficient vehicles becoming the norm. This is one of the first years we have seen the “average” MPG of cars in the U.S. hit 26 miles per gallon. Between a change in driving patters and efficiency, we are going to be below pre-COVID levels. While the whole structure shifts, we also have consumers that are slowing consumption as retail sales wane, and consumers adjust their spending patterns to conserve capital. The below chart shows how the rally in pricing in gasoline, which is also going to put downward pressure on activity. The diesel side has remained elevated driven by broad shortages in storage, and the inability for the U.S. to create or source additional diesel cargoes.

National Average Gasoline and Diesel Prices

The Jones Act limits the ability for the Gulf of Mexico to fill the void on the East Coast, which is why GoM is sending more into Europe. As Europe takes delivers from India, the Middle East, and U.S.- it allows for excess cargoes from the other two locations to find the “highest bidder” in the Atlantic Basin. This allows the East Coast to pick up some extra barrels on the back end of it. This is also just increasing the miles per ton, which will keep prices very elevated in those key regions.

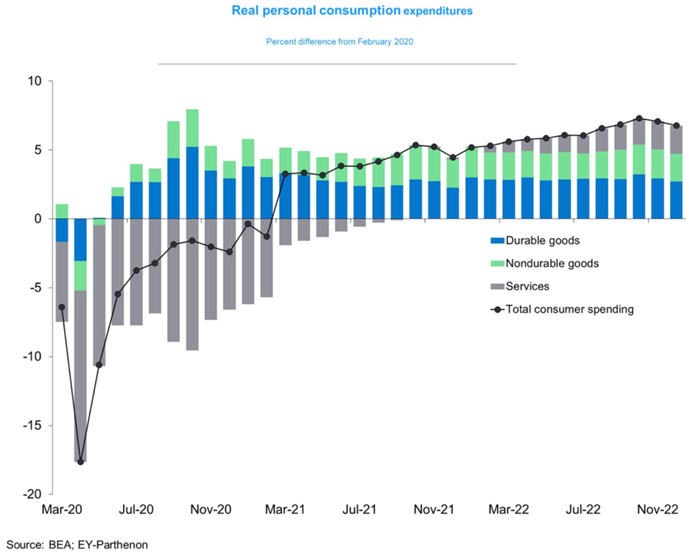

The consumer in the U.S. continues to slowdown with more cautionary data coming out this week. We had consumer spending down .2% in Dec and adjusted for inflation coming in at -.3%. The “real personal spending” was well below estimates with revisions moving in the wrong direction. This all happened as the “key” Fed measurements of inflation showed another increase m/m and will keep a .25% increase in the Fed funds rate a guarantee.

The below chart shows how things are just beginning to roll over, and we are still well above Feb 2020 numbers. The pace of the slowdown will accelerate as real wages are negative and savings dwindle even faster.

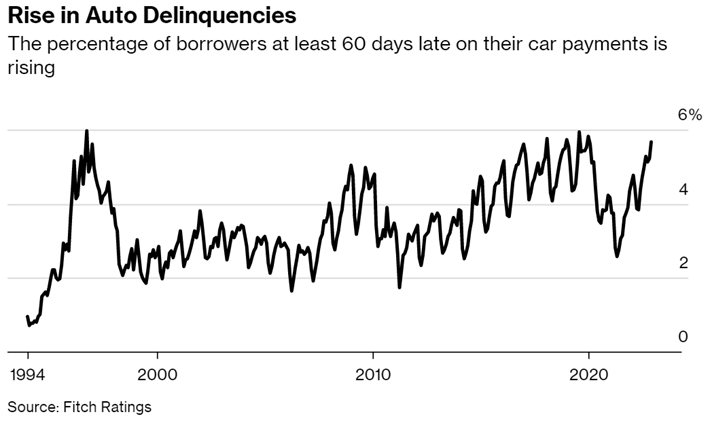

A key bellwether for the U.S. consumer is the car loan delinquency rate. “Now, more Americans are falling behind on their car payments than during the financial crisis. In December, the percentage of subprime auto borrowers who were at least 60 days late on their bills rose to 5.67%, up from a seven-year low of 2.58% in April 2021, according to Fitch Ratings. That compares to 5.04% in January 2009, the peak during the Great Recession.”

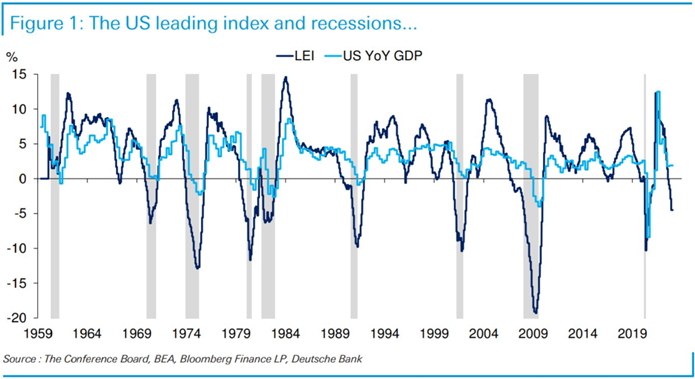

All of the leading economic data points to a continued slowdown in the U.S. with data shifting negative even further. A LEI at 1% typically means the ISM data will come in at 40-45 in a two-to-three-month period.

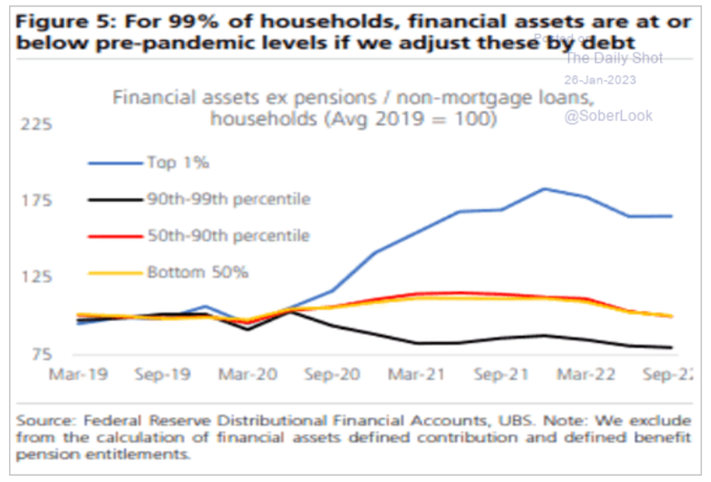

A big component of pressure is also the struggle of financial assets when factoring in debt. We currently have 99% of households under pressure once you factor in debt, which is something we have been highlighting the last few quarters. The view that there is a savings glut that will backstop demand is gone, and the consumer is going to keep weakening over the next few quarters.

As the consumer weakens, we are going to have even more pressure to the downside on the manufacturing and service/consumer front.

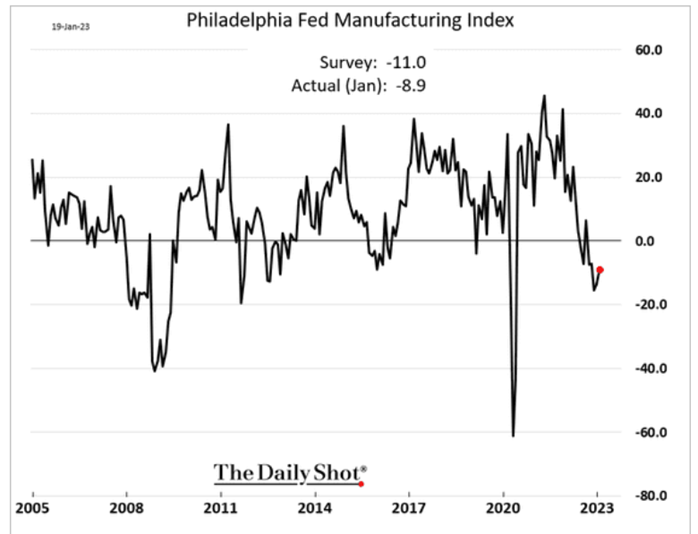

The regional Fed data is a great way to track near term shifts in the direction of the economy. It’s comprised of key data points that will provide a look at how things are going now and over the next several months.

As we like to say- “nothing dies in a straight line” and when you look at the recent index- you can see that we are still contracting, but the recent declines have leveled off. There are two components to this- seasonality and timing. There was a bit of support as people came back from holiday in the region, and expectations were bouncing a bit off the lows but still signaling a sharp decline.

New Orders are a pivotal test to expectations over the next 3 months, which all still remain in contraction. We should get some stability in the near term just given the speed at which we dropped off from expansion. But, companies still need to manage their inventories and manufacturing order books so there is normally some seasonal strength in January. The big test will be Feb/March, and how companies are situating themselves for the spring season.

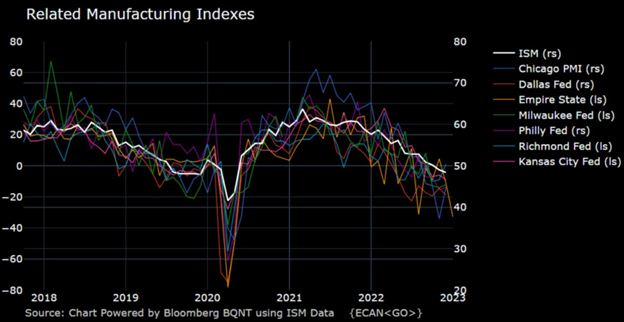

When we look at the regional data combined, you can see how things bounce around a bit but the direction is clear. The U.S. economy is losing steam and now firmly in contraction being led by the manufacturing sector.

The data in the U.S. is broken down between manufacturing and service measurements. The manufacturing is obviously an important piece of economic output, but the U.S. is also VERY reliant on service data. Unfortunately, the data on the service side is accelerating down at a much faster pace than the manfucaturing data, and to understand why that’s important- services makes up about 70% of the U.S. economy.

It shouldn’t be surprising to see this create a pressure point that shows up in all the leading indicators. As you can see from the shaded periods marking a recession, we have never been this low on the Leading Index without having a recession. It shows that GDP is going to struggle to rise and will likely fall into contraction in Q4’22 and Q1’23. More fun times ahead!

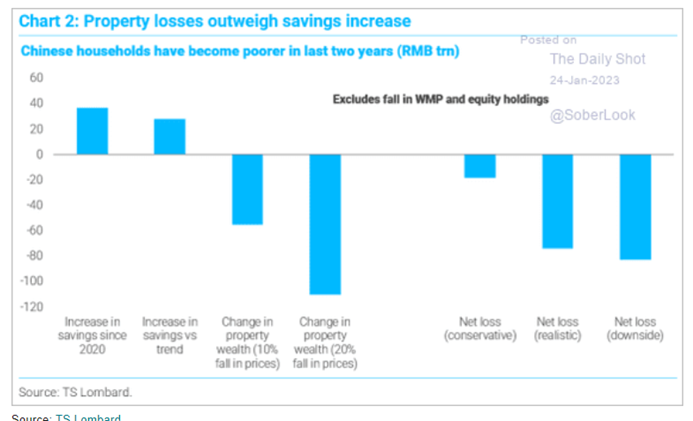

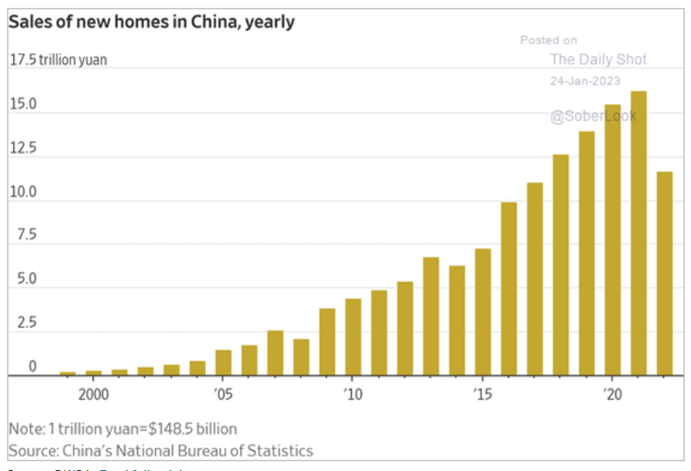

We have been talking a lot about the pressure in China and that the Chinese consumer is NOT as strong as initially talked about. Our view is that the build up in savings is really about addressing the massive losses local consumers absorbed because of real estate impacts. The below chart is fantastic in showing that when you take the savings built up since 2020 doesn’t even come close to covering the losses from the loss in property/real estate losses.

The real estate market isn’t improving in the near term, and if anything, it will continue to get worse. China’s birth rate has pivoted lower, and their population is now firmly in decline. It’s going to be difficult to continue building ghost cities and other useless infrastructure when you can’t fill or utilize what has already been built. The belief that China is going to “save the market” again is grossly overstated with the market setting up for a big disappointment to the downside.

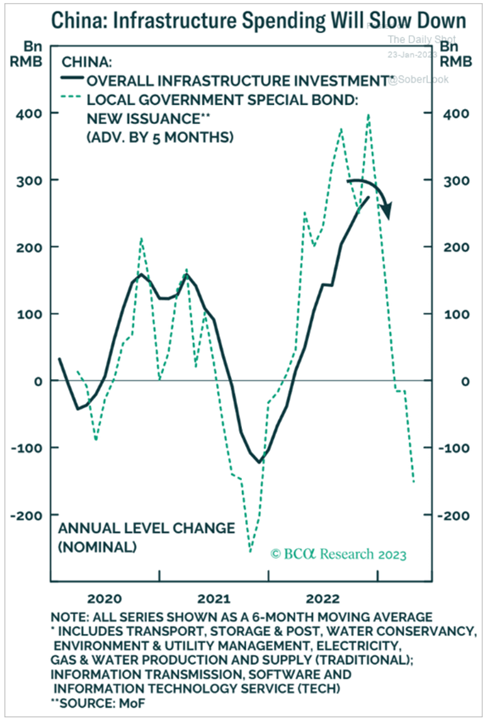

The dark horse in the race sending China lower is the slowdown in infrastructure spending. We have been highlighting for YEARS now that the infrastructure uplift was losing a significant amount of moment. The lending was falling flat and many of the bonds/loans that have been structured since 2018 are steeply underwater. After the recent surge in attempted lending (which didn’t have much uptake), the CCP and PBoC are talking about a bigger drop in infrastructure investing. A lot of that is on the back of a slowdown in SPBs or Special Purpose Bonds.

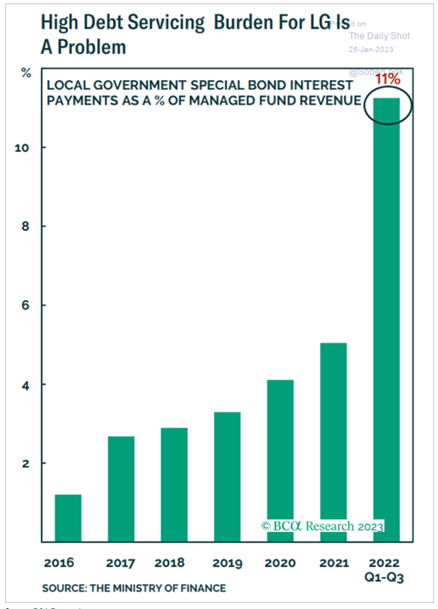

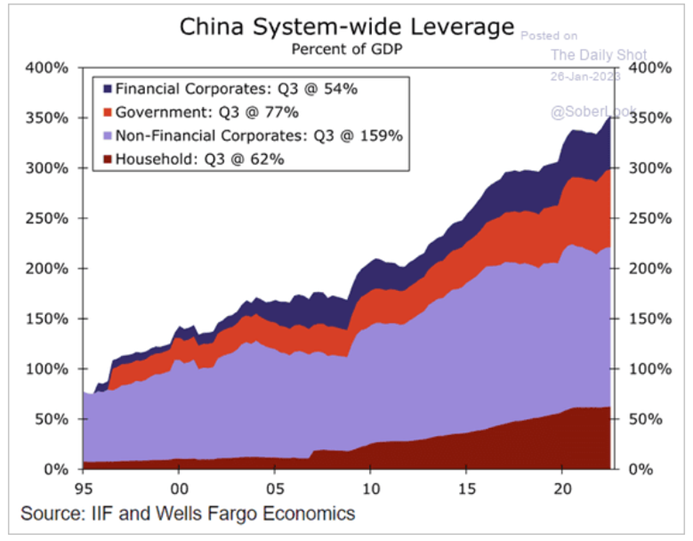

The reason for the big drop in SPBs is the MASSIVE SIZE OF LOCAL GOVERNMENT DEBT. The below chart puts into perspective just how massive the increase in debt has been over the last few years. Local governments rely significantly on the revenue from land sales and real estate, and with that dead in the water, the main source of revenue has all but evaporated. This is going to be a huge overhang for “growth” as government spending shrinks just as the tried and true method of bumping GDP numbers with infrastructure spending falls flat!

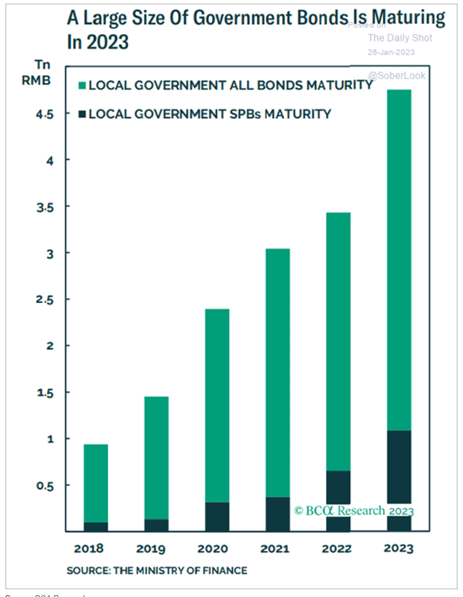

The issue gets even worse when you factor in just how many government bonds are maturing in 2023. There is a cliff of maturities that is going to also weigh on economics as local governments are forced to pay off debt or roll it. If they roll it, it will be at a much higher interest rate. This will push interest expense even higher and put more stress on balance sheets throughout China.

The system wide leverage is only getting worse as we progress throughout 2022, and based on all the data sets above- doesn’t improve. Leverage ratios only get worse in Q4’22 and won’t be improving in 2023 as China announced increasing their deficit. This will put more pressure on Chinese debt and hinder their ability to borrow at the municipal level.

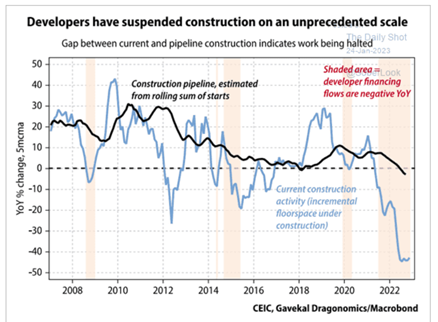

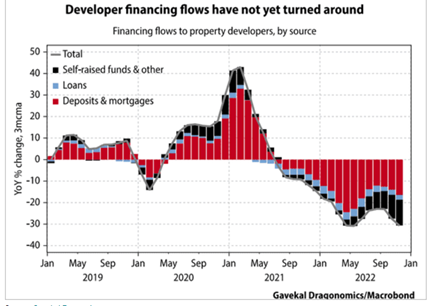

Even with a push for continued support from the PBoC, CCP, and large banks- developers have been unable to gain any momentum. We see this only becoming a bigger overhang as leverage ratios rise again, and the financials of the developers weaken again. The CCP has tried multiple ways to stem the bleeding but even with their efforts, the problems have only expanded over the course of 2022.

These are just a few reasons why we believe the Chinese reopening story is grossly overstated, and will result in more pain as growth falls flat.