- Our regression estimates suggest a revenue growth acceleration over the next two years.

- The EBITDA growth rate, however, can decelerate by NTM 2024.

- The relative valuation suggests the stock is reasonably valued at this level.

Part 1 of this article discussed Precision Drilling Corporation’s (PDS) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

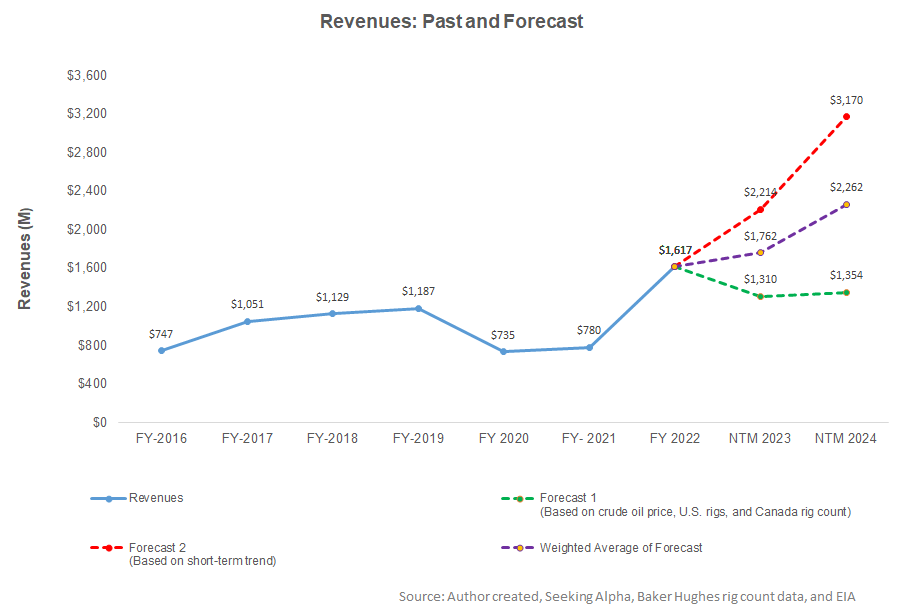

Based on a regression equation on the relationship between the crude oil price, the US rig count, the Canadian rig count, and PDS’s reported revenues for the past eight years and the previous four quarters, we expect revenues to increase by 9% in the next 12 months (or NTM 2023) and 28% in NTM 2024 (sequentially). For the short-term trend, we have also considered seasonality.

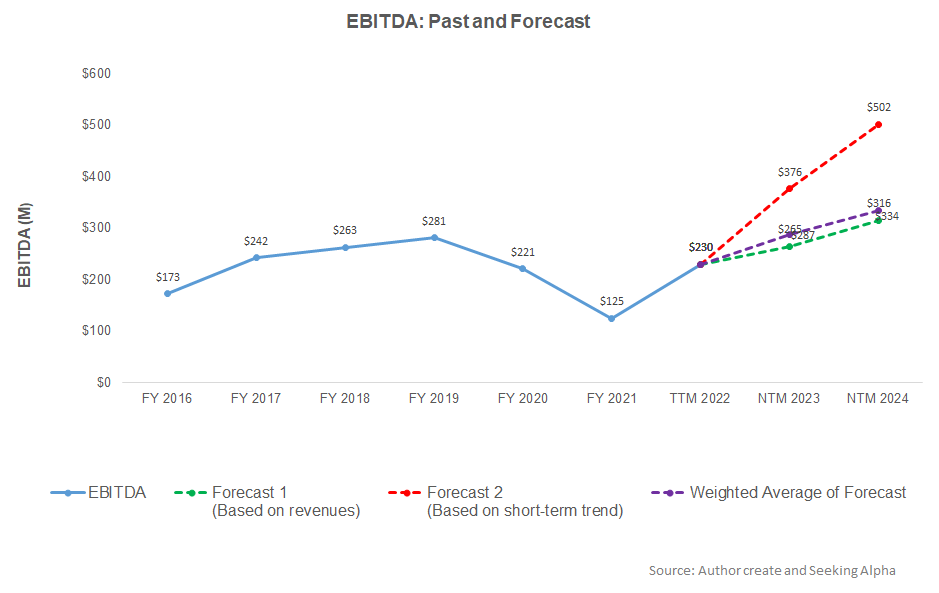

Based on a simple regression model using the average forecast revenues, the company’s EBITDA can improve by 25% and 16% in NTM 2023 and NTM 2024, respectively.

Relative Valuation Analysis

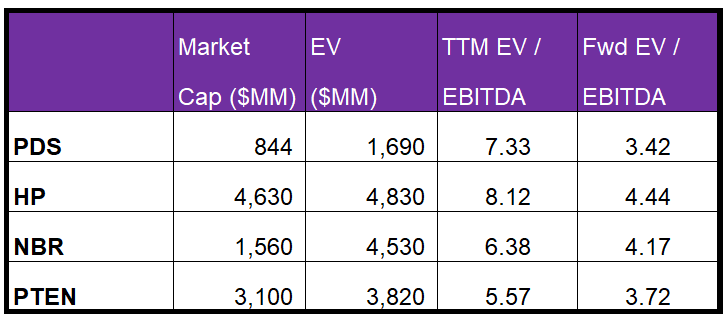

PDS’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers because its EBITDA is expected to increase more sharply in the next four quarters. This typically reflects in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple (7.3x) is marginally higher than its peers’ (HP, NBR, and PTEN) average of 6.7x. So, the stock appears to be reasonably valued at the current level.

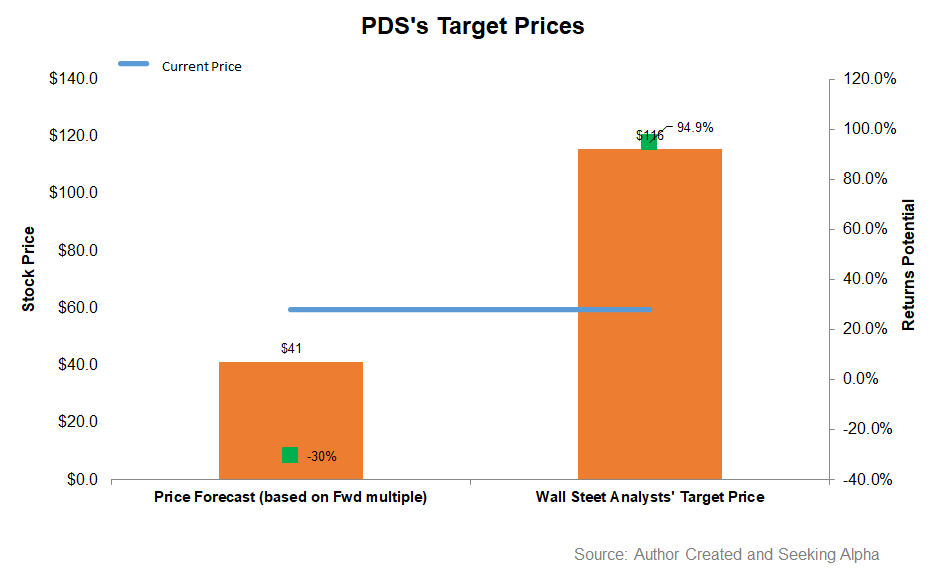

EV has been calculated using PDS’s EV/EBITDA multiple. The returns potential using the forward EV/EBITDA multiple (3.4x), given our regression model-derived EBITDA, is lower (30% downside) than sell-side analysts’ expected returns (95% upside) from the stock.

Analyst Rating

The sell-side analysts’ target price for PDS is $115.7, which, at the current price, has a return potential of 78%. Out of the 12 sell-side analysts rating PDS, 11 rated it a “buy” or a “strong buy,” while one rated it a “Hold.” None rated it a “sell.”

What’s The Take On PDS?

In Q4, PDS re-contracted six of its natural rigs for five years, which would ensure $800 million of contracted international backlog. Although leading-edge day rates are improving, Q1 daily operating margins may remain unchanged due to the adverse effects of a higher percentage of shallower rigs and seasonality on boiler revenue. The deterioration of the WCS-WTI spread can also drag profitability down in Q1. Despite some of these challenges, PDS’s operating margin improved impressively in Q4, and the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

In 2023, PDS expects to generate strong free cash flow after cash flows showed improvement during Q4 2022. Much of its 2023 capex is front-end loaded. Its leverage is much lower than its peers, and it plans to reduce debt in 2023. So, it has a robust balance sheet, which can leverage further in 2023.