There hasn’t been any change in the market that would break us from the current crude ranges. As we approached the bottom of the WTI/Brent ranges, we saw a strong bounce off the bottom. There isn’t enough data in either direction to break us from the current setup.

China has increased their purchase of crude again, but it’s happening as physical pricing is weakening in key markets- including Middle East and West Africa. This just confirms our view that the boats we saw heading over to China are filled with Russian product/crude leaving more volume in the water.

There is also more refined product coming to market from Russia. They are sending more into Saudi Arabia with another wave of product hitting the market: “Russia is ramping up its diesel supplies to Saudi Arabia using ship-to-ship (STS) loadings in addition to direct supplies, market sources said and Refinitiv data showed.” This is inline with our expectations, and we expect to see builds increasing in the Middle East, Africa, and Singapore regarding middle distillate and residual.

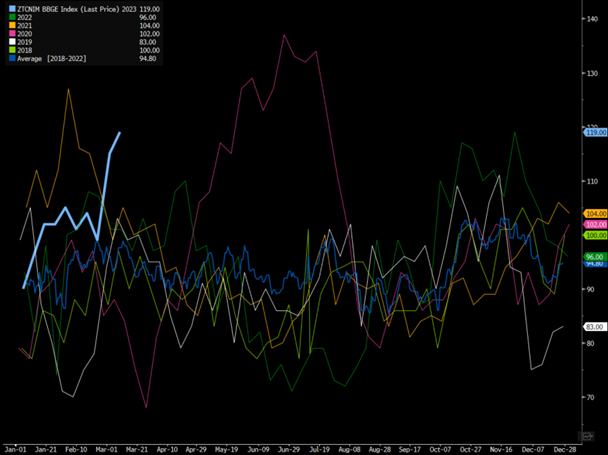

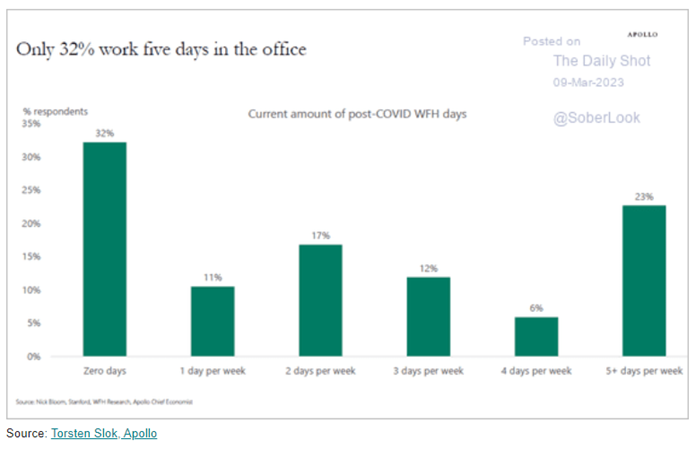

The issue that Russia is facing trying to get product into the market will result in additional run cuts. “Russian refineries reduced throughput in the first days of March as the facilities adjust to European bans on oil imports, seasonal maintenance and temporary domestic crude-production cuts. Russian facilities processed an average daily 5.59 million barrels a day from March 1-8, a 2% drop on February levels, according to calculations based on industry data seen by Bloomberg. If the refineries retain these runs through the whole month, Russia’s crude processing may be the lowest since October.” The reduction in run rates is putting more crude at the coast waiting to be exported. So even though Russia cut production (technically), we will still see the same amount of crude hitting the water.

Saudi and Iran had a productive meeting to normalize their political ties. They have agreed to reopen diplomatic relations over the next two months, which isn’t surprising given the stress Iran has been under.

“The two sides also expressed their appreciation and thanks to the leadership and government of the People’s Republic of China for hosting and sponsoring the talks and their efforts to make them a success. And the three countries announce that the Kingdom of Saudi Arabia and the Islamic Republic of Iran have reached an agreement that includes agreeing to resume diplomatic relations between them and reopen their embassies and representations within a maximum period of two months, and includes their affirmation of respect for the sovereignty of countries and non-interference in their internal affairs, and they agreed that the foreign ministers of the two countries hold a meeting To activate this, arrange the exchange of ambassadors and discuss ways to strengthen relations between them. They also agreed to activate the security cooperation agreement between them, signed on 1/22/1422 AH, corresponding to 4/17/2001 AD, and the general agreement for cooperation in the field of economy, trade, investment, technology, science, culture, sports and youth, signed on 2/2/1419 AH corresponding to 5/27/1998 AD. Each of the three countries expressed their keenness to make every effort to enhance regional and international peace and security. It was issued in Beijing on March 10, 2023 AD.”

Iran needed to find some new support as their cash balances are dangerously low and internal strife continues to build.

1) Iran internal strife has spread to the oil industry, which complicates the power struggle as this was pivotal in 1979.

2) Capital running dry to maintain activity in Yemen/Syria

3) Lack of support from Russia

4) Stability needed to get “support” from Asia/KSA.

Iran has relied on Russia in the past for equipment and engineering, which has been completely shut down. China is looking to keep their options open for discounted crude, so it’s in their best interest to keep volumes moving. Iran needs the cash, and is clearly willing to make a deal as Iran loses proxy support given lack of funding and support. Iran and KSA will continue to be at odds, but this is a mutually beneficial deal for all parties. I am sure in the background- Iran will stop sending sophisticated equipment to Yemen, and KSA will stop bombing large parts of Yemen. This will create a semblance of calm in the region and eliminate some near term risk in the Persian Gulf and Strait of Hormuz.

Over the next few months, we believe that the demand data is going to disappoint to the downside and cause builds to remain elevated around the world. This will push us down and out into a new range, but the limited supply coming from OPEC will keep us from hitting “recession level pricing.” We aren’t expecting a collapse in crude pricing just a “reset” to a lower trading range following a disappointing driving season and China reopening.

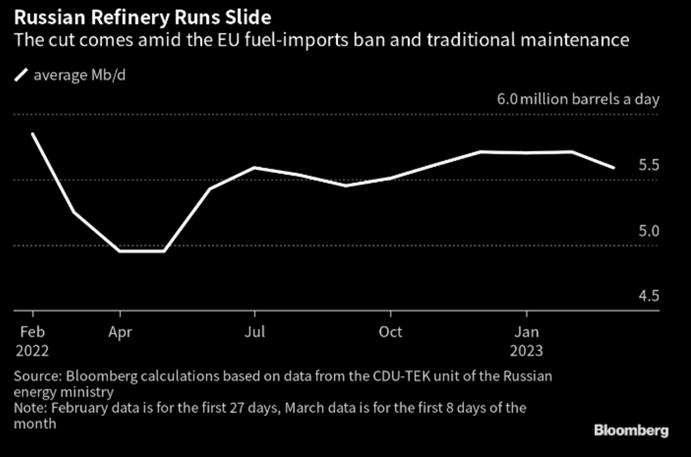

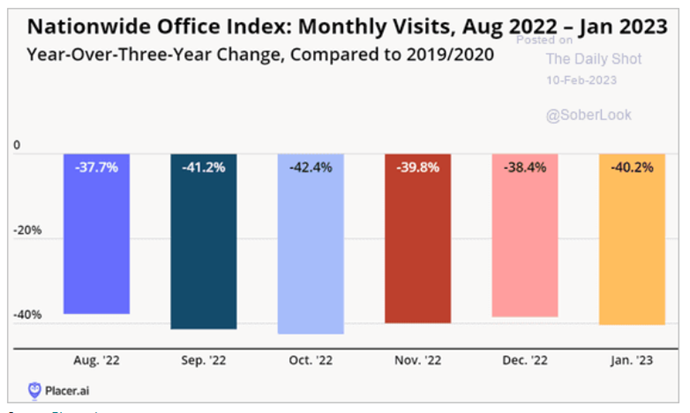

When we look at how WFH/Flexible schedules shifted, only 32% of respondents are heading into the office every day. The rest are spread across the spectrum, but it’s changing the way people are driving during the week.

No matter the metric, we are seeing a more permanent shift, which has been our base case since COVID concerns started to fade. Our view was that flexible schedules would become the norm.

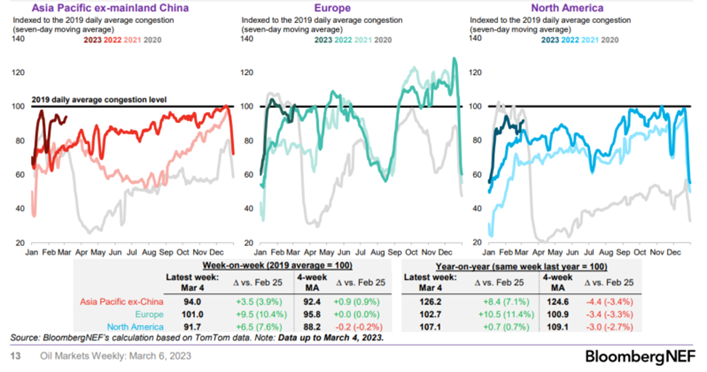

These pivots inherently change the driving landscape from Monday-Friday, while we have seen a small increase on the weekend. But this increase won’t be enough to offset the loss of weekly commuting. We also have the benefit of improved MPG that has made driven miles inherently more efficient. The MPG component is a VERY slow process because the average age of a U.S. vehicle is 12.1 years old as of 2021. So it will take time for the efficiency gains to really come into the market, and ’22 was the first year we saw some meaningful improvement that can be measured. There were several months last year that set new records for miles driven, but we still had gasoline demand down about 10%.

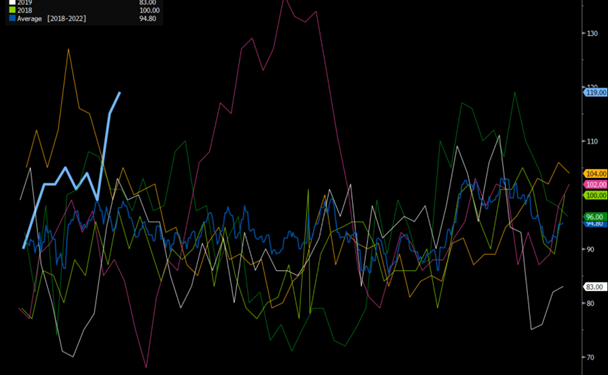

It’s important to clarify that we DO NOT see a collapse in gasoline demand, but more a sustainable shift lower vs what is deemed “normal.” The 2019 level (solid black line) is showing where we were prior to COVID, but even that year was a soft one in terms of economic growth. This is just saying that the 2019 comp isn’t the “hardest” one to go against, but you can see a fairly consistent 10% reduction vs this normal year. We believe that in North America we will have a reduced number vs “normal” by about 5%-10% especially as economic stress increase internally.

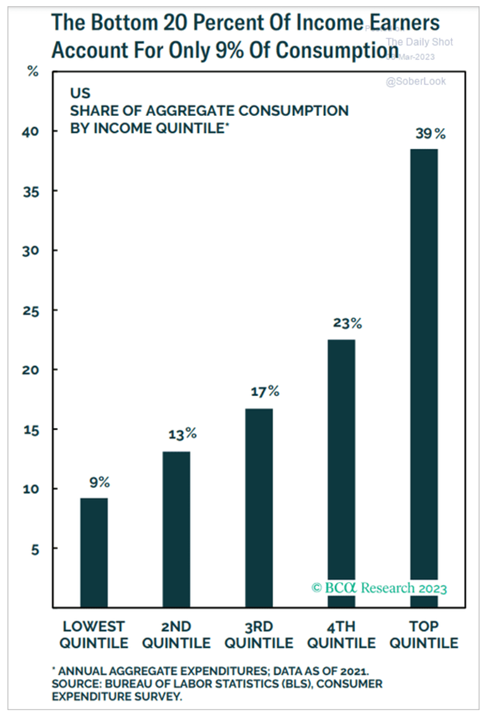

The economic pressure point is growing as the lowest quintiles struggle to spend, which is expanding further and further up the scale. The top quintile was always going to travel in the summer, but the lower quintiles are the ones that take one vacation a year. The increase in total costs will likely shift to a “staycation” instead of traveling to preserve cash.

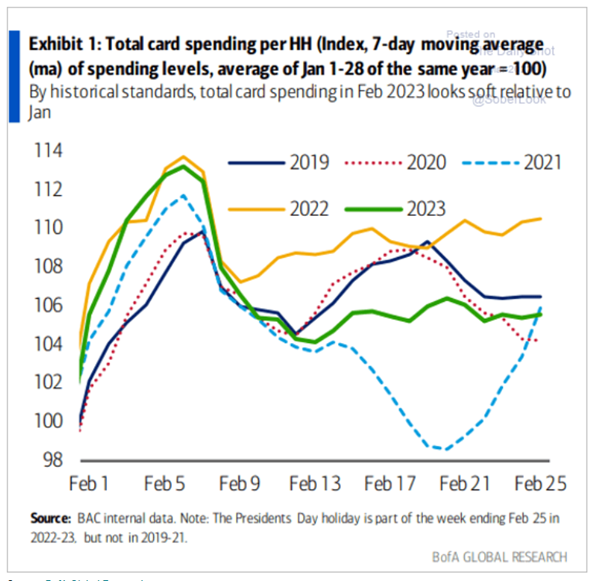

There are also some bigger shifts happening with the top quintile, and their spending habits as more retail stores and other businesses market/cater to the highest earning level. Across the board, we are seeing credit card spending level off following another record in credit card debt and interest rates on CC.

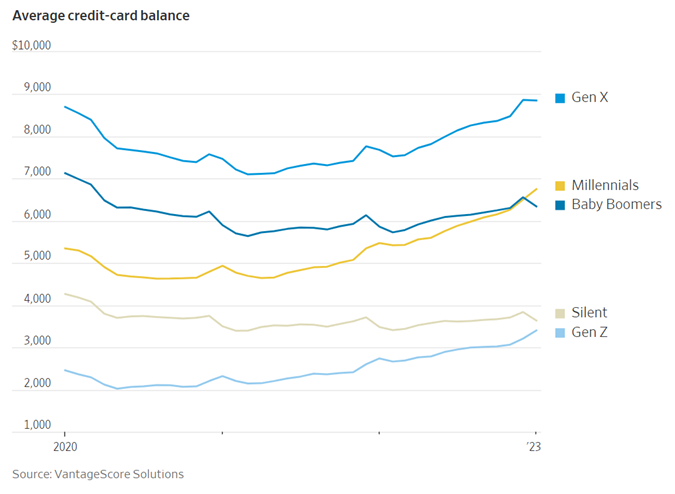

There has been a steady increase in credit card balances over the last few years, and on an aggregate- it’s at the highest level it’s ever been.

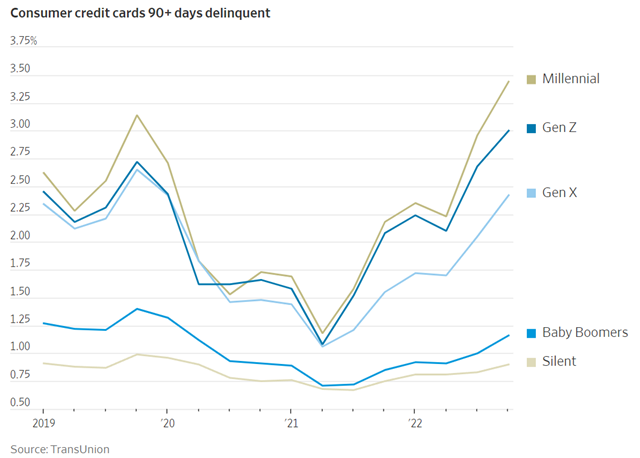

Consumer delinquencies are on the rise again with more pressure coming.

The U.S. Now Has:

- a record $16.5 trillion in household debt

- Record $11.9 trillion in mortgages

- Record $1.6 trillion in auto loans

- Record $986 billion in credit card debt

- Total mortgage debt is now more than double the 2006 peak.

Meanwhile, 36% of Americans have more credit card debt than savings with balances rising at the fastest pace since 1999. This is all while mortgage rates just hit 7.1% and credit card debt rates hit a record 24.9%. We are “fighting” inflation with debt, and the whole cycle is going to end terribly.

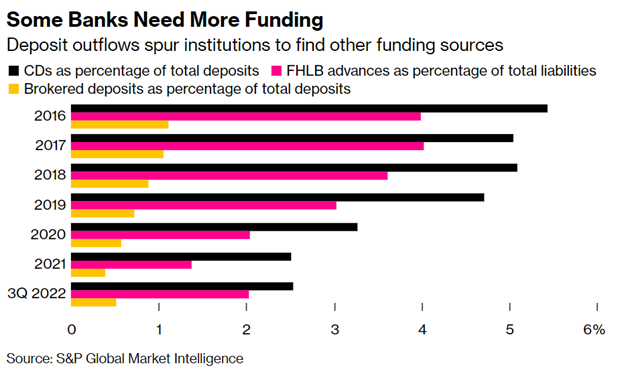

We did a whole show and breakdown of the issues at small banks- now with the collapse of Silicon Valley Bank- we are seeing it come to fruition. The pressure is growing as credit cards risk rise, bad debt expense grows, and clients become concerned. This creates a broad run on a bank. The risk is growing as banks are unable to issue new debt at higher rates as more pain grows. They are beginning to compete more aggressively for deposits to bring in new cash that can be used to write new loans/bonds.

“The very biggest banks can afford to slow-walk their rate increases, simply because they still have relatively high deposit levels. Overall, the average rate on a one-year CD is roughly 1.5%. That’s up from 0.25% a week before the Fed began raising rates a year ago, but still well below inflation. After a year of record profits, the foot-dragging has earned banks plenty of ire from politicians globally. Nevertheless, banks are feeling more pressure to boost rates, which will raise funding costs and crimp profit margins. According to Barclays, the median large-cap bank can expect growth in net interest income, a measure of lending profits, to slow to 11% this year, from 22% last year.”

For example, many banks have written mortgages and car loans on assets that have now seen price declines. Car loan delinquencies are rising as well as CC’s, which causes banks to set aside a growing “bad debt expense” that can not be used to lend. This shrinks the available capital used to lend. You have to consider that a “Deposit” is a liability for the bank that has to be paid back. So if people panic and pull money quickly, the bank won’t have all the cash available resulting in an insolvency. Silicon Valley Bank took in a big run of deposits over the last few years and decided to invest it in long duration treasuries at record low rates. As rates surged, they faced mounting pressure on multiple sides that were starting to surface last year. Unfortunately, bank runs/collapses never happen to just one bank so more fun to come!

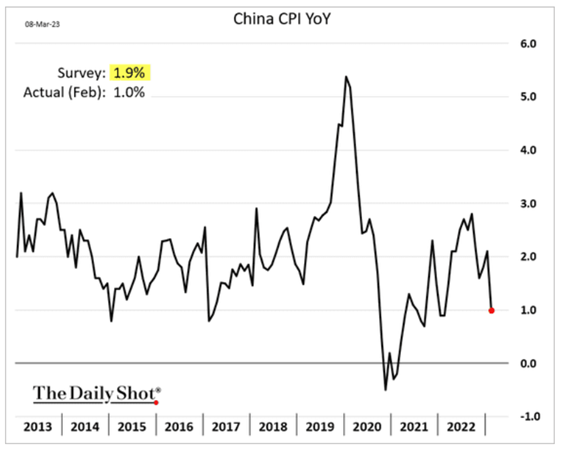

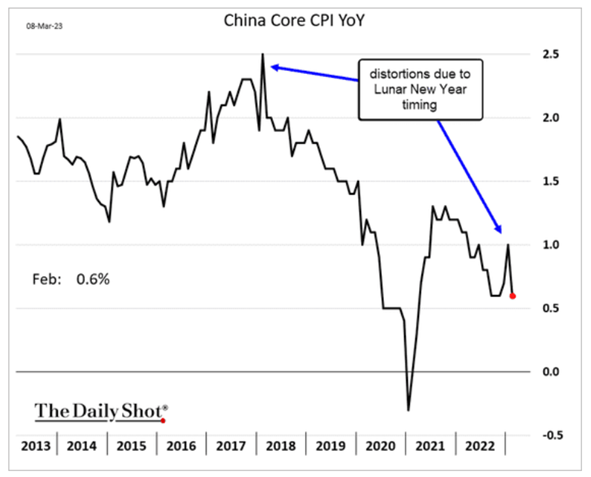

On the China front, we are getting some additional data points showing a general slowdown in domestic activity. Local inflation data missed estimates as people slowed purchases, which was supported on the other side by imports.

The below import data shows a big miss against estimates, which supports our view that PMI was a bit overstated. Retail sales will likely be strong when it’s released this month because it will merge Jan and Feb data. This will hide weakness in Feb because we know Jan was VERY strong given the end of the lockups and Lunar New Year. Post Lunar New year- we have seen things slowdown much faster than the market is expecting.

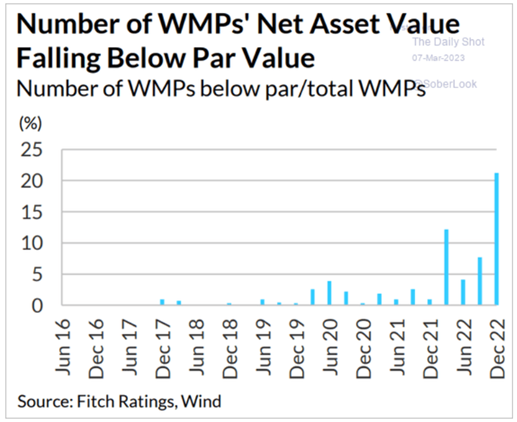

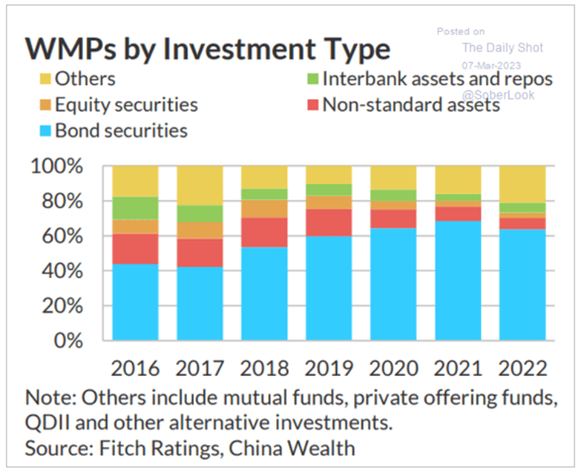

A lot of this slowdown is being driven by a reduction in consumer activity as they all remain under pressure. Many consumers have lost a significant amount of money in WMPs (Wealth Management Products) that were all tied to real estate and housing. As the market imploded, consumers lost downpayments as well as savings that were used to purchase WMPs.

The issues aren’t limited to just urban areas.

China’s debt problems have spread to far-flung villages, according to a report submitted to the ongoing session of the political advisory body (CPPCC).

The deets (Yicai):

- By H1 2019, the total outstanding debt of China’s 700,000 villages reached RMB 0.9 trillion.

- This is exacerbated by villages’ limited revenue-raising power, making even modest debt levels unsustainable.

And it isn’t just a few bad apples:

- For example, three-quarters of villages in Hunan province are indebted, averaging RMB 1.08 million per village.

ICYDK: The lowest tier of the Chinese government is at the township/sub-district level.

- Villages are “self-governed” by village committees, under the guidance of township-level governments.

- They also run rural collective economic organizations (RCEOs), which can manage villagers’ assets, such as land, livestock, or cash.

How did villages become debt-laden?

First, higher-level officials frequently failed to make good on promises to fund rural development initiatives, such as public facility buildings or drinking water projects.

- This forced village organizations to foot the bills – usually through debt.

Second, RCEOs have taken on debt to start enterprises, which have often been poorly run and incurred huge losses.

The report proposes addressing village debt through:

- Letting township-level governments manage the finances of village organizations

- Hiring professional accounting firms to manage the books of RCEOs

Get smart: This is more of a social stability issue than a financial one.

- The size of these debts is tiny compared to those of local governments.

- However, the last thing Beijing wants is a wave of anguish – or anger – spreading among villagers who’ve lost life savings due to poorly run RCEOs.

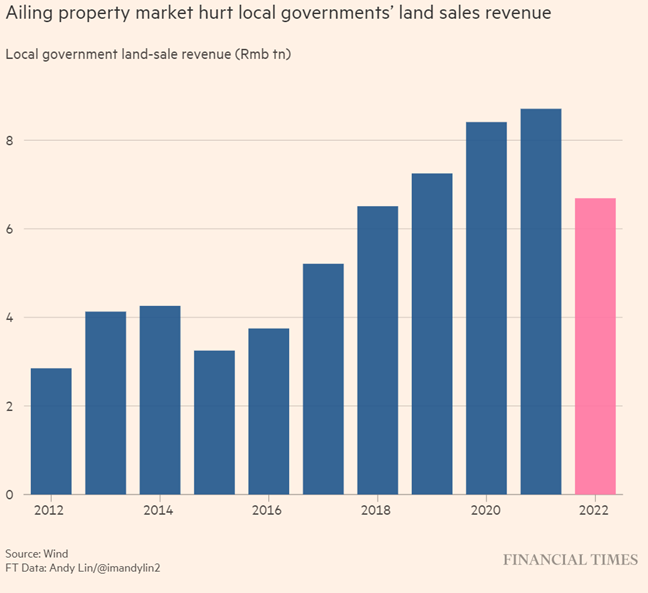

There are a significant amount of local governments that are also cash strapped and likely insolvent. We have seen a lot of “double booking” before in China- but it has moved to a new level of strain. “Cash-strapped local governments in China artificially boosted their revenues last year by selling swaths of land to their own investment vehicles, an official think-tank said, raising concerns about the extent of their financial woes. The report suggested local governments had overstated their revenue after LGFVs, which are responsible for financing infrastructure construction, stepped in as the biggest land buyer. “Local authorities have a strong incentive to sell assets at inflated prices or have LGFVs purchase land to artificially prop up fiscal revenue,” the think-tank said.”

The level of borrowing continues to get pressed higher as local governments are forced to not only issue new debt but also roll their maturing debt. There is a MASSIVE leverage bubble that has been built over the last decade that is coming to a rapid conclusion. It’s another key reason that the PBoC is very cautious regarding rates and underlying liquidity. We expect credit impulses to remain range bounce with limited to no monetary support.

“It is well-known that the budgets of many local governments have been terribly squeezed by falling revenues and rising expenditures, but it turns out (probably to no one’s surprise) that even this may understate the problem. In transactions worthy of Enron, some local governments have borrowed money which, through LGFV purchases in their own land auctions, they were effectively recording as revenue. The good news is that Beijing came down hard on these transaction last year. But it’s important to recognize that these transactions simply disguise what must happen anyway. For now the only way to maintain politically-desired GDP growth rates requires spending that can only be funded by rapid increases in the overall debt burden. Of course it is better to increase debt transparently and on the books, instead of hiding it and treating the proceeds as revenue, but the real issue is that growth in economic activity above some very low level cannot happen without even faster growth in debt. This doesn’t have to be a total loss, however. Beijing might be able to take advantage of these transgressions to force faster reforms, including more liquidation of assets, on local governments. Let’s see.”

Policy shifts won’t be enough to “fix” the situation because China is facing the same problems of every country that has gone down their path has faced: “There is a reason why every country that has followed this growth model saw a period of healthy growth, followed by a period of very unhealthy growth driven by surging debt, followed by a very difficult (and seemingly out-of-the-blue) adjustment.” China is at the point of “difficult” adjustments based on TERRIBLE policies over the last several decades. This is by no means saying that other countries aren’t in a similar poor position on leverage and debt- China just happens to have the largest debt bubble vs GDP. The implicit assumption is that the right set of reforms can start China off with a clean sheet, as if over a decade of misallocated infrastructure investment, a vastly over-extended property sector, and among the highest debt levels in the world, hadn’t happened. But China can only manage average growth rates of close to 5% over the rest of this decade the way they managed it over the past decade: with an unsustainable increase in debt that generates economic activity whose real value to the economy is questionable. Much of the soft-budget “growth” of the past decade, in other words, must be reversed and, as every historical precedent reminds us, it will be reversed as soon as China is unable to increase debt fast enough to roll over the hidden losses embedded in its balance sheet.

The point is that all the reforms in the world can’t cause years of investment misallocation suddenly to disappear. If there wasn’t a problem with growth in the past decade, then there is nothing to worry about. If there was, then it must ultimately be accounted for.